Key Insights

The North American Medium-Density Fiberboard (MDF) market is experiencing substantial growth, propelled by escalating demand from the construction and furniture sectors. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of 8.2%. This robust expansion is attributed to several key drivers: increased residential and commercial construction, rising disposable incomes fostering home improvement and furniture purchases, and MDF's inherent versatility across diverse applications. Market segmentation is anticipated across various MDF grades, based on density and application-specific characteristics, further enhancing its broad appeal.

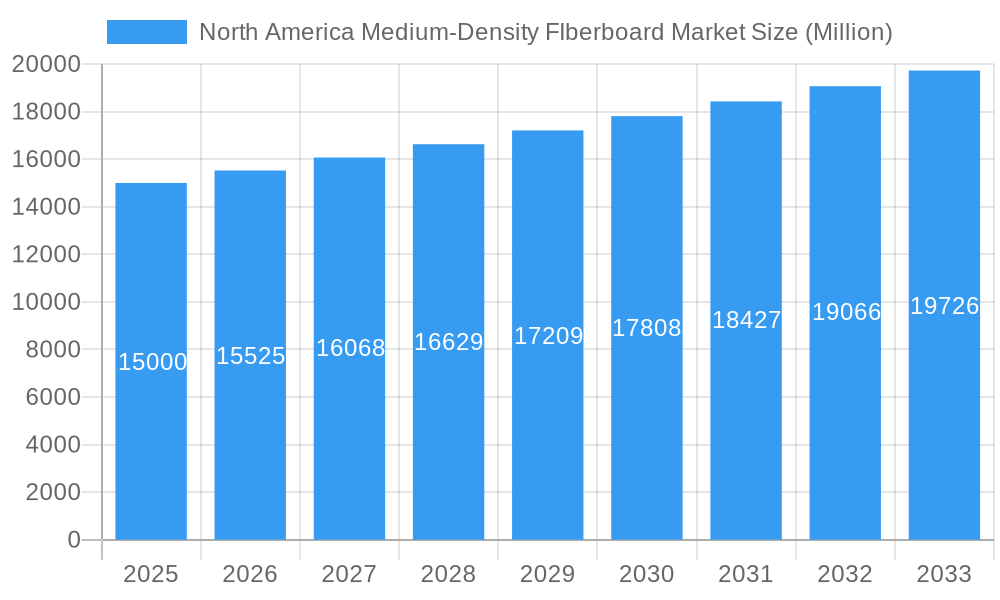

North America Medium-Density FIberboard Market Market Size (In Billion)

While challenges such as fluctuating raw material costs and formaldehyde emission concerns persist, advancements in manufacturing processes and the development of sustainable alternatives are actively addressing these restraints. Leading market participants are strategically focusing on product diversification, capacity expansion, and sustainable practices to leverage this growth opportunity.

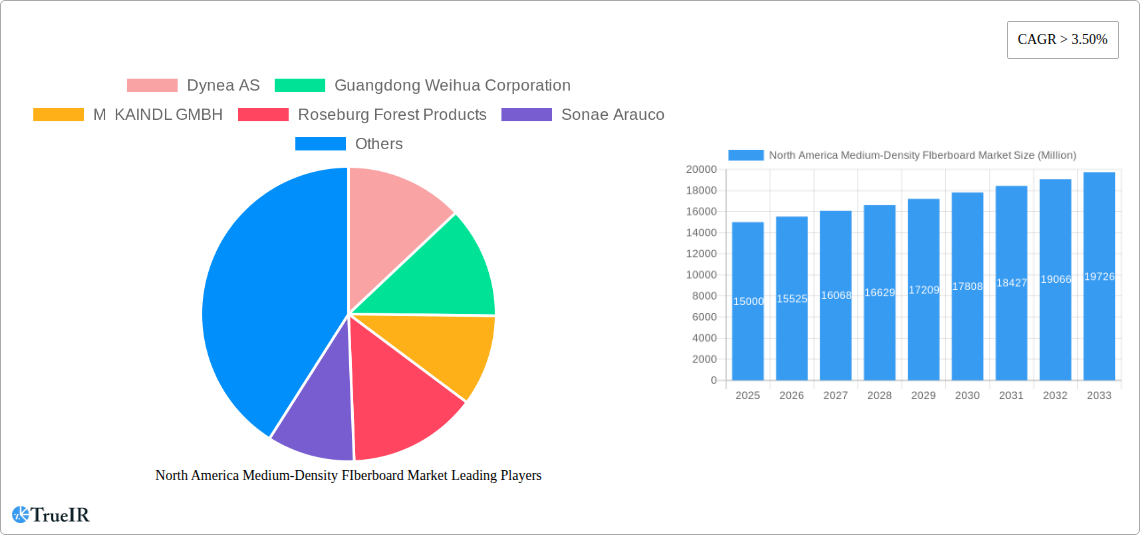

North America Medium-Density FIberboard Market Company Market Share

The market size was valued at 44.96 billion in the base year, 2025. The forecast period anticipates sustained expansion driven by ongoing economic development, persistent demand for housing and renovation, and the continued utility of MDF in furniture production. Competitive analysis will focus on key player strategies, market share, and innovations in eco-friendly MDF alternatives.

North America Medium-Density Fiberboard (MDF) Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America Medium-Density Fiberboard (MDF) market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033 (Study Period: 2019–2033, Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025–2033, Historical Period: 2019–2024), this report meticulously examines market size, growth drivers, challenges, competitive landscape, and future outlook. The report leverages extensive quantitative and qualitative data to provide a clear understanding of the current market dynamics and future trajectory of the North American MDF industry.

North America Medium-Density Fiberboard Market Structure & Competitive Landscape

The North American MDF market exhibits a moderately concentrated structure, with several major players holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately competitive landscape. Innovation in manufacturing processes, particularly focusing on sustainability and reduced environmental impact, is a key driver. Regulatory changes concerning formaldehyde emissions and sustainable forestry practices significantly influence market dynamics. Product substitutes, such as particleboard and other engineered wood products, pose moderate competitive pressure. The end-user segment is primarily driven by construction, furniture manufacturing, and cabinetry, with construction accounting for approximately xx% of total demand in 2024. M&A activity within the sector has been relatively moderate in recent years, with approximately xx major transactions recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, HHI (2024) estimated at xx.

- Innovation Drivers: Sustainability, reduced emissions, improved performance characteristics.

- Regulatory Impacts: Stringent environmental regulations impacting production and material sourcing.

- Product Substitutes: Particleboard, other engineered wood products.

- End-User Segmentation: Construction (xx%), Furniture (xx%), Cabinetry (xx%), Others (xx%).

- M&A Trends: Moderate activity, xx major transactions (2019-2024).

North America Medium-Density Fiberboard Market Trends & Opportunities

The North American MDF market is projected to witness robust growth over the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) estimated at xx%. This growth is fueled by several factors, including increasing construction activities, particularly in residential and commercial sectors, a growing demand for furniture and cabinetry, and the expanding use of MDF in various applications like flooring and interior design. Technological advancements, such as the use of recycled materials and improved manufacturing processes, are enhancing the market's competitiveness and sustainability. Shifting consumer preferences toward eco-friendly and high-performance building materials are further propelling market growth. However, competitive pressures from substitutes and fluctuating raw material prices represent ongoing challenges. Market penetration rates for MDF in various applications show significant room for expansion, particularly in non-traditional sectors.

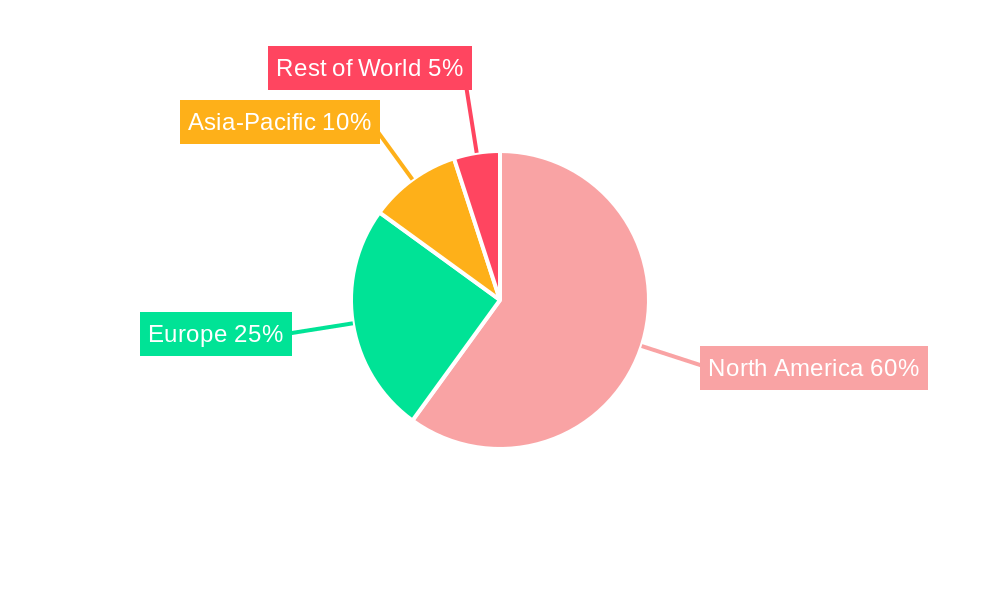

Dominant Markets & Segments in North America Medium-Density Fiberboard Market

The United States currently dominates the North American MDF market, accounting for approximately xx% of total regional demand in 2024. Strong growth is also anticipated in Canada, driven by infrastructure development and increasing residential construction.

Key Growth Drivers in the US:

- Robust housing market and construction activities.

- Strong demand from the furniture and cabinetry industry.

- Favorable government policies promoting sustainable building materials.

Key Growth Drivers in Canada:

- Significant infrastructure investments.

- Growing residential construction sector.

- Increasing demand from the furniture industry.

The thickness segment of 19mm-25mm currently holds the largest market share, followed by the thickness segment of 12mm-18mm. The increasing demand for furniture and cabinetry is driving the growth of the 12mm-18mm thickness segment. Furthermore, construction applications dominate the end-use segment.

North America Medium-Density Fiberboard Market Product Analysis

Product innovations in the MDF market focus on enhancing performance characteristics, improving sustainability, and reducing environmental impact. Advancements include the incorporation of recycled materials, the development of formaldehyde-free or low-formaldehyde MDF, and the creation of specialized MDF products with improved moisture resistance or enhanced density. These innovations cater to specific market needs and provide competitive advantages to manufacturers.

Key Drivers, Barriers & Challenges in North America Medium-Density FIberboard Market

Key Drivers: Growing construction sector, rising demand for furniture and cabinetry, technological advancements leading to improved product quality and sustainability. Government policies promoting green building materials further contribute to market growth.

Key Challenges: Fluctuations in raw material prices (wood fiber), intense competition from substitute products, stringent environmental regulations, and potential supply chain disruptions. These factors can impact profitability and market growth.

Growth Drivers in the North America Medium-Density Fiberboard Market Market

The increasing demand for sustainable building materials, coupled with technological innovations such as the use of recycled wood fibers and improved manufacturing processes, is a significant growth driver. The expanding construction and furniture industries in North America also fuel market expansion.

Challenges Impacting North America Medium-Density Fiberboard Market Growth

Supply chain disruptions, increased raw material costs, and stringent environmental regulations pose significant challenges to market growth. Competition from alternative building materials also restricts market expansion.

Key Players Shaping the North America Medium-Density Fiberboard Market Market

- Dynea AS

- Guangdong Weihua Corporation

- M KAINDL GMBH

- Roseburg Forest Products

- Sonae Arauco

- Swiss Krono AG

- West Frase Timber Co Ltd

- Weyerhaeuser Company

Significant North America Medium-Density Fiberboard Market Industry Milestones

- June 2022: Roseburg Forest Products announced plans to explore the feasibility of a second MDF panel plant or bioenergy production unit, potentially utilizing 300,000 bone-dry tons of wood residuals annually. This signifies a significant commitment to expansion and sustainable resource utilization.

- March 2021: Alberta Biobord Corporation announced plans for a fuel pellet and MDF board plant, aiming to address a third of the North American MDF market shortage. The USD 1 billion investment and planned 450 Million sq. ft. annual production capacity demonstrate substantial investment in meeting market demand.

Future Outlook for North America Medium-Density Fiberboard Market Market

The North American MDF market is poised for continued growth, driven by sustained demand from the construction and furniture sectors, coupled with ongoing technological advancements towards more sustainable and high-performance products. Strategic investments in expanding production capacities and exploring new applications will further shape the market's trajectory, unlocking significant opportunities for market participants.

North America Medium-Density FIberboard Market Segmentation

-

1. Application

- 1.1. Cabinet

- 1.2. Flooring

- 1.3. Furniture

- 1.4. Molding, Door and Millwork

- 1.5. Packaging System

- 1.6. Other Applications

-

2. End-user Industry

- 2.1. Residential

- 2.2. Commercial

- 2.3. Institutional

- 3. Geography

-

4. North America

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

North America Medium-Density FIberboard Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Medium-Density FIberboard Market Regional Market Share

Geographic Coverage of North America Medium-Density FIberboard Market

North America Medium-Density FIberboard Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Demand for MDF in Furniture Making; Easy Availability of Raw Materials

- 3.3. Market Restrains

- 3.3.1. Increase in Demand for MDF in Furniture Making; Easy Availability of Raw Materials

- 3.4. Market Trends

- 3.4.1. Increasing Usage in the Residential Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Medium-Density FIberboard Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cabinet

- 5.1.2. Flooring

- 5.1.3. Furniture

- 5.1.4. Molding, Door and Millwork

- 5.1.5. Packaging System

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Institutional

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.4. Market Analysis, Insights and Forecast - by North America

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dynea AS

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Guangdong Weihua Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 M KAINDL GMBH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Roseburg Forest Products

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sonae Arauco

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Swiss Krono AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 West Frase Timber Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Weyerhaeuser Company*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Dynea AS

List of Figures

- Figure 1: North America Medium-Density FIberboard Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Medium-Density FIberboard Market Share (%) by Company 2025

List of Tables

- Table 1: North America Medium-Density FIberboard Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: North America Medium-Density FIberboard Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: North America Medium-Density FIberboard Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Medium-Density FIberboard Market Revenue billion Forecast, by North America 2020 & 2033

- Table 5: North America Medium-Density FIberboard Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Medium-Density FIberboard Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: North America Medium-Density FIberboard Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: North America Medium-Density FIberboard Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: North America Medium-Density FIberboard Market Revenue billion Forecast, by North America 2020 & 2033

- Table 10: North America Medium-Density FIberboard Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States North America Medium-Density FIberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Medium-Density FIberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Medium-Density FIberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Medium-Density FIberboard Market?

The projected CAGR is approximately 8.2%.

2. Which companies are prominent players in the North America Medium-Density FIberboard Market?

Key companies in the market include Dynea AS, Guangdong Weihua Corporation, M KAINDL GMBH, Roseburg Forest Products, Sonae Arauco, Swiss Krono AG, West Frase Timber Co Ltd, Weyerhaeuser Company*List Not Exhaustive.

3. What are the main segments of the North America Medium-Density FIberboard Market?

The market segments include Application, End-user Industry, Geography, North America.

4. Can you provide details about the market size?

The market size is estimated to be USD 44.96 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Demand for MDF in Furniture Making; Easy Availability of Raw Materials.

6. What are the notable trends driving market growth?

Increasing Usage in the Residential Segment.

7. Are there any restraints impacting market growth?

Increase in Demand for MDF in Furniture Making; Easy Availability of Raw Materials.

8. Can you provide examples of recent developments in the market?

June 2022: Roseburg announced that it is exploring the feasibility of locating a second MDF panel plant or bioenergy production unit within its current Western operating footprint. The proposed facility will use up to 300,000 bone-dry tons of wood residuals every year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Medium-Density FIberboard Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Medium-Density FIberboard Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Medium-Density FIberboard Market?

To stay informed about further developments, trends, and reports in the North America Medium-Density FIberboard Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence