Key Insights

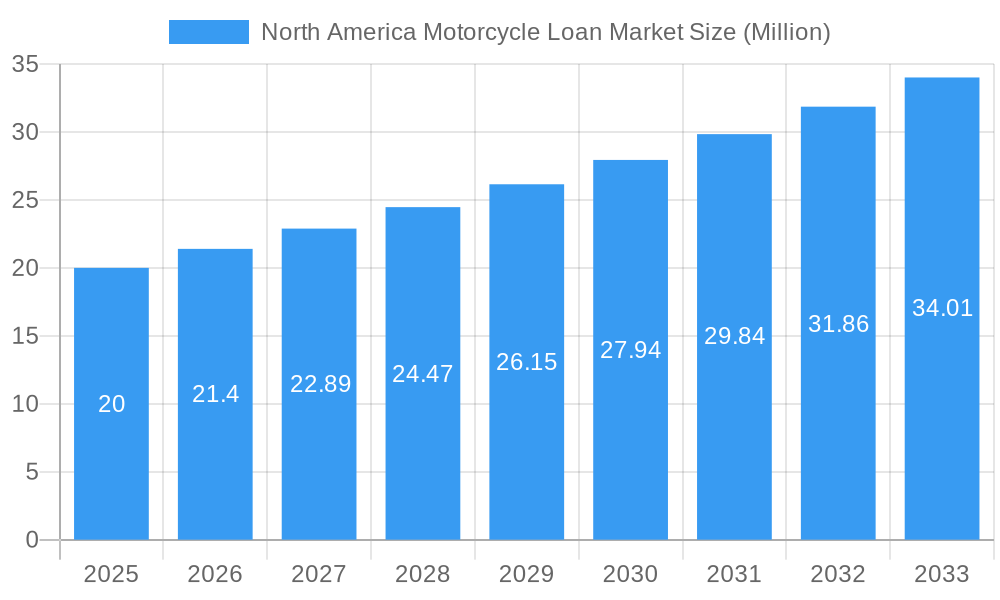

The North American motorcycle loan market, valued at $20 million in 2025, is projected to experience robust growth, driven by a rising demand for motorcycles, particularly among younger demographics seeking adventure and personalized transportation. Favorable financing options offered by banks, NBFCs, OEMs, and fintech companies are further fueling market expansion. The increasing popularity of used motorcycles and the emergence of innovative financing solutions like peer-to-peer lending contribute to this growth. Segment analysis reveals that loans with tenures of 3-5 years are currently the most popular, reflecting consumer preferences and lending strategies. While the market is dominated by traditional players like Harley-Davidson Financial Services, Ally Financial, and JPMorgan Chase, the entry of fintech companies is injecting competition and fostering innovation in lending practices. Geographic distribution shows the United States holding the largest market share within North America, followed by Canada, with the Rest of North America exhibiting considerable growth potential.

North America Motorcycle Loan Market Market Size (In Million)

The 7% CAGR projected for the forecast period (2025-2033) indicates a steady and sustained expansion. However, potential restraints include economic fluctuations affecting consumer spending and potential regulatory changes impacting lending practices. The market is expected to see increased competition as more financial institutions and fintech players enter the space. The increasing focus on digital lending platforms and improved risk assessment models should further enhance efficiency and accessibility within the market. The segmentation by loan amount sanctioned indicates a significant portion of loans falling within the 25-50% range, suggesting a balanced distribution across various borrowing capacities. Continued growth is expected to be fueled by targeted marketing campaigns by lenders, focusing on specific demographics and their preferences, and by the continuous evolution of the motorcycle industry itself.

North America Motorcycle Loan Market Company Market Share

North America Motorcycle Loan Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America motorcycle loan market, covering the period 2019-2033. It offers invaluable insights into market size, segmentation, competitive dynamics, and future growth prospects, making it an essential resource for industry stakeholders, investors, and financial institutions. The report leverages extensive data analysis and incorporates key industry developments to provide a holistic view of this dynamic market. With a focus on key players such as Harley-Davidson Financial Services, Kawasaki Motors Finance Corporation, Ally Financial Inc., JPMorgan Chase, Honda Financial Services, Bank of America Corporation, Wells Fargo, TD Bank, Yamaha Motor Finance Corporation, Mountain America Credit Union (and others), this report is a definitive guide to navigating the complexities of the North American motorcycle loan landscape.

North America Motorcycle Loan Market Structure & Competitive Landscape

The North American motorcycle loan market exhibits a moderately concentrated structure, with key players holding significant market share. The market is characterized by a mix of banks, Non-Banking Financial Companies (NBFCs), Original Equipment Manufacturers (OEMs), and Fintech companies, each employing distinct strategies to capture market share. Innovation is driven by technological advancements in lending processes, risk assessment, and customer service, while regulatory changes, particularly concerning consumer protection and lending practices, significantly impact market operations. Product substitutes, such as leasing options and personal loans, create competitive pressure. The market shows moderate M&A activity, with larger players strategically acquiring smaller firms to expand their reach and enhance their product offerings. Concentration ratios indicate a xx% market share held by the top five players in 2024, with an expected increase to xx% by 2033. M&A volume in the sector averaged xx deals annually during the historical period (2019-2024), indicating a moderate level of consolidation. End-user segmentation is driven by factors such as age, income, and riding experience, influencing loan amounts and tenures.

North America Motorcycle Loan Market Market Trends & Opportunities

The North American motorcycle loan market is experiencing robust growth, driven by rising motorcycle sales, favorable financing options, and increasing consumer demand for leisure activities. The market size reached xx Million in 2024 and is projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx Million by 2033. Technological advancements, such as online lending platforms and digital credit scoring, are streamlining the loan application process and expanding market access. Consumer preferences are shifting towards longer loan tenures and flexible repayment options, driving product innovation in the market. Competitive dynamics are intensified by the entry of Fintech companies offering innovative lending solutions. Market penetration rate is currently estimated at xx%, expected to rise to xx% by 2033, fueled by increasing motorcycle ownership and financial inclusion initiatives.

Dominant Markets & Segments in North America Motorcycle Loan Market

The USA constitutes the dominant market within North America, accounting for approximately xx% of the total market value in 2024. Canada holds the second largest market share.

- By Provider Type: OEMs are expected to dominate in terms of market share, followed by banks and NBFCs. Fintech companies are gradually increasing their presence.

- By Percentage of Amount Sanctioned: The 25-50% segment is expected to represent the largest portion of the market, reflecting the typical loan-to-value ratio for motorcycle financing.

- By Tenure: The 3-5 year tenure segment holds significant market share, driven by consumer preference for manageable monthly payments.

- Key Growth Drivers in the USA: Robust motorcycle sales, established financial infrastructure, and favorable lending regulations.

- Key Growth Drivers in Canada: Expanding middle class, increasing disposable income, and government support for recreational activities.

The Rest of North America segment is expected to witness moderate growth, driven by rising tourism and the popularity of motorcycles as a mode of transportation in specific regions.

North America Motorcycle Loan Market Product Analysis

Product innovation in the North American motorcycle loan market focuses on enhancing customer experience through digital platforms, personalized financing solutions, and streamlined application processes. The competitive advantage lies in offering attractive interest rates, flexible repayment options, and efficient customer service. Technological advancements, like AI-powered risk assessment tools and mobile-first lending platforms, are improving the speed and accuracy of loan approvals, while also enabling greater accessibility for a wider range of borrowers. The current trend favors products that cater to a variety of motorcycle types (new, used, high-value, etc.), and those that bundle insurance and maintenance plans into comprehensive packages.

Key Drivers, Barriers & Challenges in North America Motorcycle Loan Market

Key Drivers: Rising motorcycle sales, increasing disposable incomes, favorable lending regulations, and technological advancements are major drivers. The growing popularity of recreational riding further fuels this market.

Challenges: Economic downturns, fluctuations in interest rates, increasing competition among lenders, and stringent regulatory compliance requirements pose significant challenges. Supply chain disruptions, particularly impacting motorcycle production and availability, can indirectly influence loan demand and portfolio risk. Increased regulatory scrutiny of lending practices and consumer protection measures may result in reduced profitability for lenders.

Growth Drivers in the North America Motorcycle Loan Market Market

The growth of the North American motorcycle loan market is fueled by several factors. The rising popularity of motorcycles as a recreational activity and mode of transportation is key. Economic expansion and rising disposable incomes allow more people to afford both motorcycles and financing options. Technological advancements, such as online lending platforms, streamline processes and make access to loans easier. Further, favorable government policies and regulations promote motorcycle ownership and industry growth.

Challenges Impacting North America Motorcycle Loan Market Growth

Several challenges hinder market expansion. Economic recessions and high-interest rates can dampen demand for loans. Stringent regulatory compliance requirements and credit risk assessment complexities can increase operating costs for lenders. Fierce competition from both traditional and non-traditional financial institutions (Fintech) also presents a challenge. Additionally, potential supply chain bottlenecks in the production of motorcycles could indirectly affect loan demand. These factors could result in market saturation or slower-than-expected growth.

Key Players Shaping the North America Motorcycle Loan Market Market

- Harley-Davidson Financial Services

- Kawasaki Motors Finance Corporation

- Ally Financial Inc.

- JPMorgan Chase & Co.

- Honda Financial Services

- Bank of America Corporation

- Wells Fargo

- TD Bank

- Yamaha Motor Finance Corporation

- Mountain America Credit Union

Significant North America Motorcycle Loan Market Industry Milestones

- June 2023: Stark Future secures a €20M loan from Banco Santander to boost motocross bike production, highlighting the financial support available for EV motorcycle manufacturers and its impact on the overall market demand.

- April 2022: Harley-Davidson raises USD 550 Million through asset-backed securities (ABS), showcasing the strong investment potential within the motorcycle financing sector and strengthening the confidence of investors in the market's stability.

Future Outlook for North America Motorcycle Loan Market Market

The North American motorcycle loan market is poised for continued growth, driven by several factors. The increasing popularity of motorcycles as a leisure pursuit, coupled with favorable financing options and technological advancements like online lending platforms, are expected to further fuel the market’s expansion. The rising affluence of the population and greater access to credit will likely stimulate demand for motorcycle loans. Strategic partnerships between lenders and motorcycle manufacturers are also anticipated to drive market growth. This convergence of factors points to a strong and promising outlook for the North American motorcycle loan market in the coming years.

North America Motorcycle Loan Market Segmentation

-

1. Provider Type

- 1.1. Banks

- 1.2. NBFCs (Non-Banking Financial Services)

- 1.3. OEM (Original Equipment Manufacturer)

- 1.4. Others (Fintech Companies)

-

2. Percentage of Amount Sanctioned

- 2.1. Less than 25%

- 2.2. 25-50%

- 2.3. 51-75%

- 2.4. More than 75%

-

3. Tenure

- 3.1. Less than 3 Years

- 3.2. 3-5 Years

- 3.3. More than 5 Years

North America Motorcycle Loan Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Motorcycle Loan Market Regional Market Share

Geographic Coverage of North America Motorcycle Loan Market

North America Motorcycle Loan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Motorcycle Ownership; Customized Loan Options

- 3.3. Market Restrains

- 3.3.1. Market Saturation and Competition; Changing Mobility Preferences

- 3.4. Market Trends

- 3.4.1. Banks are the Major Source for Financing in United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Provider Type

- 5.1.1. Banks

- 5.1.2. NBFCs (Non-Banking Financial Services)

- 5.1.3. OEM (Original Equipment Manufacturer)

- 5.1.4. Others (Fintech Companies)

- 5.2. Market Analysis, Insights and Forecast - by Percentage of Amount Sanctioned

- 5.2.1. Less than 25%

- 5.2.2. 25-50%

- 5.2.3. 51-75%

- 5.2.4. More than 75%

- 5.3. Market Analysis, Insights and Forecast - by Tenure

- 5.3.1. Less than 3 Years

- 5.3.2. 3-5 Years

- 5.3.3. More than 5 Years

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Provider Type

- 6. United States North America Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 7. Canada North America Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 8. Mexico North America Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 9. Rest of North America North America Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Harley-Davidson Financial Services

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Kawasaki Motors Finance Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Ally Financial Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 JPMorgan Chase

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Honda Financial Services

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Bank of American Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Wells Fargo

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 TD Bank

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Yamaha motor finance corporation **List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Mountain America Credit Union

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Harley-Davidson Financial Services

List of Figures

- Figure 1: North America Motorcycle Loan Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Motorcycle Loan Market Share (%) by Company 2025

List of Tables

- Table 1: North America Motorcycle Loan Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: North America Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 3: North America Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 4: North America Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 5: North America Motorcycle Loan Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Motorcycle Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America North America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: North America Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 12: North America Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 13: North America Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 14: North America Motorcycle Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States North America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Motorcycle Loan Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the North America Motorcycle Loan Market?

Key companies in the market include Harley-Davidson Financial Services, Kawasaki Motors Finance Corporation, Ally Financial Inc, JPMorgan Chase, Honda Financial Services, Bank of American Corporation, Wells Fargo, TD Bank, Yamaha motor finance corporation **List Not Exhaustive, Mountain America Credit Union.

3. What are the main segments of the North America Motorcycle Loan Market?

The market segments include Provider Type, Percentage of Amount Sanctioned, Tenure.

4. Can you provide details about the market size?

The market size is estimated to be USD 20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Motorcycle Ownership; Customized Loan Options.

6. What are the notable trends driving market growth?

Banks are the Major Source for Financing in United States.

7. Are there any restraints impacting market growth?

Market Saturation and Competition; Changing Mobility Preferences.

8. Can you provide examples of recent developments in the market?

June 2023: Barcelona-based Stark Future bags €20M loan to scale up production of powerful motocross bike.it has signed a €20M loan agreement with Banco Santander.The funding will enable Stark Future to scale up its production capabilities, streamline manufacturing processes, and bolster research and development efforts related to the Stark VARG.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Motorcycle Loan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Motorcycle Loan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Motorcycle Loan Market?

To stay informed about further developments, trends, and reports in the North America Motorcycle Loan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence