Key Insights

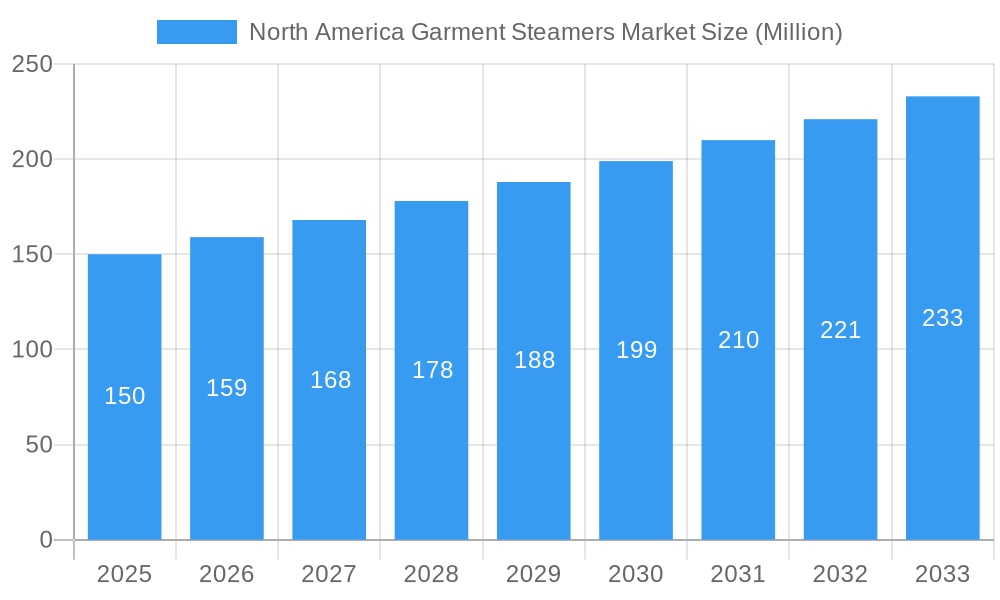

The North America garment steamers market, valued at approximately $150 million in 2025, is projected to experience steady growth, driven by several key factors. The increasing demand for convenient and efficient clothing care solutions among busy consumers fuels this market expansion. Consumers are increasingly opting for garment steamers over traditional ironing, primarily due to their ease of use, time-saving capabilities, and suitability for delicate fabrics. The rise in online retail channels, offering a wider variety of products and brands, further contributes to market growth. The market is segmented by product type (handheld, upright, tank type - fixed and removable), distribution channel (multi-brand stores, specialty stores, online, and other channels), and geography (United States, Canada, and Rest of North America). Handheld steamers dominate the product type segment due to their portability and affordability, while online sales are rapidly gaining traction, exceeding specialty stores in terms of market share.

North America Garment Steamers Market Market Size (In Million)

This growth is anticipated to continue at a Compound Annual Growth Rate (CAGR) of 5.67% from 2025 to 2033, reaching an estimated market value of approximately $250 million by 2033. While competitive intensity among established players like Panasonic, Groupe SEB SA, Philips, and Haier remains high, the market also presents opportunities for smaller brands to cater to niche consumer demands and preferences. Factors such as fluctuating raw material prices and increasing consumer awareness of environmentally friendly alternatives could potentially pose constraints on market growth. However, the ongoing development of innovative features, such as steam intensity control and advanced fabric protection technologies, is likely to offset these challenges and maintain the market's positive trajectory. The United States accounts for the largest share of the North American market, owing to its larger consumer base and higher disposable income levels compared to Canada.

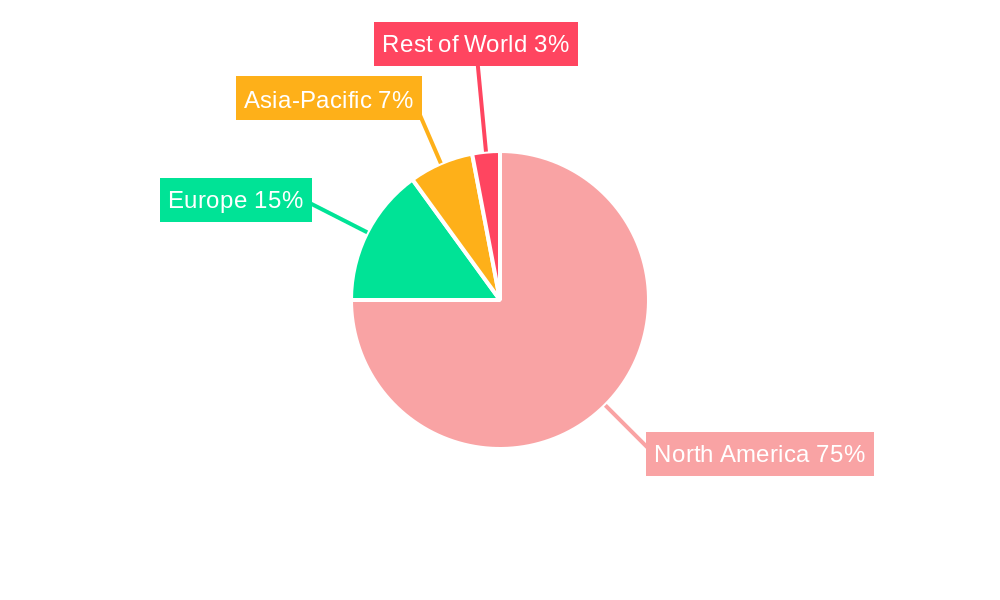

North America Garment Steamers Market Company Market Share

North America Garment Steamers Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America garment steamers market, covering the period from 2019 to 2033. It offers invaluable insights into market size, growth drivers, competitive dynamics, and future trends, empowering businesses to make informed strategic decisions. The report meticulously examines key segments, including product type (handheld, upright), tank type (fixed, removable), distribution channels (multi-brand stores, specialty stores, online, others), and geographic regions (United States, Canada, Rest of North America). Leading players like Panasonic, Groupe SEB SA, Philips, Haier Group Corporation, Reliable Corporation, Pursteam, Salav, Maryant, Jiffy Steamer Company, and Midea are thoroughly analyzed, providing a complete picture of this dynamic market.

North America Garment Steamers Market Structure & Competitive Landscape

The North American garment steamers market exhibits a moderately concentrated structure, with the top five players holding an estimated 40% market share in 2025. Innovation, particularly in areas such as steam technology and design, is a key driver of growth. Regulatory changes related to energy efficiency and product safety also influence market dynamics. The market faces competition from alternative clothing care methods, such as dry cleaning and laundry services. The end-user segment is largely comprised of consumers and businesses in the hospitality and retail sectors. Mergers and acquisitions (M&A) activity has been moderate in recent years, with a noticeable increase in the past two years with a total of xx M&A deals recorded between 2019 and 2024, indicating consolidation in the sector. This trend is expected to accelerate, particularly with increased investments of xx Million USD in the sector.

- Market Concentration: High (Top 5 players holding 40% market share in 2025)

- Innovation Drivers: Improved steam technology, ergonomic designs, smart features.

- Regulatory Impacts: Energy efficiency standards, product safety regulations.

- Product Substitutes: Dry cleaning services, traditional ironing.

- End-User Segmentation: Consumers, hospitality industry, retail businesses.

- M&A Trends: Moderate activity, increasing in recent years.

North America Garment Steamers Market Trends & Opportunities

The North American garment steamers market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. This growth is driven by several factors, including rising disposable incomes, increased consumer awareness of garment care, and the convenience offered by steamers compared to traditional ironing. Technological advancements are leading to the introduction of lightweight and more efficient models. Consumer preferences are shifting towards cordless and handheld steamers that promote ease of use and mobility. The increasing popularity of online shopping also boosts market penetration, especially for online retailers which hold xx% market share. Competitive dynamics are shaping the market, with companies focusing on product differentiation and brand building. Market penetration rates are steadily increasing, driven by affordability and convenience factors.

Dominant Markets & Segments in North America Garment Steamers Market

The United States constitutes the largest market for garment steamers in North America, accounting for xx% of the total market value in 2025. Handheld steamers dominate the product type segment, with an estimated xx% market share due to their affordability and versatility. Removable tank steamers are increasingly popular, offering greater convenience in terms of refilling water. Online channels dominate distribution, accounting for xx% of sales in 2025, due to increased online shopping and retailer accessibility.

- Key Growth Drivers in the United States: Strong consumer demand, established retail infrastructure, high disposable incomes.

- Key Growth Drivers in Canada: Growing urban population, rising middle class, increased adoption of convenient household appliances.

- Key Growth Drivers in Handheld Segment: Affordability, portability, and ease of use.

- Key Growth Drivers in Removable Tank Segment: Convenience, longer steaming time.

- Key Growth Drivers in Online Distribution: Increased e-commerce penetration, wider product selection, competitive pricing.

North America Garment Steamers Market Product Analysis

Recent innovations in garment steamers focus on enhancing steam output, improving portability, and integrating smart features. The market is witnessing a shift towards cordless models with longer steaming times and improved ergonomics. Features such as adjustable steam settings and multiple attachments cater to diverse consumer needs. These features improve market fit, enabling penetration into different consumer segments, thereby increasing adoption.

Key Drivers, Barriers & Challenges in North America Garment Steamers Market

Key Drivers: Rising disposable incomes, increased awareness of garment care, technological advancements in steamer design and steam technology, and the convenience offered by steamers compared to ironing.

Challenges: Intense competition among established players, potential supply chain disruptions, and fluctuating raw material prices, impacting overall production costs and profit margins by approximately xx%.

Growth Drivers in the North America Garment Steamers Market

The market's growth is fueled by rising disposable incomes, a shift towards convenient home appliances, and continuous technological improvements resulting in more efficient and user-friendly steamers. Government initiatives promoting energy-efficient appliances also contribute positively.

Challenges Impacting North America Garment Steamers Market Growth

Challenges include intense competition from established brands, the potential for supply chain disruptions, and the fluctuating cost of raw materials impacting production efficiency. Furthermore, increasing consumer awareness of potential environmental impacts and increased regulatory scrutiny around manufacturing could pose further challenges.

Key Players Shaping the North America Garment Steamers Market

- Panasonic

- Groupe SEB SA

- Philips

- Haier Group Corporation

- Reliable Corporation

- Pursteam

- Salav

- Maryant

- Jiffy Steamer Company

- Midea

Significant North America Garment Steamers Market Industry Milestones

- April 2022: Hillhouse Capital acquired Philips' home appliances business, potentially leading to increased investment and market expansion in garment steamers.

- February 2023: Haier Group Corporation launched 83 new smart home products, including potentially relevant appliances that could indirectly influence the garment steamer market through synergies or technological crossovers.

Future Outlook for North America Garment Steamers Market

The North America garment steamers market is poised for continued growth, driven by ongoing technological innovation, increased consumer demand for convenience, and the expanding e-commerce sector. Strategic partnerships, product diversification, and expansion into new markets present significant opportunities for market players. The market is projected to witness sustained growth and increased market penetration across various segments and geographic regions, offering lucrative opportunities for established players and new entrants.

North America Garment Steamers Market Segmentation

-

1. Product Type

- 1.1. Handheld

- 1.2. Upright

-

2. Tank Type

- 2.1. Fixed

- 2.2. Removable

-

3. Distribution Channel

- 3.1. Multi brands store

- 3.2. Speciality Store

- 3.3. Online

- 3.4. Other Distribution Channel

North America Garment Steamers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Garment Steamers Market Regional Market Share

Geographic Coverage of North America Garment Steamers Market

North America Garment Steamers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Gentle and Safe on Fabrics

- 3.3. Market Restrains

- 3.3.1. Availability of Alternatives

- 3.4. Market Trends

- 3.4.1. United States Leading the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Garment Steamers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Handheld

- 5.1.2. Upright

- 5.2. Market Analysis, Insights and Forecast - by Tank Type

- 5.2.1. Fixed

- 5.2.2. Removable

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Multi brands store

- 5.3.2. Speciality Store

- 5.3.3. Online

- 5.3.4. Other Distribution Channel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Groupe SEB SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Philips

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Haier Group Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Reliable Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pursteam

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Salav

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Maryant

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Jiffy Steamer Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Midea

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: North America Garment Steamers Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Garment Steamers Market Share (%) by Company 2025

List of Tables

- Table 1: North America Garment Steamers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: North America Garment Steamers Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: North America Garment Steamers Market Revenue Million Forecast, by Tank Type 2020 & 2033

- Table 4: North America Garment Steamers Market Volume K Unit Forecast, by Tank Type 2020 & 2033

- Table 5: North America Garment Steamers Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: North America Garment Steamers Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: North America Garment Steamers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Garment Steamers Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: North America Garment Steamers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: North America Garment Steamers Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: North America Garment Steamers Market Revenue Million Forecast, by Tank Type 2020 & 2033

- Table 12: North America Garment Steamers Market Volume K Unit Forecast, by Tank Type 2020 & 2033

- Table 13: North America Garment Steamers Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: North America Garment Steamers Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: North America Garment Steamers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Garment Steamers Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States North America Garment Steamers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States North America Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada North America Garment Steamers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Garment Steamers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Garment Steamers Market?

The projected CAGR is approximately 5.67%.

2. Which companies are prominent players in the North America Garment Steamers Market?

Key companies in the market include Panasonic, Groupe SEB SA, Philips, Haier Group Corporation, Reliable Corporation, Pursteam, Salav, Maryant, Jiffy Steamer Company, Midea.

3. What are the main segments of the North America Garment Steamers Market?

The market segments include Product Type, Tank Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Gentle and Safe on Fabrics.

6. What are the notable trends driving market growth?

United States Leading the Market.

7. Are there any restraints impacting market growth?

Availability of Alternatives.

8. Can you provide examples of recent developments in the market?

February 2023: Haier Group Corporation expanded its product portfolio with the launch of 83 new-age products of smart home solutions. Among the products, it includes Android and Google-certified Smart LED TVs, Wi-Fi-enabled Washing Machines, the new Clean Cool Range of ACs with the largest indoor unit in the industry, and Smart Refrigerators.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Garment Steamers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Garment Steamers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Garment Steamers Market?

To stay informed about further developments, trends, and reports in the North America Garment Steamers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence