Key Insights

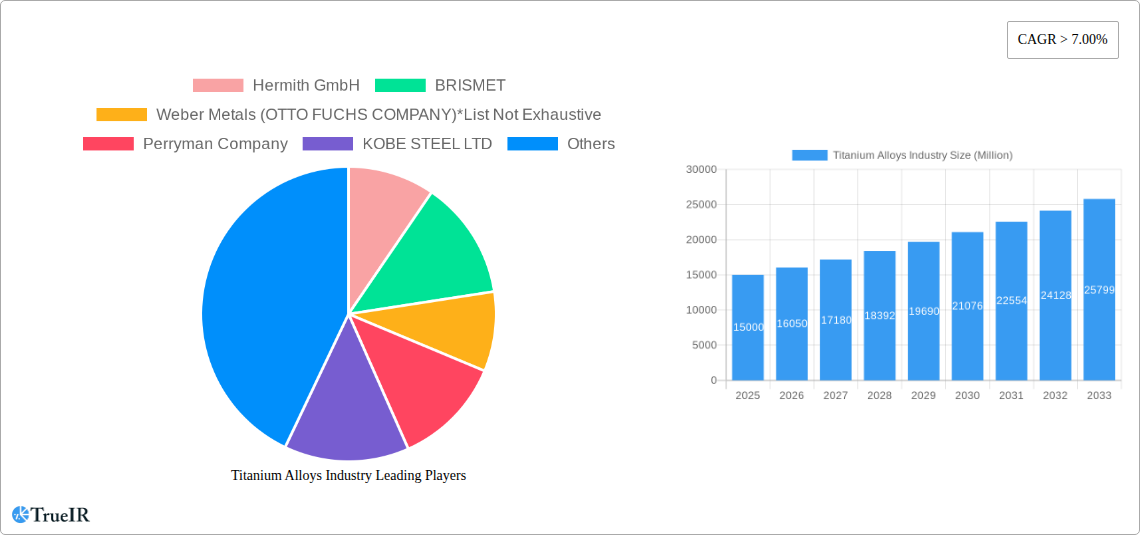

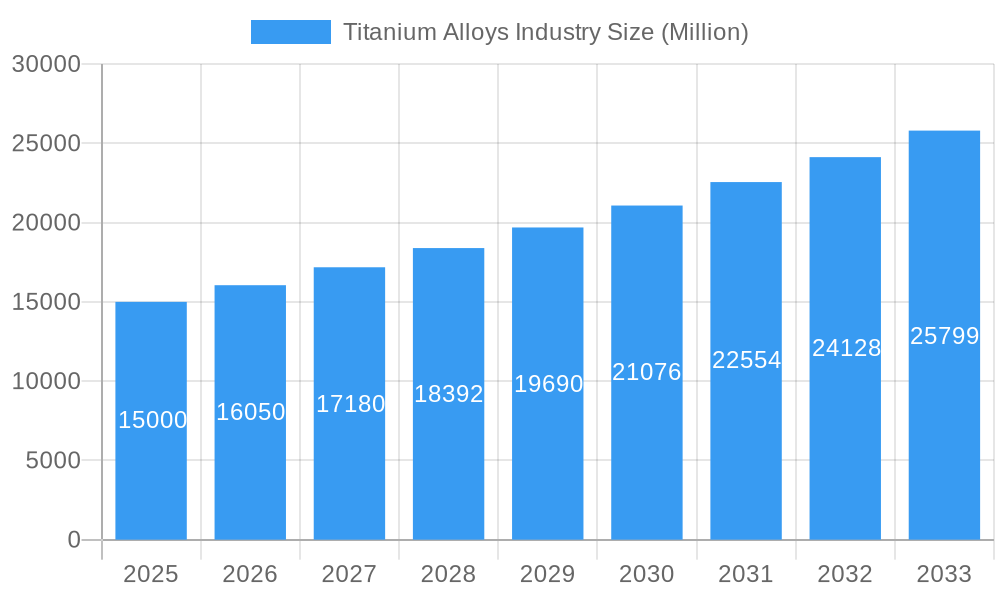

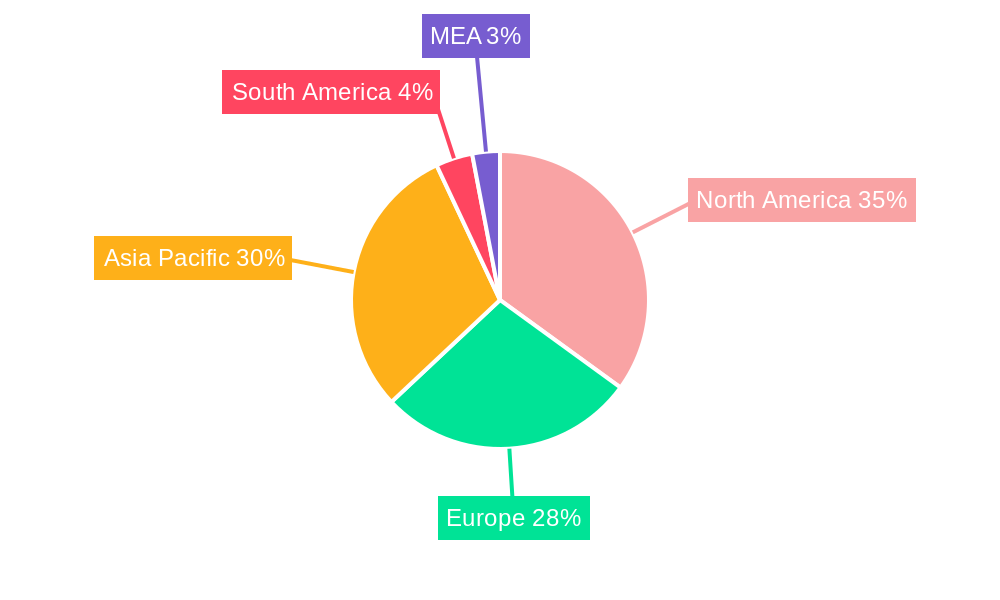

The titanium alloys market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 7% from 2025 to 2033. This expansion is driven by increasing demand across diverse end-user industries. The aerospace sector, a significant consumer of titanium alloys due to their high strength-to-weight ratio and corrosion resistance, remains a primary growth driver. Automotive and shipbuilding industries are also contributing significantly, with a growing adoption of titanium alloys in lightweighting initiatives to improve fuel efficiency and performance. The chemical and power generation sectors are further bolstering market growth, driven by the need for corrosion-resistant materials in demanding environments. Technological advancements leading to improved alloy properties and processing techniques are also fueling market expansion. The market is segmented by microstructure (alpha, alpha-beta, and beta alloys) and end-user industry, with alpha and near-alpha alloys currently holding the largest market share due to their superior weldability and formability. While the high cost of titanium alloys remains a restraining factor, ongoing research and development efforts aimed at cost reduction and improved processing efficiency are expected to mitigate this challenge. Geographically, North America and Asia Pacific are key regions, with China and the United States representing substantial market shares. Europe's established aerospace and automotive sectors also contribute significantly to the regional market. Competitive dynamics are shaped by a mix of established players like VSMPO-AVISMA Corporation, ATI, and Kobe Steel, along with smaller specialized producers catering to niche applications.

Titanium Alloys Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates a continued upward trajectory for the titanium alloys market. Emerging applications in medical implants, sporting goods, and other specialized industries are expected to further contribute to growth. However, economic fluctuations and supply chain vulnerabilities can potentially impact market growth. Manufacturers are actively focusing on optimizing production processes and developing innovative alloys with enhanced properties to enhance competitiveness and meet the evolving demands of various industries. Sustainable manufacturing practices and efforts to minimize the environmental footprint of titanium alloy production are also gaining traction, reflecting the growing emphasis on environmental responsibility within the industry. The market’s future success hinges on addressing cost challenges while continuing to innovate and meet the demands of high-growth sectors.

Titanium Alloys Industry Company Market Share

Titanium Alloys Industry Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the global titanium alloys industry, offering invaluable insights for stakeholders across the value chain. With a focus on market dynamics, competitive landscapes, and future growth projections, this report is a must-read for industry professionals, investors, and researchers. The study period spans 2019-2033, with 2025 serving as the base and estimated year.

Titanium Alloys Industry Market Structure & Competitive Landscape

The titanium alloys market is characterized by a moderately concentrated structure, with several major players dominating global production and sales. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately consolidated market. Innovation is a key driver, with companies continuously developing advanced alloys with improved strength-to-weight ratios, corrosion resistance, and high-temperature capabilities. Stringent regulatory frameworks, particularly concerning environmental protection and worker safety, significantly impact market operations. Product substitutes, such as aluminum alloys and composites, present competitive pressure, though titanium's unique properties maintain its dominance in specific high-value applications. The market is segmented by end-user industry (aerospace, automotive and shipbuilding, chemical, power and desalination, and others) and microstructure (alpha and near-alpha, alpha-beta, and beta alloys). M&A activity has been moderate in recent years, with a total transaction value estimated at xx Million USD between 2019 and 2024. Key trends include strategic partnerships for technology advancement and capacity expansion.

- Market Concentration: Estimated HHI of xx indicates moderate consolidation.

- Innovation Drivers: Development of advanced alloys with superior properties.

- Regulatory Impacts: Stringent environmental and safety regulations.

- Product Substitutes: Competition from aluminum alloys and composites.

- End-User Segmentation: Significant variation in demand across sectors.

- M&A Trends: Moderate activity with a focus on technological synergy.

Titanium Alloys Industry Market Trends & Opportunities

The global titanium alloys market is poised for significant growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by increasing demand from key end-use sectors, particularly aerospace, driven by the ongoing expansion of the global air travel market and military applications. Technological advancements, including the development of additive manufacturing techniques and improved alloy formulations, are further boosting market expansion. Consumer preferences for lightweight, high-strength materials in various applications also play a critical role. Intense competition among manufacturers is leading to price pressures; however, innovation and specialization continue to create opportunities for differentiation and premium pricing. Market penetration rates for titanium alloys are expected to increase significantly in emerging markets, driven by investments in infrastructure and industrial development. The aerospace sector is estimated to capture xx% of the market share in 2033, while automotive and shipbuilding contribute approximately xx%.

Dominant Markets & Segments in Titanium Alloys Industry

The aerospace sector is currently the dominant end-user industry for titanium alloys, accounting for approximately xx Million USD in 2025. The increasing demand for lightweight, high-strength materials in aircraft manufacturing, including next-generation aircraft and military aviation, drives this dominance. Within microstructure, alpha and near-alpha alloys hold the largest market share due to their superior corrosion resistance and excellent mechanical properties at elevated temperatures. North America and Europe represent significant markets, benefiting from a well-established aerospace industry and high technological advancements. Asia-Pacific is emerging as a rapidly growing market, driven by increasing investments in infrastructure and industrialization.

- Key Growth Drivers for Aerospace:

- Increasing aircraft production and fleet expansion.

- Demand for lightweight and high-performance materials in military aviation.

- Technological advancements in additive manufacturing and alloy design.

- Key Growth Drivers for Alpha and Near-alpha Alloys:

- Superior corrosion resistance.

- Excellent mechanical properties at high temperatures.

- Wide applicability in demanding aerospace applications.

- Dominant Regions: North America, Europe, and increasingly, Asia-Pacific.

Titanium Alloys Industry Product Analysis

Titanium alloy products showcase significant diversity, encompassing various forms like sheets, plates, bars, forgings, and castings. These are tailored to specific applications, prioritizing performance characteristics such as strength-to-weight ratio, corrosion resistance, and high-temperature stability. Technological advancements like additive manufacturing, enable complex geometries and reduced material waste, leading to customized solutions. Innovations in alloy compositions further enhance performance and expand usage. The market's competitive landscape hinges on achieving optimal performance parameters for specific end-user sectors, particularly in aerospace, where weight reduction is paramount.

Key Drivers, Barriers & Challenges in Titanium Alloys Industry

Key Drivers: Technological advancements in alloy development and processing, growing demand from the aerospace and defense sectors, and governmental incentives for the adoption of lightweight and high-performance materials drive market growth. Specific examples include the increasing popularity of additive manufacturing and the development of new alloys with enhanced properties.

Challenges: The high cost of titanium alloys compared to alternative materials presents a significant challenge. Supply chain disruptions, geopolitical instability and trade restrictions, and environmental concerns related to titanium processing also hinder growth. Additionally, the complexity and high capital cost of processing present barriers to entry for new players.

Growth Drivers in the Titanium Alloys Industry Market

Technological advancements in alloy formulations, particularly in improving strength-to-weight ratios and high-temperature properties, are major drivers. Increased demand from aerospace and defense sectors, fuelled by modernization and fleet expansion, substantially impacts growth. Furthermore, supportive government policies and incentives aimed at promoting lightweight materials in various industries contribute significantly.

Challenges Impacting Titanium Alloys Industry Growth

High production costs due to energy-intensive processing and expensive raw materials limit market penetration. Supply chain vulnerabilities and geopolitical uncertainties create instability. Stringent environmental regulations related to processing and waste management impose additional operational challenges. Finally, intense competition from alternative materials like aluminum and composites puts pressure on pricing and market share.

Key Players Shaping the Titanium Alloys Industry Market

- Hermith GmbH

- BRISMET

- Weber Metals (OTTO FUCHS COMPANY)

- Perryman Company

- KOBE STEEL LTD

- ATI

- Daido Steel Co Ltd

- Toho Titanium Co Ltd

- VSMPO-AVISMA Corporation

- Howmet Aerospace

- CRS Holdings LLC

- Eramet

- M/s Bansal Brothers

- AMG Advanced Metallurgical Group N V

- Mishra Dhatu Nigam Limited

- TIMET (Precision Castparts Corp)

Significant Titanium Alloys Industry Industry Milestones

- November 2022: PTC Industries and Mishra Dhatu Nigam (MIDHANI) signed an MOU for a technological partnership to manufacture titanium alloy components for defense and aerospace. This collaboration fosters domestic production and strengthens the supply chain.

- July 2022: Perryman Company announced plans to significantly expand its titanium melting capacity by 16 Million pounds, solidifying its position as a leading global producer. This expansion enhances global supply and supports industry growth.

Future Outlook for Titanium Alloys Industry Market

The titanium alloys market is projected to witness sustained growth, driven by continuous technological advancements, increasing demand from high-growth sectors, and supportive government initiatives. Strategic partnerships and investments in capacity expansion will further bolster market expansion. The market's future hinges on addressing cost and supply chain challenges while capitalizing on opportunities in emerging applications and technologies.

Titanium Alloys Industry Segmentation

-

1. Microstructure

- 1.1. Alpha and Near-alpha Alloy

- 1.2. Alpha-beta Alloy

- 1.3. Beta Alloy

-

2. End-user Industry

- 2.1. Aerospace

- 2.2. Automotive and Shipbuilding

- 2.3. Chemical

- 2.4. Power and Desalination

- 2.5. Other End-user Industries

Titanium Alloys Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Titanium Alloys Industry Regional Market Share

Geographic Coverage of Titanium Alloys Industry

Titanium Alloys Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Usage of Titanium Alloys in the Aerospace Sector; Increasing Demand for Titanium Alloys for Combat Vehicles to Replace Steel and Aluminum

- 3.3. Market Restrains

- 3.3.1. High Reactivity of Alloy Demands Specialized Care During Production; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Demand of Titanium Alloys in the Aerospace Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Titanium Alloys Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Microstructure

- 5.1.1. Alpha and Near-alpha Alloy

- 5.1.2. Alpha-beta Alloy

- 5.1.3. Beta Alloy

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Aerospace

- 5.2.2. Automotive and Shipbuilding

- 5.2.3. Chemical

- 5.2.4. Power and Desalination

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Microstructure

- 6. Asia Pacific Titanium Alloys Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Microstructure

- 6.1.1. Alpha and Near-alpha Alloy

- 6.1.2. Alpha-beta Alloy

- 6.1.3. Beta Alloy

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Aerospace

- 6.2.2. Automotive and Shipbuilding

- 6.2.3. Chemical

- 6.2.4. Power and Desalination

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Microstructure

- 7. North America Titanium Alloys Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Microstructure

- 7.1.1. Alpha and Near-alpha Alloy

- 7.1.2. Alpha-beta Alloy

- 7.1.3. Beta Alloy

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Aerospace

- 7.2.2. Automotive and Shipbuilding

- 7.2.3. Chemical

- 7.2.4. Power and Desalination

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Microstructure

- 8. Europe Titanium Alloys Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Microstructure

- 8.1.1. Alpha and Near-alpha Alloy

- 8.1.2. Alpha-beta Alloy

- 8.1.3. Beta Alloy

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Aerospace

- 8.2.2. Automotive and Shipbuilding

- 8.2.3. Chemical

- 8.2.4. Power and Desalination

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Microstructure

- 9. Rest of the World Titanium Alloys Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Microstructure

- 9.1.1. Alpha and Near-alpha Alloy

- 9.1.2. Alpha-beta Alloy

- 9.1.3. Beta Alloy

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Aerospace

- 9.2.2. Automotive and Shipbuilding

- 9.2.3. Chemical

- 9.2.4. Power and Desalination

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Microstructure

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Hermith GmbH

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 BRISMET

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Weber Metals (OTTO FUCHS COMPANY)*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Perryman Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 KOBE STEEL LTD

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 ATI

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Daido Steel Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Toho Titanium Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 VSMPO-AVISMA Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Howmet Aerospace

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 CRS Holdings LLC

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Eramet

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 M/s Bansal Brothers

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 AMG Advanced Metallurgical Group N V

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Mishra Dhatu Nigam Limited

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 TIMET (Precision Castparts Corp )

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.1 Hermith GmbH

List of Figures

- Figure 1: Global Titanium Alloys Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Titanium Alloys Industry Revenue (undefined), by Microstructure 2025 & 2033

- Figure 3: Asia Pacific Titanium Alloys Industry Revenue Share (%), by Microstructure 2025 & 2033

- Figure 4: Asia Pacific Titanium Alloys Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Titanium Alloys Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Titanium Alloys Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Titanium Alloys Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Titanium Alloys Industry Revenue (undefined), by Microstructure 2025 & 2033

- Figure 9: North America Titanium Alloys Industry Revenue Share (%), by Microstructure 2025 & 2033

- Figure 10: North America Titanium Alloys Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: North America Titanium Alloys Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Titanium Alloys Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Titanium Alloys Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Titanium Alloys Industry Revenue (undefined), by Microstructure 2025 & 2033

- Figure 15: Europe Titanium Alloys Industry Revenue Share (%), by Microstructure 2025 & 2033

- Figure 16: Europe Titanium Alloys Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Europe Titanium Alloys Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Titanium Alloys Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Titanium Alloys Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Titanium Alloys Industry Revenue (undefined), by Microstructure 2025 & 2033

- Figure 21: Rest of the World Titanium Alloys Industry Revenue Share (%), by Microstructure 2025 & 2033

- Figure 22: Rest of the World Titanium Alloys Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Rest of the World Titanium Alloys Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Rest of the World Titanium Alloys Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Titanium Alloys Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Titanium Alloys Industry Revenue undefined Forecast, by Microstructure 2020 & 2033

- Table 2: Global Titanium Alloys Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Titanium Alloys Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Titanium Alloys Industry Revenue undefined Forecast, by Microstructure 2020 & 2033

- Table 5: Global Titanium Alloys Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Titanium Alloys Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Titanium Alloys Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Titanium Alloys Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Titanium Alloys Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Titanium Alloys Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Titanium Alloys Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Titanium Alloys Industry Revenue undefined Forecast, by Microstructure 2020 & 2033

- Table 13: Global Titanium Alloys Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Titanium Alloys Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United States Titanium Alloys Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Titanium Alloys Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Mexico Titanium Alloys Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Titanium Alloys Industry Revenue undefined Forecast, by Microstructure 2020 & 2033

- Table 19: Global Titanium Alloys Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Titanium Alloys Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Germany Titanium Alloys Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Titanium Alloys Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy Titanium Alloys Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: France Titanium Alloys Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Titanium Alloys Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Titanium Alloys Industry Revenue undefined Forecast, by Microstructure 2020 & 2033

- Table 27: Global Titanium Alloys Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Titanium Alloys Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: South America Titanium Alloys Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Middle East and Africa Titanium Alloys Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Titanium Alloys Industry?

The projected CAGR is approximately 4.82%.

2. Which companies are prominent players in the Titanium Alloys Industry?

Key companies in the market include Hermith GmbH, BRISMET, Weber Metals (OTTO FUCHS COMPANY)*List Not Exhaustive, Perryman Company, KOBE STEEL LTD, ATI, Daido Steel Co Ltd, Toho Titanium Co Ltd, VSMPO-AVISMA Corporation, Howmet Aerospace, CRS Holdings LLC, Eramet, M/s Bansal Brothers, AMG Advanced Metallurgical Group N V, Mishra Dhatu Nigam Limited, TIMET (Precision Castparts Corp ).

3. What are the main segments of the Titanium Alloys Industry?

The market segments include Microstructure, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Usage of Titanium Alloys in the Aerospace Sector; Increasing Demand for Titanium Alloys for Combat Vehicles to Replace Steel and Aluminum.

6. What are the notable trends driving market growth?

Increasing Demand of Titanium Alloys in the Aerospace Industry.

7. Are there any restraints impacting market growth?

High Reactivity of Alloy Demands Specialized Care During Production; Other Restraints.

8. Can you provide examples of recent developments in the market?

In November 2022, PTC Industries and Defence PSU Mishra Dhatu Nigam (MIDHANI) signed a memorandum of understanding (MOU) for a technological partnership. In accordance with their MOU, PTC Industries and Midhani will make use of each other's technological resources to manufacture titanium alloy pipes and tubes using locally processed raw materials; manufacture titanium alloy plates and sheets; and fabricate critical parts and LRUs for the defense and aerospace industries using PTC's advanced machining facility and Midhani's forged and rolled products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Titanium Alloys Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Titanium Alloys Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Titanium Alloys Industry?

To stay informed about further developments, trends, and reports in the Titanium Alloys Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence