Key Insights

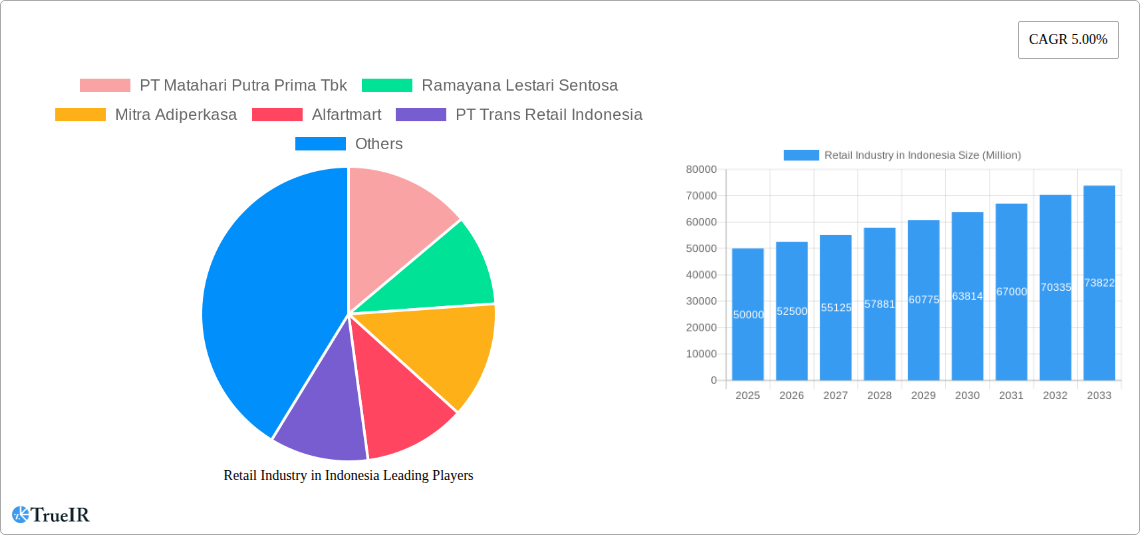

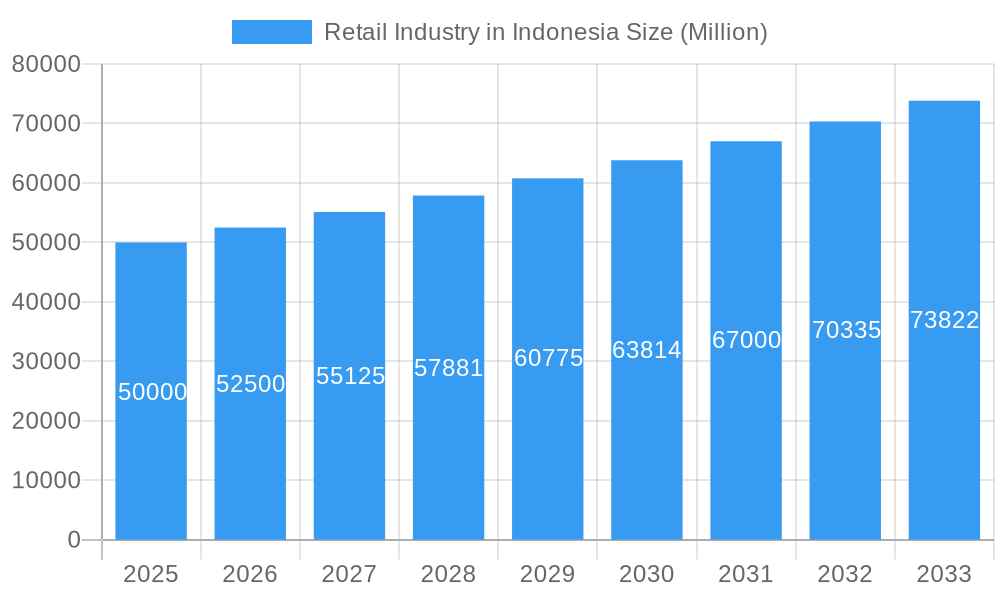

Indonesia's retail market, projected at $56.87 billion in 2025, is poised for substantial expansion. Driven by a growing middle class, increased disposable income, and ongoing urbanization, the market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.6% from 2025 to 2033. Key growth catalysts include the rapid adoption of e-commerce, the strategic implementation of omnichannel retail by established businesses, and a heightened consumer demand for convenient shopping solutions. Emerging trends such as the widespread use of mobile payments, personalized marketing efforts, and a growing consumer focus on sustainable and ethical product sourcing are actively reshaping the competitive dynamics of the Indonesian retail sector. While challenges like ensuring supply chain resilience amidst global volatility and managing intense price competition from both online and offline retailers persist, the market outlook remains highly positive.

Retail Industry in Indonesia Market Size (In Billion)

The market is segmented by a varied landscape of participants, encompassing global corporations such as AEON Group and Lotte Mart, alongside dominant domestic entities like PT Matahari Putra Prima Tbk and Ramayana Lestari Sentosa. The presence of numerous small-scale retailers and the swift rise of e-commerce platforms contribute to a fiercely competitive arena. Success within this market hinges on an organization's capacity to align with evolving consumer demands, effectively utilize technological advancements, and maintain robust supply chain operations. Recognizing regional differences in consumer behavior and purchasing power necessitates tailored market strategies, with urban centers and developing areas showing the greatest growth potential. Strategic alliances, technology investments, and innovative business frameworks will be paramount for companies seeking to leverage the opportunities within this dynamic market. Furthermore, supportive government policies aimed at enhancing infrastructure and fostering economic development in Indonesia underscore the optimistic market trajectory.

Retail Industry in Indonesia Company Market Share

Indonesia Retail Industry Report: 2019-2033 Forecast

Dive deep into the dynamic Indonesian retail landscape with this comprehensive market analysis, projecting growth from 2025 to 2033. This report provides critical insights into market structure, competitive dynamics, key players, and future opportunities within Indonesia's thriving retail sector. With a detailed study period spanning 2019-2024 (historical) and a forecast period encompassing 2025-2033 (with a base year of 2025), this report is essential for businesses navigating this expansive market.

Retail Industry in Indonesia Market Structure & Competitive Landscape

Indonesia's retail market is characterized by a diverse range of players, from large multinational corporations to small, independent businesses. Market concentration is moderate, with several dominant players controlling significant market share, but a substantial portion held by numerous smaller competitors. The Herfindahl-Hirschman Index (HHI) for the Indonesian retail sector in 2024 was estimated at xx, indicating a moderately competitive market. However, recent years have witnessed increased consolidation through mergers and acquisitions (M&A), driven by the desire to achieve economies of scale and expand market reach. The total value of M&A deals in the Indonesian retail sector from 2019 to 2024 reached approximately xx Million.

- Innovation Drivers: E-commerce growth, omnichannel strategies, and the adoption of advanced technologies such as AI and big data analytics are transforming the sector.

- Regulatory Impacts: Government policies regarding foreign investment, e-commerce regulations, and consumer protection laws significantly influence market dynamics. Recent changes in regulations concerning online marketplaces have created both opportunities and challenges.

- Product Substitutes: The emergence of online marketplaces and the growing popularity of direct-to-consumer brands are presenting viable substitutes for traditional brick-and-mortar stores.

- End-User Segmentation: The Indonesian market is highly segmented by demographics (age, income, location), lifestyle, and purchasing behavior. Understanding these nuances is crucial for effective market penetration.

- M&A Trends: Recent years have seen a rise in strategic acquisitions, particularly involving e-commerce players acquiring traditional retailers to expand their reach and capabilities. This trend is expected to continue.

Retail Industry in Indonesia Market Trends & Opportunities

The Indonesian retail market exhibits robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth is fueled by a young and expanding population, rising disposable incomes, and increasing urbanization. The market size reached approximately xx Million in 2024 and is projected to reach xx Million by 2033. Market penetration rates vary significantly across different segments, with e-commerce experiencing particularly rapid growth.

Technological shifts, including the widespread adoption of mobile commerce and digital payment systems, are reshaping consumer behavior. Consumers are increasingly demanding convenience, personalization, and seamless omnichannel experiences. The rise of social commerce and the influence of key opinion leaders (KOLs) further contribute to the evolving dynamics. Competitive intensity remains high, with existing players constantly seeking to innovate and differentiate their offerings.

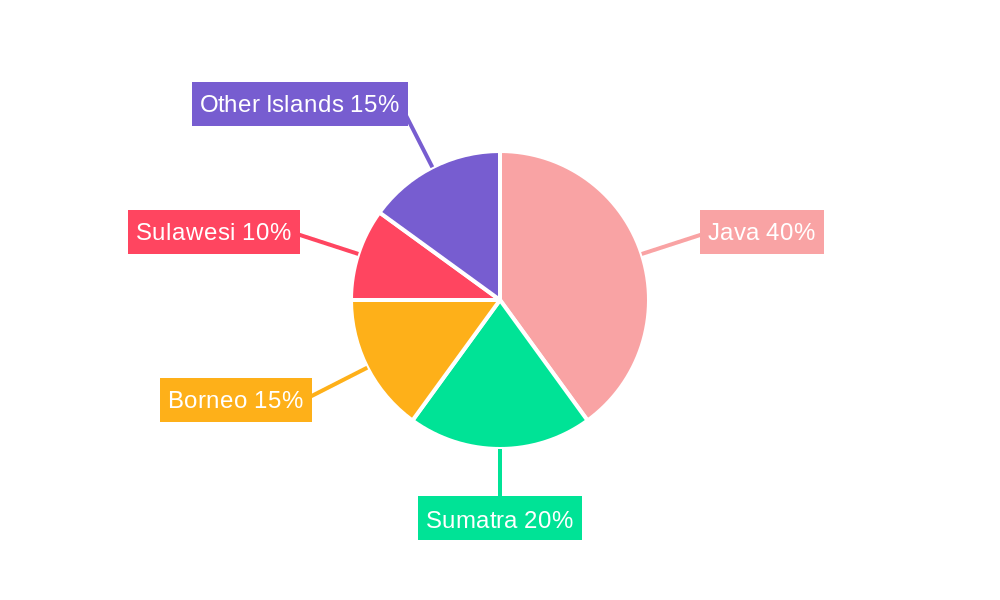

Dominant Markets & Segments in Retail Industry in Indonesia

While the Indonesian retail market is geographically diverse, the most dominant regions are concentrated in major metropolitan areas like Jakarta, Surabaya, and Bandung. These urban centers benefit from higher population density, improved infrastructure, and greater consumer spending.

- Key Growth Drivers:

- Expanding Middle Class: A rapidly growing middle class with increasing disposable income fuels retail growth across diverse segments.

- Improved Infrastructure: Ongoing investments in infrastructure, including transportation and logistics, enhance market accessibility and efficiency.

- Government Support: Favorable government policies and initiatives aimed at stimulating economic growth create a conducive environment for retail businesses.

- E-commerce Boom: The phenomenal growth of e-commerce, fueled by widespread internet and smartphone penetration, significantly contributes to retail market expansion.

The most dominant retail segments include groceries, apparel, electronics, and home furnishings. Each segment exhibits unique growth dynamics driven by specific factors. The grocery segment, for instance, benefits from growing urbanization and changing consumer lifestyles.

Retail Industry in Indonesia Product Analysis

The Indonesian retail market showcases a diverse range of products catering to diverse consumer needs. Significant product innovations involve the integration of technology, personalized offerings, and enhanced customer experiences. For instance, the adoption of omnichannel strategies, mobile payment systems, and personalized marketing campaigns are transforming the retail landscape. Companies are leveraging data analytics to optimize product assortment, pricing, and promotional strategies. The market is witnessing a shift towards sustainable and ethically sourced products, aligning with growing consumer awareness of environmental and social responsibility.

Key Drivers, Barriers & Challenges in Retail Industry in Indonesia

Key Drivers:

- Rising Disposable Incomes: A growing middle class with higher purchasing power fuels increased consumer spending.

- E-commerce Expansion: The rapid growth of e-commerce provides significant market opportunities.

- Government Initiatives: Government policies supporting infrastructure development and ease of doing business create a positive environment.

Challenges:

- Supply Chain Disruptions: Logistical complexities and infrastructure limitations can cause supply chain bottlenecks. Estimated annual losses due to supply chain issues are xx Million.

- Regulatory Hurdles: Navigating complex regulations and obtaining necessary permits can create operational challenges.

- Intense Competition: The highly competitive retail market necessitates continuous innovation and efficient operations to maintain a strong market position.

Growth Drivers in the Retail Industry in Indonesia Market

Key growth drivers include the expanding middle class, increased urbanization, rising internet and smartphone penetration, and supportive government policies. The government's focus on infrastructure development and digitalization further fuels market expansion. The adoption of omnichannel strategies and innovative technologies like AI and big data enhances operational efficiency and customer engagement.

Challenges Impacting Retail Industry in Indonesia Growth

Challenges include infrastructure limitations in some regions, supply chain inefficiencies, and intense competition. Maintaining competitive pricing in a price-sensitive market remains a challenge. Moreover, regulatory complexities and the need for skilled labor can also hinder growth.

Key Players Shaping the Retail Industry in Indonesia Market

- PT Matahari Putra Prima Tbk

- Ramayana Lestari Sentosa

- Mitra Adiperkasa

- Alfamart

- PT Trans Retail Indonesia

- Hero Supermarket Group

- Erajaya Swasembada

- AEON Group

- Lotte Mart

- Indomaret

Significant Retail Industry in Indonesia Industry Milestones

- February 2021: Giordano opens a large-scale store in Bumi Raya City Mall, Pontianak, signaling expansion into regional markets.

Future Outlook for Retail Industry in Indonesia Market

The Indonesian retail market is poised for sustained growth over the forecast period (2025-2033). Continued economic expansion, rising consumer spending, and the ongoing development of digital infrastructure will drive market expansion. The increasing adoption of e-commerce and omnichannel strategies presents significant opportunities for businesses to expand their reach and enhance customer experiences. Strategic investments in technology, logistics, and supply chain management will be crucial for success in this dynamic and competitive market.

Retail Industry in Indonesia Segmentation

-

1. Product

- 1.1. Food and Beverages

- 1.2. Personal and Household Care

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Electronic and Household Appliances

- 1.6. Other Products

-

2. Distribution Channel

- 2.1. Supermar

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Retail Industry in Indonesia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Retail Industry in Indonesia Regional Market Share

Geographic Coverage of Retail Industry in Indonesia

Retail Industry in Indonesia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1 Online Retailing is Gaining More Traction

- 3.4.2 Yet Physical Retailing is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Retail Industry in Indonesia Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Food and Beverages

- 5.1.2. Personal and Household Care

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Electronic and Household Appliances

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermar

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Retail Industry in Indonesia Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Food and Beverages

- 6.1.2. Personal and Household Care

- 6.1.3. Apparel, Footwear, and Accessories

- 6.1.4. Furniture, Toys, and Hobby

- 6.1.5. Electronic and Household Appliances

- 6.1.6. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermar

- 6.2.2. Specialty Stores

- 6.2.3. Online

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Retail Industry in Indonesia Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Food and Beverages

- 7.1.2. Personal and Household Care

- 7.1.3. Apparel, Footwear, and Accessories

- 7.1.4. Furniture, Toys, and Hobby

- 7.1.5. Electronic and Household Appliances

- 7.1.6. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermar

- 7.2.2. Specialty Stores

- 7.2.3. Online

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Retail Industry in Indonesia Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Food and Beverages

- 8.1.2. Personal and Household Care

- 8.1.3. Apparel, Footwear, and Accessories

- 8.1.4. Furniture, Toys, and Hobby

- 8.1.5. Electronic and Household Appliances

- 8.1.6. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermar

- 8.2.2. Specialty Stores

- 8.2.3. Online

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Retail Industry in Indonesia Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Food and Beverages

- 9.1.2. Personal and Household Care

- 9.1.3. Apparel, Footwear, and Accessories

- 9.1.4. Furniture, Toys, and Hobby

- 9.1.5. Electronic and Household Appliances

- 9.1.6. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermar

- 9.2.2. Specialty Stores

- 9.2.3. Online

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Retail Industry in Indonesia Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Food and Beverages

- 10.1.2. Personal and Household Care

- 10.1.3. Apparel, Footwear, and Accessories

- 10.1.4. Furniture, Toys, and Hobby

- 10.1.5. Electronic and Household Appliances

- 10.1.6. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermar

- 10.2.2. Specialty Stores

- 10.2.3. Online

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PT Matahari Putra Prima Tbk

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ramayana Lestari Sentosa

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mitra Adiperkasa

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Alfartmart

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 PT Trans Retail Indonesia

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hero Supermarket Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Erajaya Swasembada

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AEON Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Lotte Mart

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Indomarket**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 PT Matahari Putra Prima Tbk

List of Figures

- Figure 1: Global Retail Industry in Indonesia Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Retail Industry in Indonesia Revenue (billion), by Product 2025 & 2033

- Figure 3: North America Retail Industry in Indonesia Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Retail Industry in Indonesia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Retail Industry in Indonesia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Retail Industry in Indonesia Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Retail Industry in Indonesia Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Retail Industry in Indonesia Revenue (billion), by Product 2025 & 2033

- Figure 9: South America Retail Industry in Indonesia Revenue Share (%), by Product 2025 & 2033

- Figure 10: South America Retail Industry in Indonesia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: South America Retail Industry in Indonesia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America Retail Industry in Indonesia Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Retail Industry in Indonesia Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Retail Industry in Indonesia Revenue (billion), by Product 2025 & 2033

- Figure 15: Europe Retail Industry in Indonesia Revenue Share (%), by Product 2025 & 2033

- Figure 16: Europe Retail Industry in Indonesia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Europe Retail Industry in Indonesia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Retail Industry in Indonesia Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Retail Industry in Indonesia Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Retail Industry in Indonesia Revenue (billion), by Product 2025 & 2033

- Figure 21: Middle East & Africa Retail Industry in Indonesia Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East & Africa Retail Industry in Indonesia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa Retail Industry in Indonesia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa Retail Industry in Indonesia Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Retail Industry in Indonesia Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Retail Industry in Indonesia Revenue (billion), by Product 2025 & 2033

- Figure 27: Asia Pacific Retail Industry in Indonesia Revenue Share (%), by Product 2025 & 2033

- Figure 28: Asia Pacific Retail Industry in Indonesia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Retail Industry in Indonesia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Retail Industry in Indonesia Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Retail Industry in Indonesia Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Retail Industry in Indonesia Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Retail Industry in Indonesia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Retail Industry in Indonesia Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Retail Industry in Indonesia Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Global Retail Industry in Indonesia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Retail Industry in Indonesia Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Retail Industry in Indonesia Revenue billion Forecast, by Product 2020 & 2033

- Table 11: Global Retail Industry in Indonesia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Retail Industry in Indonesia Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Retail Industry in Indonesia Revenue billion Forecast, by Product 2020 & 2033

- Table 17: Global Retail Industry in Indonesia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Retail Industry in Indonesia Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Retail Industry in Indonesia Revenue billion Forecast, by Product 2020 & 2033

- Table 29: Global Retail Industry in Indonesia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Retail Industry in Indonesia Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Retail Industry in Indonesia Revenue billion Forecast, by Product 2020 & 2033

- Table 38: Global Retail Industry in Indonesia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Retail Industry in Indonesia Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Retail Industry in Indonesia Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail Industry in Indonesia?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Retail Industry in Indonesia?

Key companies in the market include PT Matahari Putra Prima Tbk, Ramayana Lestari Sentosa, Mitra Adiperkasa, Alfartmart, PT Trans Retail Indonesia, Hero Supermarket Group, Erajaya Swasembada, AEON Group, Lotte Mart, Indomarket**List Not Exhaustive.

3. What are the main segments of the Retail Industry in Indonesia?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 56.87 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Online Retailing is Gaining More Traction. Yet Physical Retailing is Dominating the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In February 2021, Apparel retailer Giordano unveiled a large-scale store in the newly opened Bumi Raya City Mall in Pontianak, Indonesia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Retail Industry in Indonesia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Retail Industry in Indonesia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Retail Industry in Indonesia?

To stay informed about further developments, trends, and reports in the Retail Industry in Indonesia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence