Key Insights

The North American agricultural irrigation machinery market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by several key factors. Increasing water scarcity in various agricultural regions across North America, coupled with rising demand for efficient irrigation solutions to maximize crop yields, is a primary growth driver. The adoption of precision irrigation technologies, such as drip irrigation and sprinkler systems with advanced sensor integration and automation, is gaining traction, enhancing water-use efficiency and reducing operational costs. Furthermore, government initiatives promoting sustainable agricultural practices and water conservation are fostering market expansion. The market is segmented by irrigation type (sprinkler, drip, other) and crop type (crop, non-crop), with drip irrigation systems experiencing significant growth due to their superior water efficiency compared to traditional sprinkler systems. Major players like The Toro Company, Jain Irrigation Systems Ltd, and Rain Bird Corporation are actively investing in research and development, introducing innovative products to cater to evolving farmer needs and technological advancements. The United States, being the largest agricultural producer in North America, constitutes a significant market share, followed by Canada and Mexico. Market growth, however, is expected to be slightly tempered by fluctuating commodity prices and the initial high investment costs associated with advanced irrigation technologies.

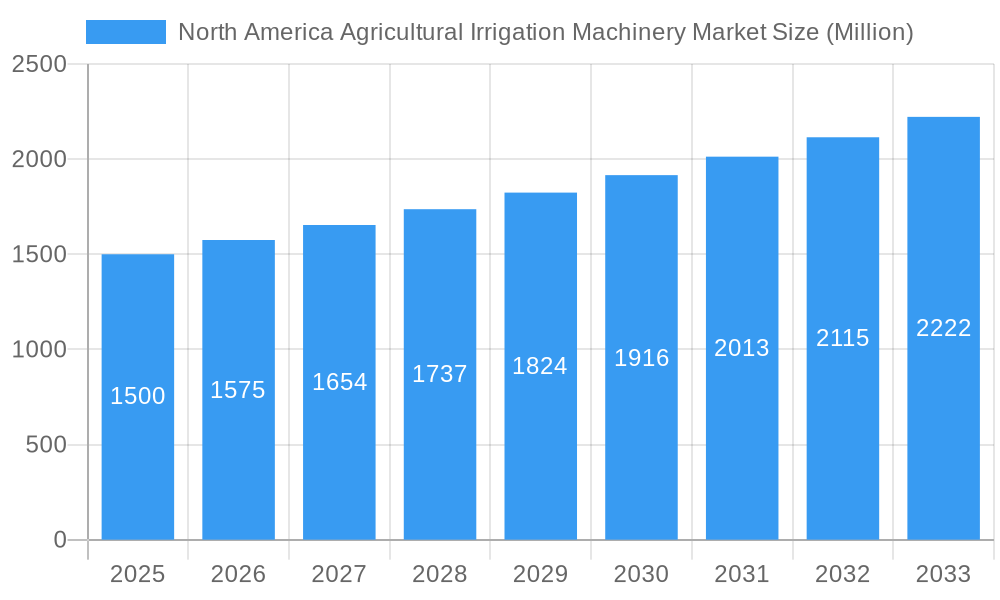

North America Agricultural Irrigation Machinery Market Market Size (In Billion)

The forecast period of 2025-2033 anticipates a continued expansion of the North American agricultural irrigation machinery market, with a projected CAGR of 5.10%. This growth is likely to be influenced by advancements in smart irrigation technologies, increasing adoption of precision agriculture techniques, and a growing awareness among farmers regarding the importance of efficient water management for sustainable agriculture. The market will likely witness consolidation among key players, with mergers and acquisitions driving increased market share for established companies. Furthermore, the emergence of innovative business models, such as irrigation-as-a-service, could contribute to market expansion by increasing accessibility and affordability of advanced irrigation technologies for smaller farms. The competitive landscape is characterized by both established players and emerging technological innovators, creating a dynamic and constantly evolving market landscape.

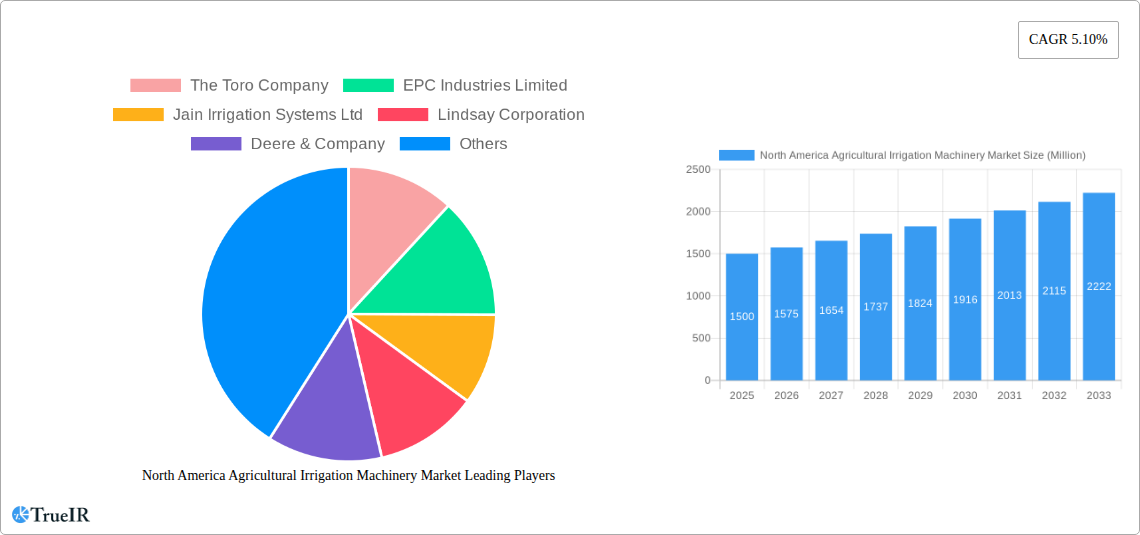

North America Agricultural Irrigation Machinery Market Company Market Share

North America Agricultural Irrigation Machinery Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the North America Agricultural Irrigation Machinery market, offering invaluable insights for industry stakeholders, investors, and researchers. Leveraging extensive data analysis and expert forecasts, this report covers the period from 2019 to 2033, with a focus on the current market landscape and future growth trajectory. The report uses 2025 as the base year and provides estimations for the same year. The forecast period spans from 2025 to 2033, while the historical period examined is 2019-2024.

North America Agricultural Irrigation Machinery Market Structure & Competitive Landscape

The North American agricultural irrigation machinery market exhibits a moderately concentrated structure, with key players such as The Toro Company, Deere & Company, Lindsay Corporation, and Valmont Industries holding significant market share. The market concentration ratio (CR4) is estimated at xx%, indicating a degree of oligopolistic competition. Innovation is a major driver, with companies continually investing in developing water-efficient irrigation technologies, precision agriculture solutions, and smart irrigation systems. Stringent environmental regulations, particularly concerning water usage and sustainability, significantly impact market dynamics, encouraging the adoption of water-saving technologies. Substitutes for agricultural irrigation machinery include manual irrigation methods, although their efficiency and scalability are limited. End-users primarily consist of large-scale commercial farms and agricultural businesses, alongside smaller farms and individual landowners, creating distinct segments with varying needs and purchasing power. Mergers and acquisitions (M&A) activity has been moderate in recent years, with xx M&A deals recorded between 2019 and 2024, primarily focused on consolidating market share and expanding product portfolios. Further consolidation is anticipated as companies seek to leverage economies of scale and enhance their technological capabilities. The market is witnessing a shift towards automation and data-driven solutions, demanding enhanced technical capabilities and collaborations.

North America Agricultural Irrigation Machinery Market Market Trends & Opportunities

The North American agricultural irrigation machinery market is experiencing robust growth, driven by increasing demand for efficient irrigation solutions in response to water scarcity concerns and the growing need for increased crop yields. The market size is estimated at $xx Million in 2025 and is projected to reach $xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Technological advancements, particularly in precision irrigation, sensor technology, and automation, are transforming the industry, leading to improved water use efficiency and reduced operational costs. Consumer preferences are shifting towards sustainable and environmentally friendly irrigation solutions, fueling demand for drip irrigation systems and water-smart technologies. Competitive dynamics are characterized by ongoing innovation, strategic partnerships, and mergers & acquisitions, with established players and emerging technology companies vying for market share. Market penetration of advanced irrigation systems remains relatively low in certain regions, presenting significant opportunities for growth, particularly in areas with water stress or inefficient irrigation practices. The increasing adoption of precision agriculture techniques and the rising integration of IoT (Internet of Things) devices within irrigation systems are further expected to bolster market growth.

Dominant Markets & Segments in North America Agricultural Irrigation Machinery Market

The Western United States stands as the dominant region within the North American agricultural irrigation machinery market due to its extensive agricultural lands and prevalent water scarcity challenges. California, in particular, accounts for a substantial share due to its intensive agricultural activities and ongoing water management policies.

By Irrigation Type:

- Drip Irrigation: This segment is experiencing the fastest growth, fueled by its high water-use efficiency and suitability for various crops. Government incentives and awareness campaigns promoting water conservation are further driving its adoption.

- Sprinkler Irrigation: Although a mature segment, sprinkler irrigation continues to hold a significant market share due to its wide applicability and relatively lower initial investment costs. However, its growth is projected to be slower than that of drip irrigation.

- Other: This category includes various emerging irrigation technologies like subsurface drip irrigation and micro-sprinklers, which are gradually gaining traction due to their precise water delivery and increased efficiency.

By Crop Type:

- Crop: The crop segment dominates the market, with high demand from major crop producers for efficient and reliable irrigation systems to ensure optimal yields.

- Non-Crop: The non-crop segment, comprising landscaping, turf management, and other non-agricultural applications, is exhibiting steady growth, driven by the increasing demand for water-efficient landscaping solutions in urban and suburban areas.

Key Growth Drivers:

- Government initiatives promoting water conservation: Several government agencies and programs provide financial incentives and support for the adoption of efficient irrigation technologies.

- Growing awareness of water scarcity: Water scarcity is becoming an increasingly pressing issue across North America, driving the demand for water-efficient irrigation solutions.

- Increasing adoption of precision agriculture: Farmers are increasingly adopting precision agriculture techniques, including variable rate irrigation, to optimize water use and improve crop yields.

North America Agricultural Irrigation Machinery Market Product Analysis

Technological advancements are shaping the product landscape, with a focus on developing smart irrigation systems equipped with sensors, data analytics, and automation capabilities. These systems offer greater precision, efficiency, and remote monitoring capabilities, enhancing water management and optimizing resource allocation. The competitive advantage lies in offering innovative features, superior water-use efficiency, easy integration with precision agriculture platforms, and robust after-sales support. Products are categorized by type, capacity, and features, catering to the diverse needs of end-users. The market is witnessing the increasing adoption of cloud-based platforms for data management and analysis, enhancing the operational efficiency and decision-making capabilities of farmers.

Key Drivers, Barriers & Challenges in North America Agricultural Irrigation Machinery Market

Key Drivers:

- Increasing water scarcity in several regions is driving demand for water-efficient irrigation technologies.

- Growing adoption of precision agriculture and smart farming technologies.

- Government policies and incentives promoting water conservation and efficient irrigation practices.

Challenges & Restraints:

High initial investment costs associated with advanced irrigation systems can hinder adoption, especially among smaller farms. Supply chain disruptions and fluctuating raw material prices can impact the availability and cost of irrigation machinery. Stringent environmental regulations and compliance requirements can add complexity and costs for manufacturers and users. Competition from established players and new entrants can pressure profit margins and limit growth opportunities. These factors combined can potentially reduce the market's overall growth rate by approximately xx% by 2033.

Growth Drivers in the North America Agricultural Irrigation Machinery Market Market

Key drivers include increasing awareness of water scarcity, governmental support for water-efficient technologies, the rising adoption of precision agriculture, and technological advancements in irrigation systems (e.g., IoT integration, automation). Economic growth in the agricultural sector also stimulates investment in advanced irrigation equipment.

Challenges Impacting North America Agricultural Irrigation Machinery Market Growth

Challenges include high upfront investment costs, potential supply chain disruptions, stringent environmental regulations, and intense competition among established players and new entrants. These factors can collectively hinder market expansion and limit the adoption of advanced irrigation technologies.

Key Players Shaping the North America Agricultural Irrigation Machinery Market Market

- The Toro Company

- EPC Industries Limited

- Jain Irrigation Systems Ltd

- Lindsay Corporation

- Deere & Company

- T-L Irrigation Co

- Rain Bird Corporation

- Nelson Irrigation Corporation

- Netafim Limited

- Valmont Industries

Significant North America Agricultural Irrigation Machinery Market Industry Milestones

- 2021: Introduction of a new line of smart irrigation controllers by Lindsay Corporation, featuring advanced data analytics capabilities.

- 2022: Merger of two smaller irrigation equipment manufacturers, leading to increased market consolidation.

- 2023: Launch of a government initiative providing subsidies for the adoption of water-efficient irrigation technologies in California.

- 2024: Several key players announce partnerships to develop integrated precision agriculture solutions incorporating advanced irrigation systems.

Future Outlook for North America Agricultural Irrigation Machinery Market Market

The North America Agricultural Irrigation Machinery market is poised for continued growth, driven by sustained investment in water-efficient technologies and the expansion of precision agriculture practices. Strategic opportunities lie in developing innovative solutions that address water scarcity challenges, improve operational efficiency, and reduce environmental impact. The market potential is substantial, particularly in regions with water stress and growing agricultural production needs. The increasing integration of technology within irrigation systems will continue to transform the industry, creating new avenues for growth and innovation.

North America Agricultural Irrigation Machinery Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

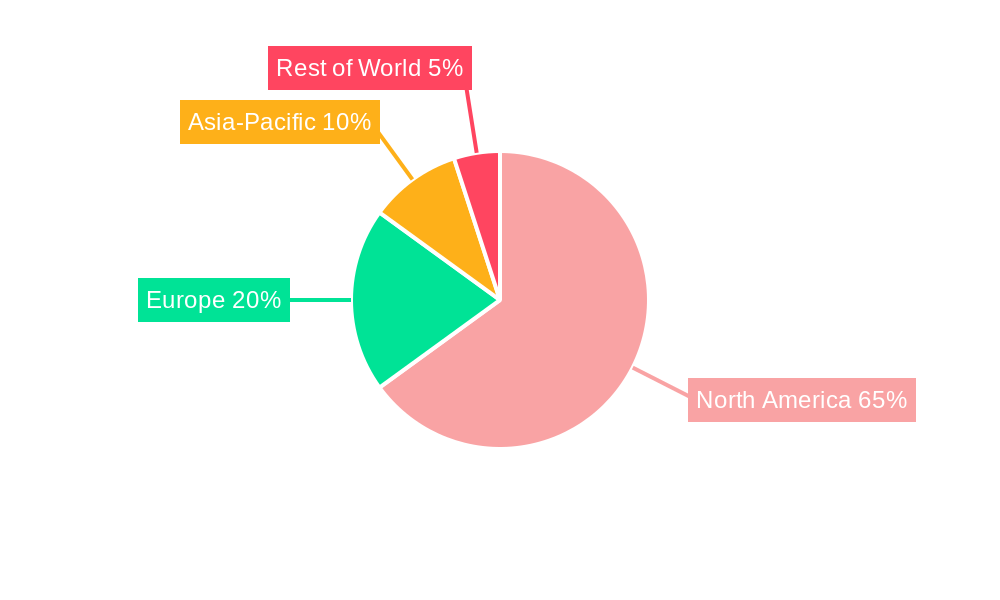

North America Agricultural Irrigation Machinery Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Agricultural Irrigation Machinery Market Regional Market Share

Geographic Coverage of North America Agricultural Irrigation Machinery Market

North America Agricultural Irrigation Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Declining Labour Availability and Rising Cost of Farm Labour; Rapid Technological Advancements by Key Players

- 3.3. Market Restrains

- 3.3.1. High Cost of Agricultural Machinery and Repair; Data Privacy Concerns in Modern Farming

- 3.4. Market Trends

- 3.4.1. Increasing Water Scarcity Driving the Adoption of Micro-irrigation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Agricultural Irrigation Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Toro Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EPC Industries Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jain Irrigation Systems Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lindsay Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Deere & Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 T-L Irrigation Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rain Bird Corporatio

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nelson Irrigation Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Netafim Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Valmont Industries

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Toro Company

List of Figures

- Figure 1: North America Agricultural Irrigation Machinery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Agricultural Irrigation Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States North America Agricultural Irrigation Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Agricultural Irrigation Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Agricultural Irrigation Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Agricultural Irrigation Machinery Market?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the North America Agricultural Irrigation Machinery Market?

Key companies in the market include The Toro Company, EPC Industries Limited, Jain Irrigation Systems Ltd, Lindsay Corporation, Deere & Company, T-L Irrigation Co, Rain Bird Corporatio, Nelson Irrigation Corporation, Netafim Limited, Valmont Industries.

3. What are the main segments of the North America Agricultural Irrigation Machinery Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Declining Labour Availability and Rising Cost of Farm Labour; Rapid Technological Advancements by Key Players.

6. What are the notable trends driving market growth?

Increasing Water Scarcity Driving the Adoption of Micro-irrigation.

7. Are there any restraints impacting market growth?

High Cost of Agricultural Machinery and Repair; Data Privacy Concerns in Modern Farming.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Agricultural Irrigation Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Agricultural Irrigation Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Agricultural Irrigation Machinery Market?

To stay informed about further developments, trends, and reports in the North America Agricultural Irrigation Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence