Key Insights

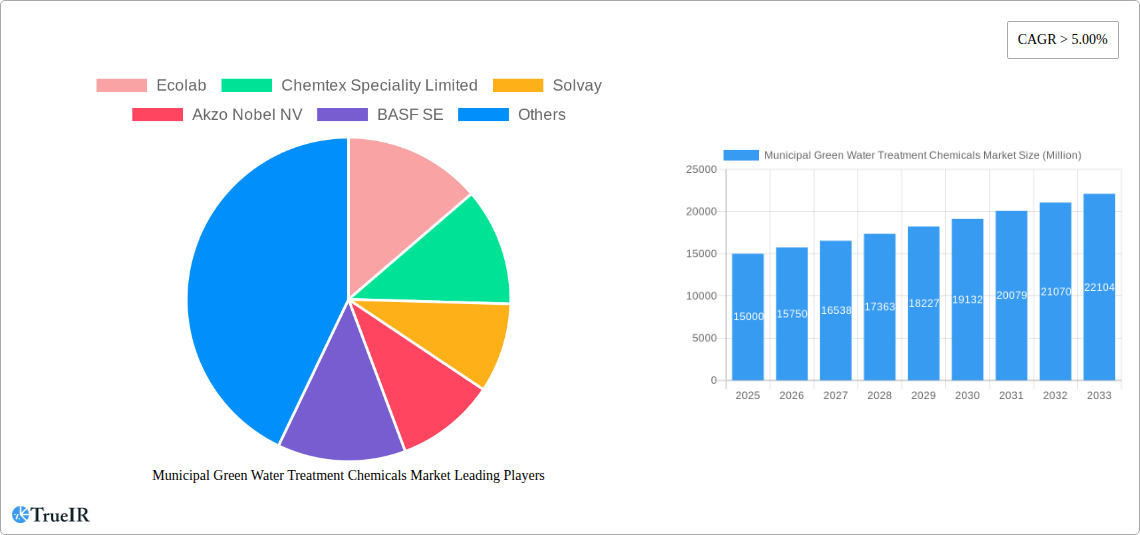

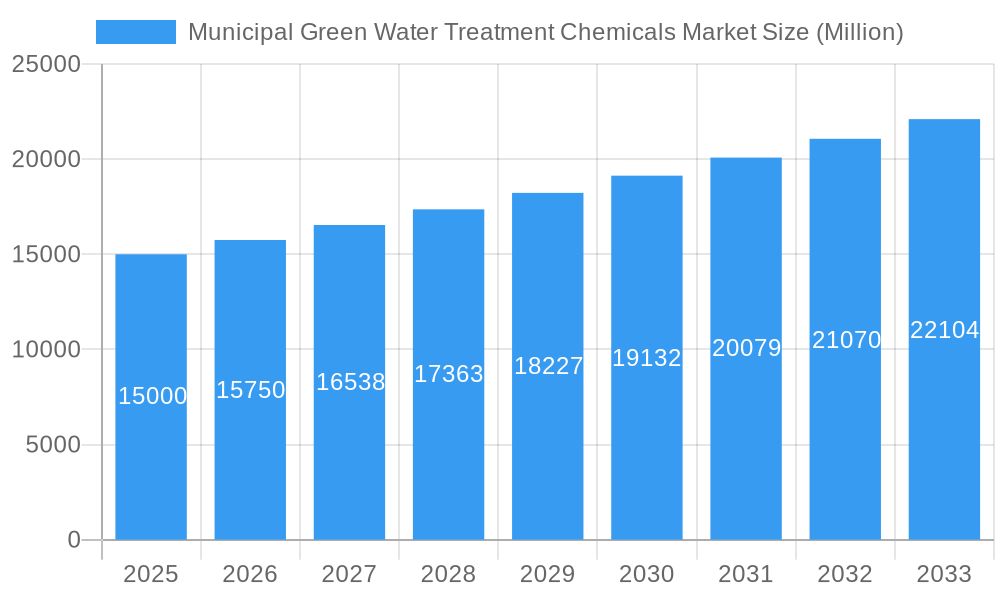

The global municipal green water treatment chemicals market is experiencing robust growth, driven by increasing urbanization, stringent environmental regulations, and a growing focus on sustainable water management practices. A CAGR exceeding 5% indicates a significant expansion projected through 2033. Key drivers include the rising demand for potable water, the need to treat wastewater effectively to protect ecosystems, and a shift towards eco-friendly chemical solutions with minimal environmental impact. The market is segmented by product type, with biocides and disinfectants, coagulants and flocculants, and corrosion and scale inhibitors holding significant market share, reflecting the crucial roles these chemicals play in water purification. Growth is further fueled by technological advancements leading to the development of more efficient and environmentally benign treatment solutions. Major players like Ecolab, Chemtex Speciality Limited, and Solvay are actively shaping the market landscape through innovation and strategic partnerships. Geographic growth is varied, with regions like Asia Pacific experiencing rapid expansion due to large-scale infrastructure development and increasing industrial activity. However, market penetration in less developed regions presents significant opportunities for future growth. While the market faces challenges such as fluctuating raw material prices and the need for continuous technological upgrades to meet evolving regulatory standards, the overall growth trajectory remains positive, promising substantial market expansion in the coming years.

Municipal Green Water Treatment Chemicals Market Market Size (In Billion)

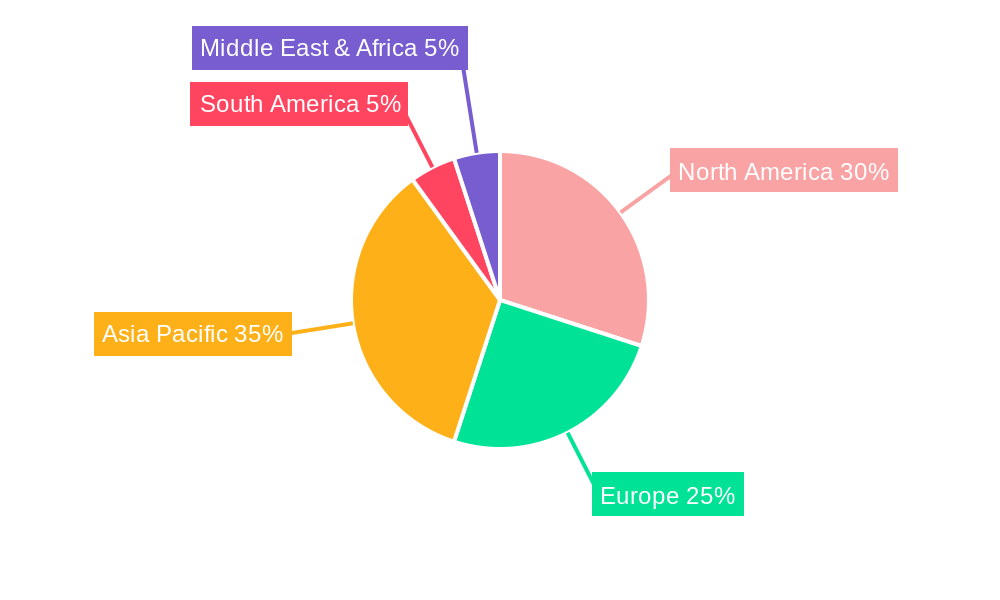

The North American market, particularly the United States, is expected to maintain a strong position due to its robust infrastructure and well-established water treatment industry. However, the Asia-Pacific region, driven by rapid industrialization and urbanization in countries such as China and India, is projected to witness the most significant growth, potentially surpassing North America in market share within the forecast period. Europe and other regions will also contribute to the overall market growth, albeit at a comparatively slower pace. The market's dynamic nature requires continuous adaptation to evolving environmental regulations, including the development of greener chemicals and sustainable treatment processes. This will involve investments in research and development, creating opportunities for both established players and emerging companies to contribute to the advancement of municipal green water treatment technology and solutions.

Municipal Green Water Treatment Chemicals Market Company Market Share

Municipal Green Water Treatment Chemicals Market: A Comprehensive Market Analysis (2019-2033)

This dynamic report offers a comprehensive analysis of the Municipal Green Water Treatment Chemicals market, providing invaluable insights for stakeholders across the value chain. Leveraging rigorous research and data analysis spanning the period 2019-2033 (Historical Period: 2019-2024; Base Year: 2025; Estimated Year: 2025; Forecast Period: 2025-2033), this report unveils key trends, opportunities, and challenges shaping this rapidly evolving market. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Municipal Green Water Treatment Chemicals Market Market Structure & Competitive Landscape

The Municipal Green Water Treatment Chemicals market exhibits a moderately consolidated structure, with key players like Ecolab, Chemtex Speciality Limited, Solvay, Akzo Nobel NV, BASF SE, and others holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx in 2025, indicating a moderately competitive landscape. Innovation is a key driver, with companies investing heavily in R&D to develop eco-friendly and high-performance chemicals. Regulatory changes concerning water quality standards and environmental protection significantly influence market dynamics. Product substitution, driven by advancements in green technologies, poses both opportunities and challenges. End-user segmentation is primarily driven by the size and requirements of municipal water treatment plants. The market has witnessed moderate M&A activity in recent years, with xx number of deals recorded between 2019 and 2024, primarily focused on expanding product portfolios and geographical reach.

- Market Concentration: HHI estimated at xx in 2025.

- Innovation Drivers: R&D investments in bio-based and sustainable chemicals.

- Regulatory Impacts: Stringent water quality standards and environmental regulations.

- Product Substitutes: Growing adoption of advanced oxidation processes and membrane technologies.

- End-User Segmentation: Municipal water treatment plants, categorized by size and capacity.

- M&A Trends: xx number of mergers and acquisitions between 2019 and 2024.

Municipal Green Water Treatment Chemicals Market Market Trends & Opportunities

The Municipal Green Water Treatment Chemicals market is experiencing robust growth, driven by increasing urbanization, rising water pollution concerns, and stringent government regulations promoting water quality. Technological advancements, such as the development of more efficient and sustainable treatment technologies, are creating new opportunities for market expansion. Shifting consumer preferences toward environmentally friendly products are further bolstering market growth. The market is witnessing intensified competition, with companies focusing on innovation, cost optimization, and strategic partnerships to maintain a competitive edge. The market penetration rate for green water treatment chemicals is estimated at xx% in 2025 and is projected to increase to xx% by 2033.

Dominant Markets & Segments in Municipal Green Water Treatment Chemicals Market

The North American region currently dominates the Municipal Green Water Treatment Chemicals market, driven by stringent environmental regulations, robust infrastructure investments, and a high concentration of major players. Within product types, the Coagulant and Flocculant segment holds the largest market share, followed by Biocide and Disinfectant.

Key Growth Drivers in North America:

- Stringent environmental regulations and water quality standards.

- Significant investments in water infrastructure development and upgrades.

- High adoption rate of advanced water treatment technologies.

Key Growth Drivers in the Coagulant and Flocculant Segment:

- Increasing demand for effective and efficient water treatment solutions.

- Growing awareness of waterborne diseases and the need for improved water quality.

- Technological advancements leading to the development of superior coagulants and flocculants.

Key Growth Drivers in the Biocide and Disinfectant Segment:

- Increasing prevalence of waterborne diseases and the need for effective disinfection.

- Growing demand for environmentally friendly biocides and disinfectants.

- Stringent regulations regarding the use of harmful chemicals in water treatment.

The detailed analysis of market dominance across various regions and product types highlights significant growth potential in developing economies, driven by increasing urbanization and industrialization.

Municipal Green Water Treatment Chemicals Market Product Analysis

The market is witnessing a surge in product innovation, with companies focusing on developing eco-friendly, high-performance chemicals. These advancements include the development of bio-based coagulants, biodegradable disinfectants, and advanced oxidation processes. Such innovations are driven by stringent environmental regulations and a growing preference for sustainable solutions. The competitive advantage lies in delivering superior performance, cost-effectiveness, and environmental compatibility.

Key Drivers, Barriers & Challenges in Municipal Green Water Treatment Chemicals Market

Key Drivers: Growing environmental concerns, stringent government regulations on water quality, increasing urbanization and industrialization, and technological advancements are driving market growth. For example, the implementation of stricter discharge limits for wastewater is pushing municipalities to adopt more effective and environmentally friendly treatment methods.

Key Barriers & Challenges: Supply chain disruptions, fluctuating raw material prices, and the complexity of regulatory compliance pose significant challenges. Furthermore, intense competition and the potential for product substitution create pricing pressure and necessitate continuous innovation. These challenges contribute to an estimated xx% reduction in market growth rate.

Growth Drivers in the Municipal Green Water Treatment Chemicals Market Market

Stringent environmental regulations, coupled with rising urbanization and industrialization, are fueling the demand for efficient water treatment solutions. Technological advancements, particularly in green chemistry and sustainable technologies, are creating new opportunities for market expansion. Government initiatives promoting water conservation and improved water quality further bolster market growth.

Challenges Impacting Municipal Green Water Treatment Chemicals Market Growth

Regulatory complexities and evolving environmental standards create uncertainty and increased costs for manufacturers. Supply chain disruptions and fluctuations in raw material prices impact production and profitability. Intense competition from established players and the emergence of new technologies require continuous innovation and adaptation for market survival. These factors collectively pose a significant impediment to market growth.

Key Players Shaping the Municipal Green Water Treatment Chemicals Market Market

- Ecolab

- Chemtex Speciality Limited

- Solvay

- Akzo Nobel NV

- BASF SE

- Arkema Group

- Accepta The Water Treatment Products Company

- SUEZ

- Kemira

- DuPont

- Chemtrade Logistics Inc

- ChemTreat Inc

- Solenis

- Lonza

- Thermax Global

- Veolia

- American Water Chemicals Inc

- Albemarle Corporation

- Avista Technologies Inc

Significant Municipal Green Water Treatment Chemicals Market Industry Milestones

- 2021: Ecolab launched a new line of sustainable coagulants.

- 2022: Solvay acquired a smaller water treatment chemicals company, expanding its product portfolio.

- 2023: New EU regulations on water quality came into effect, impacting market dynamics.

- 2024: BASF invested heavily in R&D for developing bio-based water treatment chemicals. (Further milestones to be added based on available data).

Future Outlook for Municipal Green Water Treatment Chemicals Market Market

The Municipal Green Water Treatment Chemicals market is poised for continued growth, driven by increasing demand for sustainable and efficient water treatment solutions. Strategic partnerships, technological advancements, and expanding regulatory requirements will shape market dynamics. Opportunities abound for companies investing in R&D, sustainable product development, and global expansion. The market's growth trajectory is influenced by continued government support for clean water initiatives and consumer awareness of environmentally responsible practices.

Municipal Green Water Treatment Chemicals Market Segmentation

-

1. Product Type

- 1.1. Biocide and Disinfectant

- 1.2. Coagulant and Flocculant

- 1.3. Corrosion and Scale Inhibitor

- 1.4. Defoamer and Defoaming Agent

- 1.5. pH Adjuster and Softener

- 1.6. Others

Municipal Green Water Treatment Chemicals Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. United Kingdom

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Municipal Green Water Treatment Chemicals Market Regional Market Share

Geographic Coverage of Municipal Green Water Treatment Chemicals Market

Municipal Green Water Treatment Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand in Asia-Pacific and Middle East & Africa; Rising Environmental Concerns for Release of Toxic Wastes

- 3.3. Market Restrains

- 3.3.1. ; Dearth of Awareness Regarding Chemical Water Treatment Technologies; Other Restraints

- 3.4. Market Trends

- 3.4.1. Corrosion and Scale Inhibitors to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Municipal Green Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Biocide and Disinfectant

- 5.1.2. Coagulant and Flocculant

- 5.1.3. Corrosion and Scale Inhibitor

- 5.1.4. Defoamer and Defoaming Agent

- 5.1.5. pH Adjuster and Softener

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East

- 5.2.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific Municipal Green Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Biocide and Disinfectant

- 6.1.2. Coagulant and Flocculant

- 6.1.3. Corrosion and Scale Inhibitor

- 6.1.4. Defoamer and Defoaming Agent

- 6.1.5. pH Adjuster and Softener

- 6.1.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. North America Municipal Green Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Biocide and Disinfectant

- 7.1.2. Coagulant and Flocculant

- 7.1.3. Corrosion and Scale Inhibitor

- 7.1.4. Defoamer and Defoaming Agent

- 7.1.5. pH Adjuster and Softener

- 7.1.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Municipal Green Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Biocide and Disinfectant

- 8.1.2. Coagulant and Flocculant

- 8.1.3. Corrosion and Scale Inhibitor

- 8.1.4. Defoamer and Defoaming Agent

- 8.1.5. pH Adjuster and Softener

- 8.1.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Municipal Green Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Biocide and Disinfectant

- 9.1.2. Coagulant and Flocculant

- 9.1.3. Corrosion and Scale Inhibitor

- 9.1.4. Defoamer and Defoaming Agent

- 9.1.5. pH Adjuster and Softener

- 9.1.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East Municipal Green Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Biocide and Disinfectant

- 10.1.2. Coagulant and Flocculant

- 10.1.3. Corrosion and Scale Inhibitor

- 10.1.4. Defoamer and Defoaming Agent

- 10.1.5. pH Adjuster and Softener

- 10.1.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Saudi Arabia Municipal Green Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Biocide and Disinfectant

- 11.1.2. Coagulant and Flocculant

- 11.1.3. Corrosion and Scale Inhibitor

- 11.1.4. Defoamer and Defoaming Agent

- 11.1.5. pH Adjuster and Softener

- 11.1.6. Others

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Ecolab

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Chemtex Speciality Limited

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Solvay

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Akzo Nobel NV

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 BASF SE

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Arkema Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Accepta The Water Treatment Products Company

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 SUEZ

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Kemira

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 DuPont

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Chemtrade Logistics Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 ChemTreat Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Solenis

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Lonza

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Thermax Global

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Veolia*List Not Exhaustive

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 American Water Chemicals Inc

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.18 Albemarle Corporation

- 12.2.18.1. Overview

- 12.2.18.2. Products

- 12.2.18.3. SWOT Analysis

- 12.2.18.4. Recent Developments

- 12.2.18.5. Financials (Based on Availability)

- 12.2.19 Avista Technologies Inc

- 12.2.19.1. Overview

- 12.2.19.2. Products

- 12.2.19.3. SWOT Analysis

- 12.2.19.4. Recent Developments

- 12.2.19.5. Financials (Based on Availability)

- 12.2.1 Ecolab

List of Figures

- Figure 1: Global Municipal Green Water Treatment Chemicals Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Municipal Green Water Treatment Chemicals Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: Asia Pacific Municipal Green Water Treatment Chemicals Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Asia Pacific Municipal Green Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: Asia Pacific Municipal Green Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Municipal Green Water Treatment Chemicals Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 7: North America Municipal Green Water Treatment Chemicals Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 8: North America Municipal Green Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Municipal Green Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Municipal Green Water Treatment Chemicals Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 11: Europe Municipal Green Water Treatment Chemicals Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Municipal Green Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Municipal Green Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Municipal Green Water Treatment Chemicals Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: South America Municipal Green Water Treatment Chemicals Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: South America Municipal Green Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America Municipal Green Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East Municipal Green Water Treatment Chemicals Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 19: Middle East Municipal Green Water Treatment Chemicals Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Middle East Municipal Green Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Middle East Municipal Green Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Saudi Arabia Municipal Green Water Treatment Chemicals Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 23: Saudi Arabia Municipal Green Water Treatment Chemicals Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Saudi Arabia Municipal Green Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Saudi Arabia Municipal Green Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Municipal Green Water Treatment Chemicals Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Municipal Green Water Treatment Chemicals Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Municipal Green Water Treatment Chemicals Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 4: Global Municipal Green Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: China Municipal Green Water Treatment Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: India Municipal Green Water Treatment Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Japan Municipal Green Water Treatment Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: South Korea Municipal Green Water Treatment Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Rest of Asia Pacific Municipal Green Water Treatment Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Municipal Green Water Treatment Chemicals Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 11: Global Municipal Green Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: United States Municipal Green Water Treatment Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Canada Municipal Green Water Treatment Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Mexico Municipal Green Water Treatment Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Global Municipal Green Water Treatment Chemicals Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 16: Global Municipal Green Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Germany Municipal Green Water Treatment Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Municipal Green Water Treatment Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: United Kingdom Municipal Green Water Treatment Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Italy Municipal Green Water Treatment Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Municipal Green Water Treatment Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Municipal Green Water Treatment Chemicals Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 23: Global Municipal Green Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Brazil Municipal Green Water Treatment Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Argentina Municipal Green Water Treatment Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Rest of South America Municipal Green Water Treatment Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Global Municipal Green Water Treatment Chemicals Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 28: Global Municipal Green Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Global Municipal Green Water Treatment Chemicals Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 30: Global Municipal Green Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: South Africa Municipal Green Water Treatment Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Rest of Middle East Municipal Green Water Treatment Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Municipal Green Water Treatment Chemicals Market?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Municipal Green Water Treatment Chemicals Market?

Key companies in the market include Ecolab, Chemtex Speciality Limited, Solvay, Akzo Nobel NV, BASF SE, Arkema Group, Accepta The Water Treatment Products Company, SUEZ, Kemira, DuPont, Chemtrade Logistics Inc, ChemTreat Inc, Solenis, Lonza, Thermax Global, Veolia*List Not Exhaustive, American Water Chemicals Inc, Albemarle Corporation, Avista Technologies Inc.

3. What are the main segments of the Municipal Green Water Treatment Chemicals Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand in Asia-Pacific and Middle East & Africa; Rising Environmental Concerns for Release of Toxic Wastes.

6. What are the notable trends driving market growth?

Corrosion and Scale Inhibitors to Dominate the Market.

7. Are there any restraints impacting market growth?

; Dearth of Awareness Regarding Chemical Water Treatment Technologies; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Municipal Green Water Treatment Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Municipal Green Water Treatment Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Municipal Green Water Treatment Chemicals Market?

To stay informed about further developments, trends, and reports in the Municipal Green Water Treatment Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence