Key Insights

The United Kingdom's nuclear power sector is undergoing a strategic evolution, propelled by the nation's net-zero emissions target by 2050. Leveraging established infrastructure and significant existing capacity, the UK nuclear market presents a notable investment prospect. The market is projected to reach $54.8 billion by 2025, with a compound annual growth rate (CAGR) of 8.5%. This growth is bolstered by government initiatives to deploy new nuclear facilities, replacing aging reactors and enhancing energy security. Key market accelerators include stringent environmental mandates, energy independence objectives, and technological advancements like Small Modular Reactors (SMRs), which offer enhanced safety, efficiency, and cost benefits. Continued investment in research and development and robust government backing further fuels industry expansion.

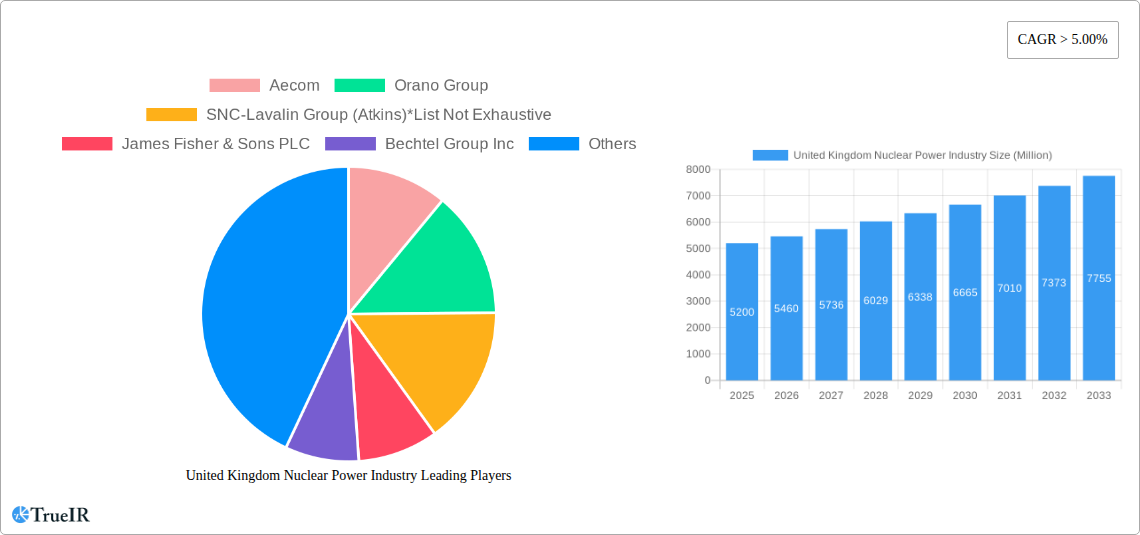

United Kingdom Nuclear Power Industry Market Size (In Billion)

Despite positive growth trajectories, market entry faces hurdles, primarily the substantial capital expenditure required for new nuclear plant construction. Regulatory complexities, public perception regarding nuclear safety, and competition from established renewable energy sources like wind and solar present ongoing challenges. The market is predominantly characterized by commercial power reactors with capacities ranging from 100-1000 MW. Key industry participants, including major SMR developers and established energy operators, are pivotal in shaping the sector's future. While European influences are present, the UK's independent policy and regulatory landscape defines its unique market dynamic. The forecast period (2025-2033) anticipates sustained expansion driven by new construction and infrastructure modernization. The increasing adoption of SMR technology is poised to accelerate industry transformation and unlock considerable value.

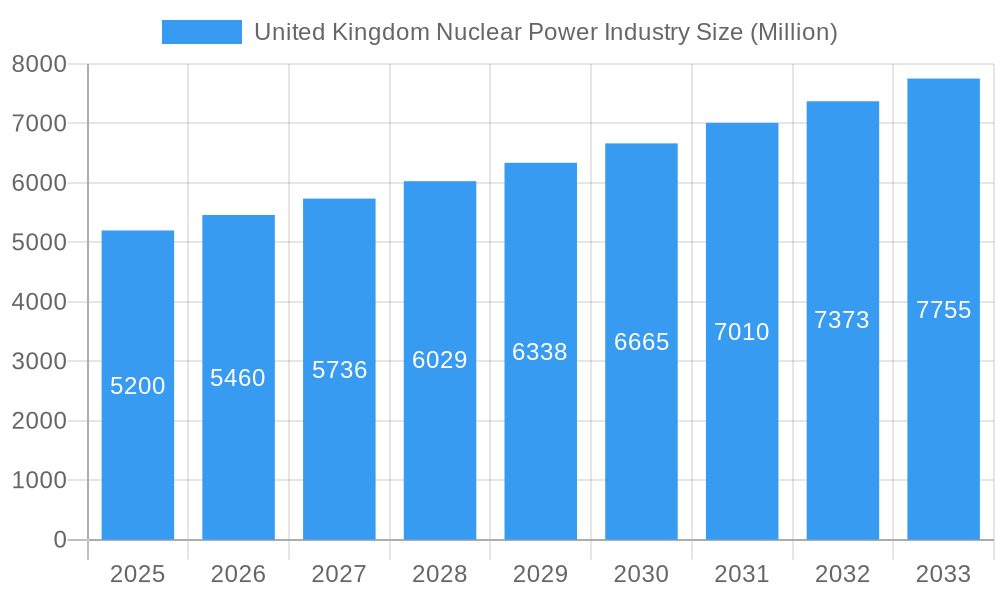

United Kingdom Nuclear Power Industry Company Market Share

United Kingdom Nuclear Power Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the UK nuclear power industry, covering market structure, trends, opportunities, and challenges from 2019 to 2033. With a base year of 2025 and a forecast period spanning 2025-2033, this report is an essential resource for industry stakeholders, investors, and policymakers seeking to understand this dynamic sector. The report leverages extensive data analysis and expert insights to deliver actionable intelligence. The UK nuclear power market, valued at £xx Million in 2025, is poised for significant growth, driven by factors including energy security concerns and government initiatives promoting nuclear energy.

United Kingdom Nuclear Power Industry Market Structure & Competitive Landscape

The UK nuclear power market exhibits moderate concentration, with several major players dominating various segments. Key players include: Aecom, Orano Group, SNC-Lavalin Group (Atkins), James Fisher & Sons PLC, Bechtel Group Inc, Fluor Corporation, Babcock International Group PLC, and Studsvik AB. However, the market also features a number of smaller specialized firms.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a moderately concentrated market.

- Innovation Drivers: Government investment in advanced reactor technologies and R&D initiatives are key innovation drivers. The focus on Small Modular Reactors (SMRs) is significantly shaping innovation.

- Regulatory Impacts: Stringent safety regulations and licensing processes influence market dynamics and capital expenditure. The Office for Nuclear Regulation (ONR) plays a critical role.

- Product Substitutes: Renewable energy sources (wind, solar) pose competition, but nuclear power offers a consistent, low-carbon baseload power alternative.

- End-User Segmentation: The primary end-users are electricity generation companies and national grids.

- M&A Trends: The past five years have seen xx Million in M&A activity in the UK nuclear sector, driven by consolidation and expansion strategies among key players. Further consolidation is anticipated in the coming years.

United Kingdom Nuclear Power Industry Market Trends & Opportunities

The UK nuclear power market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors: increasing demand for reliable and low-carbon electricity, government policies promoting nuclear power, and advancements in reactor technology, specifically SMRs. Market penetration rates for nuclear power in the UK's energy mix are expected to increase from xx% in 2025 to xx% by 2033. Technological shifts toward advanced reactor designs, such as SMRs, offer improved safety, efficiency, and cost-effectiveness. Growing environmental concerns and the need to meet net-zero targets are further boosting the market. The competitive landscape is characterized by both established players and new entrants seeking to capitalize on this growth potential. The development of new nuclear projects and the decommissioning of older plants presents both challenges and opportunities for market participants.

Dominant Markets & Segments in United Kingdom Nuclear Power Industry

The UK's nuclear power market is dominated by the Commercial Power Reactor application segment, accounting for the vast majority of installed capacity. Within reactor types, Pressurized Water Reactors (PWRs) currently hold the largest market share. The 100-1000 MW capacity segment is the most significant, but significant growth is anticipated in the Below 100 MW segment due to the increasing interest and development of SMR technology.

- Key Growth Drivers:

- Government Support: Government policies and financial incentives are crucial drivers for new nuclear projects.

- Energy Security: Nuclear power provides a reliable and independent energy source, reducing reliance on volatile global energy markets.

- Climate Change Mitigation: Nuclear power's low-carbon footprint aligns with national climate goals.

- Technological Advancements: Innovations in SMR technology are making nuclear power more efficient and cost-effective.

The England and Wales regions currently represent the most significant markets within the UK, with significant existing infrastructure and ongoing projects.

United Kingdom Nuclear Power Industry Product Analysis

Significant product innovation is underway, particularly focusing on Small Modular Reactors (SMRs) which offer enhanced safety features, reduced capital costs, and shorter construction times compared to traditional large-scale reactors. These advancements are improving the market fit of nuclear power, making it a more attractive option for both utility companies and government agencies.

Key Drivers, Barriers & Challenges in United Kingdom Nuclear Power Industry

Key Drivers: Strong government support for nuclear energy, including substantial funding commitments and policy initiatives, is a major driver. The need for reliable baseload power and decarbonization targets further propel the market. Advancements in SMR technology offer cost-effective and efficient solutions.

Challenges and Restraints: High upfront capital costs and long construction lead times for nuclear power plants remain significant barriers. Regulatory hurdles and public perception issues can delay project approvals and implementation. Supply chain vulnerabilities, particularly for specialized materials and components, could affect project timelines and budgets. These factors collectively impact overall project viability and market growth. The estimated impact of these challenges is a reduction in the projected market value by approximately £xx Million by 2033.

Growth Drivers in the United Kingdom Nuclear Power Industry Market

The UK nuclear power industry is significantly boosted by government initiatives aimed at securing energy independence and achieving net-zero emissions. Technological advancements, particularly the development of SMRs, contribute to improved efficiency and cost-competitiveness. The need for reliable baseload power provides a strong underlying demand for nuclear energy.

Challenges Impacting United Kingdom Nuclear Power Industry Growth

High capital costs and extended lead times for nuclear power plant construction remain significant hurdles. Regulatory complexities and public perception of nuclear power can cause delays and increase uncertainties. Potential supply chain disruptions could further impact the pace of growth. These factors can significantly affect project feasibility and market expansion.

Key Players Shaping the United Kingdom Nuclear Power Industry Market

Significant United Kingdom Nuclear Power Industry Industry Milestones

- November 2022: Rolls-Royce's nuclear power division selects four sites for microreactor construction, signifying a shift towards smaller-scale nuclear power generation.

- October 2022: The Welsh government and the British Nuclear Decommissioning Authority (NDA) collaborate on a small-scale nuclear power facility in Trawsfynydd, demonstrating a commitment to diversifying nuclear energy sources.

Future Outlook for United Kingdom Nuclear Power Industry Market

The UK nuclear power market is projected to witness sustained growth in the coming years, driven by increasing energy demand, stringent environmental regulations, and technological advancements in SMRs. The government's continued support and investment in the sector will create significant opportunities for market expansion and innovation. The successful deployment of SMR technology will play a critical role in shaping the future of the UK nuclear power landscape. This presents substantial opportunities for both established players and new entrants looking to capitalize on the growing market potential.

United Kingdom Nuclear Power Industry Segmentation

-

1. Reactor Type

- 1.1. Pressurized Water Reactor

- 1.2. Pressurized Heavy Water Reactor

- 1.3. Boiling Water Reactor

- 1.4. High-temperature Gas-cooled Reactor

- 1.5. Liquid Metal Fast Breeder Reactor

- 1.6. Other Reactor Types

-

2. Application

- 2.1. Commercial Power Reactor

- 2.2. Prototype Power Reactor

- 2.3. Research Reactor

-

3. Capacity

- 3.1. Below 100 MW

- 3.2. 100-1000 MW

- 3.3. Above 1000 MW

United Kingdom Nuclear Power Industry Segmentation By Geography

- 1. United Kingdom

United Kingdom Nuclear Power Industry Regional Market Share

Geographic Coverage of United Kingdom Nuclear Power Industry

United Kingdom Nuclear Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Presence of Strict Government Regulations to Control Air Pollution

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Commercial Power Reactor Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Nuclear Power Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 5.1.1. Pressurized Water Reactor

- 5.1.2. Pressurized Heavy Water Reactor

- 5.1.3. Boiling Water Reactor

- 5.1.4. High-temperature Gas-cooled Reactor

- 5.1.5. Liquid Metal Fast Breeder Reactor

- 5.1.6. Other Reactor Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial Power Reactor

- 5.2.2. Prototype Power Reactor

- 5.2.3. Research Reactor

- 5.3. Market Analysis, Insights and Forecast - by Capacity

- 5.3.1. Below 100 MW

- 5.3.2. 100-1000 MW

- 5.3.3. Above 1000 MW

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aecom

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Orano Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SNC-Lavalin Group (Atkins)*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 James Fisher & Sons PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bechtel Group Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fluor Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Babcock International Group PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Studsvik AB

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Aecom

List of Figures

- Figure 1: United Kingdom Nuclear Power Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Kingdom Nuclear Power Industry Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Nuclear Power Industry Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 2: United Kingdom Nuclear Power Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: United Kingdom Nuclear Power Industry Revenue billion Forecast, by Capacity 2020 & 2033

- Table 4: United Kingdom Nuclear Power Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United Kingdom Nuclear Power Industry Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 6: United Kingdom Nuclear Power Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: United Kingdom Nuclear Power Industry Revenue billion Forecast, by Capacity 2020 & 2033

- Table 8: United Kingdom Nuclear Power Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Nuclear Power Industry?

The projected CAGR is approximately 8.5%.

2. Which companies are prominent players in the United Kingdom Nuclear Power Industry?

Key companies in the market include Aecom, Orano Group, SNC-Lavalin Group (Atkins)*List Not Exhaustive, James Fisher & Sons PLC, Bechtel Group Inc, Fluor Corporation, Babcock International Group PLC, Studsvik AB.

3. What are the main segments of the United Kingdom Nuclear Power Industry?

The market segments include Reactor Type, Application, Capacity.

4. Can you provide details about the market size?

The market size is estimated to be USD 54.8 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Presence of Strict Government Regulations to Control Air Pollution.

6. What are the notable trends driving market growth?

Commercial Power Reactor Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

In November 2022, The nuclear power division of Rolls-Royce selected four abandoned sites in Britain to construct a new fleet of microreactors. The Nuclear Decommissioning Authority, which manages some of Britain's first nuclear facilities, owns the four locations in England and Wales.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Nuclear Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Nuclear Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Nuclear Power Industry?

To stay informed about further developments, trends, and reports in the United Kingdom Nuclear Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence