Key Insights

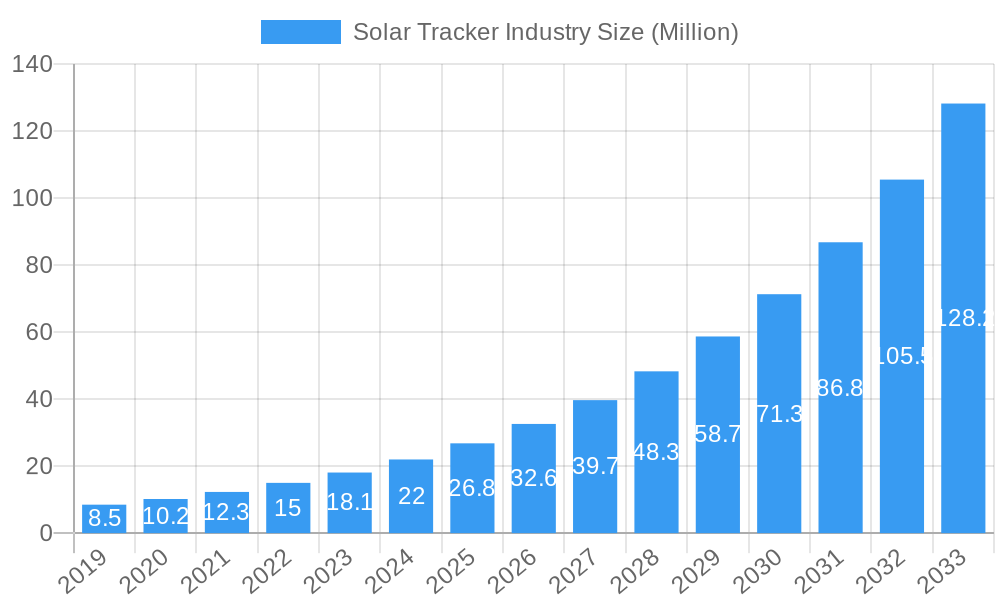

The global solar tracker market is poised for remarkable expansion, projected to reach a substantial USD 36.62 billion by 2025, driven by an impressive Compound Annual Growth Rate (CAGR) of 22.38%. This robust growth trajectory is underpinned by a confluence of factors, most notably the escalating global demand for renewable energy solutions, driven by ambitious climate change mitigation targets and government incentives promoting solar power adoption. Technological advancements in solar tracker systems, leading to increased energy yields and improved reliability, further fuel this market dynamism. The increasing cost-competitiveness of solar energy compared to traditional fossil fuels also acts as a significant catalyst, making solar tracker installations a more attractive investment for utilities, commercial entities, and residential users alike. Furthermore, the continuous expansion of solar power infrastructure, particularly in utility-scale projects, necessitates the widespread deployment of advanced tracking solutions to maximize energy generation efficiency.

Solar Tracker Industry Market Size (In Million)

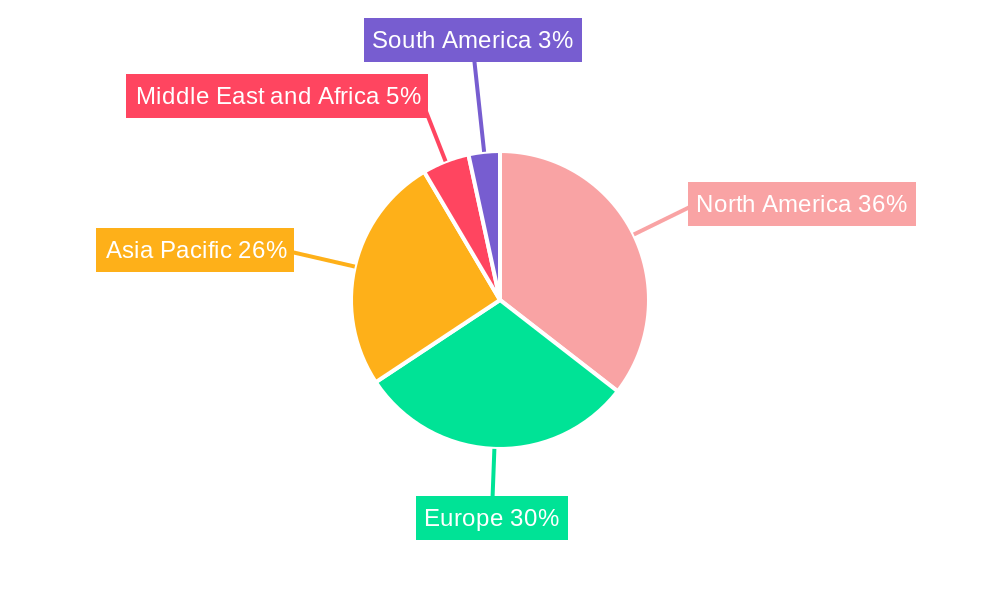

The market is segmented into Single Axis and Dual Axis trackers, with a pronounced trend towards the adoption of sophisticated Dual Axis trackers, especially in regions with optimal solar irradiance and large-scale solar farms. Key players like Nextracker Inc., Array Technologies Inc., and Arctech Solar Holdings Co. Ltd. are at the forefront of innovation, introducing smart tracking algorithms and robust mechanical designs that enhance performance and durability. Geographically, North America and Europe are currently leading the market, owing to mature renewable energy policies and substantial installed solar capacity. However, the Asia Pacific region, particularly China and India, is expected to witness the fastest growth due to rapid industrialization, increasing energy consumption, and supportive government policies for solar energy development. While the market presents immense opportunities, potential restraints include the high initial capital investment for advanced tracking systems and the need for skilled labor for installation and maintenance. Nonetheless, the overwhelming imperative for sustainable energy sources and the continuous drive for cost reduction in solar energy generation solidify the optimistic outlook for the solar tracker industry.

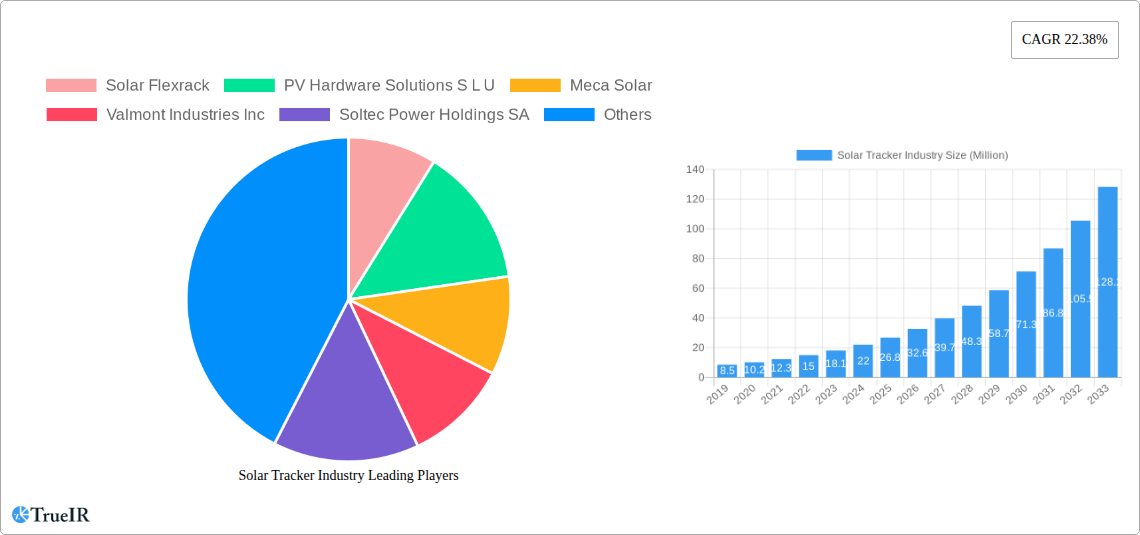

Solar Tracker Industry Company Market Share

Comprehensive Solar Tracker Industry Market Report: Growth, Trends, and Competitive Landscape (2019-2033)

This in-depth report provides a detailed analysis of the global solar tracker industry, a critical component in maximizing solar energy generation. Spanning the historical period of 2019-2024 and projecting through 2033, with a base and estimated year of 2025, this study offers unparalleled insights into market dynamics, technological advancements, and future growth trajectories. The report leverages high-volume keywords such as solar tracker market size, solar tracker technology, renewable energy trackers, and photovoltaic tracker solutions to ensure maximum SEO visibility and engagement for industry professionals.

Solar Tracker Industry Market Structure & Competitive Landscape

The solar tracker market exhibits a moderately concentrated structure, characterized by a mix of established global players and emerging regional manufacturers. Innovation in tracker design, driven by the need for increased energy yield and reduced installation costs, remains a primary catalyst for competitive advantage. Regulatory frameworks, particularly those supporting renewable energy adoption and net metering policies, significantly influence market penetration and growth. Product substitutes, primarily fixed-tilt solar mounting systems, are continuously challenged by the superior efficiency gains offered by solar trackers, especially in utility-scale and large commercial installations. End-user segmentation reveals a dominant share held by utility-scale solar projects, followed by commercial and industrial (C&I) sectors, and a growing residential segment. Mergers and acquisitions (M&A) are a recurring trend, as larger companies seek to consolidate market share, acquire innovative technologies, and expand their geographical reach. The solar PV tracker market is witnessing strategic alliances and acquisitions aimed at enhancing manufacturing capabilities and R&D investments. For instance, the global tracker market concentration is estimated to be around 60% among the top five players. M&A activities in recent years have totaled over $1000 Million, indicating significant consolidation and strategic investment.

Solar Tracker Industry Market Trends & Opportunities

The global solar tracker market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of over 15% during the forecast period. This upward trajectory is fueled by the escalating demand for renewable energy solutions, driven by ambitious government targets for carbon emission reduction and increasing energy independence. Technological advancements are at the forefront of market evolution, with a continuous focus on developing more efficient, reliable, and cost-effective tracker systems. Innovations such as intelligent tracking algorithms, advanced weather forecasting integration, and robust structural designs that withstand extreme environmental conditions are becoming standard. Consumer preferences are increasingly leaning towards solutions that offer higher energy output and lower Levelized Cost of Energy (LCOE). The solar tracker market size is projected to reach over $15,000 Million by 2033. The market penetration rate for solar trackers in utility-scale projects is already exceeding 70% and is expected to climb further. Competitive dynamics are intensifying, with companies investing heavily in R&D to differentiate their offerings through features like higher stow angles for wind mitigation, enhanced durability, and integrated monitoring and control systems. Opportunities abound in emerging markets with rapidly growing solar installations and in segments requiring high energy yields, such as concentrated solar power (CSP) and agrivoltaics. The shift towards bifacial solar modules also presents a significant opportunity for tracker manufacturers to develop specialized solutions that optimize energy capture from both sides of the panel.

Dominant Markets & Segments in Solar Tracker Industry

Single-axis trackers represent the dominant segment within the solar tracker industry, accounting for over 70% of the global market share. This dominance is attributed to their optimal balance of cost-effectiveness and energy yield enhancement, making them ideal for the vast majority of utility-scale solar farms and large commercial installations. The inherent simplicity of their design also translates to lower manufacturing and maintenance costs. Key growth drivers for single-axis trackers include supportive government policies that incentivize large-scale solar development, the availability of vast tracts of land for solar farm construction, and the consistent decrease in the cost of solar panels, making tracker systems a more attractive investment.

- Infrastructure Development: Massive investments in grid infrastructure and energy transmission networks are facilitating the deployment of large solar projects, directly benefiting the single-axis tracker segment.

- Policy Support: Government subsidies, tax credits, and renewable portfolio standards (RPS) are creating a favorable environment for utility-scale solar development, where single-axis trackers are the preferred technology.

- Cost-Effectiveness: The ability of single-axis trackers to increase energy production by 15-25% over fixed-tilt systems at a relatively moderate increase in upfront cost makes them highly appealing for economic viability.

Dual-axis trackers, while representing a smaller market share (approximately 30%), offer the highest energy yield gains, often exceeding 30-40% compared to fixed-tilt systems. They are particularly well-suited for niche applications where maximizing energy capture is paramount and space constraints or specific geographical conditions favor their use, such as in arid regions with high direct solar irradiance or for smaller, high-performance solar installations. The demand for dual-axis trackers is driven by specialized projects and applications where the premium on energy output justifies the higher initial investment and complexity.

Solar Tracker Industry Product Analysis

Product innovation in the solar tracker industry is characterized by a relentless pursuit of increased energy yield, enhanced durability, and simplified installation. Key advancements include the development of more robust and wind-resistant tracker designs, the integration of sophisticated control systems that optimize tracking algorithms based on real-time weather data, and the introduction of portrait-oriented modules that are compatible with new solar panel technologies. Competitive advantages are being built on features like superior stowing capabilities for extreme weather, lower foundation requirements, and streamlined assembly processes that reduce labor costs. The market is witnessing a trend towards integrated solutions that combine tracking hardware with intelligent software for performance monitoring and predictive maintenance, offering a comprehensive value proposition to end-users.

Key Drivers, Barriers & Challenges in Solar Tracker Industry

Key Drivers: The solar tracker industry is propelled by several powerful forces. Foremost is the global push for decarbonization and the increasing adoption of renewable energy, driven by environmental concerns and government mandates for cleaner energy sources. Technological advancements in solar panel efficiency and tracker reliability further boost demand. Falling manufacturing costs of solar trackers, coupled with government incentives and favorable financing options for solar projects, are making tracker systems more accessible and economically viable. The growing demand for higher energy yields and reduced LCOE in utility-scale and C&I projects also serves as a significant driver.

Barriers & Challenges: Despite strong growth, the solar tracker market faces certain challenges. Supply chain disruptions, exacerbated by global events, can impact the availability and cost of raw materials and components, potentially delaying project timelines. Regulatory complexities and permitting processes in different regions can also pose hurdles. Intense competition among numerous players can lead to price pressures, impacting profit margins. Furthermore, the higher upfront capital expenditure for tracker systems compared to fixed-tilt installations can be a barrier for some smaller projects or in markets with limited access to financing. The maintenance and operational costs associated with more complex tracking systems also require careful consideration.

Growth Drivers in the Solar Tracker Industry Market

The solar tracker industry market is experiencing robust growth driven by several key factors. The urgent need for climate change mitigation is accelerating the global transition to renewable energy, with solar power at the forefront. Supportive government policies, including tax credits, subsidies, and mandates for renewable energy generation, are creating a highly conducive environment for solar tracker deployment. Technological advancements in tracker design, such as improved wind resistance and higher tracking accuracy, are increasing energy yields and enhancing the economic viability of solar projects. Furthermore, the declining costs of solar panels and balance-of-system components are making the overall investment in solar tracker systems more attractive, particularly for utility-scale projects seeking to maximize their return on investment.

Challenges Impacting Solar Tracker Industry Growth

Several challenges are impacting the growth trajectory of the solar tracker industry. Supply chain volatility, including the availability and pricing of critical materials like steel and electronic components, can lead to project delays and increased costs. Navigating diverse and sometimes complex regulatory landscapes across different countries and regions can create administrative burdens and slow down project approvals. The competitive nature of the market often leads to price pressures, potentially affecting profitability margins for manufacturers. Additionally, while tracker systems offer superior energy generation, their higher initial capital cost compared to fixed-tilt systems can be a deterrent for some developers, especially in markets with constrained financing options.

Key Players Shaping the Solar Tracker Industry Market

- Solar Flexrack

- PV Hardware Solutions S L U

- Meca Solar

- Valmont Industries Inc

- Soltec Power Holdings SA

- Nextracker Inc

- DCE Solar

- Ideematec Deutschland GmbH

- Arctech Solar Holdings Co Ltd

- Array Technologies Inc

Significant Solar Tracker Industry Industry Milestones

- Feb 2023: PV Hardware (PVH), a leading solar PV tracker manufacturer from Spain's Gransolar Group, announced plans to build the world's largest solar tracker factory in Valencia, Spain, aiming to expand its annual global manufacturing and supply capability to 25 GW. This move signifies a major capacity expansion to meet growing global demand.

- Oct 2022: Gonvarri Solar Steel announced an agreement to supply approximately 1.2 GW of solar trackers and racks solutions for multiple solar projects in the Iberian Peninsula. Iberdrola SA's order included 289 MW of Gonvarri Solar Steel's TracSmarT+ 1V single and double row trackers and 938 MW of its RackSmarT fixed structures, highlighting significant utility-scale project wins.

- Sept 2022: FTC Solar Inc. launched its new and differentiated portrait (1P) Solar Tracker Solution named Pioneer. This product innovation caters to evolving solar module configurations and aims to provide enhanced performance and flexibility for project developers.

Future Outlook for Solar Tracker Industry Market

The future outlook for the solar tracker industry is exceptionally bright, driven by sustained global momentum towards renewable energy adoption. Strategic opportunities lie in expanding into emerging markets with rapidly growing solar infrastructure, developing advanced tracker solutions for bifacial modules and agrivoltaic applications, and enhancing the integration of smart technologies for predictive maintenance and grid optimization. The continuous drive for cost reduction and efficiency improvements will further solidify the dominance of solar trackers in utility-scale and large commercial projects. Investments in R&D for next-generation tracker systems, capable of withstanding more extreme weather conditions and offering greater modularity, will be crucial for sustained market leadership. The market potential is further amplified by supportive policies and the increasing awareness of the economic and environmental benefits of solar energy.

Solar Tracker Industry Segmentation

-

1. Axis Type

- 1.1. Single Axis

- 1.2. Dual Axis

Solar Tracker Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Mexico

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Italy

- 2.5. Spain

- 2.6. NORDIC

- 2.7. Turkey

- 2.8. Russia

- 2.9. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Malaysia

- 3.6. Thailand

- 3.7. Indonesia

- 3.8. Vietnam

- 3.9. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. Saudi Arabia

- 4.2. United Arab Emirates

- 4.3. South Africa

- 4.4. Qatar

- 4.5. Nigeria

- 4.6. Egypt

- 4.7. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Colombia

- 5.3. Chile

- 5.4. Rest of South America

Solar Tracker Industry Regional Market Share

Geographic Coverage of Solar Tracker Industry

Solar Tracker Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Demand for Clean Energy Sources4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Other Alternative Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Single Axis Solar Trackers to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Solar Tracker Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Axis Type

- 5.1.1. Single Axis

- 5.1.2. Dual Axis

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Axis Type

- 6. North America Solar Tracker Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Axis Type

- 6.1.1. Single Axis

- 6.1.2. Dual Axis

- 6.1. Market Analysis, Insights and Forecast - by Axis Type

- 7. Europe Solar Tracker Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Axis Type

- 7.1.1. Single Axis

- 7.1.2. Dual Axis

- 7.1. Market Analysis, Insights and Forecast - by Axis Type

- 8. Asia Pacific Solar Tracker Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Axis Type

- 8.1.1. Single Axis

- 8.1.2. Dual Axis

- 8.1. Market Analysis, Insights and Forecast - by Axis Type

- 9. Middle East and Africa Solar Tracker Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Axis Type

- 9.1.1. Single Axis

- 9.1.2. Dual Axis

- 9.1. Market Analysis, Insights and Forecast - by Axis Type

- 10. South America Solar Tracker Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Axis Type

- 10.1.1. Single Axis

- 10.1.2. Dual Axis

- 10.1. Market Analysis, Insights and Forecast - by Axis Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Solar Flexrack

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PV Hardware Solutions S L U

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Meca Solar

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Valmont Industries Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Soltec Power Holdings SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nextracker Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DCE Solar

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ideematec Deutschland GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Arctech Solar Holdings Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Array Technologies Inc *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Solar Flexrack

List of Figures

- Figure 1: Global Solar Tracker Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Solar Tracker Industry Revenue (Million), by Axis Type 2025 & 2033

- Figure 3: North America Solar Tracker Industry Revenue Share (%), by Axis Type 2025 & 2033

- Figure 4: North America Solar Tracker Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Solar Tracker Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Solar Tracker Industry Revenue (Million), by Axis Type 2025 & 2033

- Figure 7: Europe Solar Tracker Industry Revenue Share (%), by Axis Type 2025 & 2033

- Figure 8: Europe Solar Tracker Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Solar Tracker Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Solar Tracker Industry Revenue (Million), by Axis Type 2025 & 2033

- Figure 11: Asia Pacific Solar Tracker Industry Revenue Share (%), by Axis Type 2025 & 2033

- Figure 12: Asia Pacific Solar Tracker Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Solar Tracker Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East and Africa Solar Tracker Industry Revenue (Million), by Axis Type 2025 & 2033

- Figure 15: Middle East and Africa Solar Tracker Industry Revenue Share (%), by Axis Type 2025 & 2033

- Figure 16: Middle East and Africa Solar Tracker Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East and Africa Solar Tracker Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America Solar Tracker Industry Revenue (Million), by Axis Type 2025 & 2033

- Figure 19: South America Solar Tracker Industry Revenue Share (%), by Axis Type 2025 & 2033

- Figure 20: South America Solar Tracker Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: South America Solar Tracker Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Solar Tracker Industry Revenue Million Forecast, by Axis Type 2020 & 2033

- Table 2: Global Solar Tracker Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Solar Tracker Industry Revenue Million Forecast, by Axis Type 2020 & 2033

- Table 4: Global Solar Tracker Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Mexico Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Solar Tracker Industry Revenue Million Forecast, by Axis Type 2020 & 2033

- Table 9: Global Solar Tracker Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Germany Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Italy Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Spain Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: NORDIC Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Turkey Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Solar Tracker Industry Revenue Million Forecast, by Axis Type 2020 & 2033

- Table 20: Global Solar Tracker Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: China Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Malaysia Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Thailand Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Indonesia Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Vietnam Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Solar Tracker Industry Revenue Million Forecast, by Axis Type 2020 & 2033

- Table 31: Global Solar Tracker Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Saudi Arabia Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: United Arab Emirates Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: South Africa Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Qatar Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Nigeria Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Egypt Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Solar Tracker Industry Revenue Million Forecast, by Axis Type 2020 & 2033

- Table 40: Global Solar Tracker Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Brazil Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Colombia Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Chile Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Rest of South America Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Solar Tracker Industry?

The projected CAGR is approximately 22.38%.

2. Which companies are prominent players in the Solar Tracker Industry?

Key companies in the market include Solar Flexrack, PV Hardware Solutions S L U, Meca Solar, Valmont Industries Inc, Soltec Power Holdings SA, Nextracker Inc, DCE Solar, Ideematec Deutschland GmbH, Arctech Solar Holdings Co Ltd, Array Technologies Inc *List Not Exhaustive.

3. What are the main segments of the Solar Tracker Industry?

The market segments include Axis Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 36.62 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Demand for Clean Energy Sources4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Single Axis Solar Trackers to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Other Alternative Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

Feb 2023: PV Hardware (PVH), a leading solar PV tracker manufacturer from Spain's Gransolar Group, plans to build the world's largest solar tracker factory in Spain's Valencia. It will expand its annual global manufacturing and supply capability to 25 GW.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Solar Tracker Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Solar Tracker Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Solar Tracker Industry?

To stay informed about further developments, trends, and reports in the Solar Tracker Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence