Key Insights

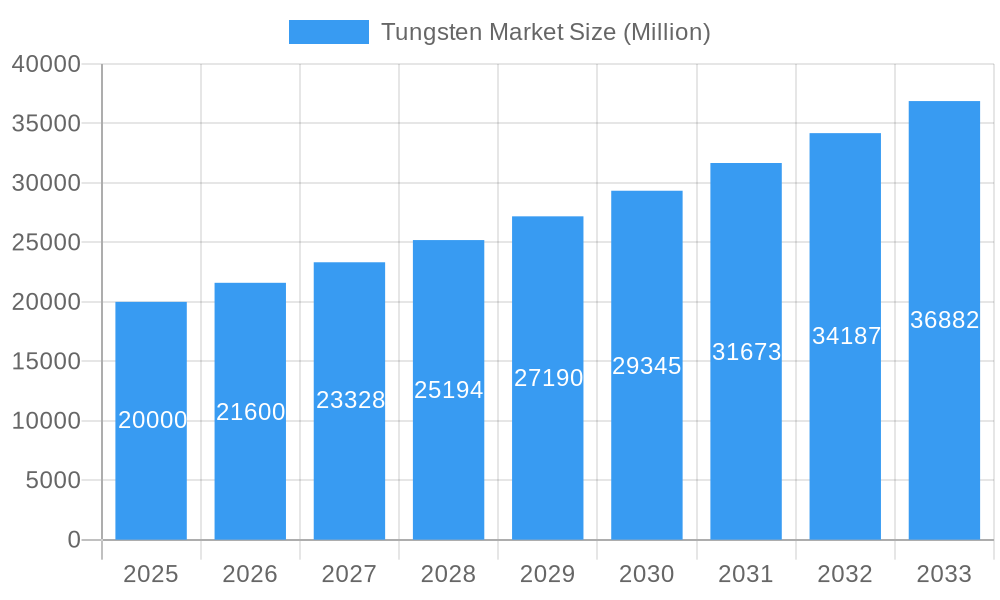

The global tungsten market is poised for substantial growth, with projections indicating a market size of 6.41 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 8% from 2025 to 2033. This expansion is primarily fueled by robust demand in critical sectors including automotive and aerospace, where tungsten's superior properties—such as high melting point, exceptional hardness, and wear resistance—are essential. The expanding electrical and electronics industry also plays a significant role, utilizing tungsten's conductivity and durability in components like filaments and electrodes. The market's trajectory is further supported by the increasing adoption of advanced manufacturing processes and the growing demand for sophisticated machine tools and equipment. Emerging applications in defense and medical devices are also anticipated to contribute to market expansion.

Tungsten Market Market Size (In Billion)

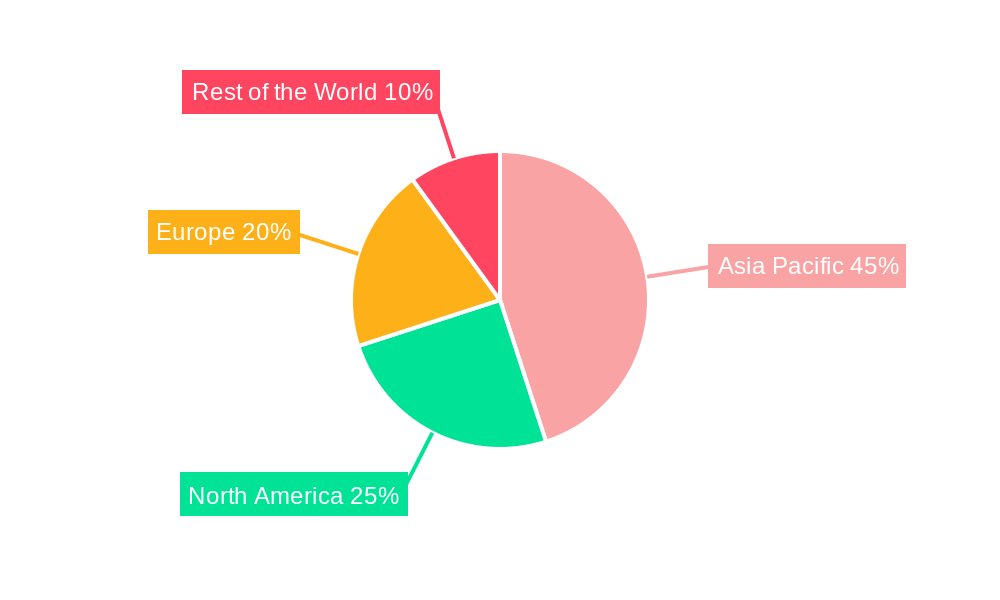

Market segmentation highlights significant contributions from Tungsten Mill Products and Tungsten Alloys, driven by their widespread industrial application. The "Foils" and "Ribbons" segments are experiencing consistent growth, owing to their vital role in specialized electronic components and lighting. Geographically, the Asia Pacific region, led by China, dominates the market share due to its extensive manufacturing infrastructure and substantial tungsten reserves. North America and Europe are also key markets, propelled by advanced technological applications and rigorous quality standards. Market challenges, including the fluctuating prices of raw tungsten ore and environmental regulations surrounding its extraction and processing, are being addressed through technological innovations in recycling and the development of more efficient production methodologies. The competitive environment features established global leaders alongside a growing number of regional manufacturers, all focused on innovation and market consolidation.

Tungsten Market Company Market Share

Unveiling the Global Tungsten Market: A Comprehensive Analysis 2019–2033

This in-depth report provides a dynamic, SEO-optimized exploration of the global Tungsten Market, leveraging high-volume keywords to enhance search rankings and engage industry audiences. Our analysis spans the historical period of 2019–2024, the base year of 2025, and extends to a comprehensive forecast period of 2025–2033. With an estimated market size reaching 100 Million by 2025, this report delves into the intricate dynamics of tungsten supply, demand, and application across diverse sectors. Gain critical insights into market structure, key trends, dominant segments, product innovations, and the overarching competitive landscape that defines the future of this vital industrial metal.

Tungsten Market Market Structure & Competitive Landscape

The global tungsten market exhibits a moderate to high level of concentration, with a few major players dominating production and downstream processing. China Minmetals Non-Ferrous Metals Co Ltd, Xiamen Tungsten Co Ltd, and Jiangxi Tungsten Holding Group Co Ltd are significant forces, contributing substantially to global supply. Innovation drivers include the development of advanced tungsten alloys and carbides with enhanced properties for demanding applications. Regulatory impacts, particularly concerning environmental standards and trade policies, play a crucial role in shaping market access and production costs. Product substitutes, such as molybdenum and tantalum in certain high-temperature applications, pose a competitive threat, necessitating continuous product development. End-user segmentation reveals strong demand from the automotive, aerospace, and machine tools and equipment industries, each with unique requirements. Mergers and acquisitions (M&A) trends indicate a strategic consolidation, with larger entities acquiring smaller specialists to expand their product portfolios and geographical reach. For instance, recent M&A activity has aimed at bolstering capabilities in specialized tungsten product manufacturing. The competitive landscape is characterized by a blend of integrated producers and specialized manufacturers, all striving to meet the escalating demand for high-performance tungsten materials.

Tungsten Market Market Trends & Opportunities

The global tungsten market is poised for robust growth, driven by an ever-increasing demand from critical industrial sectors and the unique properties of tungsten, such as its exceptionally high melting point, density, and hardness. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033, reaching an estimated 180 Million by the end of the forecast period. This expansion is fueled by several key trends. Firstly, the continuous advancements in additive manufacturing (3D printing) are opening new avenues for tungsten powders and components, enabling the creation of complex geometries and customized parts for aerospace, medical devices, and defense applications. Kennametal Inc.'s innovation in corrosion-resistant tungsten carbide grades for metal additive manufacturing exemplifies this trend. Secondly, the burgeoning automotive sector, particularly the shift towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS), requires specialized tungsten components for their high-performance capabilities, including in battery technologies and sensor systems. Thirdly, the aerospace industry's sustained need for lightweight yet incredibly strong materials for aircraft components, engine parts, and defense systems continues to be a significant demand driver. The "Other End-user Industries" segment, encompassing applications in oil and gas exploration, mining, and general industrial machinery, also presents substantial growth opportunities. Furthermore, technological shifts towards more sustainable production methods and recycling initiatives are gaining traction, presenting opportunities for companies that can offer environmentally conscious tungsten solutions. The increasing focus on high-performance cutting tools for advanced manufacturing processes is another significant opportunity, driving demand for superior tungsten carbide grades. The market penetration of specialized tungsten products is expected to deepen as industries recognize their performance advantages over conventional materials. Consumer preferences, while not directly applicable to raw materials, translate into industry demand for materials that offer durability, efficiency, and reliability in end-user products. The competitive dynamics are evolving, with a focus on vertical integration, product differentiation, and securing stable raw material supplies. The ongoing geopolitical landscape and global supply chain resilience are also becoming critical factors influencing market opportunities and strategic planning.

Dominant Markets & Segments in Tungsten Market

The Tungsten Market is characterized by distinct regional dominance and segment leadership. Asia Pacific, particularly China, stands as the leading region in both production and consumption of tungsten. This dominance is driven by its extensive tungsten reserves, established manufacturing base, and significant domestic demand from its robust automotive, electronics, and machinery sectors. Within this region, China’s government policies promoting industrial growth and technological advancement further solidify its leading position.

Dominant Segments by Product:

- Carbides: Tungsten carbides represent the largest and most crucial segment within the tungsten market. Their extreme hardness, wear resistance, and high-temperature strength make them indispensable for cutting tools, drill bits, wear parts, and various industrial components. The increasing sophistication of manufacturing processes and the demand for precision engineering fuel the growth of the tungsten carbide segment.

- Tungsten Alloys: Tungsten alloys, known for their high density, strength, and radiation shielding properties, are critical in aerospace, defense (e.g., ammunition), medical imaging equipment, and specialized industrial applications. Their unique characteristics make them a preferred choice where performance under extreme conditions is paramount.

- Tungsten Mill Products: This segment includes various forms like tungsten wires, rods, sheets, and foils, which serve as raw materials or semi-finished components for a wide range of downstream applications. Their versatility makes them essential in electrical and electronic components, lighting, and specialized manufacturing processes.

- Tungsten Chemicals: While a smaller segment, tungsten chemicals find critical applications in catalysts, pigments, lubricants, and chemical synthesis, supporting various industrial processes and the production of specialized materials.

Dominant Segments by End-user Industry:

- Machine Tools and Equipment: This industry is a primary consumer of tungsten products, particularly tungsten carbides, for manufacturing high-performance cutting tools, inserts, and wear parts. The global push for industrial automation and precision manufacturing directly correlates with the demand in this segment.

- Automotive: The automotive sector’s demand for tungsten is growing, especially with the emphasis on electric vehicles. Tungsten components are used in batteries, high-performance engine parts, lighting systems, and wear-resistant parts in vehicle manufacturing equipment.

- Aerospace: The stringent performance requirements of the aerospace industry make tungsten indispensable. Its use in engine components, landing gear, and critical structural parts, along with its application in defense systems, drives significant demand.

- Electrical and Electronics: Tungsten's high melting point and electrical conductivity make it vital for filaments in lighting, electrodes in various electronic devices, and components in high-temperature electronic applications.

Key growth drivers across these segments include infrastructure development, government policies supporting advanced manufacturing and defense, and the continuous pursuit of material innovation to meet evolving industrial challenges. The market's trajectory is significantly influenced by technological advancements in tungsten processing and the development of new applications that leverage tungsten’s unique properties.

Tungsten Market Product Analysis

The tungsten market is witnessing significant product innovation, primarily focused on enhancing material performance for demanding applications. Tungsten carbides are continuously being refined to offer superior wear resistance, hardness, and thermal stability, crucial for advanced cutting tools and wear-resistant components in industries like automotive and aerospace. Tungsten alloys are being engineered for specific density, strength, and machinability characteristics, finding niche applications in medical devices and defense. Innovations in tungsten mill products are geared towards achieving tighter tolerances and improved surface finishes for use in sensitive electronic and optical systems. Furthermore, the development of specialized tungsten chemicals is enabling advancements in catalyst technologies and advanced material synthesis. The competitive advantage for manufacturers lies in their ability to develop application-specific tungsten solutions and maintain consistent quality in their production processes.

Key Drivers, Barriers & Challenges in Tungsten Market

Key Drivers:

The tungsten market is propelled by several critical factors. Technological advancements in mining and processing are enhancing extraction efficiency and reducing production costs. The growing demand from high-growth sectors such as automotive (especially EVs), aerospace, and defense, which rely on tungsten's unique properties like extreme hardness and high melting point, acts as a significant demand driver. Government initiatives promoting advanced manufacturing, infrastructure development, and strategic material stockpiling further bolster market growth. The increasing adoption of tungsten in renewable energy technologies also presents a growing opportunity.

Key Barriers & Challenges:

Despite robust growth drivers, the tungsten market faces considerable barriers and challenges. The primary challenge is the geographical concentration of tungsten reserves, with China dominating global supply, leading to potential supply chain vulnerabilities and price volatility. Stringent environmental regulations associated with tungsten mining and processing can increase operational costs and compliance burdens. The capital-intensive nature of tungsten mining and refining requires substantial upfront investment, posing a barrier to entry for new players. Fluctuations in global economic conditions and downstream industry demand can directly impact tungsten consumption. Furthermore, the ongoing development of alternative materials that can substitute tungsten in certain applications presents a competitive pressure. Supply chain disruptions due to geopolitical events or trade disputes can significantly impact the availability and cost of tungsten products.

Growth Drivers in the Tungsten Market Market

The growth drivers in the tungsten market are multifaceted, encompassing technological, economic, and regulatory influences. Economically, the expansion of key end-user industries like automotive, aerospace, and electronics directly translates to increased demand for tungsten and its derivatives. Technological advancements, particularly in metal additive manufacturing and the development of high-performance materials, are creating new applications and expanding the utility of tungsten. Regulatory support for advanced manufacturing and strategic materials, including efforts to secure domestic supply chains, also acts as a significant growth catalyst. Furthermore, the global push for energy efficiency and advanced infrastructure projects often necessitates the use of durable and high-performance materials like tungsten.

Challenges Impacting Tungsten Market Growth

Several challenges are impacting the growth of the tungsten market. Supply chain security remains a primary concern due to the geographical concentration of tungsten ore production. Fluctuations in raw material prices and the potential for trade restrictions can lead to market volatility. Stringent environmental regulations governing mining and processing operations can increase compliance costs and impact production levels. The capital-intensive nature of tungsten mining and refining presents a barrier to entry and expansion. Additionally, the development of substitute materials in certain applications poses a competitive threat, requiring continuous innovation from tungsten producers to maintain market share. Economic downturns in key consuming regions can also lead to a slowdown in demand.

Key Players Shaping the Tungsten Market Market

- China Minmetals Non-Ferrous Metals Co Ltd

- Xiamen Tungsten Co Ltd

- A L M T Corp

- Jiangxi Tungsten Holding Group Co Ltd

- Umicore N V

- Nippon Tungsten Co Ltd

- Chongyi Zhangyuan Tungsten Co Ltd

- Wolf Minerals Limited

- Guangdong XiangLu Tungsten Co Ltd

- China Molybdenum Co Ltd

- Global Tungsten and Powders

- Sandvik Group

- Almonty Industries Inc

- Kennametal Inc

- Allegheny Technologies Incorporated

- Treibacher Industrie

- WOLFRAM COMPANY JSC

- International Metalworking Companies

- QuesTek Innovations LLC

- Betek GmbH & Co KG

- Jiangxi Yaosheng Tungsten

- Plansee Group

- China Tungsten and Hightech

- Ormonde Mining plc

- Buffalo Tungsten Inc

- H C Starck GmbH

Significant Tungsten Market Industry Milestones

- January 2022: The Plansee Group reached a formal agreement to buy the Indianapolis-based Mi-Tech Tungsten Metals. This acquisition strengthens Plansee Group's position in the North American market and enhances its capabilities in providing specialized tungsten-based products. Mi-Tech Tungsten Metals is recognized as a key supplier in the US for tungsten products, impacting the competitive landscape.

- September 2021: Kennametal Inc. introduced KAR85-AM-K, their most corrosion-resistant tungsten carbide grade for metal additive manufacturing. This development signifies a push towards advanced material solutions for 3D printing, catering to industries requiring high-performance components with enhanced durability and longevity. Its availability through Kennametal's binder jet 3D printing capability highlights innovation in manufacturing processes.

Future Outlook for Tungsten Market Market

The future outlook for the tungsten market is characterized by sustained growth driven by innovation and increasing demand from critical industries. Strategic opportunities lie in the continued expansion of additive manufacturing applications, the growing needs of the electric vehicle sector, and the aerospace industry's persistent demand for high-performance materials. Investments in sustainable mining practices and recycling technologies will be crucial for long-term market viability and meeting evolving regulatory and consumer expectations. Companies that can offer customized tungsten solutions, secure stable supply chains, and adapt to technological advancements will be well-positioned to capitalize on the market's considerable potential. The trend towards digitalization and automation in manufacturing will further underscore the importance of tungsten's unique properties in enabling cutting-edge technologies and industrial processes.

Tungsten Market Segmentation

-

1. Type

- 1.1. Foils

- 1.2. Ribbons

- 1.3. Wires

- 1.4. Tubes

-

2. Product

- 2.1. Carbides

- 2.2. Tungsten Alloys

- 2.3. Tungsten Mill Products

- 2.4. Tungsten Chemicals

-

3. End-user Industry

- 3.1. Automotive

- 3.2. Aerospace

- 3.3. Electrical and Electronics

- 3.4. Machine Tools and Equipment

- 3.5. Other End-user Industries

Tungsten Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East

- 4.3. Africa

Tungsten Market Regional Market Share

Geographic Coverage of Tungsten Market

Tungsten Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing End-use Sectors such as Automotive

- 3.2.2 Aerospace

- 3.2.3 Electrical and Electronics

- 3.2.4 as well as a rise in the need for Wear-resistant Material; Utilization of Tungsten in Electronic and Electrical Components such as Electron Emitters

- 3.2.5 Lead-in Wires

- 3.2.6 and Electrical Contacts

- 3.3. Market Restrains

- 3.3.1 Increasing demand and Supply Gaps

- 3.3.2 as well as Toxicity caused by the Usage of Tungsten Carbide; Other Restaints

- 3.4. Market Trends

- 3.4.1. Machine Tools and Equipment Segment is Anticipated to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tungsten Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Foils

- 5.1.2. Ribbons

- 5.1.3. Wires

- 5.1.4. Tubes

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Carbides

- 5.2.2. Tungsten Alloys

- 5.2.3. Tungsten Mill Products

- 5.2.4. Tungsten Chemicals

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Aerospace

- 5.3.3. Electrical and Electronics

- 5.3.4. Machine Tools and Equipment

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Tungsten Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Foils

- 6.1.2. Ribbons

- 6.1.3. Wires

- 6.1.4. Tubes

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Carbides

- 6.2.2. Tungsten Alloys

- 6.2.3. Tungsten Mill Products

- 6.2.4. Tungsten Chemicals

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Automotive

- 6.3.2. Aerospace

- 6.3.3. Electrical and Electronics

- 6.3.4. Machine Tools and Equipment

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Tungsten Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Foils

- 7.1.2. Ribbons

- 7.1.3. Wires

- 7.1.4. Tubes

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Carbides

- 7.2.2. Tungsten Alloys

- 7.2.3. Tungsten Mill Products

- 7.2.4. Tungsten Chemicals

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Automotive

- 7.3.2. Aerospace

- 7.3.3. Electrical and Electronics

- 7.3.4. Machine Tools and Equipment

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Tungsten Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Foils

- 8.1.2. Ribbons

- 8.1.3. Wires

- 8.1.4. Tubes

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Carbides

- 8.2.2. Tungsten Alloys

- 8.2.3. Tungsten Mill Products

- 8.2.4. Tungsten Chemicals

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Automotive

- 8.3.2. Aerospace

- 8.3.3. Electrical and Electronics

- 8.3.4. Machine Tools and Equipment

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Tungsten Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Foils

- 9.1.2. Ribbons

- 9.1.3. Wires

- 9.1.4. Tubes

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. Carbides

- 9.2.2. Tungsten Alloys

- 9.2.3. Tungsten Mill Products

- 9.2.4. Tungsten Chemicals

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Automotive

- 9.3.2. Aerospace

- 9.3.3. Electrical and Electronics

- 9.3.4. Machine Tools and Equipment

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 China Minmetals Non-Ferrous Metals Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Xiamen Tungsten Co Ltd *List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 A L M T Corp

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Jiangxi Tungsten Holding Group Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Umicore N V

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Nippon Tungsten Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Chongyi Zhangyuan Tungsten Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Wolf Minerals Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Guangdong XiangLu Tungsten Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 China Molybdenum Co Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Global Tungsten and Powders

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Sandvik Group

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Almonty Industries Inc

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Kennametal Inc

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Allegheny Technologies Incorporated

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Treibacher Industrie

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 WOLFRAM Company JSC

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 International Metalworking Companies

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 QuesTek Innovations LLC

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 Betek GmbH & Co KG

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.21 Jiangxi Yaosheng Tungsten

- 10.2.21.1. Overview

- 10.2.21.2. Products

- 10.2.21.3. SWOT Analysis

- 10.2.21.4. Recent Developments

- 10.2.21.5. Financials (Based on Availability)

- 10.2.22 Plansee Group

- 10.2.22.1. Overview

- 10.2.22.2. Products

- 10.2.22.3. SWOT Analysis

- 10.2.22.4. Recent Developments

- 10.2.22.5. Financials (Based on Availability)

- 10.2.23 China Tungsten and Hightech

- 10.2.23.1. Overview

- 10.2.23.2. Products

- 10.2.23.3. SWOT Analysis

- 10.2.23.4. Recent Developments

- 10.2.23.5. Financials (Based on Availability)

- 10.2.24 Ormonde Mining plc

- 10.2.24.1. Overview

- 10.2.24.2. Products

- 10.2.24.3. SWOT Analysis

- 10.2.24.4. Recent Developments

- 10.2.24.5. Financials (Based on Availability)

- 10.2.25 Buffalo Tungsten Inc

- 10.2.25.1. Overview

- 10.2.25.2. Products

- 10.2.25.3. SWOT Analysis

- 10.2.25.4. Recent Developments

- 10.2.25.5. Financials (Based on Availability)

- 10.2.26 H C Starck GmbH

- 10.2.26.1. Overview

- 10.2.26.2. Products

- 10.2.26.3. SWOT Analysis

- 10.2.26.4. Recent Developments

- 10.2.26.5. Financials (Based on Availability)

- 10.2.1 China Minmetals Non-Ferrous Metals Co Ltd

List of Figures

- Figure 1: Global Tungsten Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Tungsten Market Revenue (billion), by Type 2025 & 2033

- Figure 3: Asia Pacific Tungsten Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Tungsten Market Revenue (billion), by Product 2025 & 2033

- Figure 5: Asia Pacific Tungsten Market Revenue Share (%), by Product 2025 & 2033

- Figure 6: Asia Pacific Tungsten Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 7: Asia Pacific Tungsten Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Asia Pacific Tungsten Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Asia Pacific Tungsten Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Tungsten Market Revenue (billion), by Type 2025 & 2033

- Figure 11: North America Tungsten Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: North America Tungsten Market Revenue (billion), by Product 2025 & 2033

- Figure 13: North America Tungsten Market Revenue Share (%), by Product 2025 & 2033

- Figure 14: North America Tungsten Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 15: North America Tungsten Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: North America Tungsten Market Revenue (billion), by Country 2025 & 2033

- Figure 17: North America Tungsten Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Tungsten Market Revenue (billion), by Type 2025 & 2033

- Figure 19: Europe Tungsten Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Tungsten Market Revenue (billion), by Product 2025 & 2033

- Figure 21: Europe Tungsten Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Europe Tungsten Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Europe Tungsten Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe Tungsten Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Tungsten Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Tungsten Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Rest of the World Tungsten Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Rest of the World Tungsten Market Revenue (billion), by Product 2025 & 2033

- Figure 29: Rest of the World Tungsten Market Revenue Share (%), by Product 2025 & 2033

- Figure 30: Rest of the World Tungsten Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 31: Rest of the World Tungsten Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Rest of the World Tungsten Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of the World Tungsten Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Tungsten Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Tungsten Market Revenue billion Forecast, by Product 2020 & 2033

- Table 3: Global Tungsten Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Tungsten Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Tungsten Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Tungsten Market Revenue billion Forecast, by Product 2020 & 2033

- Table 7: Global Tungsten Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Tungsten Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Tungsten Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Tungsten Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Japan Tungsten Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: South Korea Tungsten Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Tungsten Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Tungsten Market Revenue billion Forecast, by Type 2020 & 2033

- Table 15: Global Tungsten Market Revenue billion Forecast, by Product 2020 & 2033

- Table 16: Global Tungsten Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Tungsten Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: United States Tungsten Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Canada Tungsten Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Mexico Tungsten Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Tungsten Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Global Tungsten Market Revenue billion Forecast, by Product 2020 & 2033

- Table 23: Global Tungsten Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Tungsten Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Germany Tungsten Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Tungsten Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Italy Tungsten Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: France Tungsten Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Tungsten Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Global Tungsten Market Revenue billion Forecast, by Type 2020 & 2033

- Table 31: Global Tungsten Market Revenue billion Forecast, by Product 2020 & 2033

- Table 32: Global Tungsten Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 33: Global Tungsten Market Revenue billion Forecast, by Country 2020 & 2033

- Table 34: South America Tungsten Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Middle East Tungsten Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Africa Tungsten Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tungsten Market?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Tungsten Market?

Key companies in the market include China Minmetals Non-Ferrous Metals Co Ltd, Xiamen Tungsten Co Ltd *List Not Exhaustive, A L M T Corp, Jiangxi Tungsten Holding Group Co Ltd, Umicore N V, Nippon Tungsten Co Ltd, Chongyi Zhangyuan Tungsten Co Ltd, Wolf Minerals Limited, Guangdong XiangLu Tungsten Co Ltd, China Molybdenum Co Ltd, Global Tungsten and Powders, Sandvik Group, Almonty Industries Inc, Kennametal Inc, Allegheny Technologies Incorporated, Treibacher Industrie, WOLFRAM Company JSC, International Metalworking Companies, QuesTek Innovations LLC, Betek GmbH & Co KG, Jiangxi Yaosheng Tungsten, Plansee Group, China Tungsten and Hightech, Ormonde Mining plc, Buffalo Tungsten Inc, H C Starck GmbH.

3. What are the main segments of the Tungsten Market?

The market segments include Type, Product, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.41 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing End-use Sectors such as Automotive. Aerospace. Electrical and Electronics. as well as a rise in the need for Wear-resistant Material; Utilization of Tungsten in Electronic and Electrical Components such as Electron Emitters. Lead-in Wires. and Electrical Contacts.

6. What are the notable trends driving market growth?

Machine Tools and Equipment Segment is Anticipated to Hold a Significant Share.

7. Are there any restraints impacting market growth?

Increasing demand and Supply Gaps. as well as Toxicity caused by the Usage of Tungsten Carbide; Other Restaints.

8. Can you provide examples of recent developments in the market?

January 2022: The Plansee Group reached a formal agreement to buy the Indianapolis-based Mi-Tech Tungsten Metals. Mi-Tech, which employs almost 100 people, is regarded as one of the main providers of tungsten-based products in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tungsten Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tungsten Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tungsten Market?

To stay informed about further developments, trends, and reports in the Tungsten Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence