Key Insights

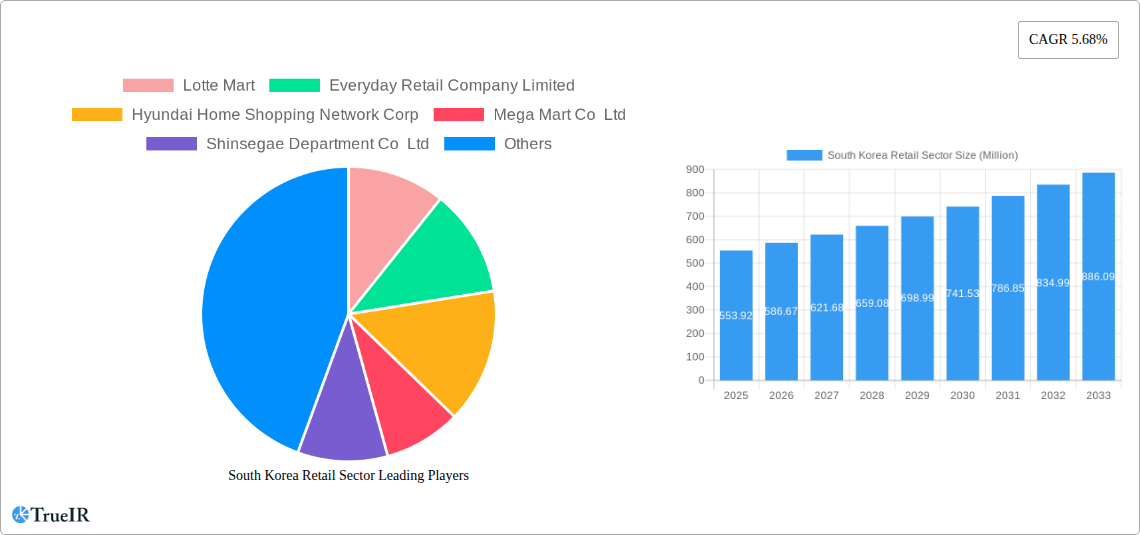

The South Korean retail sector, valued at $553.92 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.68% from 2025 to 2033. This expansion is driven by several key factors. Rising disposable incomes, coupled with a burgeoning young population increasingly embracing online shopping and omnichannel experiences, fuel significant demand. Furthermore, the increasing adoption of innovative technologies, such as mobile payment systems and advanced e-commerce platforms, is streamlining transactions and enhancing consumer convenience, thus bolstering market growth. The sector's diverse landscape, encompassing hypermarkets (like Lotte Mart and E-Mart), convenience stores (7-Eleven), department stores (Shinsegae Department), and specialty retailers (such as Costco Wholesale Korea), caters to a wide range of consumer preferences. Competition remains fierce, with established players continually adapting their strategies to attract and retain customers. While specific restraints are not provided, potential challenges could include inflationary pressures affecting consumer spending and evolving geopolitical factors. Nevertheless, the South Korean retail market presents lucrative opportunities for both domestic and international players.

South Korea Retail Sector Market Size (In Million)

The forecast period (2025-2033) anticipates a steady upward trajectory. Growth will likely be propelled by strategic investments in logistics and supply chain management, enabling efficient delivery services. The increasing popularity of experiential retail, where shopping becomes an engaging event rather than a mere transaction, is also anticipated to stimulate growth. Key players are likely to focus on personalization, loyalty programs, and data-driven marketing strategies to better understand and cater to individual consumer needs. This dynamic environment requires agility and adaptability for businesses to thrive in the competitive South Korean retail landscape.

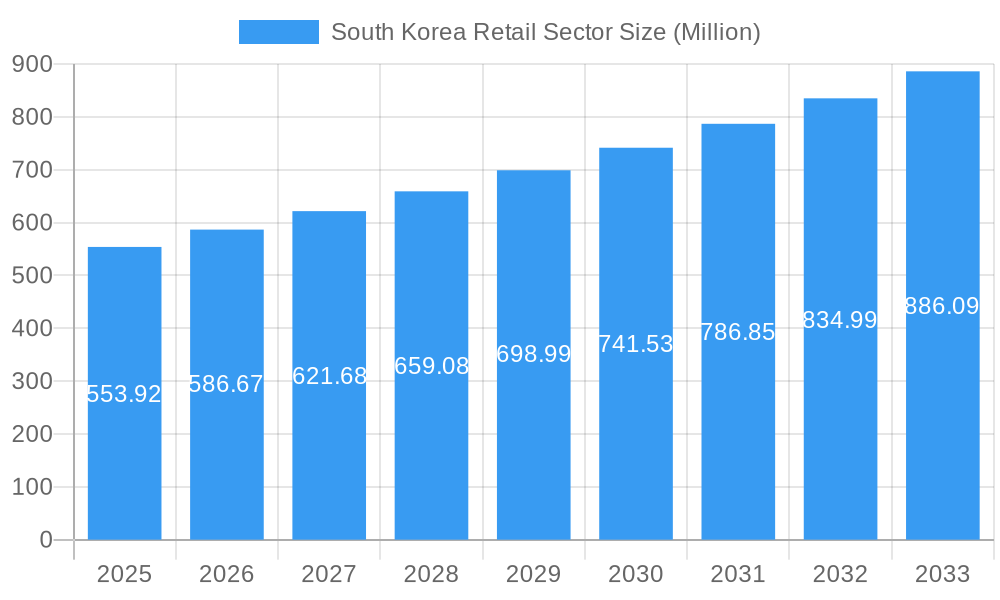

South Korea Retail Sector Company Market Share

South Korea Retail Sector: A Comprehensive Market Analysis (2019-2033)

This dynamic report provides an in-depth analysis of the South Korea retail sector, offering invaluable insights for investors, businesses, and industry professionals. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report leverages extensive data analysis and expert insights to illuminate market trends, opportunities, and challenges. The South Korean retail market, valued at xx Million in 2024, is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

South Korea Retail Sector Market Structure & Competitive Landscape

This section delves into the competitive landscape of the South Korean retail sector, examining market concentration, innovation drivers, regulatory influences, and M&A activities. The market is characterized by a mix of large conglomerates and smaller, specialized retailers. The concentration ratio for the top 5 players is estimated at xx%, indicating a moderately concentrated market.

- Market Concentration: The top five players – Shinsegae Department Co Ltd, Lotte Mart, E-Mart Inc, Homeplus Co Ltd, and Hyundai Home Shopping Network Corp – control a significant share of the market, although the presence of numerous smaller players ensures a dynamic competitive environment.

- Innovation Drivers: E-commerce growth, omnichannel strategies, and the increasing adoption of technology in retail operations are major innovation drivers.

- Regulatory Impacts: Government regulations concerning consumer protection, data privacy, and fair competition significantly impact market dynamics.

- Product Substitutes: The rise of online marketplaces and direct-to-consumer brands presents significant competitive pressure for traditional brick-and-mortar retailers.

- End-User Segmentation: The market is segmented by consumer demographics (age, income, location), shopping preferences (online vs. offline), and product categories.

- M&A Trends: The past five years have witnessed xx Million in M&A activity within the sector, driven by consolidation efforts and expansion strategies. A majority of these deals involve smaller retailers being acquired by larger companies.

South Korea Retail Sector Market Trends & Opportunities

This section analyzes key market trends and emerging opportunities in the South Korean retail sector. The market demonstrates robust growth, fueled by rising disposable incomes, evolving consumer preferences, and rapid technological advancements. The increasing adoption of e-commerce and omnichannel strategies is transforming the retail landscape, creating new opportunities for businesses that can adapt quickly.

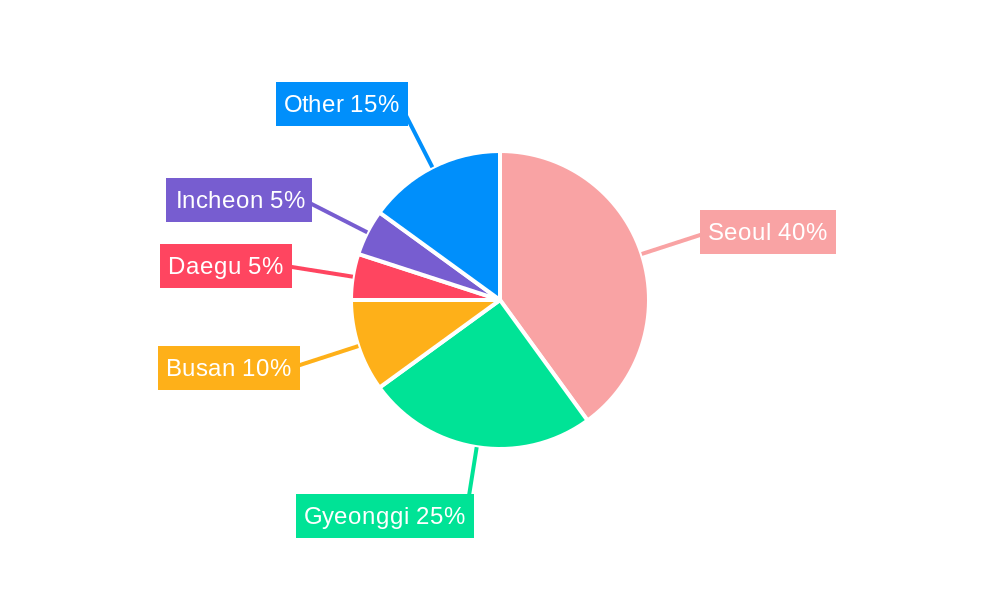

Dominant Markets & Segments in South Korea Retail Sector

Seoul and other major metropolitan areas dominate the retail market due to higher population density, greater purchasing power, and established retail infrastructure. The grocery segment, followed by apparel and electronics, constitutes the largest segments in terms of market value.

- Key Growth Drivers:

- Robust infrastructure: Well-developed transportation and logistics networks facilitate efficient supply chains.

- Government support: Government initiatives to promote e-commerce and digital transformation contribute to sector growth.

- Rising disposable incomes: Increasing affluence of the South Korean population fuels higher retail spending.

- Favorable demographics: A relatively young population with high tech adoption rate presents a significant opportunity.

South Korea Retail Sector Product Analysis

Product innovation is a key factor driving competition. The trend is towards personalized shopping experiences, increased product variety, and the integration of technology to enhance customer convenience. For instance, the adoption of mobile payment systems and the use of big data for targeted marketing are transforming the retail experience. The success of any new product hinges on its ability to satisfy the evolving demands of a sophisticated and tech-savvy consumer base.

Key Drivers, Barriers & Challenges in South Korea Retail Sector

Key Drivers: Rising disposable incomes, technological advancements (e.g., mobile payments, e-commerce), and supportive government policies are driving market growth. The increase in foreign tourism also presents a significant opportunity for retailers.

Challenges: Intense competition, increasing labor costs, and evolving consumer expectations are key challenges. Supply chain disruptions, as seen during the recent global pandemic, also pose a significant risk to retailers. Furthermore, regulatory changes and high real estate costs in major cities add further complexity.

Growth Drivers in the South Korea Retail Sector Market

Rapid technological adoption, evolving consumer preferences towards convenience and online shopping, and government initiatives to boost the digital economy are key growth drivers. The increasing affluence of the population and a robust infrastructure also contribute significantly to the market's expansion.

Challenges Impacting South Korea Retail Growth

High operating costs, including real estate and labor, intense competition from both domestic and international players, and fluctuating consumer confidence pose significant challenges to retailers in South Korea. The need to adapt to rapidly changing consumer preferences and technological innovations adds further pressure.

Key Players Shaping the South Korea Retail Sector Market

- Lotte Mart

- Everyday Retail Company Limited

- Hyundai Home Shopping Network Corp

- Mega Mart Co Ltd

- Shinsegae Department Co Ltd

- 7-Eleven

- E-Mart Inc

- Costco Wholesale Korea Ltd

- Homeplus Co Ltd

- Grand Department Store Co Ltd*

- Five Guys**List Not Exhaustive

Significant South Korea Retail Sector Industry Milestones

- September 2023: Lotte Mart announced the creation of a unique shopping zone targeting non-Korean tourists in its key locations. This initiative directly addresses the growing tourism sector and unlocks additional revenue streams.

- June 2023: The opening of the first Five Guys restaurant in Seoul marks the entry of a major international player into the South Korean burger market, increasing competition and potentially influencing consumer preferences.

Future Outlook for South Korea Retail Sector Market

The South Korea retail sector is poised for continued growth, driven by technological advancements, evolving consumer behaviors, and government support for digital transformation. Strategic investments in omnichannel capabilities, personalized shopping experiences, and sustainable practices will be crucial for businesses to thrive in this dynamic market. The sector’s robust growth trajectory is expected to continue, particularly in the e-commerce and omnichannel segments.

South Korea Retail Sector Segmentation

-

1. Product Type

- 1.1. Food, Beverage, and Tobacco Products

- 1.2. Personal Care and Household

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Industrial and Automotive

- 1.6. Electronic and Household Appliances

- 1.7. Pharmaceuticals and Luxury Goods

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

South Korea Retail Sector Segmentation By Geography

- 1. South Korea

South Korea Retail Sector Regional Market Share

Geographic Coverage of South Korea Retail Sector

South Korea Retail Sector REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products

- 3.3. Market Restrains

- 3.3.1. Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products

- 3.4. Market Trends

- 3.4.1. Growing E-Commerce is Driving the Retail Market in South Korea

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Retail Sector Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Food, Beverage, and Tobacco Products

- 5.1.2. Personal Care and Household

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Industrial and Automotive

- 5.1.6. Electronic and Household Appliances

- 5.1.7. Pharmaceuticals and Luxury Goods

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lotte Mart

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Everyday Retail Company Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hyundai Home Shopping Network Corp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mega Mart Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shinsegae Department Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 7-Eleven

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 E-Mart Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Costco Wholesale Korea Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Homeplus Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Grand Department Store Co Ltd*

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Five Guys**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Lotte Mart

List of Figures

- Figure 1: South Korea Retail Sector Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Korea Retail Sector Share (%) by Company 2025

List of Tables

- Table 1: South Korea Retail Sector Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: South Korea Retail Sector Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: South Korea Retail Sector Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: South Korea Retail Sector Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: South Korea Retail Sector Revenue Million Forecast, by Region 2020 & 2033

- Table 6: South Korea Retail Sector Volume Billion Forecast, by Region 2020 & 2033

- Table 7: South Korea Retail Sector Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: South Korea Retail Sector Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: South Korea Retail Sector Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: South Korea Retail Sector Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: South Korea Retail Sector Revenue Million Forecast, by Country 2020 & 2033

- Table 12: South Korea Retail Sector Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Retail Sector?

The projected CAGR is approximately 5.68%.

2. Which companies are prominent players in the South Korea Retail Sector?

Key companies in the market include Lotte Mart, Everyday Retail Company Limited, Hyundai Home Shopping Network Corp, Mega Mart Co Ltd, Shinsegae Department Co Ltd, 7-Eleven, E-Mart Inc, Costco Wholesale Korea Ltd, Homeplus Co Ltd, Grand Department Store Co Ltd*, Five Guys**List Not Exhaustive.

3. What are the main segments of the South Korea Retail Sector?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 553.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products.

6. What are the notable trends driving market growth?

Growing E-Commerce is Driving the Retail Market in South Korea.

7. Are there any restraints impacting market growth?

Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products.

8. Can you provide examples of recent developments in the market?

September 2023: Lotte Mart, a South Korean supermarket retail store chain, announced that it will create a unique shopping zone for non-Korean tourists at its stores that travelers and tourists frequently visit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Retail Sector," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Retail Sector report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Retail Sector?

To stay informed about further developments, trends, and reports in the South Korea Retail Sector, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence