Key Insights

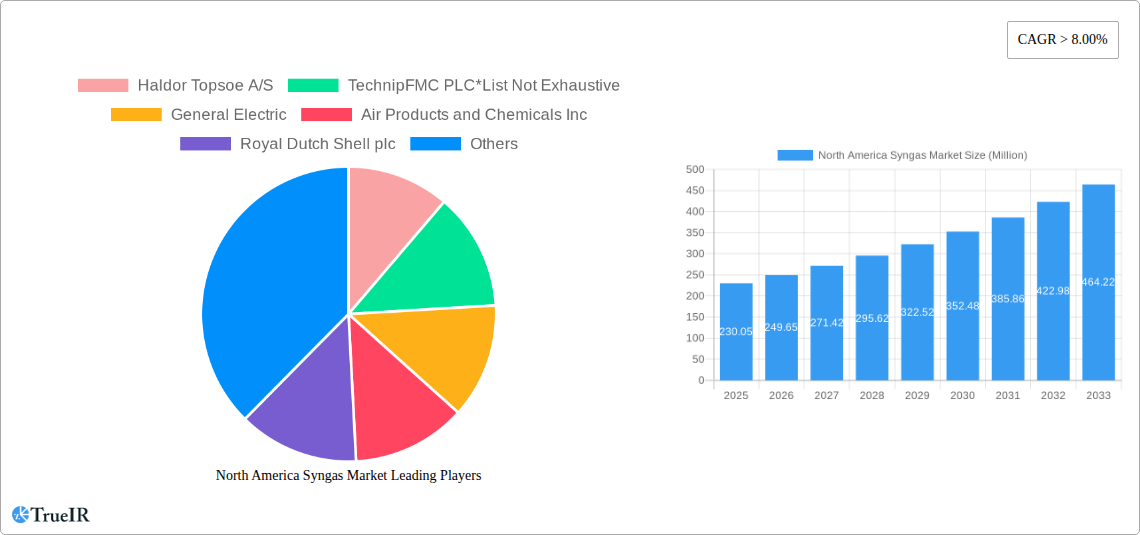

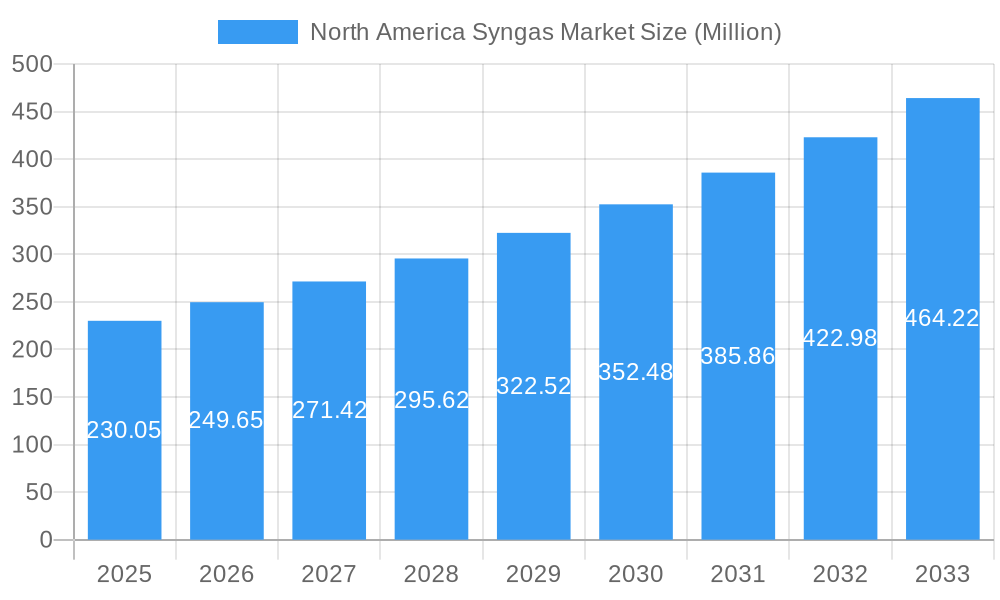

The North American syngas market, valued at approximately $230.05 million in 2025, is projected to experience robust growth, exceeding an 8% CAGR from 2025 to 2033. This expansion is fueled by several key drivers. The increasing demand for cleaner energy sources is pushing power generation companies to adopt syngas as a more sustainable alternative to traditional fossil fuels. Furthermore, the burgeoning chemical industry, particularly in the production of dimethyl ether (DME) and other value-added chemicals, is significantly boosting syngas demand. The prevalent use of coal, natural gas, and biomass as feedstocks within North America further contributes to the market's growth trajectory. Technological advancements in gasification processes, including steam reforming, partial oxidation, and auto-thermal reforming, are enhancing efficiency and cost-effectiveness, making syngas a more attractive option. While the market faces potential restraints such as fluctuating feedstock prices and stringent environmental regulations, the overall positive outlook for cleaner energy and chemical production ensures sustained market growth. The segment breakdown reveals a diverse market with significant contributions from fixed-bed, entrained flow, and fluidized-bed gasifiers, each catering to different applications and feedstock types. Major players like Haldor Topsoe, TechnipFMC, and General Electric are driving innovation and market penetration, solidifying their positions in this evolving landscape. The continued focus on sustainability and the development of advanced technologies promise further growth in the North American syngas market.

North America Syngas Market Market Size (In Million)

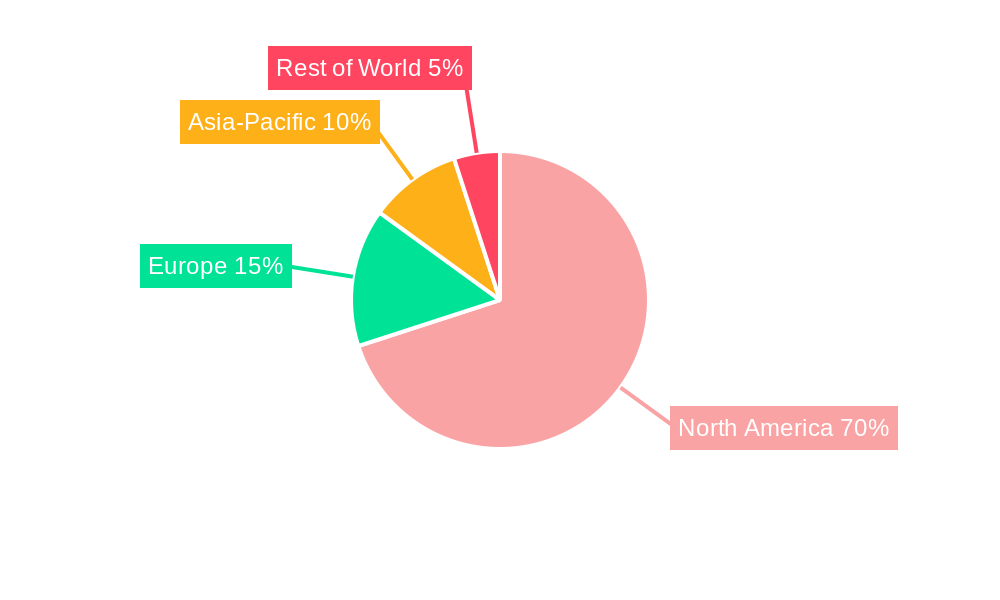

Within the North American context, the United States constitutes the largest market segment, driven by robust industrial activity and a significant chemical production sector. Canada also contributes substantially, owing to its resource-rich environment and ongoing investments in renewable energy infrastructure. Mexico, while smaller in contribution compared to the US and Canada, demonstrates consistent growth potential. This regional diversity within the North American market reflects varying levels of industrial development, energy policies, and feedstock availability. The specific mix of gasifier types and applications varies across these regions, reflecting the differing priorities and resource bases. Future market performance will heavily rely on government policies promoting clean energy, ongoing technological improvements within gasification and syngas utilization, and the ability of industry players to adapt to fluctuations in commodity prices.

North America Syngas Market Company Market Share

North America Syngas Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America syngas market, offering invaluable insights for businesses, investors, and policymakers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report leverages rigorous data analysis and expert insights to deliver a clear understanding of market dynamics, trends, and future projections. The market is segmented by gasifier type (Fixed Bed, Entrained Flow, Fluidized Bed), application (Power Generation, Chemicals, Dimethyl Ether: Liquid Fuels, Gaseous Fuels), feedstock (Coal, Natural Gas, Petroleum, Pet-coke, Biomass), and technology (Steam Reforming, Partial Oxidation, Auto-thermal Reforming, Combined or Two-step Reforming, Biomass Gasification). Key players include Haldor Topsoe A/S, TechnipFMC PLC, General Electric, Air Products and Chemicals Inc, Royal Dutch Shell plc, Siemens, KBR Inc, BASF SE, Sasol, Linde plc, SynGas Technology LLC, Air Liquide, BP plc, and Dakota Gasification Company Inc. The report projects a total market value exceeding xx Million by 2033.

North America Syngas Market Structure & Competitive Landscape

The North American syngas market exhibits a moderately consolidated structure, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025. Several large multinational corporations dominate the market, controlling a significant share of production and distribution. However, the presence of smaller, specialized players fosters innovation and competition, particularly in niche segments like biomass gasification.

Market Concentration: The HHI is expected to remain relatively stable during the forecast period (2025-2033), suggesting a continuation of the current competitive landscape. However, strategic mergers and acquisitions (M&A) activity could alter this dynamic.

Innovation Drivers: Technological advancements in gasification technologies, particularly those focused on efficiency and sustainability, are key drivers of innovation. The development of carbon capture and storage (CCS) technologies is also significantly shaping the market.

Regulatory Impacts: Government regulations regarding emissions and renewable energy targets exert a significant influence on market growth and investment decisions. Stringent environmental standards drive the adoption of cleaner technologies and sustainable feedstocks.

Product Substitutes: While syngas has unique applications, competition exists from other energy sources, such as natural gas and renewable electricity, in certain market segments (e.g., power generation).

End-User Segmentation: The market's end-user segments are diverse, including power generation companies, chemical manufacturers, and producers of liquid and gaseous fuels. The demand from each segment varies depending on factors like energy prices and government policies.

M&A Trends: A moderate level of M&A activity is anticipated, driven by companies seeking to expand their market share, access new technologies, or diversify their product portfolios. The total value of M&A transactions in the North America syngas market is projected to reach xx Million during 2025-2033.

North America Syngas Market Market Trends & Opportunities

The North America syngas market is experiencing robust growth, driven by increasing demand for cleaner energy sources and the expanding chemical industry. The market size, valued at xx Million in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period, reaching xx Million by 2033. This growth is fueled by several key factors: Firstly, the increasing adoption of carbon capture and storage (CCS) technologies is reducing the environmental footprint of syngas production, making it a more attractive option for environmentally conscious businesses. Secondly, the growing demand for various chemicals and fuels is another significant driver, creating substantial demand for syngas as a feedstock. Thirdly, continuous technological improvements are leading to increased efficiency and cost-effectiveness in syngas production, further propelling the growth of the market. Furthermore, government policies and regulations encouraging the use of cleaner energy sources are fostering the expansion of the syngas market. Despite these positive trends, the market faces several challenges, including fluctuating energy prices and the competition from other energy sources. The market penetration rate for syngas-based power generation is expected to increase from xx% in 2025 to xx% by 2033, reflecting the growing adoption of this technology. The penetration rate for chemical applications is projected to grow similarly, reflecting the demand for syngas in this sector.

Dominant Markets & Segments in North America Syngas Market

The North American syngas market exhibits significant geographical diversity, with robust activity across multiple regions. Currently, the Gulf Coast region stands out as a dominant force, primarily due to its well-established infrastructure and unparalleled access to abundant natural gas resources. The power generation segment continues to be the largest application area, driven by sustained demand from major electricity producers seeking efficient and cleaner energy solutions.

-

Key Growth Drivers:

- The region's rich endowment of natural gas reserves provides a cost-effective and readily available feedstock.

- Extensive existing infrastructure for syngas production, processing, and distribution facilitates market expansion.

- Supportive government policies, including tax incentives and mandates for cleaner energy alternatives, are significant catalysts for market growth.

- Increasing investments in Carbon Capture and Storage (CCS) technologies are enhancing the sustainability profile of syngas production.

- Growing demand for syngas as a versatile intermediate for a wide array of chemical products.

-

Dominant Segments:

- Gasifier Type: Entrained flow gasifiers are projected to maintain their leadership owing to their high efficiency and ability to process a broad spectrum of feedstocks. However, fluidized bed gasifiers are anticipated to experience considerable growth, driven by their superior performance with diverse and challenging biomass feedstocks.

- Application: Power generation remains the leading application. The chemical industry follows closely, utilizing syngas for the production of various chemicals. The dimethyl ether (DME) segment is identified as having the highest potential growth rate, propelled by its increasing use as a clean fuel alternative.

- Feedstock: While natural gas currently dominates as the primary feedstock due to its availability and cost-effectiveness, the utilization of biomass is expected to witness a steady and significant increase. This shift is largely attributed to the escalating global emphasis on sustainability and the circular economy.

- Technology: Steam reforming continues to be the most prevalent technology for syngas production. However, partial oxidation (POX) and autothermal reforming (ATR) technologies are gaining substantial traction. This is due to their enhanced adaptability and efficiency in handling a wider range of feedstocks and operating conditions, offering greater flexibility to producers.

A detailed analysis underscores that the dominance of regions like the Gulf Coast is further amplified by their established industrial infrastructure, consistent access to natural gas, and a conducive regulatory environment. These factors collectively encourage substantial investments in the development and expansion of syngas production facilities, solidifying their position in the market.

North America Syngas Market Product Analysis

Recent technological advancements have led to the development of more efficient and environmentally friendly syngas production processes. Innovations in gasification technologies, such as improved catalyst designs and process optimization techniques, have resulted in enhanced energy efficiency and reduced emissions. Furthermore, advancements in carbon capture and storage (CCS) technologies are making syngas production increasingly sustainable. These innovations are enhancing the competitiveness of syngas in various applications, particularly power generation and chemical production. New designs focusing on waste stream usage are increasing market fit.

Key Drivers, Barriers & Challenges in North America Syngas Market

Key Drivers: The increasing demand for cleaner energy sources and the growing chemical industry are the primary drivers of market growth. Government incentives and policies supporting renewable energy and carbon emission reduction further stimulate the market. Technological advancements, including improved gasification efficiencies and the integration of CCS technologies, play a critical role.

Key Barriers and Challenges: Fluctuating energy prices and competition from other energy sources pose significant challenges. Regulatory complexities and environmental concerns can hinder investment and expansion. Supply chain disruptions and potential material shortages can impact production costs and availability. The estimated impact of these challenges on market growth is xx% reduction in projected growth by 2033.

Growth Drivers in the North America Syngas Market Market

The North American syngas market's growth is fueled by increasing demand from power generation and the chemical industry. Government policies favoring clean energy and investments in CCS technologies are significant catalysts. Technological advancements, including improved gasification efficiency and feedstock diversification, further drive expansion.

Challenges Impacting North America Syngas Market Growth

Regulatory hurdles, fluctuating energy prices, and competition from alternative energy sources pose substantial challenges. Supply chain vulnerabilities and potential feedstock shortages also impede growth. Addressing these issues through strategic planning and technological innovation is crucial for sustained market development.

Key Players Shaping the North America Syngas Market Market

- Haldor Topsoe A/S

- TechnipFMC PLC

- General Electric

- Air Products and Chemicals Inc

- Royal Dutch Shell plc

- Siemens

- KBR Inc

- BASF SE

- Sasol

- Linde plc

- SynGas Technology LLC

- Air Liquide

- BP plc

- Dakota Gasification Company Inc

Significant North America Syngas Market Industry Milestones

- 2022 Q4: Air Products and Chemicals Inc. announced a substantial investment in a new syngas facility, notably incorporating advanced Carbon Capture and Storage (CCS) technology to minimize environmental impact.

- 2023 Q1: A significant strategic partnership was forged between Haldor Topsoe A/S and a leading energy corporation, focusing on the joint development of cutting-edge biomass gasification technologies to enhance sustainable syngas production.

- 2024 Q2: The commissioning of a new, state-of-the-art biomass-based syngas production facility in the Midwest region marked a significant expansion in production capacity, contributing to regional energy diversification.

- 2025 Q3: Multiple key industry players are expected to make announcements regarding ambitious plans for expanding existing facilities and making strategic investments in more modern, high-efficiency syngas production technologies to meet growing market demand and regulatory requirements.

Future Outlook for North America Syngas Market Market

The North America syngas market is poised for continued growth driven by increasing demand from various sectors and the rising adoption of cleaner energy solutions. Strategic investments in CCS technology and advancements in gasification processes promise to enhance sustainability and efficiency. The focus on biomass-based syngas is expected to lead to greater environmental benefits, thus attracting further investments into this area. The market's strong growth trajectory is predicted to continue over the forecast period, creating substantial opportunities for businesses and investors alike.

North America Syngas Market Segmentation

-

1. Feedstock

- 1.1. Coal

- 1.2. Natural Gas

- 1.3. Petroleum

- 1.4. Pet-coke

- 1.5. Biomass

-

2. Technology

- 2.1. Steam Reforming

- 2.2. Partial Oxidation

- 2.3. Auto-thermal Reforming

- 2.4. Combined or Two-step Reforming

- 2.5. Biomass Gasification

-

3. Gasifier Type

- 3.1. Fixed Bed

- 3.2. Entrained Flow

- 3.3. Fluidized Bed

-

4. Application

- 4.1. Power Generation

-

4.2. Chemicals

- 4.2.1. Methanol

- 4.2.2. Ammonia

- 4.2.3. Oxo Chemicals

- 4.2.4. n-Butanol

- 4.2.5. Hydrogen

- 4.2.6. Dimethyl Ether

- 4.3. Liquid Fuels

- 4.4. Gaseous Fuels

-

5. Geography

- 5.1. United States

- 5.2. Canada

- 5.3. Mexico

- 5.4. Rest of North America

North America Syngas Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Syngas Market Regional Market Share

Geographic Coverage of North America Syngas Market

North America Syngas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 8.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Feedstock Flexibility for Syngas Production; Growing Demand for Electricity; Growing Chemical Industry

- 3.3. Market Restrains

- 3.3.1. ; High Capital Investment and Funding

- 3.4. Market Trends

- 3.4.1. Increasing Usage in Power Generation Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Syngas Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Feedstock

- 5.1.1. Coal

- 5.1.2. Natural Gas

- 5.1.3. Petroleum

- 5.1.4. Pet-coke

- 5.1.5. Biomass

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Steam Reforming

- 5.2.2. Partial Oxidation

- 5.2.3. Auto-thermal Reforming

- 5.2.4. Combined or Two-step Reforming

- 5.2.5. Biomass Gasification

- 5.3. Market Analysis, Insights and Forecast - by Gasifier Type

- 5.3.1. Fixed Bed

- 5.3.2. Entrained Flow

- 5.3.3. Fluidized Bed

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Power Generation

- 5.4.2. Chemicals

- 5.4.2.1. Methanol

- 5.4.2.2. Ammonia

- 5.4.2.3. Oxo Chemicals

- 5.4.2.4. n-Butanol

- 5.4.2.5. Hydrogen

- 5.4.2.6. Dimethyl Ether

- 5.4.3. Liquid Fuels

- 5.4.4. Gaseous Fuels

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.5.4. Rest of North America

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.6.2. Canada

- 5.6.3. Mexico

- 5.6.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Feedstock

- 6. United States North America Syngas Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Feedstock

- 6.1.1. Coal

- 6.1.2. Natural Gas

- 6.1.3. Petroleum

- 6.1.4. Pet-coke

- 6.1.5. Biomass

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Steam Reforming

- 6.2.2. Partial Oxidation

- 6.2.3. Auto-thermal Reforming

- 6.2.4. Combined or Two-step Reforming

- 6.2.5. Biomass Gasification

- 6.3. Market Analysis, Insights and Forecast - by Gasifier Type

- 6.3.1. Fixed Bed

- 6.3.2. Entrained Flow

- 6.3.3. Fluidized Bed

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Power Generation

- 6.4.2. Chemicals

- 6.4.2.1. Methanol

- 6.4.2.2. Ammonia

- 6.4.2.3. Oxo Chemicals

- 6.4.2.4. n-Butanol

- 6.4.2.5. Hydrogen

- 6.4.2.6. Dimethyl Ether

- 6.4.3. Liquid Fuels

- 6.4.4. Gaseous Fuels

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. United States

- 6.5.2. Canada

- 6.5.3. Mexico

- 6.5.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Feedstock

- 7. Canada North America Syngas Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Feedstock

- 7.1.1. Coal

- 7.1.2. Natural Gas

- 7.1.3. Petroleum

- 7.1.4. Pet-coke

- 7.1.5. Biomass

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Steam Reforming

- 7.2.2. Partial Oxidation

- 7.2.3. Auto-thermal Reforming

- 7.2.4. Combined or Two-step Reforming

- 7.2.5. Biomass Gasification

- 7.3. Market Analysis, Insights and Forecast - by Gasifier Type

- 7.3.1. Fixed Bed

- 7.3.2. Entrained Flow

- 7.3.3. Fluidized Bed

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Power Generation

- 7.4.2. Chemicals

- 7.4.2.1. Methanol

- 7.4.2.2. Ammonia

- 7.4.2.3. Oxo Chemicals

- 7.4.2.4. n-Butanol

- 7.4.2.5. Hydrogen

- 7.4.2.6. Dimethyl Ether

- 7.4.3. Liquid Fuels

- 7.4.4. Gaseous Fuels

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. United States

- 7.5.2. Canada

- 7.5.3. Mexico

- 7.5.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Feedstock

- 8. Mexico North America Syngas Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Feedstock

- 8.1.1. Coal

- 8.1.2. Natural Gas

- 8.1.3. Petroleum

- 8.1.4. Pet-coke

- 8.1.5. Biomass

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Steam Reforming

- 8.2.2. Partial Oxidation

- 8.2.3. Auto-thermal Reforming

- 8.2.4. Combined or Two-step Reforming

- 8.2.5. Biomass Gasification

- 8.3. Market Analysis, Insights and Forecast - by Gasifier Type

- 8.3.1. Fixed Bed

- 8.3.2. Entrained Flow

- 8.3.3. Fluidized Bed

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Power Generation

- 8.4.2. Chemicals

- 8.4.2.1. Methanol

- 8.4.2.2. Ammonia

- 8.4.2.3. Oxo Chemicals

- 8.4.2.4. n-Butanol

- 8.4.2.5. Hydrogen

- 8.4.2.6. Dimethyl Ether

- 8.4.3. Liquid Fuels

- 8.4.4. Gaseous Fuels

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. United States

- 8.5.2. Canada

- 8.5.3. Mexico

- 8.5.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Feedstock

- 9. Rest of North America North America Syngas Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Feedstock

- 9.1.1. Coal

- 9.1.2. Natural Gas

- 9.1.3. Petroleum

- 9.1.4. Pet-coke

- 9.1.5. Biomass

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Steam Reforming

- 9.2.2. Partial Oxidation

- 9.2.3. Auto-thermal Reforming

- 9.2.4. Combined or Two-step Reforming

- 9.2.5. Biomass Gasification

- 9.3. Market Analysis, Insights and Forecast - by Gasifier Type

- 9.3.1. Fixed Bed

- 9.3.2. Entrained Flow

- 9.3.3. Fluidized Bed

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Power Generation

- 9.4.2. Chemicals

- 9.4.2.1. Methanol

- 9.4.2.2. Ammonia

- 9.4.2.3. Oxo Chemicals

- 9.4.2.4. n-Butanol

- 9.4.2.5. Hydrogen

- 9.4.2.6. Dimethyl Ether

- 9.4.3. Liquid Fuels

- 9.4.4. Gaseous Fuels

- 9.5. Market Analysis, Insights and Forecast - by Geography

- 9.5.1. United States

- 9.5.2. Canada

- 9.5.3. Mexico

- 9.5.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Feedstock

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Haldor Topsoe A/S

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 TechnipFMC PLC*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 General Electric

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Air Products and Chemicals Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Royal Dutch Shell plc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Siemens

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 KBR Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 BASF SE

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sasol

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Linde plc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 SynGas Technology LLC

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Air Liquide

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 BP p l c

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Dakota Gasification Company Inc

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 Haldor Topsoe A/S

List of Figures

- Figure 1: North America Syngas Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Syngas Market Share (%) by Company 2025

List of Tables

- Table 1: North America Syngas Market Revenue Million Forecast, by Feedstock 2020 & 2033

- Table 2: North America Syngas Market Volume K Tons Forecast, by Feedstock 2020 & 2033

- Table 3: North America Syngas Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: North America Syngas Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 5: North America Syngas Market Revenue Million Forecast, by Gasifier Type 2020 & 2033

- Table 6: North America Syngas Market Volume K Tons Forecast, by Gasifier Type 2020 & 2033

- Table 7: North America Syngas Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: North America Syngas Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 9: North America Syngas Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: North America Syngas Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 11: North America Syngas Market Revenue Million Forecast, by Region 2020 & 2033

- Table 12: North America Syngas Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 13: North America Syngas Market Revenue Million Forecast, by Feedstock 2020 & 2033

- Table 14: North America Syngas Market Volume K Tons Forecast, by Feedstock 2020 & 2033

- Table 15: North America Syngas Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 16: North America Syngas Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 17: North America Syngas Market Revenue Million Forecast, by Gasifier Type 2020 & 2033

- Table 18: North America Syngas Market Volume K Tons Forecast, by Gasifier Type 2020 & 2033

- Table 19: North America Syngas Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: North America Syngas Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 21: North America Syngas Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: North America Syngas Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: North America Syngas Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: North America Syngas Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: North America Syngas Market Revenue Million Forecast, by Feedstock 2020 & 2033

- Table 26: North America Syngas Market Volume K Tons Forecast, by Feedstock 2020 & 2033

- Table 27: North America Syngas Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 28: North America Syngas Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 29: North America Syngas Market Revenue Million Forecast, by Gasifier Type 2020 & 2033

- Table 30: North America Syngas Market Volume K Tons Forecast, by Gasifier Type 2020 & 2033

- Table 31: North America Syngas Market Revenue Million Forecast, by Application 2020 & 2033

- Table 32: North America Syngas Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 33: North America Syngas Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 34: North America Syngas Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 35: North America Syngas Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: North America Syngas Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 37: North America Syngas Market Revenue Million Forecast, by Feedstock 2020 & 2033

- Table 38: North America Syngas Market Volume K Tons Forecast, by Feedstock 2020 & 2033

- Table 39: North America Syngas Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 40: North America Syngas Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 41: North America Syngas Market Revenue Million Forecast, by Gasifier Type 2020 & 2033

- Table 42: North America Syngas Market Volume K Tons Forecast, by Gasifier Type 2020 & 2033

- Table 43: North America Syngas Market Revenue Million Forecast, by Application 2020 & 2033

- Table 44: North America Syngas Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 45: North America Syngas Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: North America Syngas Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 47: North America Syngas Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: North America Syngas Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 49: North America Syngas Market Revenue Million Forecast, by Feedstock 2020 & 2033

- Table 50: North America Syngas Market Volume K Tons Forecast, by Feedstock 2020 & 2033

- Table 51: North America Syngas Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 52: North America Syngas Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 53: North America Syngas Market Revenue Million Forecast, by Gasifier Type 2020 & 2033

- Table 54: North America Syngas Market Volume K Tons Forecast, by Gasifier Type 2020 & 2033

- Table 55: North America Syngas Market Revenue Million Forecast, by Application 2020 & 2033

- Table 56: North America Syngas Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 57: North America Syngas Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 58: North America Syngas Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 59: North America Syngas Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: North America Syngas Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Syngas Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the North America Syngas Market?

Key companies in the market include Haldor Topsoe A/S, TechnipFMC PLC*List Not Exhaustive, General Electric, Air Products and Chemicals Inc, Royal Dutch Shell plc, Siemens, KBR Inc, BASF SE, Sasol, Linde plc, SynGas Technology LLC, Air Liquide, BP p l c, Dakota Gasification Company Inc.

3. What are the main segments of the North America Syngas Market?

The market segments include Feedstock, Technology, Gasifier Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 230.05 Million as of 2022.

5. What are some drivers contributing to market growth?

; Feedstock Flexibility for Syngas Production; Growing Demand for Electricity; Growing Chemical Industry.

6. What are the notable trends driving market growth?

Increasing Usage in Power Generation Industry.

7. Are there any restraints impacting market growth?

; High Capital Investment and Funding.

8. Can you provide examples of recent developments in the market?

Investments in carbon capture and storage technologies

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Syngas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Syngas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Syngas Market?

To stay informed about further developments, trends, and reports in the North America Syngas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence