Key Insights

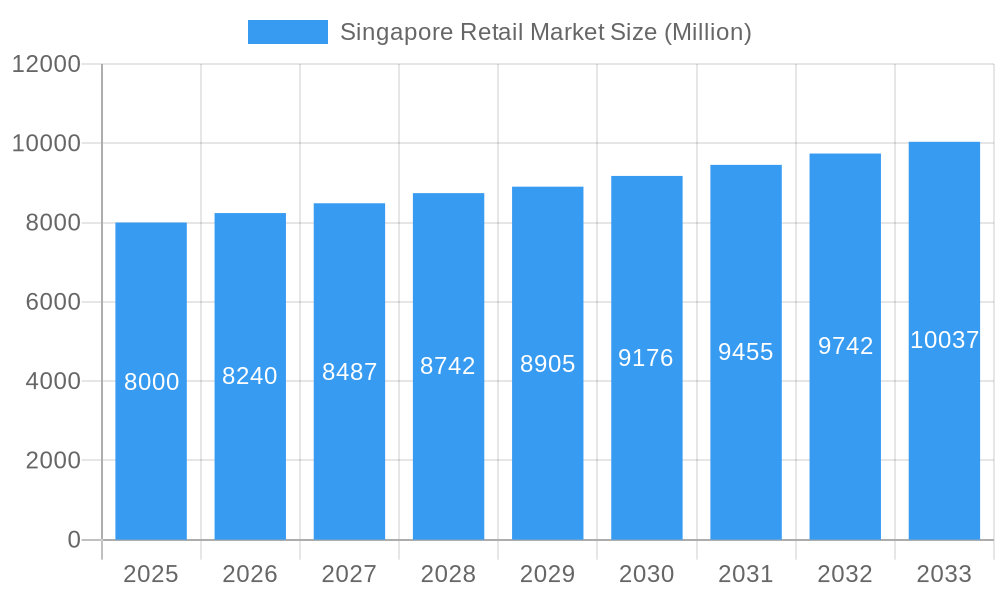

Singapore's retail market is experiencing significant expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of 3.7%. This dynamic sector is propelled by a growing affluent demographic with increased disposable income, a strong consumer preference for convenience and omnichannel shopping, and the sustained proliferation of e-commerce. Leading market participants, including Sheng Siong Group, Dairy Farm International Holdings, and NTUC FairPrice, maintain dominance through established brand equity and extensive retail footprints. Key challenges encompass escalating operational expenses, rigorous competition from incumbents and new entrants, and the continuous evolution of consumer expectations for personalized and sustainable offerings. The market is segmented across crucial categories such as groceries, apparel, electronics, and pharmaceuticals, each exhibiting distinct growth patterns and competitive pressures. The forecast period, from the base year of 2025 to 2033, anticipates sustained growth, further stimulated by governmental support for retail digitalization and innovation, alongside robust tourism and ongoing foreign investment.

Singapore Retail Market Market Size (In Billion)

The competitive environment features a blend of multinational corporations and agile, specialized retailers. Larger entities leverage economies of scale and sophisticated supply chain management, whereas smaller businesses often differentiate through niche products and bespoke customer engagement. Success in this market is contingent upon retailers' agility in responding to evolving consumer preferences, their adoption of technological advancements, and their adeptness in cost management. Future expansion will be significantly influenced by the integration of innovative retail technologies, the seamless fusion of online and offline channels, and the capacity to resonate with increasingly conscious consumers prioritizing sustainability and ethical practices. The ongoing surge in e-commerce and the strategic deployment of data-driven approaches will continue to shape the market's trajectory, alongside the crucial influence of government regulations pertaining to data privacy and e-commerce conduct. The estimated market size is 144.42 billion.

Singapore Retail Market Company Market Share

Singapore Retail Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Singapore retail market, encompassing historical performance (2019-2024), current status (Base Year: 2025), and future projections (Forecast Period: 2025-2033). It leverages high-impact keywords to ensure maximum visibility and relevance for industry professionals, investors, and researchers. The report delves into market structure, competitive dynamics, dominant segments, key players, and future growth opportunities within the vibrant Singapore retail landscape. The market size is estimated at $xx Million in 2025 and is projected to reach $xx Million by 2033, exhibiting a CAGR of xx%.

Singapore Retail Market Market Structure & Competitive Landscape

The Singapore retail market is a dynamic ecosystem characterized by a robust presence of both globally recognized multinational corporations and agile, locally-owned enterprises. The market exhibits moderate concentration, with several leading players commanding significant market share, yet it avoids monopolistic dominance. Between 2019 and 2024, the average Herfindahl-Hirschman Index (HHI) stood at xx, confirming a moderately concentrated competitive environment. Key innovation drivers are prominently seen in the accelerated adoption of sophisticated e-commerce platforms, the strategic implementation of omnichannel retail strategies, and a growing emphasis on delivering highly personalized customer experiences. The regulatory landscape, primarily focused on safeguarding consumer rights and ensuring data privacy, exerts a considerable influence on operational practices. Furthermore, the constant evolution of product substitutes, particularly through the proliferation of online marketplaces and alternative shopping channels, continues to exert pressure on traditional retail models.

End-user segmentation is remarkably diverse, encompassing a wide spectrum of demographic profiles and distinct purchasing behaviors. The market consistently witnesses active Mergers & Acquisitions (M&A) activity, with an average of xx M&A deals annually recorded between 2019 and 2024. These transactions are predominantly geared towards expanding market reach into new consumer segments and integrating cutting-edge technological advancements. Such strategic acquisitions by larger entities are crucial for enhancing their overall market penetration and augmenting their operational capabilities. Deeper analysis further highlights a pronounced and growing consumer preference for sustainable and ethically sourced products, a trend that significantly shapes supplier selection processes and informs product development strategies.

Singapore Retail Market Market Trends & Opportunities

The Singapore retail market is currently undergoing a profound transformation, propelled by rapid technological advancements and the continuous evolution of consumer preferences. The market size is demonstrating robust and sustained growth, with a projected Compound Annual Growth Rate (CAGR) of xx% anticipated from 2025 to 2033. The meteoric rise of e-commerce has fundamentally reshaped the competitive arena, compelling traditional brick-and-mortar retailers to strategically adapt by integrating seamless online channels and significantly enhancing their digital footprint. Consumers are increasingly vocal in their demand for highly personalized shopping journeys, frictionless omnichannel experiences, and convenient, efficient delivery options. This evolving consumer behavior necessitates substantial investments in advanced technologies and a relentless focus on optimizing supply chain operations. The market penetration rate of e-commerce is projected to reach an impressive xx% by 2033. Prime opportunities for growth are found in the development of specialized niche product offerings, the strategic leveraging of data analytics for hyper-personalized marketing campaigns, and the enhancement of the overall customer experience through innovative technological solutions. Moreover, the burgeoning focus on environmental sustainability and ethical consumerism presents significant avenues for businesses to establish distinct brand identities and foster greater consumer loyalty.

Dominant Markets & Segments in Singapore Retail Market

The Singapore retail market demonstrates strength across various segments, with no single region or segment exhibiting overwhelming dominance. However, the food and beverage sector, driven by robust consumer demand and a diverse culinary landscape, remains a significant contributor to overall market revenue. The apparel and fashion segment also displays substantial growth, particularly within the online channel.

- Key Growth Drivers in Food & Beverage:

- High disposable incomes

- A diverse and sophisticated consumer base

- Increasing demand for convenient and healthy food options

- Government initiatives supporting the F&B sector

- Key Growth Drivers in Apparel & Fashion:

- High fashion consciousness

- Growing online retail penetration

- Influencer marketing driving brand awareness

The consistent growth across multiple segments reflects the dynamism and resilience of the Singapore retail market, making it an attractive investment destination.

Singapore Retail Market Product Analysis

The Singapore retail market witnesses continuous product innovation, reflecting the rapid pace of technological advancements and evolving consumer preferences. Retailers are increasingly adopting data-driven approaches to personalize product offerings and optimize inventory management. The integration of augmented reality (AR) and virtual reality (VR) technologies is enhancing the customer experience, while the rise of subscription boxes and personalized product recommendations is driving engagement. The competitive advantage lies in providing innovative products, seamless omnichannel experiences, and exceptional customer service. Technological advancements like AI-powered recommendation engines and personalized marketing are shaping future trends.

Key Drivers, Barriers & Challenges in Singapore Retail Market

Key Drivers:

- Rising disposable incomes: Increased purchasing power fuels higher retail spending.

- Technological advancements: E-commerce, omnichannel strategies, and data analytics drive market growth.

- Favorable government policies: Supportive regulatory environment promotes investment and innovation.

Key Challenges:

- High operating costs: Rent, labor, and logistics costs in Singapore are relatively high. This impacts profitability, particularly for smaller retailers. The impact on profit margins is estimated to be approximately xx% annually.

- Intense competition: The market is highly competitive, necessitating constant innovation and differentiation.

- Supply chain disruptions: Global events can significantly affect supply chains and increase costs.

Growth Drivers in the Singapore Retail Market Market

The sustained growth of the Singapore retail market is significantly propelled by a confluence of factors, including increasing disposable incomes, proactive and supportive government policies, and the relentless pace of technological advancements that are accelerating e-commerce adoption and the implementation of sophisticated omnichannel strategies. The vibrant and continually expanding tourism sector also plays a crucial role in bolstering retail sales. Furthermore, the government's strategic vision for creating a "Smart Nation," coupled with its strong emphasis on promoting digitalization and fostering a culture of innovation, cultivates an exceptionally conducive environment for robust retail sector expansion.

Challenges Impacting Singapore Retail Market Growth

The Singapore retail market faces notable challenges, including persistently high operating costs, particularly concerning rental expenses and labor costs. Intense market competition, alongside the potential for unforeseen supply chain disruptions, also poses significant hurdles. The ever-shifting landscape of consumer preferences and the imperative for continuous adaptation to maintain a competitive edge present ongoing challenges. Moreover, the complexities of regulatory frameworks and the increasing emphasis on environmental sustainability considerations further influence and shape growth trajectories within the market.

Key Players Shaping the Singapore Retail Market Market

- Japan Foods Holding Ltd

- Sheng Siong Group Ltd

- Watsons

- RedMart Ltd

- ABR Holdings Ltd

- NTUC

- QAF Limited

- U Stars

- Dairy Farm International Holdings (DFI)

- Font Creative Pte Ltd

Significant Singapore Retail Market Industry Milestones

- April 2021: Closure of Singaporean retailer Naiise, highlighting the challenges faced by smaller businesses during the pandemic.

Future Outlook for Singapore Retail Market Market

The future trajectory of the Singapore retail market is exceptionally promising, poised for continued and robust growth. This expansion will be primarily driven by ongoing technological innovation, the dynamic evolution of consumer preferences, and the unwavering support of government policies. Key opportunities for businesses lie in the creation of highly personalized shopping experiences, the strategic implementation of seamless omnichannel strategies, and the adoption of sustainable retail practices that resonate with environmentally conscious consumers. The market is anticipated to exhibit substantial expansion in the coming years, fueled by the increasing prevalence of e-commerce and the widespread adoption of omnichannel approaches. Furthermore, the escalating consumer demand for personalized interactions and an increasing preference for sustainably produced goods will be pivotal in shaping the future growth patterns of the market.

Singapore Retail Market Segmentation

-

1. Product

- 1.1. Food and Beverage

- 1.2. Personal and Household Care

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Electronic and Household Appliances

- 1.6. Other Products

-

2. Distribution Channel

- 2.1. Hypermarkets, Supermarkets, and Convenience Stores

- 2.2. Specialty Stores

- 2.3. Department Stores

- 2.4. E-commerce

- 2.5. Other Distribution Channels

Singapore Retail Market Segmentation By Geography

- 1. Singapore

Singapore Retail Market Regional Market Share

Geographic Coverage of Singapore Retail Market

Singapore Retail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Upgrading Technology is Helping the Market to Record More Revenues

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Retail Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Food and Beverage

- 5.1.2. Personal and Household Care

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Electronic and Household Appliances

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets, Supermarkets, and Convenience Stores

- 5.2.2. Specialty Stores

- 5.2.3. Department Stores

- 5.2.4. E-commerce

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Japan Foods Holding Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sheng Siong Group Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Watsons

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 RedMart Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ABR Holdings Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NTUC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 QAF Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 U Stars

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dairy Farm International Holdings (DFI)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Font Creative Pte Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Japan Foods Holding Ltd

List of Figures

- Figure 1: Singapore Retail Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Singapore Retail Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Retail Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Singapore Retail Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Singapore Retail Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Singapore Retail Market Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Singapore Retail Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Singapore Retail Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Retail Market?

The projected CAGR is approximately 3.7%.

2. Which companies are prominent players in the Singapore Retail Market?

Key companies in the market include Japan Foods Holding Ltd, Sheng Siong Group Ltd, Watsons, RedMart Ltd, ABR Holdings Ltd, NTUC, QAF Limited, U Stars, Dairy Farm International Holdings (DFI), Font Creative Pte Ltd.

3. What are the main segments of the Singapore Retail Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 144.42 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Upgrading Technology is Helping the Market to Record More Revenues.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In April 2021, Singapore homegrown retailer Naiise has shut down after struggling to survive through the pandemic, with its owner Dennis Tay filing for personal bankruptcy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Retail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Retail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Retail Market?

To stay informed about further developments, trends, and reports in the Singapore Retail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence