Key Insights

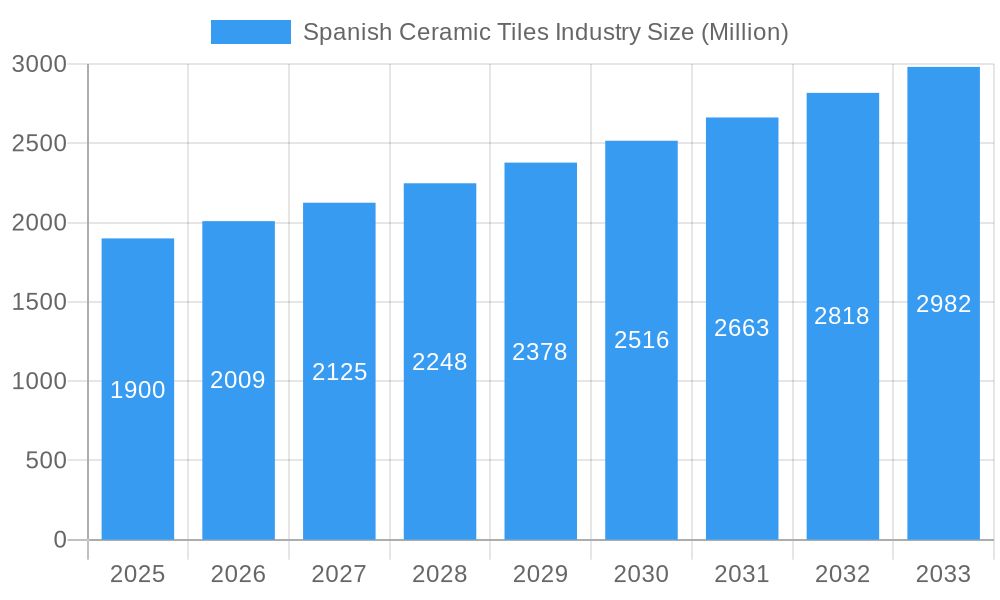

The Spanish ceramic tile industry, valued at €1.9 billion in 2025, exhibits a robust growth trajectory, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.45% from 2025 to 2033. This growth is fueled by several key drivers. Firstly, the ongoing construction boom in both residential and commercial sectors within Spain and increasing exports to neighboring European countries contribute significantly to market expansion. Secondly, the increasing preference for sustainable and eco-friendly building materials, coupled with innovations in tile design and technology (e.g., scratch-free and glazed tiles), are driving demand for high-quality Spanish ceramic tiles. Furthermore, the growing popularity of large-format tiles and the rise of personalized designs are further enhancing market appeal. However, challenges remain. Fluctuations in raw material prices and increasing energy costs present significant headwinds. Competition from other global tile producers, especially those with lower production costs, also poses a threat. The market is segmented by product type (glazed, porcelain, scratch-free, others), application (floor, wall, others), construction type (new construction, renovation/replacement), and end-user (residential, commercial). Major players like Ceramica Mayor SA, Grupo Halcon, and Pamesa are vying for market share through innovation, strategic partnerships, and expansion into new markets. The forecast suggests continued growth, with potential for even higher expansion if sustainable production methods become more widespread and international trade relations remain favorable. The long-term outlook remains positive, indicating substantial opportunities for growth and investment in this dynamic sector.

Spanish Ceramic Tiles Industry Market Size (In Billion)

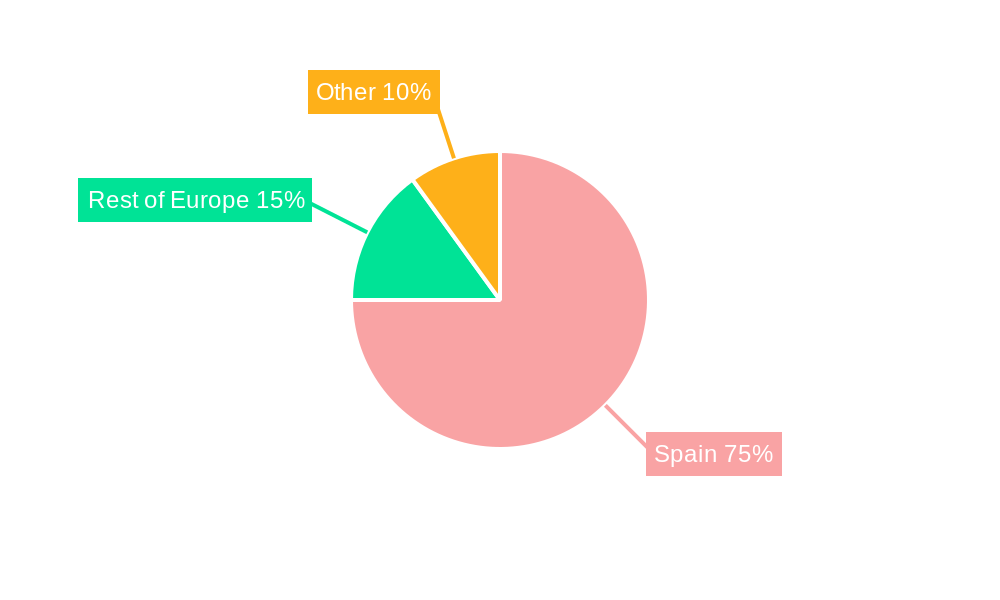

The segmentation analysis reveals a strong emphasis on the residential sector, accounting for approximately 60% of the market. Within product types, porcelain tiles dominate due to their durability and aesthetics. New construction projects form a larger part of the market compared to renovation and replacement, however, the latter segment is expected to experience relatively faster growth driven by renovation trends and growing disposable income. Regional variations within Spain exist, with concentrated demand in urban and coastal areas due to higher construction activity. The focus on exports, particularly within the European Union, is crucial for maintaining sustained industry growth in the long term, as export markets provide opportunities to offset any potential slowdown in domestic demand.

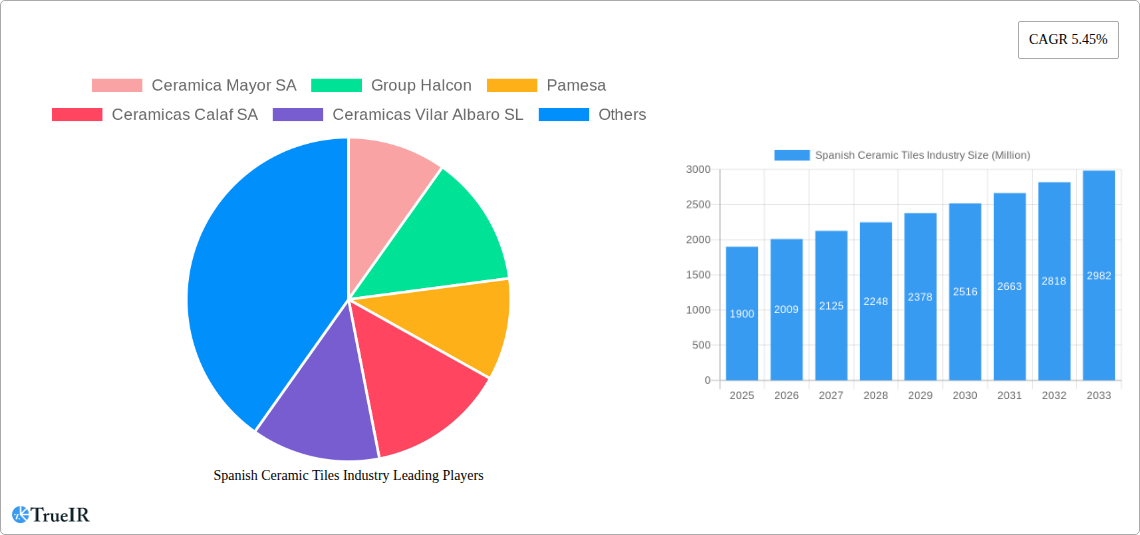

Spanish Ceramic Tiles Industry Company Market Share

Spanish Ceramic Tiles Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Spanish ceramic tiles industry, offering invaluable insights for investors, manufacturers, and industry professionals. With a focus on market trends, competitive dynamics, and future projections, this report covers the period from 2019 to 2033, utilizing 2025 as the base and estimated year. The report projects a market size of €XX Million in 2025 and presents a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033.

Spanish Ceramic Tiles Industry Market Structure & Competitive Landscape

The Spanish ceramic tile industry is characterized by a moderately concentrated market structure, where a few prominent players hold significant market share, complemented by a robust network of smaller, specialized manufacturers. To provide a quantitative understanding of this concentration, the Herfindahl-Hirschman Index (HHI) will be meticulously calculated and detailed within the comprehensive report. Innovation remains a paramount driver, with industry participants consistently pushing boundaries through the development of novel products, cutting-edge designs, and advanced manufacturing processes, all aimed at bolstering competitive advantage. Regulatory frameworks, particularly stringent environmental regulations and evolving labor laws, exert a substantial influence on operational expenditures and the imperative for sustainable practices. The industry also contends with the challenge of product substitution, as alternative flooring and wall covering materials present a constant competitive pressure. The diverse range of end-user segments is spearheaded by the residential construction sector, followed by the commercial and industrial segments. Mergers and acquisitions (M&A) activity has been observed at a moderate pace, with a recorded volume of approximately XX deals valued at €XX Million transacting between 2019 and 2024. The competitive arena is shaped by the following key entities:

- Ceramica Mayor SA

- Group Halcon

- Pamesa

- Ceramicas Calaf SA

- Ceramicas Vilar Albaro SL

- Ceramica Da Vinci SL

- Aztec

- STN Ceramica

- Cerámicas Belcaire SA (ROCA Group)

- Apavisa Porcelanico

- List Not Exhaustive

Spanish Ceramic Tiles Industry Market Trends & Opportunities

The Spanish ceramic tile market experienced fluctuating growth during the historical period (2019-2024) influenced by economic cycles and construction activity. The market is expected to exhibit a robust recovery and growth during the forecast period (2025-2033), driven by several key factors. Technological advancements, such as the adoption of digital printing and large-format tiles, are transforming product design and manufacturing processes. Consumer preferences are shifting towards sustainable, eco-friendly materials, influencing demand for recycled and low-emission tiles. Growing urbanization and infrastructure development projects are contributing to a steady increase in demand, while competitive dynamics, including pricing strategies and product differentiation, play a crucial role in market share gains. The report further analyzes market penetration rates for different product segments and explores the potential impact of global economic trends and trade policies on market growth.

Dominant Markets & Segments in Spanish Ceramic Tiles Industry

The Spanish domestic market remains the dominant segment within the country's ceramic tile industry. Within the industry, Porcelain tiles represent the largest product segment by volume and value. In terms of application, floor tiles dominate the market, due to their extensive use in both residential and commercial construction. New construction projects account for a significant proportion of demand, surpassing replacement and renovation activities, reflecting overall construction activity in Spain. The residential end-user segment dominates, followed by the commercial and industrial sectors.

- Key Growth Drivers:

- Increasing investment in residential and infrastructure projects.

- Government initiatives promoting sustainable construction practices.

- Rising disposable income driving home renovations.

Spanish Ceramic Tiles Industry Product Analysis

The Spanish ceramic tile industry is characterized by a wide range of products including glazed, porcelain, scratch-free, and other specialized tiles. Technological advancements such as inkjet printing enable highly realistic designs and textures, enhancing product appeal. Companies are focusing on improving durability, water resistance, and hygiene features, catering to consumer demand for high-performance tiles suitable for various applications. This focus on innovation and adaptation to diverse needs is a crucial aspect of competitiveness in this market.

Key Drivers, Barriers & Challenges in Spanish Ceramic Tiles Industry

Key Drivers:

- Technological Advancements: The relentless pursuit of innovation in digital printing, advanced glazing techniques, and automated manufacturing processes is significantly elevating product quality, aesthetic appeal, and production efficiency.

- Robust Economic Growth & Urbanization: Sustained economic expansion, coupled with increasing urbanization and a growing demand for both new construction and extensive renovation projects, directly stimulates demand for ceramic tiles.

- Pro-Sustainability Government Policies: Government initiatives promoting green building certifications, energy-efficient construction, and circular economy principles are creating a favorable environment and strong incentives for the adoption of sustainable and durable ceramic tiles.

Key Barriers & Challenges:

- Intensifying Global Competition: The influx of lower-cost ceramic tile products from emerging economies presents a significant challenge to profitability, particularly in export markets. (Quantifiable impact: An estimated xx% decrease in export sales over the past three years).

- Volatile Supply Chain Dynamics: Fluctuations in the global prices of essential raw materials (such as clay, feldspar, and kaolin) and persistent logistical hurdles in transportation contribute to increased and unpredictable production costs. (Quantifiable impact: An average xx% increase in production costs attributed to supply chain issues).

- Evolving Environmental Regulations: Adapting to increasingly stringent environmental mandates, including emissions control, water management, and waste reduction, necessitates substantial capital investment in state-of-the-art, cleaner production technologies and sustainable operational practices.

Growth Drivers in the Spanish Ceramic Tiles Industry Market

The Spanish ceramic tile industry's trajectory of growth is being significantly propelled by a confluence of factors. The robust activity in both the residential and commercial construction sectors, fueled by sustained economic expansion and supportive government infrastructure development programs, is a primary catalyst. Furthermore, continuous technological advancements are not only enhancing the intrinsic quality and aesthetic diversity of ceramic tiles but also enabling the creation of specialized products with enhanced performance characteristics. The rise in disposable incomes and an overall improvement in living standards are also playing a crucial role, driving increased consumer spending on home renovations, aesthetic upgrades, and premium building materials. Complementing these economic and technological drivers, supportive government policies that champion sustainable construction practices and energy efficiency are increasingly positioning ceramic tiles as the material of choice for environmentally conscious building projects, further bolstering market demand.

Challenges Impacting Spanish Ceramic Tiles Industry Growth

The industry faces challenges including intensifying global competition, particularly from low-cost producers. Supply chain vulnerabilities resulting from geopolitical instability and energy price fluctuations affect raw material availability and production costs. Stringent environmental regulations also add to operational costs, requiring significant investments in cleaner technologies and compliance measures.

Key Players Shaping the Spanish Ceramic Tiles Industry Market

- Ceramica Mayor SA

- Group Halcon

- Pamesa

- Ceramicas Calaf SA

- Ceramicas Vilar Albaro SL

- Ceramica Da Vinci SL

- Aztec

- STN Ceramica

- Cerámicas Belcaire SA (ROCA Group)

- Apavisa Porcelanico

Significant Spanish Ceramic Tiles Industry Industry Milestones

- March 2022: Apavisa Porcelánico achieved significant brand visibility and market penetration potential in the crucial North American market by participating prominently at Coverings, the leading international trade fair for ceramic tile and stone in Las Vegas.

- February 2023: The successful launch of Apavisa Porcelánico's innovative Cevisama 23 collection at the prestigious Cevisama fair showcased their advanced design capabilities and commitment to product innovation, positioning them to attract new customer demographics and potentially expand their market share within Spain and internationally.

Future Outlook for Spanish Ceramic Tiles Industry Market

The Spanish ceramic tile industry is firmly positioned for a sustained period of robust growth. This positive outlook is underpinned by the ongoing dynamism in construction activities, both domestically and internationally, coupled with a relentless drive for innovation in product design, aesthetic finishes, and advanced manufacturing technologies. The escalating global demand for sustainable, durable, and high-performance building materials further enhances the industry's prospects. To maintain and strengthen its competitive edge, strategic and targeted investments in research and development (R&D) will be paramount, with a specific focus on product differentiation, the exploration of niche markets, and the cultivation of emerging international markets. The market's inherent potential remains substantial, with promising opportunities anticipated in both established domestic markets and nascent international territories, driven by evolving consumer preferences and global construction trends.

Spanish Ceramic Tiles Industry Segmentation

-

1. Product

- 1.1. Glazed

- 1.2. Porcelain

- 1.3. Scratch Free

- 1.4. Other Products

-

2. Application

- 2.1. Floor Tiles

- 2.2. Wall Tiles

- 2.3. Other Applications

-

3. Construction Type

- 3.1. New Construction

- 3.2. Replacement and Renovation

-

4. End User

- 4.1. Residential

- 4.2. Construction

Spanish Ceramic Tiles Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Spanish Ceramic Tiles Industry Regional Market Share

Geographic Coverage of Spanish Ceramic Tiles Industry

Spanish Ceramic Tiles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Construction and Renovation Activities; Rising Export of Spanish Ceramic Tiles

- 3.3. Market Restrains

- 3.3.1. High Competitiveness in Players of Ceramic Tiles Market; Substitution by Other Products

- 3.4. Market Trends

- 3.4.1. Increasing Production of Ceramic Tiles in Spain

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Spanish Ceramic Tiles Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Glazed

- 5.1.2. Porcelain

- 5.1.3. Scratch Free

- 5.1.4. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Floor Tiles

- 5.2.2. Wall Tiles

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Construction Type

- 5.3.1. New Construction

- 5.3.2. Replacement and Renovation

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Residential

- 5.4.2. Construction

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Spanish Ceramic Tiles Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Glazed

- 6.1.2. Porcelain

- 6.1.3. Scratch Free

- 6.1.4. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Floor Tiles

- 6.2.2. Wall Tiles

- 6.2.3. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Construction Type

- 6.3.1. New Construction

- 6.3.2. Replacement and Renovation

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Residential

- 6.4.2. Construction

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Spanish Ceramic Tiles Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Glazed

- 7.1.2. Porcelain

- 7.1.3. Scratch Free

- 7.1.4. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Floor Tiles

- 7.2.2. Wall Tiles

- 7.2.3. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Construction Type

- 7.3.1. New Construction

- 7.3.2. Replacement and Renovation

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Residential

- 7.4.2. Construction

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Spanish Ceramic Tiles Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Glazed

- 8.1.2. Porcelain

- 8.1.3. Scratch Free

- 8.1.4. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Floor Tiles

- 8.2.2. Wall Tiles

- 8.2.3. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Construction Type

- 8.3.1. New Construction

- 8.3.2. Replacement and Renovation

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Residential

- 8.4.2. Construction

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Spanish Ceramic Tiles Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Glazed

- 9.1.2. Porcelain

- 9.1.3. Scratch Free

- 9.1.4. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Floor Tiles

- 9.2.2. Wall Tiles

- 9.2.3. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Construction Type

- 9.3.1. New Construction

- 9.3.2. Replacement and Renovation

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. Residential

- 9.4.2. Construction

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Spanish Ceramic Tiles Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Glazed

- 10.1.2. Porcelain

- 10.1.3. Scratch Free

- 10.1.4. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Floor Tiles

- 10.2.2. Wall Tiles

- 10.2.3. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Construction Type

- 10.3.1. New Construction

- 10.3.2. Replacement and Renovation

- 10.4. Market Analysis, Insights and Forecast - by End User

- 10.4.1. Residential

- 10.4.2. Construction

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ceramica Mayor SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Group Halcon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pamesa

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ceramicas Calaf SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ceramicas Vilar Albaro SL

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ceramica Da Vinci SL

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Aztec

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 STN Ceramica

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ceramicas Belcaire SA (ROCA Group)*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Apavisa Porcelanico

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Ceramica Mayor SA

List of Figures

- Figure 1: Global Spanish Ceramic Tiles Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Spanish Ceramic Tiles Industry Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Spanish Ceramic Tiles Industry Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Spanish Ceramic Tiles Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Spanish Ceramic Tiles Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Spanish Ceramic Tiles Industry Revenue (Million), by Construction Type 2025 & 2033

- Figure 7: North America Spanish Ceramic Tiles Industry Revenue Share (%), by Construction Type 2025 & 2033

- Figure 8: North America Spanish Ceramic Tiles Industry Revenue (Million), by End User 2025 & 2033

- Figure 9: North America Spanish Ceramic Tiles Industry Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Spanish Ceramic Tiles Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Spanish Ceramic Tiles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Spanish Ceramic Tiles Industry Revenue (Million), by Product 2025 & 2033

- Figure 13: South America Spanish Ceramic Tiles Industry Revenue Share (%), by Product 2025 & 2033

- Figure 14: South America Spanish Ceramic Tiles Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: South America Spanish Ceramic Tiles Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America Spanish Ceramic Tiles Industry Revenue (Million), by Construction Type 2025 & 2033

- Figure 17: South America Spanish Ceramic Tiles Industry Revenue Share (%), by Construction Type 2025 & 2033

- Figure 18: South America Spanish Ceramic Tiles Industry Revenue (Million), by End User 2025 & 2033

- Figure 19: South America Spanish Ceramic Tiles Industry Revenue Share (%), by End User 2025 & 2033

- Figure 20: South America Spanish Ceramic Tiles Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: South America Spanish Ceramic Tiles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Spanish Ceramic Tiles Industry Revenue (Million), by Product 2025 & 2033

- Figure 23: Europe Spanish Ceramic Tiles Industry Revenue Share (%), by Product 2025 & 2033

- Figure 24: Europe Spanish Ceramic Tiles Industry Revenue (Million), by Application 2025 & 2033

- Figure 25: Europe Spanish Ceramic Tiles Industry Revenue Share (%), by Application 2025 & 2033

- Figure 26: Europe Spanish Ceramic Tiles Industry Revenue (Million), by Construction Type 2025 & 2033

- Figure 27: Europe Spanish Ceramic Tiles Industry Revenue Share (%), by Construction Type 2025 & 2033

- Figure 28: Europe Spanish Ceramic Tiles Industry Revenue (Million), by End User 2025 & 2033

- Figure 29: Europe Spanish Ceramic Tiles Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Spanish Ceramic Tiles Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe Spanish Ceramic Tiles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa Spanish Ceramic Tiles Industry Revenue (Million), by Product 2025 & 2033

- Figure 33: Middle East & Africa Spanish Ceramic Tiles Industry Revenue Share (%), by Product 2025 & 2033

- Figure 34: Middle East & Africa Spanish Ceramic Tiles Industry Revenue (Million), by Application 2025 & 2033

- Figure 35: Middle East & Africa Spanish Ceramic Tiles Industry Revenue Share (%), by Application 2025 & 2033

- Figure 36: Middle East & Africa Spanish Ceramic Tiles Industry Revenue (Million), by Construction Type 2025 & 2033

- Figure 37: Middle East & Africa Spanish Ceramic Tiles Industry Revenue Share (%), by Construction Type 2025 & 2033

- Figure 38: Middle East & Africa Spanish Ceramic Tiles Industry Revenue (Million), by End User 2025 & 2033

- Figure 39: Middle East & Africa Spanish Ceramic Tiles Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: Middle East & Africa Spanish Ceramic Tiles Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East & Africa Spanish Ceramic Tiles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Spanish Ceramic Tiles Industry Revenue (Million), by Product 2025 & 2033

- Figure 43: Asia Pacific Spanish Ceramic Tiles Industry Revenue Share (%), by Product 2025 & 2033

- Figure 44: Asia Pacific Spanish Ceramic Tiles Industry Revenue (Million), by Application 2025 & 2033

- Figure 45: Asia Pacific Spanish Ceramic Tiles Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Asia Pacific Spanish Ceramic Tiles Industry Revenue (Million), by Construction Type 2025 & 2033

- Figure 47: Asia Pacific Spanish Ceramic Tiles Industry Revenue Share (%), by Construction Type 2025 & 2033

- Figure 48: Asia Pacific Spanish Ceramic Tiles Industry Revenue (Million), by End User 2025 & 2033

- Figure 49: Asia Pacific Spanish Ceramic Tiles Industry Revenue Share (%), by End User 2025 & 2033

- Figure 50: Asia Pacific Spanish Ceramic Tiles Industry Revenue (Million), by Country 2025 & 2033

- Figure 51: Asia Pacific Spanish Ceramic Tiles Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 4: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 5: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 7: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 9: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 15: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 17: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Brazil Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 23: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 25: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 26: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: France Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Spain Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Benelux Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Nordics Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 37: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 39: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 40: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Turkey Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Israel Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: GCC Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: North Africa Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 48: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 49: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 50: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 51: Global Spanish Ceramic Tiles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: India Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Korea Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Oceania Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Spanish Ceramic Tiles Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spanish Ceramic Tiles Industry?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the Spanish Ceramic Tiles Industry?

Key companies in the market include Ceramica Mayor SA, Group Halcon, Pamesa, Ceramicas Calaf SA, Ceramicas Vilar Albaro SL, Ceramica Da Vinci SL, Aztec, STN Ceramica, Ceramicas Belcaire SA (ROCA Group)*List Not Exhaustive, Apavisa Porcelanico.

3. What are the main segments of the Spanish Ceramic Tiles Industry?

The market segments include Product, Application, Construction Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.9 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Construction and Renovation Activities; Rising Export of Spanish Ceramic Tiles.

6. What are the notable trends driving market growth?

Increasing Production of Ceramic Tiles in Spain.

7. Are there any restraints impacting market growth?

High Competitiveness in Players of Ceramic Tiles Market; Substitution by Other Products.

8. Can you provide examples of recent developments in the market?

February 2023: Apavisa Porcelánico launched a new collection, Cevisama 23. This collection offers a visual and tactile experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spanish Ceramic Tiles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spanish Ceramic Tiles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spanish Ceramic Tiles Industry?

To stay informed about further developments, trends, and reports in the Spanish Ceramic Tiles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence