Key Insights

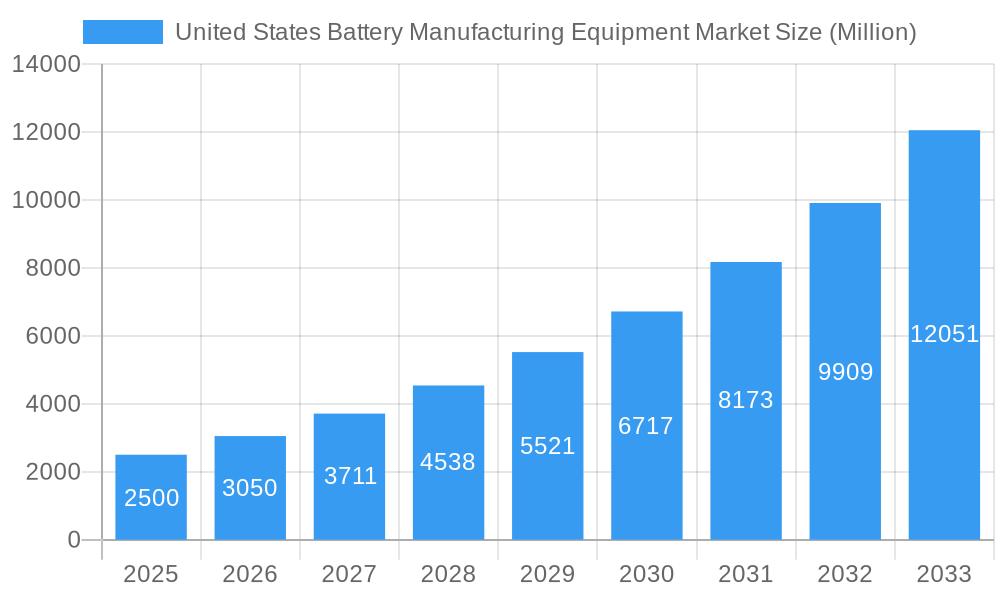

The United States battery manufacturing equipment market is poised for substantial expansion, driven by escalating demand for electric vehicles (EVs) and advanced energy storage systems. This growth is further propelled by significant government investments in renewable energy infrastructure and supportive policies promoting clean energy transitions. The US market is estimated to reach $9.77 billion by 2025, reflecting robust domestic manufacturing initiatives and substantial investments from leading automotive and energy corporations. Key market segments include equipment for battery cell formation and testing, coating and drying, calendaring, slitting, mixing, electrode stacking, and assembly and handling.

United States Battery Manufacturing Equipment Market Market Size (In Billion)

The market's growth is projected to remain robust through the forecast period (2025-2033), fueled by increasing EV adoption and the expansion of grid-scale energy storage projects. Key market drivers include innovation in automation, AI-driven process optimization, and the integration of sustainable manufacturing practices. Strategic collaborations between equipment manufacturers and battery producers will be crucial in developing specialized solutions for diverse battery chemistries and manufacturing processes. Intense competition will necessitate differentiation through technological advancements, superior product quality, and comprehensive after-sales support.

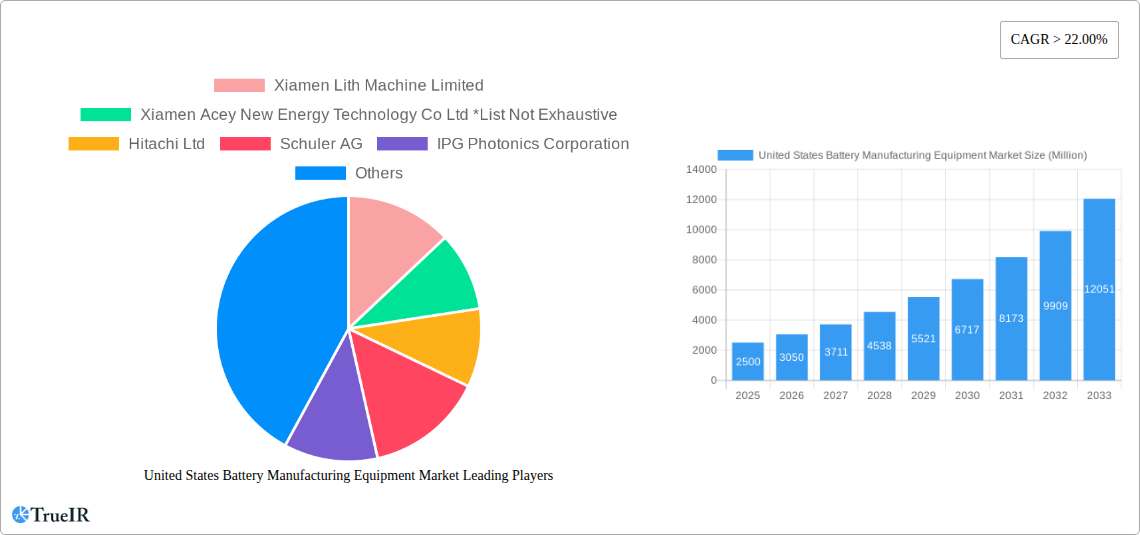

United States Battery Manufacturing Equipment Market Company Market Share

This comprehensive market report offers deep insights into the United States battery manufacturing equipment market, covering the period 2019-2033, with a base year of 2025. The analysis provides projections for market trends and opportunities, detailing key market segments, prominent players, and significant industry developments. The market is forecast to exhibit a Compound Annual Growth Rate (CAGR) of 27.61% during the forecast period.

United States Battery Manufacturing Equipment Market Market Structure & Competitive Landscape

The US battery manufacturing equipment market exhibits a moderately concentrated structure, with several key players holding significant market share. However, the landscape is dynamic, characterized by ongoing innovation and strategic mergers and acquisitions (M&A). The market concentration ratio (CR4) is estimated at xx%, indicating a relatively competitive environment. Innovation is a primary driver, with companies continuously developing advanced equipment to meet the rising demand for higher-capacity, longer-lasting, and more cost-effective batteries. Regulatory frameworks, including environmental regulations and safety standards, significantly impact market dynamics. Product substitution, driven by advancements in materials science and manufacturing processes, poses both a challenge and an opportunity for existing players. The market is segmented by end-user into automotive, industrial, and other end-users, with the automotive segment currently dominating. M&A activity has been moderate in recent years, with a total volume of approximately xx deals in the past five years. These deals primarily involve technology acquisitions and strategic partnerships aimed at expanding product portfolios and strengthening market positions.

United States Battery Manufacturing Equipment Market Market Trends & Opportunities

The US battery manufacturing equipment market is experiencing robust growth, driven by the burgeoning electric vehicle (EV) sector and the increasing adoption of energy storage solutions in various industries. The market size is projected to reach xx Million by 2033 from xx Million in 2025, reflecting a significant expansion in the demand for advanced battery technologies. Technological shifts, such as the adoption of automation and AI-driven solutions in manufacturing processes, are creating new opportunities for equipment providers. Consumer preferences are shifting towards more sustainable and environmentally friendly battery solutions, driving demand for equipment that supports these innovations. Furthermore, the competitive dynamics are characterized by intense R&D efforts, strategic alliances, and capacity expansions, aiming to capture market share in this rapidly evolving landscape. The market penetration rate for advanced battery manufacturing equipment is increasing steadily, projected to reach xx% by 2033. The high CAGR of xx% is propelled by the growing demand for electric vehicles, energy storage solutions and government incentives for renewable energy.

Dominant Markets & Segments in United States Battery Manufacturing Equipment Market

- Dominant Segment: The automotive segment is the dominant end-user in the US battery manufacturing equipment market, fueled by the accelerating adoption of electric vehicles.

- Leading Machine Type: Electrode stacking and assembly & handling machines hold the largest market share among different machine types due to the complex processes involved in battery cell production.

- Key Growth Drivers:

- Government Incentives: Federal and state-level incentives for EV adoption and renewable energy initiatives are significantly boosting demand.

- Infrastructure Development: Investments in charging infrastructure and grid modernization are creating favorable conditions for battery storage solutions.

- Technological Advancements: Continuous innovation in battery chemistry and manufacturing processes is driving the need for advanced equipment.

The automotive sector's dominance is driven by the explosive growth of the electric vehicle market, requiring substantial investment in battery manufacturing infrastructure. The significant investment in charging infrastructure and the increasing adoption of renewable energy sources further propel the growth of this segment. The market for electrode stacking and assembly & handling machines is expanding rapidly due to the complex nature of these processes, which require specialized and advanced equipment to ensure high precision and efficiency.

United States Battery Manufacturing Equipment Market Product Analysis

The US battery manufacturing equipment market features a wide range of advanced products, including high-speed coating and drying systems, automated calendaring and slitting machines, efficient mixing equipment, precise electrode stacking systems, robust assembly and handling machines, and sophisticated formation and testing systems. These innovations deliver increased efficiency, improved quality control, and enhanced overall productivity in battery production. The competitive advantage lies in offering integrated solutions that incorporate automation, advanced process control, and data analytics to optimize manufacturing processes.

Key Drivers, Barriers & Challenges in United States Battery Manufacturing Equipment Market

Key Drivers:

- Rising EV Adoption: The rapid growth of the electric vehicle market is a primary driver, creating immense demand for battery manufacturing capacity.

- Government Support: Federal and state government initiatives promoting renewable energy and electric vehicles are boosting market growth.

- Technological Advancements: Continuous innovation in battery technologies is driving the need for advanced manufacturing equipment.

Key Challenges:

- Supply Chain Disruptions: Global supply chain challenges related to raw materials and components can impact production and lead times. These disruptions are estimated to have cost the industry approximately xx Million in 2022.

- Regulatory Hurdles: Navigating complex environmental regulations and safety standards can increase costs and delay project implementation.

- Intense Competition: The market is becoming increasingly competitive, with both established players and new entrants vying for market share.

Growth Drivers in the United States Battery Manufacturing Equipment Market Market

The growth of the United States Battery Manufacturing Equipment Market is primarily driven by the increasing demand for electric vehicles, energy storage systems, and renewable energy initiatives. Government incentives, technological advancements, and infrastructure development further fuel this growth. The rapid adoption of renewable energy solutions, coupled with the expansion of the electric vehicle market, drives the need for improved battery manufacturing capabilities and, subsequently, advanced equipment.

Challenges Impacting United States Battery Manufacturing Equipment Market Growth

Several factors hinder the growth of the US battery manufacturing equipment market, including supply chain disruptions causing production delays and increased costs. Stringent environmental regulations and safety standards add complexity and expense to operations. The intense competition among established players and new entrants creates pressure on pricing and profitability.

Key Players Shaping the United States Battery Manufacturing Equipment Market Market

- Hitachi Ltd

- Schuler AG

- IPG Photonics Corporation

- Durr AG

- Xiamen Lith Machine Limited

- Xiamen Acey New Energy Technology Co Ltd

- Xiamen Tmax Battery Equipments Limited

Significant United States Battery Manufacturing Equipment Market Industry Milestones

- December 2022: General Motors and LG Energy Solution announce a USD 275 Million investment expansion in their Tennessee battery plant, increasing production by over 40%.

- November 2022: Hyundai Motor Group and SK On sign an MOU for a new EV battery manufacturing facility in Georgia, representing a USD 4-5 Billion investment and creating over 3,500 jobs.

Future Outlook for United States Battery Manufacturing Equipment Market Market

The future outlook for the US battery manufacturing equipment market is highly positive, driven by continued growth in the EV and renewable energy sectors. Strategic partnerships, technological advancements, and government support are expected to further accelerate market expansion. The market presents significant opportunities for companies that can provide innovative, efficient, and sustainable solutions for battery manufacturing.

United States Battery Manufacturing Equipment Market Segmentation

-

1. Machine Type

- 1.1. Coating & Dryer

- 1.2. Calendaring

- 1.3. Slitting

- 1.4. Mixing

- 1.5. Electrode Stacking

- 1.6. Assembly & Handling Machines

- 1.7. Formation & Testing Machines

-

2. End User

- 2.1. Automotive

- 2.2. Industrial

- 2.3. Other End Users

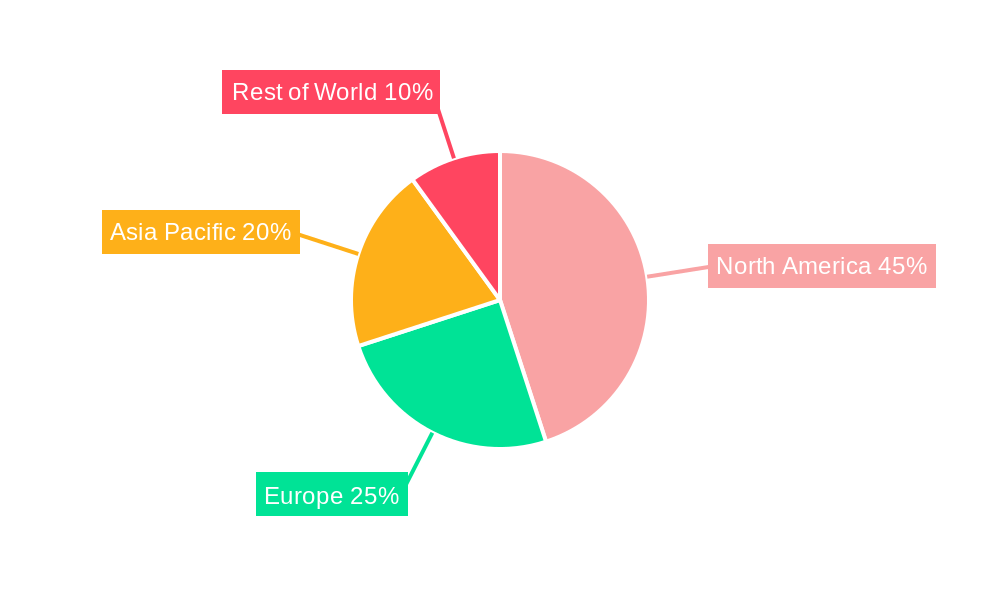

United States Battery Manufacturing Equipment Market Segmentation By Geography

- 1. United States

United States Battery Manufacturing Equipment Market Regional Market Share

Geographic Coverage of United States Battery Manufacturing Equipment Market

United States Battery Manufacturing Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 27.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adopting of Alternative Clean Energy Sources (Ex

- 3.4. Market Trends

- 3.4.1. Automotive Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 5.1.1. Coating & Dryer

- 5.1.2. Calendaring

- 5.1.3. Slitting

- 5.1.4. Mixing

- 5.1.5. Electrode Stacking

- 5.1.6. Assembly & Handling Machines

- 5.1.7. Formation & Testing Machines

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Industrial

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Xiamen Lith Machine Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Xiamen Acey New Energy Technology Co Ltd *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schuler AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IPG Photonics Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Durr AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Xiamen Tmax Battery Equipments Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Xiamen Lith Machine Limited

List of Figures

- Figure 1: United States Battery Manufacturing Equipment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Battery Manufacturing Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Machine Type 2020 & 2033

- Table 2: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Machine Type 2020 & 2033

- Table 3: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by End User 2020 & 2033

- Table 5: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Machine Type 2020 & 2033

- Table 8: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Machine Type 2020 & 2033

- Table 9: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 10: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by End User 2020 & 2033

- Table 11: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Battery Manufacturing Equipment Market?

The projected CAGR is approximately 27.61%.

2. Which companies are prominent players in the United States Battery Manufacturing Equipment Market?

Key companies in the market include Xiamen Lith Machine Limited, Xiamen Acey New Energy Technology Co Ltd *List Not Exhaustive, Hitachi Ltd, Schuler AG, IPG Photonics Corporation, Durr AG, Xiamen Tmax Battery Equipments Limited.

3. What are the main segments of the United States Battery Manufacturing Equipment Market?

The market segments include Machine Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.77 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Automotive Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adopting of Alternative Clean Energy Sources (Ex: Solar. Hydro).

8. Can you provide examples of recent developments in the market?

In December 2022, General Motors and LG Energy Solution will spend an additional USD 275 million in their joint venture battery plant in Tennessee to increase production by more than 40%. The joint venture, Ultium Cells LLC, announced that the new investment is in addition to the USD 2.3 billion announced in April 2021 to build the 2.8 million-square-foot facility. Production at the plant is expected to begin in late 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Battery Manufacturing Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Battery Manufacturing Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Battery Manufacturing Equipment Market?

To stay informed about further developments, trends, and reports in the United States Battery Manufacturing Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence