Key Insights

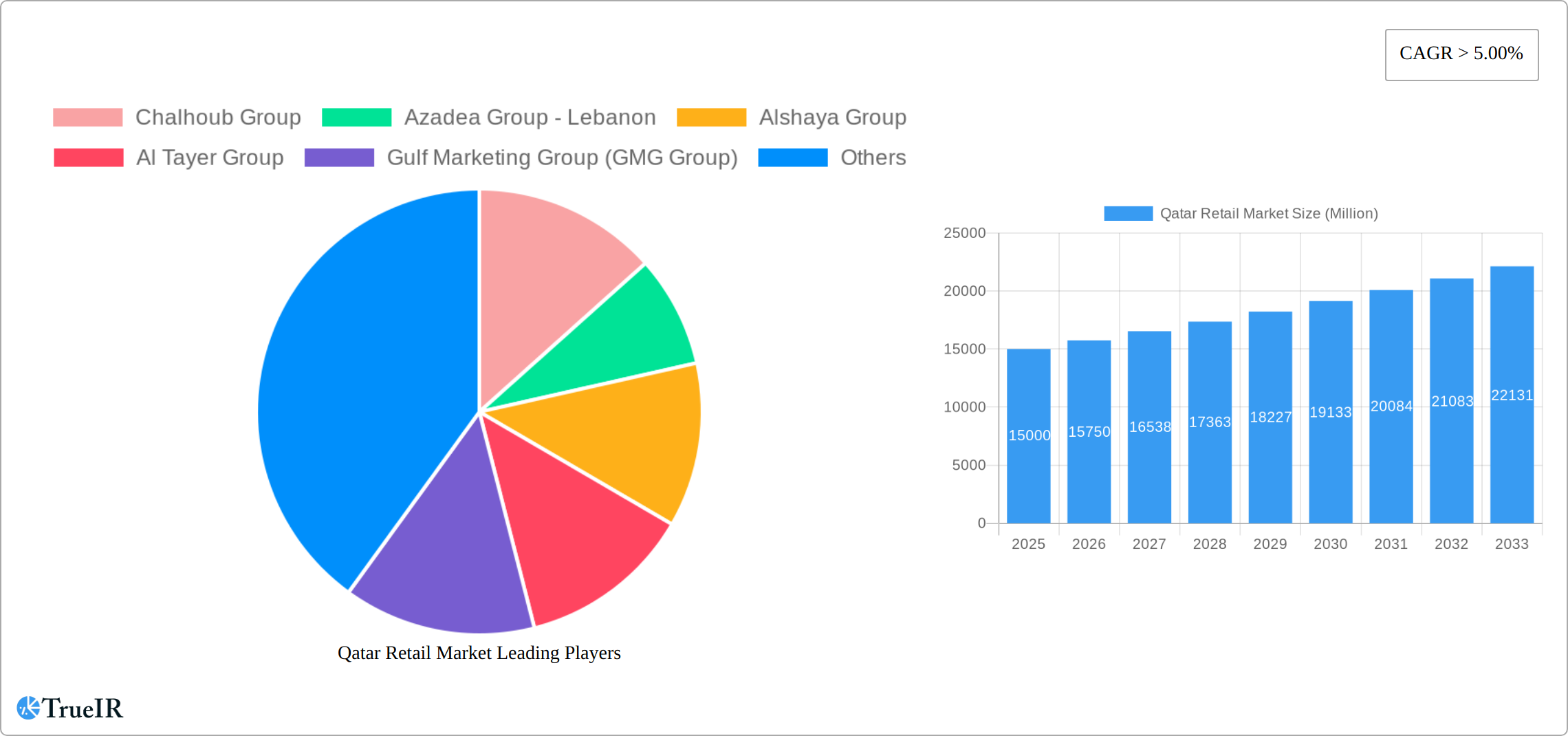

The Qatar retail market, exhibiting a CAGR exceeding 5% from 2019 to 2024, is poised for continued growth through 2033. Driven by a burgeoning population, rising disposable incomes, and significant investments in infrastructure development, including mega-projects like the FIFA World Cup and ongoing urban expansion, the market presents substantial opportunities for established players and new entrants alike. Key growth drivers include the increasing preference for e-commerce and omnichannel experiences, a growing influx of tourists contributing to retail spending, and the government's focus on diversifying the economy, fostering a more robust and resilient retail sector. Leading players like Chalhoub Group, Azadea Group, Alshaya Group, and Majid Al Futtaim Retail are strategically positioning themselves to capitalize on these trends, employing innovative strategies such as personalized shopping experiences, enhanced customer loyalty programs, and the adoption of cutting-edge technologies. However, challenges remain, including the global economic climate, potential inflationary pressures, and the ongoing need for effective supply chain management to meet the growing demand.

Qatar Retail Market Market Size (In Billion)

The segmentation of the Qatari retail market is likely diverse, encompassing sectors such as fashion and apparel, food and beverage, electronics, home furnishings, and luxury goods. The competitive landscape is highly concentrated, with a few major players holding significant market share. Future growth will depend on these companies’ ability to adapt to evolving consumer preferences, embrace digital transformation, and navigate geopolitical factors impacting the regional economy. Understanding consumer behavior, particularly among younger demographics increasingly reliant on digital platforms, will be crucial for sustained success. Moreover, a focus on sustainable and ethical retail practices will increasingly resonate with conscious consumers, shaping future market dynamics and influencing investment strategies. Analyzing these factors in detail provides a comprehensive understanding of the opportunities and challenges within the Qatar retail market, highlighting the importance of strategic planning and adaptability for successful navigation in this dynamic environment.

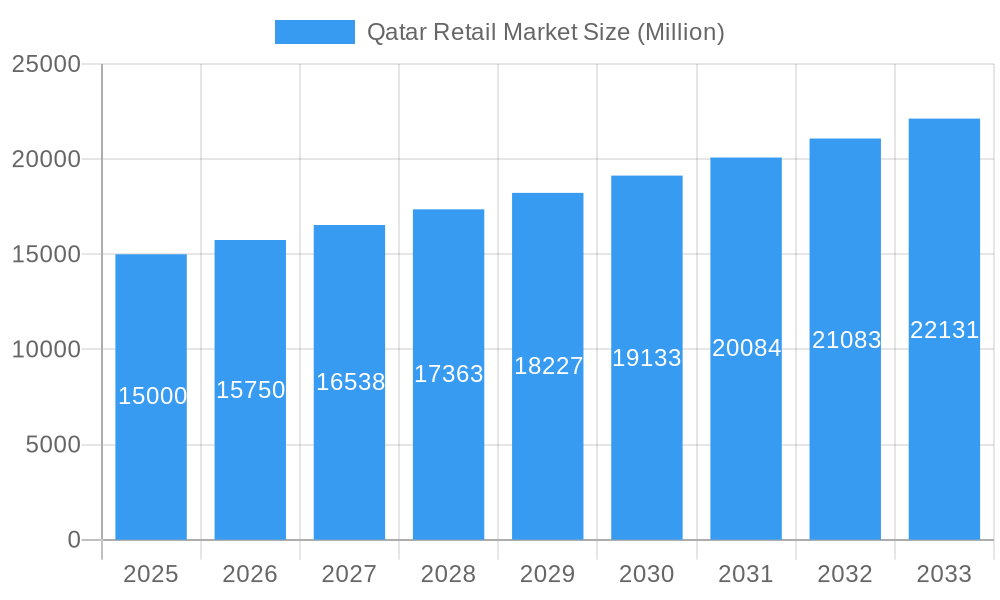

Qatar Retail Market Company Market Share

Qatar Retail Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Qatar retail market, covering its structure, competitive landscape, trends, opportunities, and future outlook from 2019 to 2033. Leveraging extensive market research and data, this report offers invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. Expect detailed analysis of market size (reaching XX Million by 2033), CAGR, and market penetration rates across key segments.

Qatar Retail Market Market Structure & Competitive Landscape

The Qatari retail market presents a moderately concentrated structure, dominated by several key players commanding significant market share. While the Herfindahl-Hirschman Index (HHI) suggests a moderately consolidated market (estimated at [Insert HHI Value]), the sector is highly dynamic. This dynamism stems from continuous innovation, evolving consumer preferences, and a robust mergers and acquisitions (M&A) landscape. The influx of international retailers further intensifies competition and shapes the market's trajectory.

- Market Concentration: In 2025, the top five players (Chalhoub Group, Azadea Group, Alshaya Group, Al Tayer Group, and Majid Al Futtaim) collectively held an estimated [Insert Percentage]% of the market share, highlighting the consolidated nature of the industry. However, the presence of numerous smaller players and emerging e-commerce platforms introduces a layer of complexity.

- Innovation Drivers: The Qatari retail market is driven by several key innovations: the rapid growth of e-commerce, a focus on personalized shopping experiences, the strategic implementation of omnichannel strategies, and significant technological advancements in retail technologies. These factors are reshaping consumer interactions and competitive strategies.

- Regulatory Impacts: Government policies concerning foreign investment, consumer protection, and retail licensing significantly influence market dynamics. These regulations are estimated to impact market growth by [Insert Percentage]%, underscoring the importance of understanding and adapting to the regulatory environment.

- Product Substitutes: The rise of e-commerce platforms and online marketplaces presents a potent substitute for traditional brick-and-mortar stores, forcing retailers to adapt and integrate online channels into their strategies.

- End-User Segmentation: The market is segmented based on demographics (age, income, lifestyle), purchasing behavior (online versus offline), and product categories. The apparel and accessories segment is predicted to be the largest, with a projected market share of [Insert Percentage]% in 2025, demonstrating the strength of this category.

- M&A Trends: Consolidation and expansion strategies are evident through increased M&A activity. An estimated [Insert Number] deals took place between 2019 and 2024, signifying a push towards larger, more integrated retail entities.

Qatar Retail Market Market Trends & Opportunities

The Qatari retail market is experiencing robust growth, driven by a burgeoning population, rising disposable incomes, and increased consumer spending. The market, valued at [Insert Value] Million QAR in 2025, is projected to reach [Insert Value] Million QAR by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of [Insert Percentage]%. This growth is fueled by several key trends:

The rapid adoption of e-commerce is fundamentally transforming the retail landscape, with online sales experiencing significant growth. The demand for convenient and personalized shopping experiences is driving the adoption of omnichannel strategies by retailers. The increasing popularity of luxury brands and premium products significantly contributes to market expansion. Furthermore, evolving consumer preferences towards sustainability and ethical sourcing are influencing product selection and brand loyalty, presenting opportunities for businesses that prioritize these values. The competitive landscape remains dynamic, characterized by intense competition among established players and the emergence of agile new entrants.

Dominant Markets & Segments in Qatar Retail Market

The luxury goods sector is expected to be the most dominant segment within the Qatari retail market, experiencing robust growth due to high purchasing power and a strong preference for premium brands among consumers. Doha, as the capital city, represents the largest retail market, followed by other major urban centers. This dominance is further strengthened by the concentration of high-income households, the presence of large shopping malls, and substantial tourist footfall.

- Key Growth Drivers:

- Robust economic growth and high disposable incomes, fueled by Qatar's diversified economy and strong government investments.

- Favorable government policies designed to support the development and growth of the retail sector.

- The expanding tourism sector contributes substantially to consumer spending and boosts retail activity.

- Significant investments in modern retail infrastructure, including shopping malls and e-commerce logistics, enhance consumer experience and market reach.

The government's ongoing investments in infrastructure and tourism initiatives solidify Doha's position as the leading retail market in Qatar, while also creating opportunities in other rapidly developing urban areas.

Qatar Retail Market Product Analysis

Product innovation in the Qatar retail market is largely driven by technological advancements. Retailers are increasingly adopting technologies such as artificial intelligence (AI), big data analytics, and mobile commerce to enhance the shopping experience. The focus on personalization, convenience, and seamless omnichannel integration is shaping product development. The market success of these innovations is highly dependent on their effective integration within existing retail infrastructure and alignment with consumer preferences.

Key Drivers, Barriers & Challenges in Qatar Retail Market

Key Drivers: The Qatar retail market is propelled by rising disposable incomes, expanding population, government investments in infrastructure, and the growth of e-commerce. Favorable demographic trends and government initiatives to support retail businesses further enhance the market's growth trajectory.

Challenges: The market faces challenges including intense competition, high operating costs, and supply chain complexities. Regulatory hurdles and fluctuations in global economic conditions also pose significant challenges to sustained market growth.

Growth Drivers in the Qatar Retail Market Market

Strong economic growth, a young and growing population, increased tourism, and government initiatives supporting retail development are major drivers. Technological advancements, particularly in e-commerce and omnichannel strategies, further fuel market expansion.

Challenges Impacting Qatar Retail Market Growth

Despite its growth potential, the Qatari retail market faces several challenges. High operating costs, intense competition from established international and emerging local brands, and a dependence on imports all create significant headwinds. Supply chain disruptions and complexities in the regulatory environment further add pressure, requiring retailers to develop robust strategies for mitigation.

Key Players Shaping the Qatar Retail Market Market

- Chalhoub Group - A leading luxury goods retailer with a strong presence in the region.

- Azadea Group - Lebanon - A prominent regional retailer with diverse brands and retail formats.

- Alshaya Group - A large international retailer operating numerous well-known brands in Qatar.

- Al Tayer Group - A major player with a strong portfolio of international and local brands.

- Gulf Marketing Group (GMG Group) - A significant player known for its diverse brand portfolio and market expertise.

- Gourmia - [Add brief description of Gourmia's business and relevance to Qatari retail]

- Tayama - [Add brief description of Tayama's business and relevance to Qatari retail]

- Majid al Futtaim retail - A large, diversified retail conglomerate with a significant presence in Qatar.

- Al Mana - A prominent Qatari conglomerate with interests in various sectors, including retail.

- Al Jassim Group - A significant player with a focus on specific retail sectors in Qatar. [Specify sector if known]

Significant Qatar Retail Market Industry Milestones

- September 2022: Chalhoub Group acquired a majority share of Threads Styling, expanding its online luxury retail presence.

- May 2022: Azadea Group partnered with Bose in the UAE, enhancing its portfolio of lifestyle brands.

Future Outlook for Qatar Retail Market Market

The Qatar retail market is poised for continued growth, driven by strong economic fundamentals and ongoing investments in infrastructure. Strategic opportunities exist for retailers to leverage technological advancements, cater to evolving consumer preferences, and capitalize on the growth of e-commerce. The market's future success hinges on adaptability, innovation, and a keen understanding of consumer needs.

Qatar Retail Market Segmentation

-

1. Product

- 1.1. Food and Beverages

- 1.2. Personal and Household Care

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Electronic and Household Appliances

- 1.6. Other Products

-

2. Distribution Channel

- 2.1. Supermar

- 2.2. Speciality Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Qatar Retail Market Segmentation By Geography

- 1. Qatar

Qatar Retail Market Regional Market Share

Geographic Coverage of Qatar Retail Market

Qatar Retail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Disposable Income and Affluent Standard of Living is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Retail Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Food and Beverages

- 5.1.2. Personal and Household Care

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Electronic and Household Appliances

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermar

- 5.2.2. Speciality Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Chalhoub Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Azadea Group - Lebanon

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alshaya Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Al Tayer Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gulf Marketing Group (GMG Group)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gourmia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tayama

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Majid al futtaim retail

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Al Mana

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Al Jassim Group**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Chalhoub Group

List of Figures

- Figure 1: Qatar Retail Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Qatar Retail Market Share (%) by Company 2025

List of Tables

- Table 1: Qatar Retail Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Qatar Retail Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Qatar Retail Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Qatar Retail Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 5: Qatar Retail Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Qatar Retail Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Retail Market?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the Qatar Retail Market?

Key companies in the market include Chalhoub Group, Azadea Group - Lebanon, Alshaya Group, Al Tayer Group, Gulf Marketing Group (GMG Group), Gourmia, Tayama, Majid al futtaim retail, Al Mana, Al Jassim Group**List Not Exhaustive.

3. What are the main segments of the Qatar Retail Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Disposable Income and Affluent Standard of Living is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In September 2022, Chalhoub Group acquired a majority share of Threads Styling, a personal shopping platform and online luxury retailer in London. Except for the shares held by Sophie Hill, Threads Styling's founder, and CEO, Chalhoub Group purchased all of the company's shares.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Retail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Retail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Retail Market?

To stay informed about further developments, trends, and reports in the Qatar Retail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence