Key Insights

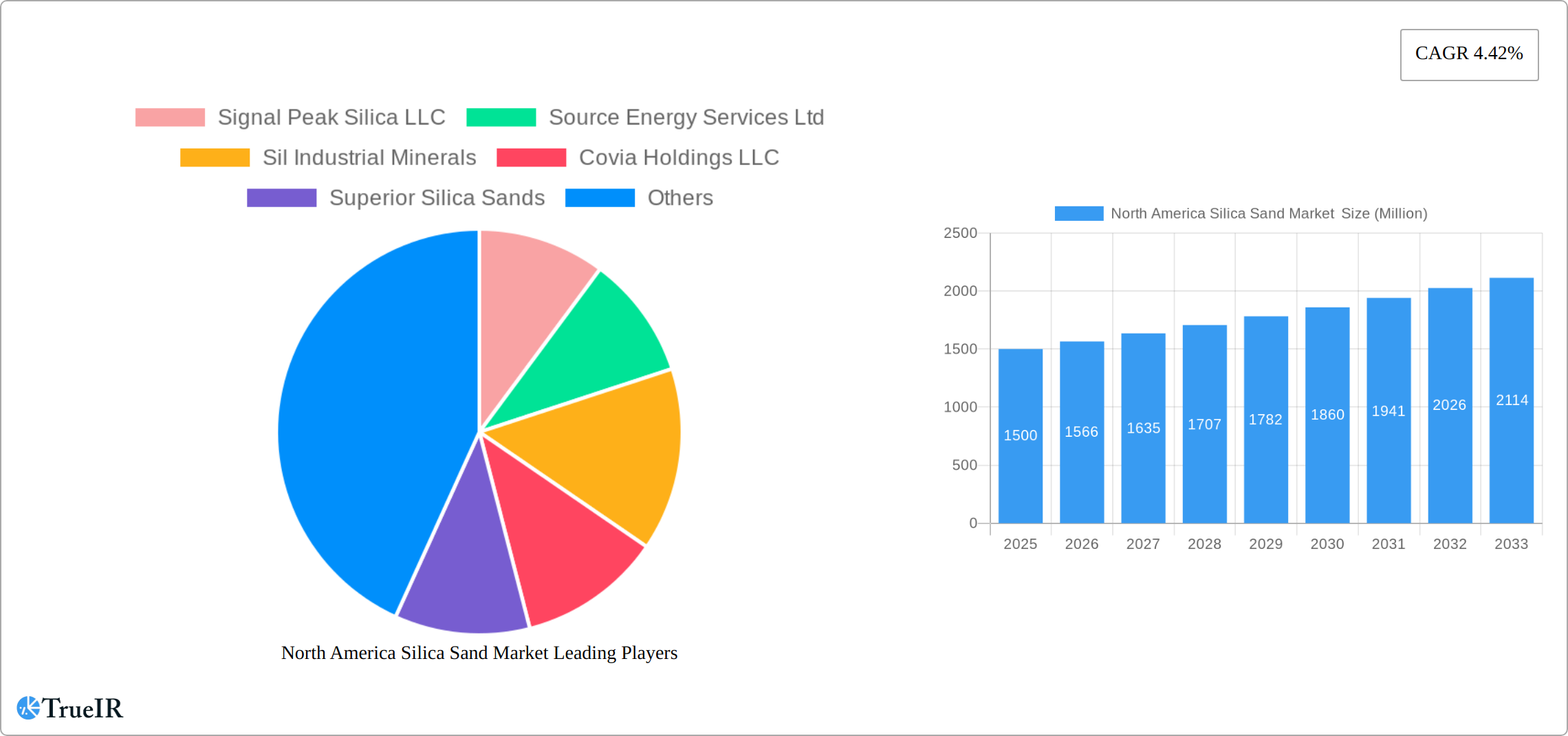

The North American silica sand market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.42% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning construction industry, particularly in infrastructure development and residential building, significantly boosts demand for silica sand in concrete and mortar production. Furthermore, the increasing adoption of hydraulic fracturing (fracking) in the oil and gas sector contributes substantially to market growth, as silica sand is a crucial component in this process. The growth in the manufacturing sectors like glass, ceramics, and paints and coatings further enhances the market's prospects. While specific regional breakdowns for North America aren't provided, the US market likely holds the largest share due to its substantial construction activity and energy sector. Canada and Mexico contribute significantly, although their growth rates may differ based on their specific economic developments.

North America Silica Sand Market Market Size (In Billion)

However, the market also faces certain restraints. Fluctuations in commodity prices, particularly oil and gas, can impact the demand for silica sand in the energy sector. Environmental regulations concerning silica dust and its potential health hazards present another challenge for manufacturers and necessitate the adoption of environmentally friendly extraction and processing techniques. Competition among numerous established players like U.S. Silica, Covia Holdings LLC, and Sibelco, along with emerging smaller companies, adds another layer of complexity. Despite these challenges, the overall positive outlook for construction, energy, and manufacturing sectors points towards sustained growth in the North American silica sand market in the coming years. The market segmentation highlights diverse end-user industries which contribute to its resilience against specific sector downturns. The robust demand coupled with strategic acquisitions and technological advancements in production will continue to shape the market landscape.

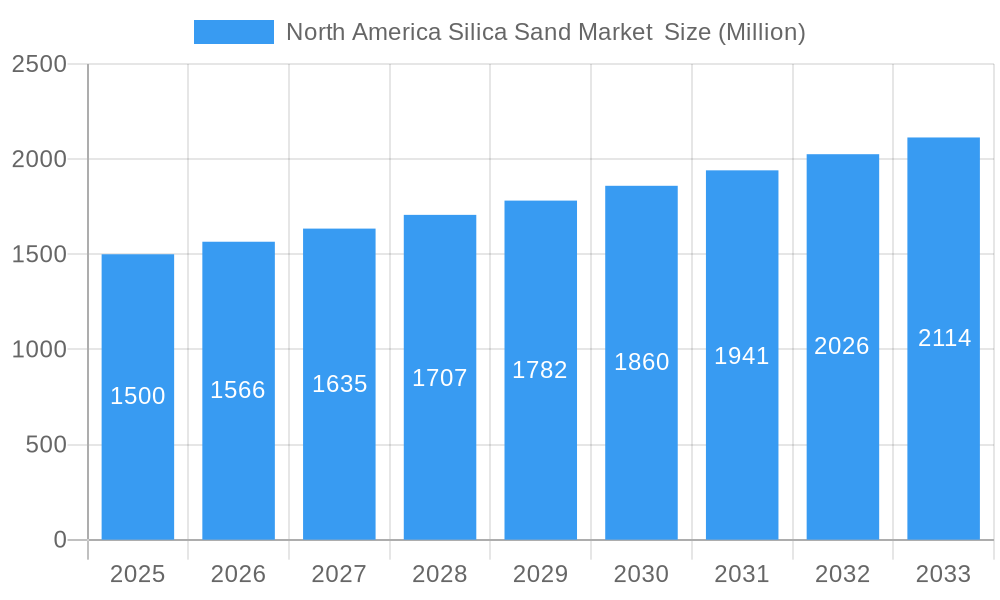

North America Silica Sand Market Company Market Share

North America Silica Sand Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the North America silica sand market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this study unveils the market's structure, competitive landscape, dominant segments, and future growth trajectory. Leveraging extensive market research and data analysis, this report delivers actionable intelligence to navigate the complexities of this crucial industry. The report forecasts a market value exceeding xx Million by 2033, presenting lucrative opportunities for businesses across the value chain.

North America Silica Sand Market Structure & Competitive Landscape

The North American silica sand market exhibits a moderately concentrated structure, with a handful of major players controlling a significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately consolidated landscape. Innovation in processing techniques, particularly in the areas of purity and particle size control, remains a key driver of market differentiation. Regulatory compliance concerning environmental protection and worker safety significantly impacts operational costs and profitability. Substitute materials, such as glass cullet and other mineral fillers, pose a competitive threat to silica sand in certain applications.

- Market Concentration: HHI (2024): xx

- M&A Activity (2019-2024): xx transactions, with a total value of xx Million.

- Key Segmentation: The market is segmented by end-user industry (Glass Manufacturing, Foundry, Chemical Production, Construction, Paints and Coatings, Ceramics and Refractories, Filtration, Oil and Gas Recovery, Other End-User Industries), geographical region (United States, Canada, Mexico), and product type (e.g., industrial grade, high-purity).

- Innovation Drivers: Advances in processing technologies, leading to higher purity and customized particle size distribution.

- Regulatory Impacts: Environmental regulations and safety standards influencing operational costs and sustainable practices.

North America Silica Sand Market Market Trends & Opportunities

The North America silica sand market is experiencing robust growth, driven by increasing demand from key end-user industries. The market size expanded from xx Million in 2019 to xx Million in 2024, exhibiting a CAGR of xx% during the historical period. Technological advancements, such as improved mining techniques and enhanced processing capabilities, are contributing to increased efficiency and reduced costs. Consumer preferences towards sustainable building materials and eco-friendly manufacturing processes are driving the adoption of silica sand in various applications. The evolving competitive landscape, marked by strategic partnerships, acquisitions, and capacity expansions, further shapes the market dynamics. Market penetration rates vary widely across different end-user segments, with the construction and glass manufacturing sectors demonstrating higher growth potential. The forecast period (2025-2033) anticipates a CAGR of xx%, driven by increasing infrastructure investments and expanding industrial output.

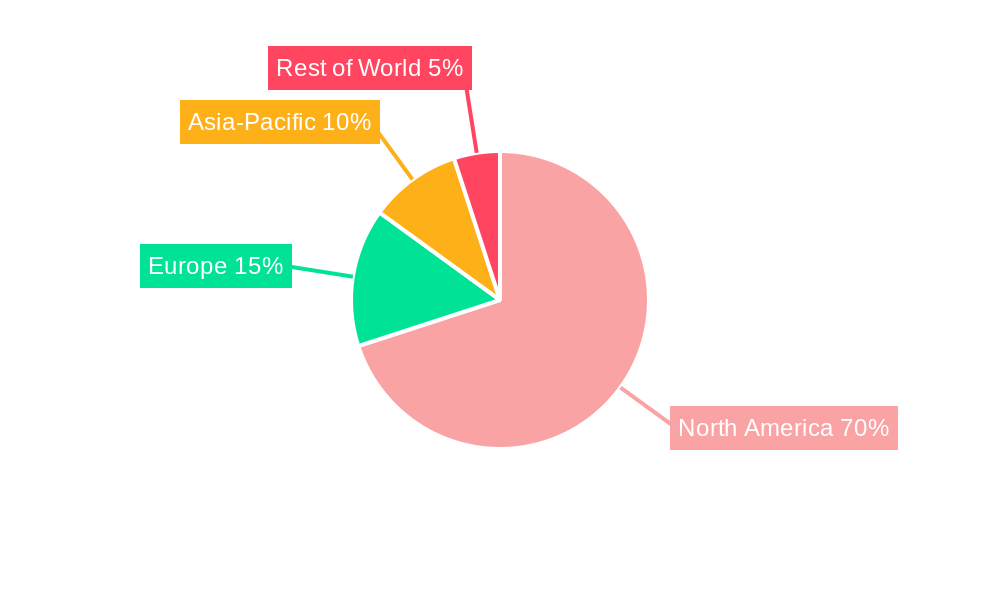

Dominant Markets & Segments in North America Silica Sand Market

The United States unequivocally leads the North American silica sand market, driven by its expansive and resilient construction industry, alongside a substantial and consistent demand from the critical glass manufacturing sector. These two end-user industries are the primary consumers of silica sand, collectively accounting for approximately 65% of the total market share, with construction contributing around 38% and glass manufacturing around 27%. The robustness of these sectors is further bolstered by several key growth drivers:

- Key Growth Drivers in the US Construction Sector: Significant and ongoing investments in public infrastructure projects, a steady increase in new housing starts reflecting demographic shifts, and proactive government initiatives aimed at stimulating and supporting construction activities all contribute to sustained demand for silica sand.

- Key Growth Drivers in the Glass Manufacturing Sector: The automotive industry's continuous demand for high-quality flat glass, the robust growth in the production of containers for food and beverage packaging, and the expansion of the architectural and specialty glass segments are major catalysts for silica sand consumption.

- Canada & Mexico: While currently representing smaller market shares compared to the United States, both Canada and Mexico are exhibiting strong and promising growth trajectories. This expansion is fueled by burgeoning industrial development, the initiation of large-scale construction projects, and an increasing integration into North American supply chains.

North America Silica Sand Market Product Analysis

Technological advancements are continuously improving the quality and properties of silica sand. Innovations focus on achieving higher purity levels, precise particle size distributions, and specialized surface treatments to enhance performance in specific applications. This ensures improved efficiency and performance benefits for end-users, strengthening competitive advantages for silica sand producers.

Key Drivers, Barriers & Challenges in North America Silica Sand Market

Key Drivers: The North American silica sand market is experiencing robust growth, primarily propelled by substantial investments in infrastructure development across the United States and Canada. This is complemented by a consistently rising demand from the essential glass manufacturing and construction sectors. Furthermore, ongoing technological advancements are leading to the production of higher-quality, specialized silica sand products, opening up new application areas and enhancing existing ones.

Challenges: The market is not without its hurdles. Significant fluctuations in commodity prices can impact profitability and investment decisions. Stringent environmental regulations and lengthy permitting processes can create operational complexities and increase compliance costs. Intense competition among a large number of producers, coupled with the increasing emergence and adoption of substitute materials in certain applications, exerts downward pressure on pricing. Supply chain disruptions, exacerbated by transportation bottlenecks, geopolitical instability, or unforeseen events, pose a continuous threat to market stability and growth. The estimated impact of cumulative supply chain issues on market growth in 2024 was approximately 4-6%.

Growth Drivers in the North America Silica Sand Market Market

The growth of the North America silica sand market is propelled by several factors. Firstly, the burgeoning construction sector, fueled by infrastructure projects and housing developments, drives substantial demand. Secondly, the glass manufacturing industry's consistent expansion, particularly in sectors such as automotive glass and containers, fuels market growth. Thirdly, technological advances in silica sand processing enhance product quality and expand its applications across various sectors.

Challenges Impacting North America Silica Sand Market Growth

Despite its robust growth, the North American silica sand market faces several significant challenges that can impede its expansion. Increasingly stringent environmental regulations across the region necessitate substantial investments in new technologies and operational adjustments to ensure compliance, thereby increasing overall production costs. Supply chain disruptions, whether stemming from global geopolitical events, localized logistics hurdles, or transportation infrastructure limitations, can lead to unpredictable price volatility and shortages, impacting both producers and consumers. Furthermore, the market is characterized by a high degree of competition, with numerous established and emerging players vying for market share. This intense competition, combined with the ongoing development and adoption of substitute materials in specific applications, can exert considerable pricing pressure, potentially impacting profit margins for silica sand producers.

Key Players Shaping the North America Silica Sand Market Market

- Signal Peak Silica LLC

- Source Energy Services Ltd

- Sil Industrial Minerals

- Covia Holdings LLC

- Superior Silica Sands

- Capital Sand Company

- Sibelco

- Athabasca Minerals Inc

- Atlas Sand Company LLC

- Hi-Crush Inc

- Badger Mining Corporation

- U S Silica

Significant North America Silica Sand Market Industry Milestones

- November 2022: AMI Silica LLC, a subsidiary of Athabasca Minerals Inc., entered into a multi-year Transload Agreement with CRL Transload Services Ltd, boosting its logistical capabilities.

- April 2022: Source Energy Services Ltd. significantly expanded its frac sand production capacity through an acquisition, enhancing its market position.

Future Outlook for North America Silica Sand Market Market

The North America silica sand market is poised for sustained growth, driven by robust demand from key end-user industries. Strategic investments in capacity expansions, technological upgrades, and sustainable practices will further shape the market's future trajectory. The increasing focus on infrastructure development and the construction industry's continued expansion provide substantial growth catalysts. Furthermore, the ongoing innovation in silica sand processing and applications across diverse sectors ensures a positive outlook for the market's potential.

North America Silica Sand Market Segmentation

-

1. End-User Industry

- 1.1. Glass Manufacturing

- 1.2. Foundry

- 1.3. Chemical Production

- 1.4. Construction

- 1.5. Paints and Coatings

- 1.6. Ceramics and Refractories

- 1.7. Filtration

- 1.8. Oil and Gas Recovery

- 1.9. Other End-User Industry

-

2. Product Type

- 2.1. High-Purity Silica Sand

- 2.2. Foundry Silica Sand

- 2.3. Construction Silica Sand

- 2.4. Other

North America Silica Sand Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Silica Sand Market Regional Market Share

Geographic Coverage of North America Silica Sand Market

North America Silica Sand Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Glass Industry; Increasing Consumption in the Foundry Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Availability of Substitutes; Illegal Mining of Sand

- 3.4. Market Trends

- 3.4.1. Oil and Gas Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Glass Manufacturing

- 5.1.2. Foundry

- 5.1.3. Chemical Production

- 5.1.4. Construction

- 5.1.5. Paints and Coatings

- 5.1.6. Ceramics and Refractories

- 5.1.7. Filtration

- 5.1.8. Oil and Gas Recovery

- 5.1.9. Other End-User Industry

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. High-Purity Silica Sand

- 5.2.2. Foundry Silica Sand

- 5.2.3. Construction Silica Sand

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. United States North America Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6.1.1. Glass Manufacturing

- 6.1.2. Foundry

- 6.1.3. Chemical Production

- 6.1.4. Construction

- 6.1.5. Paints and Coatings

- 6.1.6. Ceramics and Refractories

- 6.1.7. Filtration

- 6.1.8. Oil and Gas Recovery

- 6.1.9. Other End-User Industry

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. High-Purity Silica Sand

- 6.2.2. Foundry Silica Sand

- 6.2.3. Construction Silica Sand

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by End-User Industry

- 7. Canada North America Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-User Industry

- 7.1.1. Glass Manufacturing

- 7.1.2. Foundry

- 7.1.3. Chemical Production

- 7.1.4. Construction

- 7.1.5. Paints and Coatings

- 7.1.6. Ceramics and Refractories

- 7.1.7. Filtration

- 7.1.8. Oil and Gas Recovery

- 7.1.9. Other End-User Industry

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. High-Purity Silica Sand

- 7.2.2. Foundry Silica Sand

- 7.2.3. Construction Silica Sand

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by End-User Industry

- 8. Mexico North America Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-User Industry

- 8.1.1. Glass Manufacturing

- 8.1.2. Foundry

- 8.1.3. Chemical Production

- 8.1.4. Construction

- 8.1.5. Paints and Coatings

- 8.1.6. Ceramics and Refractories

- 8.1.7. Filtration

- 8.1.8. Oil and Gas Recovery

- 8.1.9. Other End-User Industry

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. High-Purity Silica Sand

- 8.2.2. Foundry Silica Sand

- 8.2.3. Construction Silica Sand

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by End-User Industry

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Signal Peak Silica LLC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Source Energy Services Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Sil Industrial Minerals

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Covia Holdings LLC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Superior Silica Sands

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Capital Sand Company

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Sibelco

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Athabasca Minerals Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Atlas Sand Company LLC

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Hi-Crush Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Badger Mining Corporation

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 U S Silica

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.1 Signal Peak Silica LLC

List of Figures

- Figure 1: North America Silica Sand Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Silica Sand Market Share (%) by Company 2025

List of Tables

- Table 1: North America Silica Sand Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 2: North America Silica Sand Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 3: North America Silica Sand Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 4: North America Silica Sand Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 5: North America Silica Sand Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: North America Silica Sand Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: North America Silica Sand Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 8: North America Silica Sand Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 9: North America Silica Sand Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: North America Silica Sand Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 11: North America Silica Sand Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: North America Silica Sand Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: North America Silica Sand Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 14: North America Silica Sand Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 15: North America Silica Sand Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 16: North America Silica Sand Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 17: North America Silica Sand Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: North America Silica Sand Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 19: North America Silica Sand Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 20: North America Silica Sand Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 21: North America Silica Sand Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 22: North America Silica Sand Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 23: North America Silica Sand Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: North America Silica Sand Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Silica Sand Market ?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the North America Silica Sand Market ?

Key companies in the market include Signal Peak Silica LLC, Source Energy Services Ltd, Sil Industrial Minerals, Covia Holdings LLC, Superior Silica Sands, Capital Sand Company, Sibelco, Athabasca Minerals Inc, Atlas Sand Company LLC, Hi-Crush Inc, Badger Mining Corporation, U S Silica.

3. What are the main segments of the North America Silica Sand Market ?

The market segments include End-User Industry, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Glass Industry; Increasing Consumption in the Foundry Industry; Other Drivers.

6. What are the notable trends driving market growth?

Oil and Gas Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Availability of Substitutes; Illegal Mining of Sand.

8. Can you provide examples of recent developments in the market?

November 2022: AMI Silica LLC, a subsidiary of Athabasca Minerals Inc., entered into a multi-year Transload Agreement with CRL Transload Services Ltd for sand trans-loading and storage services at its Taylor, British Columbia location, where it mines silica sand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Silica Sand Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Silica Sand Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Silica Sand Market ?

To stay informed about further developments, trends, and reports in the North America Silica Sand Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence