Key Insights

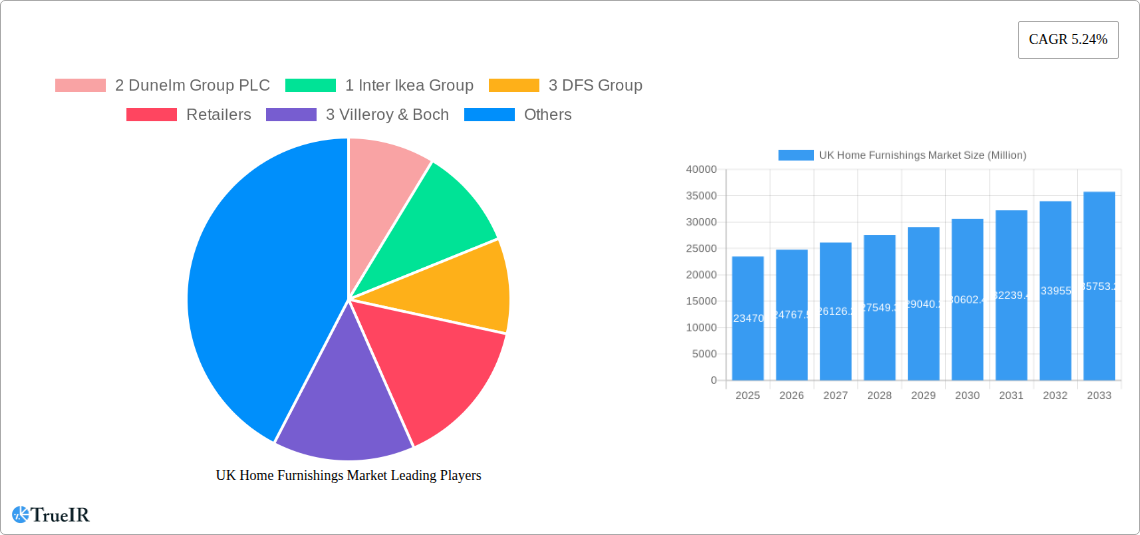

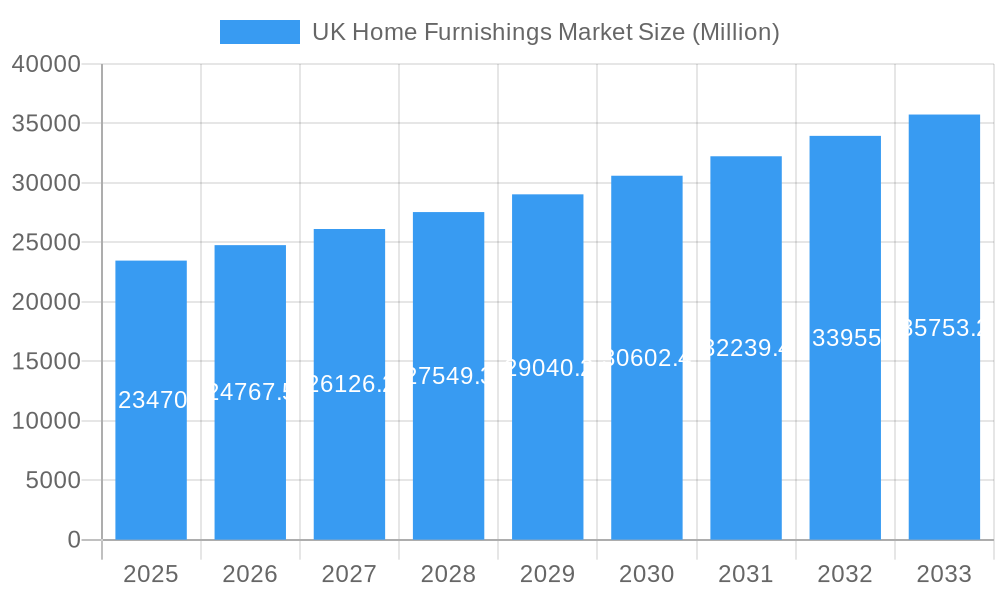

The UK home furnishings market, valued at £23.47 billion in 2025, is experiencing robust growth, projected to maintain a compound annual growth rate (CAGR) of 5.24% from 2025 to 2033. This expansion is driven by several key factors. Firstly, a rising disposable income among UK households fuels increased spending on home improvement and furnishing upgrades. Secondly, the growing popularity of online shopping, facilitated by a wider range of products and convenient delivery options, significantly boosts sales within the e-commerce segment. Furthermore, shifting consumer preferences towards sustainable and ethically sourced products are influencing purchasing decisions, creating opportunities for businesses that prioritize eco-friendly materials and practices. The market is segmented by product categories such as home furniture, textiles, and lighting, with home furniture likely holding the largest share due to its higher average price point and necessity in household setups. Distribution channels are diversified, including supermarkets, specialist home decor stores, online retailers, and direct-to-consumer brands, reflecting the evolving consumer landscape. The competitive landscape is characterized by a mix of established players like Dunelm and IKEA, alongside smaller, specialized retailers catering to niche market segments.

UK Home Furnishings Market Market Size (In Billion)

The projected growth trajectory is expected to continue, although at a potentially moderated pace toward the latter half of the forecast period. Factors such as economic fluctuations, inflation, and potential shifts in consumer spending habits could influence the market's overall performance. Nevertheless, the enduring appeal of home improvement, coupled with continuous innovation in product design and retail strategies, suggests that the UK home furnishings market remains poised for sustained growth. The focus on enhancing the home environment, driven by changing lifestyles and remote working trends, are key drivers, underpinning long-term market optimism. Competition is likely to intensify among both online and offline players as they strive to capture market share. Successful businesses will need to adapt their offerings to meet the evolving needs and preferences of UK consumers.

UK Home Furnishings Market Company Market Share

UK Home Furnishings Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the UK home furnishings market, offering invaluable insights for businesses, investors, and industry stakeholders. Covering the period 2019-2033, with a focus on 2025, this report examines market size, growth trends, competitive dynamics, and future opportunities within this dynamic sector. Leveraging high-volume keywords such as "UK home furnishings market," "home furniture market," "home textiles market," and "online home furnishings," this report is designed to provide maximum search engine visibility and actionable intelligence.

UK Home Furnishings Market Structure & Competitive Landscape

The UK home furnishings market is characterized by a moderately concentrated structure, with a few dominant players alongside numerous smaller retailers and manufacturers. The market concentration ratio (CR5) for 2024 is estimated at xx%, indicating the influence of major players like Dunelm Group PLC and DFS Group. However, the market also exhibits significant fragmentation, particularly within the home accessories and smaller niche product segments.

Innovation Drivers: Technological advancements, particularly in e-commerce, smart home technology, and sustainable materials, are key innovation drivers. The rising popularity of online shopping platforms is significantly impacting distribution channels.

Regulatory Impacts: Regulations concerning product safety, environmental standards, and consumer protection influence market practices. Changes in these regulations can impact manufacturing costs and product availability.

Product Substitutes: The market faces competition from substitute products such as second-hand furniture and DIY home improvement projects. The rise of the circular economy is also becoming a significant factor.

End-User Segmentation: The market caters to diverse end-users, including homeowners, renters, and businesses. Consumer preferences vary across demographics and lifestyles, influencing product demand and market segmentation.

M&A Trends: The past five years have witnessed xx M&A deals in the UK home furnishings market (2019-2024). Consolidation among larger players is expected to continue, driven by economies of scale and expansion into new market segments. This trend is likely to lead to further market concentration in the coming years.

UK Home Furnishings Market Market Trends & Opportunities

The UK home furnishings market experienced a CAGR of xx% during the historical period (2019-2024). The market size in 2024 reached approximately £xx Million. The estimated market size for 2025 is £xx Million, projecting a continued growth trajectory. Several factors contribute to this growth:

- Shifting Consumer Preferences: Increased disposable income, changing lifestyles, and a growing emphasis on home improvement and personalization are driving market demand. The market is witnessing a rise in demand for sustainable and ethically sourced products.

- Technological Advancements: E-commerce penetration continues to grow, significantly impacting how consumers shop for home furnishings. The adoption of smart home technology offers exciting opportunities for manufacturers and retailers to provide innovative product offerings.

- Competitive Dynamics: Increased competition from both established players and new entrants, particularly in the online space, is influencing pricing strategies and product innovation.

The forecast period (2025-2033) anticipates a CAGR of xx%, indicating substantial growth potential driven by consistent consumer demand and continued technological innovation within the sector. Market penetration for online sales is expected to reach xx% by 2033.

Dominant Markets & Segments in UK Home Furnishings Market

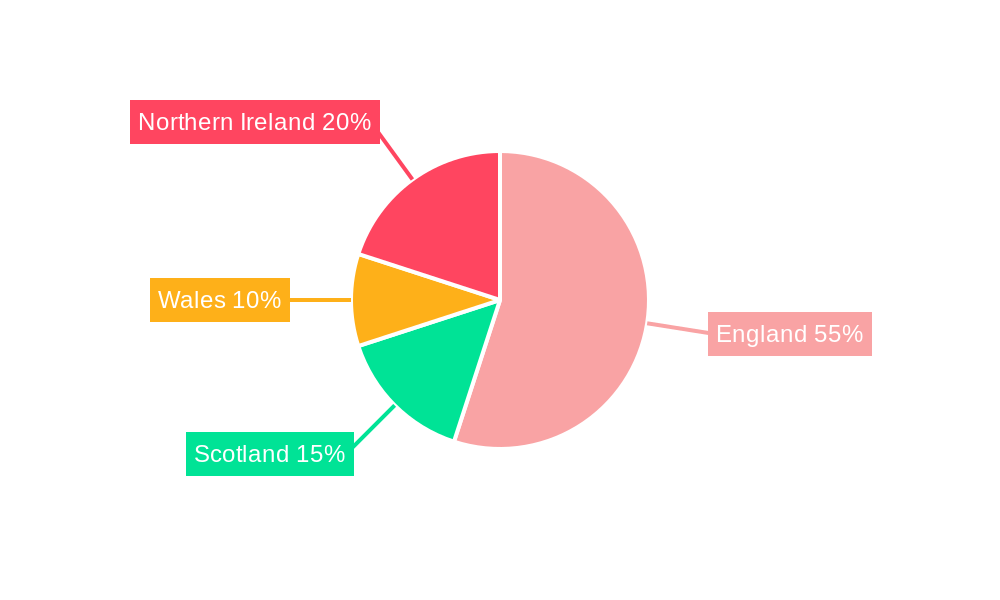

The UK home furnishings market shows strong regional variation, with London and the South East exhibiting the highest sales volumes, driven by higher disposable incomes and population density.

Product Segments:

- Home Furniture: This segment remains the largest, with high demand for sofas, beds, and dining sets. Growth is driven by consumer spending on home improvement and changing lifestyles.

- Home Textiles: This segment includes bedding, curtains, and towels. Demand is influenced by seasonal changes and home fashion trends.

- Online Distribution Channel: The fastest-growing distribution channel, driven by convenience and wider product availability. This segment has experienced significant growth, impacting traditional retail channels.

Key Growth Drivers:

- Improving Infrastructure: Improved logistics and supply chains contribute to efficient delivery, supporting the growth of e-commerce.

- Government Policies: Policies that support homeownership and renovation projects stimulate market demand.

UK Home Furnishings Market Product Analysis

Product innovation is focused on enhancing functionality, sustainability, and aesthetics. Smart home technology integration is gaining traction, as seen in IKEA's DIRIGERA hub. Sustainable materials and eco-friendly manufacturing processes are becoming increasingly important to appeal to environmentally conscious consumers. This trend reflects a market shift towards conscious consumerism and sustainable practices. The growing demand for personalized and bespoke furniture further drives product differentiation and innovation.

Key Drivers, Barriers & Challenges in UK Home Furnishings Market

Key Drivers:

- Rising disposable incomes and improved living standards fuel demand for home furnishings.

- The popularity of home improvement and home staging initiatives boosts sales.

- Technological advancements in smart home technology and e-commerce enhance consumer experience.

Challenges:

- Supply chain disruptions and increased raw material costs impact manufacturing and pricing. This factor led to a xx% increase in production costs in 2022.

- Intense competition, especially from online retailers, puts pressure on margins.

- Shifting consumer preferences necessitate ongoing product innovation and adaptation.

Growth Drivers in the UK Home Furnishings Market Market

Strong growth drivers include increasing disposable incomes leading to higher spending on home improvements, the rising popularity of home staging and interior design trends, and the continuous development of smart home technology and e-commerce solutions improving customer experience.

Challenges Impacting UK Home Furnishings Market Growth

Key challenges impacting growth include fluctuating raw material prices, supply chain vulnerabilities increasing production costs, fierce competition especially from online platforms impacting pricing strategies, and the need for consistent innovation to keep up with ever-evolving consumer trends.

Key Players Shaping the UK Home Furnishings Market Market

- Dunelm Group PLC

- Inter Ikea Group

- DFS Group

- Villeroy & Boch

- Wayfair Inc

- Yorkshire Linen Co

- Beaumont and Brown

- Burleigh Pottery

- Steinhoff United Kingdom Retail Ltd

- Victoria PLC

- Denby

- Duresta Upholstery Ltd

- British Home Store

- The Victoria Linen Co Ltd*

- JYSK

Significant UK Home Furnishings Market Industry Milestones

- October 2022: Wayfair opens its first AllModern brick-and-mortar store.

- October 2022: IKEA launches the new IKEA Home smart app and DIRIGERA hub.

Future Outlook for UK Home Furnishings Market Market

The UK home furnishings market is poised for continued growth, driven by sustained consumer demand, technological advancements, and the rise of the online retail sector. Strategic opportunities exist for businesses to capitalize on emerging trends in sustainable products, personalized home décor, and smart home integration. The market is expected to witness further consolidation, with larger players seeking to expand their market share through acquisitions and strategic partnerships.

UK Home Furnishings Market Segmentation

-

1. Product

- 1.1. Home Furniture

- 1.2. Home Textile

- 1.3. Flooring

- 1.4. Wall Decor

- 1.5. Tableware and Cookware

- 1.6. Lighting and Lamps

- 1.7. Sanitaryware

- 1.8. Home Accessories

- 1.9. Other Products

-

2. Distribution Channel

- 2.1. Supermarkets and Hypermarkets

- 2.2. Home Decor Stores

- 2.3. Gift Shops

- 2.4. Direct to Consumer

- 2.5. Online

- 2.6. Other Distribution Channels

UK Home Furnishings Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Home Furnishings Market Regional Market Share

Geographic Coverage of UK Home Furnishings Market

UK Home Furnishings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The rise of online shopping has significantly impacted the home furnishings market. E-commerce platforms provide consumers with greater access to a wide variety of products and the convenience of shopping from home

- 3.2.2 which has boosted market growth.

- 3.3. Market Restrains

- 3.3.1 The home furnishings market has faced supply chain disruptions

- 3.3.2 particularly related to raw materials and transportation. Issues such as delays in imports and increased costs of materials can impact product availability and pricing.

- 3.4. Market Trends

- 3.4.1 There is a strong trend towards sustainable and eco-friendly home furnishings. Consumers are increasingly looking for products made from recycled or responsibly sourced materials

- 3.4.2 and companies are focusing on reducing their environmental impact through sustainable practices.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Home Furnishings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Home Furniture

- 5.1.2. Home Textile

- 5.1.3. Flooring

- 5.1.4. Wall Decor

- 5.1.5. Tableware and Cookware

- 5.1.6. Lighting and Lamps

- 5.1.7. Sanitaryware

- 5.1.8. Home Accessories

- 5.1.9. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets and Hypermarkets

- 5.2.2. Home Decor Stores

- 5.2.3. Gift Shops

- 5.2.4. Direct to Consumer

- 5.2.5. Online

- 5.2.6. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America UK Home Furnishings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Home Furniture

- 6.1.2. Home Textile

- 6.1.3. Flooring

- 6.1.4. Wall Decor

- 6.1.5. Tableware and Cookware

- 6.1.6. Lighting and Lamps

- 6.1.7. Sanitaryware

- 6.1.8. Home Accessories

- 6.1.9. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets and Hypermarkets

- 6.2.2. Home Decor Stores

- 6.2.3. Gift Shops

- 6.2.4. Direct to Consumer

- 6.2.5. Online

- 6.2.6. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America UK Home Furnishings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Home Furniture

- 7.1.2. Home Textile

- 7.1.3. Flooring

- 7.1.4. Wall Decor

- 7.1.5. Tableware and Cookware

- 7.1.6. Lighting and Lamps

- 7.1.7. Sanitaryware

- 7.1.8. Home Accessories

- 7.1.9. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets and Hypermarkets

- 7.2.2. Home Decor Stores

- 7.2.3. Gift Shops

- 7.2.4. Direct to Consumer

- 7.2.5. Online

- 7.2.6. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe UK Home Furnishings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Home Furniture

- 8.1.2. Home Textile

- 8.1.3. Flooring

- 8.1.4. Wall Decor

- 8.1.5. Tableware and Cookware

- 8.1.6. Lighting and Lamps

- 8.1.7. Sanitaryware

- 8.1.8. Home Accessories

- 8.1.9. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets and Hypermarkets

- 8.2.2. Home Decor Stores

- 8.2.3. Gift Shops

- 8.2.4. Direct to Consumer

- 8.2.5. Online

- 8.2.6. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa UK Home Furnishings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Home Furniture

- 9.1.2. Home Textile

- 9.1.3. Flooring

- 9.1.4. Wall Decor

- 9.1.5. Tableware and Cookware

- 9.1.6. Lighting and Lamps

- 9.1.7. Sanitaryware

- 9.1.8. Home Accessories

- 9.1.9. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets and Hypermarkets

- 9.2.2. Home Decor Stores

- 9.2.3. Gift Shops

- 9.2.4. Direct to Consumer

- 9.2.5. Online

- 9.2.6. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific UK Home Furnishings Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Home Furniture

- 10.1.2. Home Textile

- 10.1.3. Flooring

- 10.1.4. Wall Decor

- 10.1.5. Tableware and Cookware

- 10.1.6. Lighting and Lamps

- 10.1.7. Sanitaryware

- 10.1.8. Home Accessories

- 10.1.9. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets and Hypermarkets

- 10.2.2. Home Decor Stores

- 10.2.3. Gift Shops

- 10.2.4. Direct to Consumer

- 10.2.5. Online

- 10.2.6. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 2 Dunelm Group PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 1 Inter Ikea Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 3 DFS Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Retailers

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3 Villeroy & Boch

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 1 Wayfair Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 8 Yorkshire Linen Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 7 Beaumont and Brown

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 6 Burleigh Pottery

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 4 Steinhoff United Kingdom Retail Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 2 Victoria PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 4 Denby

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 5 Duresta Upholstery Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 6 British Home Store

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Manufacturers

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 9 The Victoria Linen Co Ltd*

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 5 JYSK

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 2 Dunelm Group PLC

List of Figures

- Figure 1: Global UK Home Furnishings Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UK Home Furnishings Market Revenue (Million), by Product 2025 & 2033

- Figure 3: North America UK Home Furnishings Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America UK Home Furnishings Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America UK Home Furnishings Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America UK Home Furnishings Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America UK Home Furnishings Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America UK Home Furnishings Market Revenue (Million), by Product 2025 & 2033

- Figure 9: South America UK Home Furnishings Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: South America UK Home Furnishings Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: South America UK Home Furnishings Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America UK Home Furnishings Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America UK Home Furnishings Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe UK Home Furnishings Market Revenue (Million), by Product 2025 & 2033

- Figure 15: Europe UK Home Furnishings Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Europe UK Home Furnishings Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Europe UK Home Furnishings Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe UK Home Furnishings Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe UK Home Furnishings Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa UK Home Furnishings Market Revenue (Million), by Product 2025 & 2033

- Figure 21: Middle East & Africa UK Home Furnishings Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East & Africa UK Home Furnishings Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa UK Home Furnishings Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa UK Home Furnishings Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa UK Home Furnishings Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific UK Home Furnishings Market Revenue (Million), by Product 2025 & 2033

- Figure 27: Asia Pacific UK Home Furnishings Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Asia Pacific UK Home Furnishings Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific UK Home Furnishings Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific UK Home Furnishings Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific UK Home Furnishings Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Home Furnishings Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global UK Home Furnishings Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global UK Home Furnishings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global UK Home Furnishings Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Global UK Home Furnishings Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global UK Home Furnishings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global UK Home Furnishings Market Revenue Million Forecast, by Product 2020 & 2033

- Table 11: Global UK Home Furnishings Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global UK Home Furnishings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global UK Home Furnishings Market Revenue Million Forecast, by Product 2020 & 2033

- Table 17: Global UK Home Furnishings Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global UK Home Furnishings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global UK Home Furnishings Market Revenue Million Forecast, by Product 2020 & 2033

- Table 29: Global UK Home Furnishings Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global UK Home Furnishings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global UK Home Furnishings Market Revenue Million Forecast, by Product 2020 & 2033

- Table 38: Global UK Home Furnishings Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global UK Home Furnishings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific UK Home Furnishings Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Home Furnishings Market?

The projected CAGR is approximately 5.24%.

2. Which companies are prominent players in the UK Home Furnishings Market?

Key companies in the market include 2 Dunelm Group PLC, 1 Inter Ikea Group, 3 DFS Group, Retailers, 3 Villeroy & Boch, 1 Wayfair Inc, 8 Yorkshire Linen Co, 7 Beaumont and Brown, 6 Burleigh Pottery, 4 Steinhoff United Kingdom Retail Ltd, 2 Victoria PLC, 4 Denby, 5 Duresta Upholstery Ltd, 6 British Home Store, Manufacturers, 9 The Victoria Linen Co Ltd*, 5 JYSK.

3. What are the main segments of the UK Home Furnishings Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.47 Million as of 2022.

5. What are some drivers contributing to market growth?

The rise of online shopping has significantly impacted the home furnishings market. E-commerce platforms provide consumers with greater access to a wide variety of products and the convenience of shopping from home. which has boosted market growth..

6. What are the notable trends driving market growth?

There is a strong trend towards sustainable and eco-friendly home furnishings. Consumers are increasingly looking for products made from recycled or responsibly sourced materials. and companies are focusing on reducing their environmental impact through sustainable practices..

7. Are there any restraints impacting market growth?

The home furnishings market has faced supply chain disruptions. particularly related to raw materials and transportation. Issues such as delays in imports and increased costs of materials can impact product availability and pricing..

8. Can you provide examples of recent developments in the market?

October 2022 - The online home furnishings retailer has opened its first brick-and-mortar store under the AllModern banner, at MarketStreet Lynnfield in Lynnfield, Massachusetts. A second location is set to open this fall at Legacy Place in Dedham, Massachusetts. Wayfair announced in December that it planned to open physical stores under all of its banners beginning in 2022, with two AllModern and one Joss & Main location at Burlington Mall in Burlington, Massachusetts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Home Furnishings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Home Furnishings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Home Furnishings Market?

To stay informed about further developments, trends, and reports in the UK Home Furnishings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence