Key Insights

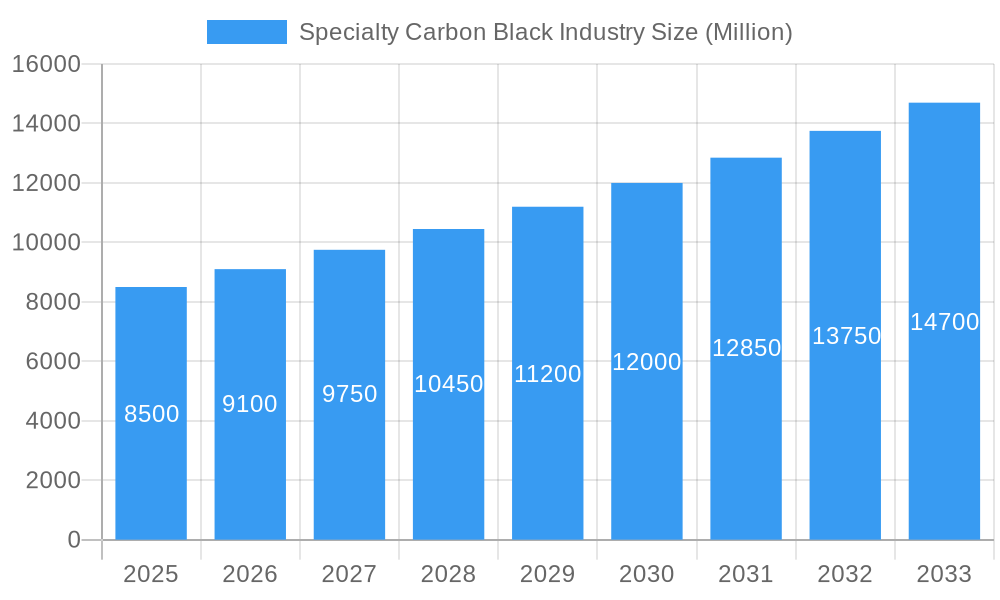

The global Specialty Carbon Black market is poised for robust expansion, projected to reach a substantial market size of approximately $8,500 million by 2025 and is anticipated to grow at a Compound Annual Growth Rate (CAGR) exceeding 7.00% through 2033. This significant growth is propelled by a confluence of escalating demand across key application sectors, notably in plastics, paints and coatings, printing inks and toners, and critically, in battery electrodes. The increasing adoption of electric vehicles (EVs) and the subsequent surge in demand for high-performance lithium-ion batteries are a primary catalyst, with specialty carbon black playing an indispensable role in enhancing conductivity and energy density. Furthermore, the burgeoning construction industry and the continuous innovation in automotive coatings are contributing to the sustained demand for advanced carbon black formulations that offer superior UV resistance, color depth, and durability.

Specialty Carbon Black Industry Market Size (In Billion)

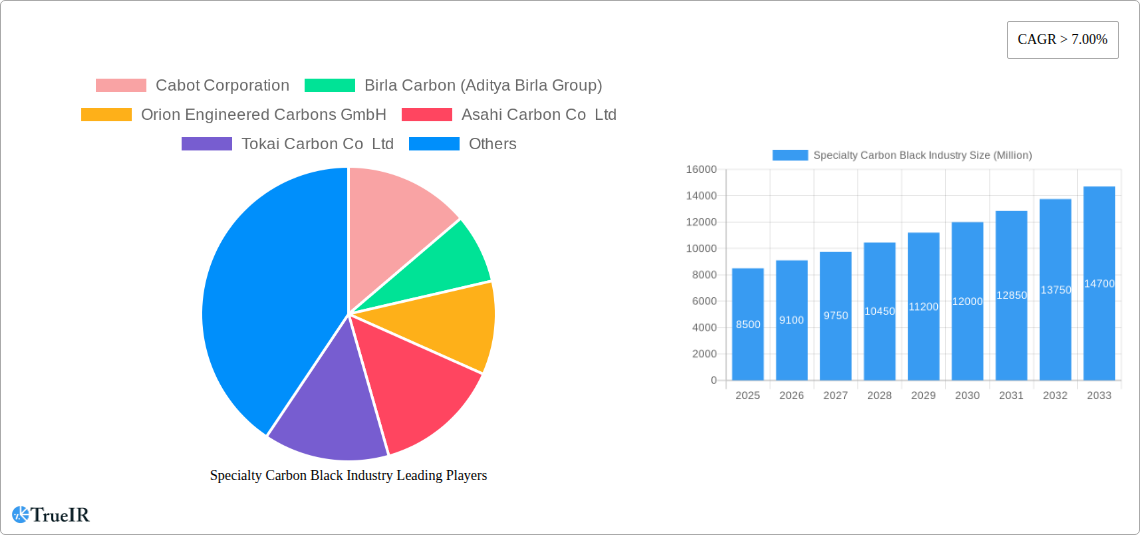

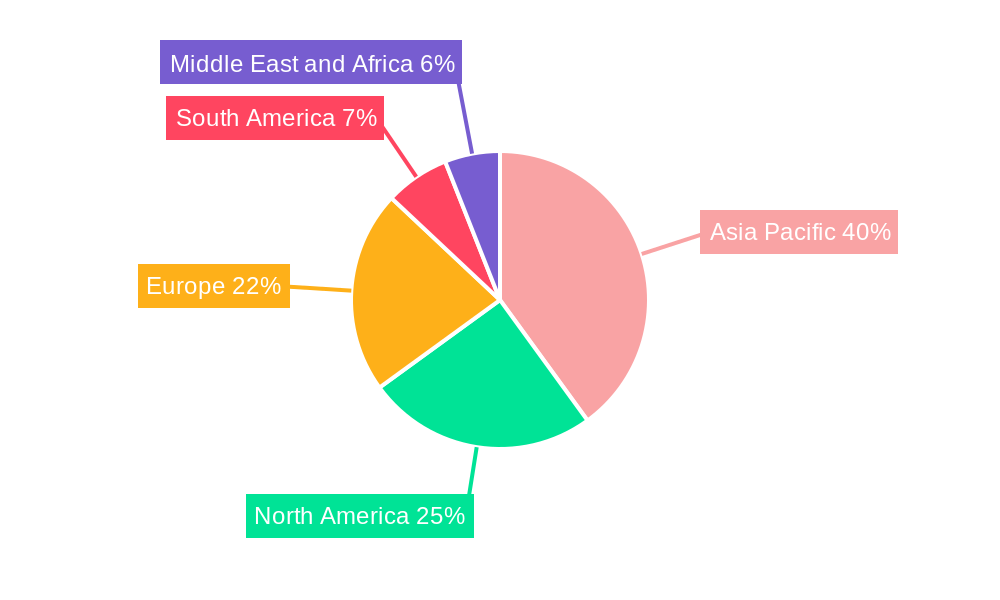

The market's dynamism is further shaped by evolving industry trends and a competitive landscape featuring established players like Cabot Corporation, Birla Carbon, and Orion Engineered Carbons. These companies are investing heavily in research and development to introduce novel grades of specialty carbon black with tailored properties, such as improved dispersibility and reduced environmental impact. The Asia Pacific region, led by China and India, is expected to remain the dominant market due to its vast manufacturing base and rapid industrialization. However, restraints such as fluctuating raw material prices, particularly for petroleum-based feedstocks, and stringent environmental regulations pose challenges. Nevertheless, the ongoing technological advancements in material science and the increasing focus on sustainable production methods are expected to mitigate these concerns and foster continued market growth, making it a highly attractive sector for investment and innovation.

Specialty Carbon Black Industry Company Market Share

Specialty Carbon Black Industry: Market Analysis, Trends, and Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the global Specialty Carbon Black Industry, covering market structure, competitive landscape, key trends, growth drivers, challenges, and future outlook. Leveraging high-volume SEO keywords such as "specialty carbon black market," "carbon black applications," "plastics carbon black," "coatings carbon black," "battery electrodes carbon black," and "specialty carbon black forecast," this report is designed to engage industry professionals and enhance search engine visibility. The study encompasses the historical period from 2019 to 2024, the base year of 2025, and a robust forecast period extending to 2033, with an estimated year also at 2025.

Specialty Carbon Black Industry Market Structure & Competitive Landscape

The Specialty Carbon Black Industry exhibits a moderately concentrated market structure, with key players investing heavily in research and development to drive innovation. The market's dynamism is influenced by evolving regulatory landscapes concerning environmental impact and product safety, pushing manufacturers towards sustainable production methods and advanced product formulations. Product substitutes, while present in certain low-end applications, are generally outcompeted by the superior performance characteristics of specialty carbon black in high-demand sectors. End-user segmentation is critical, with significant growth observed across plastics, paints and coatings, printing inks and toners, and emerging applications like battery electrodes. Mergers and acquisitions (M&A) play a pivotal role in market consolidation and expansion, with an estimated M&A deal volume in the hundreds of millions of dollars annually. Key strategies involve vertical integration, technological partnerships, and capacity expansions to meet the escalating demand for high-performance carbon black grades.

Specialty Carbon Black Industry Market Trends & Opportunities

The global Specialty Carbon Black Industry is poised for significant expansion, driven by an insatiable demand for enhanced material properties across a multitude of applications. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% over the forecast period (2025-2033), translating to a market value estimated to reach over $XX Billion by 2033. Technological advancements are at the forefront, with manufacturers focusing on developing carbon black grades with tailored particle sizes, surface area, and structure to impart specific functionalities such as improved conductivity, UV resistance, and pigmentation. Consumer preferences are increasingly leaning towards sustainable and high-performance materials, directly influencing the demand for specialty carbon blacks in sectors like electric vehicles (EVs) and advanced packaging. Competitive dynamics are characterized by a keen focus on product differentiation, cost optimization through efficient production processes, and strategic collaborations to gain market share. The increasing penetration of specialty carbon blacks into burgeoning markets like advanced battery technologies represents a substantial opportunity for growth and innovation.

Dominant Markets & Segments in Specialty Carbon Black Industry

The Plastics segment is a dominant force within the Specialty Carbon Black Industry, driven by its widespread use as a pigment, UV stabilizer, and reinforcing filler in various plastic applications, from automotive components to consumer goods. The growth in this segment is fueled by the expanding global automotive industry, which relies heavily on lightweight and durable plastics enhanced by carbon black. Furthermore, the burgeoning construction sector's demand for high-performance plastics in pipes, profiles, and films contributes significantly to the market's expansion.

- Key Growth Drivers in Plastics:

- Increasing demand for UV-resistant and weatherable plastics in outdoor applications.

- Growing adoption of black masterbatches for aesthetic appeal and performance enhancement.

- Expansion of the automotive industry, particularly in emerging economies, driving demand for reinforced plastics.

- Strict regulations mandating UV protection in plastic products.

The Paints and Coatings segment also holds substantial market share, owing to the excellent opacity, tinting strength, and conductivity that specialty carbon black provides. Its use in automotive coatings, industrial paints, and architectural coatings ensures superior durability and aesthetic appeal. The growing infrastructure development worldwide, coupled with increasing consumer spending on home improvement and renovation, is a significant catalyst for this segment.

- Key Growth Drivers in Paints and Coatings:

- Rising demand for high-performance automotive coatings with enhanced scratch resistance and UV protection.

- Growth in the industrial coatings sector, driven by infrastructure projects and manufacturing output.

- Increasing preference for aesthetically pleasing and durable architectural paints.

- Development of specialized coatings with conductive properties for electronic applications.

The Printing Inks and Toners segment continues to be a vital consumer of specialty carbon blacks, where they are essential for providing deep black coloration, printability, and fade resistance. The ongoing digital transformation, coupled with the resurgence of print media in certain niche markets, sustains the demand for high-quality printing inks and toners.

- Key Growth Drivers in Printing Inks and Toners:

- Continued demand for high-quality printing in packaging and publications.

- Growth in the digital printing sector, requiring specialized toner formulations.

- Use in security printing applications for enhanced durability and anti-counterfeiting measures.

Emerging segments like Battery Electrodes are witnessing exponential growth. Specialty carbon blacks are crucial for enhancing the electrical conductivity of electrodes in lithium-ion batteries and other energy storage devices. The global push towards electrification and renewable energy storage solutions is a primary driver for this rapidly expanding market.

- Key Growth Drivers in Battery Electrodes:

- Rapid growth of the electric vehicle (EV) market and demand for high-performance batteries.

- Increasing adoption of renewable energy storage solutions for grid stabilization and residential use.

- Technological advancements in battery design requiring improved conductivity.

The Other Applications segment, encompassing diverse uses such as rubber reinforcement in tires, conductive additives in polymers for anti-static applications, and specialized pigments, also contributes to the overall market demand.

Specialty Carbon Black Industry Product Analysis

Product innovation in the Specialty Carbon Black Industry is centered on developing grades with precisely controlled particle size distribution, surface chemistry, and aggregate structure. These advancements enable enhanced performance in critical applications, offering superior pigmentation, UV protection, electrical conductivity, and reinforcement. Competitive advantages are derived from proprietary manufacturing processes that yield unique product characteristics, catering to niche market demands. The market increasingly favors eco-friendly and sustainable carbon black variants, driving research into cleaner production methods and alternative feedstock.

Key Drivers, Barriers & Challenges in Specialty Carbon Black Industry

The Specialty Carbon Black Industry is propelled by technological advancements in end-use applications, such as the burgeoning electric vehicle market demanding high-performance battery materials, and the growing need for durable and aesthetically pleasing plastics and coatings. Economic factors, including global manufacturing growth and infrastructure development, further stimulate demand. Policy-driven initiatives promoting sustainability and performance standards also play a significant role.

However, the industry faces considerable challenges. Supply chain disruptions, volatile raw material prices (primarily derived from petroleum), and stringent environmental regulations pose significant restraints. Intense competition among established players and emerging manufacturers can lead to price pressures. The capital-intensive nature of production facilities and the need for continuous R&D investment are also substantial barriers to entry.

Growth Drivers in the Specialty Carbon Black Industry Market

Key growth drivers in the Specialty Carbon Black Industry include the accelerating adoption of electric vehicles, which significantly boosts demand for conductive carbon blacks in battery electrodes. The continuous innovation in plastics and coatings, seeking enhanced UV resistance, durability, and aesthetic appeal, further fuels market expansion. Stringent environmental regulations encouraging the use of high-performance materials that can extend product lifespans indirectly contribute to growth. Furthermore, the expanding construction and infrastructure development sectors globally create a consistent demand for specialty carbon blacks in various building materials and protective coatings.

Challenges Impacting Specialty Carbon Black Industry Growth

Challenges impacting Specialty Carbon Black Industry growth are multifaceted. Fluctuations in the price and availability of key raw materials, primarily derived from crude oil, can create cost volatility and impact profit margins. Increasingly stringent environmental regulations regarding emissions and waste management necessitate significant investments in advanced production technologies and compliance measures. The highly competitive landscape, with both established global players and regional manufacturers, can lead to pricing pressures and market fragmentation. Moreover, the development of alternative materials or technologies that could potentially substitute carbon black in specific applications presents a long-term challenge.

Key Players Shaping the Specialty Carbon Black Industry Market

- Cabot Corporation

- Birla Carbon (Aditya Birla Group)

- Orion Engineered Carbons GmbH

- Asahi Carbon Co Ltd

- Tokai Carbon Co Ltd

- Omsk Carbon Group

- Continental Carbon Company

- Himadri Speciality Chemical Ltd

- Phillips Carbon Black Limited

- Ralson

- Black Bear Carbon B V

Significant Specialty Carbon Black Industry Industry Milestones

- February 2022: Orion Engineered Carbons opened a new production line in Italy for carbon black manufacturing, having 25 kiloton capacity for specialty and technical rubber carbon black, mainly for the European market, enhancing supply capabilities for a crucial region.

- August 2021: Orion Engineered Carbons began construction of its second plant in China for production of high-performance and specialty carbon black. The new manufacturing plant will be based in Huaibei, China and is expected to begin production by 2023, signifying strategic expansion into a key growth market and increasing global production capacity.

Future Outlook for Specialty Carbon Black Industry Market

The future outlook for the Specialty Carbon Black Industry is exceptionally promising, underpinned by sustained demand from key sectors and emerging technological frontiers. The relentless growth of the electric vehicle market will continue to drive innovation and demand for conductive carbon blacks in battery applications, representing a significant growth catalyst. Furthermore, advancements in sustainable manufacturing processes and the development of novel carbon black grades with enhanced functionalities will open new avenues for market penetration. Strategic investments in capacity expansion and research and development by leading players, coupled with the increasing focus on high-performance materials across industries, position the Specialty Carbon Black Industry for robust and continued growth in the coming years.

Specialty Carbon Black Industry Segmentation

-

1. Application

- 1.1. Plastics

- 1.2. Paints and Coating

- 1.3. Printing Inks and Toners

- 1.4. Battery Electrodes

- 1.5. Other Applications

Specialty Carbon Black Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Specialty Carbon Black Industry Regional Market Share

Geographic Coverage of Specialty Carbon Black Industry

Specialty Carbon Black Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand in Lithium Ion Batteries; Growing Demand for Sepciality Carbon Black in Non-rubber Applications

- 3.3. Market Restrains

- 3.3.1. Rising Demand in Lithium Ion Batteries; Growing Demand for Sepciality Carbon Black in Non-rubber Applications

- 3.4. Market Trends

- 3.4.1. Increasing Usage in the Plastic Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Specialty Carbon Black Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Plastics

- 5.1.2. Paints and Coating

- 5.1.3. Printing Inks and Toners

- 5.1.4. Battery Electrodes

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Specialty Carbon Black Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Plastics

- 6.1.2. Paints and Coating

- 6.1.3. Printing Inks and Toners

- 6.1.4. Battery Electrodes

- 6.1.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Specialty Carbon Black Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Plastics

- 7.1.2. Paints and Coating

- 7.1.3. Printing Inks and Toners

- 7.1.4. Battery Electrodes

- 7.1.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Specialty Carbon Black Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Plastics

- 8.1.2. Paints and Coating

- 8.1.3. Printing Inks and Toners

- 8.1.4. Battery Electrodes

- 8.1.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Specialty Carbon Black Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Plastics

- 9.1.2. Paints and Coating

- 9.1.3. Printing Inks and Toners

- 9.1.4. Battery Electrodes

- 9.1.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Specialty Carbon Black Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Plastics

- 10.1.2. Paints and Coating

- 10.1.3. Printing Inks and Toners

- 10.1.4. Battery Electrodes

- 10.1.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cabot Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Birla Carbon (Aditya Birla Group)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Orion Engineered Carbons GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Asahi Carbon Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Tokai Carbon Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Omsk Carbon Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Continental Carbon Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Himadri Speciality Chemical Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Phillips Carbon Black Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ralson

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Black Bear Carbon B V *List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Cabot Corporation

List of Figures

- Figure 1: Global Specialty Carbon Black Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Specialty Carbon Black Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: Asia Pacific Specialty Carbon Black Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: Asia Pacific Specialty Carbon Black Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: Asia Pacific Specialty Carbon Black Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Specialty Carbon Black Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Specialty Carbon Black Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Specialty Carbon Black Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Specialty Carbon Black Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Specialty Carbon Black Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Specialty Carbon Black Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Specialty Carbon Black Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Specialty Carbon Black Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Specialty Carbon Black Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: South America Specialty Carbon Black Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America Specialty Carbon Black Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Specialty Carbon Black Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Specialty Carbon Black Industry Revenue (Million), by Application 2025 & 2033

- Figure 19: Middle East and Africa Specialty Carbon Black Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Specialty Carbon Black Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Specialty Carbon Black Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Specialty Carbon Black Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Specialty Carbon Black Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Specialty Carbon Black Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Specialty Carbon Black Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: China Specialty Carbon Black Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: India Specialty Carbon Black Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Japan Specialty Carbon Black Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: South Korea Specialty Carbon Black Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of Asia Pacific Specialty Carbon Black Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Specialty Carbon Black Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Specialty Carbon Black Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States Specialty Carbon Black Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Canada Specialty Carbon Black Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico Specialty Carbon Black Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Specialty Carbon Black Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Specialty Carbon Black Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Germany Specialty Carbon Black Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Specialty Carbon Black Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Specialty Carbon Black Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: France Specialty Carbon Black Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Specialty Carbon Black Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Specialty Carbon Black Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Specialty Carbon Black Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Brazil Specialty Carbon Black Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Argentina Specialty Carbon Black Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of South America Specialty Carbon Black Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Specialty Carbon Black Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Specialty Carbon Black Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Saudi Arabia Specialty Carbon Black Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Specialty Carbon Black Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa Specialty Carbon Black Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Specialty Carbon Black Industry?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the Specialty Carbon Black Industry?

Key companies in the market include Cabot Corporation, Birla Carbon (Aditya Birla Group), Orion Engineered Carbons GmbH, Asahi Carbon Co Ltd, Tokai Carbon Co Ltd, Omsk Carbon Group, Continental Carbon Company, Himadri Speciality Chemical Ltd, Phillips Carbon Black Limited, Ralson, Black Bear Carbon B V *List Not Exhaustive.

3. What are the main segments of the Specialty Carbon Black Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand in Lithium Ion Batteries; Growing Demand for Sepciality Carbon Black in Non-rubber Applications.

6. What are the notable trends driving market growth?

Increasing Usage in the Plastic Industry.

7. Are there any restraints impacting market growth?

Rising Demand in Lithium Ion Batteries; Growing Demand for Sepciality Carbon Black in Non-rubber Applications.

8. Can you provide examples of recent developments in the market?

In February 2022, Orion Engineered Carbons opened a new production line in Italy for carbon black manufacturing, having 25 kiloton capacity for specialty and technical rubber carbon black, mainly for European market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Specialty Carbon Black Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Specialty Carbon Black Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Specialty Carbon Black Industry?

To stay informed about further developments, trends, and reports in the Specialty Carbon Black Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence