Key Insights

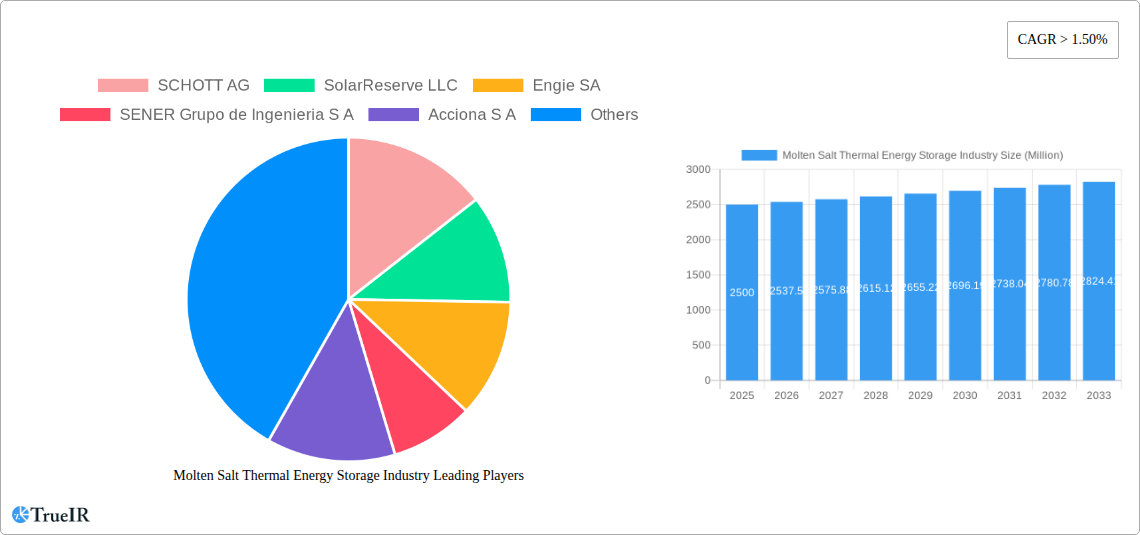

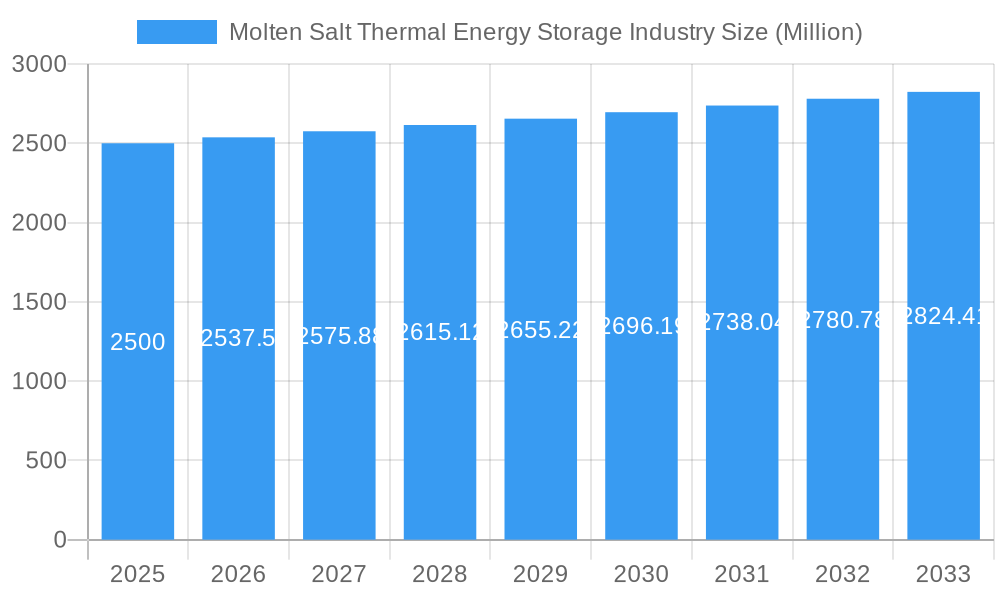

The Molten Salt Thermal Energy Storage (MSTES) market is poised for significant expansion, driven by the escalating demand for dependable and efficient energy storage solutions to integrate renewable sources like solar and wind power. With a projected Compound Annual Growth Rate (CAGR) of 9.8%, the market, valued at $2.22 billion in the base year 2025, is expected to witness substantial growth through 2033. Key growth catalysts include supportive government policies for renewable energy, the imperative for grid stability, and technological advancements in MSTES enhancing efficiency and cost-effectiveness. Major market segments include parabolic troughs, Fresnel reflectors, and power tower technologies, each offering distinct benefits and applications. Geographically, North America, Europe, and Asia-Pacific are key regions, with notable activity in the United States, Germany, the UK, China, and India. Despite challenges such as initial capital expenditure and material constraints, continuous innovation and favorable policy environments are anticipated to propel market growth.

Molten Salt Thermal Energy Storage Industry Market Size (In Billion)

The competitive arena features prominent players including SCHOTT AG, Engie SA, and Acciona S.A., alongside specialized firms like SolarReserve LLC and BrightSource Energy Inc. These entities are actively engaged in R&D, project development, and system integration, contributing to market dynamism. The historical period (2019-2024) established a foundation of increasing demand and adoption. The forecast period (2025-2033) indicates sustained growth, propelled by expanding renewable energy capacity, evolving energy storage requirements, and ongoing technological refinements that boost MSTES efficiency and affordability, presenting a compelling investment and innovation landscape.

Molten Salt Thermal Energy Storage Industry Company Market Share

Molten Salt Thermal Energy Storage Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Molten Salt Thermal Energy Storage (MSTS) industry, encompassing market size, trends, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report leverages extensive research and data analysis to offer invaluable insights for industry stakeholders, investors, and researchers. The global MSTS market is projected to reach $XX Million by 2033, exhibiting a CAGR of XX% during the forecast period (2025-2033).

Molten Salt Thermal Energy Storage Industry Market Structure & Competitive Landscape

The Molten Salt Thermal Energy Storage market exhibits a moderately concentrated structure, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at XX, indicating a moderately consolidated market. Key innovation drivers include advancements in materials science, improved thermal efficiency, and the integration of MSTS with renewable energy sources. Stringent environmental regulations and policies promoting renewable energy adoption significantly influence market growth. Product substitutes, such as compressed air energy storage and pumped hydro storage, pose some competition. The industry is segmented primarily by technology (Parabolic Troughs, Fresnel Reflector, Power Tower) and application (utility-scale power generation, industrial process heat).

- Market Concentration: HHI estimated at XX.

- Innovation Drivers: Advanced materials, improved thermal efficiency, renewable energy integration.

- Regulatory Impacts: Stringent environmental regulations, renewable energy mandates.

- Product Substitutes: Compressed air energy storage, pumped hydro storage.

- End-User Segmentation: Utility-scale power generation, industrial process heat, others.

- M&A Trends: XX major M&A transactions valued at approximately $XX Million were recorded between 2019 and 2024, driven by the need for scale and technological advancements. This trend is expected to continue, with an estimated $XX Million in M&A activity predicted during 2025-2033.

Molten Salt Thermal Energy Storage Industry Market Trends & Opportunities

The MSTS market is experiencing robust growth, fueled by the increasing demand for renewable energy and the need for reliable energy storage solutions. The market size has grown from $XX Million in 2019 to an estimated $XX Million in 2025, driven by factors such as declining costs, technological advancements, and supportive government policies. Technological shifts towards higher efficiency molten salts and improved heat transfer systems are driving market penetration. Consumer preference is shifting towards sustainable and reliable energy solutions, further boosting MSTS adoption. Intense competition among key players is fostering innovation and price reductions, creating favorable market conditions. The global market size is projected to reach $XX Million by 2033, with a substantial increase in market penetration rates driven by the continued growth of renewable energy capacity and supportive government policies.

Dominant Markets & Segments in Molten Salt Thermal Energy Storage Industry

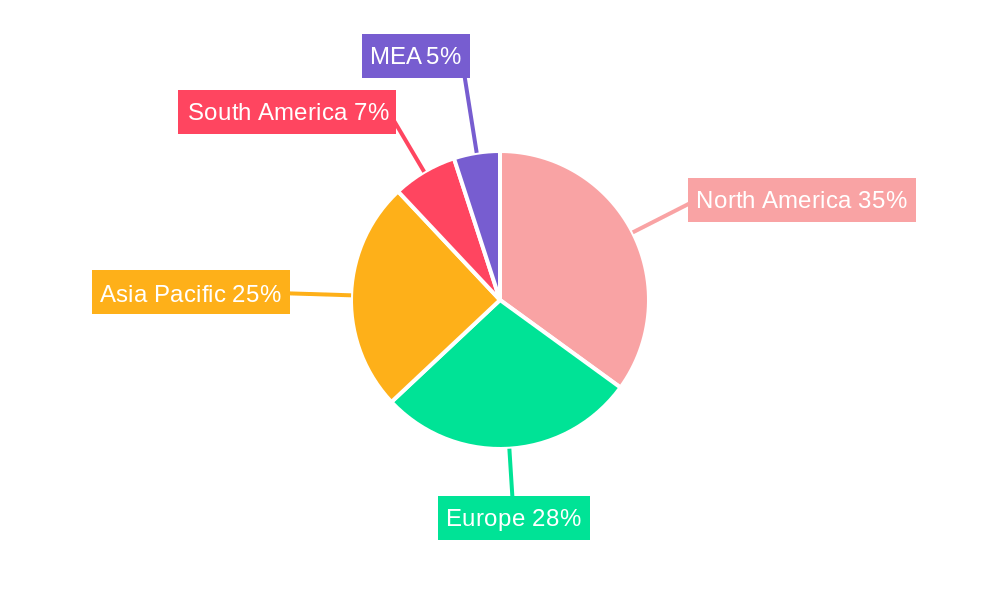

The global Molten Salt Thermal Energy Storage (MSTS) market is experiencing dynamic shifts, with the United States currently leading due to its established Concentrated Solar Power (CSP) infrastructure and robust government support. However, China is rapidly emerging as a significant player, fueled by its aggressive renewable energy expansion targets and targeted investments in CSP technologies. Other notable markets include various European countries and increasingly, regions with substantial solar resources and energy storage needs.

In terms of technologies, Parabolic Trough systems continue to hold a substantial market share, primarily attributed to their proven maturity, reliability, and cost-effectiveness for established applications. Nevertheless, Power Tower systems are projected for considerable growth. This is driven by their inherent advantage of higher energy density, enabling more efficient storage of thermal energy and potentially leading to smaller footprints and lower levelized costs of storage in the long run.

Key Growth Drivers:

- Accelerated Renewable Energy Deployment: The worldwide surge in solar PV and CSP installations is a primary catalyst, creating an immediate need for effective energy storage to address intermittency and grid integration challenges.

- Proactive Government Policies and Incentives: Favorable regulatory frameworks, including tax credits, subsidies, renewable portfolio standards (RPS), and investment grants specifically for energy storage, are significantly stimulating market demand and project viability.

- Continuous Technological Advancements: Ongoing innovation in molten salt formulations (higher temperature stability, reduced corrosivity), enhanced thermal storage efficiency, advanced heat exchangers, and sophisticated system integration are making MSTS more competitive and versatile.

- Increasing Demand for Grid Stability and Flexibility: As grids incorporate higher percentages of variable renewable energy, the demand for dispatchable power and ancillary services provided by MSTS is growing.

Market Dominance Analysis: The United States' current leadership is a testament to its pioneering role in CSP development, strong policy backing, and a mature project pipeline. However, China's rapid industrialization, massive renewable energy targets, and strategic focus on advancing CSP and MSTS technologies position it to significantly increase its market share and potentially challenge the existing dominance in the coming years. The growing adoption of these technologies in India, the Middle East, and North Africa also points towards a more diversified global market landscape.

Molten Salt Thermal Energy Storage Industry Product Analysis

The innovation landscape within the MSTS industry is characterized by a relentless pursuit of enhanced thermal efficiency, cost reduction, and superior system reliability. Recent breakthroughs in material science have been pivotal, leading to the development of novel molten salt compositions exhibiting improved thermal stability at higher temperatures, reduced corrosivity, and extended operational lifespans. These advanced materials are critical for enabling higher system performance and reducing long-term maintenance requirements.

These technological advancements are not only optimizing existing applications but also broadening the scope of MSTS. Beyond utility-scale energy storage for grid balancing, MSTS is increasingly being deployed for industrial process heat applications, where its ability to store and deliver high-temperature heat efficiently can significantly decarbonize manufacturing processes. Furthermore, its potential in district heating and cooling systems is being explored, offering sustainable and reliable thermal energy solutions for communities.

The competitive advantage in this evolving market lies in offering integrated MSTS solutions that are not only cost-effective and highly reliable but also boast exceptional thermal efficiency and demonstrably long operational lifetimes. This includes optimizing heat transfer, minimizing thermal losses, and ensuring seamless integration with renewable energy sources and existing energy infrastructure.

Key Drivers, Barriers & Challenges in Molten Salt Thermal Energy Storage Industry

Key Drivers:

The global imperative to decarbonize the energy sector and achieve climate goals is the foremost driver. This is intrinsically linked to the accelerating adoption of intermittent renewable energy sources like solar and wind, which necessitate robust energy storage solutions to ensure grid stability and dispatchability. Complementing this, supportive government policies—including mandates, incentives, and R&D funding—are playing a crucial role in de-risking investments and accelerating market penetration. Continuous technological improvements in molten salt formulations, heat transfer, and system design are driving down costs and enhancing performance, making MSTS an increasingly attractive option.

Challenges & Restraints:

Despite the positive trajectory, high initial capital expenditure remains a significant barrier for widespread adoption, particularly for smaller-scale applications. The complexity associated with the design, construction, and operation of high-temperature molten salt systems can also present challenges, requiring specialized expertise. Furthermore, the supply chain for certain specialized materials and components can be complex and prone to disruptions. Regulatory uncertainties, lengthy permitting processes, and the need for standardized safety protocols, especially in emerging markets, can also impede timely project deployment and scalability.

Growth Drivers in the Molten Salt Thermal Energy Storage Industry Market

Technological advancements, particularly in molten salt materials and system designs, are driving down costs and increasing efficiency. Government support through subsidies and tax incentives is essential. Furthermore, the increasing integration of MSTS with renewable energy sources like solar and wind power provides a strong impetus for growth.

Challenges Impacting Molten Salt Thermal Energy Storage Industry Growth

The Molten Salt Thermal Energy Storage (MSTS) industry, while promising, faces several critical challenges that temper its growth trajectory. The substantial upfront capital investment required for constructing MSTS facilities remains a primary hurdle, making it difficult for projects to compete with established, lower-cost energy generation and storage options. The inherent complexity of handling and managing high-temperature molten salts necessitates specialized engineering expertise, stringent safety protocols, and advanced operational procedures, which can hinder broader market understanding and adoption. Concerns regarding the long-term reliability and safety associated with operating at extreme temperatures, although being addressed through innovation, continue to influence investor confidence. Furthermore, the global supply chain for specialized molten salt materials and components can be intricate and subject to availability issues, potentially leading to project delays and cost overruns. A shortage of a skilled workforce with the necessary expertise in designing, building, and operating these advanced systems also poses a significant impediment to scaling up the industry.

Key Players Shaping the Molten Salt Thermal Energy Storage Industry Market

- SCHOTT AG

- SolarReserve LLC

- Engie SA

- SENER Grupo de Ingenieria S A

- Acciona S A

- Abengoa SA

- Yara International ASA

- BrightSource Energy Inc

Significant Molten Salt Thermal Energy Storage Industry Industry Milestones

- November 2022: Hyme Energy ApS partners with Bornholms Energi & Forsyning (BEOF) to build a 1 MW/20 MWh molten salt thermal energy storage demonstrator in Denmark, scheduled for completion in 2024. This signifies a significant step towards the commercialization of smaller-scale MSTS applications.

Future Outlook for Molten Salt Thermal Energy Storage Industry Market

The Molten Salt Thermal Energy Storage (MSTS) market is poised for substantial and accelerated growth in the coming years. This optimistic outlook is underpinned by a confluence of factors, including continuous technological advancements that are enhancing efficiency and reducing costs, coupled with increasingly supportive government policies and the undeniable global drive towards decarbonization and renewable energy integration. Strategic partnerships between technology providers, project developers, and utilities, alongside sustained investment in research and development for next-generation molten salt materials and system designs, will be crucial in accelerating market expansion and unlocking new applications.

The market potential is particularly significant in regions with high renewable energy penetration, such as those with abundant solar resources, where MSTS offers a vital solution for grid stabilization, load shifting, and ensuring a reliable power supply. The increasing demand for dispatchable renewable energy and the need to enhance grid flexibility will further propel the adoption of MSTS. Beyond large-scale grid applications, the future will likely see MSTS playing a more prominent role in industrial heat decarbonization and potentially in localized energy systems, contributing to a more resilient and sustainable energy future.

Molten Salt Thermal Energy Storage Industry Segmentation

-

1. Technology

- 1.1. Parabolic Troughs

- 1.2. Fresnel Reflector

- 1.3. Power Tower

Molten Salt Thermal Energy Storage Industry Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. South America

- 5. Middle East and Africa

Molten Salt Thermal Energy Storage Industry Regional Market Share

Geographic Coverage of Molten Salt Thermal Energy Storage Industry

Molten Salt Thermal Energy Storage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adopting of Alternative Clean Energy Sources (Ex

- 3.4. Market Trends

- 3.4.1. Parabolic Trough Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Molten Salt Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Parabolic Troughs

- 5.1.2. Fresnel Reflector

- 5.1.3. Power Tower

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Asia Pacific

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Molten Salt Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Parabolic Troughs

- 6.1.2. Fresnel Reflector

- 6.1.3. Power Tower

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Asia Pacific Molten Salt Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Parabolic Troughs

- 7.1.2. Fresnel Reflector

- 7.1.3. Power Tower

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Europe Molten Salt Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Parabolic Troughs

- 8.1.2. Fresnel Reflector

- 8.1.3. Power Tower

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South America Molten Salt Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Parabolic Troughs

- 9.1.2. Fresnel Reflector

- 9.1.3. Power Tower

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Molten Salt Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Parabolic Troughs

- 10.1.2. Fresnel Reflector

- 10.1.3. Power Tower

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SCHOTT AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SolarReserve LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Engie SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SENER Grupo de Ingenieria S A

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Acciona S A

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Abengoa SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Yara International ASA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BrightSource Energy Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 SCHOTT AG

List of Figures

- Figure 1: Global Molten Salt Thermal Energy Storage Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Molten Salt Thermal Energy Storage Industry Revenue (billion), by Technology 2025 & 2033

- Figure 3: North America Molten Salt Thermal Energy Storage Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Molten Salt Thermal Energy Storage Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Molten Salt Thermal Energy Storage Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific Molten Salt Thermal Energy Storage Industry Revenue (billion), by Technology 2025 & 2033

- Figure 7: Asia Pacific Molten Salt Thermal Energy Storage Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 8: Asia Pacific Molten Salt Thermal Energy Storage Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Asia Pacific Molten Salt Thermal Energy Storage Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Molten Salt Thermal Energy Storage Industry Revenue (billion), by Technology 2025 & 2033

- Figure 11: Europe Molten Salt Thermal Energy Storage Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Europe Molten Salt Thermal Energy Storage Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Molten Salt Thermal Energy Storage Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Molten Salt Thermal Energy Storage Industry Revenue (billion), by Technology 2025 & 2033

- Figure 15: South America Molten Salt Thermal Energy Storage Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: South America Molten Salt Thermal Energy Storage Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Molten Salt Thermal Energy Storage Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Molten Salt Thermal Energy Storage Industry Revenue (billion), by Technology 2025 & 2033

- Figure 19: Middle East and Africa Molten Salt Thermal Energy Storage Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 20: Middle East and Africa Molten Salt Thermal Energy Storage Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Molten Salt Thermal Energy Storage Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Molten Salt Thermal Energy Storage Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Global Molten Salt Thermal Energy Storage Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Molten Salt Thermal Energy Storage Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: Global Molten Salt Thermal Energy Storage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Molten Salt Thermal Energy Storage Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 6: Global Molten Salt Thermal Energy Storage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Molten Salt Thermal Energy Storage Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 8: Global Molten Salt Thermal Energy Storage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Molten Salt Thermal Energy Storage Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 10: Global Molten Salt Thermal Energy Storage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Molten Salt Thermal Energy Storage Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 12: Global Molten Salt Thermal Energy Storage Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Molten Salt Thermal Energy Storage Industry?

The projected CAGR is approximately 9.8%.

2. Which companies are prominent players in the Molten Salt Thermal Energy Storage Industry?

Key companies in the market include SCHOTT AG, SolarReserve LLC, Engie SA, SENER Grupo de Ingenieria S A, Acciona S A, Abengoa SA, Yara International ASA, BrightSource Energy Inc.

3. What are the main segments of the Molten Salt Thermal Energy Storage Industry?

The market segments include Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.22 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Parabolic Trough Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adopting of Alternative Clean Energy Sources (Ex: Solar. Hydro).

8. Can you provide examples of recent developments in the market?

November 2022: Hyme Energy ApS announced that the company is partnering with Bornholms Energi & Forsyning (BEOF) to build its first molten salt thermal energy storage demonstrator on the Danish island of Bornholm. The storage facility is scheduled for completion in 2024 and will have a capacity of 1 MW/20 MWh. It will provide heat, power, and ancillary services to the local network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Molten Salt Thermal Energy Storage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Molten Salt Thermal Energy Storage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Molten Salt Thermal Energy Storage Industry?

To stay informed about further developments, trends, and reports in the Molten Salt Thermal Energy Storage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence