Key Insights

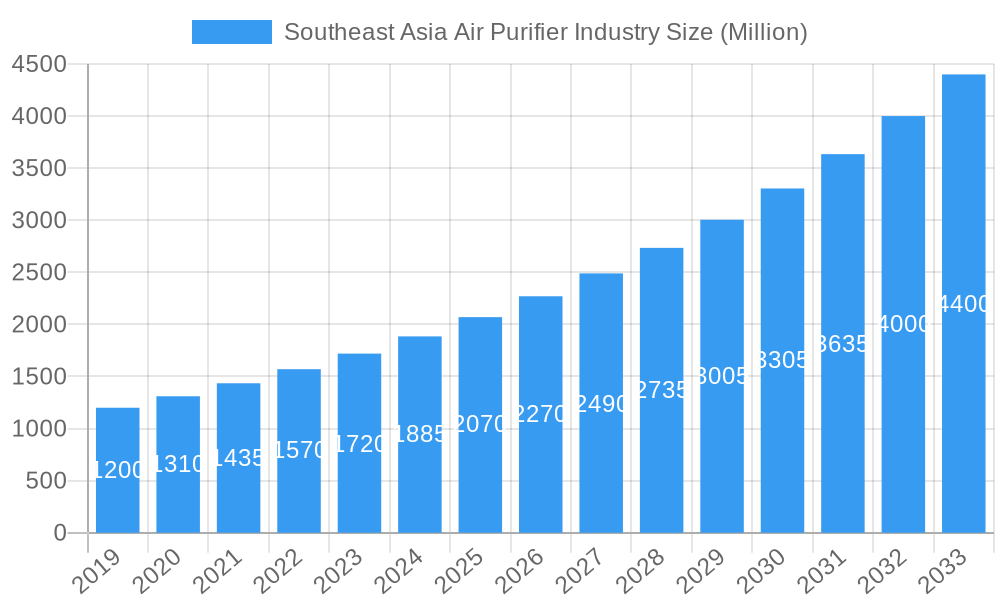

The Southeast Asian air purifier market is projected for substantial growth, expected to reach USD 7.65 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.2% from 2025 to 2033. This expansion is driven by increasing air quality concerns, rising disposable incomes, and heightened health consciousness. Growing middle classes in Indonesia, Vietnam, and the Philippines are seeking solutions for indoor air pollution from industrial emissions, vehicle exhaust, and household activities. The prevalence of respiratory illnesses and allergies further fuels demand for effective air purification. The adoption of High-efficiency Particulate Air (HEPA) filters, known for their superior pollutant capture, is a key factor. Stand-alone units currently dominate due to their ease of installation and portability, serving both residential and commercial needs.

Southeast Asia Air Purifier Industry Market Size (In Billion)

Evolving consumer preferences and technological innovation are shaping the market. Beyond HEPA, activated carbon for odor control and UV-C light for sterilization are gaining prominence. While the residential sector is the primary market, commercial spaces like offices, hospitals, and educational institutions are increasing investments for healthier environments. Industrial applications, though smaller, are growing due to regulatory compliance and the need for cleaner production. Leading companies such as Dyson, Daikin, LG, and Samsung are introducing smart, energy-efficient, and aesthetically designed products. Challenges include the high initial cost of premium purifiers and varying levels of consumer awareness regarding long-term benefits. However, the strong emphasis on health and well-being, alongside ongoing urbanization and industrialization, ensures sustained and dynamic growth for the Southeast Asian air purifier market.

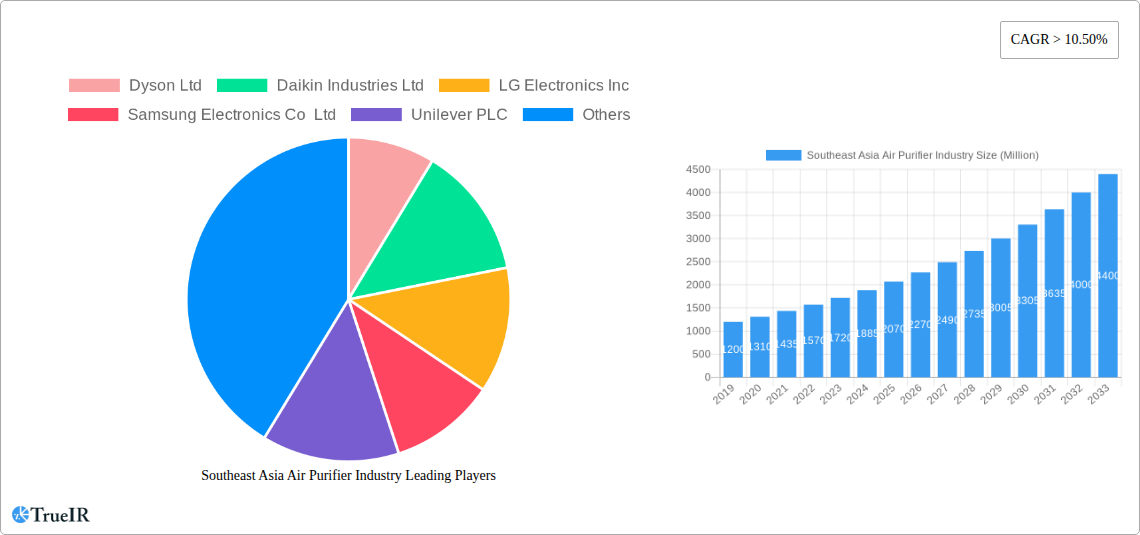

Southeast Asia Air Purifier Industry Company Market Share

This SEO-optimized description provides a clear overview of the Southeast Asia Air Purifier Industry market size, growth, and forecast.

Southeast Asia Air Purifier Industry Market Structure & Competitive Landscape

The Southeast Asian air purifier market is characterized by a moderate to high level of competition, with leading global players vying for market share against established regional brands. Market concentration is influenced by continuous innovation in filtration technologies and smart functionalities. Regulatory frameworks, while evolving, are increasingly focusing on indoor air quality standards, impacting product development and market entry strategies. The threat of product substitutes, such as ventilation systems, is present but often countered by the targeted benefits of air purifiers in removing specific pollutants. End-user segmentation is a key strategic focus, with significant growth observed across residential, commercial, and industrial sectors due to rising awareness of health implications. Mergers and acquisitions (M&A) are less prevalent in this nascent but rapidly expanding market, with most growth driven organically through product innovation and market penetration. Key players are investing heavily in R&D to differentiate their offerings and capture a larger consumer base.

Southeast Asia Air Purifier Industry Market Trends & Opportunities

The Southeast Asian air purifier market is poised for substantial expansion, projected to reach a market size of xx Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025-2033. This growth trajectory is fueled by a confluence of factors, including escalating air pollution levels across major urban centers, a growing consumer consciousness regarding respiratory health, and increasing disposable incomes that enable adoption of premium home appliances. The market has witnessed significant technological shifts, with a pronounced demand for purifiers incorporating advanced filtration systems like High-efficiency Particulate Air (HEPA) filters, coupled with smart features such as app connectivity, real-time air quality monitoring, and automated operation. Consumer preferences are increasingly leaning towards energy-efficient, aesthetically pleasing, and multi-functional devices that can address a broader spectrum of indoor pollutants, including allergens, VOCs, and airborne pathogens. The competitive dynamics are intensifying, with both established international brands and agile local players striving to capture market share through product innovation, strategic pricing, and effective marketing campaigns targeting health-conscious demographics. The residential segment continues to dominate, driven by increased urbanization and a growing number of nuclear families. However, the commercial and industrial sectors are emerging as significant growth avenues, propelled by stricter workplace air quality regulations and a desire for healthier indoor environments in offices, schools, hospitals, and manufacturing facilities. The burgeoning middle class across countries like Indonesia, Vietnam, and the Philippines represents a vast untapped market with significant growth potential for affordable yet effective air purification solutions. The ongoing development of smart city initiatives and increased government focus on public health are expected to further accelerate market penetration and drive demand for sophisticated air purification technologies.

Dominant Markets & Segments in Southeast Asia Air Purifier Industry

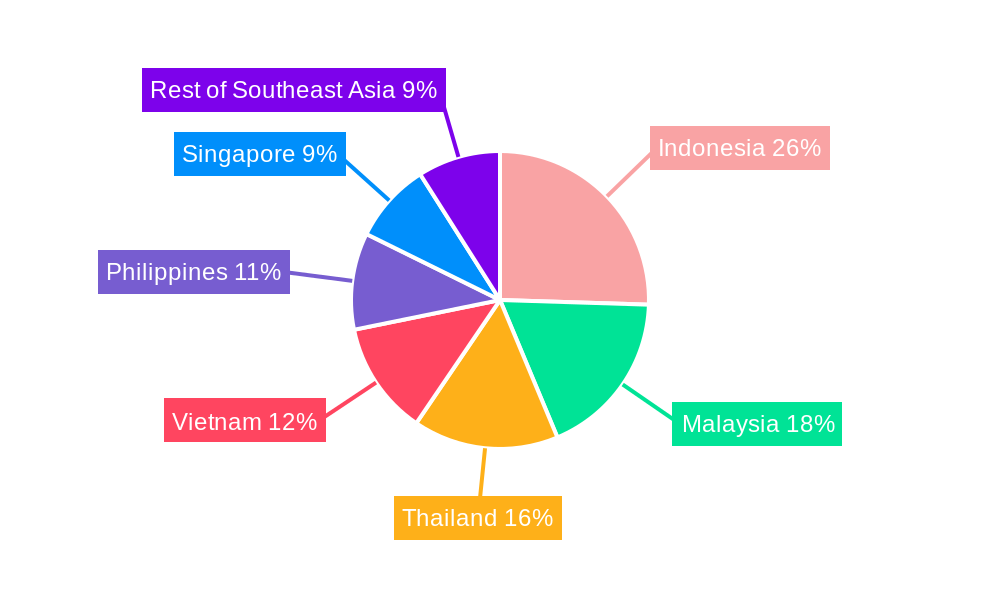

The Southeast Asia air purifier industry exhibits distinct patterns of dominance across various segments, with the Residential End-User segment currently holding the largest market share. This is primarily driven by increasing urbanization, rising disposable incomes, and a heightened awareness among households regarding the health risks associated with poor indoor air quality. Countries like Indonesia and Thailand are leading the charge in terms of market volume and value, owing to their large populations and significant industrialization, which often contribute to elevated pollution levels.

Geography:

- Indonesia: The largest market, driven by its vast population, rapid industrial growth, and increasing prevalence of respiratory illnesses. Government initiatives promoting healthier living spaces also contribute.

- Thailand: A significant market with strong demand in both urban and semi-urban areas, fueled by growing health consciousness and a well-developed appliance retail infrastructure.

- Malaysia: Exhibits steady growth, with a focus on premium and technologically advanced purifiers, supported by a higher per capita income.

- Vietnam: A rapidly expanding market with immense potential, driven by fast-paced urbanization and increasing environmental concerns.

- Philippines: Experiencing robust growth, particularly in urban centers, due to rising awareness of air pollution's health impacts.

- Singapore: A mature market with a high penetration rate, characterized by demand for sophisticated, smart, and energy-efficient air purifiers.

Filtration Technology:

- High-efficiency Particulate Air (HEPA): This segment is the undisputed leader, accounting for the largest market share. Its effectiveness in capturing fine particulate matter (PM2.5), allergens, and other microscopic airborne contaminants makes it the preferred choice for health-conscious consumers.

- Other Filtration Technologies: While HEPA dominates, other technologies like activated carbon filters (for odor removal), UV-C sterilization, and ionizers are gaining traction as supplementary features in multi-stage filtration systems.

Type:

- Stand-alone: This type of air purifier, designed for individual room use, commands the largest market share due to its portability, ease of installation, and versatility for different living and working spaces.

- In-duct: While a smaller segment, in-duct purifiers are gaining attention in new construction and renovation projects, offering a more integrated and discreet air purification solution for entire homes or buildings.

End-User:

- Residential: The dominant end-user segment, driven by individual health concerns and the desire for clean indoor environments in homes.

- Commercial: A rapidly growing segment, encompassing offices, hotels, retail spaces, and educational institutions, where maintaining good indoor air quality is crucial for employee productivity, customer satisfaction, and regulatory compliance.

- Industrial: A niche but important segment, focused on specialized air purification solutions for manufacturing plants, laboratories, and healthcare facilities to control specific airborne contaminants and ensure worker safety.

Southeast Asia Air Purifier Industry Product Analysis

Product innovation in the Southeast Asian air purifier market is primarily focused on enhancing filtration efficiency, integrating smart functionalities, and improving user experience. Companies are increasingly developing multi-stage filtration systems that combine HEPA filters with activated carbon, UV-C light, and ionization to tackle a wider array of pollutants, including fine dust, VOCs, allergens, and viruses. The integration of IoT capabilities, enabling remote control via smartphone apps, real-time air quality monitoring, and automated performance adjustments based on sensor data, is a key competitive advantage. Products are also designed with energy efficiency, low noise levels, and aesthetic appeal to meet the demands of modern consumers. Emerging trends include the introduction of 2-in-1 devices like purifier fans, offering dual functionality, and specialized purifiers for larger spaces or specific applications like allergies or pet dander.

Key Drivers, Barriers & Challenges in Southeast Asia Air Purifier Industry

Key Drivers: The Southeast Asian air purifier market is propelled by several critical factors. Rising environmental pollution levels, particularly in urban areas, are creating a significant demand for cleaner indoor air. Escalating health consciousness among consumers, driven by increased awareness of respiratory illnesses and allergies, is a primary driver. Government initiatives and growing urbanization, leading to denser living and working spaces, further contribute to the need for air purification solutions. Technological advancements in filtration and smart features are making products more effective and appealing.

Barriers & Challenges: Despite the growth potential, the industry faces several challenges. High initial costs of premium air purifiers can be a barrier for price-sensitive consumers in some emerging economies. Supply chain disruptions and fluctuations in raw material prices can impact production and cost-effectiveness. Intense competition from established global brands and emerging local players can lead to price wars and pressure on profit margins. Stringent and evolving regulatory landscapes across different countries require continuous adaptation and compliance efforts. Consumer education regarding the specific benefits and proper usage of air purifiers remains an ongoing challenge.

Growth Drivers in the Southeast Asia Air Purifier Industry Market

Key growth drivers in the Southeast Asia air purifier market are multifaceted. Technological advancements are paramount, with the widespread adoption of HEPA and advanced filtration systems, alongside the integration of smart home technologies, significantly boosting product appeal and efficacy. Economic factors, such as rising disposable incomes and a burgeoning middle class across countries like Indonesia and Vietnam, are expanding the consumer base capable of affording these devices. Regulatory support and health awareness campaigns are also crucial, with governments increasingly prioritizing public health and indoor air quality, while public awareness of pollution's impact on health continues to grow, creating a receptive market. The trend towards increased urbanization further concentrates populations in areas susceptible to pollution, amplifying the need for indoor air solutions.

Challenges Impacting Southeast Asia Air Purifier Industry Growth

Several challenges can impede the growth of the Southeast Asia air purifier industry. Price sensitivity remains a significant barrier in many developing economies, where the upfront cost of purifiers can be prohibitive for a large segment of the population. Supply chain complexities and geopolitical uncertainties can lead to volatility in component availability and pricing, impacting manufacturing and distribution. Intense competitive pressure from numerous global and local brands can lead to margin erosion and necessitate continuous innovation and aggressive marketing strategies. Furthermore, inconsistent regulatory frameworks across different Southeast Asian nations require companies to navigate a complex web of compliance standards, adding to operational overheads. Educating consumers about the long-term benefits versus initial cost is an ongoing challenge.

Key Players Shaping the Southeast Asia Air Purifier Industry Market

- Dyson Ltd

- Daikin Industries Ltd

- LG Electronics Inc

- Samsung Electronics Co Ltd

- Unilever PLC

- Koninklijke Philips N V

- Xiaomi Corp

- Sharp Corporation

- Amway (Malaysia) Holdings Berhad

- WINIX Inc

- Panasonic Corporation

- IQAir

Significant Southeast Asia Air Purifier Industry Industry Milestones

- December 2022: Philips Malaysia launched the Air Performer 2-in-1 purifier fan, a dual-function device for air circulation and simultaneous filtration.

- December 2022: PT LG Electronics Indonesia (LG) unveiled a new series of indoor air treatment products at the LG Air Solution Convention 2022, slated for Indonesian market entry in January 2023.

Future Outlook for Southeast Asia Air Purifier Industry Market

The future outlook for the Southeast Asia air purifier industry is exceptionally promising, driven by sustained growth catalysts. Increased adoption of smart home technology, coupled with a growing emphasis on health and wellness, will continue to fuel demand. Emerging economies in the region present significant untapped potential, and strategic market penetration by key players focusing on both premium and affordable solutions is expected. Government policies aimed at improving air quality and public health will further bolster the market. Opportunities lie in developing localized products, enhancing energy efficiency, and expanding distribution networks to reach a broader consumer base, solidifying the air purifier as an essential household appliance.

Southeast Asia Air Purifier Industry Segmentation

-

1. Filtration Technology

- 1.1. High-efficiency Particulate Air (HEPA)

- 1.2. Other Fi

-

2. Type

- 2.1. Stand-alone

- 2.2. In-duct

-

3. End-User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

-

4. Geography

- 4.1. Indonesia

- 4.2. Malaysia

- 4.3. Thailand

- 4.4. Vietnam

- 4.5. Philippines

- 4.6. Singapore

- 4.7. Rest of Southeast Asia

Southeast Asia Air Purifier Industry Segmentation By Geography

- 1. Indonesia

- 2. Malaysia

- 3. Thailand

- 4. Vietnam

- 5. Philippines

- 6. Singapore

- 7. Rest of Southeast Asia

Southeast Asia Air Purifier Industry Regional Market Share

Geographic Coverage of Southeast Asia Air Purifier Industry

Southeast Asia Air Purifier Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Airborne Diseases and Growing Health Consciousness4.; Increasing awareness among consumers about the importance of indoor air quality

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. High-Efficiency Particulate Air (HEPA) Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Southeast Asia Air Purifier Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 5.1.1. High-efficiency Particulate Air (HEPA)

- 5.1.2. Other Fi

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Stand-alone

- 5.2.2. In-duct

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Indonesia

- 5.4.2. Malaysia

- 5.4.3. Thailand

- 5.4.4. Vietnam

- 5.4.5. Philippines

- 5.4.6. Singapore

- 5.4.7. Rest of Southeast Asia

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Indonesia

- 5.5.2. Malaysia

- 5.5.3. Thailand

- 5.5.4. Vietnam

- 5.5.5. Philippines

- 5.5.6. Singapore

- 5.5.7. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 6. Indonesia Southeast Asia Air Purifier Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 6.1.1. High-efficiency Particulate Air (HEPA)

- 6.1.2. Other Fi

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Stand-alone

- 6.2.2. In-duct

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Residential

- 6.3.2. Commercial

- 6.3.3. Industrial

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Indonesia

- 6.4.2. Malaysia

- 6.4.3. Thailand

- 6.4.4. Vietnam

- 6.4.5. Philippines

- 6.4.6. Singapore

- 6.4.7. Rest of Southeast Asia

- 6.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 7. Malaysia Southeast Asia Air Purifier Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 7.1.1. High-efficiency Particulate Air (HEPA)

- 7.1.2. Other Fi

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Stand-alone

- 7.2.2. In-duct

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Residential

- 7.3.2. Commercial

- 7.3.3. Industrial

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Indonesia

- 7.4.2. Malaysia

- 7.4.3. Thailand

- 7.4.4. Vietnam

- 7.4.5. Philippines

- 7.4.6. Singapore

- 7.4.7. Rest of Southeast Asia

- 7.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 8. Thailand Southeast Asia Air Purifier Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 8.1.1. High-efficiency Particulate Air (HEPA)

- 8.1.2. Other Fi

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Stand-alone

- 8.2.2. In-duct

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Residential

- 8.3.2. Commercial

- 8.3.3. Industrial

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Indonesia

- 8.4.2. Malaysia

- 8.4.3. Thailand

- 8.4.4. Vietnam

- 8.4.5. Philippines

- 8.4.6. Singapore

- 8.4.7. Rest of Southeast Asia

- 8.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 9. Vietnam Southeast Asia Air Purifier Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 9.1.1. High-efficiency Particulate Air (HEPA)

- 9.1.2. Other Fi

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Stand-alone

- 9.2.2. In-duct

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Residential

- 9.3.2. Commercial

- 9.3.3. Industrial

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Indonesia

- 9.4.2. Malaysia

- 9.4.3. Thailand

- 9.4.4. Vietnam

- 9.4.5. Philippines

- 9.4.6. Singapore

- 9.4.7. Rest of Southeast Asia

- 9.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 10. Philippines Southeast Asia Air Purifier Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 10.1.1. High-efficiency Particulate Air (HEPA)

- 10.1.2. Other Fi

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Stand-alone

- 10.2.2. In-duct

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Residential

- 10.3.2. Commercial

- 10.3.3. Industrial

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Indonesia

- 10.4.2. Malaysia

- 10.4.3. Thailand

- 10.4.4. Vietnam

- 10.4.5. Philippines

- 10.4.6. Singapore

- 10.4.7. Rest of Southeast Asia

- 10.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 11. Singapore Southeast Asia Air Purifier Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 11.1.1. High-efficiency Particulate Air (HEPA)

- 11.1.2. Other Fi

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. Stand-alone

- 11.2.2. In-duct

- 11.3. Market Analysis, Insights and Forecast - by End-User

- 11.3.1. Residential

- 11.3.2. Commercial

- 11.3.3. Industrial

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. Indonesia

- 11.4.2. Malaysia

- 11.4.3. Thailand

- 11.4.4. Vietnam

- 11.4.5. Philippines

- 11.4.6. Singapore

- 11.4.7. Rest of Southeast Asia

- 11.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 12. Rest of Southeast Asia Southeast Asia Air Purifier Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 12.1.1. High-efficiency Particulate Air (HEPA)

- 12.1.2. Other Fi

- 12.2. Market Analysis, Insights and Forecast - by Type

- 12.2.1. Stand-alone

- 12.2.2. In-duct

- 12.3. Market Analysis, Insights and Forecast - by End-User

- 12.3.1. Residential

- 12.3.2. Commercial

- 12.3.3. Industrial

- 12.4. Market Analysis, Insights and Forecast - by Geography

- 12.4.1. Indonesia

- 12.4.2. Malaysia

- 12.4.3. Thailand

- 12.4.4. Vietnam

- 12.4.5. Philippines

- 12.4.6. Singapore

- 12.4.7. Rest of Southeast Asia

- 12.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Dyson Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Daikin Industries Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 LG Electronics Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Samsung Electronics Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Unilever PLC

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Koninklijke Philips N V

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Xiaomi Corp

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Sharp Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Amway (Malaysia) Holdings Berhad*List Not Exhaustive

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 WINIX Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Panasonic Corporation

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 IQAir

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Dyson Ltd

List of Figures

- Figure 1: Southeast Asia Air Purifier Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Southeast Asia Air Purifier Industry Share (%) by Company 2025

List of Tables

- Table 1: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Filtration Technology 2020 & 2033

- Table 2: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 3: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 5: Southeast Asia Air Purifier Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 7: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 9: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Filtration Technology 2020 & 2033

- Table 12: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 13: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: Southeast Asia Air Purifier Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 16: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 17: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 19: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Filtration Technology 2020 & 2033

- Table 22: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 23: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 24: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 25: Southeast Asia Air Purifier Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 26: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 27: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Filtration Technology 2020 & 2033

- Table 32: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 33: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 34: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 35: Southeast Asia Air Purifier Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 36: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 37: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Filtration Technology 2020 & 2033

- Table 42: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 43: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 44: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 45: Southeast Asia Air Purifier Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 46: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 47: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 48: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 49: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Filtration Technology 2020 & 2033

- Table 52: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 53: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 54: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 55: Southeast Asia Air Purifier Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 56: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 57: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 58: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 59: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Filtration Technology 2020 & 2033

- Table 62: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 63: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 64: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 65: Southeast Asia Air Purifier Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 66: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 67: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 68: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 69: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 70: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Filtration Technology 2020 & 2033

- Table 72: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 73: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 74: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 75: Southeast Asia Air Purifier Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 76: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 77: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 78: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 79: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 80: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Air Purifier Industry?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Southeast Asia Air Purifier Industry?

Key companies in the market include Dyson Ltd, Daikin Industries Ltd, LG Electronics Inc, Samsung Electronics Co Ltd, Unilever PLC, Koninklijke Philips N V, Xiaomi Corp, Sharp Corporation, Amway (Malaysia) Holdings Berhad*List Not Exhaustive, WINIX Inc, Panasonic Corporation, IQAir.

3. What are the main segments of the Southeast Asia Air Purifier Industry?

The market segments include Filtration Technology, Type, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.65 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Airborne Diseases and Growing Health Consciousness4.; Increasing awareness among consumers about the importance of indoor air quality.

6. What are the notable trends driving market growth?

High-Efficiency Particulate Air (HEPA) Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Installation and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

December 2022: Philips Malaysia brought in and launched the Air Performer 2-in-1 purifier fan that does the job of circulating and filtering air simultaneously.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Air Purifier Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Air Purifier Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Air Purifier Industry?

To stay informed about further developments, trends, and reports in the Southeast Asia Air Purifier Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence