Key Insights

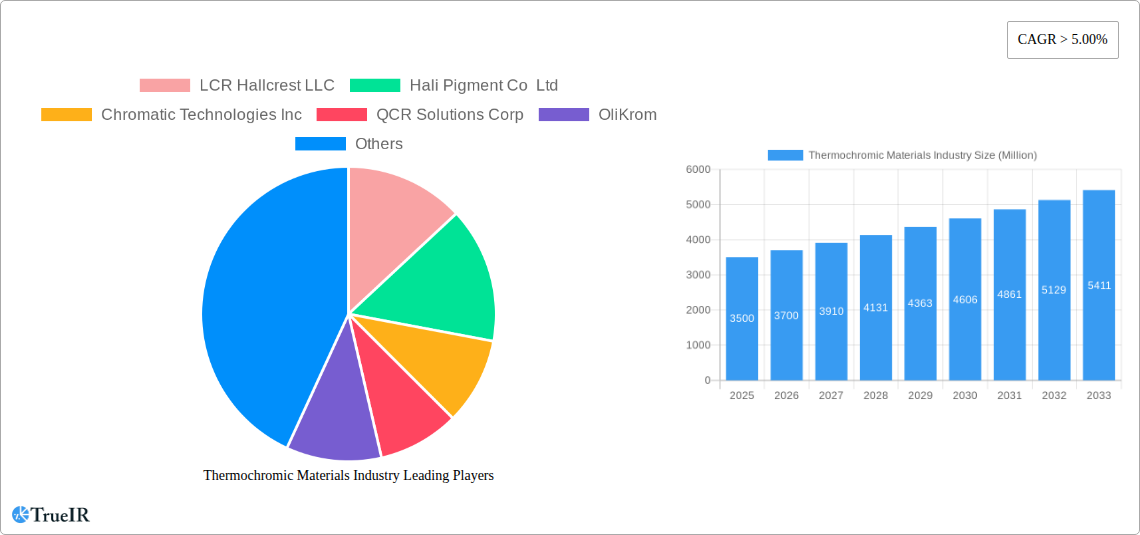

The global Thermochromic Materials market is poised for significant expansion, driven by increasing demand across diverse industrial applications and a growing awareness of their functional benefits. Valued at an estimated USD 3,500 million in 2025, the market is projected to witness a robust Compound Annual Growth Rate (CAGR) exceeding 5.00% through 2033. This growth trajectory is primarily fueled by advancements in material science leading to more sophisticated and reliable thermochromic formulations, coupled with their adoption in sectors like smart packaging, safety indicators, and innovative consumer products. The demand for reversible thermochromic materials, which can repeatedly change color with temperature fluctuations, is particularly strong due to their reusability and suitability for dynamic temperature monitoring. Furthermore, the market's expansion is bolstered by increasing investment in research and development by key players, aiming to introduce novel applications and enhance the performance characteristics of existing thermochromic solutions.

Thermochromic Materials Industry Market Size (In Billion)

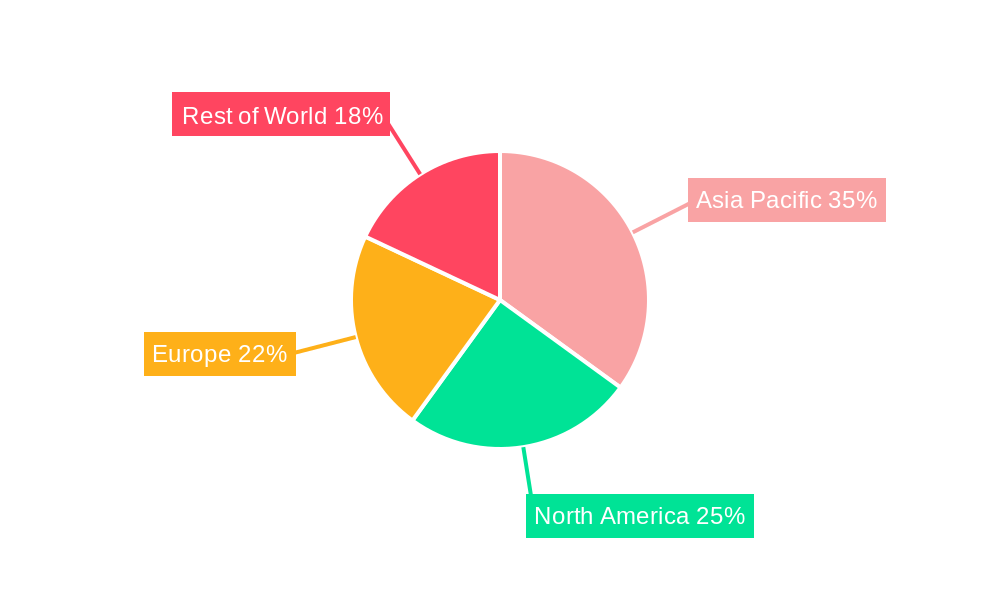

Key segments contributing to this market growth include the printing and packaging industries, where thermochromic inks and coatings are utilized for brand protection, tamper-evidence, and temperature indication. Food packaging, in particular, benefits from these materials to ensure product freshness and safety by signaling temperature abuse. The cosmetics sector is also embracing thermochromic pigments for novel color-changing effects in makeup and nail polish. However, the market faces certain restraints, including the relatively higher cost of specialized thermochromic materials compared to conventional alternatives and stringent regulatory compliance in certain applications, especially those involving food contact. Despite these challenges, the Asia Pacific region is expected to emerge as a dominant force, driven by rapid industrialization, a burgeoning manufacturing base, and increasing consumer spending in countries like China and India. The United States and European nations also represent substantial markets, with a strong focus on innovation and high-value applications.

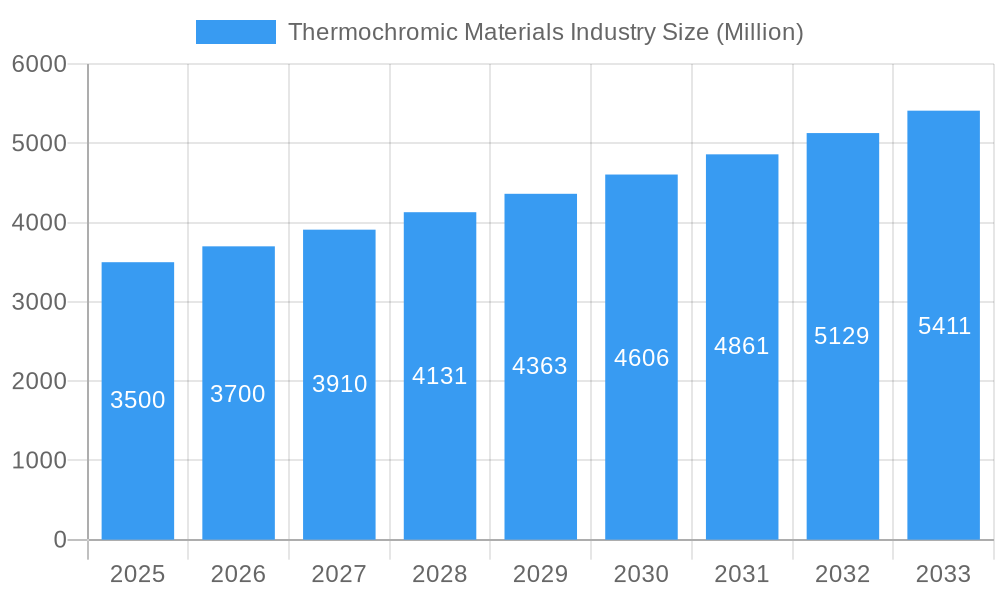

Thermochromic Materials Industry Company Market Share

Unveiling the Future: A Comprehensive Report on the Thermochromic Materials Industry Market (2019–2033)

This in-depth report provides a definitive analysis of the global Thermochromic Materials Industry, a dynamic sector driven by innovation and expanding applications. Leveraging extensive data from 2019–2024, with a base and estimated year of 2025, and a robust forecast period of 2025–2033, this report equips industry stakeholders with critical insights into market dynamics, competitive landscapes, and future growth trajectories. Our analysis covers key segments including Reversible and Irreversible Thermochromic Materials, with material types such as Liquid Crystal, Leuco Dyes, Pigments, and Other Materials. We delve into diverse applications ranging from Roof Coatings and Printing to Food Packaging and Cosmetics, exploring the intricate interplay of these elements.

Thermochromic Materials Industry Market Structure & Competitive Landscape

The Thermochromic Materials Industry exhibits a moderately concentrated market structure, with a blend of established global players and emerging specialists. Key innovation drivers include the constant demand for enhanced product functionality, improved energy efficiency, and advanced safety features across various applications. Regulatory impacts, particularly concerning material safety and environmental sustainability, are increasingly shaping product development and market entry strategies. The threat of product substitutes is moderate, with advancements in other smart materials posing a gradual challenge. End-user segmentation reveals a strong reliance on diverse industrial applications, with ongoing shifts towards consumer-facing products. Merger and acquisition (M&A) trends are observed to be active, with larger chemical conglomerates acquiring niche players to enhance their portfolios and technological capabilities. For instance, approximately 50 M&A activities are projected within the forecast period, primarily driven by the pursuit of innovative intellectual property and expanded market reach. Concentration ratios indicate that the top 5 players collectively hold an estimated 40% of the market share, suggesting room for further consolidation and competitive maneuvering.

- Market Concentration: Moderately concentrated with top players holding significant share.

- Innovation Drivers: Product functionality, energy efficiency, safety features, smart packaging.

- Regulatory Impacts: Increasing emphasis on material safety, environmental compliance, and labeling.

- Product Substitutes: Emerging smart materials and advanced sensor technologies.

- End-User Segmentation: Industrial coatings, printing, packaging, textiles, security features.

- M&A Trends: Strategic acquisitions by larger entities to gain technological prowess and market access.

Thermochromic Materials Industry Market Trends & Opportunities

The global Thermochromic Materials Industry is poised for substantial growth, projected to reach an estimated market size of over $5,000 Million by 2033. This expansion is underpinned by a compound annual growth rate (CAGR) of approximately 7.5% during the forecast period. A significant trend is the escalating demand for smart packaging solutions, driven by consumer preferences for products that indicate temperature integrity and freshness. In the food and beverage sector, thermochromic inks are crucial for maintaining product quality and reducing spoilage, representing a market penetration rate of over 30% for temperature-sensitive products. Technological shifts are characterized by the development of more durable, versatile, and cost-effective thermochromic formulations. The integration of thermochromic materials into the Internet of Things (IoT) ecosystem, enabling real-time monitoring and data logging, presents a nascent but rapidly growing opportunity.

Furthermore, the automotive industry is increasingly adopting thermochromic coatings for enhanced thermal management and aesthetic appeal, contributing an estimated $500 Million to the market by 2033. In the realm of construction, thermochromic roof coatings are gaining traction for their ability to reduce building energy consumption by reflecting solar radiation when temperatures rise, an application expected to contribute over $700 Million by the end of the forecast period. Consumer electronics are also emerging as a significant application area, with thermochromic indicators used for product authentication and user feedback. The increasing awareness of product safety and authenticity is fueling the demand for thermochromic security inks in banknotes, documents, and high-value goods. The competitive dynamics are intensifying, with companies focusing on R&D to develop advanced functionalities such as color-tunable thermochromic materials and multi-temperature indicators.

Opportunities abound in the development of sustainable and bio-based thermochromic materials, aligning with global environmental initiatives and consumer demand for eco-friendly products. The expansion of e-commerce and cold chain logistics further amplifies the need for reliable temperature monitoring, creating a sustained demand for thermochromic solutions. The printing industry, a traditional stronghold, continues to innovate with advanced printing techniques enabling intricate designs and widespread application of thermochromic inks. The cosmetics sector is also exploring novel applications, incorporating thermochromic effects for interactive product packaging and unique user experiences.

Dominant Markets & Segments in Thermochromic Materials Industry

The global Thermochromic Materials Industry is dominated by the Pigment material segment, which accounted for an estimated 60% of the market in 2025 and is projected to maintain its leadership throughout the forecast period, reaching a market value exceeding $3,000 Million. This dominance is attributed to the pigment's versatility, cost-effectiveness, and widespread applicability across various industries, including printing, packaging, and coatings. The Printing application segment is also a significant growth driver, expected to contribute over $2,000 Million by 2033, fueled by the demand for innovative packaging, security features, and promotional materials.

Regionally, Asia-Pacific is the leading market, driven by its robust manufacturing base, rapid industrialization, and increasing adoption of advanced materials in countries like China, India, and South Korea. The region's market size is estimated to exceed $2,500 Million by 2033. Key growth drivers in this region include substantial investments in infrastructure, favorable government policies supporting manufacturing and technological advancements, and a large consumer base demanding innovative products.

Within the Type segmentation, Reversible Thermochromic Materials hold a larger market share, estimated at over 70% of the total thermochromic material market, due to their ability to change color multiple times with temperature fluctuations, making them ideal for applications requiring continuous monitoring and feedback, such as smart packaging and temperature indicators. The Leuco Dyes material segment, while smaller than pigments, is experiencing rapid growth, particularly in applications requiring vibrant color changes and complex patterns.

The Food Packaging application segment is another major contributor, driven by stringent food safety regulations and the consumer's desire for visual assurance of product freshness. This segment is projected to grow at a CAGR of 8.2%, reaching an estimated $1,500 Million by 2033. The Roof Coatings application is witnessing a surge in demand due to increasing awareness of energy efficiency and sustainable building practices.

- Dominant Material: Pigment

- Growth Drivers: Versatility, cost-effectiveness, wide range of applications.

- Market Share: Over 60% in 2025, projected to exceed $3,000 Million by 2033.

- Dominant Application: Printing

- Growth Drivers: Innovative packaging, security printing, promotional materials.

- Market Value: Estimated to exceed $2,000 Million by 2033.

- Dominant Region: Asia-Pacific

- Growth Drivers: Industrialization, manufacturing prowess, supportive government policies.

- Market Size: Estimated to exceed $2,500 Million by 2033.

- Leading Type: Reversible Thermochromic Material

- Growth Drivers: Continuous temperature monitoring, reusability.

- Market Share: Over 70% of the thermochromic material market.

- Key Growing Application: Food Packaging

- Growth Drivers: Food safety regulations, consumer demand for freshness indicators.

- CAGR: 8.2%, projected market value of $1,500 Million by 2033.

Thermochromic Materials Industry Product Analysis

The Thermochromic Materials Industry is characterized by continuous product innovation, focusing on enhanced color stability, wider operating temperature ranges, and improved durability. Key advancements include the development of microencapsulated thermochromic pigments that offer superior protection against environmental factors and enable finer printing resolutions. Liquid crystal-based thermochromic materials are gaining traction for their high sensitivity and precise temperature indication capabilities, particularly in medical applications and advanced sensors. The competitive advantage for manufacturers lies in developing proprietary formulations that offer unique color palettes, faster response times, and greater resistance to UV radiation and chemical exposure, thereby catering to niche market demands and premium applications.

Key Drivers, Barriers & Challenges in Thermochromic Materials Industry

The growth of the Thermochromic Materials Industry is propelled by several key drivers. Technologically, the demand for advanced functionality in packaging, textiles, and coatings, coupled with the increasing integration of smart materials into everyday products, is a significant catalyst. Economically, the rising consumer awareness of product safety and quality, especially in the food and pharmaceutical sectors, is driving adoption. Policy-driven factors, such as government initiatives promoting energy efficiency and sustainable manufacturing, also play a crucial role. For instance, stringent regulations on food spoilage monitoring are directly fueling demand for thermochromic indicators.

However, the industry faces several challenges. Supply chain issues, particularly concerning the availability and price volatility of raw materials, can impact production costs and lead times. Regulatory hurdles, including evolving chemical safety standards and compliance requirements in different regions, add complexity for manufacturers. Competitive pressures are intensifying as more players enter the market, leading to price erosion in some segments. The relatively higher cost of some advanced thermochromic materials compared to conventional alternatives can also act as a restraint, particularly in price-sensitive markets.

Growth Drivers in the Thermochromic Materials Industry Market

The growth of the Thermochromic Materials Industry is primarily fueled by technological advancements, such as the development of more sensitive and durable thermochromic formulations, enabling their integration into a wider array of products. Economically, the increasing consumer demand for smart packaging, which enhances product safety and consumer experience, is a significant driver. Government regulations promoting energy efficiency, particularly in building materials like roof coatings, also contribute to market expansion. Furthermore, the growing use of thermochromic inks in security printing for authentication purposes across currencies, official documents, and brand protection is a consistent growth catalyst.

Challenges Impacting Thermochromic Materials Industry Growth

Several challenges can impede the growth of the Thermochromic Materials Industry. Regulatory complexities surrounding the use of certain chemicals in thermochromic formulations in different geographical regions can hinder market entry and product development. Supply chain disruptions and the fluctuating costs of raw materials, essential for pigment and dye production, can impact profitability and product pricing. Intense competitive pressures from both established players and new entrants can lead to price wars and reduced profit margins. The higher initial cost of some advanced thermochromic solutions compared to traditional materials can also be a barrier to widespread adoption in cost-sensitive applications, thus slowing down market penetration.

Key Players Shaping the Thermochromic Materials Industry Market

- LCR Hallcrest LLC

- Hali Pigment Co Ltd

- Chromatic Technologies Inc

- QCR Solutions Corp

- OliKrom

- SFXC

- MICI

- RPM International Inc

- Good Life Innovations Ltd

- FX Pigments Pvt Ltd

- Smarol Industry Co Ltd

- Kolortek Co Ltd

- Kolorjet Chemicals Pvt Ltd

- Colourchange

Significant Thermochromic Materials Industry Industry Milestones

- 2019: Introduction of advanced UV-curable thermochromic inks for high-speed printing applications.

- 2020: Launch of bio-based thermochromic materials, addressing growing environmental concerns.

- 2021: Significant investment in R&D for multi-functional thermochromic coatings with self-healing properties.

- 2022: Expansion of thermochromic applications in the medical device industry for temperature monitoring.

- 2023: Increased focus on developing thermochromic materials for smart textiles and wearable technology.

- 2024: Strategic partnerships formed to enhance supply chain resilience and raw material sourcing.

Future Outlook for Thermochromic Materials Industry Market

The future outlook for the Thermochromic Materials Industry is highly promising, driven by continued innovation and expanding applications. Strategic opportunities lie in the development of even more sophisticated thermochromic functionalities, such as dynamically tunable colors and integrated sensing capabilities for the Internet of Things. The growing emphasis on sustainability will create a significant market for eco-friendly and recyclable thermochromic solutions. Emerging markets in developing economies present substantial untapped potential. The convergence of thermochromic technology with other smart materials and advanced manufacturing techniques will unlock novel product categories and reinforce the industry's growth trajectory, reaching an estimated market value of over $5,000 Million by 2033.

Thermochromic Materials Industry Segmentation

-

1. Type

- 1.1. Reversible Thermochromic Material

- 1.2. Irreversible Thermochromic Material

-

2. Material

- 2.1. Liquid Crystal

- 2.2. Leuco Dyes

- 2.3. Pigment

- 2.4. Other Materials

-

3. Application

- 3.1. Roof Coatings

- 3.2. Printing

- 3.3. Food Packaging

- 3.4. Cosmetics

- 3.5. Other Applications

Thermochromic Materials Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Thermochromic Materials Industry Regional Market Share

Geographic Coverage of Thermochromic Materials Industry

Thermochromic Materials Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Increasing Demand for Themochromic Material as Roof Coat; Growing Demand of Thermochromic Ink in Printing

- 3.2.2 Packaging

- 3.2.3 and High Temperature Alert Warnings; Others Drivers

- 3.3. Market Restrains

- 3.3.1 ; Increasing Demand for Themochromic Material as Roof Coat; Growing Demand of Thermochromic Ink in Printing

- 3.3.2 Packaging

- 3.3.3 and High Temperature Alert Warnings; Others Drivers

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Thermochromic Material as Roof Coat

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Thermochromic Materials Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Reversible Thermochromic Material

- 5.1.2. Irreversible Thermochromic Material

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Liquid Crystal

- 5.2.2. Leuco Dyes

- 5.2.3. Pigment

- 5.2.4. Other Materials

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Roof Coatings

- 5.3.2. Printing

- 5.3.3. Food Packaging

- 5.3.4. Cosmetics

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East

- 5.4.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Thermochromic Materials Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Reversible Thermochromic Material

- 6.1.2. Irreversible Thermochromic Material

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Liquid Crystal

- 6.2.2. Leuco Dyes

- 6.2.3. Pigment

- 6.2.4. Other Materials

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Roof Coatings

- 6.3.2. Printing

- 6.3.3. Food Packaging

- 6.3.4. Cosmetics

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Thermochromic Materials Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Reversible Thermochromic Material

- 7.1.2. Irreversible Thermochromic Material

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Liquid Crystal

- 7.2.2. Leuco Dyes

- 7.2.3. Pigment

- 7.2.4. Other Materials

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Roof Coatings

- 7.3.2. Printing

- 7.3.3. Food Packaging

- 7.3.4. Cosmetics

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Thermochromic Materials Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Reversible Thermochromic Material

- 8.1.2. Irreversible Thermochromic Material

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Liquid Crystal

- 8.2.2. Leuco Dyes

- 8.2.3. Pigment

- 8.2.4. Other Materials

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Roof Coatings

- 8.3.2. Printing

- 8.3.3. Food Packaging

- 8.3.4. Cosmetics

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Thermochromic Materials Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Reversible Thermochromic Material

- 9.1.2. Irreversible Thermochromic Material

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Liquid Crystal

- 9.2.2. Leuco Dyes

- 9.2.3. Pigment

- 9.2.4. Other Materials

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Roof Coatings

- 9.3.2. Printing

- 9.3.3. Food Packaging

- 9.3.4. Cosmetics

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Thermochromic Materials Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Reversible Thermochromic Material

- 10.1.2. Irreversible Thermochromic Material

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Liquid Crystal

- 10.2.2. Leuco Dyes

- 10.2.3. Pigment

- 10.2.4. Other Materials

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Roof Coatings

- 10.3.2. Printing

- 10.3.3. Food Packaging

- 10.3.4. Cosmetics

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Saudi Arabia Thermochromic Materials Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Reversible Thermochromic Material

- 11.1.2. Irreversible Thermochromic Material

- 11.2. Market Analysis, Insights and Forecast - by Material

- 11.2.1. Liquid Crystal

- 11.2.2. Leuco Dyes

- 11.2.3. Pigment

- 11.2.4. Other Materials

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Roof Coatings

- 11.3.2. Printing

- 11.3.3. Food Packaging

- 11.3.4. Cosmetics

- 11.3.5. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 LCR Hallcrest LLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Hali Pigment Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Chromatic Technologies Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 QCR Solutions Corp

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 OliKrom

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 SFXC

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 MICI

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 RPM International Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Good Life Innovations Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 FX Pigments Pvt Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Smarol Industry Co Ltd

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Kolortek Co Ltd

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Kolorjet Chemicals Pvt Ltd

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Colourchange*List Not Exhaustive

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 LCR Hallcrest LLC

List of Figures

- Figure 1: Global Thermochromic Materials Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Thermochromic Materials Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: Asia Pacific Thermochromic Materials Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Thermochromic Materials Industry Revenue (Million), by Material 2025 & 2033

- Figure 5: Asia Pacific Thermochromic Materials Industry Revenue Share (%), by Material 2025 & 2033

- Figure 6: Asia Pacific Thermochromic Materials Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: Asia Pacific Thermochromic Materials Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Asia Pacific Thermochromic Materials Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Asia Pacific Thermochromic Materials Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Thermochromic Materials Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: North America Thermochromic Materials Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: North America Thermochromic Materials Industry Revenue (Million), by Material 2025 & 2033

- Figure 13: North America Thermochromic Materials Industry Revenue Share (%), by Material 2025 & 2033

- Figure 14: North America Thermochromic Materials Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: North America Thermochromic Materials Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: North America Thermochromic Materials Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Thermochromic Materials Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Thermochromic Materials Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Europe Thermochromic Materials Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Thermochromic Materials Industry Revenue (Million), by Material 2025 & 2033

- Figure 21: Europe Thermochromic Materials Industry Revenue Share (%), by Material 2025 & 2033

- Figure 22: Europe Thermochromic Materials Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Europe Thermochromic Materials Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Thermochromic Materials Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Thermochromic Materials Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Thermochromic Materials Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: South America Thermochromic Materials Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Thermochromic Materials Industry Revenue (Million), by Material 2025 & 2033

- Figure 29: South America Thermochromic Materials Industry Revenue Share (%), by Material 2025 & 2033

- Figure 30: South America Thermochromic Materials Industry Revenue (Million), by Application 2025 & 2033

- Figure 31: South America Thermochromic Materials Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America Thermochromic Materials Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Thermochromic Materials Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Thermochromic Materials Industry Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East Thermochromic Materials Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East Thermochromic Materials Industry Revenue (Million), by Material 2025 & 2033

- Figure 37: Middle East Thermochromic Materials Industry Revenue Share (%), by Material 2025 & 2033

- Figure 38: Middle East Thermochromic Materials Industry Revenue (Million), by Application 2025 & 2033

- Figure 39: Middle East Thermochromic Materials Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East Thermochromic Materials Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East Thermochromic Materials Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Saudi Arabia Thermochromic Materials Industry Revenue (Million), by Type 2025 & 2033

- Figure 43: Saudi Arabia Thermochromic Materials Industry Revenue Share (%), by Type 2025 & 2033

- Figure 44: Saudi Arabia Thermochromic Materials Industry Revenue (Million), by Material 2025 & 2033

- Figure 45: Saudi Arabia Thermochromic Materials Industry Revenue Share (%), by Material 2025 & 2033

- Figure 46: Saudi Arabia Thermochromic Materials Industry Revenue (Million), by Application 2025 & 2033

- Figure 47: Saudi Arabia Thermochromic Materials Industry Revenue Share (%), by Application 2025 & 2033

- Figure 48: Saudi Arabia Thermochromic Materials Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Saudi Arabia Thermochromic Materials Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Thermochromic Materials Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Thermochromic Materials Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 3: Global Thermochromic Materials Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Thermochromic Materials Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Thermochromic Materials Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Thermochromic Materials Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 7: Global Thermochromic Materials Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Thermochromic Materials Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Thermochromic Materials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Thermochromic Materials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Japan Thermochromic Materials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Thermochromic Materials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Thermochromic Materials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Thermochromic Materials Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 15: Global Thermochromic Materials Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 16: Global Thermochromic Materials Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global Thermochromic Materials Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: United States Thermochromic Materials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Canada Thermochromic Materials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Mexico Thermochromic Materials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Thermochromic Materials Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Thermochromic Materials Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 23: Global Thermochromic Materials Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Thermochromic Materials Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Germany Thermochromic Materials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Thermochromic Materials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: France Thermochromic Materials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Italy Thermochromic Materials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Thermochromic Materials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Thermochromic Materials Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 31: Global Thermochromic Materials Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 32: Global Thermochromic Materials Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Global Thermochromic Materials Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Brazil Thermochromic Materials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Argentina Thermochromic Materials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Thermochromic Materials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Thermochromic Materials Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Thermochromic Materials Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 39: Global Thermochromic Materials Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Global Thermochromic Materials Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Global Thermochromic Materials Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 42: Global Thermochromic Materials Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 43: Global Thermochromic Materials Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Global Thermochromic Materials Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 45: South Africa Thermochromic Materials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East Thermochromic Materials Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thermochromic Materials Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Thermochromic Materials Industry?

Key companies in the market include LCR Hallcrest LLC, Hali Pigment Co Ltd, Chromatic Technologies Inc, QCR Solutions Corp, OliKrom, SFXC, MICI, RPM International Inc, Good Life Innovations Ltd, FX Pigments Pvt Ltd, Smarol Industry Co Ltd, Kolortek Co Ltd, Kolorjet Chemicals Pvt Ltd, Colourchange*List Not Exhaustive.

3. What are the main segments of the Thermochromic Materials Industry?

The market segments include Type, Material, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Themochromic Material as Roof Coat; Growing Demand of Thermochromic Ink in Printing. Packaging. and High Temperature Alert Warnings; Others Drivers.

6. What are the notable trends driving market growth?

Increasing Demand for Thermochromic Material as Roof Coat.

7. Are there any restraints impacting market growth?

; Increasing Demand for Themochromic Material as Roof Coat; Growing Demand of Thermochromic Ink in Printing. Packaging. and High Temperature Alert Warnings; Others Drivers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thermochromic Materials Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thermochromic Materials Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thermochromic Materials Industry?

To stay informed about further developments, trends, and reports in the Thermochromic Materials Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence