Key Insights

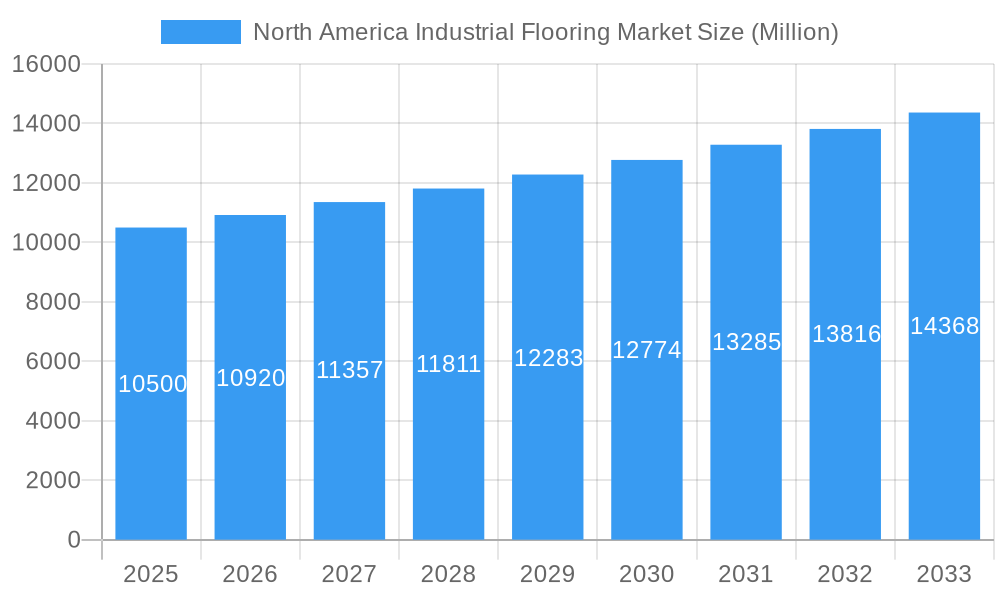

The North American industrial flooring market is poised for robust growth, projected to surpass $10.5 billion in 2025 and expand at a Compound Annual Growth Rate (CAGR) exceeding 4.00% through 2033. This expansion is fueled by a confluence of escalating demand for durable, low-maintenance, and highly functional flooring solutions across a diverse range of industries. Key drivers include the increasing need for resilient and hygienic surfaces in the food and beverage and healthcare sectors, the rising adoption of advanced materials like epoxy and polyaspartic for their superior chemical resistance and rapid curing times in chemical and transportation facilities, and the general trend towards infrastructure upgrades and new construction projects. The transportation and aviation sector, in particular, presents significant opportunities due to the stringent requirements for impact resistance, abrasion, and chemical spill containment.

North America Industrial Flooring Market Market Size (In Billion)

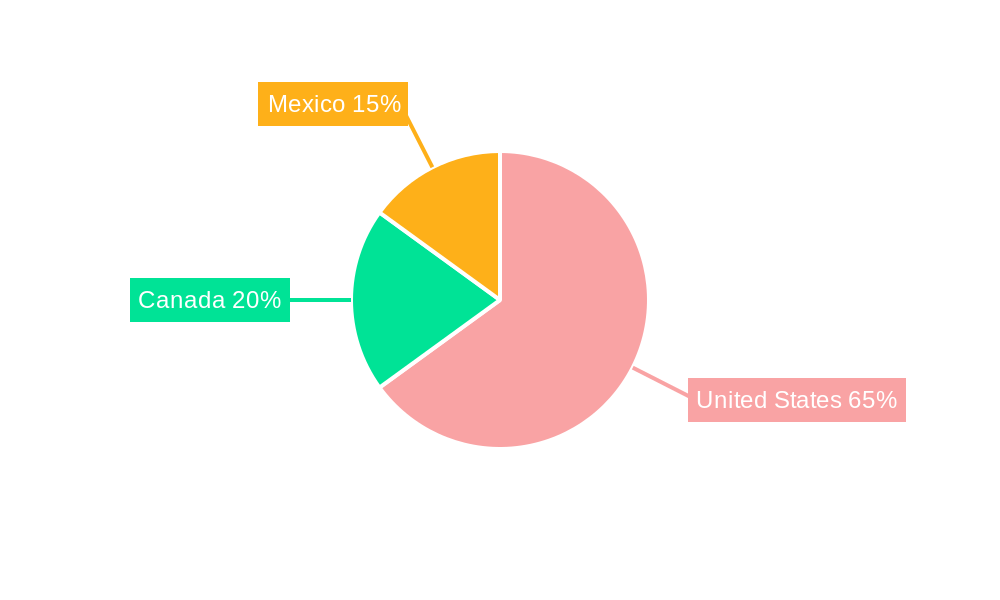

The market is segmented by resin type, application, end-user industry, and geography, with resin types like Epoxy, Polyaspartic, and Polyurethane dominating due to their exceptional performance characteristics. Applications on concrete and wood are the most prevalent, reflecting their widespread use in industrial settings. Geographically, the United States commands the largest market share, driven by its vast industrial base and high investment in manufacturing and infrastructure. Canada and Mexico are also contributing significantly to market growth, with increasing industrialization and adoption of modern flooring technologies. Leading companies such as Stonhard, Tremco Incorporated, RPM International Inc., MBCC Group, and Sherwin-Williams Company are actively innovating and expanding their product portfolios to cater to these evolving market demands, focusing on sustainability, enhanced performance, and customized solutions.

North America Industrial Flooring Market Company Market Share

Here is a dynamic, SEO-optimized report description for the North America Industrial Flooring Market:

This in-depth report provides a comprehensive analysis of the North America Industrial Flooring Market, a critical sector underpinning the operational efficiency and safety of diverse industries. Spanning the historical period of 2019-2024, with a base year of 2025 and a robust forecast extending to 2033, this study delves into the intricate market dynamics, trends, and opportunities shaping the future of industrial flooring solutions across the United States, Canada, and Mexico. Our analysis leverages high-volume keywords such as "industrial flooring," "epoxy flooring," "polyaspartic coatings," "urethane flooring," "concrete coatings," "food and beverage flooring," "chemical plant flooring," "transportation flooring," "healthcare facility flooring," and "industrial floor coatings" to ensure maximum search visibility and engagement with industry professionals, manufacturers, specifiers, and investors.

North America Industrial Flooring Market Market Structure & Competitive Landscape

The North America Industrial Flooring Market exhibits a moderately consolidated structure, characterized by a blend of established global players and specialized regional providers. Key innovation drivers stem from the demand for enhanced durability, chemical resistance, anti-microbial properties, and rapid installation times across various end-user industries. Regulatory impacts, particularly concerning environmental sustainability and worker safety standards, are increasingly influencing material choices and application methods. Product substitutes, while present, often fall short of the specialized performance characteristics offered by advanced industrial flooring systems. The market is segmented by resin type (Epoxy, Polyaspartic, Polyurethane, Acrylic, Other Resin Types), application (Concrete, Wood, Other Applications), and end-user industry (Food and Beverage, Chemical, Transportation and Aviation, Healthcare, Other End-user Industries). Mergers and acquisitions (M&A) play a significant role in market consolidation and expansion, with recent activities aimed at synergizing expertise and geographical reach. For instance, the acquisition of Kalman Floor Company by Twintec USA underscores this trend, enhancing capabilities in design and construction of specialized flooring solutions. The concentration ratio within the top five players is estimated to be around 40-50%, indicating room for smaller players and niche market penetration.

North America Industrial Flooring Market Market Trends & Opportunities

The North America Industrial Flooring Market is poised for significant expansion, driven by sustained industrial growth, increasing awareness of safety and hygiene standards, and the continuous evolution of material science. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period of 2025-2033. Technological shifts are central to this growth, with a notable rise in the adoption of high-performance materials like polyaspartic and advanced epoxy formulations that offer superior abrasion resistance, faster curing times, and enhanced chemical inertness. These advancements cater to the stringent requirements of demanding sectors such as food and beverage, chemical processing, and healthcare. Consumer preferences are increasingly leaning towards flooring solutions that minimize operational downtime, reduce maintenance costs, and contribute to a safer and more productive working environment. The demand for sustainable and eco-friendly flooring options is also gaining traction, pushing manufacturers to develop low-VOC (Volatile Organic Compound) and recycled content formulations. Competitive dynamics are intensifying, with companies focusing on product differentiation through specialized coatings, customized installation services, and integrated solutions that extend beyond basic flooring to include surface preparation and maintenance. The increasing emphasis on smart manufacturing and automation also necessitates flooring systems that can withstand heavy loads, frequent traffic, and potential impact, further driving innovation and market penetration for advanced industrial flooring. Opportunities abound in sectors undergoing significant infrastructure upgrades or expansion, such as the burgeoning logistics and warehousing industry, as well as sectors with stringent regulatory compliance needs like pharmaceutical manufacturing and food processing plants.

Dominant Markets & Segments in North America Industrial Flooring Market

The United States stands as the dominant market within North America's industrial flooring sector, accounting for an estimated 70-75% of the total market value. This dominance is fueled by its vast industrial base, significant investments in infrastructure, and a highly developed manufacturing sector across diverse industries. Within the United States, the Food and Beverage industry is a leading end-user segment, demanding highly durable, hygienic, and easy-to-clean flooring solutions to meet stringent FDA and USDA regulations. The Chemical industry also represents a substantial segment, requiring flooring with exceptional chemical resistance against a wide range of corrosive substances.

- Resin Type Dominance: Epoxy flooring continues to hold a significant market share due to its cost-effectiveness, versatility, and proven performance across numerous applications. However, Polyaspartic flooring is rapidly gaining traction due to its rapid cure times, UV stability, and superior abrasion and chemical resistance, making it ideal for high-traffic areas and environments requiring minimal downtime. Polyurethane flooring is favored for its flexibility, impact resistance, and ability to withstand thermal shock, making it a strong choice for demanding industrial settings.

- Application Preferences: Concrete remains the predominant substrate for industrial flooring due to its strength and widespread availability. Surface preparation and advanced coating technologies for concrete are therefore central to market growth.

- End-user Industry Growth Drivers:

- Food and Beverage: Strict hygiene regulations, the need for seamless and antimicrobial surfaces, and increased production volumes drive demand for specialized epoxy and polyurethane systems.

- Chemical: The necessity for robust chemical resistance against aggressive solvents, acids, and alkalis fuels the adoption of high-performance epoxy and polyaspartic coatings.

- Transportation and Aviation: Demands for durable, slip-resistant, and impact-resistant flooring in warehouses, hangars, and manufacturing facilities are key growth drivers.

- Healthcare: The growing emphasis on infection control and cleanroom environments in hospitals and pharmaceutical manufacturing facilities spurs the demand for seamless, antimicrobial, and easily sanitizable flooring solutions.

Canada and Mexico are also witnessing steady growth, driven by increasing industrial activity and investments in manufacturing and infrastructure. The strategic location and evolving manufacturing capabilities of Mexico present a significant opportunity for market expansion.

North America Industrial Flooring Market Product Analysis

Product innovation in the North America Industrial Flooring Market is primarily focused on enhancing performance characteristics and application efficiency. Advanced epoxy formulations now offer improved chemical resistance, UV stability, and reduced cure times. Polyaspartic coatings have emerged as a game-changer, providing unparalleled durability, rapid installation capabilities, and excellent resistance to abrasion, impact, and a broad spectrum of chemicals, making them highly competitive for demanding industrial environments. Innovations in antimicrobial additives and seamless, monolithic systems are crucial for the Food & Beverage and Healthcare sectors, ensuring hygiene and compliance. The development of eco-friendly, low-VOC options addresses growing environmental concerns and regulatory pressures. These technological advancements provide competitive advantages by meeting specific application needs with greater efficacy and reduced operational disruption.

Key Drivers, Barriers & Challenges in North America Industrial Flooring Market

Key Drivers:

- Infrastructure Development and Industrial Expansion: Increased investment in manufacturing, logistics, and warehousing facilities across North America necessitates robust and durable flooring solutions.

- Growing Demand for Hygiene and Safety: Stringent regulations in sectors like Food & Beverage and Healthcare are driving the adoption of specialized, easy-to-clean, and antimicrobial flooring systems.

- Technological Advancements: Innovations in resin types (e.g., polyaspartics) offer faster curing times, superior durability, and enhanced chemical resistance, improving operational efficiency.

- Sustainability Initiatives: The demand for eco-friendly, low-VOC, and long-lasting flooring solutions is on the rise.

Barriers & Challenges:

- High Initial Installation Costs: The premium pricing of advanced industrial flooring systems can be a barrier for some businesses, especially smaller enterprises.

- Skilled Labor Shortages: The availability of trained professionals for proper surface preparation and installation is critical and can sometimes be a constraint.

- Economic Fluctuations: Downturns in the broader economy can impact capital expenditure on facility upgrades and new construction, affecting demand.

- Supply Chain Disruptions: Global supply chain issues can lead to raw material price volatility and availability challenges for manufacturers.

Growth Drivers in the North America Industrial Flooring Market Market

The North America Industrial Flooring Market is propelled by several key growth drivers. Continuous industrial expansion, particularly in manufacturing, logistics, and warehousing sectors, directly translates to increased demand for durable and functional flooring. Regulatory mandates for enhanced safety and hygiene in industries like food and beverage, pharmaceuticals, and healthcare are significant catalysts, pushing for the adoption of specialized, compliant flooring solutions. Technological innovations are also pivotal; the development of faster-curing, more chemically resistant, and environmentally friendly flooring materials like polyaspartics and advanced epoxies provides significant performance advantages and operational efficiencies. Furthermore, the ongoing need for infrastructure modernization and renovation across the continent fuels demand for high-performance industrial flooring systems that can withstand heavy traffic, extreme temperatures, and corrosive environments.

Challenges Impacting North America Industrial Flooring Market Growth

Despite robust growth prospects, the North America Industrial Flooring Market faces several challenges. The initial capital investment required for high-performance industrial flooring systems can be substantial, posing a barrier for budget-conscious businesses. A persistent challenge is the shortage of skilled labor necessary for the meticulous surface preparation and precise installation of these specialized flooring solutions, which can impact project timelines and quality. Economic volatility and potential recessions can lead to reduced capital expenditure on facility upgrades, thereby dampening demand. Moreover, the global supply chain can experience disruptions, leading to volatility in raw material prices and potential delays in product availability, affecting manufacturers and installers alike. Competitive pressures among manufacturers also drive the need for constant innovation and cost optimization.

Key Players Shaping the North America Industrial Flooring Market Market

- Stonhard

- Tremco Incorporated

- RPM International Inc

- MBCC Group

- Sherwin-Williams Company

- Lubrizol Corporation

- 3M

- Nippon Paint Holdings Co Ltd

- Northern Industrial Flooring

- Akzo Nobel N V

- Applied Flooring

- Mohawk Industries Inc

- CoGri Group Ltd

- Cornerstone Flooring

- Sika AG

Significant North America Industrial Flooring Market Industry Milestones

- December 2022: MAPEI launched a calculator for industrial-flooring products, enhancing accessibility and planning for Canadian customers via the MAPEI Canada Website.

- January 2022: Twintec USA announced the acquisition of Kalman Floor Company, a strategic move to synergize core competencies, enhance design and construction capabilities for flooring solutions, and accelerate its growth trajectory across North America.

Future Outlook for North America Industrial Flooring Market Market

The future outlook for the North America Industrial Flooring Market remains exceptionally strong, driven by an ongoing commitment to operational excellence, safety, and sustainability across industries. Continued investment in advanced manufacturing, automation, and the expansion of logistics and e-commerce infrastructure will sustain robust demand for high-performance flooring. The increasing emphasis on hygiene and compliance in critical sectors like food processing and healthcare will further propel the market for specialized, seamless, and antimicrobial solutions. Innovations in material science, particularly in polyaspartic and eco-friendly formulations, will continue to shape product offerings, enabling faster installations and enhanced durability. Strategic opportunities lie in catering to niche applications within emerging industries and expanding service offerings to include comprehensive maintenance and repair solutions, solidifying the market's trajectory for sustained growth and innovation.

North America Industrial Flooring Market Segmentation

-

1. Resin Type

- 1.1. Epoxy

- 1.2. Polyaspartic

- 1.3. Polyurethane

- 1.4. Acrylic

- 1.5. Other Resin Types

-

2. Application

- 2.1. Concrete

- 2.2. Wood

- 2.3. Other Applications

-

3. End-user Industry

- 3.1. Food and Beverage

- 3.2. Chemical

- 3.3. Transporation and Aviation

- 3.4. Healthcare

- 3.5. Other End-user Industries

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

North America Industrial Flooring Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Industrial Flooring Market Regional Market Share

Geographic Coverage of North America Industrial Flooring Market

North America Industrial Flooring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness about the Advantages of Industrial Flooring; Increasing Demand from the Food and Beverage Industry

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations on VOCs Released from Industrial Floorings

- 3.4. Market Trends

- 3.4.1. Growth in the Food & Beverage Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Industrial Flooring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Epoxy

- 5.1.2. Polyaspartic

- 5.1.3. Polyurethane

- 5.1.4. Acrylic

- 5.1.5. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Concrete

- 5.2.2. Wood

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food and Beverage

- 5.3.2. Chemical

- 5.3.3. Transporation and Aviation

- 5.3.4. Healthcare

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. United States North America Industrial Flooring Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 6.1.1. Epoxy

- 6.1.2. Polyaspartic

- 6.1.3. Polyurethane

- 6.1.4. Acrylic

- 6.1.5. Other Resin Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Concrete

- 6.2.2. Wood

- 6.2.3. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food and Beverage

- 6.3.2. Chemical

- 6.3.3. Transporation and Aviation

- 6.3.4. Healthcare

- 6.3.5. Other End-user Industries

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 7. Canada North America Industrial Flooring Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 7.1.1. Epoxy

- 7.1.2. Polyaspartic

- 7.1.3. Polyurethane

- 7.1.4. Acrylic

- 7.1.5. Other Resin Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Concrete

- 7.2.2. Wood

- 7.2.3. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food and Beverage

- 7.3.2. Chemical

- 7.3.3. Transporation and Aviation

- 7.3.4. Healthcare

- 7.3.5. Other End-user Industries

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 8. Mexico North America Industrial Flooring Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 8.1.1. Epoxy

- 8.1.2. Polyaspartic

- 8.1.3. Polyurethane

- 8.1.4. Acrylic

- 8.1.5. Other Resin Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Concrete

- 8.2.2. Wood

- 8.2.3. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food and Beverage

- 8.3.2. Chemical

- 8.3.3. Transporation and Aviation

- 8.3.4. Healthcare

- 8.3.5. Other End-user Industries

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Stonhard

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Tremco Incorporated*List Not Exhaustive

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 RPM International Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 MBCC Group

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Sherwin-Williams Company

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Lubrizol Corporation

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 3M

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Nippon Paint Holdings Co Ltd

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Northern Industrial Flooring

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Akzo Nobel N V

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Applied Flooring

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Mohawk Industries Inc

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 CoGri Group Ltd

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.14 Cornerstone Flooring

- 9.2.14.1. Overview

- 9.2.14.2. Products

- 9.2.14.3. SWOT Analysis

- 9.2.14.4. Recent Developments

- 9.2.14.5. Financials (Based on Availability)

- 9.2.15 Sika AG

- 9.2.15.1. Overview

- 9.2.15.2. Products

- 9.2.15.3. SWOT Analysis

- 9.2.15.4. Recent Developments

- 9.2.15.5. Financials (Based on Availability)

- 9.2.1 Stonhard

List of Figures

- Figure 1: North America Industrial Flooring Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Industrial Flooring Market Share (%) by Company 2025

List of Tables

- Table 1: North America Industrial Flooring Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 2: North America Industrial Flooring Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: North America Industrial Flooring Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: North America Industrial Flooring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: North America Industrial Flooring Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Industrial Flooring Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 7: North America Industrial Flooring Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: North America Industrial Flooring Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: North America Industrial Flooring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: North America Industrial Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: North America Industrial Flooring Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 12: North America Industrial Flooring Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: North America Industrial Flooring Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: North America Industrial Flooring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: North America Industrial Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Industrial Flooring Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 17: North America Industrial Flooring Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: North America Industrial Flooring Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 19: North America Industrial Flooring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: North America Industrial Flooring Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Industrial Flooring Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the North America Industrial Flooring Market?

Key companies in the market include Stonhard, Tremco Incorporated*List Not Exhaustive, RPM International Inc, MBCC Group, Sherwin-Williams Company, Lubrizol Corporation, 3M, Nippon Paint Holdings Co Ltd, Northern Industrial Flooring, Akzo Nobel N V, Applied Flooring, Mohawk Industries Inc, CoGri Group Ltd, Cornerstone Flooring, Sika AG.

3. What are the main segments of the North America Industrial Flooring Market?

The market segments include Resin Type, Application, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness about the Advantages of Industrial Flooring; Increasing Demand from the Food and Beverage Industry.

6. What are the notable trends driving market growth?

Growth in the Food & Beverage Industry.

7. Are there any restraints impacting market growth?

Stringent Regulations on VOCs Released from Industrial Floorings.

8. Can you provide examples of recent developments in the market?

December 2022: MAPEI launched calculator for industrial-flooring products that is available within the 'Your Tools' section of the MAPEI Canada Website.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Industrial Flooring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Industrial Flooring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Industrial Flooring Market?

To stay informed about further developments, trends, and reports in the North America Industrial Flooring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence