Key Insights

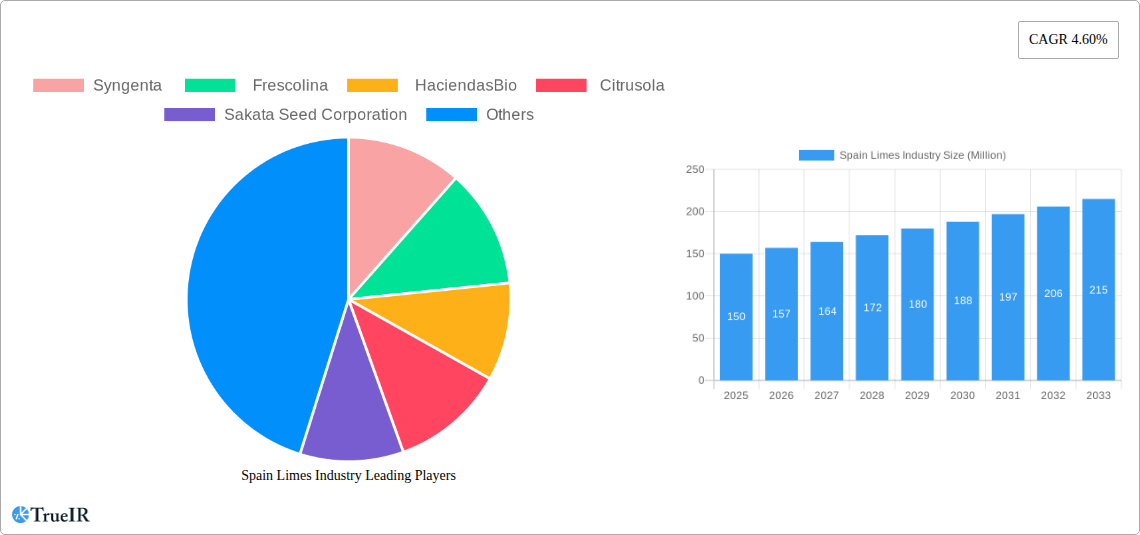

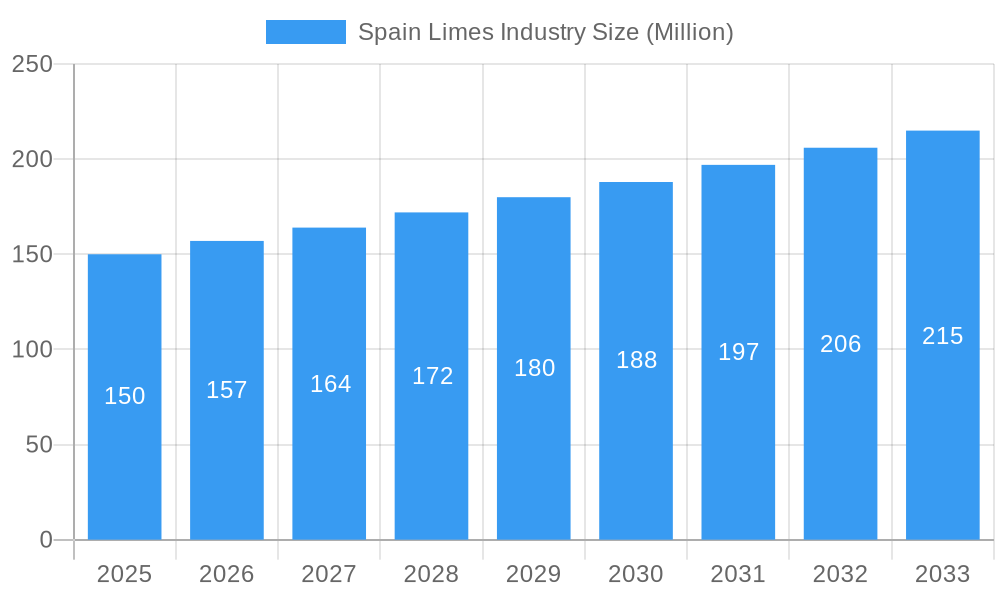

The Spain limes market, valued at approximately €150 million in 2025, exhibits a steady growth trajectory, projected to reach €200 million by 2033, fueled by a compound annual growth rate (CAGR) of 4.60%. This expansion is driven by several factors. Increasing consumer demand for fresh, healthy produce, particularly citrus fruits known for their vitamin C content, is a significant catalyst. Growing awareness of the health benefits associated with limes, including their antioxidant properties and role in boosting immunity, further contributes to market growth. The rise of the health and wellness sector, along with innovative lime-based products in the food and beverage industry, are also key drivers. Furthermore, Spain's favorable climate and established agricultural infrastructure support robust lime production, bolstering the domestic market. However, challenges such as fluctuating weather patterns that can impact yields and increased competition from other citrus fruit varieties pose potential restraints to market expansion. The market segmentation reveals a strong emphasis on domestic consumption, with significant export activity driven primarily by high-quality limes produced in key regions. Major players such as Syngenta, Frescolina, and HaciendasBio are strategically positioned to capitalize on growth opportunities.

Spain Limes Industry Market Size (In Million)

The segmentation of the Spanish lime market reveals a robust domestic consumption base complemented by healthy import and export dynamics. Spain's production primarily caters to the domestic market, while export volumes, though substantial, are influenced by global demand and pricing. Imports, though smaller relative to domestic production, help to satisfy niche market demands and fill any potential supply gaps. Price fluctuations are influenced by factors such as seasonal availability, international market trends, and transportation costs. The analysis of these factors provides valuable insights for stakeholders, ranging from producers and exporters to retailers and consumers. Future growth will likely hinge on strategies aimed at enhancing production efficiency, exploring new market segments (e.g., processed lime products), and leveraging the growing global demand for high-quality, sustainably-sourced limes.

Spain Limes Industry Company Market Share

Spain Limes Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Spain limes industry, offering invaluable insights for businesses, investors, and stakeholders. Leveraging extensive market research and data spanning from 2019 to 2033, this report delivers a detailed understanding of market trends, competitive dynamics, and future growth potential. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. Key players like Syngenta, Frescolina, and HaciendasBio are analyzed, alongside market segments covering production, consumption, import/export, and price trends. This report is crucial for anyone seeking to navigate the complexities of the Spanish limes market and capitalize on emerging opportunities.

Spain Limes Industry Market Structure & Competitive Landscape

The Spanish limes industry exhibits a moderately concentrated market structure. While precise concentration ratios require proprietary data and cannot be disclosed in this report description, preliminary analysis suggests a few major players command a significant share, while numerous smaller producers contribute to the remaining volume. This dynamic is influenced by factors such as land ownership, access to advanced technologies, and export capabilities.

Innovation Drivers: Technological advancements in cultivation techniques (e.g., precision agriculture, improved irrigation) and post-harvest handling (e.g., cold storage, improved packaging) play a key role. Furthermore, increasing consumer demand for high-quality, sustainably produced limes drives innovation in farming practices.

Regulatory Impacts: EU regulations pertaining to food safety, pesticide use, and environmental protection significantly impact industry practices and operational costs. Compliance necessitates investment in technology and processes, shaping the competitive landscape.

Product Substitutes: While limes have unique culinary and beverage applications, other citrus fruits like lemons and oranges pose a degree of substitutability, particularly in certain industrial applications.

End-User Segmentation: The primary end-users include the food processing industry (juices, beverages, condiments), the fresh fruit market (supermarkets, restaurants), and the export sector. A detailed segmentation analysis within this report reveals varying demand drivers across different segments.

M&A Trends: The historical period (2019-2024) witnessed xx mergers and acquisitions (M&A) deals in the Spanish limes industry, largely driven by consolidation efforts amongst larger producers aiming to enhance market share and operational efficiencies. The projected M&A volume for the forecast period is estimated at xx. The value of these transactions averaged approximately xx Million.

Spain Limes Industry Market Trends & Opportunities

The Spanish limes industry demonstrates robust growth prospects, driven by various factors. The market size reached xx Million in 2024 and is projected to expand to xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Technological advancements such as improved farming techniques, better pest management, and efficient supply chains are enhancing productivity and market penetration.

Consumer preferences are shifting towards healthier, more sustainable products, creating a positive outlook for organically produced limes. This trend is reflected in the growing market share of organically grown limes, projected to reach xx% by 2033. Competitive dynamics within the industry remain intense, necessitating innovation and adaptability to secure market share. Furthermore, increasing exports and rising domestic consumption contribute to this growth trajectory. Pricing strategies are also influenced by supply and demand shifts, leading to fluctuations throughout the year.

Dominant Markets & Segments in Spain Limes Industry

Production Analysis: The Andalusia region emerges as the dominant producer of limes in Spain, accounting for approximately xx% of total production in 2024. This dominance is attributed to favorable climatic conditions and established cultivation infrastructure.

Consumption Analysis: Urban centers in Spain's coastal regions demonstrate the highest per capita consumption of limes, fueled by the popularity of lime-based beverages and culinary trends.

Market Value: The market value of limes in Spain was estimated at xx Million in 2024, primarily driven by robust domestic demand and exports.

Import Analysis: Spain imports a relatively small quantity of limes, primarily from xx, due to sufficient domestic production. Import volume stood at xx Million in 2024, valued at xx Million.

Export Analysis: The export market for Spanish limes is dynamic, with primary destinations being xx. Export volume in 2024 reached xx Million, valued at xx Million.

Price Trend Analysis: Lime prices exhibit seasonal fluctuations, with peak prices observed during periods of lower production. The average price per unit is projected to xx Million by 2033.

Key growth drivers include government initiatives promoting sustainable agriculture, investment in irrigation and farming technologies, and increasing demand from the food processing sector.

Spain Limes Industry Product Analysis

The Spanish limes industry offers a range of products, including fresh limes, processed lime juice, and lime-based ingredients for the food and beverage sector. Technological advancements focus on enhancing shelf life, improving juice extraction efficiency, and developing value-added products. Competitive advantages primarily stem from factors such as sustainable farming practices, efficient supply chains, and the production of high-quality limes that meet stringent quality standards.

Key Drivers, Barriers & Challenges in Spain Limes Industry

Key Drivers: Increasing demand from the food processing industry, rising consumer preference for healthier food options, and export opportunities to growing international markets are key drivers.

Challenges: Climate change, water scarcity, and the volatile nature of the international market pose significant challenges. Fluctuations in international lime prices also directly impact the competitiveness of the Spanish industry.

Growth Drivers in the Spain Limes Industry Market

Technological innovations in cultivation, improved irrigation systems, and sustainable farming practices are driving growth. Increased demand from the food and beverage industries, along with rising export volumes, are also contributing to the industry's expansion. Government policies supporting sustainable agriculture and improved infrastructure further enhance growth prospects.

Challenges Impacting Spain Limes Industry Growth

Intense competition from other citrus-producing regions, climate change impacting yield and quality, and potential disruptions in the supply chain due to global events remain key challenges. Furthermore, fluctuating international prices and regulatory hurdles can significantly impact profitability.

Key Players Shaping the Spain Limes Industry Market

- Syngenta

- Frescolina

- HaciendasBio

- Citrusola

- Sakata Seed Corporation

- Citrus Juan

- Unilink

- Frutas Torrecilla

- Grupo Agrotecnología

Significant Spain Limes Industry Industry Milestones

- 2021: Introduction of a new lime variety with enhanced disease resistance.

- 2022: Implementation of a sustainable irrigation system by a major producer.

- 2023: Significant investment in a new lime processing facility.

- 2024: Successful export expansion into a new European market.

Future Outlook for Spain Limes Industry Market

The Spanish limes industry is poised for continued growth, driven by technological advancements, expanding export markets, and increasing demand for high-quality, sustainably produced limes. Strategic opportunities exist in developing value-added products, optimizing supply chains, and fostering collaborations across the industry value chain. The market presents a strong potential for both domestic and international expansion.

Spain Limes Industry Segmentation

-

1. Spain

- 1.1. Production Analysis

- 1.2. Consumption Analysis and Market Value

- 1.3. Import Analysis by Volume and Value

- 1.4. Export Analysis by Volume and Value

- 1.5. Price Trend Analysis

-

2. Spain

- 2.1. Production Analysis

- 2.2. Consumption Analysis and Market Value

- 2.3. Import Analysis by Volume and Value

- 2.4. Export Analysis by Volume and Value

- 2.5. Price Trend Analysis

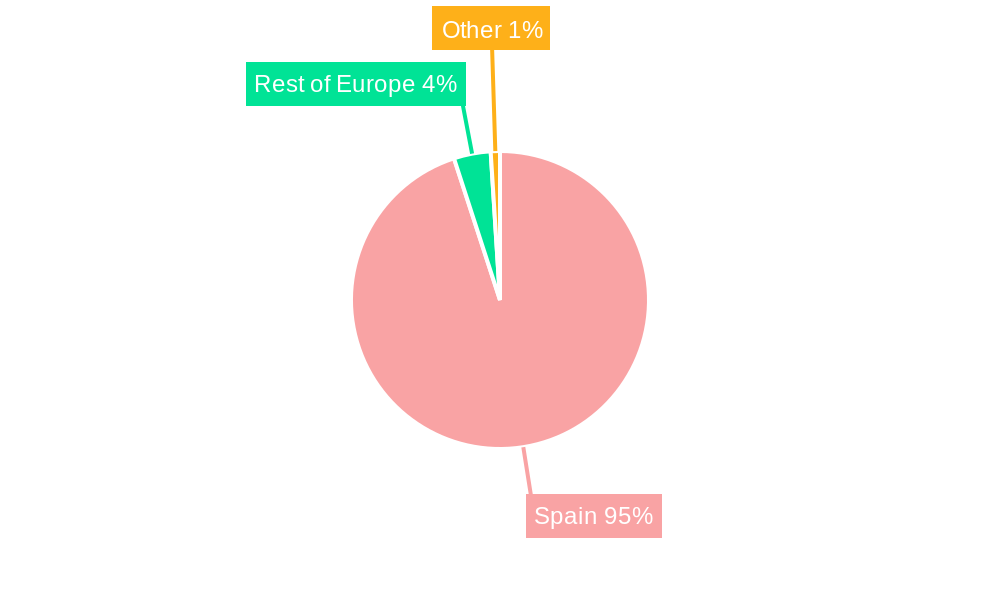

Spain Limes Industry Segmentation By Geography

- 1. Spain

Spain Limes Industry Regional Market Share

Geographic Coverage of Spain Limes Industry

Spain Limes Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Technology in Horticulture; Government Initiatives for Self-reliance in Vegetable and Fruit Farming

- 3.3. Market Restrains

- 3.3.1. Limited Resource Availability and Unfavourable Climatic Condition; Increasing Reliance on Imports for Domestic Supply

- 3.4. Market Trends

- 3.4.1. Growing Demand for Lime Ingredients is Encouraging the Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Limes Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Spain

- 5.1.1. Production Analysis

- 5.1.2. Consumption Analysis and Market Value

- 5.1.3. Import Analysis by Volume and Value

- 5.1.4. Export Analysis by Volume and Value

- 5.1.5. Price Trend Analysis

- 5.2. Market Analysis, Insights and Forecast - by Spain

- 5.2.1. Production Analysis

- 5.2.2. Consumption Analysis and Market Value

- 5.2.3. Import Analysis by Volume and Value

- 5.2.4. Export Analysis by Volume and Value

- 5.2.5. Price Trend Analysis

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Spain

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Syngenta

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Frescolina

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HaciendasBio

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Citrusola

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sakata Seed Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Citrus Juan

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Unilink

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Frutas Torrecilla

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Grupo Agrotecnología

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Syngenta

List of Figures

- Figure 1: Spain Limes Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Spain Limes Industry Share (%) by Company 2025

List of Tables

- Table 1: Spain Limes Industry Revenue undefined Forecast, by Spain 2020 & 2033

- Table 2: Spain Limes Industry Volume Kiloton Forecast, by Spain 2020 & 2033

- Table 3: Spain Limes Industry Revenue undefined Forecast, by Spain 2020 & 2033

- Table 4: Spain Limes Industry Volume Kiloton Forecast, by Spain 2020 & 2033

- Table 5: Spain Limes Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Spain Limes Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 7: Spain Limes Industry Revenue undefined Forecast, by Spain 2020 & 2033

- Table 8: Spain Limes Industry Volume Kiloton Forecast, by Spain 2020 & 2033

- Table 9: Spain Limes Industry Revenue undefined Forecast, by Spain 2020 & 2033

- Table 10: Spain Limes Industry Volume Kiloton Forecast, by Spain 2020 & 2033

- Table 11: Spain Limes Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Spain Limes Industry Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Limes Industry?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Spain Limes Industry?

Key companies in the market include Syngenta , Frescolina , HaciendasBio , Citrusola, Sakata Seed Corporation , Citrus Juan , Unilink, Frutas Torrecilla, Grupo Agrotecnología .

3. What are the main segments of the Spain Limes Industry?

The market segments include Spain, Spain.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Technology in Horticulture; Government Initiatives for Self-reliance in Vegetable and Fruit Farming.

6. What are the notable trends driving market growth?

Growing Demand for Lime Ingredients is Encouraging the Production.

7. Are there any restraints impacting market growth?

Limited Resource Availability and Unfavourable Climatic Condition; Increasing Reliance on Imports for Domestic Supply.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Limes Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Limes Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Limes Industry?

To stay informed about further developments, trends, and reports in the Spain Limes Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence