Key Insights

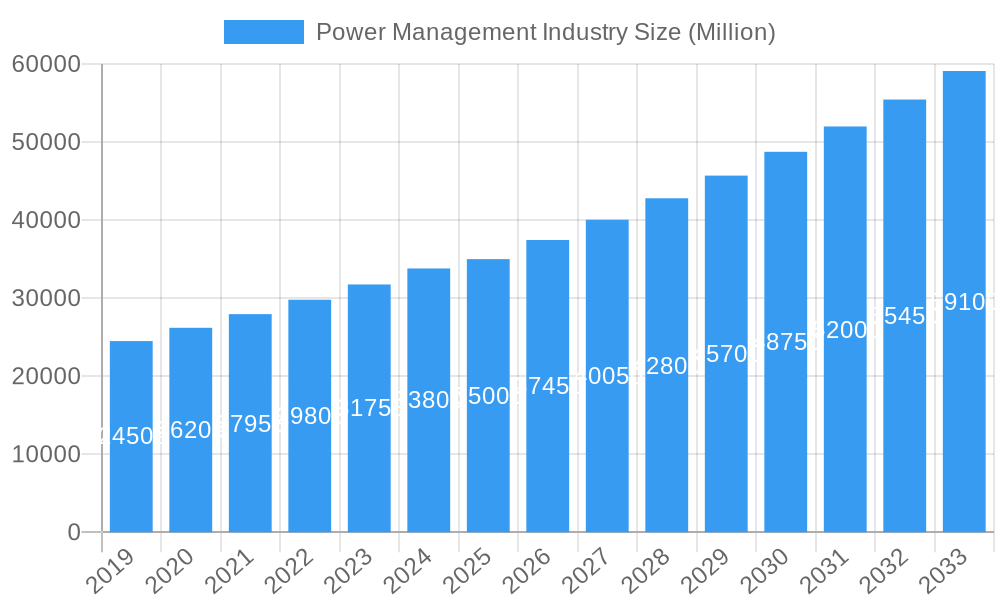

The global Power Management Industry is experiencing robust growth, projected to reach an estimated market size of approximately USD 35,000 million by 2025, with a Compound Annual Growth Rate (CAGR) of 7.02% from 2019 to 2033. This expansion is primarily fueled by the increasing demand for energy efficiency across various sectors, driven by stringent environmental regulations and rising energy costs. Utilities are a significant end-user segment, investing heavily in smart grid technologies and advanced power distribution systems to optimize energy consumption and reduce transmission losses. Data centers, with their ever-growing energy footprints, are also a major contributor to market growth, adopting sophisticated power management solutions to ensure reliability, minimize downtime, and reduce operational expenses. Furthermore, the Oil & Gas sector is increasingly implementing power management systems for offshore platforms and onshore facilities to enhance safety, improve operational efficiency, and comply with environmental standards.

Power Management Industry Market Size (In Billion)

The marine industry is also witnessing a surge in demand for advanced power management systems, particularly with the adoption of hybrid and electric propulsion technologies, alongside the need for efficient power distribution on vessels. This trend is reinforced by the increasing focus on reducing emissions and fuel consumption in maritime operations. Emerging economies, especially in the Asia Pacific region, are expected to be key growth drivers due to rapid industrialization, expanding infrastructure, and increasing adoption of digital technologies for power monitoring and control. While the market is expanding, certain restraints, such as the high initial investment cost of advanced power management systems and the complexity of integration with existing infrastructure, may pose challenges. However, ongoing technological advancements, including AI-powered analytics and IoT integration, are continuously addressing these concerns, paving the way for more efficient, reliable, and sustainable power management solutions across the globe. Key companies like ABB Ltd, Wartsila Oyj Abp, and Kongsberg Gruppen ASA are at the forefront of innovation, offering comprehensive solutions that cater to the diverse needs of these evolving industries.

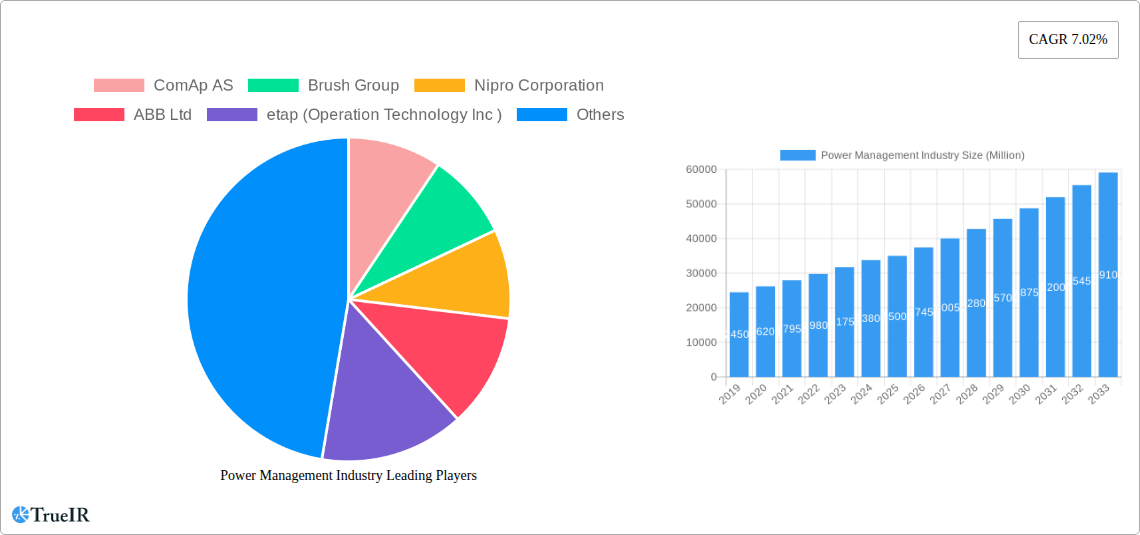

Power Management Industry Company Market Share

Power Management Industry Market Structure & Competitive Landscape

The power management industry is characterized by a moderately concentrated market structure, with a blend of large multinational corporations and specialized niche players. Innovation drivers, such as the growing demand for energy efficiency, the integration of renewable energy sources, and the evolution of smart grids, are significantly shaping competitive dynamics. Regulatory impacts, including government mandates for emissions reduction and energy conservation, are creating both opportunities and challenges for market participants. The threat of product substitutes is relatively low for core power management solutions, but emerging technologies like advanced battery storage and localized energy generation are beginning to influence the market landscape. End-user segmentation reveals diverse needs across Utilities, Data Centers, Oil and Gas, Marine, and Other End Users, each requiring tailored power management strategies. Mergers and Acquisitions (M&A) activity is a notable trend, with companies seeking to expand their technological capabilities, market reach, and product portfolios. In the historical period (2019-2024), approximately 500 Million in M&A deals were recorded, indicating consolidation and strategic partnerships aimed at strengthening market positions. The concentration ratio among the top five players is estimated to be around 60%, highlighting the significant market share held by leading entities.

Power Management Industry Market Trends & Opportunities

The global power management industry is poised for robust growth, projected to reach a market size of XXX Million by 2033, expanding at a Compound Annual Growth Rate (CAGR) of XX.XX% from a base year of 2025. This upward trajectory is fueled by a confluence of technological advancements, evolving consumer preferences, and shifting competitive dynamics. The relentless drive towards digitalization and automation across various sectors, particularly within industrial operations and burgeoning data centers, necessitates sophisticated power management solutions to ensure optimal energy utilization and operational efficiency. Furthermore, the increasing integration of renewable energy sources, such as solar and wind power, into existing grids presents a significant opportunity for advanced power management systems capable of balancing intermittent supply and demand.

Technological shifts are a primary catalyst. The proliferation of the Internet of Things (IoT) is creating a demand for smarter, more connected power management devices that can monitor, control, and optimize energy consumption in real-time. Artificial intelligence (AI) and machine learning (ML) are increasingly being embedded into power management systems, enabling predictive maintenance, load forecasting, and intelligent energy allocation. This leads to substantial cost savings for end-users and contributes to grid stability. Consumer preferences are also evolving, with a growing emphasis on sustainability and reduced environmental impact. This is driving demand for energy-efficient products and solutions, pushing manufacturers to innovate and develop greener alternatives.

Competitive dynamics are intensifying as established players invest heavily in research and development to stay ahead of the curve. Strategic collaborations and partnerships are becoming more prevalent, as companies aim to leverage each other's expertise and expand their market penetration. The market penetration rate for advanced power management solutions is expected to rise significantly, particularly in developed economies where regulatory frameworks often encourage or mandate energy efficiency. Emerging markets, with their rapidly industrializing economies and growing infrastructure needs, also represent significant untapped potential. The pursuit of digital transformation by industries worldwide is directly translating into a greater reliance on reliable and efficient power management, creating a sustained demand for innovative solutions throughout the forecast period (2025–2033).

Dominant Markets & Segments in Power Management Industry

The Utilities sector stands as a dominant market within the power management industry, driven by the critical need for reliable and efficient electricity generation, transmission, and distribution. Government policies focused on grid modernization, the integration of renewable energy, and the enhancement of grid resilience are substantial growth drivers in this segment. Utilities are investing heavily in smart grid technologies, advanced metering infrastructure, and sophisticated power control systems to manage the increasing complexity of modern grids and to ensure a stable power supply to a growing demand. The sheer scale of infrastructure and the continuous operational requirements of the utility sector create a persistent and substantial market for a wide array of power management solutions, from large-scale generation control to localized grid management.

Data Centers represent another rapidly expanding and dominant segment. The exponential growth in data consumption and processing, fueled by cloud computing, artificial intelligence, and the Internet of Things, places immense pressure on data center operators to manage power consumption efficiently and ensure uninterrupted operations. Key growth drivers include the need for high-density computing power, the implementation of advanced cooling systems, and the stringent uptime requirements characteristic of this industry. Power management solutions for data centers focus on optimizing energy usage, reducing operational costs, and minimizing their environmental footprint. The increasing adoption of hyperscale data centers globally is further amplifying the demand for cutting-edge power management technologies.

The Oil and Gas industry, while perhaps less characterized by rapid growth compared to utilities and data centers, remains a significant and stable market for power management solutions. The emphasis here is on operational safety, efficiency, and the management of power in remote and often harsh environments. Growth drivers include the need for reliable power in exploration and production activities, the optimization of energy consumption in refining and petrochemical processes, and compliance with stringent environmental regulations. Power management systems are crucial for ensuring the continuous and safe operation of complex industrial facilities, managing large power loads, and integrating energy-efficient technologies.

The Marine sector, though a smaller segment in comparison, exhibits unique power management needs driven by vessel efficiency, emissions reduction, and the increasing electrification of maritime operations. Growth drivers include the implementation of stricter environmental regulations for shipping, the adoption of hybrid and electric propulsion systems, and the demand for advanced navigation and control systems. Power management solutions in this segment are vital for optimizing fuel consumption, ensuring the reliable operation of onboard systems, and meeting the evolving demands of the global shipping industry.

Other End Users encompass a diverse range of industries, including manufacturing, commercial buildings, and transportation, all of which have varying but significant power management requirements. The common thread across these segments is the ongoing pursuit of energy efficiency, cost reduction, and operational optimization, making power management an integral aspect of their business strategies.

Power Management Industry Product Analysis

The power management industry is witnessing a surge in product innovations, driven by the convergence of digital technologies and the imperative for enhanced energy efficiency. Advanced power controllers, intelligent substations, and sophisticated grid management software are at the forefront, offering granular control and real-time monitoring capabilities. Innovations in solid-state transformers, advanced energy storage systems, and smart inverters are revolutionizing how power is managed and distributed, particularly with the integration of renewable energy sources. These products offer significant competitive advantages by reducing energy losses, improving grid stability, and enabling dynamic load balancing, thereby meeting the evolving demands for sustainability and operational excellence across diverse end-user segments.

Key Drivers, Barriers & Challenges in Power Management Industry

Key Drivers:

- Growing Demand for Energy Efficiency: Increasing global energy consumption and rising energy costs are compelling industries to adopt power management solutions that optimize energy usage and reduce operational expenses.

- Integration of Renewable Energy Sources: The rise of solar, wind, and other renewable energy technologies necessitates sophisticated power management systems to balance intermittent supply with demand and ensure grid stability.

- Digitalization and Automation: The widespread adoption of IoT, AI, and automation across industries is driving demand for intelligent power management systems that can monitor, control, and optimize energy consumption in real-time.

- Stringent Environmental Regulations: Government mandates and international agreements aimed at reducing carbon emissions and promoting sustainable energy practices are accelerating the adoption of energy-efficient power management solutions.

Barriers & Challenges:

- High Initial Investment Costs: The upfront cost of implementing advanced power management systems can be a significant barrier for some organizations, particularly small and medium-sized enterprises.

- Cybersecurity Concerns: The increasing connectivity of power management systems raises concerns about cybersecurity vulnerabilities and the potential for disruptions to critical infrastructure.

- Interoperability and Standardization Issues: A lack of universal standards for power management technologies can lead to interoperability challenges between different systems and components.

- Supply Chain Disruptions: Global supply chain volatility, as seen in recent years, can impact the availability and cost of key components used in power management solutions, leading to project delays and increased expenses.

Growth Drivers in the Power Management Industry Market

The power management industry is experiencing accelerated growth, propelled by several key drivers. Technological innovation, particularly in the areas of digitalization, IoT integration, and AI-powered analytics, is enabling more intelligent and efficient energy management. The global push towards decarbonization and the increasing adoption of renewable energy sources necessitate advanced solutions for grid stability and load balancing. Furthermore, stringent government regulations and incentives promoting energy efficiency and emissions reduction are creating a favorable market environment. Economic factors, such as rising energy prices and the desire for operational cost optimization across industries like Utilities, Data Centers, and Oil and Gas, are also significant growth catalysts.

Challenges Impacting Power Management Industry Growth

Despite the robust growth potential, the power management industry faces several significant challenges. The high initial capital investment required for advanced power management systems can be a deterrent for many organizations, especially small and medium-sized enterprises. Cybersecurity threats pose a substantial risk, as interconnected systems are vulnerable to malicious attacks that could disrupt critical power infrastructure. Interoperability issues, stemming from a lack of universal standardization among different power management technologies, can complicate integration and increase implementation costs. Moreover, global supply chain disruptions can impact the availability and pricing of essential components, leading to project delays and cost overruns.

Key Players Shaping the Power Management Industry Market

- ComAp AS

- Brush Group

- Nipro Corporation

- ABB Ltd

- etap (Operation Technology Inc)

- Wartsila Oyj Abp

- INTECH Process Automation Inc

- RH Marine Netherlands BV

- Marine Control Services

- Kongsberg Gruppen ASA

- SELMA

Significant Power Management Industry Industry Milestones

- 2021: Launch of advanced grid modernization software by ABB Ltd, enhancing real-time grid monitoring and control.

- 2022: Wartsila Oyj Abp announces a major acquisition of a leading energy storage solutions provider, expanding its renewable energy integration capabilities.

- 2023: ComAp AS introduces a new generation of intelligent generator controllers with enhanced connectivity and remote management features.

- 2024: etap (Operation Technology Inc) releases a significant update to its power system analysis software, incorporating AI-driven predictive maintenance capabilities.

- 2025: Marine Control Services partners with a leading marine technology firm to develop advanced electric propulsion power management systems for a new fleet of vessels.

Future Outlook for Power Management Industry Market

The future outlook for the power management industry is exceptionally strong, driven by the increasing global imperative for energy efficiency, grid modernization, and sustainable energy solutions. Strategic opportunities lie in the continued development and adoption of smart grid technologies, the integration of distributed energy resources, and the application of AI and IoT for predictive analytics and autonomous grid operations. The burgeoning demand from data centers, the electrification of transportation, and the need for resilient power infrastructure in developing nations will fuel sustained market growth. Companies that focus on innovation, cybersecurity, and addressing the evolving needs of diverse end-user segments are well-positioned to capitalize on the substantial market potential throughout the forecast period and beyond.

Power Management Industry Segmentation

-

1. End User

- 1.1. Utilities

- 1.2. Data Centers

- 1.3. Oil and Gas

- 1.4. Marine

- 1.5. Other End Users

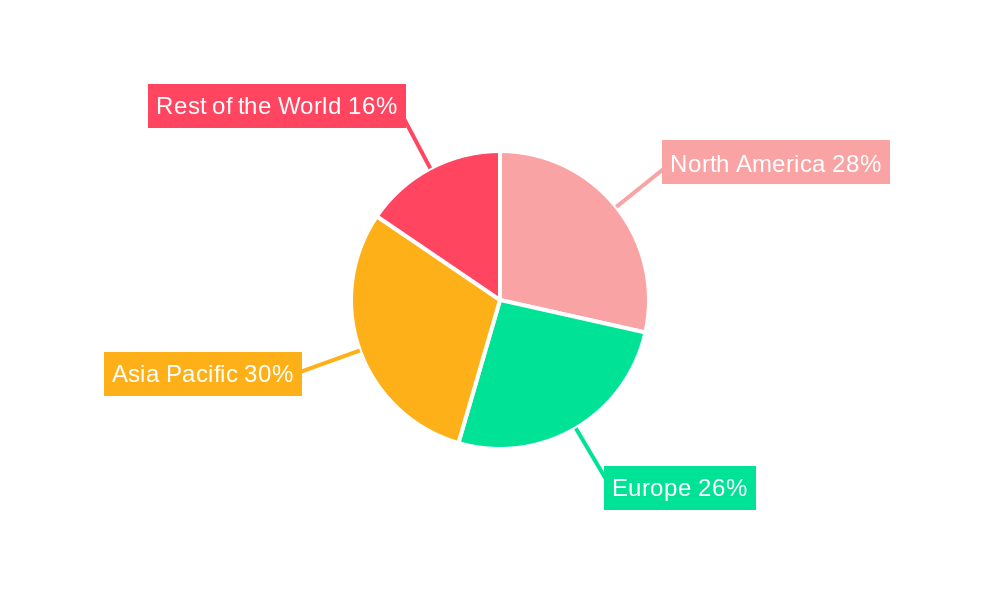

Power Management Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Power Management Industry Regional Market Share

Geographic Coverage of Power Management Industry

Power Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Increasing Focus on Safety

- 3.2.2 Especially in the Manufacturing Environment; Increase in Awareness Regarding Energy Efficiency due to Government Regulations

- 3.3. Market Restrains

- 3.3.1 ; Increasing Focus on Safety

- 3.3.2 Especially in the Manufacturing Environment; Increase in Awareness Regarding Energy Efficiency due to Government Regulations

- 3.4. Market Trends

- 3.4.1 Increasing Focus on Safety

- 3.4.2 Especially in Manufacturing Environment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Power Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Utilities

- 5.1.2. Data Centers

- 5.1.3. Oil and Gas

- 5.1.4. Marine

- 5.1.5. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Power Management Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Utilities

- 6.1.2. Data Centers

- 6.1.3. Oil and Gas

- 6.1.4. Marine

- 6.1.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Power Management Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Utilities

- 7.1.2. Data Centers

- 7.1.3. Oil and Gas

- 7.1.4. Marine

- 7.1.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Power Management Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Utilities

- 8.1.2. Data Centers

- 8.1.3. Oil and Gas

- 8.1.4. Marine

- 8.1.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Rest of the World Power Management Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Utilities

- 9.1.2. Data Centers

- 9.1.3. Oil and Gas

- 9.1.4. Marine

- 9.1.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ComAp AS

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Brush Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Nipro Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 ABB Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 etap (Operation Technology Inc )

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Wartsila Oyj Abp

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 INTECH Process Automation Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 RH Marine Netherlands BV

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Marine Control Services

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Kongsberg Gruppen ASA

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 SELMA*List Not Exhaustive

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 ComAp AS

List of Figures

- Figure 1: Global Power Management Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Power Management Industry Revenue (Million), by End User 2025 & 2033

- Figure 3: North America Power Management Industry Revenue Share (%), by End User 2025 & 2033

- Figure 4: North America Power Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Power Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Power Management Industry Revenue (Million), by End User 2025 & 2033

- Figure 7: Europe Power Management Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: Europe Power Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Power Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Power Management Industry Revenue (Million), by End User 2025 & 2033

- Figure 11: Asia Pacific Power Management Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Asia Pacific Power Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Power Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Power Management Industry Revenue (Million), by End User 2025 & 2033

- Figure 15: Rest of the World Power Management Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Rest of the World Power Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Power Management Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Power Management Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 2: Global Power Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Power Management Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Power Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Power Management Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Power Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Power Management Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Power Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Power Management Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Global Power Management Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Power Management Industry?

The projected CAGR is approximately 7.02%.

2. Which companies are prominent players in the Power Management Industry?

Key companies in the market include ComAp AS, Brush Group, Nipro Corporation, ABB Ltd, etap (Operation Technology Inc ), Wartsila Oyj Abp, INTECH Process Automation Inc, RH Marine Netherlands BV, Marine Control Services, Kongsberg Gruppen ASA, SELMA*List Not Exhaustive.

3. What are the main segments of the Power Management Industry?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Focus on Safety. Especially in the Manufacturing Environment; Increase in Awareness Regarding Energy Efficiency due to Government Regulations.

6. What are the notable trends driving market growth?

Increasing Focus on Safety. Especially in Manufacturing Environment.

7. Are there any restraints impacting market growth?

; Increasing Focus on Safety. Especially in the Manufacturing Environment; Increase in Awareness Regarding Energy Efficiency due to Government Regulations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Power Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Power Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Power Management Industry?

To stay informed about further developments, trends, and reports in the Power Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence