Key Insights

The Saudi Arabia plastic components market is poised for significant expansion, driven by robust demand from the construction sector, growing consumer goods market, and increasing adoption within life sciences and food & beverage industries. The market is forecast to achieve a Compound Annual Growth Rate (CAGR) of 6.2%, reaching a market size of 4.8 billion by 2033, with a base year of 2024. Key growth catalysts include government-led infrastructure development initiatives, rising disposable incomes, and a strong focus on localization across industries. The extensive product range, including sheets, films, plates, tubes, containers, and household articles, caters to diverse end-use applications, fueling market growth. While challenges such as volatile oil prices and environmental concerns persist, strategic investments in advanced plastic technologies and recycling are actively mitigating these risks. A competitive landscape featuring both domestic and international players fosters innovation, with the expansion of industrial parks and specialized manufacturing zones further enhancing the sector's investment appeal.

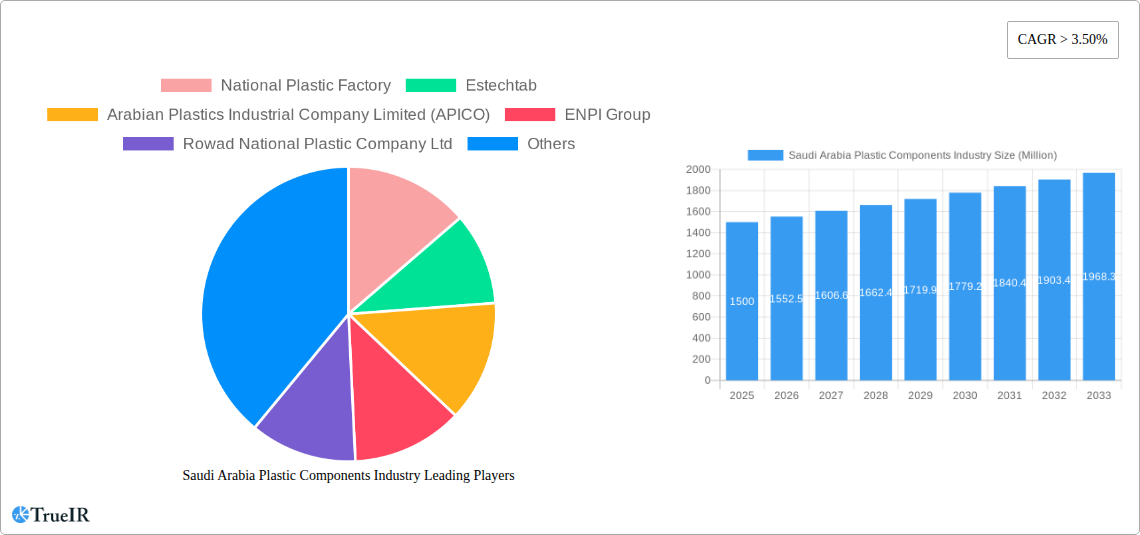

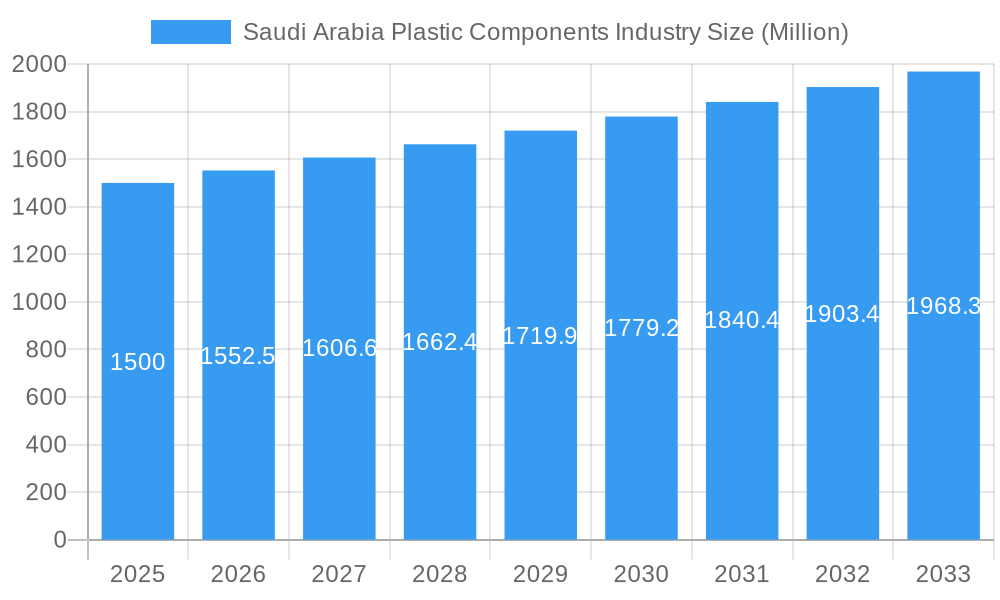

Saudi Arabia Plastic Components Industry Market Size (In Billion)

The Saudi Arabia plastic components market is projected to sustain its upward trajectory through 2033, with diversification into specialized applications like aerospace and advanced medical devices expected to drive further growth. The integration of sustainable practices, including the increased use of recycled and biodegradable plastics, will be paramount. Companies prioritizing innovation and sustainable solutions will be best positioned to leverage future market opportunities. The consistent growth, supported by governmental backing and substantial infrastructural investments, solidifies Saudi Arabia's position as a key player in the regional plastic components industry. The building and construction segment remains a critical growth driver, with ongoing projects consistently boosting demand for plastic components.

Saudi Arabia Plastic Components Industry Company Market Share

Saudi Arabia Plastic Components Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Saudi Arabia plastic components industry, offering invaluable insights for businesses, investors, and policymakers. Leveraging extensive market research and data analysis across the 2019-2033 period (with a base year of 2025 and a forecast period of 2025-2033), this report unveils the industry's structure, trends, opportunities, and challenges. The report features a comprehensive analysis of key players, including National Plastic Factory, Estechtab, Arabian Plastics Industrial Company Limited (APICO), ENPI Group, Rowad National Plastic Company Ltd, Zamil Plastics Industries Limited, Tamam Plastic Factory, Takween Advanced Industries, Saudi Can Co Ltd, PCC, Al Watania Plastics, Rayan Plastic Factory Company, and Saudi Plastic Products Company Ltd. The report also segments the market by product type (Sheets, Film, and Plates; Tubes; Containers; Household Articles; Floor Cover and Wall Cover; Textile Fabrics; Other Products) and end-user industry (Building and Construction; Consumer Goods; Life Sciences; Aerospace; Food and Beverage; Other Applications). This report is crucial for understanding the current market landscape and making informed strategic decisions in this rapidly evolving sector. The market size in 2025 is estimated to be XX Million USD.

Saudi Arabia Plastic Components Industry Market Structure & Competitive Landscape

The Saudi Arabian plastic components industry exhibits a moderately concentrated market structure in 2025, with the top five players accounting for approximately xx% of the total market share. Innovation is driven by the increasing demand for lightweight, durable, and cost-effective materials across various end-user sectors. Government regulations focusing on sustainability and waste management are significantly impacting the industry, encouraging the adoption of recycled plastics and eco-friendly manufacturing processes. The primary product substitutes include bioplastics and other advanced materials; however, their market penetration remains relatively low. The industry's end-user segmentation is diverse, with significant contributions from the building and construction, consumer goods, and food and beverage sectors. M&A activity has been moderate in recent years, with approximately xx M&A deals recorded between 2019 and 2024, primarily focused on consolidation and expansion into new market segments.

- Market Concentration: Top 5 players hold xx% market share (2025).

- Innovation Drivers: Demand for lightweight, durable, and sustainable materials.

- Regulatory Impacts: Emphasis on recycling and environmental sustainability.

- Product Substitutes: Bioplastics and other advanced materials, but with limited market penetration.

- End-User Segmentation: Building & Construction, Consumer Goods, Food & Beverage are dominant segments.

- M&A Trends: Moderate activity, focused on consolidation and expansion (xx deals from 2019-2024).

Saudi Arabia Plastic Components Industry Market Trends & Opportunities

The Saudi Arabian plastic components market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by robust growth across various end-user industries, particularly the burgeoning construction and infrastructure development sectors. Technological advancements, such as the adoption of advanced polymer materials and automation in manufacturing processes, are further enhancing efficiency and product quality. Consumer preferences are shifting towards sustainable and eco-friendly plastic products, creating opportunities for manufacturers offering recycled or biodegradable options. The competitive landscape is dynamic, with both established players and new entrants vying for market share. Market penetration rates for specific product segments, like household articles and packaging, are expected to increase significantly, reaching xx% by 2033. This expansion is fueled by rising disposable incomes and a growing middle class. The government's Vision 2030 initiative further contributes to this positive outlook by promoting industrial diversification and technological advancement.

Dominant Markets & Segments in Saudi Arabia Plastic Components Industry

The dominant segment within the Saudi Arabian plastic components market in 2025 is the Building and Construction sector, driven by large-scale infrastructure projects and a booming real estate market. The Sheets, Film, and Plates product type represents the largest segment by volume, fueled by high demand in packaging and construction applications.

Key Growth Drivers (Building and Construction):

- Extensive infrastructure development projects under Vision 2030.

- Rapid urbanization and population growth.

- Increased government spending on housing and construction initiatives.

Key Growth Drivers (Sheets, Film, and Plates):

- High demand from packaging and construction industries.

- Versatile applications across various sectors.

- Relatively low cost compared to other materials.

The geographical dominance is concentrated in major urban centers like Riyadh, Jeddah, and Dammam, reflecting the high concentration of manufacturing facilities and end-user industries in these regions.

Saudi Arabia Plastic Components Industry Product Analysis

Product innovation is focused on enhancing material properties, such as strength, durability, and flexibility, through the use of advanced polymer blends and additives. Applications are expanding into niche sectors, including medical devices and aerospace components, driven by the growing demand for lightweight and high-performance materials. Competitive advantages are established through efficient manufacturing processes, superior product quality, and strong relationships with key end-users. Technological advancements, particularly in polymer chemistry and additive manufacturing, are transforming the industry by enabling the creation of customized and high-precision components.

Key Drivers, Barriers & Challenges in Saudi Arabia Plastic Components Industry

Key Drivers: The burgeoning construction sector, government initiatives promoting industrial diversification (Vision 2030), and rising demand for consumer goods are propelling the market. Technological advancements in polymer science are leading to the development of high-performance plastics with specialized properties.

Key Challenges: Fluctuations in global oil prices impact raw material costs. Stringent environmental regulations regarding plastic waste management present significant challenges. Intense competition from both domestic and international players puts pressure on profit margins. Supply chain disruptions can cause delays and increased costs, especially during periods of geopolitical instability.

Growth Drivers in the Saudi Arabia Plastic Components Industry Market

The Saudi Arabian plastic components market's growth is fueled by the government's Vision 2030 initiative, which emphasizes infrastructure development and industrial diversification. This leads to increased demand for plastic components in construction, packaging, and consumer goods. Technological advancements in polymer science also drive innovation and the creation of high-performance plastics. Furthermore, favorable demographics, with a growing population and rising disposable incomes, further stimulate demand.

Challenges Impacting Saudi Arabia Plastic Components Industry Growth

The industry faces challenges including reliance on imported raw materials, making it susceptible to global price fluctuations and supply chain disruptions. Stringent environmental regulations, aiming to reduce plastic waste, necessitate increased investment in sustainable practices and technologies. Competition from international players with lower production costs creates pressure on local manufacturers.

Key Players Shaping the Saudi Arabia Plastic Components Industry Market

- National Plastic Factory

- Estechtab

- Arabian Plastics Industrial Company Limited (APICO)

- ENPI Group

- Rowad National Plastic Company Ltd

- Zamil Plastics Industries Limited

- Tamam Plastic Factory

- Takween Advanced Industries

- Saudi Can Co Ltd

- PCC

- Al Watania Plastics

- Rayan Plastic Factory Company

- Saudi Plastic Products Company Ltd

Significant Saudi Arabia Plastic Components Industry Industry Milestones

- 2020: Introduction of new environmental regulations regarding plastic waste management.

- 2022: Successful completion of a major infrastructure project utilizing a significant quantity of plastic components.

- 2023: Launch of a new recycled plastic product line by a leading manufacturer.

Future Outlook for Saudi Arabia Plastic Components Industry Market

The Saudi Arabian plastic components industry is poised for continued growth, driven by sustained infrastructure development, government support, and technological advancements. Strategic opportunities exist in developing sustainable and eco-friendly products, expanding into niche market segments, and leveraging technological innovations to enhance manufacturing efficiency and product quality. The market is expected to witness a significant increase in the adoption of advanced polymer materials and smart manufacturing technologies, further boosting its competitiveness.

Saudi Arabia Plastic Components Industry Segmentation

-

1. Product Type

- 1.1. Sheets, Film, and Plates

- 1.2. Tubes

- 1.3. Containers

- 1.4. Household Articles

- 1.5. Floor Cover and Wall Cover

- 1.6. Textile Fabrics

- 1.7. Other Products

-

2. End-user Industry

- 2.1. Building and Construction

- 2.2. Consumer Goods

- 2.3. Life Sciences

- 2.4. Aerospace

- 2.5. Food and Beverage

- 2.6. Other Applications

Saudi Arabia Plastic Components Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Plastic Components Industry Regional Market Share

Geographic Coverage of Saudi Arabia Plastic Components Industry

Saudi Arabia Plastic Components Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Government Spending on Construction Activities; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Slowdown in Automotive Industry Growth; Unfavorable Conditions Arising Due to COVID-19 Outbreak

- 3.4. Market Trends

- 3.4.1 Sheets

- 3.4.2 Film

- 3.4.3 and Plates to Dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Plastic Components Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Sheets, Film, and Plates

- 5.1.2. Tubes

- 5.1.3. Containers

- 5.1.4. Household Articles

- 5.1.5. Floor Cover and Wall Cover

- 5.1.6. Textile Fabrics

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Building and Construction

- 5.2.2. Consumer Goods

- 5.2.3. Life Sciences

- 5.2.4. Aerospace

- 5.2.5. Food and Beverage

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 National Plastic Factory

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Estechtab

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arabian Plastics Industrial Company Limited (APICO)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ENPI Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rowad National Plastic Company Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zamil Plastics Industries Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tamam Plastic Factory

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Takween Advanced Industries

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saudi Can Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PCC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Al Watania Plastics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Rayan Plastic Factory Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Saudi Plastic Products Company Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 National Plastic Factory

List of Figures

- Figure 1: Saudi Arabia Plastic Components Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Plastic Components Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Plastic Components Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Saudi Arabia Plastic Components Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 5: Saudi Arabia Plastic Components Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Saudi Arabia Plastic Components Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: Saudi Arabia Plastic Components Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 10: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 11: Saudi Arabia Plastic Components Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Plastic Components Industry?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Saudi Arabia Plastic Components Industry?

Key companies in the market include National Plastic Factory, Estechtab, Arabian Plastics Industrial Company Limited (APICO), ENPI Group, Rowad National Plastic Company Ltd, Zamil Plastics Industries Limited, Tamam Plastic Factory, Takween Advanced Industries, Saudi Can Co Ltd, PCC, Al Watania Plastics, Rayan Plastic Factory Company, Saudi Plastic Products Company Ltd.

3. What are the main segments of the Saudi Arabia Plastic Components Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.8 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Government Spending on Construction Activities; Other Drivers.

6. What are the notable trends driving market growth?

Sheets. Film. and Plates to Dominate the market.

7. Are there any restraints impacting market growth?

; Slowdown in Automotive Industry Growth; Unfavorable Conditions Arising Due to COVID-19 Outbreak.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3,950, USD 4,950, and USD 6,950 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Plastic Components Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Plastic Components Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Plastic Components Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Plastic Components Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence