Key Insights

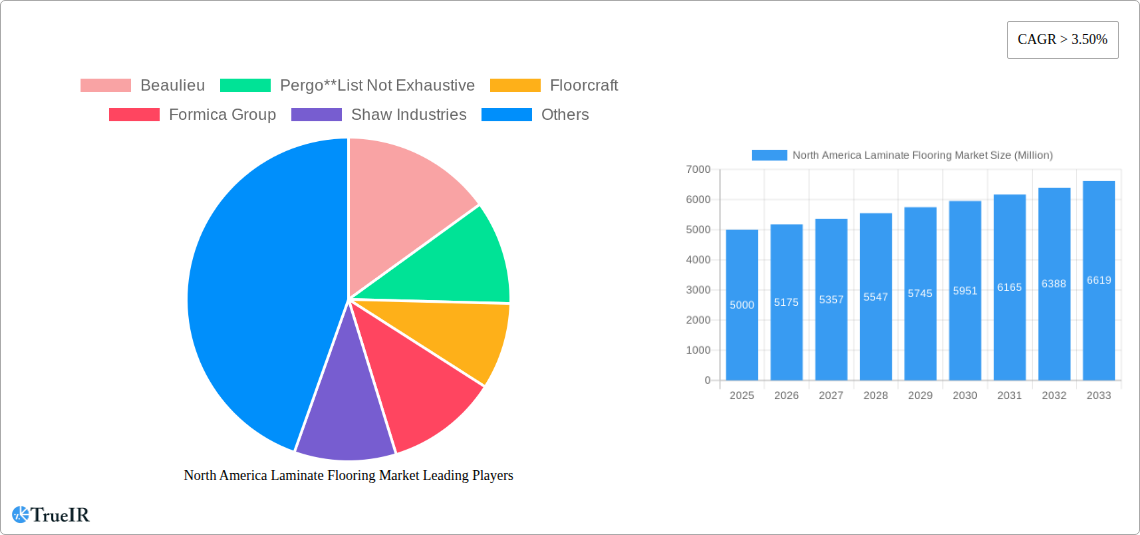

The North American laminate flooring market, currently valued at approximately $5 billion in 2025, is experiencing robust growth, projected to maintain a CAGR exceeding 3.5% through 2033. This expansion is driven primarily by the increasing popularity of laminate flooring in both residential and commercial settings. Consumers are drawn to its affordability, durability, and wide array of styles and designs mimicking more expensive materials like hardwood and stone. The rise of e-commerce further fuels market growth, offering convenient purchasing options alongside expanding offline retail channels that provide tactile experiences and expert advice. However, the market faces constraints from growing concerns about environmental sustainability and the perception of laminate flooring as a less premium alternative compared to natural materials. To overcome this, manufacturers are increasingly focusing on producing eco-friendly options with recycled content and improved durability, emphasizing longevity and reduced environmental impact. The market segmentation reveals a strong preference for high-density fiberboard laminated flooring, indicating a trend toward superior quality and performance. The residential segment dominates, reflecting the broad appeal of laminate flooring among homeowners seeking cost-effective and attractive floor coverings.

North America Laminate Flooring Market Market Size (In Billion)

The North American laminate flooring market’s success hinges on manufacturers' ability to innovate and address consumer concerns regarding sustainability. Strategies like incorporating recycled materials, promoting responsible sourcing practices, and emphasizing product longevity are crucial for sustained growth. Competitive pressures from other flooring types, such as vinyl and engineered wood, necessitate continuous product development and marketing efforts that highlight the advantages of laminate flooring, particularly in terms of cost-effectiveness and maintenance. The expanding online distribution channel presents significant opportunities for reaching wider consumer bases, requiring companies to optimize their e-commerce strategies and provide seamless online purchasing experiences. Regional variations within North America – driven by factors like construction activity, economic conditions, and housing preferences – require targeted marketing and distribution strategies to capture maximum market potential.

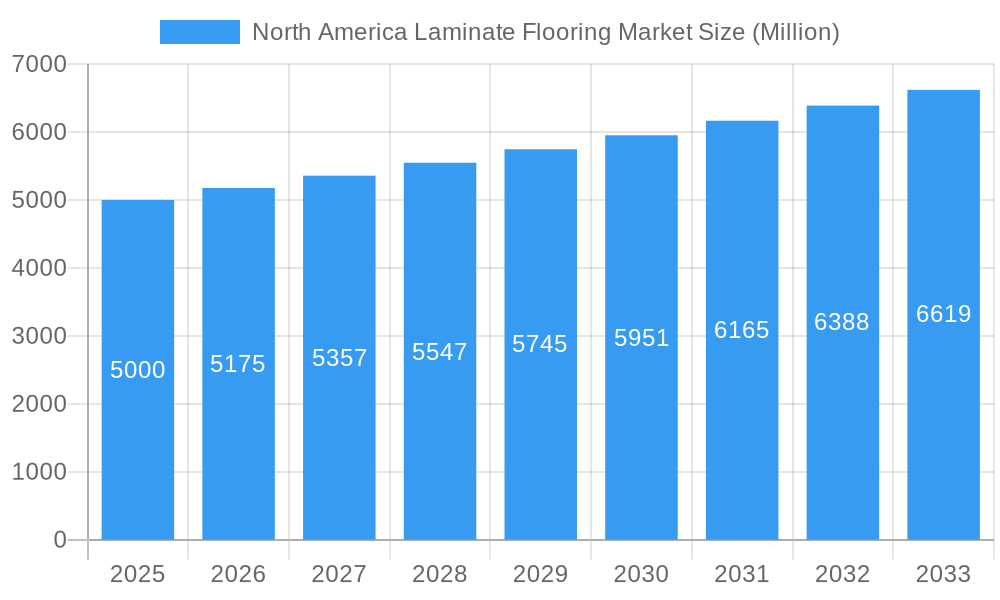

North America Laminate Flooring Market Company Market Share

North America Laminate Flooring Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America laminate flooring market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this study meticulously examines market dynamics, competitive landscapes, and future growth potential. The report leverages extensive data analysis and expert insights to provide a clear, actionable understanding of this dynamic market. The market size is projected to reach xx Million by 2033.

North America Laminate Flooring Market Structure & Competitive Landscape

The North American laminate flooring market exhibits a moderately concentrated structure, with key players like Beaulieu, Pergo, Floorcraft, Formica Group, Shaw Industries, Tarkett, Armstrong Flooring Inc, Mannington Mills, Richmond, and Mohawk Industries holding significant market share. The market's competitive intensity is driven by factors including product innovation, pricing strategies, and brand reputation. Regulatory compliance, particularly concerning environmental standards and VOC emissions, significantly impacts the industry. The presence of substitute flooring materials, such as vinyl, hardwood, and tile, exerts competitive pressure. The market is segmented by product type (High-density Fiberboard Laminated Flooring, Medium-density Fiberboard Laminated Flooring), end-user (Residential, Commercial), and distribution channel (Offline Stores, Online Stores).

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market.

- Innovation Drivers: The market is driven by innovations in surface textures, designs, and click-lock installation systems. Sustainability initiatives focusing on recycled materials and reduced emissions are also key drivers.

- Regulatory Impacts: Environmental regulations related to formaldehyde emissions and sustainable sourcing influence product development and manufacturing processes.

- Product Substitutes: Competition from alternative flooring options necessitates continuous product innovation and competitive pricing.

- End-User Segmentation: The residential segment dominates the market, driven by new construction and renovation activities. The commercial segment is experiencing growth due to increasing demand in office spaces and hospitality settings.

- M&A Trends: The past five years have witnessed xx mergers and acquisitions, with a focus on expanding product portfolios and market reach. The average deal size is estimated at xx Million.

North America Laminate Flooring Market Market Trends & Opportunities

The North America laminate flooring market is witnessing robust growth, driven by several key factors. The market size, valued at xx Million in 2025, is projected to register a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors including increasing disposable incomes, a rising preference for aesthetically pleasing and easy-to-maintain flooring options, and the expanding construction industry. Technological advancements, such as the development of water-resistant and scratch-resistant laminate flooring, further contribute to market expansion. Consumer preferences are shifting towards more realistic wood grain designs and wider planks, influencing product development. Competitive pressures drive innovation and improved value propositions for consumers.

Dominant Markets & Segments in North America Laminate Flooring Market

The residential segment currently dominates the North American laminate flooring market, accounting for approximately xx% of the total market share in 2025. The high demand for cost-effective and durable flooring solutions in residential construction and renovation projects fuels this dominance. Within product types, high-density fiberboard (HDF) laminated flooring commands a larger market share compared to medium-density fiberboard (MDF) due to its superior durability and water resistance. Offline stores remain the dominant distribution channel, although online sales are gradually increasing, particularly among younger consumers. The US dominates the North American market due to a large housing market and high consumer spending.

- Key Growth Drivers for Residential Segment:

- Increasing housing starts.

- Growing disposable incomes among homeowners.

- Favorable government policies and incentives.

- Key Growth Drivers for High-Density Fiberboard (HDF) Laminate Flooring:

- Superior durability and water resistance.

- Enhanced performance compared to MDF counterparts.

- Higher perceived value for consumers.

North America Laminate Flooring Market Product Analysis

Recent product innovations in the North American laminate flooring market focus on enhancing durability, water resistance, and aesthetic appeal. The introduction of thicker HDF cores, improved wear layers, and realistic wood grain designs are key advancements. The development of click-lock installation systems simplifies installation and reduces installation costs, making laminate flooring more attractive to both professionals and DIY consumers. These features enhance the competitiveness of laminate flooring compared to traditional hardwood and tile options.

Key Drivers, Barriers & Challenges in North America Laminate Flooring Market

Key Drivers: Rising disposable incomes, an increase in home renovations, and the growing preference for aesthetically pleasing and easy-to-maintain flooring options are driving the market's expansion. Furthermore, technological advancements leading to improvements in durability and water resistance are also significant contributors.

Key Challenges: Fluctuations in raw material prices, particularly for wood-based materials, impact manufacturing costs and profitability. The competitive landscape, with several major players and substitute products, necessitates constant product innovation and competitive pricing. Environmental regulations regarding VOC emissions and sustainable sourcing add to manufacturing complexities and costs. Supply chain disruptions also pose a challenge.

Growth Drivers in the North America Laminate Flooring Market Market

The North America laminate flooring market growth is driven by increasing demand for affordable and durable flooring solutions. Technological advancements, such as improved water resistance and realistic designs, are also boosting market appeal. Government policies and incentives related to energy efficiency and sustainable materials can further stimulate growth. The rising trend of home renovations and new residential construction acts as a major driver.

Challenges Impacting North America Laminate Flooring Market Growth

Significant challenges include competition from substitute materials like vinyl and tile, fluctuations in raw material prices, and rising labor costs. Environmental regulations and supply chain disruptions also hinder market growth. Additionally, consumer preferences may shift, requiring manufacturers to adapt to evolving design trends.

Key Players Shaping the North America Laminate Flooring Market Market

- Beaulieu

- Pergo

- Floorcraft

- Formica Group

- Shaw Industries

- Tarkett

- Armstrong Flooring Inc

- Mannington Mills

- Richmond

- Mohawk Industries

Significant North America Laminate Flooring Market Industry Milestones

- February 2023: Shaw Industries Group, Inc. completed its acquisition of a controlling interest in Watershed Solar LLC, expanding into renewable energy solutions.

- October 2023: Tarkett launched its Collaborative portfolio, featuring eleven new flooring designs, enhancing its product offerings.

Future Outlook for North America Laminate Flooring Market Market

The North America laminate flooring market is poised for continued growth, driven by technological innovations, sustainable product development, and increasing demand from the residential and commercial sectors. Strategic opportunities exist in expanding into niche segments, focusing on eco-friendly materials, and exploring new distribution channels. The market is expected to remain competitive, with ongoing innovation and product differentiation crucial for success.

North America Laminate Flooring Market Segmentation

-

1. Product Type

- 1.1. High-density Fiberboard Laminated Flooring

- 1.2. Medium-density Fiberboard Laminated Flooring

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Offline Stores

- 3.2. Online Stores

-

4. Geography

- 4.1. United States

- 4.2. Canada

North America Laminate Flooring Market Segmentation By Geography

- 1. United States

- 2. Canada

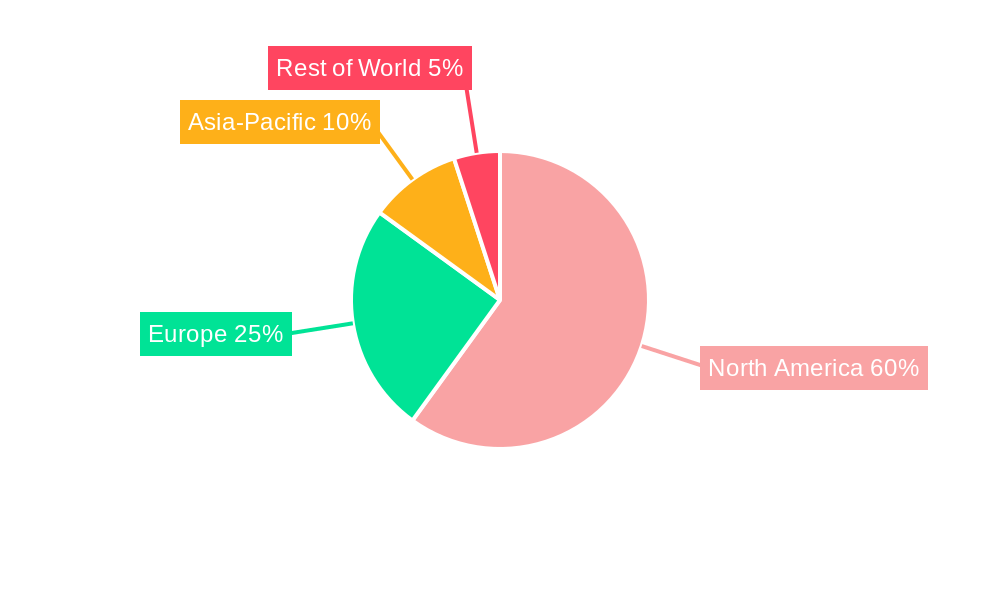

North America Laminate Flooring Market Regional Market Share

Geographic Coverage of North America Laminate Flooring Market

North America Laminate Flooring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Infrastructure spending and advancement in smart infrastructure; Increasing value of commercial property construction

- 3.3. Market Restrains

- 3.3.1. Increasing real estate price with inflation restraining demand; Domination by carpet and rug sale affecting laminate flooring

- 3.4. Market Trends

- 3.4.1. Increase In Use Of Laminated Floor Covering

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Laminate Flooring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. High-density Fiberboard Laminated Flooring

- 5.1.2. Medium-density Fiberboard Laminated Flooring

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline Stores

- 5.3.2. Online Stores

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Laminate Flooring Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. High-density Fiberboard Laminated Flooring

- 6.1.2. Medium-density Fiberboard Laminated Flooring

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Offline Stores

- 6.3.2. Online Stores

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Laminate Flooring Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. High-density Fiberboard Laminated Flooring

- 7.1.2. Medium-density Fiberboard Laminated Flooring

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Offline Stores

- 7.3.2. Online Stores

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Beaulieu

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Pergo**List Not Exhaustive

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Floorcraft

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Formica Group

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Shaw Industries

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Tarkett

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Armstrong Flooring Inc

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Mannington Mills

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Richmond

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Mohawk Industries

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.1 Beaulieu

List of Figures

- Figure 1: North America Laminate Flooring Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Laminate Flooring Market Share (%) by Company 2025

List of Tables

- Table 1: North America Laminate Flooring Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: North America Laminate Flooring Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: North America Laminate Flooring Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Laminate Flooring Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 5: North America Laminate Flooring Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: North America Laminate Flooring Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 7: North America Laminate Flooring Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: North America Laminate Flooring Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 9: North America Laminate Flooring Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: North America Laminate Flooring Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: North America Laminate Flooring Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 12: North America Laminate Flooring Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 13: North America Laminate Flooring Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 14: North America Laminate Flooring Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: North America Laminate Flooring Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Laminate Flooring Market?

The projected CAGR is approximately 8.4%.

2. Which companies are prominent players in the North America Laminate Flooring Market?

Key companies in the market include Beaulieu, Pergo**List Not Exhaustive, Floorcraft, Formica Group, Shaw Industries, Tarkett, Armstrong Flooring Inc, Mannington Mills, Richmond, Mohawk Industries.

3. What are the main segments of the North America Laminate Flooring Market?

The market segments include Product Type, End User, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

High Infrastructure spending and advancement in smart infrastructure; Increasing value of commercial property construction.

6. What are the notable trends driving market growth?

Increase In Use Of Laminated Floor Covering.

7. Are there any restraints impacting market growth?

Increasing real estate price with inflation restraining demand; Domination by carpet and rug sale affecting laminate flooring.

8. Can you provide examples of recent developments in the market?

In February 2023, Shaw Industries Group, Inc. announced the completion of its acquisition of a controlling interest in Watershed Solar LLC, a provider of patented renewable energy solutions. The technology, known as PowerCap, features low-profile, high-output solar arrays installed on landfills, coal ash closures, and rooftops. This innovative approach transforms liabilities or underutilized spaces into valuable renewable energy assets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Laminate Flooring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Laminate Flooring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Laminate Flooring Market?

To stay informed about further developments, trends, and reports in the North America Laminate Flooring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence