Key Insights

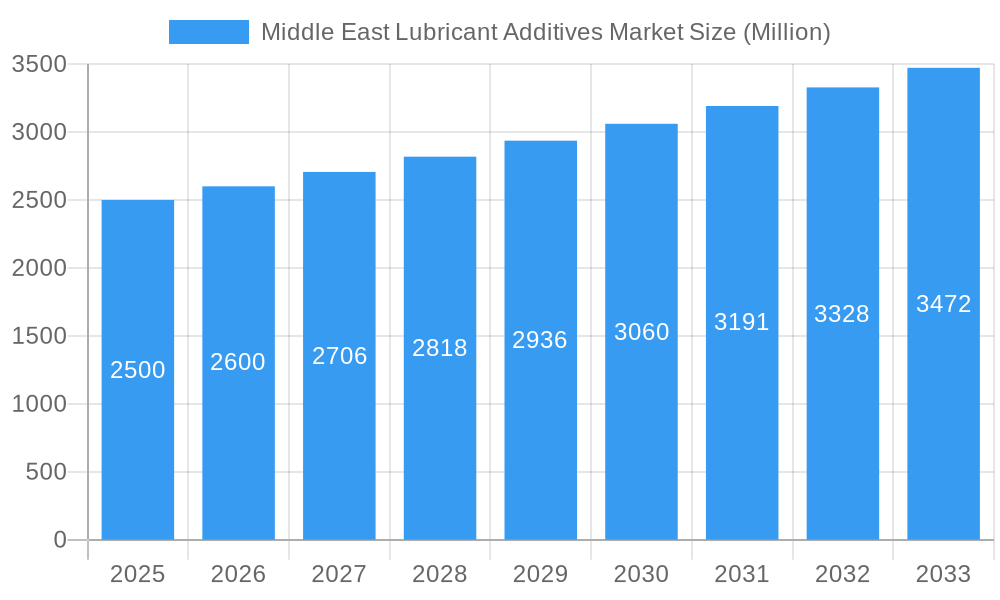

The Middle East lubricant additives market, valued at approximately $X million in 2025, is projected to experience robust growth, exhibiting a CAGR exceeding 4% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning automotive and transportation sector within the region, fueled by infrastructure development and increasing vehicle ownership, significantly boosts demand for high-performance lubricant additives. Furthermore, the growth of heavy industries, including construction and power generation, contributes to the market's expansion. The increasing adoption of advanced lubricant technologies to enhance engine efficiency, extend equipment lifespan, and reduce emissions further fuels market growth. Specific additive types like dispersants & emulsifiers, viscosity index improvers, and detergents are witnessing particularly strong demand due to their critical role in optimizing engine performance and extending oil change intervals. While the region's economic fluctuations and potential reliance on fluctuating global crude oil prices pose some challenges, the long-term outlook remains positive, driven by sustained industrial growth and infrastructure projects across the Middle East.

Middle East Lubricant Additives Market Market Size (In Billion)

The competitive landscape is characterized by a mix of international giants like ExxonMobil, TotalEnergies, and Lubrizol, alongside regional players such as Qhatran Kaveh Motor Oil Company and ADNOC. These companies are actively engaged in research and development to enhance product offerings, focusing on environmentally friendly and high-performance additives. Market segmentation reveals a significant share held by the automotive and transportation end-use industry, followed by construction and power generation. Engine oil and transmission/hydraulic fluids account for the largest portion of product type segments. Strategic partnerships, technological advancements, and expansion into new applications within diverse industries, including metalworking and food & beverage processing, will shape future market dynamics, creating opportunities for both established and emerging players in the Middle East lubricant additives market. The market's trajectory is inextricably linked to the region’s economic prosperity and its continued investment in infrastructure and industrial development.

Middle East Lubricant Additives Market Company Market Share

Middle East Lubricant Additives Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East Lubricant Additives Market, covering the period from 2019 to 2033. It offers crucial insights into market dynamics, competitive landscape, growth drivers, and future outlook, empowering businesses to make informed strategic decisions. The report encompasses detailed segmentation by function, product type, and end-user industry, supported by extensive quantitative and qualitative data. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

Middle East Lubricant Additives Market Market Structure & Competitive Landscape

The Middle East lubricant additives market is characterized by a moderately concentrated structure. Leading global players such as Exxon Mobil Corporation, TotalEnergies SE, BASF SE, and Chevron Corporation hold substantial market share. Complementing these giants is a vibrant ecosystem of regional and specialized manufacturers, including Qhatran Kaveh Motor Oil Company, Nouryon, Infineum International, Evonik Industries AG, LANXESS, Croda International PLC, Kemipex, The Lubrizol Corporation, Gunash Chemistry Industry Co-Ltd, ENOC Company, Abu Dhabi National Oil Company (ADNOC), and Afton Chemical. This diverse presence ensures a dynamic and competitive marketplace.

The competitive landscape is further shaped by ongoing strategic mergers and acquisitions (M&A) activities. The volume of M&A transactions in the sector has seen a notable surge in recent years, with prominent players actively pursuing consolidation to broaden their product portfolios and expand their geographical footprint. A prime example of this trend is Aramco's acquisition of Valvoline Global Products in August 2022, underscoring the industry's move towards consolidation. Innovation in additive technology remains a critical differentiator, necessitating sustained research and development investments to stay ahead. Moreover, increasingly stringent environmental regulations and the escalating demand for sustainable lubricant solutions are significantly influencing market dynamics. The emergence of bio-based and eco-friendly additive substitutes is also a key factor shaping future market strategies.

- Market Concentration: The market is estimated to have a Herfindahl-Hirschman Index (HHI) of approximately xx, indicating a moderately concentrated market structure.

- M&A Activity: An estimated xx Million in M&A transactions were recorded within the lubricant additives sector in the Middle East between 2019 and 2024, highlighting a period of significant consolidation.

- Innovation Drivers: Stringent emission norms and the escalating demand for high-performance lubricants are powerful catalysts driving innovation in additive technology, pushing for advanced formulations.

- Regulatory Impacts: Evolving and increasingly stringent environmental regulations pertaining to lubricant additives are significantly impacting product formulations, R&D priorities, and overall market competitiveness.

- Product Substitutes: The market is witnessing the rise of bio-based and other environmentally friendly additives, presenting a growing competitive challenge and opportunity for sustainable solutions.

- End-user Segmentation: The market caters to a highly diverse range of end-user segments, each with distinct performance requirements and specific preferences for lubricant additive formulations.

Middle East Lubricant Additives Market Market Trends & Opportunities

The Middle East lubricant additives market is experiencing significant growth, driven by the expansion of the automotive and industrial sectors within the region. The market size, valued at xx Million in 2024, is projected to reach xx Million by 2033, exhibiting a compound annual growth rate (CAGR) of xx%. This growth is fueled by several key trends:

- Technological Advancements: The rising demand for advanced engine oil formulations and specialized lubricant additives for high-performance machinery is fostering innovation in additive chemistry. This includes the development of bio-based additives and additives to enhance fuel efficiency and reduce emissions.

- Consumer Preferences: A growing awareness of environmental issues and stricter emission standards are shaping consumer preferences towards environmentally friendly lubricants.

- Government Regulations: Governments in the Middle East are implementing stringent regulations on vehicular emissions and industrial pollution, driving demand for improved lubricant additives.

- Infrastructure Development: Massive infrastructure projects in the region, such as road construction, building development, and industrial expansion, contribute to the growing demand for lubricants.

- Economic Growth: Continued economic growth across the region, especially in key markets like the UAE and Saudi Arabia, further fuels market expansion.

Market penetration rates for advanced additives, such as friction modifiers and oxidation inhibitors, are expected to increase significantly during the forecast period. The competition in the market is intense, but opportunities exist for companies that focus on innovation and product differentiation.

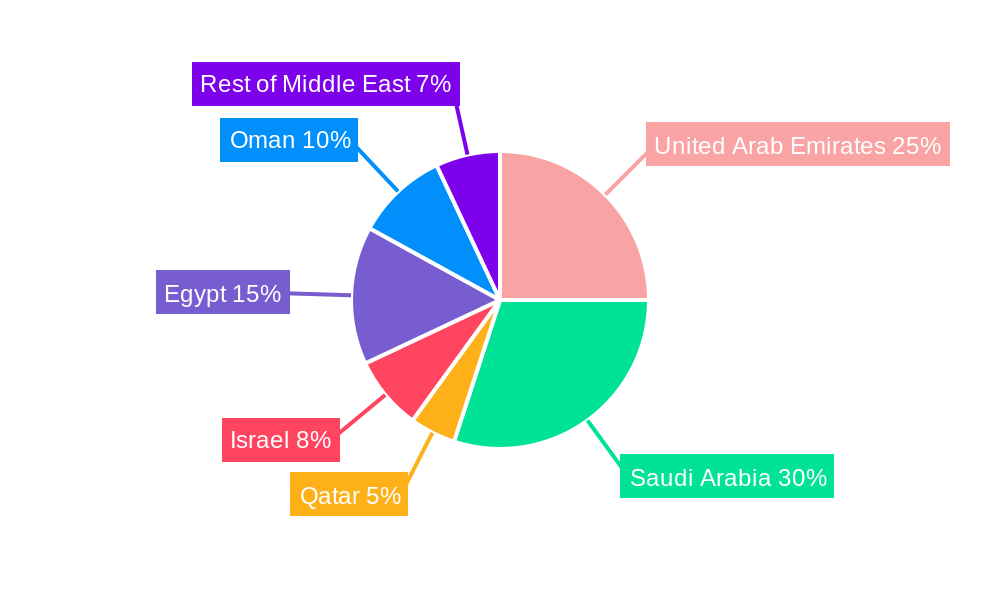

Dominant Markets & Segments in Middle East Lubricant Additives Market

While the entire Middle East region shows strong growth potential, the UAE and Saudi Arabia are currently the dominant markets due to their robust automotive industries, advanced manufacturing sectors, and significant infrastructure projects. Significant growth is also anticipated in other countries with expanding industrial bases.

Leading Region: The UAE and Saudi Arabia lead the Middle East lubricant additives market.

Leading Segments:

- Function: Dispersants & Emulsifiers, Viscosity Index Improvers, and Detergents currently represent significant market shares due to their widespread application in various lubricant formulations.

- Product Type: Engine oil remains the leading product type, followed by transmission and hydraulic fluids.

- End-user Industry: The automotive & transportation sector is the largest end-user industry, accounting for a significant portion of the total market demand, followed by the construction and heavy equipment sectors.

Key Growth Drivers:

- Robust automotive sector growth: High rates of vehicle ownership and production.

- Expanding industrial infrastructure: Large-scale projects in construction, power generation, and manufacturing.

- Favorable government policies: Initiatives promoting industrial growth and technological advancement.

- Rising middle class and disposable incomes: Increased demand for automobiles and high-performance vehicles.

Middle East Lubricant Additives Market Product Analysis

The Middle East lubricant additives market is characterized by ongoing technological advancements. Manufacturers are focusing on developing high-performance additives to improve fuel efficiency, extend lubricant life, and enhance engine performance. Product innovations include bio-based additives, environmentally friendly formulations, and additives that meet increasingly stringent emission standards. The market sees a strong emphasis on additives that deliver improved wear protection, corrosion resistance, and oxidation stability. These product developments are driven by the needs of the automotive, industrial, and energy sectors, as well as evolving regulatory requirements.

Key Drivers, Barriers & Challenges in Middle East Lubricant Additives Market

Key Drivers:

The market is driven by rapid industrialization, rising vehicle ownership, and increasing focus on improving fuel efficiency and reducing emissions. Government initiatives promoting sustainable development and technological advancement are further propelling market growth. Economic expansion and the implementation of advanced technologies in manufacturing and transportation are also key factors.

Key Challenges:

Fluctuations in crude oil prices impact the cost of raw materials and production, creating challenges for pricing and profitability. Intense competition from both domestic and international players necessitates innovative product development and efficient cost management. Moreover, stringent environmental regulations may necessitate costly upgrades to production facilities and reformulation of existing products. Supply chain disruptions due to global events can also negatively impact production and delivery.

Growth Drivers in the Middle East Lubricant Additives Market Market

The market's growth is propelled by several interconnected factors. The expansion of the automotive and industrial sectors, fueled by economic growth and infrastructure development projects, is a primary driver. Governments' push for sustainable practices and stringent emission regulations are simultaneously creating opportunities for environmentally friendly additives. Technological advancements in additive chemistry continuously improve product performance and efficiency, enhancing market appeal.

Challenges Impacting Middle East Lubricant Additives Market Growth

Challenges include price volatility of raw materials, intense competition among established players and new entrants, and the regulatory complexities associated with environmental compliance. Supply chain disruptions and the dependence on global supply chains also present obstacles to consistent market growth. Furthermore, potential economic downturns could reduce investment in manufacturing and transportation, impacting lubricant demand.

Key Players Shaping the Middle East Lubricant Additives Market Market

- Qhatran Kaveh Motor Oil Company

- Nouryon

- Infineum International

- Exxon Mobil Corporation

- TotalEnergies SE

- Evonik Industries AG

- LANXESS

- Croda International PLC

- Kemipex

- BASF SE

- Chevron Corporation

- The Lubrizol Corporation

- Gunash Chemistry Industry Co-Ltd

- ENOC Company

- Abu Dhabi National Oil Company (ADNOC)

- Afton Chemical

Significant Middle East Lubricant Additives Market Industry Milestones

- March 2022: ADNOC launched a new Voyager Green Series range of lubricant products formulated with 100% plant-derived base oil for the UAE market. This signifies a shift towards sustainable products.

- August 2022: Aramco acquired Valvoline Global Products, significantly expanding its presence in the lubricant additives market and strengthening its R&D capabilities. This merger had a substantial impact on market consolidation.

- September 2022: SI Group expanded its lubricant additive portfolio with new aminic antioxidants, broadening its product offerings and strengthening its competitive position. This reflects the ongoing innovation within the industry.

Future Outlook for Middle East Lubricant Additives Market Market

The Middle East lubricant additives market is poised for continued growth, driven by sustained economic expansion, large-scale infrastructure projects, and an increasing focus on environmental sustainability. Strategic opportunities exist for companies focusing on innovation, particularly in the development and marketing of high-performance, environmentally friendly additives. The market's future will be shaped by technological advancements, evolving regulatory landscapes, and the ongoing consolidation through mergers and acquisitions. This presents a robust opportunity for both established players and emerging innovators to capitalize on the growth potential of this dynamic market.

Middle East Lubricant Additives Market Segmentation

-

1. Function

- 1.1. Dispersants & Emulsifiers

- 1.2. Viscosity Index Improvers

- 1.3. Detergents

- 1.4. Corrosion Inhibitors

- 1.5. Oxidation Inhibitors

- 1.6. Extreme-Pressure Additives

- 1.7. Friction Modifiers

- 1.8. Other Functions

-

2. Product Type

- 2.1. Engine Oil

- 2.2. Transmission and Hydraulic Fluid

- 2.3. Metalworking Fluid

- 2.4. General Industrial Oil

- 2.5. Gear Oil

- 2.6. Grease

- 2.7. Process Oil

- 2.8. Other Product Types

-

3. End-user Industry

- 3.1. Automotive & Transportation

- 3.2. Construction

- 3.3. Power Generation

- 3.4. Heavy Equipment

- 3.5. Metallurgy & Metal Working

- 3.6. Food & Beverage

- 3.7. Other End-user Industries

-

4. Geography

- 4.1. Saudi Arabia

- 4.2. United Arab Emirates

- 4.3. Iran

- 4.4. Qatar

- 4.5. Rest of Middle-East

Middle East Lubricant Additives Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Iran

- 4. Qatar

- 5. Rest of Middle East

Middle East Lubricant Additives Market Regional Market Share

Geographic Coverage of Middle East Lubricant Additives Market

Middle East Lubricant Additives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Synthetic Oil Penetration in the Region; Growing Automotive Sector in the Middle East

- 3.3. Market Restrains

- 3.3.1. Rising Raw Material Costs; Supply Chain Disruptions

- 3.4. Market Trends

- 3.4.1. Increasing Consumption of Lubricant Additives in the Automotive and Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Lubricant Additives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Dispersants & Emulsifiers

- 5.1.2. Viscosity Index Improvers

- 5.1.3. Detergents

- 5.1.4. Corrosion Inhibitors

- 5.1.5. Oxidation Inhibitors

- 5.1.6. Extreme-Pressure Additives

- 5.1.7. Friction Modifiers

- 5.1.8. Other Functions

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Engine Oil

- 5.2.2. Transmission and Hydraulic Fluid

- 5.2.3. Metalworking Fluid

- 5.2.4. General Industrial Oil

- 5.2.5. Gear Oil

- 5.2.6. Grease

- 5.2.7. Process Oil

- 5.2.8. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive & Transportation

- 5.3.2. Construction

- 5.3.3. Power Generation

- 5.3.4. Heavy Equipment

- 5.3.5. Metallurgy & Metal Working

- 5.3.6. Food & Beverage

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Iran

- 5.4.4. Qatar

- 5.4.5. Rest of Middle-East

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.5.2. United Arab Emirates

- 5.5.3. Iran

- 5.5.4. Qatar

- 5.5.5. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Saudi Arabia Middle East Lubricant Additives Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Function

- 6.1.1. Dispersants & Emulsifiers

- 6.1.2. Viscosity Index Improvers

- 6.1.3. Detergents

- 6.1.4. Corrosion Inhibitors

- 6.1.5. Oxidation Inhibitors

- 6.1.6. Extreme-Pressure Additives

- 6.1.7. Friction Modifiers

- 6.1.8. Other Functions

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Engine Oil

- 6.2.2. Transmission and Hydraulic Fluid

- 6.2.3. Metalworking Fluid

- 6.2.4. General Industrial Oil

- 6.2.5. Gear Oil

- 6.2.6. Grease

- 6.2.7. Process Oil

- 6.2.8. Other Product Types

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Automotive & Transportation

- 6.3.2. Construction

- 6.3.3. Power Generation

- 6.3.4. Heavy Equipment

- 6.3.5. Metallurgy & Metal Working

- 6.3.6. Food & Beverage

- 6.3.7. Other End-user Industries

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Saudi Arabia

- 6.4.2. United Arab Emirates

- 6.4.3. Iran

- 6.4.4. Qatar

- 6.4.5. Rest of Middle-East

- 6.1. Market Analysis, Insights and Forecast - by Function

- 7. United Arab Emirates Middle East Lubricant Additives Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Function

- 7.1.1. Dispersants & Emulsifiers

- 7.1.2. Viscosity Index Improvers

- 7.1.3. Detergents

- 7.1.4. Corrosion Inhibitors

- 7.1.5. Oxidation Inhibitors

- 7.1.6. Extreme-Pressure Additives

- 7.1.7. Friction Modifiers

- 7.1.8. Other Functions

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Engine Oil

- 7.2.2. Transmission and Hydraulic Fluid

- 7.2.3. Metalworking Fluid

- 7.2.4. General Industrial Oil

- 7.2.5. Gear Oil

- 7.2.6. Grease

- 7.2.7. Process Oil

- 7.2.8. Other Product Types

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Automotive & Transportation

- 7.3.2. Construction

- 7.3.3. Power Generation

- 7.3.4. Heavy Equipment

- 7.3.5. Metallurgy & Metal Working

- 7.3.6. Food & Beverage

- 7.3.7. Other End-user Industries

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Saudi Arabia

- 7.4.2. United Arab Emirates

- 7.4.3. Iran

- 7.4.4. Qatar

- 7.4.5. Rest of Middle-East

- 7.1. Market Analysis, Insights and Forecast - by Function

- 8. Iran Middle East Lubricant Additives Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Function

- 8.1.1. Dispersants & Emulsifiers

- 8.1.2. Viscosity Index Improvers

- 8.1.3. Detergents

- 8.1.4. Corrosion Inhibitors

- 8.1.5. Oxidation Inhibitors

- 8.1.6. Extreme-Pressure Additives

- 8.1.7. Friction Modifiers

- 8.1.8. Other Functions

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Engine Oil

- 8.2.2. Transmission and Hydraulic Fluid

- 8.2.3. Metalworking Fluid

- 8.2.4. General Industrial Oil

- 8.2.5. Gear Oil

- 8.2.6. Grease

- 8.2.7. Process Oil

- 8.2.8. Other Product Types

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Automotive & Transportation

- 8.3.2. Construction

- 8.3.3. Power Generation

- 8.3.4. Heavy Equipment

- 8.3.5. Metallurgy & Metal Working

- 8.3.6. Food & Beverage

- 8.3.7. Other End-user Industries

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Saudi Arabia

- 8.4.2. United Arab Emirates

- 8.4.3. Iran

- 8.4.4. Qatar

- 8.4.5. Rest of Middle-East

- 8.1. Market Analysis, Insights and Forecast - by Function

- 9. Qatar Middle East Lubricant Additives Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Function

- 9.1.1. Dispersants & Emulsifiers

- 9.1.2. Viscosity Index Improvers

- 9.1.3. Detergents

- 9.1.4. Corrosion Inhibitors

- 9.1.5. Oxidation Inhibitors

- 9.1.6. Extreme-Pressure Additives

- 9.1.7. Friction Modifiers

- 9.1.8. Other Functions

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Engine Oil

- 9.2.2. Transmission and Hydraulic Fluid

- 9.2.3. Metalworking Fluid

- 9.2.4. General Industrial Oil

- 9.2.5. Gear Oil

- 9.2.6. Grease

- 9.2.7. Process Oil

- 9.2.8. Other Product Types

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Automotive & Transportation

- 9.3.2. Construction

- 9.3.3. Power Generation

- 9.3.4. Heavy Equipment

- 9.3.5. Metallurgy & Metal Working

- 9.3.6. Food & Beverage

- 9.3.7. Other End-user Industries

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Saudi Arabia

- 9.4.2. United Arab Emirates

- 9.4.3. Iran

- 9.4.4. Qatar

- 9.4.5. Rest of Middle-East

- 9.1. Market Analysis, Insights and Forecast - by Function

- 10. Rest of Middle East Middle East Lubricant Additives Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Function

- 10.1.1. Dispersants & Emulsifiers

- 10.1.2. Viscosity Index Improvers

- 10.1.3. Detergents

- 10.1.4. Corrosion Inhibitors

- 10.1.5. Oxidation Inhibitors

- 10.1.6. Extreme-Pressure Additives

- 10.1.7. Friction Modifiers

- 10.1.8. Other Functions

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Engine Oil

- 10.2.2. Transmission and Hydraulic Fluid

- 10.2.3. Metalworking Fluid

- 10.2.4. General Industrial Oil

- 10.2.5. Gear Oil

- 10.2.6. Grease

- 10.2.7. Process Oil

- 10.2.8. Other Product Types

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Automotive & Transportation

- 10.3.2. Construction

- 10.3.3. Power Generation

- 10.3.4. Heavy Equipment

- 10.3.5. Metallurgy & Metal Working

- 10.3.6. Food & Beverage

- 10.3.7. Other End-user Industries

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Saudi Arabia

- 10.4.2. United Arab Emirates

- 10.4.3. Iran

- 10.4.4. Qatar

- 10.4.5. Rest of Middle-East

- 10.1. Market Analysis, Insights and Forecast - by Function

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Qhatran Kaveh Motor Oil Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nouryon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Infineum International

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Exxon Mobil Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TotalEnergies SE*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Evonik Industries AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LANXESS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Croda International PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kemipex

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BASF SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Chevron Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 The Lubrizol Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Gunash Chemistry Industry Co-Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ENOC Company

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Abu Dhabi National Oil Company (ADNOC)

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Afton Chemical

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Qhatran Kaveh Motor Oil Company

List of Figures

- Figure 1: Middle East Lubricant Additives Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East Lubricant Additives Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Lubricant Additives Market Revenue undefined Forecast, by Function 2020 & 2033

- Table 2: Middle East Lubricant Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 3: Middle East Lubricant Additives Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Middle East Lubricant Additives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 5: Middle East Lubricant Additives Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Middle East Lubricant Additives Market Revenue undefined Forecast, by Function 2020 & 2033

- Table 7: Middle East Lubricant Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 8: Middle East Lubricant Additives Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 9: Middle East Lubricant Additives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: Middle East Lubricant Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Middle East Lubricant Additives Market Revenue undefined Forecast, by Function 2020 & 2033

- Table 12: Middle East Lubricant Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 13: Middle East Lubricant Additives Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Middle East Lubricant Additives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: Middle East Lubricant Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Middle East Lubricant Additives Market Revenue undefined Forecast, by Function 2020 & 2033

- Table 17: Middle East Lubricant Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 18: Middle East Lubricant Additives Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 19: Middle East Lubricant Additives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Middle East Lubricant Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Middle East Lubricant Additives Market Revenue undefined Forecast, by Function 2020 & 2033

- Table 22: Middle East Lubricant Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 23: Middle East Lubricant Additives Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 24: Middle East Lubricant Additives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 25: Middle East Lubricant Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Middle East Lubricant Additives Market Revenue undefined Forecast, by Function 2020 & 2033

- Table 27: Middle East Lubricant Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 28: Middle East Lubricant Additives Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 29: Middle East Lubricant Additives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: Middle East Lubricant Additives Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Lubricant Additives Market?

The projected CAGR is approximately 2.43%.

2. Which companies are prominent players in the Middle East Lubricant Additives Market?

Key companies in the market include Qhatran Kaveh Motor Oil Company, Nouryon, Infineum International, Exxon Mobil Corporation, TotalEnergies SE*List Not Exhaustive, Evonik Industries AG, LANXESS, Croda International PLC, Kemipex, BASF SE, Chevron Corporation, The Lubrizol Corporation, Gunash Chemistry Industry Co-Ltd, ENOC Company, Abu Dhabi National Oil Company (ADNOC), Afton Chemical.

3. What are the main segments of the Middle East Lubricant Additives Market?

The market segments include Function, Product Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Synthetic Oil Penetration in the Region; Growing Automotive Sector in the Middle East.

6. What are the notable trends driving market growth?

Increasing Consumption of Lubricant Additives in the Automotive and Construction Industry.

7. Are there any restraints impacting market growth?

Rising Raw Material Costs; Supply Chain Disruptions.

8. Can you provide examples of recent developments in the market?

September 2022 : SI Group announced the expansion of its lubricant additive portfolio with new aminic antioxidants primarily used in lubricants, greases, and industrial, automotive, and heat transfer fluids.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Lubricant Additives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Lubricant Additives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Lubricant Additives Market?

To stay informed about further developments, trends, and reports in the Middle East Lubricant Additives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence