Key Insights

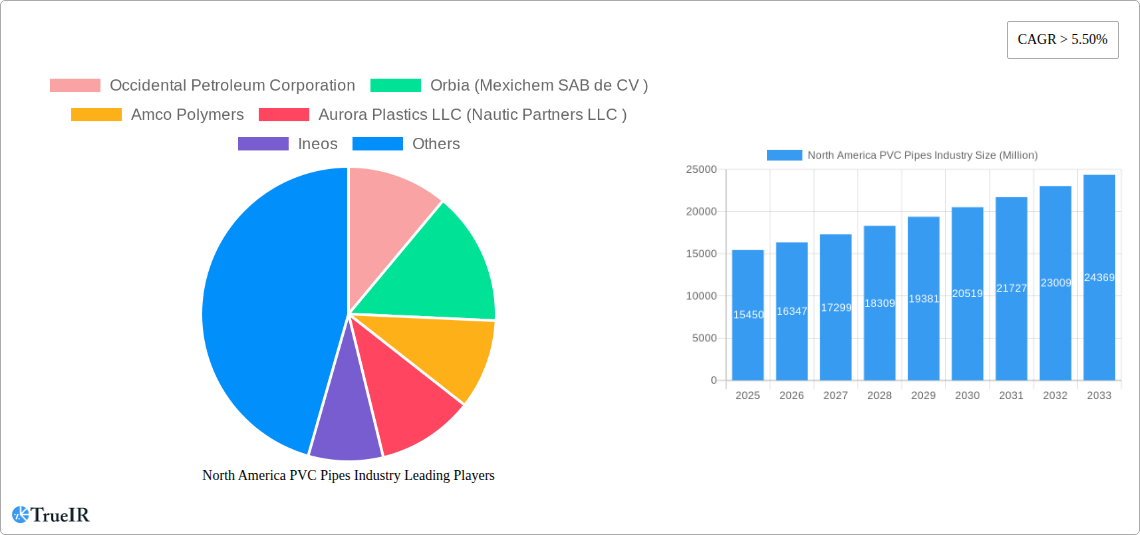

The North American Polyvinyl Chloride (PVC) market is poised for significant expansion, projected to reach an estimated market size of $15,450 million by 2025, with a robust Compound Annual Growth Rate (CAGR) exceeding 5.50%. This growth is propelled by a confluence of powerful drivers, including the escalating demand from the building and construction sector, where PVC's durability, cost-effectiveness, and ease of installation make it an indispensable material for pipes, fittings, profiles, and flooring. The automotive industry's increasing adoption of PVC for interior components, wiring insulation, and underbody coatings further fuels market expansion. Furthermore, the healthcare sector's reliance on PVC for medical devices, tubing, and packaging, owing to its biocompatibility and sterilizability, contributes substantially to market value. Emerging economies within North America are witnessing rapid urbanization and infrastructure development, creating sustained demand for PVC-based products.

North America PVC Pipes Industry Market Size (In Billion)

Key trends shaping the North America PVC market include a growing emphasis on sustainable PVC production and recycling initiatives, driven by environmental concerns and regulatory pressures. Innovations in PVC formulations are leading to enhanced product performance, such as low-smoke PVC for specialized applications and chlorinated PVC (CPVC) for high-temperature plumbing systems. The market is segmented across various product types, with rigid PVC, particularly clear and non-clear varieties, dominating due to its extensive use in pipes and films. Flexible PVC also holds a significant share, finding applications in hoses, tubing, and films. Restraints, such as volatile raw material prices and the emergence of alternative materials in certain applications, are being addressed through technological advancements and strategic sourcing. The competitive landscape is characterized by the presence of major global players and regional manufacturers vying for market share through product innovation and capacity expansion.

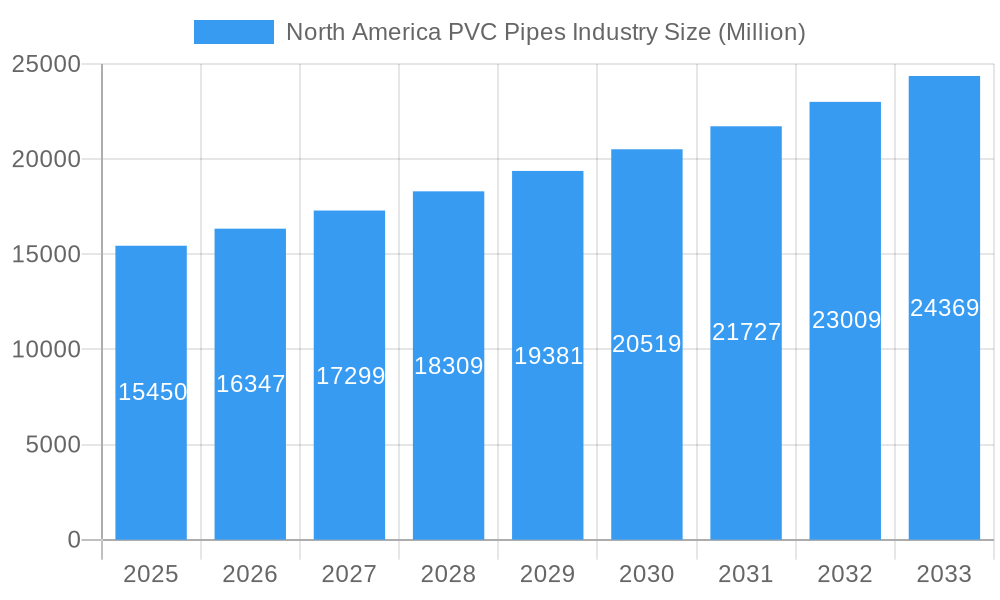

North America PVC Pipes Industry Company Market Share

Here is a dynamic, SEO-optimized report description for the North America PVC Pipes Industry, designed for immediate use without modification.

This comprehensive report delivers an in-depth analysis of the North America PVC Pipes Industry, offering critical insights into market dynamics, competitive strategies, and future growth trajectories. Covering the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this vital sector. We delve into the intricate details of market structure, trends, dominant segments, product innovations, key drivers, and challenges, providing a complete picture of the industry's evolution. Our analysis leverages high-volume SEO keywords such as "North America PVC pipes," "PVC pipes market," "rigid PVC," "flexible PVC," "CPVC," "building and construction PVC," "automotive PVC," "healthcare PVC," "PVC pipes forecast," and "PVC pipes industry trends" to ensure maximum visibility and reach.

North America PVC Pipes Industry Market Structure & Competitive Landscape

The North America PVC Pipes Industry is characterized by a moderately concentrated market, driven by significant capital investments and economies of scale in production. Innovation plays a crucial role, with companies continuously investing in R&D to enhance product performance, durability, and sustainability, particularly in areas like low-smoke PVC and bio-based formulations. Regulatory impacts, such as stringent environmental standards and building codes, shape manufacturing processes and product approvals, favoring established players with compliance expertise. Product substitutes, while present, often struggle to match the cost-effectiveness and versatility of PVC in core applications like pipes and fittings. End-user segmentation reveals a strong reliance on the building and construction sector, followed by electrical and electronics, and automotive. Merger and acquisition (M&A) trends indicate strategic consolidation to expand market reach and technological capabilities; recent activity has seen volumes in the hundreds of millions of dollars, aiming to bolster product portfolios and operational efficiencies. The market concentration is estimated to be around 65-75% by major players in terms of revenue.

North America PVC Pipes Industry Market Trends & Opportunities

The North America PVC Pipes Industry is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 4.5%–5.5% during the forecast period (2025–2033). This expansion is fueled by a confluence of factors, including sustained investment in infrastructure development across the United States, Canada, and Mexico, driven by government initiatives aimed at modernizing aging water and wastewater systems. Technological shifts are also a significant trend, with an increasing demand for specialized PVC formulations such as Chlorinated PVC (CPVC) for high-temperature applications and low-smoke PVC for enhanced safety in enclosed environments. Consumer preferences are leaning towards sustainable solutions, spurring innovation in bio-based PVC derived from renewable resources, as exemplified by recent product launches. Competitive dynamics are intensifying, with major players like Orbia, Westlake Corporation, and Formosa Plastics Corporation vying for market share through capacity expansions, strategic partnerships, and product differentiation. The growing adoption of PVC in automotive for lightweighting and in healthcare for medical devices presents new avenues for market penetration, alongside traditional applications in pipes and fittings, films and sheets, and wires and cables. Opportunities abound for companies that can offer advanced, eco-friendly PVC solutions that meet evolving regulatory requirements and consumer demands for performance and sustainability. The market penetration for PVC in the building and construction sector is already high, estimated at over 80% for piping applications.

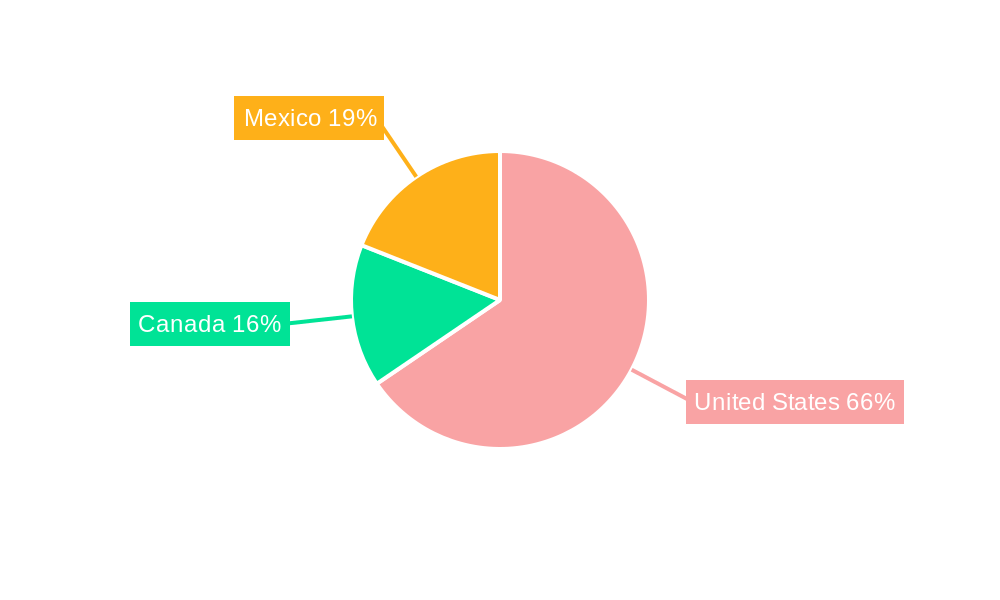

Dominant Markets & Segments in North America PVC Pipes Industry

The United States emerges as the dominant market within the North America PVC Pipes Industry, accounting for an estimated 60-65% of the total regional revenue. This dominance is primarily attributed to its extensive infrastructure projects, significant investments in residential and commercial construction, and a large industrial base.

Key Growth Drivers in the Dominant Market (United States):

- Infrastructure Modernization: Ongoing federal and state investments in upgrading water, wastewater, and transportation infrastructure are significant demand catalysts. Projects like the Bipartisan Infrastructure Law are expected to inject billions into these sectors.

- Building and Construction Boom: A steady demand for new residential and commercial construction, coupled with renovation activities, consistently drives the consumption of PVC pipes and fittings.

- Regulatory Support for PVC: Favorable regulations and established standards for PVC in plumbing, electrical conduits, and other applications solidify its market position.

- Technological Advancements: The adoption of specialized PVC, such as CPVC for its superior thermal and chemical resistance, expands its application scope.

Dominant Segments:

- Product Type: Rigid PVC is the leading segment, primarily driven by its extensive use in pipes and fittings. Non-clear Rigid PVC holds the largest share within this sub-segment due to its widespread application in water supply, drainage, and sewage systems. Chlorinated PVC (CPVC) is a high-growth niche within rigid PVC due to its superior performance in demanding thermal and chemical environments.

- Application: Pipes and Fittings represent the largest application segment, commanding over 50% of the market share. This is intrinsically linked to the building and construction and water infrastructure sectors. Films and Sheets and Wires and Cables are also significant contributors.

- End-user Industry: Building and Construction is the paramount end-user industry, driving demand for a vast array of PVC products. The Electrical and Electronics and Automotive sectors are demonstrating robust growth, propelled by innovation and increasing PVC adoption for specialized components. Healthcare is a growing segment, with demand for medical-grade PVC in devices and packaging.

Other Contributing Regions:

- Canada: Exhibits steady growth, driven by infrastructure spending and a mature construction market.

- Mexico: Shows promising growth potential, supported by increased foreign investment in manufacturing and infrastructure development.

North America PVC Pipes Industry Product Analysis

The North America PVC Pipes Industry showcases a landscape rich with product innovation focused on enhanced performance and sustainability. Rigid PVC, the backbone of the market, continues to see advancements in formulations for increased tensile strength, impact resistance, and fire retardancy, crucial for demanding applications in building and construction. Flexible PVC is evolving with improved pliability and durability for use in hoses, tubing, and various consumer goods. The growing demand for specialized materials has propelled the market for Chlorinated PVC (CPVC) and Low-smoke PVC, offering superior thermal resistance and safety features respectively. These product advancements are directly addressing niche market needs and stringent industry standards, providing competitive advantages through superior material properties and application-specific solutions.

Key Drivers, Barriers & Challenges in North America PVC Pipes Industry

Key Drivers: The North America PVC Pipes Industry is propelled by robust infrastructure development initiatives across the region, particularly in the United States, aimed at modernizing aging water and transportation systems. Favorable government regulations and building codes that support the use of PVC in plumbing, electrical, and construction applications provide a stable demand base. Technological advancements leading to enhanced PVC formulations, such as improved fire retardancy and chemical resistance in CPVC, are expanding its application scope. The cost-effectiveness and durability of PVC compared to traditional materials like metal pipes further underpin its market dominance.

Barriers & Challenges: Despite strong growth drivers, the industry faces challenges. Fluctuations in raw material prices, particularly ethylene and chlorine, can impact production costs and profit margins. Intense competition from alternative materials, such as PEX and HDPE pipes in certain plumbing applications, requires continuous innovation and cost optimization. Stringent environmental regulations and increasing consumer demand for sustainable alternatives pose a challenge, pushing manufacturers to invest in recycling technologies and bio-based feedstocks. Supply chain disruptions, as witnessed in recent years, can affect material availability and lead times, impacting production schedules.

Growth Drivers in the North America PVC Pipes Industry Market

Key growth drivers for the North America PVC Pipes Industry include the substantial government spending on infrastructure renewal and expansion across the United States, Canada, and Mexico, focusing on water systems, transportation, and energy networks. The continued expansion of residential and commercial construction, fueled by population growth and urbanization, consistently drives demand for PVC pipes and fittings. Technological innovations, such as the development of advanced PVC compounds with enhanced properties like higher temperature resistance (CPVC) and improved fire safety (low-smoke PVC), are opening up new application segments and increasing market penetration. Favorable regulatory frameworks and established industry standards that recognize the performance and reliability of PVC further support its widespread adoption.

Challenges Impacting North America PVC Pipes Industry Growth

Challenges impacting North America PVC Pipes Industry growth include volatility in the prices of key raw materials like ethylene and chlorine, which can affect profitability and competitiveness. Intense competition from alternative piping materials, such as PEX and HDPE, necessitates continuous innovation and cost management. Increasing environmental scrutiny and a growing preference for sustainable materials are pushing the industry to invest in recycling infrastructure and explore bio-based PVC alternatives. Furthermore, global supply chain complexities can lead to disruptions in the availability of feedstocks and finished products, impacting production schedules and delivery timelines. Regulatory changes concerning plastic waste management and emissions can also present compliance hurdles.

Key Players Shaping the North America PVC Pipes Industry Market

- Occidental Petroleum Corporation

- Orbia (Mexichem SAB de CV)

- Amco Polymers

- Aurora Plastics LLC (Nautic Partners LLC)

- Ineos

- SABIC

- LG Chem

- Shin-Etsu Chemical Co Ltd

- Formosa Plastics Corporation

- Westlake Corporation

Significant North America PVC Pipes Industry Industry Milestones

- December 2022: Wavin, a division of Orbia's Building and Infrastructure company, introduced a portfolio of bio-based drinking water solutions to provide water utilities and infrastructure contractors with a cutting-edge sustainable product line. The new products from Wavin are made with a biobased PVC that substitutes ethylene with an alternative bio-ethylene derived from a biomass waste stream and uses vegetable oil.

- August 2022: Aurora Plastics expanded its operations located in Streetsboro, Ohio. With more than 100 million pounds of additional capacity, the expansion will enable the company to increase its thermoplastic compounding capabilities in rigid PVC, rigid PVC alloys, and CPVC.

Future Outlook for North America PVC Pipes Industry Market

The future outlook for the North America PVC Pipes Industry remains exceptionally positive, driven by sustained demand for essential infrastructure upgrades and a resilient construction sector. Strategic investments in advanced, sustainable PVC formulations, including bio-based alternatives and high-performance compounds like CPVC, will be crucial for capturing market share and meeting evolving regulatory and consumer expectations. Opportunities will arise from the increasing adoption of PVC in emerging applications within the automotive, healthcare, and renewable energy sectors. Companies that can effectively navigate supply chain challenges, embrace circular economy principles, and innovate in product development are well-positioned for significant growth and market leadership in the coming years.

North America PVC Pipes Industry Segmentation

-

1. Product Type

-

1.1. Rigid PVC

- 1.1.1. Clear Rigid PVC

- 1.1.2. Non-clear Rigid PVC

-

1.2. Flexible PVC

- 1.2.1. Clear Flexible PVC

- 1.2.2. Non-clear Flexible PVC

- 1.3. Low-smoke PVC

- 1.4. Chlorinated PVC

-

1.1. Rigid PVC

-

2. Application

- 2.1. Pipes and Fittings

- 2.2. Films and Sheets

- 2.3. Wires and Cables

- 2.4. Bottles

- 2.5. Profiles, Hoses, and Tubings

- 2.6. Other Applications

-

3. End-user Industry

- 3.1. Healthcare

- 3.2. Automotive

- 3.3. Electrical and Electronics

- 3.4. Packaging

- 3.5. Footwear

- 3.6. Building and Construction

- 3.7. Other End-user Industries

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

North America PVC Pipes Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America PVC Pipes Industry Regional Market Share

Geographic Coverage of North America PVC Pipes Industry

North America PVC Pipes Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Application in the Healthcare and Medical Devices Industries; Rising Demand from the Construction Industry

- 3.3. Market Restrains

- 3.3.1. Hazardous Impact on Humans and the Environment; Other Restraints

- 3.4. Market Trends

- 3.4.1. Growing Demand from the Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America PVC Pipes Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Rigid PVC

- 5.1.1.1. Clear Rigid PVC

- 5.1.1.2. Non-clear Rigid PVC

- 5.1.2. Flexible PVC

- 5.1.2.1. Clear Flexible PVC

- 5.1.2.2. Non-clear Flexible PVC

- 5.1.3. Low-smoke PVC

- 5.1.4. Chlorinated PVC

- 5.1.1. Rigid PVC

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pipes and Fittings

- 5.2.2. Films and Sheets

- 5.2.3. Wires and Cables

- 5.2.4. Bottles

- 5.2.5. Profiles, Hoses, and Tubings

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Healthcare

- 5.3.2. Automotive

- 5.3.3. Electrical and Electronics

- 5.3.4. Packaging

- 5.3.5. Footwear

- 5.3.6. Building and Construction

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America PVC Pipes Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Rigid PVC

- 6.1.1.1. Clear Rigid PVC

- 6.1.1.2. Non-clear Rigid PVC

- 6.1.2. Flexible PVC

- 6.1.2.1. Clear Flexible PVC

- 6.1.2.2. Non-clear Flexible PVC

- 6.1.3. Low-smoke PVC

- 6.1.4. Chlorinated PVC

- 6.1.1. Rigid PVC

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Pipes and Fittings

- 6.2.2. Films and Sheets

- 6.2.3. Wires and Cables

- 6.2.4. Bottles

- 6.2.5. Profiles, Hoses, and Tubings

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Healthcare

- 6.3.2. Automotive

- 6.3.3. Electrical and Electronics

- 6.3.4. Packaging

- 6.3.5. Footwear

- 6.3.6. Building and Construction

- 6.3.7. Other End-user Industries

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America PVC Pipes Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Rigid PVC

- 7.1.1.1. Clear Rigid PVC

- 7.1.1.2. Non-clear Rigid PVC

- 7.1.2. Flexible PVC

- 7.1.2.1. Clear Flexible PVC

- 7.1.2.2. Non-clear Flexible PVC

- 7.1.3. Low-smoke PVC

- 7.1.4. Chlorinated PVC

- 7.1.1. Rigid PVC

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Pipes and Fittings

- 7.2.2. Films and Sheets

- 7.2.3. Wires and Cables

- 7.2.4. Bottles

- 7.2.5. Profiles, Hoses, and Tubings

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Healthcare

- 7.3.2. Automotive

- 7.3.3. Electrical and Electronics

- 7.3.4. Packaging

- 7.3.5. Footwear

- 7.3.6. Building and Construction

- 7.3.7. Other End-user Industries

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America PVC Pipes Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Rigid PVC

- 8.1.1.1. Clear Rigid PVC

- 8.1.1.2. Non-clear Rigid PVC

- 8.1.2. Flexible PVC

- 8.1.2.1. Clear Flexible PVC

- 8.1.2.2. Non-clear Flexible PVC

- 8.1.3. Low-smoke PVC

- 8.1.4. Chlorinated PVC

- 8.1.1. Rigid PVC

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Pipes and Fittings

- 8.2.2. Films and Sheets

- 8.2.3. Wires and Cables

- 8.2.4. Bottles

- 8.2.5. Profiles, Hoses, and Tubings

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Healthcare

- 8.3.2. Automotive

- 8.3.3. Electrical and Electronics

- 8.3.4. Packaging

- 8.3.5. Footwear

- 8.3.6. Building and Construction

- 8.3.7. Other End-user Industries

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Occidental Petroleum Corporation

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Orbia (Mexichem SAB de CV )

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Amco Polymers

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Aurora Plastics LLC (Nautic Partners LLC )

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Ineos

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 SABIC

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 LG Chem

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Shin-Etsu Chemical Co Ltd

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Formosa Plastics Corporation

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Westlake Corporation

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Occidental Petroleum Corporation

List of Figures

- Figure 1: North America PVC Pipes Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America PVC Pipes Industry Share (%) by Company 2025

List of Tables

- Table 1: North America PVC Pipes Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: North America PVC Pipes Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: North America PVC Pipes Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: North America PVC Pipes Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: North America PVC Pipes Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: North America PVC Pipes Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 7: North America PVC Pipes Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: North America PVC Pipes Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 9: North America PVC Pipes Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 10: North America PVC Pipes Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 11: North America PVC Pipes Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 12: North America PVC Pipes Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 13: North America PVC Pipes Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: North America PVC Pipes Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 15: North America PVC Pipes Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 16: North America PVC Pipes Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 17: North America PVC Pipes Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 18: North America PVC Pipes Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 19: North America PVC Pipes Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: North America PVC Pipes Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 21: North America PVC Pipes Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 22: North America PVC Pipes Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 23: North America PVC Pipes Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 24: North America PVC Pipes Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 25: North America PVC Pipes Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 26: North America PVC Pipes Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 27: North America PVC Pipes Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: North America PVC Pipes Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 29: North America PVC Pipes Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: North America PVC Pipes Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 31: North America PVC Pipes Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 32: North America PVC Pipes Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 33: North America PVC Pipes Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 34: North America PVC Pipes Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 35: North America PVC Pipes Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 36: North America PVC Pipes Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 37: North America PVC Pipes Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 38: North America PVC Pipes Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 39: North America PVC Pipes Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: North America PVC Pipes Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America PVC Pipes Industry?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the North America PVC Pipes Industry?

Key companies in the market include Occidental Petroleum Corporation, Orbia (Mexichem SAB de CV ), Amco Polymers, Aurora Plastics LLC (Nautic Partners LLC ), Ineos, SABIC, LG Chem, Shin-Etsu Chemical Co Ltd, Formosa Plastics Corporation, Westlake Corporation.

3. What are the main segments of the North America PVC Pipes Industry?

The market segments include Product Type, Application, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Application in the Healthcare and Medical Devices Industries; Rising Demand from the Construction Industry.

6. What are the notable trends driving market growth?

Growing Demand from the Construction Industry.

7. Are there any restraints impacting market growth?

Hazardous Impact on Humans and the Environment; Other Restraints.

8. Can you provide examples of recent developments in the market?

December 2022: Wavin, a division of Orbia's Building and Infrastructure company, introduced a portfolio of bio-based drinking water solutions to provide water utilities and infrastructure contractors with a cutting-edge sustainable product line. The new products from Wavin are made with a biobased PVC that substitutes ethylene with an alternative bio-ethylene derived from a biomass waste stream and uses vegetable oil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America PVC Pipes Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America PVC Pipes Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America PVC Pipes Industry?

To stay informed about further developments, trends, and reports in the North America PVC Pipes Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence