Key Insights

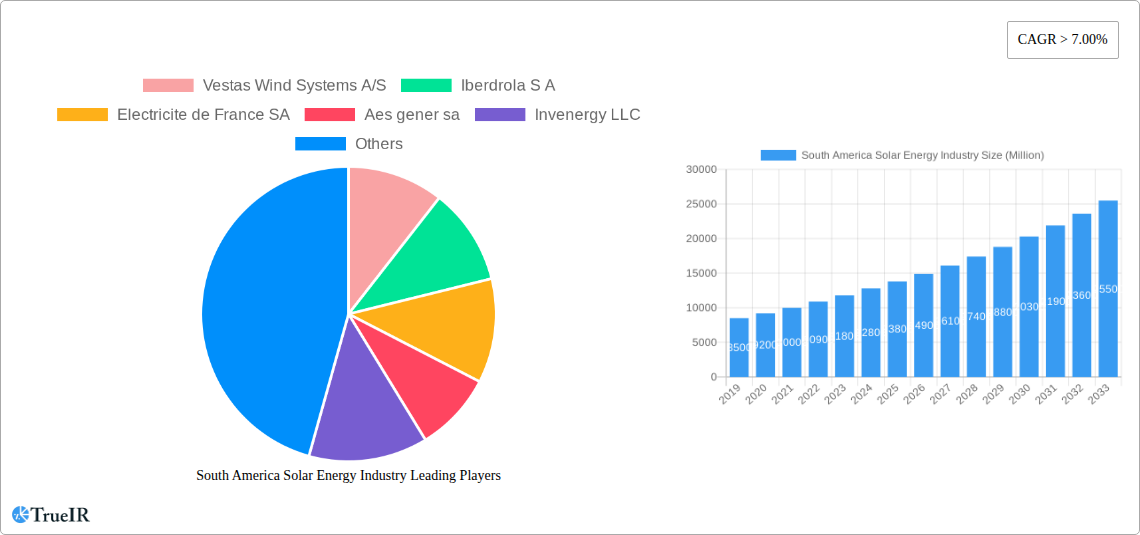

The South American solar energy market is poised for substantial growth, driven by a confluence of factors including increasing demand for renewable energy, supportive government policies, and declining technology costs. With a projected market size in the billions and a Compound Annual Growth Rate (CAGR) exceeding 7.00%, the region is rapidly transforming its energy landscape. Key drivers include the urgent need to diversify energy portfolios away from fossil fuels, enhance energy security, and meet ambitious climate change mitigation targets. The abundance of solar irradiation across much of South America, particularly in countries like Brazil and Chile, presents a significant competitive advantage. Investments in solar farms, rooftop installations, and hybrid renewable energy projects are escalating, fueled by both domestic and international stakeholders. This expansion is not only addressing energy demands but also creating job opportunities and fostering technological innovation within the sector.

South America Solar Energy Industry Market Size (In Billion)

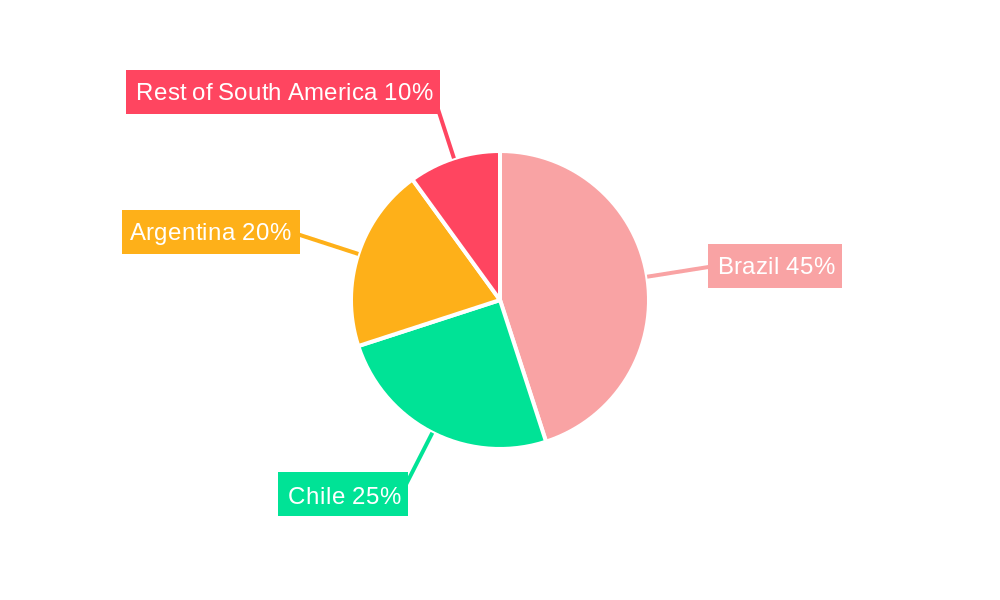

The market's trajectory is further shaped by emerging trends such as the integration of energy storage solutions to address intermittency, the development of smart grid technologies for efficient energy distribution, and the increasing adoption of distributed solar generation. While significant opportunities exist, the market also faces certain restraints. These include challenges in grid infrastructure modernization, the need for consistent and transparent regulatory frameworks, and the availability of financing for large-scale projects. Nevertheless, the overarching momentum towards a cleaner energy future, coupled with the inherent economic and environmental benefits of solar power, indicates a robust and expanding market. Segmented by type, Hydro, Solar, Bioenergy, and Wind are all contributing to the renewable energy mix, with solar increasingly taking center stage. Geographically, Brazil, Chile, and Argentina are leading the charge, with the "Rest of South America" also showing promising growth.

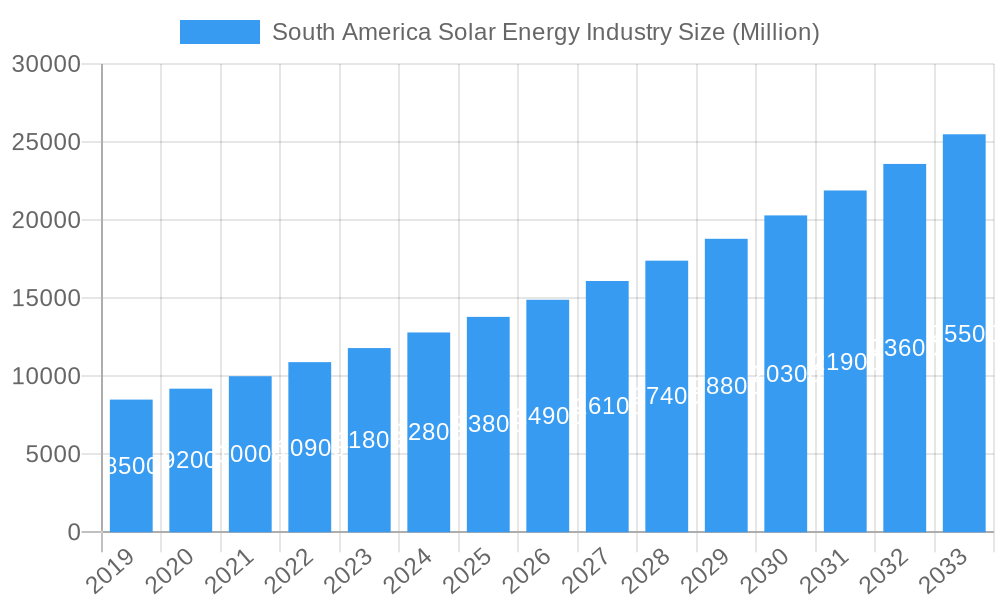

South America Solar Energy Industry Company Market Share

South America Solar Energy Industry: A Comprehensive Market Analysis 2024-2033

This in-depth report provides a dynamic and SEO-optimized analysis of the South America Solar Energy Industry, leveraging high-volume keywords to enhance search rankings and engage industry audiences. The study covers the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033. Historical data from 2019–2024 is also incorporated, offering a complete market perspective.

South America Solar Energy Industry Market Structure & Competitive Landscape

The South America solar energy market is characterized by a moderately concentrated structure, with key players investing heavily in utility-scale projects and technological advancements. Innovation is driven by the increasing demand for renewable energy, declining solar panel costs, and government incentives aimed at reducing carbon emissions. Regulatory impacts are significant, with evolving policies on grid interconnection, power purchase agreements, and import duties shaping market entry and expansion. Product substitutes, primarily other renewable energy sources like wind and hydro, are present but solar's versatility and decreasing costs are widening its adoption. End-user segmentation is diverse, encompassing utility-scale power generation, commercial and industrial installations, and distributed residential solar. Mergers and acquisitions (M&A) are a notable trend, facilitating market consolidation and strategic expansion. For instance, the past year has seen several strategic partnerships aimed at developing large-scale solar farms, with an estimated USD 500 Million in M&A activity. Concentration ratios are expected to shift as new entrants and existing players continue to invest in expanding their solar portfolios across the region.

South America Solar Energy Industry Market Trends & Opportunities

The South America solar energy industry is experiencing robust growth, fueled by a confluence of economic, environmental, and technological factors. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of 18% between 2025 and 2033, reaching an estimated value of USD 30 Billion. Technological shifts are central to this expansion, with advancements in photovoltaic (PV) module efficiency, battery storage solutions, and smart grid integration significantly improving the viability and reliability of solar power. Consumer preferences are increasingly tilting towards sustainable energy solutions, driven by growing environmental awareness and the desire for energy independence and cost savings. Competitive dynamics are evolving, with both established energy giants and agile renewable energy developers vying for market share. The declining Levelized Cost of Energy (LCOE) for solar PV is making it a more competitive option against traditional fossil fuels, further accelerating market penetration rates. Strategic opportunities lie in tapping into underserved regions, developing integrated energy solutions that combine solar with storage, and leveraging government support for renewable energy adoption. The shift towards decentralized energy generation and the increasing electrification of transportation will also create significant demand for solar power. Furthermore, innovative financing models and public-private partnerships are expected to unlock substantial investment potential. The potential for solar to meet a significant portion of South America's growing energy demand, coupled with supportive policy frameworks, positions the industry for sustained and impressive growth in the coming decade.

Dominant Markets & Segments in South America Solar Energy Industry

Brazil stands as the undisputed dominant market within the South America solar energy industry, driven by its vast landmass, abundant solar irradiation, and a strong commitment to renewable energy targets. Its expansive geography and significant population translate to immense demand for electricity, making solar a crucial component of its energy mix. Government policies, including auctions for renewable energy and tax incentives, have consistently supported the growth of utility-scale solar farms. The Solar segment, specifically utility-scale solar PV, is the leading segment due to its cost-effectiveness and scalability.

- Brazil: Accounts for an estimated 65% of the total South American solar energy market. Key growth drivers include:

- Ambitious renewable energy targets outlined in national energy plans.

- Significant investments in grid infrastructure to accommodate renewable energy sources.

- Favorable solar irradiation levels across the country, particularly in the Northeast.

- A growing number of large-scale solar projects, contributing substantially to the national grid.

- Supportive regulatory frameworks that encourage private investment.

Chile emerges as a significant player, particularly in its early adoption and leadership in utility-scale solar development. The country benefits from exceptionally high solar irradiation in its northern regions, making it an ideal location for solar power generation. Favorable policies and a proactive approach to attracting foreign investment have cemented its position.

- Chile: Represents approximately 15% of the South American solar market. Key growth drivers include:

- World-class solar irradiance in the Atacama Desert.

- Clear and stable regulatory frameworks that encourage foreign investment.

- Strong political will to diversify the energy matrix away from fossil fuels.

- A high penetration of solar PV in its electricity generation mix.

Argentina is a rapidly growing market, with increasing government support and a focus on expanding renewable energy capacity. While facing some economic challenges, its potential for solar development remains substantial, particularly in its northern regions.

- Argentina: Contributes around 10% to the market share. Key growth drivers include:

- Renewable energy mandates and incentives aimed at increasing clean energy generation.

- Attractive solar resources in key provinces.

- A growing interest from international investors in its renewable energy potential.

The Rest of South America segment, encompassing countries like Colombia, Peru, and Uruguay, is showing promising growth as they increasingly prioritize renewable energy integration. These nations are witnessing significant investment in solar projects, driven by their own unique policy initiatives and resource potential. The Solar segment, in particular, is expected to dominate across these diverse geographies.

South America Solar Energy Industry Product Analysis

The South America solar energy industry is characterized by the widespread adoption and continuous innovation of solar photovoltaic (PV) technology. This includes advancements in crystalline silicon panels, such as PERC (Passivated Emitter and Rear Cell) and bifacial modules, which enhance energy conversion efficiency. The integration of battery energy storage systems (BESS) is a key development, addressing the intermittency of solar power and improving grid stability. Applications range from massive utility-scale solar farms feeding into national grids to distributed rooftop solar for residential and commercial use. Competitive advantages stem from decreasing manufacturing costs, increasing energy yields, and growing environmental consciousness, making solar a compelling and increasingly cost-competitive energy solution across the continent.

Key Drivers, Barriers & Challenges in South America Solar Energy Industry

The South America solar energy industry is propelled by strong growth drivers, primarily the increasing global and regional demand for clean energy, supportive government policies and incentives promoting renewable energy adoption, and the significant decline in solar technology costs making it economically viable. Technological advancements in solar PV efficiency and energy storage further bolster growth.

Key challenges and restraints impacting growth include regulatory complexities and evolving policy landscapes in some nations, which can create investment uncertainty. Supply chain issues, including the availability and cost of raw materials and imported components, pose a significant risk, potentially impacting project timelines and budgets. Competitive pressures from established fossil fuel industries and the need for substantial upfront capital investment for large-scale projects also act as restraints. The intermittency of solar power, despite advancements in storage, remains a concern for grid stability in some regions.

Growth Drivers in the South America Solar Energy Industry Market

The South America Solar Energy Industry Market is experiencing robust growth driven by several key factors. Supportive government policies and incentives such as renewable energy targets, tax breaks, and favorable power purchase agreements are critical. The declining cost of solar photovoltaic (PV) technology, including panels and associated components, makes solar increasingly competitive against traditional energy sources. Increasing global and regional awareness of climate change and the need for decarbonization is also a significant driver, pushing nations to diversify their energy portfolios. Furthermore, technological advancements in solar efficiency, energy storage solutions, and grid integration are enhancing the reliability and economic viability of solar power.

Challenges Impacting South America Solar Energy Industry Growth

Several challenges are impacting the growth of the South America Solar Energy Industry. Regulatory complexities and evolving policy frameworks in certain countries can create investment uncertainty and delays. Supply chain disruptions and the volatility of raw material prices, particularly for components like polysilicon, can affect project costs and timelines. The need for substantial upfront capital investment for large-scale solar projects, coupled with access to financing, remains a barrier. Furthermore, the intermittency of solar power generation and the associated need for robust grid infrastructure and energy storage solutions continue to present technical and operational challenges. Land acquisition and permitting processes can also be lengthy and complex in some regions.

Key Players Shaping the South America Solar Energy Industry Market

- Vestas Wind Systems A/S

- Iberdrola S A

- Electricite de France SA

- Aes Gener SA

- Invenergy LLC

- Enel Green Power S p A

- ABO Wind AG

- Atlas Renewable Energy

- Mainstream Renewable Power Ltd

Significant South America Solar Energy Industry Industry Milestones

- September 2022: The government of Peru announced that five solar power plants totaling 600 MW of capacity will come into operation in 2023. These utility-scale projects include the 100 MW Continua Chachani, the 300 MW Continua Misti, the 60 MW Continua Pichu Plants in the Arequipa region, the 123 MW Clemessolar park in the Moquegua region, and the 20 MW Milagros Solar park in the Loreto region. This development signals significant investment and expansion in Peru's solar sector.

- April 2022: 16 Chilean energy projects involving a combined investment of USD 923 million were either submitted for environmental evaluation or accepted for processing. The 420 MW solar PV park Sol de Caone (Sphere Energy unit ItahueEnergy), the 236 MWp PV park Don Daro (Ebco Energa), and the 79 MWp solar farm Inca de VarasI (GPG) are among these projects. This highlights Chile's continued commitment to developing large-scale solar infrastructure and its attractive investment climate.

Future Outlook for South America Solar Energy Industry Market

The future outlook for the South America Solar Energy Industry Market is exceptionally bright, characterized by sustained growth and increasing diversification. Strategic opportunities lie in the expansion of distributed solar generation, the integration of advanced energy storage solutions to enhance grid stability, and the development of smart grid technologies. As governments continue to prioritize decarbonization goals and invest in renewable energy infrastructure, the market is poised for significant expansion. The ongoing decline in solar technology costs, coupled with increasing energy demand across the region, will further fuel investment and adoption. Emerging markets within South America are expected to see accelerated development, contributing to a more resilient and sustainable energy future for the continent.

South America Solar Energy Industry Segmentation

-

1. Type

- 1.1. Hydro

- 1.2. Solar

- 1.3. Bioenergy

- 1.4. Wind

- 1.5. Other Types

-

2. Geography

- 2.1. Brazil

- 2.2. Chile

- 2.3. Argentina

- 2.4. Rest of South America

South America Solar Energy Industry Segmentation By Geography

- 1. Brazil

- 2. Chile

- 3. Argentina

- 4. Rest of South America

South America Solar Energy Industry Regional Market Share

Geographic Coverage of South America Solar Energy Industry

South America Solar Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Integration of Renewable Energy4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. High infrastructure costs

- 3.4. Market Trends

- 3.4.1. Solar Energy is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Solar Energy Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hydro

- 5.1.2. Solar

- 5.1.3. Bioenergy

- 5.1.4. Wind

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Chile

- 5.2.3. Argentina

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Chile

- 5.3.3. Argentina

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Solar Energy Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hydro

- 6.1.2. Solar

- 6.1.3. Bioenergy

- 6.1.4. Wind

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Chile

- 6.2.3. Argentina

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Chile South America Solar Energy Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hydro

- 7.1.2. Solar

- 7.1.3. Bioenergy

- 7.1.4. Wind

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Chile

- 7.2.3. Argentina

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Argentina South America Solar Energy Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hydro

- 8.1.2. Solar

- 8.1.3. Bioenergy

- 8.1.4. Wind

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Chile

- 8.2.3. Argentina

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of South America South America Solar Energy Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hydro

- 9.1.2. Solar

- 9.1.3. Bioenergy

- 9.1.4. Wind

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Chile

- 9.2.3. Argentina

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Vestas Wind Systems A/S

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Iberdrola S A

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Electricite de France SA

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Aes gener sa

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Invenergy LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Enel Green Power S p A

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 ABO Wind AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Atlas Renewable Energy

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Mainstream Renewable Power Ltd*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Vestas Wind Systems A/S

List of Figures

- Figure 1: South America Solar Energy Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Solar Energy Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Solar Energy Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: South America Solar Energy Industry Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 3: South America Solar Energy Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: South America Solar Energy Industry Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 5: South America Solar Energy Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: South America Solar Energy Industry Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 7: South America Solar Energy Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: South America Solar Energy Industry Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 9: South America Solar Energy Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: South America Solar Energy Industry Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 11: South America Solar Energy Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: South America Solar Energy Industry Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 13: South America Solar Energy Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: South America Solar Energy Industry Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 15: South America Solar Energy Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: South America Solar Energy Industry Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 17: South America Solar Energy Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: South America Solar Energy Industry Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 19: South America Solar Energy Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 20: South America Solar Energy Industry Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 21: South America Solar Energy Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: South America Solar Energy Industry Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 23: South America Solar Energy Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: South America Solar Energy Industry Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 25: South America Solar Energy Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: South America Solar Energy Industry Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 27: South America Solar Energy Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: South America Solar Energy Industry Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 29: South America Solar Energy Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: South America Solar Energy Industry Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Solar Energy Industry?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the South America Solar Energy Industry?

Key companies in the market include Vestas Wind Systems A/S, Iberdrola S A, Electricite de France SA, Aes gener sa, Invenergy LLC, Enel Green Power S p A, ABO Wind AG, Atlas Renewable Energy, Mainstream Renewable Power Ltd*List Not Exhaustive.

3. What are the main segments of the South America Solar Energy Industry?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Integration of Renewable Energy4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Solar Energy is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High infrastructure costs.

8. Can you provide examples of recent developments in the market?

September 2022: The government of Peru announced that five solar power plants totaling 600 MW of capacity will come into operation in 2023. These utility-scale projects include the 100 MW Continua Chachani, the 300 MW Continua Misti, the 60 MW Continua Pichu Plants in the Arequipa region, the 123 MW Clemessolar park in the Moquegua region, and the 20 MW Milagros Solar park in the Loreto region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Solar Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Solar Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Solar Energy Industry?

To stay informed about further developments, trends, and reports in the South America Solar Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence