Key Insights

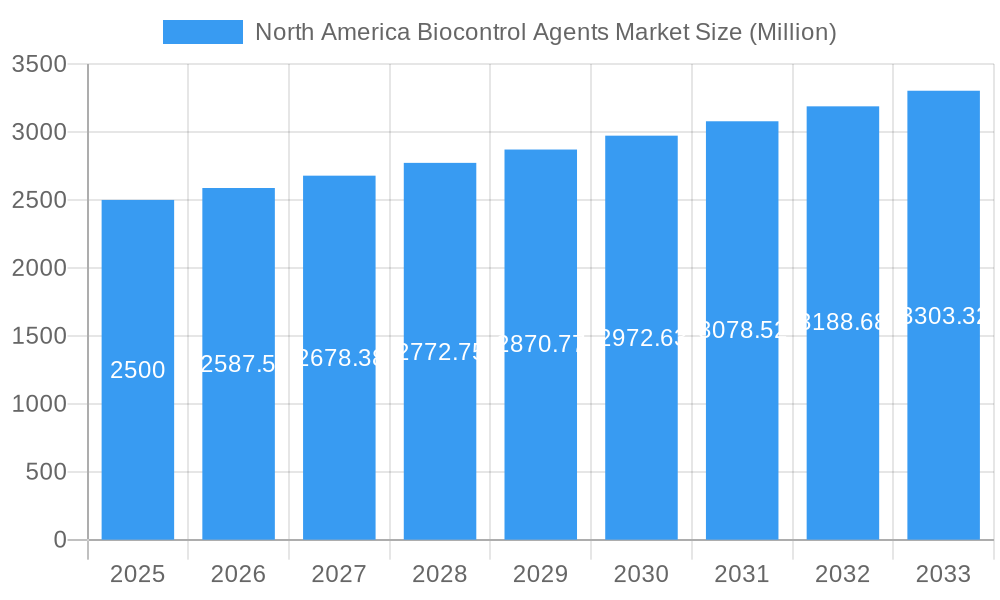

The North America biocontrol agents market, encompassing microbial and other biocontrol agents utilized across various crops (cash, horticultural, and row), is experiencing steady growth. Driven by increasing consumer demand for pesticide-free produce, stringent government regulations on synthetic pesticides, and a growing awareness of environmental sustainability, the market is projected to maintain a Compound Annual Growth Rate (CAGR) of 3.50% from 2025 to 2033. The market's segmentation reveals a significant share held by microbial agents, reflecting their efficacy and broader acceptance in integrated pest management (IPM) strategies. Geographically, the United States represents the largest market segment within North America, followed by Canada and Mexico, with the latter showing promising growth potential due to its expanding agricultural sector and increasing adoption of sustainable farming practices. Key players in this market, including Koppert Biological Systems Inc., Bioline AgroSciences Ltd., and others, are strategically focusing on research and development to introduce innovative and effective biocontrol solutions. This is further fueled by collaborative efforts with research institutions and government agencies promoting the adoption of biocontrol agents.

North America Biocontrol Agents Market Market Size (In Billion)

The market's growth trajectory, however, faces some challenges. The high initial investment required for biocontrol agent implementation, coupled with inconsistent efficacy in specific pest control scenarios, can hinder widespread adoption. Furthermore, the relatively longer application time compared to chemical pesticides may pose a constraint for farmers seeking immediate pest control. Nonetheless, ongoing technological advancements, such as improved formulations and targeted delivery systems, are mitigating these challenges. The market is expected to see increased penetration in horticultural and cash crops, driven by higher profit margins and consumer preferences for high-quality, sustainably produced fruits and vegetables. Future growth will likely hinge on addressing affordability concerns, providing comprehensive technical support to farmers, and demonstrating consistent and reliable results across diverse agricultural settings. The increasing investment in research and development of novel biocontrol agents and the rising awareness of sustainable agriculture practices will further drive the market's growth in the forecast period.

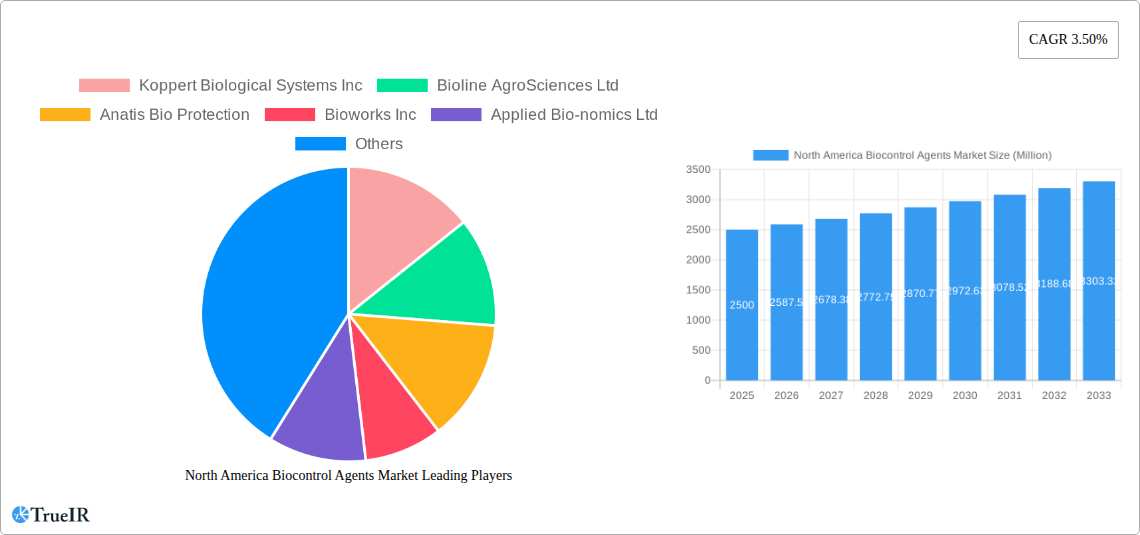

North America Biocontrol Agents Market Company Market Share

This comprehensive report provides an in-depth analysis of the North America biocontrol agents market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). It offers valuable insights for stakeholders, including manufacturers, distributors, investors, and regulatory bodies, seeking to understand market dynamics and capitalize on emerging opportunities within this rapidly growing sector. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

North America Biocontrol Agents Market Structure & Competitive Landscape

The North America biocontrol agents market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. However, the market also features numerous smaller, specialized companies, particularly in the niche segments of microbial biocontrol agents and specific crop applications. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately competitive market structure.

Key Factors Shaping the Market:

- Innovation Drivers: Continuous research and development efforts are driving the introduction of novel biocontrol agents with enhanced efficacy and broader application ranges. This includes advancements in formulation technologies and the development of agents targeting specific pests and diseases.

- Regulatory Impacts: Regulatory frameworks governing the approval and use of biocontrol agents vary across North America, impacting market access and adoption rates. Stringent regulations in some regions can act as a barrier to entry for new players.

- Product Substitutes: Conventional chemical pesticides remain a significant substitute for biocontrol agents. However, growing concerns about environmental impacts and consumer demand for organic produce are driving a gradual shift toward biocontrol solutions.

- End-User Segmentation: The market caters to diverse end-users, including large-scale commercial farms, smallholder farmers, horticultural businesses, and landscaping companies. Market penetration varies significantly across these segments.

- M&A Trends: The market has witnessed several mergers and acquisitions (M&As) in recent years, primarily driven by larger companies seeking to expand their product portfolios and geographic reach. The total value of M&A deals in the period 2019-2024 is estimated at xx Million. Examples include the 2022 merger of Andermatt Biocontrol AG with Andermatt Group AG.

North America Biocontrol Agents Market Market Trends & Opportunities

The North America biocontrol agents market is experiencing robust growth, driven by several key factors. The rising global demand for organic and sustainably produced food is a primary driver, as biocontrol agents offer a viable alternative to synthetic pesticides. Increasing awareness of the environmental and human health risks associated with chemical pesticides is further fueling the market’s expansion. Technological advancements, such as the development of novel formulation technologies and targeted biocontrol agents, are enhancing the efficacy and applicability of biocontrol agents. The market penetration rate of biocontrol agents in the North American agricultural sector is estimated at xx% in 2025, with significant growth potential in the coming years. The market is projected to reach xx Million by 2033, fueled by a CAGR of xx%. This growth is influenced by factors including increasing consumer demand for organic products, stringent regulations on chemical pesticides, and the rising adoption of sustainable agricultural practices. Competitive dynamics are also influencing growth, with established companies engaging in strategic partnerships and M&A activities to expand their market share.

Dominant Markets & Segments in North America Biocontrol Agents Market

The United States represents the largest market for biocontrol agents in North America, driven by factors including extensive agricultural production, a well-established agricultural research infrastructure, and relatively higher consumer awareness of sustainable agriculture practices. The horticultural crops segment exhibits the highest growth rate, owing to the increasing demand for organic and sustainably grown fruits and vegetables.

Key Growth Drivers:

- United States: Strong agricultural sector, advanced research infrastructure, supportive government policies promoting sustainable agriculture.

- Horticultural Crops: High consumer demand for organic produce, intensive farming practices requiring effective pest and disease management.

- Macrobials: Established use, relatively lower cost compared to other biocontrol agents.

Market Dominance Analysis:

The dominance of the United States is largely due to its substantial agricultural output, well-developed infrastructure, and supportive regulatory environment. The horticultural crops segment's high growth is fueled by strong consumer preference for organically grown produce and the need for effective pest and disease control in intensive farming systems. Macrobials, being well-established and relatively cost-effective, hold a larger market share compared to other microbial agents. Mexico's market is expanding, boosted by investments and the opening of Andermatt Group AG’s subsidiary.

North America Biocontrol Agents Market Product Analysis

Significant advancements in biocontrol agent technologies have led to the development of novel products with enhanced efficacy, improved shelf life, and easier application methods. These innovations are expanding the range of applications for biocontrol agents and driving market growth. Companies are actively developing targeted biocontrol agents and formulations designed to address specific pest and disease issues prevalent in different crops and regions. The successful market fit of these products depends on several factors, including efficacy, cost-effectiveness, ease of application, and regulatory compliance.

Key Drivers, Barriers & Challenges in North America Biocontrol Agents Market

Key Drivers:

- Growing demand for organic produce: Consumers are increasingly seeking organically grown food, driving demand for sustainable pest management solutions.

- Stringent regulations on chemical pesticides: Government regulations restricting the use of certain chemical pesticides are pushing farmers to adopt biocontrol agents.

- Technological advancements: Improvements in formulation technologies and the discovery of novel biocontrol agents are enhancing efficacy and application.

Challenges and Restraints:

The efficacy of some biocontrol agents can vary depending on environmental conditions, posing challenges for consistent pest control. Supply chain complexities, particularly in procuring specific microbial strains, can hinder market expansion. Regulatory hurdles and approval processes for new biocontrol agents can delay market entry and create uncertainty for companies. Competition from established chemical pesticide manufacturers also poses a challenge.

Growth Drivers in the North America Biocontrol Agents Market Market

The increasing consumer preference for organic food significantly impacts market growth. Government regulations that limit the use of chemical pesticides are propelling adoption of biocontrol agents. Furthermore, advancements in formulation technologies and the identification of new biocontrol agents improve efficacy and expand applicability, contributing to market growth.

Challenges Impacting North America Biocontrol Agents Market Growth

Regulatory complexities involved in biocontrol agent approval create delays. Inconsistent efficacy across varying environmental conditions can limit adoption. The substantial cost of developing new biocontrol agents and building effective supply chains also presents challenges. Finally, competition from conventional chemical pesticides continues to pose a significant barrier.

Key Players Shaping the North America Biocontrol Agents Market Market

- Koppert Biological Systems Inc

- Bioline AgroSciences Ltd

- Anatis Bio Protection

- Bioworks Inc

- Applied Bio-nomics Ltd

- Crop Defenders Ltd

- Biobee Ltd

- Beneficial Insectary Inc

- Andermatt Group AG

- Arizona Biological Control Inc

Significant North America Biocontrol Agents Market Industry Milestones

- January 2022: Beneficial Insectary and The Association for Counseling, Education & Support launched Shasta Force Farm, promoting chemical-free farming.

- January 2022: Andermatt Biocontrol AG merged with Andermatt Group AG, streamlining operations.

- September 2022: Andermatt Group AG opened a subsidiary in Mexico, expanding its reach.

Future Outlook for North America Biocontrol Agents Market Market

The North America biocontrol agents market is poised for continued robust growth, fueled by the convergence of factors such as increasing consumer demand for sustainably produced food, stricter regulations on chemical pesticides, and continuous technological advancements leading to enhanced biocontrol agent efficacy and application. Strategic partnerships and M&A activity among market players are likely to further shape market dynamics, presenting significant opportunities for innovation and market expansion. The market is well-positioned to capture a significant share of the broader pest management market in the coming years.

North America Biocontrol Agents Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

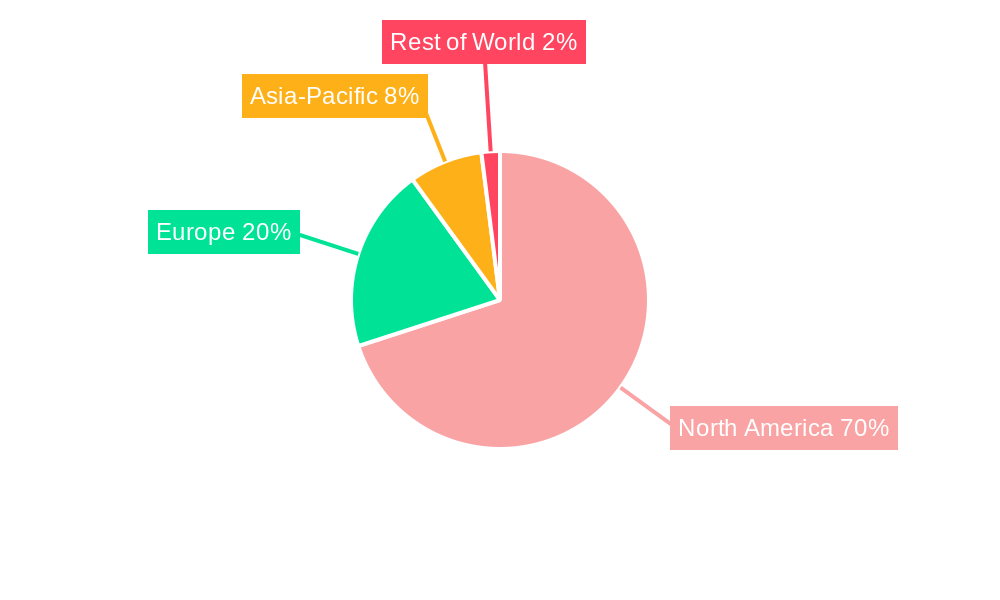

North America Biocontrol Agents Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Biocontrol Agents Market Regional Market Share

Geographic Coverage of North America Biocontrol Agents Market

North America Biocontrol Agents Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Increase in Adoption of Hybrid Seeds

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Biocontrol Agents Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Koppert Biological Systems Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bioline AgroSciences Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Anatis Bio Protection

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bioworks Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Applied Bio-nomics Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Crop Defenders Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Biobee Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Beneficial Insectary Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Andermatt Group AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Arizona Biological Control Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Koppert Biological Systems Inc

List of Figures

- Figure 1: North America Biocontrol Agents Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Biocontrol Agents Market Share (%) by Company 2025

List of Tables

- Table 1: North America Biocontrol Agents Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Biocontrol Agents Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Biocontrol Agents Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Biocontrol Agents Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Biocontrol Agents Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Biocontrol Agents Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: North America Biocontrol Agents Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Biocontrol Agents Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Biocontrol Agents Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Biocontrol Agents Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Biocontrol Agents Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Biocontrol Agents Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States North America Biocontrol Agents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Biocontrol Agents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Biocontrol Agents Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Biocontrol Agents Market?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the North America Biocontrol Agents Market?

Key companies in the market include Koppert Biological Systems Inc, Bioline AgroSciences Ltd, Anatis Bio Protection, Bioworks Inc, Applied Bio-nomics Ltd, Crop Defenders Ltd, Biobee Ltd, Beneficial Insectary Inc, Andermatt Group AG, Arizona Biological Control Inc.

3. What are the main segments of the North America Biocontrol Agents Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Increase in Adoption of Hybrid Seeds.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

September 2022: Andermatt Group AG opened its subsidiary in Mexico under the same segment with an aim to deliver Mexican farms with different biological solutions. This move helped the company strengthen its presence in Mexico.January 2022: Beneficial Insectary and The Association for Counseling, Education & Support started Shasta Force Farm with an aim to educate the farming community on the importance of chemical-free farming, providing fresh produce and garden healing therapy.January 2022: The company announced the merger of Andermatt Biocontrol AG with Andermatt Group AG, with all companies reporting directly to Andermatt Group AG. The merger increased the effectiveness of the management and simplified the company's structure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Biocontrol Agents Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Biocontrol Agents Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Biocontrol Agents Market?

To stay informed about further developments, trends, and reports in the North America Biocontrol Agents Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence