Key Insights

The Morocco Passenger Vehicles Lubricants Market is projected for substantial growth, expected to reach a market size of 220 million by 2033. With a Compound Annual Growth Rate (CAGR) of 4.8% from a 2024 base year, the market's expansion is fueled by a growing passenger vehicle fleet, driven by increasing disposable incomes and a rising middle class. This trend necessitates greater demand for essential lubricants such as engine oils, hydraulic fluids, and transmission & gear oils. Enhanced consumer awareness regarding the importance of regular maintenance and high-quality lubricants for optimal engine performance and longevity further supports market demand. Government initiatives promoting the automotive sector and infrastructure development also indirectly contribute to vehicle ownership and usage.

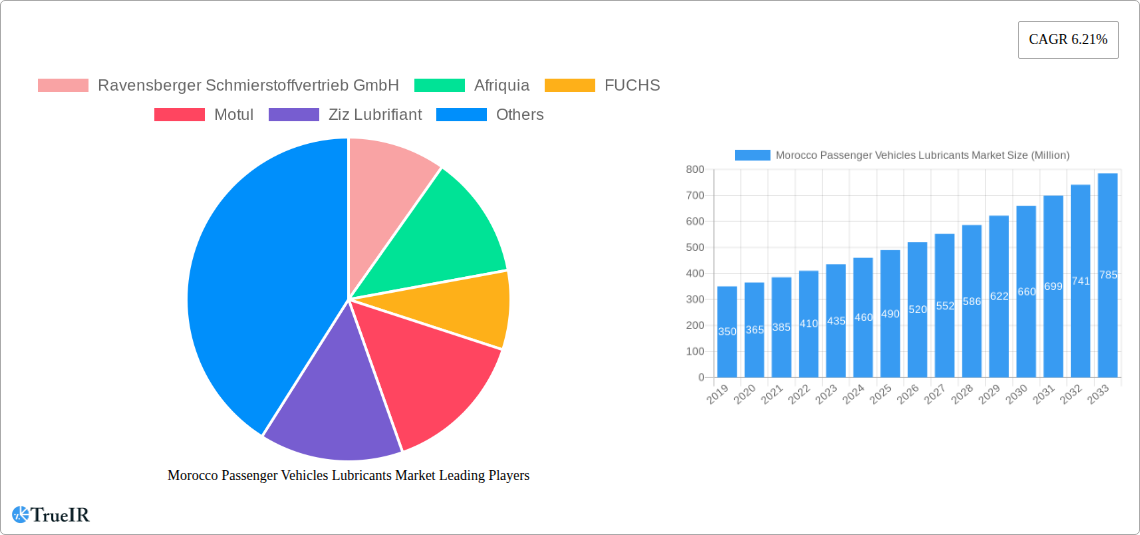

Morocco Passenger Vehicles Lubricants Market Market Size (In Million)

The competitive landscape features both global and regional players. Key contributors include Royal Dutch Shell PLC, FUCHS, and TotalEnergies, alongside local entities like Afriquia and OLA Energy. Market trends indicate a growing preference for synthetic and semi-synthetic lubricants, driven by demand for superior performance, fuel efficiency, and extended drain intervals. Technological advancements in lubricant formulations, offering improved wear protection, reduced emissions, and enhanced viscosity under extreme temperatures, are also influencing consumer choices. Potential challenges include fluctuating raw material prices, particularly for base oils, which can affect manufacturing costs. The long-term consideration of electric vehicle (EV) adoption, requiring different lubrication strategies, is noted, though its significant impact on the current passenger car lubricant market is anticipated to be gradual.

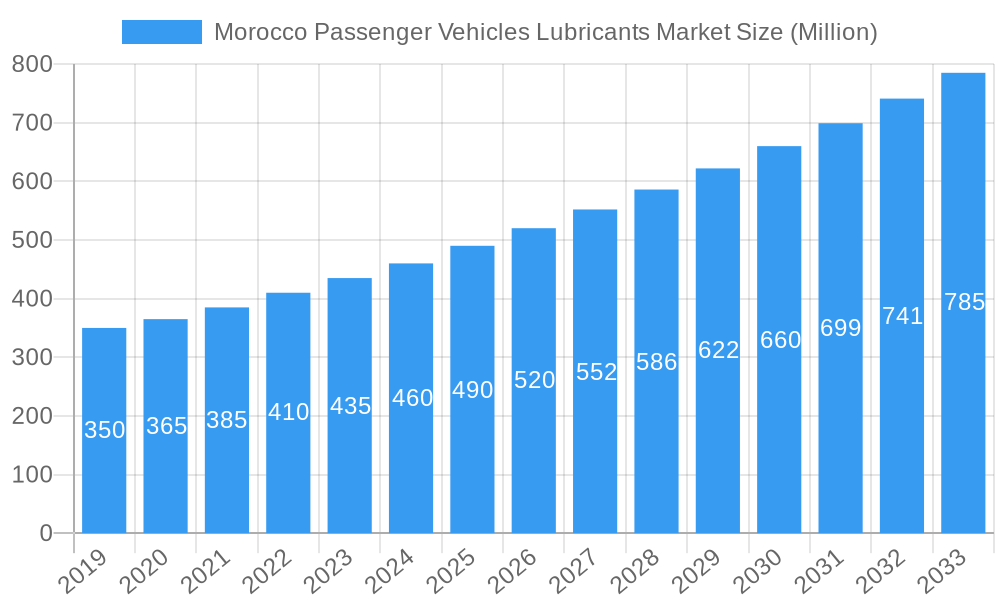

Morocco Passenger Vehicles Lubricants Market Company Market Share

Morocco Passenger Vehicles Lubricants Market Analysis, Trends, and Forecast (2024-2033)

This report offers a comprehensive analysis of the Morocco passenger vehicles lubricants market, providing critical insights into market dynamics, growth drivers, emerging trends, and future opportunities. Covering the forecast period from 2024 to 2033, with 2024 as the base year, this report is an essential resource for stakeholders seeking to understand and leverage the Moroccan automotive lubricants sector. We examine market size projections, competitive strategies, product innovations, and regulatory influences impacting passenger car lubricants in Morocco. Explore the evolving demands for vehicle maintenance products and the strategic initiatives of leading lubricant suppliers in the region.

Morocco Passenger Vehicles Lubricants Market Market Structure & Competitive Landscape

The Morocco passenger vehicles lubricants market exhibits a moderately concentrated structure, driven by established international brands and a growing presence of local players. Key innovation drivers include the demand for higher-performance engine oils, extended drain intervals, and lubricants compatible with advanced engine technologies such as turbocharging and direct injection. Regulatory impacts, primarily focused on environmental standards and vehicle emissions, are steering the development of more eco-friendly and fuel-efficient automotive lubricants. Product substitutes, while limited in high-performance applications, primarily encompass lower-grade oils or specialized fluids for niche uses. End-user segmentation reveals a strong reliance on independent workshops and authorized dealerships for lubricant purchases, with a growing interest in DIY and aftermarket channels. Mergers and acquisitions (M&A) trends are anticipated to increase as larger entities seek to expand their market share and product portfolios. For instance, recent investments by companies like OLA Energy in expanding their service station networks across North Africa, including Morocco, suggest a consolidation strategy aimed at enhancing distribution reach and brand visibility in the vehicle fluid market. The concentration ratio is estimated to be around 60-70% among the top five players, indicating a competitive yet somewhat consolidated market.

Morocco Passenger Vehicles Lubricants Market Market Trends & Opportunities

The Morocco passenger vehicles lubricants market is experiencing a robust growth trajectory, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033. This expansion is fueled by a steadily increasing passenger car parc in Morocco, driven by economic growth and rising disposable incomes, which directly translates to a higher demand for automotive engine oils, transmission fluids, and other essential vehicle maintenance lubricants. Technological shifts in engine design, leaning towards smaller displacement, turbocharged, and fuel-efficient engines, are creating a significant demand for advanced synthetic and semi-synthetic lubricants that offer superior protection, thermal stability, and extended drain intervals. Consumers are becoming more aware of the benefits of using high-quality car lubricants for engine longevity and performance, leading to a gradual shift away from conventional mineral oils towards more premium offerings. This growing consumer awareness is a key opportunity for lubricant manufacturers to educate the market and promote their advanced product lines.

The competitive dynamics within the Morocco passenger vehicles lubricants market are characterized by intense rivalry among global oil majors, independent lubricant blenders, and local distributors. Companies are increasingly focusing on product differentiation through specialized formulations, such as performance engine oils for specific vehicle types (e.g., SUVs, performance cars) and eco-friendly lubricants that meet stringent environmental regulations. The aftermarket segment for vehicle service products is a significant growth area, with opportunities for brands to build strong distribution networks and establish brand loyalty through consistent quality and effective marketing strategies. Furthermore, the increasing adoption of modern vehicle technologies necessitates the development and marketing of specialized gearbox oils, hydraulic fluids, and greases that meet the precise requirements of these systems. The expanding automotive service sector in Morocco also presents opportunities for lubricant providers to forge partnerships with workshops and service centers, ensuring wider product availability and professional application. The market penetration rate for synthetic lubricants, while still lower than in developed economies, is on an upward trend, offering substantial growth potential.

Dominant Markets & Segments in Morocco Passenger Vehicles Lubricants Market

Within the Morocco passenger vehicles lubricants market, Engine Oils stands out as the dominant segment, accounting for an estimated 65% of the total market value. This dominance is attributed to the fundamental role of engine oil in the operation and longevity of any passenger vehicle. The increasing number of vehicles on Moroccan roads, coupled with regular maintenance schedules, ensures a consistent and high demand for various types of engine oils, including conventional, synthetic blend, and full synthetic formulations. The growing popularity of vehicles equipped with advanced engine technologies, such as gasoline direct injection (GDI) and turbochargers, further propels the demand for high-performance synthetic engine oils that offer superior protection against wear, deposit formation, and thermal breakdown.

Key growth drivers for the Engine Oils segment in Morocco include:

- Increasing Vehicle Parc: A rising population and a growing middle class are leading to an increase in passenger car ownership, thereby expanding the total addressable market for engine oils.

- Technological Advancements in Engines: Modern engine designs often require specific, high-performance lubricants to ensure optimal efficiency and durability. This drives the adoption of premium synthetic and semi-synthetic engine oils.

- Consumer Awareness: As Moroccan consumers become more informed about the importance of regular maintenance and the benefits of using quality lubricants, the demand for advanced engine oils is escalating.

- Aftermarket Demand: The substantial aftermarket segment, comprising independent workshops and retail sales, plays a crucial role in driving engine oil consumption.

Beyond engine oils, Transmission & Gear Oils represent another significant segment, driven by the need for smooth gear shifting and efficient power transmission in both manual and automatic transmissions. The complexity of modern automatic transmission systems, including dual-clutch transmissions (DCTs) and continuously variable transmissions (CVTs), necessitates specialized transmission fluids with unique frictional properties and thermal stability. The growth in this segment is also linked to the increasing sophistication of vehicle powertrains and the overall expansion of the automotive maintenance products market.

Hydraulic Fluids and Greases cater to specific applications within passenger vehicles, such as power steering systems, suspension components, and various moving parts that require lubrication and protection from wear and corrosion. While these segments are smaller compared to engine oils, their demand is steadily growing, influenced by the overall expansion of the automotive aftermarket and the increasing adoption of features that rely on hydraulic systems.

Morocco Passenger Vehicles Lubricants Market Product Analysis

The Morocco passenger vehicles lubricants market is witnessing a surge in product innovations driven by the need for enhanced performance, fuel efficiency, and environmental compliance. Manufacturers are actively developing advanced synthetic and semi-synthetic engine oils that offer superior protection against wear, reduced friction, and extended drain intervals, catering to modern engine technologies. Products like Motul's recently launched CLASSIC EIGHTIES 10W-40 and CLASSIC NINETIES 10W-30 for classic cars exemplify a niche but growing market for specialized automotive lubricants. The competitive advantage lies in formulations that meet the specific viscosity grades, API, and ACEA standards required by a diverse range of passenger vehicles. Applications extend from daily commuter vehicles to high-performance cars, each demanding tailored lubricant solutions.

Key Drivers, Barriers & Challenges in Morocco Passenger Vehicles Lubricants Market

Key Drivers:

- Growing Passenger Car Parc: An increasing number of vehicles on Moroccan roads directly correlates with higher demand for automotive lubricants.

- Economic Development: Rising disposable incomes and a growing middle class are enabling more consumers to afford and maintain their vehicles with quality lubricants.

- Technological Advancements in Vehicles: Modern engines and transmissions require specialized, high-performance lubricants, driving innovation and demand for synthetic and semi-synthetic products.

- Increasing Consumer Awareness: A greater understanding of the importance of regular maintenance and the benefits of using high-quality car oils is boosting sales.

- Expansion of Aftermarket Services: A robust network of independent workshops and auto service centers facilitates the availability and sale of vehicle maintenance products.

Key Barriers & Challenges:

- Price Sensitivity: A significant portion of the market remains price-sensitive, leading to a preference for lower-cost conventional engine oils over premium alternatives.

- Counterfeit Products: The prevalence of counterfeit automotive lubricants poses a threat to genuine brands, impacting market share and consumer trust.

- Regulatory Compliance: Adhering to evolving environmental regulations and international standards for vehicle fluids can be a complex and costly process for manufacturers.

- Distribution Network Challenges: Establishing and maintaining an efficient and widespread distribution network, especially in remote areas, can be challenging for lubricant suppliers.

- Competition from Established Brands: Intense competition from well-established global and regional lubricant brands requires significant investment in marketing and product development.

Growth Drivers in the Morocco Passenger Vehicles Lubricants Market Market

The Morocco passenger vehicles lubricants market is propelled by a confluence of factors. Technologically, the increasing sophistication of passenger vehicle engines and transmissions necessitates the use of advanced synthetic and semi-synthetic lubricants to ensure optimal performance, fuel efficiency, and extended engine life. Economic growth in Morocco is leading to higher disposable incomes, enabling a larger segment of the population to purchase and maintain passenger vehicles, thus expanding the overall automotive lubricant market. Policy-driven factors, such as government initiatives to modernize the automotive sector and promote vehicle safety and environmental standards, indirectly encourage the use of high-quality car maintenance products, including lubricants. The consistent growth of the passenger car parc, driven by urbanization and a burgeoning middle class, is a fundamental economic driver for the vehicle fluid market. Furthermore, the increasing awareness among Moroccan consumers about the long-term benefits of using premium engine oils and other lubricants for vehicle longevity and performance acts as a significant market stimulus.

Challenges Impacting Morocco Passenger Vehicles Lubricants Market Growth

Several challenges impact the growth of the Morocco passenger vehicles lubricants market. Regulatory complexities surrounding the import, manufacturing, and sale of automotive lubricants can pose hurdles for both domestic and international players. Supply chain disruptions, including logistics and distribution network inefficiencies, can affect product availability and increase costs. Competitive pressures from a multitude of local and international lubricant suppliers often lead to price wars, squeezing profit margins, particularly for conventional and semi-synthetic products. The persistent issue of counterfeit vehicle maintenance products erodes brand loyalty and poses a significant threat to market integrity. Moreover, the shift towards electric vehicles (EVs) in the long term, while currently nascent in Morocco for passenger cars, represents a future challenge for the traditional internal combustion engine lubricant market. The market size for conventional lubricants is facing potential stagnation as EV adoption accelerates globally.

Key Players Shaping the Morocco Passenger Vehicles Lubricants Market Market

- Ravensberger Schmierstoffvertrieb GmbH

- Afriquia

- FUCHS

- Motul

- Ziz Lubrifiant

- TotalEnergies

- Royal Dutch Shell PLC

- Petromin Corporation

- Petrom

- OLA Energy

- Winxo

Significant Morocco Passenger Vehicles Lubricants Market Industry Milestones

- August 2021: During 2017-2020, OLA Energy invested around EUR 200 million and established 80 new service stations every year across its pan-African network, including Gabon, Morocco, Kenya, Reunion, and Egypt, significantly enhancing its distribution and retail presence in the automotive lubricants market.

- July 2021: RAVENOL and ABT Sportsline formed technical cooperation in the fields of engine oils, gearbox and limited-slip differential oils, and brake fluids, thus, bringing together first-rate experience in the high-performance category, impacting the specialty automotive fluids market.

- April 2021: Motul launched two engine oils, namely CLASSIC EIGHTIES 10W-40 and CLASSIC NINETIES 10W-30, for classic cars manufactured between the 1970s and 2000s, addressing a specific and growing niche within the classic car lubricants segment.

Future Outlook for Morocco Passenger Vehicles Lubricants Market Market

The future outlook for the Morocco passenger vehicles lubricants market is characterized by sustained growth, driven by an expanding passenger car parc and an increasing demand for higher-performance, technologically advanced lubricants. Strategic opportunities lie in the continued adoption of synthetic and semi-synthetic formulations, catering to evolving engine technologies and consumer preferences for enhanced protection and efficiency. The aftermarket segment presents a fertile ground for lubricant manufacturers to strengthen distribution networks and build brand loyalty through quality products and effective marketing. While the long-term transition towards electric vehicles may eventually impact the traditional lubricant market, the projected growth in the internal combustion engine vehicle parc in Morocco over the forecast period ensures robust demand for automotive engine oils, transmission fluids, and other essential vehicle maintenance products. Innovation in eco-friendly and fuel-saving lubricants will also be a key growth catalyst.

Morocco Passenger Vehicles Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Greases

- 1.3. Hydraulic Fluids

- 1.4. Transmission & Gear Oils

Morocco Passenger Vehicles Lubricants Market Segmentation By Geography

- 1. Morocco

Morocco Passenger Vehicles Lubricants Market Regional Market Share

Geographic Coverage of Morocco Passenger Vehicles Lubricants Market

Morocco Passenger Vehicles Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Demand for Catalytic Converters from the Automotive Industry; Increasing Demand for Platinum

- 3.2.2 Palladium

- 3.2.3 and Ruthenium from the Electronics Industry; Growing Jewelry Consumption in Asia-Pacific Countries

- 3.3. Market Restrains

- 3.3.1. High Costs Involved in Production and Maintenance; Other Restraints

- 3.4. Market Trends

- 3.4.1. Largest Segment By Product Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Morocco Passenger Vehicles Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Greases

- 5.1.3. Hydraulic Fluids

- 5.1.4. Transmission & Gear Oils

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Morocco

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ravensberger Schmierstoffvertrieb GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Afriquia

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FUCHS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Motul

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ziz Lubrifiant

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TotalEnergies

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Royal Dutch Shell PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Petromin Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Petrom

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 OLA Energy

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Winxo

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Ravensberger Schmierstoffvertrieb GmbH

List of Figures

- Figure 1: Morocco Passenger Vehicles Lubricants Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Morocco Passenger Vehicles Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: Morocco Passenger Vehicles Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Morocco Passenger Vehicles Lubricants Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 3: Morocco Passenger Vehicles Lubricants Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Morocco Passenger Vehicles Lubricants Market Volume Million Forecast, by Region 2020 & 2033

- Table 5: Morocco Passenger Vehicles Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 6: Morocco Passenger Vehicles Lubricants Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 7: Morocco Passenger Vehicles Lubricants Market Revenue million Forecast, by Country 2020 & 2033

- Table 8: Morocco Passenger Vehicles Lubricants Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Morocco Passenger Vehicles Lubricants Market?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Morocco Passenger Vehicles Lubricants Market?

Key companies in the market include Ravensberger Schmierstoffvertrieb GmbH, Afriquia, FUCHS, Motul, Ziz Lubrifiant, TotalEnergies, Royal Dutch Shell PLC, Petromin Corporation, Petrom, OLA Energy, Winxo.

3. What are the main segments of the Morocco Passenger Vehicles Lubricants Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 220 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Catalytic Converters from the Automotive Industry; Increasing Demand for Platinum. Palladium. and Ruthenium from the Electronics Industry; Growing Jewelry Consumption in Asia-Pacific Countries.

6. What are the notable trends driving market growth?

Largest Segment By Product Type : <span style="font-family: 'regular_bold';color:#0e7db3;">Engine Oils</span>.

7. Are there any restraints impacting market growth?

High Costs Involved in Production and Maintenance; Other Restraints.

8. Can you provide examples of recent developments in the market?

August 2021: During 2017-2020, OLA Energy invested around EUR 200 million and established 80 new service stations every year across its pan-African network, including Gabon, Morocco, Kenya, Reunion, and Egypt.July 2021: RAVENOL and ABT Sportsline formed technical cooperation in the fields of engine oils, gearbox and limited-slip differential oils, and brake fluids, thus, bringing together first-rate experience in the high-performance category.April 2021: Motul launched two engine oils, namely CLASSIC EIGHTIES 10W-40 and CLASSIC NINETIES 10W-30, for classic cars manufactured between the 1970s and 2000s.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Morocco Passenger Vehicles Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Morocco Passenger Vehicles Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Morocco Passenger Vehicles Lubricants Market?

To stay informed about further developments, trends, and reports in the Morocco Passenger Vehicles Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence