Key Insights

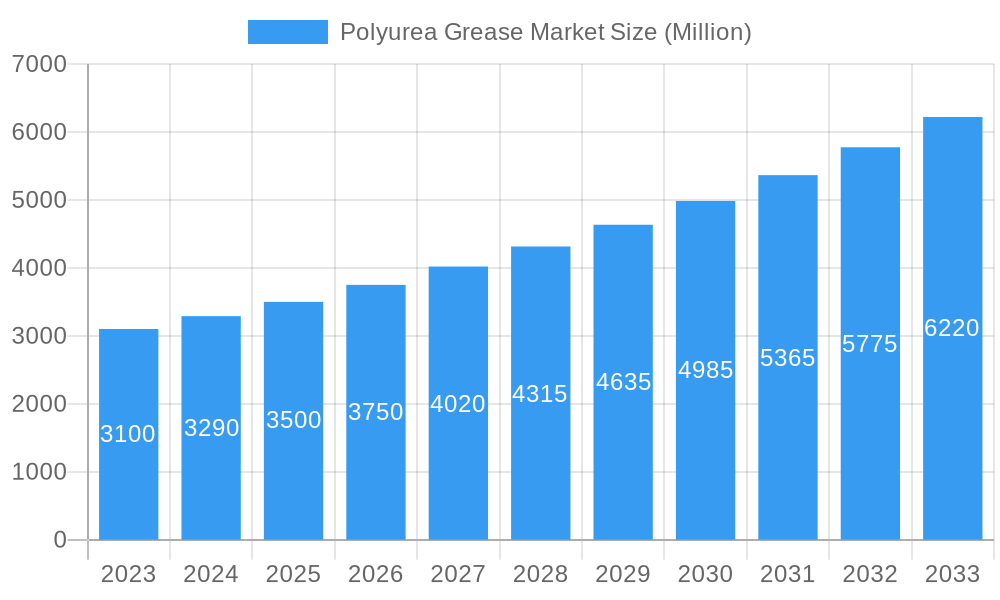

The global Polyurea Grease market is projected for significant expansion, expected to reach approximately 307.65 million units by 2025, at a CAGR of 8.61%. This growth is driven by the escalating demand for advanced lubricants in challenging industrial environments. Polyurea greases are favored for their superior thermal stability, exceptional water resistance, and robust mechanical properties, making them crucial in sectors like machinery and manufacturing, automotive, and steel production. The industry's shift towards extended service intervals and reduced maintenance requirements further stimulates the adoption of these high-performance lubricants. The expanding construction sector, particularly in emerging economies, and the rigorous operational demands of mining also contribute to this positive market trend.

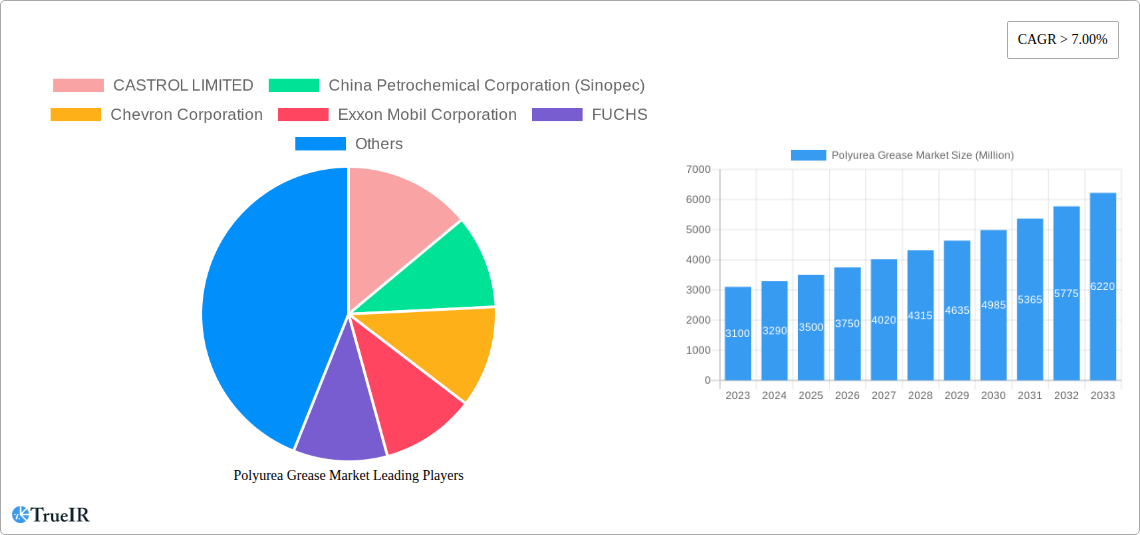

Polyurea Grease Market Market Size (In Million)

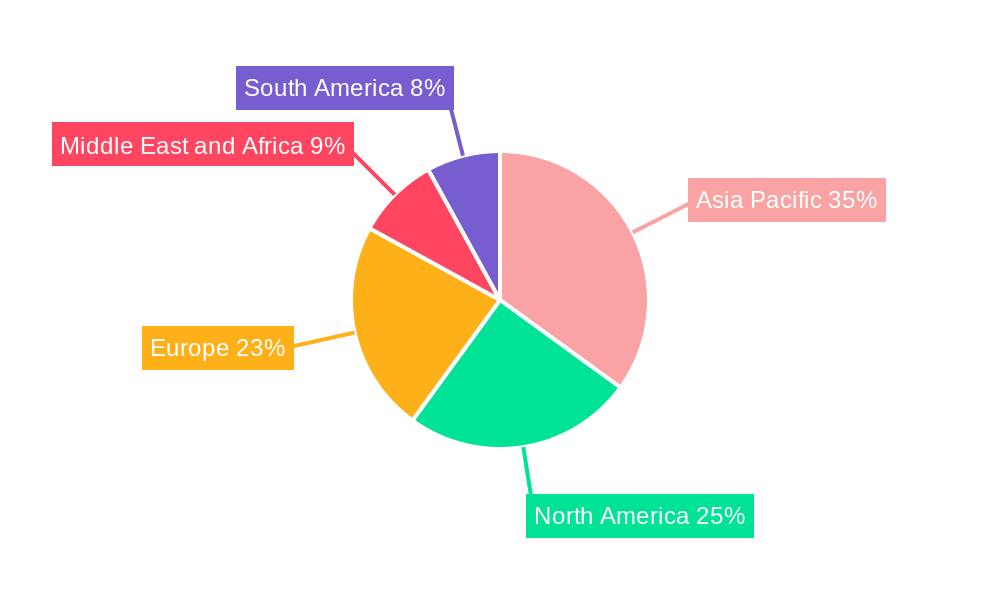

Market evolution is marked by ongoing innovation in polyurea grease formulations to align with evolving industry standards and environmental regulations. While the advantages are substantial, potential challenges include the initial cost compared to traditional lubricants and the requirement for specialized application expertise. However, the long-term economic benefits and enhanced performance often mitigate these concerns. Key industry players, including Castrol Limited, China Petrochemical Corporation (Sinopec), Chevron Corporation, Exxon Mobil Corporation, and FUCHS, are actively investing in R&D to introduce specialized polyurea grease products. The Asia Pacific region, led by China and India, is anticipated to hold the largest market share due to rapid industrialization and infrastructure development, followed by North America and Europe, which benefit from established industrial bases and a focus on operational efficiency and equipment lifespan.

Polyurea Grease Market Company Market Share

This comprehensive report delivers a dynamic and SEO-optimized analysis of the global Polyurea Grease Market. Utilizing high-volume keywords and a robust research methodology, this study offers critical insights for industry stakeholders, investors, and decision-makers. The report analyzes the historical period from 2019 to 2024, with 2025 as the base year, and provides forecasts through 2033.

Polyurea Grease Market Market Structure & Competitive Landscape

The global Polyurea Grease Market is characterized by a moderately concentrated structure, with a significant presence of both multinational corporations and regional players. Innovation is a key driver, fueled by continuous research and development in lubricant formulations aimed at enhancing performance, longevity, and environmental sustainability. Regulatory impacts, primarily concerning environmental compliance and worker safety, are shaping product development and manufacturing processes. While direct substitutes for high-performance polyurea greases are limited, advancements in other synthetic lubricant technologies present a degree of competitive pressure.

The end-user industry segmentation is diverse, with key sectors driving demand:

- Machinery and Manufacturing: A primary consumer due to the need for robust lubrication in heavy machinery and precision equipment.

- Construction: High demand for greases that can withstand extreme pressures and harsh environmental conditions.

- Automotive: Increasing use in critical components requiring long-life and high-temperature stability.

- Steel: Essential for lubrication in high-temperature and high-load applications within steel mills.

- Mining: Critical for equipment operating in extreme conditions, requiring superior wear protection and water resistance.

- Other End-user Industries: Encompassing a broad range of applications in power generation, marine, and aerospace.

Mergers and acquisitions (M&A) activity within the lubricants sector, while not exclusively focused on polyurea greases, contribute to market consolidation and strategic realignment. The report delves into market concentration ratios and provides insights into M&A trends influencing the competitive landscape.

Polyurea Grease Market Market Trends & Opportunities

The global Polyurea Grease Market is projected for substantial growth, driven by an escalating demand for high-performance lubricants across a multitude of industries. The market size is expected to witness a robust Compound Annual Growth Rate (CAGR) during the forecast period, fueled by increasing industrialization, infrastructure development, and the growing emphasis on equipment longevity and reduced maintenance costs. Technological shifts are profoundly impacting the market, with a continuous drive towards developing synthetic and semi-synthetic polyurea greases that offer superior thermal stability, extreme pressure resistance, water washout resistance, and extended service life compared to traditional mineral oil-based lubricants. These advancements are crucial for machinery operating in demanding environments found in sectors like mining, construction, and heavy manufacturing.

Consumer preferences are evolving towards environmentally friendly and safer lubricant solutions. Manufacturers are responding by developing biodegradable polyurea greases and those with lower toxicity profiles, aligning with increasing environmental regulations and corporate sustainability initiatives. Competitive dynamics are intensifying, with key players investing heavily in R&D to differentiate their product offerings through enhanced performance characteristics and specialized formulations catering to niche applications. The market penetration rate of polyurea greases is expected to rise as industries recognize the total cost of ownership benefits, including reduced downtime and extended equipment life, outweighing the initial product cost.

Opportunities abound in emerging economies where industrial activity is rapidly expanding, leading to a surge in demand for advanced lubrication solutions. Furthermore, the development of specialized polyurea greases for electric vehicles (EVs) and renewable energy infrastructure, such as wind turbines, presents a significant growth avenue. The drive for operational efficiency and asset protection in industries prone to harsh operating conditions will continue to be a primary catalyst for polyurea grease adoption. The report details the market size growth trajectory, identifies key technological shifts, analyzes evolving consumer preferences, and explores the intricate competitive landscape, providing a comprehensive view of market trends and emerging opportunities.

Dominant Markets & Segments in Polyurea Grease Market

The Polyurea Grease Market exhibits distinct regional dominance and segment leadership, driven by specific industrial activities and economic growth patterns.

Leading Region: Asia Pacific stands out as the dominant region in the global Polyurea Grease Market. This dominance is attributed to the region's robust manufacturing sector, significant investments in infrastructure development, and the presence of rapidly growing industrial economies such as China and India. The burgeoning automotive industry and extensive mining operations within the Asia Pacific further bolster the demand for high-performance greases.

Key Growth Drivers in Leading Segments:

Machinery and Manufacturing:

- Industrial Expansion: Rapid industrialization across developing economies necessitates advanced lubrication for a wide array of machinery, from precision tools to heavy industrial equipment.

- Automation & Robotics: The increasing adoption of automation and robotics in manufacturing requires lubricants that can maintain performance under continuous operation and varying loads.

- High-Performance Demands: The need for lubricants that can withstand extreme temperatures, pressures, and wear in modern manufacturing processes drives the adoption of polyurea greases.

Construction:

- Infrastructure Projects: Large-scale government and private sector investments in infrastructure projects (roads, bridges, buildings, tunnels) globally, especially in emerging markets, lead to high demand for construction equipment lubricants.

- Harsh Environmental Conditions: Construction sites are often characterized by dust, water, and extreme temperatures, demanding greases with superior water resistance and protection against abrasive wear, properties well-exhibited by polyurea greases.

- Equipment Longevity: The high capital cost of construction machinery makes extending its operational life a priority, which is achieved through effective lubrication.

Automotive:

- EV Growth: The increasing global adoption of electric vehicles, while seemingly shifting away from traditional engine oils, still requires specialized greases for components like wheel bearings, electric motor bearings, and chassis parts, where high-temperature performance and long life are crucial.

- Advanced Vehicle Technologies: Modern vehicles incorporate complex powertrains and sophisticated suspension systems that benefit from the enhanced lubrication properties of polyurea greases.

- Aftermarket Demand: Replacement and maintenance needs in the vast global automotive fleet continue to drive demand for reliable greases.

Steel:

- High-Temperature Applications: Steel mills operate at extremely high temperatures, requiring greases that maintain viscosity and lubricating properties under severe thermal stress.

- Heavy Load Bearings: Rolling mills, furnaces, and other steel production equipment subject bearings to immense loads, necessitating extreme pressure (EP) additives found in many polyurea greases.

- Corrosion Prevention: The steel industry's operating environment can be corrosive, and polyurea greases often offer excellent rust and corrosion protection.

Mining:

- Extreme Operating Conditions: Mining equipment faces dust, water, shock loads, and extreme temperatures, demanding robust lubricants that can prevent premature wear and equipment failure.

- Heavy-Duty Equipment: The use of massive excavators, haul trucks, and drilling rigs requires high-capacity greases that provide sustained lubrication under immense stress.

- Reduced Downtime: Equipment reliability is paramount in mining to minimize costly downtime, making high-performance greases a critical component.

The report provides detailed analysis of market dominance within each of these segments, supported by quantitative data and qualitative insights into the specific factors driving demand and growth.

Polyurea Grease Market Product Analysis

Polyurea greases represent a significant advancement in lubricant technology, offering superior performance characteristics that address the stringent demands of modern industrial applications. Their primary advantage lies in their excellent thermal stability, allowing them to function effectively at high temperatures where conventional greases would degrade. This, coupled with exceptional extreme pressure (EP) and anti-wear properties, makes them ideal for heavily loaded machinery in sectors like steel, mining, and heavy manufacturing. Furthermore, polyurea greases exhibit outstanding water washout resistance and corrosion protection, crucial for equipment operating in wet or corrosive environments. The competitive advantages stem from their extended service life, leading to reduced maintenance intervals, lower lubricant consumption, and ultimately, a lower total cost of ownership for end-users. Technological advancements continue to focus on developing specialized polyurea formulations tailored for specific applications, such as those required for electric vehicles or wind turbines, further enhancing their market fit and appeal.

Key Drivers, Barriers & Challenges in Polyurea Grease Market

Key Drivers:

- Technological Advancements: The development of advanced polyurea formulations with enhanced thermal stability, EP/AW properties, and water resistance is a primary driver.

- Industrial Growth: Expansion in key end-user industries like manufacturing, mining, and construction, particularly in emerging economies, fuels demand.

- Demand for Equipment Longevity: Industries are increasingly prioritizing asset protection and extended equipment lifespan, making high-performance greases essential.

- Stringent Lubrication Requirements: The need for lubricants that can perform under extreme conditions (temperature, pressure, contamination) drives adoption.

- Environmental Regulations (Indirect Driver): While not always directly mandating polyurea, regulations pushing for longer-lasting lubricants and reduced waste indirectly favor high-performance options.

Barriers & Challenges:

- Higher Initial Cost: Polyurea greases typically have a higher upfront cost compared to conventional mineral oil-based greases, which can be a barrier for cost-sensitive applications.

- Limited Awareness in Niche Segments: In certain smaller or specialized industrial sectors, awareness of the benefits and applications of polyurea greases might be limited.

- Supply Chain Disruptions: Like many chemical-based industries, the polyurea grease market can be susceptible to raw material price volatility and supply chain disruptions impacting availability and cost.

- Competition from Other Synthetic Lubricants: While polyurea offers unique benefits, other high-performance synthetic lubricants also compete for market share.

- Technical Expertise for Application: Optimal performance of polyurea greases often requires specific knowledge regarding application methods and compatibility with existing systems.

Growth Drivers in the Polyurea Grease Market Market

Key growth drivers in the Polyurea Grease Market are multifaceted. Technologically, the continuous innovation in lubricant formulations, leading to greases with superior thermal stability, extreme pressure (EP) capabilities, and water resistance, is a significant impetus. Economically, the robust expansion of industrial sectors such as manufacturing, construction, and mining globally, particularly in emerging markets, creates a substantial demand base. Government policies supporting industrial development and infrastructure projects indirectly boost the need for high-performance lubricants. Furthermore, the increasing global emphasis on extending the lifespan of industrial machinery and reducing operational downtime translates directly into a higher demand for durable and reliable greases like polyurea. The drive for efficiency and reduced maintenance costs across industries is a powerful economic factor propelling the market forward.

Challenges Impacting Polyurea Grease Market Growth

Several challenges impact the growth of the Polyurea Grease Market. Regulatory complexities, while often driving innovation towards safer and more sustainable products, can also lead to increased compliance costs for manufacturers. Supply chain issues, including the availability and fluctuating prices of key raw materials, can affect production costs and lead times, posing a significant restraint. Competitive pressures from other advanced lubricant technologies, as well as from established conventional lubricants, necessitate continuous investment in R&D and marketing to maintain market share. The higher initial cost of polyurea greases compared to traditional options can also be a barrier for adoption in price-sensitive market segments. Addressing these challenges requires strategic planning, robust supply chain management, and effective communication of the total cost of ownership benefits to end-users.

Key Players Shaping the Polyurea Grease Market Market

- CASTROL LIMITED

- China Petrochemical Corporation (Sinopec)

- Chevron Corporation

- Exxon Mobil Corporation

- FUCHS

- Kluber Lubrication

- LUKOIL

- PETRONAS Lubricants International

- Shell Global

- TotalEnergies

Significant Polyurea Grease Market Industry Milestones

- March 2023: Chevron Corporation expanded its portfolio with the launch of new grease products, including heavy-duty multi-purpose greases for extreme-pressure and other applications, enhancing their market offering and catering to evolving industry needs.

- November 2022: Shell Global completed the expansion of its lubricant blending plant on Indonesia's Java island. This expansion doubled the production capacity to 300 million liters (270,000 metric tons) per year, significantly increasing their ability to meet the growing regional and global demand for lubricants, including polyurea greases.

Future Outlook for Polyurea Grease Market Market

The future outlook for the Polyurea Grease Market is highly promising, driven by persistent industrial growth and the increasing demand for high-performance, long-lasting lubrication solutions. Strategic opportunities lie in the expanding electrification of the automotive sector, which requires specialized greases for electric motors and related components. The ongoing global investments in renewable energy infrastructure, such as wind farms, also present a significant growth avenue due to the extreme operating conditions involved. Furthermore, the continued industrialization of emerging economies will sustain a robust demand for advanced lubricants across various manufacturing and heavy industry applications. The market potential is expected to be further enhanced by ongoing advancements in polyurea technology, leading to even more specialized and environmentally friendly formulations, solidifying its position as a critical lubricant in demanding industrial environments.

Polyurea Grease Market Segmentation

-

1. End-user Industry

- 1.1. Machinery and Manufacturing

- 1.2. Construction

- 1.3. Automotive

- 1.4. Steel

- 1.5. Mining

- 1.6. Other End-user Industries

Polyurea Grease Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Polyurea Grease Market Regional Market Share

Geographic Coverage of Polyurea Grease Market

Polyurea Grease Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Polyurea Greases from Automotive and Agriculture Industries; Rising Demand for High-Efficiency Greases; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Polyurea Greases from Automotive and Agriculture Industries; Rising Demand for High-Efficiency Greases; Other Drivers

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Automotive End-User Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Polyurea Grease Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Machinery and Manufacturing

- 5.1.2. Construction

- 5.1.3. Automotive

- 5.1.4. Steel

- 5.1.5. Mining

- 5.1.6. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Asia Pacific Polyurea Grease Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Machinery and Manufacturing

- 6.1.2. Construction

- 6.1.3. Automotive

- 6.1.4. Steel

- 6.1.5. Mining

- 6.1.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. North America Polyurea Grease Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Machinery and Manufacturing

- 7.1.2. Construction

- 7.1.3. Automotive

- 7.1.4. Steel

- 7.1.5. Mining

- 7.1.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Europe Polyurea Grease Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Machinery and Manufacturing

- 8.1.2. Construction

- 8.1.3. Automotive

- 8.1.4. Steel

- 8.1.5. Mining

- 8.1.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. South America Polyurea Grease Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Machinery and Manufacturing

- 9.1.2. Construction

- 9.1.3. Automotive

- 9.1.4. Steel

- 9.1.5. Mining

- 9.1.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East and Africa Polyurea Grease Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Machinery and Manufacturing

- 10.1.2. Construction

- 10.1.3. Automotive

- 10.1.4. Steel

- 10.1.5. Mining

- 10.1.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CASTROL LIMITED

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 China Petrochemical Corporation (Sinopec)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Chevron Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Exxon Mobil Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 FUCHS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kluber Lubrication

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LUKOIL

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PETRONAS Lubricants International

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Shell Global

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TotalEnergies*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 CASTROL LIMITED

List of Figures

- Figure 1: Global Polyurea Grease Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Polyurea Grease Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 3: Asia Pacific Polyurea Grease Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: Asia Pacific Polyurea Grease Market Revenue (million), by Country 2025 & 2033

- Figure 5: Asia Pacific Polyurea Grease Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Polyurea Grease Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 7: North America Polyurea Grease Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Polyurea Grease Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America Polyurea Grease Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Polyurea Grease Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 11: Europe Polyurea Grease Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Polyurea Grease Market Revenue (million), by Country 2025 & 2033

- Figure 13: Europe Polyurea Grease Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Polyurea Grease Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 15: South America Polyurea Grease Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America Polyurea Grease Market Revenue (million), by Country 2025 & 2033

- Figure 17: South America Polyurea Grease Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Polyurea Grease Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 19: Middle East and Africa Polyurea Grease Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Middle East and Africa Polyurea Grease Market Revenue (million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Polyurea Grease Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Polyurea Grease Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Polyurea Grease Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Global Polyurea Grease Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Polyurea Grease Market Revenue million Forecast, by Country 2020 & 2033

- Table 5: China Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: India Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: Japan Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: South Korea Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Rest of Asia Pacific Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Polyurea Grease Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Polyurea Grease Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: United States Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Canada Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Mexico Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Global Polyurea Grease Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Polyurea Grease Market Revenue million Forecast, by Country 2020 & 2033

- Table 17: Germany Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Italy Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: France Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Global Polyurea Grease Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Polyurea Grease Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Brazil Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Argentina Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Rest of South America Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Global Polyurea Grease Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Polyurea Grease Market Revenue million Forecast, by Country 2020 & 2033

- Table 29: Saudi Arabia Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Polyurea Grease Market?

The projected CAGR is approximately 8.61%.

2. Which companies are prominent players in the Polyurea Grease Market?

Key companies in the market include CASTROL LIMITED, China Petrochemical Corporation (Sinopec), Chevron Corporation, Exxon Mobil Corporation, FUCHS, Kluber Lubrication, LUKOIL, PETRONAS Lubricants International, Shell Global, TotalEnergies*List Not Exhaustive.

3. What are the main segments of the Polyurea Grease Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 307.65 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Polyurea Greases from Automotive and Agriculture Industries; Rising Demand for High-Efficiency Greases; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand from Automotive End-User Industry.

7. Are there any restraints impacting market growth?

Growing Demand for Polyurea Greases from Automotive and Agriculture Industries; Rising Demand for High-Efficiency Greases; Other Drivers.

8. Can you provide examples of recent developments in the market?

In March 2023, Chevron Corporation expanded its portfolio with the launch of new grease products. The company's new portfolio includes heavy-duty multi-purpose greases for extreme-pressure and other applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Polyurea Grease Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Polyurea Grease Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Polyurea Grease Market?

To stay informed about further developments, trends, and reports in the Polyurea Grease Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence