Key Insights

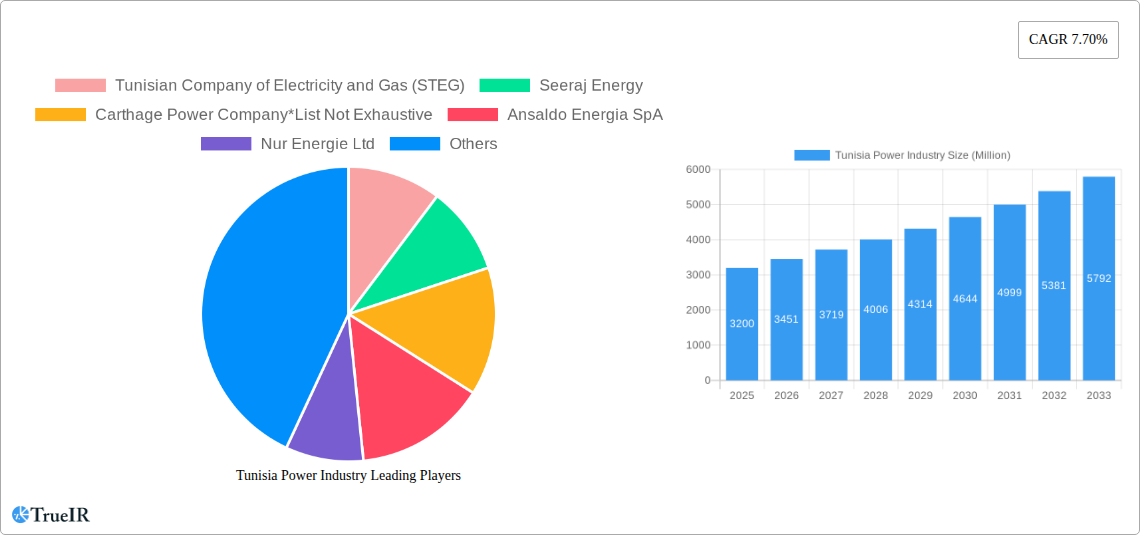

The Tunisia Power Industry is set for substantial growth, projected to achieve a market size of USD 3,200 million by 2025. The market is expected to expand at a Compound Annual Growth Rate (CAGR) of 7.70% through 2033. Key growth drivers include rising electricity demand from population growth and industrial expansion, alongside government initiatives to boost energy infrastructure and diversify the energy mix. Investments in new power generation, especially renewables, and grid modernization for improved efficiency and reliability are also significant factors. Policy reforms attracting foreign direct investment and encouraging private sector participation will further unlock the industry's potential.

Tunisia Power Industry Market Size (In Million)

Challenges include aging infrastructure requiring capital investment, volatile global energy prices impacting operational costs, and potential geopolitical and regulatory uncertainties. Despite these factors, the fundamental demand for dependable, affordable power to support economic development and industrial competitiveness points to a positive market outlook. Growth is anticipated across all key segments: production, consumption, imports, and exports. Price trends indicate a gradual increase driven by demand and infrastructure investment. Key market participants include STEG and international companies like General Electric.

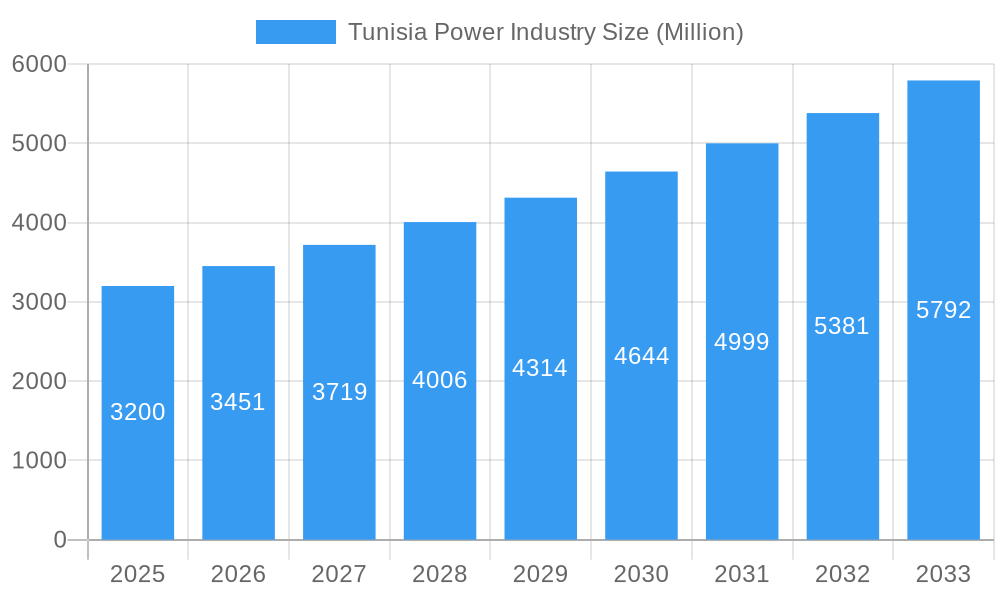

Tunisia Power Industry Company Market Share

This comprehensive Tunisia Power Industry report provides dynamic, SEO-optimized insights, utilizing high-volume keywords to enhance search visibility and engage industry stakeholders.

Tunisia Power Industry Market Structure & Competitive Landscape

The Tunisia Power Industry exhibits a moderately concentrated market structure, with the Tunisian Company of Electricity and Gas (STEG) holding a significant share, particularly in electricity generation and distribution. Innovation drivers are primarily focused on renewable energy integration, with a growing emphasis on solar and wind power projects. Regulatory impacts are substantial, with government policies playing a crucial role in shaping investment and project development, especially for Tunisia renewable energy investments and Tunisia solar power projects. Product substitutes are limited in the core electricity supply, but advancements in energy efficiency technologies offer a form of substitution for end-users. End-user segmentation is driven by industrial, commercial, and residential demand, with industrial consumption being a significant driver of Tunisia industrial power demand. Mergers and acquisitions (M&A) activity, while not as prevalent as in more mature markets, is increasing as international players explore opportunities in Tunisia power sector expansion and North Africa energy market growth. The market concentration ratio is estimated to be around 60%, reflecting STEG's dominant position. M&A volumes over the historical period (2019-2024) are projected to be in the range of xx Million USD, indicating initial stages of consolidation and foreign investment.

- Market Concentration: Moderate, with STEG as the dominant player.

- Innovation Drivers: Renewable energy integration (solar, wind), energy efficiency.

- Regulatory Impacts: Significant influence on investment and project development.

- Product Substitutes: Limited for core electricity supply; energy efficiency technologies.

- End-User Segmentation: Industrial, Commercial, Residential.

- M&A Trends: Increasing as international players enter the market.

Tunisia Power Industry Market Trends & Opportunities

The Tunisia Power Industry is poised for significant growth, driven by a burgeoning demand for electricity and a strategic push towards Tunisia clean energy transition. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately xx% from 2025 to 2033, reflecting robust Tunisia energy market expansion. Technological shifts are a cornerstone of this evolution, with substantial investments in Tunisia solar power generation and Tunisia wind energy projects. The government's commitment to increasing the share of renewables in the energy mix is a key catalyst, creating numerous opportunities for Tunisia renewable energy opportunities. Consumer preferences are increasingly leaning towards cleaner and more sustainable energy sources, aligning with global trends in sustainable energy solutions. Competitive dynamics are evolving, with the entry of new private players and international independent power producers (IPPs) challenging the traditional landscape dominated by STEG. This competition is fostering greater efficiency and innovation within the sector, leading to better Tunisia electricity prices and improved Tunisia power supply reliability. The market penetration rate of renewable energy is expected to rise from xx% in 2025 to over xx% by 2033, a testament to the country's ambitious energy agenda and the attractiveness of Tunisia energy investment.

- Market Size Growth: Robust expansion driven by increasing demand and renewable energy targets.

- Technological Shifts: Focus on solar PV, wind power, and grid modernization.

- Consumer Preferences: Growing demand for sustainable and reliable energy solutions.

- Competitive Dynamics: Evolving landscape with new private and international players.

- Market Penetration: Significant increase in renewable energy adoption.

Dominant Markets & Segments in Tunisia Power Industry

The Tunisia Power Industry is experiencing dominance across several key segments, propelled by strategic initiatives and evolving market forces.

Production Analysis:

The Tunisia power production landscape is increasingly being shaped by renewable energy sources. Solar power is emerging as a dominant segment due to abundant sunshine and government incentives for Tunisia solar power development. Wind energy also holds significant potential, particularly in coastal regions. Traditional thermal power plants, while still contributing, are facing pressure to modernize or be supplemented by cleaner alternatives to reduce carbon emissions and improve Tunisia power generation efficiency.

- Key Growth Drivers: Government targets for renewable energy, declining costs of solar PV technology, attractive investment climate for Tunisia renewable energy projects.

- Dominant Segments: Solar Photovoltaic (PV), Wind Power.

Consumption Analysis:

Tunisia electricity consumption is largely driven by the industrial sector, which accounts for a substantial portion of the total demand. This is followed by the commercial and residential sectors. Increasing industrialization and economic growth are key factors bolstering Tunisia industrial power demand. The residential sector's consumption is also on the rise due to population growth and improving living standards.

- Key Growth Drivers: Industrial growth, urbanization, population increase, demand for energy efficiency solutions.

- Dominant Segments: Industrial Consumption, Commercial Consumption, Residential Consumption.

Import Market Analysis (Value & Volume):

Tunisia's power imports primarily consist of electricity from neighboring countries, particularly Algeria, to meet peak demand and ensure grid stability. The Tunisia electricity import value is influenced by global energy prices and the volume of electricity transacted. While domestic production is being boosted, imports remain crucial for Tunisia power supply security. The import market volume is estimated to be in the range of xx Terawatt-hours (TWh) annually, with a value of xx Million USD.

- Key Growth Drivers: Grid stability, meeting peak demand, strategic energy partnerships.

- Dominant Segments: Electricity imports from neighboring countries.

Export Market Analysis (Value & Volume):

Tunisia has limited electricity export markets at present, with a focus on strengthening domestic supply. However, as renewable energy capacity expands, there is potential for future Tunisia energy exports to regional markets, particularly within the Maghreb region. The current export market analysis shows minimal activity, with volumes in the range of xx Gigawatt-hours (GWh) and a value of xx Million USD.

- Key Growth Drivers: Future regional integration, surplus renewable energy generation.

- Dominant Segments: Minimal current activity, future potential in regional electricity trade.

Price Trend Analysis:

Tunisia power prices are influenced by a combination of factors, including the cost of fuel for thermal power plants, the increasing integration of lower-cost renewables, and government subsidies. The trend is towards a gradual increase in the average electricity tariff to reflect the cost of new generation capacity and grid upgrades, while also aiming to maintain affordability. Tunisia electricity tariffs are expected to see a slight upward trend, averaging around xx USD/MWh.

- Key Growth Drivers: Fuel costs, renewable energy integration, grid investment, government policies.

- Dominant Segments: Average Electricity Tariffs, Industrial Electricity Rates.

Tunisia Power Industry Product Analysis

The Tunisia Power Industry is witnessing significant product innovation and application evolution, primarily centered around renewable energy technologies. Solar photovoltaic (PV) modules and wind turbines are at the forefront, with advancements in efficiency and cost reduction enhancing their market fit. The development of smart grid technologies and energy storage solutions represents another crucial area of product development, aiming to improve grid reliability and facilitate the integration of intermittent renewable sources. These innovations are crucial for meeting the growing demand for Tunisia sustainable power solutions and enhancing Tunisia grid modernization. The competitive advantage lies in deploying cost-effective, reliable, and environmentally friendly power generation and distribution systems, aligning with Tunisia energy efficiency initiatives.

Key Drivers, Barriers & Challenges in Tunisia Power Industry

The Tunisia Power Industry is propelled by several key drivers, including the government's strong commitment to increasing renewable energy capacity, as evidenced by ambitious targets for Tunisia renewable energy deployment. The declining cost of solar and wind technology makes these options increasingly economically viable for Tunisia power generation investment. Furthermore, the growing demand for electricity, fueled by economic development and population growth, creates a consistent market need.

However, the industry faces significant barriers and challenges. Regulatory complexities and the need for streamlined permitting processes can hinder the pace of project development for Tunisia energy projects. Dependence on imported fossil fuels for thermal power generation presents supply chain vulnerabilities and price volatility, impacting Tunisia power costs. Competitive pressures from established players and the need for substantial capital investment for new infrastructure also pose challenges.

- Key Drivers: Government policy support for renewables, falling technology costs, increasing electricity demand.

- Key Barriers & Challenges: Regulatory hurdles, fossil fuel dependence, supply chain risks, high capital investment requirements.

Growth Drivers in the Tunisia Power Industry Market

The Tunisia Power Industry is experiencing robust growth driven by several critical factors. The nation's strategic focus on diversifying its energy mix, with a significant emphasis on Tunisia renewable energy investments and Tunisia solar power initiatives, is a primary growth catalyst. This is supported by attractive government incentives and international collaborations aimed at fostering Tunisia clean energy development. Economic growth and increasing industrial activity further augment the demand for reliable and affordable electricity, underpinning Tunisia industrial power growth. Technological advancements in solar and wind power, coupled with a growing awareness of environmental sustainability, are also creating a favorable market environment for Tunisia sustainable energy solutions.

Challenges Impacting Tunisia Power Industry Growth

Despite promising growth prospects, the Tunisia Power Industry faces considerable challenges that can impede its expansion. Regulatory complexities and bureaucratic processes can slow down project approvals and implementation for Tunisia energy projects. The country's reliance on fossil fuel imports for a significant portion of its energy needs exposes it to global price volatility and supply chain disruptions, impacting Tunisia power costs and Tunisia energy security. Furthermore, the substantial capital investment requirements for large-scale power projects, particularly for grid modernization and new renewable energy installations, present a financial barrier. Intense competitive pressures, both from domestic and international players, necessitate continuous innovation and efficiency improvements to maintain market share and profitability.

Key Players Shaping the Tunisia Power Industry Market

- Tunisian Company of Electricity and Gas (STEG)

- Seeraj Energy

- Carthage Power Company

- Ansaldo Energia SpA

- Nur Energie Ltd

- General Electric Company

Significant Tunisia Power Industry Industry Milestones

- July 2020: Société Tunisienne de l'Electricité et du Gaz (STEG) signed a partnership agreement with Qair for a 200kV pilot project for a floating photovoltaic solar farm on the lake of Tunis and a study of floating solar potential.

- September 2020: Akuo Energy, in consortium with HBG Holding and Nour Energy, signed a power purchasing agreement with STEG for a 10 MWp solar plant, formalizing the Gabès project.

- May 2021: Nur Energie, in partnership with Shanghai Electric and Erebus Investments, won a contract under Tunisia's authorization regime to build a 10 MW solar PV park in Gab Sudes.

Future Outlook for Tunisia Power Industry Market

The future outlook for the Tunisia Power Industry is exceptionally promising, driven by a confluence of strategic government initiatives and growing global demand for sustainable energy. The continued expansion of Tunisia solar power generation and Tunisia wind energy projects is expected to dominate the Tunisia energy market growth. Investments in grid infrastructure and smart technologies will further enhance reliability and efficiency, supporting Tunisia power supply security. The increasing attractiveness of Tunisia energy investment will likely draw more international players, fostering competition and innovation. Opportunities for Tunisia clean energy transition and a reduced carbon footprint present a strong growth trajectory for the coming years.

Tunisia Power Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Tunisia Power Industry Segmentation By Geography

- 1. Tunisia

Tunisia Power Industry Regional Market Share

Geographic Coverage of Tunisia Power Industry

Tunisia Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Energy Transition Toward Renewables4.; The Rollout of New Technologies in Many Developed Countries

- 3.3. Market Restrains

- 3.3.1. 4.; The Technology's Exorbitant Costs and Environmental Impacts

- 3.4. Market Trends

- 3.4.1. Conventional Thermal Power to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Tunisia Power Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Tunisia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tunisian Company of Electricity and Gas (STEG)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Seeraj Energy

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Carthage Power Company*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ansaldo Energia SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nur Energie Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 General Electric Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Tunisian Company of Electricity and Gas (STEG)

List of Figures

- Figure 1: Tunisia Power Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Tunisia Power Industry Share (%) by Company 2025

List of Tables

- Table 1: Tunisia Power Industry Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: Tunisia Power Industry Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Tunisia Power Industry Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Tunisia Power Industry Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Tunisia Power Industry Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Tunisia Power Industry Revenue million Forecast, by Region 2020 & 2033

- Table 7: Tunisia Power Industry Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: Tunisia Power Industry Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Tunisia Power Industry Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Tunisia Power Industry Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Tunisia Power Industry Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Tunisia Power Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tunisia Power Industry?

The projected CAGR is approximately 1.2%.

2. Which companies are prominent players in the Tunisia Power Industry?

Key companies in the market include Tunisian Company of Electricity and Gas (STEG), Seeraj Energy, Carthage Power Company*List Not Exhaustive, Ansaldo Energia SpA, Nur Energie Ltd, General Electric Company.

3. What are the main segments of the Tunisia Power Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.3 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Energy Transition Toward Renewables4.; The Rollout of New Technologies in Many Developed Countries.

6. What are the notable trends driving market growth?

Conventional Thermal Power to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Technology's Exorbitant Costs and Environmental Impacts.

8. Can you provide examples of recent developments in the market?

In July 2020, the Société Tunisienne de l'Electricité et du Gaz (STEG) signed a partnership agreement with Qair to carry out a 200kV pilot project for a floating photovoltaic solar farm on the lake of Tunis and a study of the floating solar potential in Tunisia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tunisia Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tunisia Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tunisia Power Industry?

To stay informed about further developments, trends, and reports in the Tunisia Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence