Key Insights

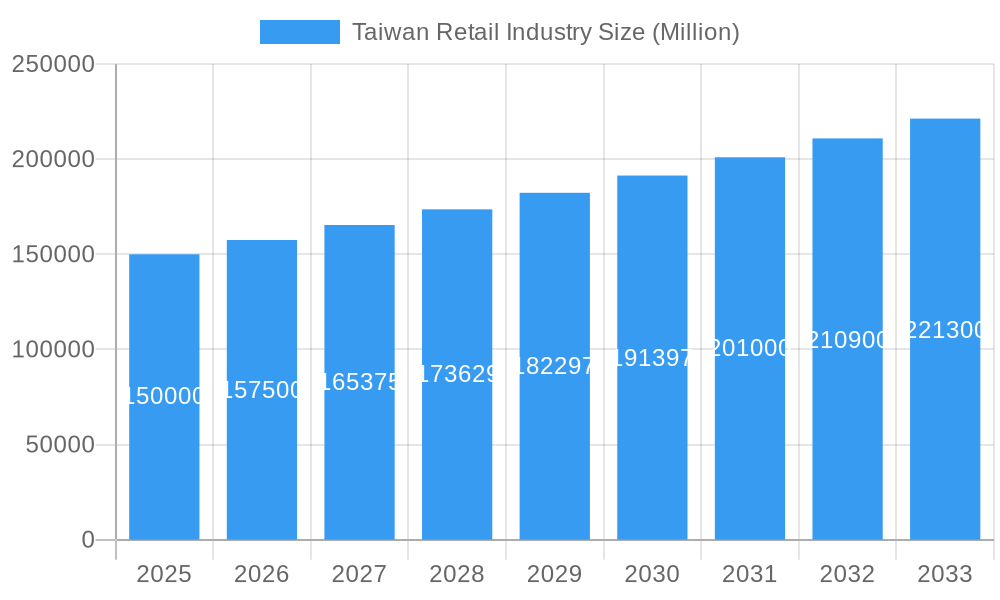

The Taiwan retail industry is a dynamic and resilient market, demonstrating consistent growth driven by evolving consumer preferences and advancements in e-commerce. From 2019 to 2024, the market experienced moderate expansion, fueled by increasing online shopping penetration and a shift towards experiential purchases. Projecting forward from a base year of 2024, with a CAGR of 4%, the market is forecast to reach approximately $130 billion by 2033. This steady expansion is underpinned by robust e-commerce infrastructure, the adoption of omnichannel strategies, and effective social media marketing.

Taiwan Retail Industry Market Size (In Billion)

Sustained success in Taiwan's retail sector hinges on adaptability and innovation. Retailers are prioritizing personalized customer experiences, utilizing data analytics for consumer insights, and investing in AI and automation to optimize efficiency and service. The growing adoption of mobile payments and fintech solutions is further transforming the industry. Government initiatives supporting sustainable consumption and SMEs also contribute to the market's positive trajectory.

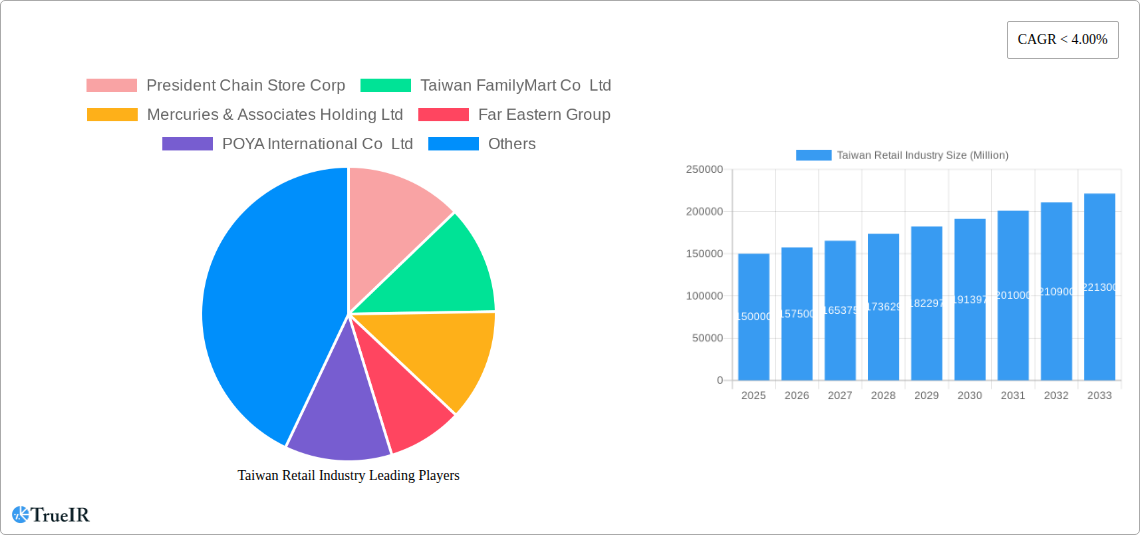

Taiwan Retail Industry Company Market Share

This comprehensive report offers invaluable insights into the Taiwan retail industry, covering market dynamics from 2019 to 2033. With a base year of 2024 and a forecast period of 2025-2033, it analyzes market structure, competition, trends, and future outlook. Leveraging detailed quantitative and qualitative data, the report provides a 360-degree view of the Taiwan retail market, which had a market size of $130 billion in 2024 and is projected to achieve significant growth by 2033.

Taiwan Retail Industry Market Structure & Competitive Landscape

This section analyzes the market concentration, innovation drivers, regulatory influences, product substitutes, end-user segmentation, and mergers & acquisitions (M&A) trends within the Taiwan retail landscape. We delve into the competitive dynamics, revealing the market share distribution amongst key players.

- Market Concentration: The Taiwan retail market exhibits a moderately concentrated structure, with a few large players commanding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at XX, indicating a moderately competitive market.

- Innovation Drivers: E-commerce integration, omnichannel strategies, and the adoption of advanced technologies like AI and big data analytics are major drivers of innovation. The focus is shifting towards personalized customer experiences and efficient supply chain management.

- Regulatory Impacts: Government regulations pertaining to consumer protection, data privacy, and fair competition significantly influence market operations. Recent amendments to consumer protection laws have impacted pricing strategies and marketing campaigns.

- Product Substitutes: The increasing popularity of online marketplaces and direct-to-consumer brands poses a competitive threat to traditional brick-and-mortar retailers.

- End-User Segmentation: The market caters to diverse consumer segments, including young adults, families, and senior citizens, each with unique shopping behaviors and preferences. This segmentation demands targeted marketing and product offerings.

- M&A Trends: The past five years have witnessed XX M&A deals in the Taiwan retail sector, with a total value exceeding $XX Million. These transactions reflect consolidation trends and the pursuit of expansion strategies among key players.

Taiwan Retail Industry Market Trends & Opportunities

This section explores the market size growth, technological transformations, evolving consumer preferences, and competitive dynamics shaping the Taiwan retail industry. We will examine the Compound Annual Growth Rate (CAGR) and market penetration rates of various segments.

The Taiwan retail market is experiencing significant growth driven by rising disposable incomes, urbanization, and the expanding middle class. The CAGR for the period 2019-2024 is estimated at XX%, and a projected CAGR of XX% is expected from 2025-2033. Technological advancements, particularly in e-commerce and mobile payments, are fundamentally changing consumer behavior. The increasing popularity of online shopping and the growing adoption of digital wallets are driving the expansion of the online retail segment. Consumer preferences are shifting towards convenience, personalized experiences, and sustainable products. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants, prompting companies to innovate and adapt to changing market conditions. Market penetration of online retail is steadily increasing, with estimates exceeding XX% in 2024. This trend is anticipated to further accelerate in the coming years.

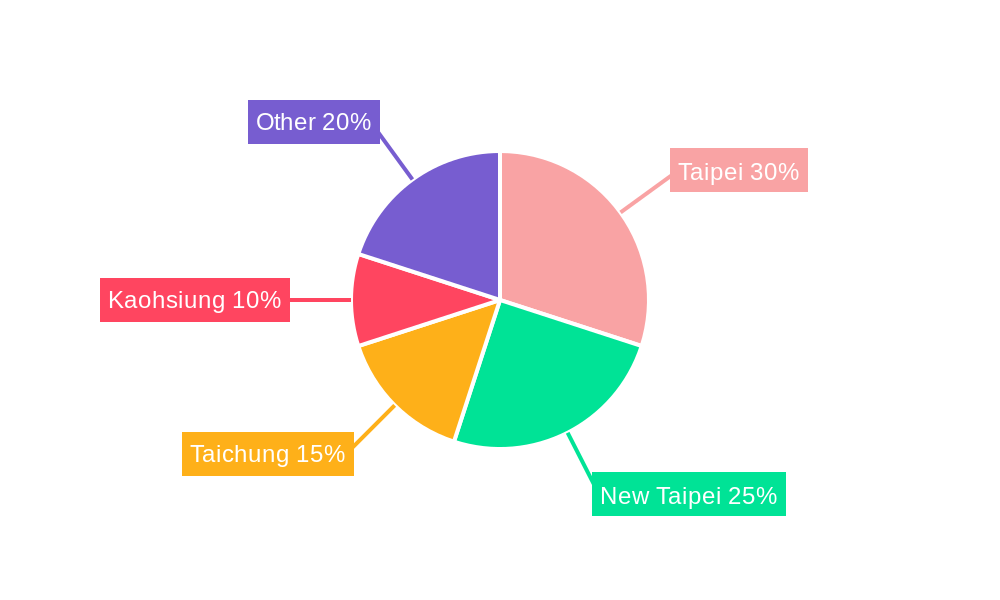

Dominant Markets & Segments in Taiwan Retail Industry

This section identifies the leading regions, countries, or segments within the Taiwan retail industry. The analysis highlights key growth drivers and explores the factors contributing to market dominance.

- Key Growth Drivers:

- Robust Infrastructure: Taiwan boasts a well-developed infrastructure, including efficient logistics networks and advanced communication technologies, facilitating seamless retail operations.

- Supportive Government Policies: Favorable government policies promoting business development and attracting foreign investment have fostered industry growth.

- Rising Consumer Spending: Increased consumer spending power fuels demand for a wider variety of retail products and services.

- Market Dominance: Taipei and other major metropolitan areas dominate the retail landscape, benefiting from high population density, affluent consumers, and robust infrastructure. However, growth in smaller cities and rural areas is also observed, driven by improved logistics and the expansion of online retail channels. The convenience store segment continues to be a dominant force, fueled by high population density and convenient accessibility.

Taiwan Retail Industry Product Analysis

This section summarizes product innovations, applications, and competitive advantages within the Taiwan retail industry, focusing on technological advancements and market fit.

The Taiwan retail industry is witnessing rapid product innovation, with a focus on personalization, convenience, and technological integration. Smart retail solutions, leveraging AI and big data, are gaining traction, enabling better inventory management, targeted marketing, and enhanced customer experiences. The adoption of mobile payment systems and omnichannel strategies is rapidly transforming the shopping landscape. Products incorporating sustainable and eco-friendly features are gaining popularity as consumer awareness of environmental issues increases. This shift aligns with global trends towards ethical and responsible consumption.

Key Drivers, Barriers & Challenges in Taiwan Retail Industry

This section outlines the key factors driving market growth and identifies challenges and restraints.

Key Drivers: Technological advancements, favorable economic conditions, and supportive government policies are key drivers. E-commerce expansion is significantly impacting market dynamics, offering new opportunities for retailers.

Challenges and Restraints: Intense competition, rising labor costs, and supply chain disruptions pose significant challenges. Evolving consumer preferences and the need to adapt to changing market trends are also critical considerations. The increasing cost of operating physical stores in prime locations is a significant constraint for traditional brick-and-mortar retailers.

Growth Drivers in the Taiwan Retail Industry Market

Technological advancements, expanding e-commerce, and favorable government policies supporting retail business are prominent growth drivers. The increasing middle class with greater disposable income fuels consumer spending.

Challenges Impacting Taiwan Retail Industry Growth

Intense competition from both domestic and international players, rising labor costs, and supply chain vulnerabilities are key challenges. The need to maintain operational efficiency while adapting to rapid technological advancements is crucial for continued success.

Key Players Shaping the Taiwan Retail Industry Market

- President Chain Store Corp

- Taiwan FamilyMart Co Ltd

- Mercuries & Associates Holding Ltd

- Far Eastern Group

- POYA International Co Ltd

- The Eslite Corporation

- Sogo Department Stores Co Ltd

- Kayee International Group Co Ltd

- Carrefour

- RT-Mart

Significant Taiwan Retail Industry Industry Milestones

- November 2020: Foodpanda expands its e-commerce operations to include over 2,500 7-Eleven stores across several Asian countries, including Taiwan, significantly boosting the online reach of convenience stores.

- January 2021: Bolttech partners with Samsung in Taiwan, offering device protection services for Samsung Galaxy smartphones and tablets, showcasing the growing importance of value-added services in the retail sector.

Future Outlook for Taiwan Retail Industry Market

The Taiwan retail industry is poised for continued growth, driven by technological advancements, shifting consumer preferences, and increasing e-commerce adoption. Strategic investments in omnichannel strategies, personalized customer experiences, and sustainable practices will be crucial for success. The integration of AI and big data analytics will play a key role in optimizing operations and enhancing customer engagement. The market is expected to maintain a healthy growth trajectory throughout the forecast period.

Taiwan Retail Industry Segmentation

-

1. Product Type

- 1.1. Food, Beverage, and Tobacco Products

- 1.2. Personal Care and Household

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Industrial and Automotive

- 1.6. Electronic and Household Appliances

- 1.7. Other Products

-

2. Distribution Channel

- 2.1. Hypermar

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Taiwan Retail Industry Segmentation By Geography

- 1. Taiwan

Taiwan Retail Industry Regional Market Share

Geographic Coverage of Taiwan Retail Industry

Taiwan Retail Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Consumer Confidence to Strengthen on Minimum Wage Hike.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Taiwan Retail Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Food, Beverage, and Tobacco Products

- 5.1.2. Personal Care and Household

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Industrial and Automotive

- 5.1.6. Electronic and Household Appliances

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermar

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Taiwan

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 President Chain Store Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Taiwan FamilyMart Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mercuries & Associates Holding Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Far Eastern Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 POYA International Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Eslite Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sogo Department Stores Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kayee International Group Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Carrefour

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 RT - Mart*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 President Chain Store Corp

List of Figures

- Figure 1: Taiwan Retail Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Taiwan Retail Industry Share (%) by Company 2025

List of Tables

- Table 1: Taiwan Retail Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Taiwan Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Taiwan Retail Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Taiwan Retail Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Taiwan Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Taiwan Retail Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Taiwan Retail Industry?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Taiwan Retail Industry?

Key companies in the market include President Chain Store Corp, Taiwan FamilyMart Co Ltd, Mercuries & Associates Holding Ltd, Far Eastern Group, POYA International Co Ltd, The Eslite Corporation, Sogo Department Stores Co Ltd, Kayee International Group Co Ltd, Carrefour, RT - Mart*List Not Exhaustive.

3. What are the main segments of the Taiwan Retail Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 130 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Consumer Confidence to Strengthen on Minimum Wage Hike..

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In January 2021, Bolttech expanded in Taiwan via a device protection partnership with Samsung. Its latest partnership with Samsung in Taiwan includes arranging for mobile device protection to owners of new Samsung Galaxy smartphones and tablets through the Samsung Care+ program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Taiwan Retail Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Taiwan Retail Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Taiwan Retail Industry?

To stay informed about further developments, trends, and reports in the Taiwan Retail Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence