Key Insights

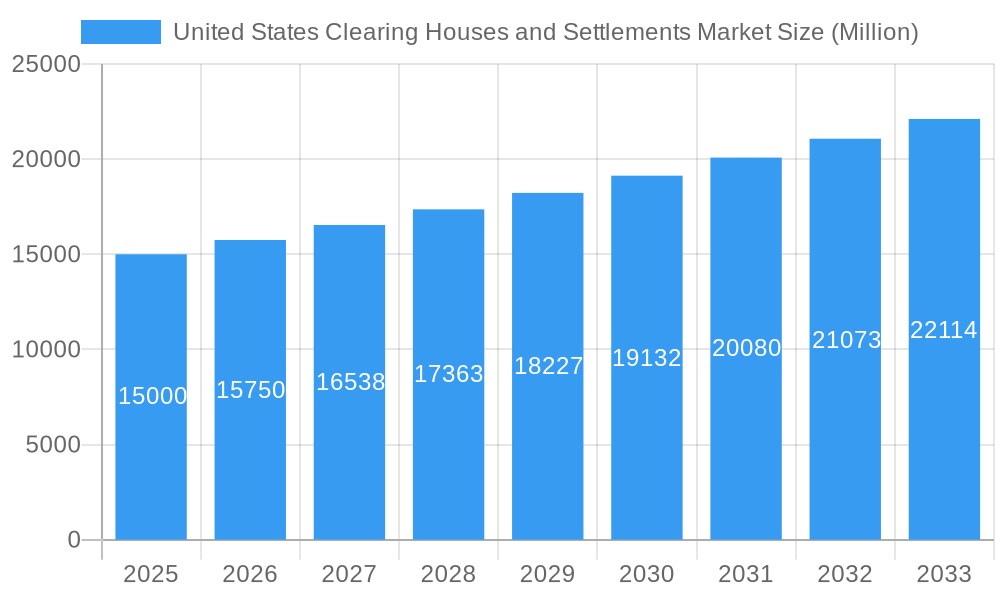

The United States Clearing Houses and Settlements market is projected for robust expansion, forecasting a Compound Annual Growth Rate (CAGR) of 5.0% through 2033. This growth is propelled by escalating trading volumes across equities, derivatives, and fixed income instruments, alongside the increasing integration of advanced technologies such as blockchain and AI. These innovations are enhancing efficiency and fortifying risk management protocols. Key market contributors include major exchanges like the New York Stock Exchange (NYSE), NASDAQ, and CBOE, which provide comprehensive clearing and settlement services for diverse financial products. Evolving regulatory frameworks designed to bolster market integrity and mitigate systemic risk are also critical drivers, stimulating demand for sophisticated clearinghouse infrastructure.

United States Clearing Houses and Settlements Market Market Size (In Billion)

The forecast period (2025-2033) anticipates a significant market size of $6.75 billion in the base year 2024, with sustained expansion driven by further technological advancements enabling faster and more cost-effective transaction processing. Key financial hubs such as New York and Chicago are expected to lead market concentration. The prevailing regulatory environment, while presenting compliance requirements, will concurrently foster market stability and enhance investor confidence, thereby contributing to sustained growth. The dynamic interplay between established entities and disruptive fintech innovators will continue to shape market evolution.

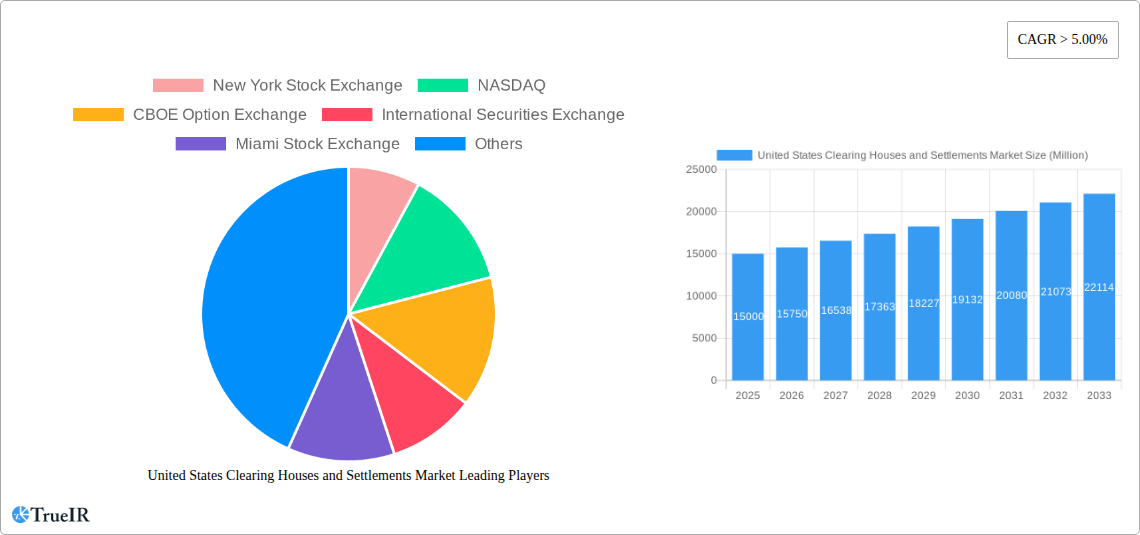

United States Clearing Houses and Settlements Market Company Market Share

United States Clearing Houses and Settlements Market: A Comprehensive Report (2019-2033)

This dynamic report offers an in-depth analysis of the United States Clearing Houses and Settlements Market, providing crucial insights for investors, industry professionals, and strategic decision-makers. Leveraging extensive data from 2019-2024 (Historical Period), a robust base year of 2025, and projecting to 2033 (Forecast Period), this report meticulously examines market size, growth trajectories, competitive dynamics, and future trends. The study period covers 2019-2033, providing a comprehensive historical and future perspective. Key segments are explored, with a focus on the impact of recent regulatory changes and technological advancements. The market's value in 2025 is estimated at xx Million, demonstrating substantial growth potential.

United States Clearing Houses and Settlements Market Market Structure & Competitive Landscape

The U.S. clearing houses and settlements market is characterized by a moderately concentrated structure, where a few key players hold substantial market influence. The estimated Herfindahl-Hirschman Index (HHI) for 2024 stands at [Insert HHI Value Here], signifying a market with a notable degree of consolidation. The landscape is actively shaped by rapid technological advancements, including the integration of blockchain, artificial intelligence (AI), and high-frequency trading (HFT) technologies, all of which necessitate highly robust and efficient clearing and settlement infrastructure. Post-2008 financial crisis, regulatory changes have profoundly impacted market operations, emphasizing enhanced financial stability and driving a trend towards consolidation and stringent compliance adherence. While direct product substitutes are scarce, alternative trading systems (ATS) with varying degrees of integration into the core clearing and settlement framework offer a degree of flexibility. The market's end-users are primarily segmented into brokerage firms, institutional investors, and market makers, each presenting distinct and evolving demands for clearing and settlement services. Merger and acquisition (M&A) activity has remained a consistent feature, with an estimated [Insert Number of Deals Here] deals projected for 2024, driven by the strategic pursuit of economies of scale and the integration of technological synergies.

United States Clearing Houses and Settlements Market Market Trends & Opportunities

The U.S. clearing houses and settlements market is projected to experience substantial growth over the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) estimated at xx%. This expansion is fueled by several factors. The increasing volume of electronic trading necessitates faster and more reliable clearing and settlement processes. The market penetration of advanced technologies, like distributed ledger technologies (DLT), is steadily increasing. This trend is further driven by regulators’ push for enhanced efficiency and reduced systemic risk in financial markets. The continuous rise in trading activity across asset classes, coupled with the expanding global reach of U.S. markets, contributes to the market's growth. The preference for robust risk management solutions among financial institutions is another key factor. However, the competitive landscape remains dynamic, with existing players investing heavily in technological upgrades and new entrants seeking to capitalize on market opportunities. This intensifying competition could place downward pressure on pricing and margins in the long term.

Dominant Markets & Segments in United States Clearing Houses and Settlements Market

The New York Stock Exchange (NYSE) continues to be the preeminent market segment, its dominance underpinned by its deeply entrenched infrastructure, consistently high trading volumes, and an extensive network of active market participants.

- Key Growth Drivers for NYSE:

- Established infrastructure and powerful network effects.

- Robust regulatory oversight fostering strong investor confidence.

- Exceptional trading volumes across a diverse range of asset classes.

Further analysis highlights the options segment as a significant area of robust growth. This surge is fueled by the escalating popularity of options trading among both retail and institutional investors, partly attributable to increased market volatility and the adoption of more sophisticated trading strategies. The proliferation of algorithmic and high-frequency trading further intensifies the demand for highly efficient and responsive clearing and settlement mechanisms within the options segment. Geographically, market activity remains predominantly concentrated in major financial hubs, particularly New York, due to the critical mass of market participants and the availability of comprehensive supporting infrastructure.

United States Clearing Houses and Settlements Market Product Analysis

Technological advancements are transforming clearing and settlement processes. The rise of real-time gross settlement (RTGS) systems, enhanced data analytics capabilities, and the exploration of blockchain technology promise increased efficiency, reduced counterparty risk, and improved transparency. The increasing use of AI and machine learning in fraud detection and risk management further enhances the robustness of the clearing and settlement infrastructure. These advancements are strongly aligned with market needs for faster and more secure transactions and are expected to drive further adoption in the coming years.

Key Drivers, Barriers & Challenges in United States Clearing Houses and Settlements Market

Key Drivers:

Technological advancements in automation and data analytics are significantly streamlining processes and contributing to cost reductions in operational efficiencies. An amplified focus on regulatory scrutiny and the mitigation of systemic risk is propelling the adoption of more resilient clearing and settlement solutions. Furthermore, the inherent and increasing complexity of modern financial markets mandates the existence of exceptionally efficient and dependable clearing and settlement systems.

Key Challenges:

The intricate and ever-evolving nature of regulatory complexities and compliance requirements presents substantial cost implications and operational hurdles. Pervasive cybersecurity threats and the potential for data breaches pose significant risks to the integrity and security of the entire clearing and settlement infrastructure. The emergence of new technologies and disruptive alternative trading platforms creates competitive pressures, compelling traditional players to continuously innovate and adapt.

Growth Drivers in the United States Clearing Houses and Settlements Market Market

Technological advancements in AI, machine learning, and blockchain technology are accelerating automation and improving the speed and efficiency of transactions. Increased regulatory scrutiny and a focus on systemic risk are driving the adoption of robust clearing and settlement solutions. The rise in electronic trading necessitates efficient clearing and settlement mechanisms to handle increased trading volumes.

Challenges Impacting United States Clearing Houses and Settlements Market Growth

Regulatory complexities and evolving compliance standards create operational burdens and cost pressures. Cybersecurity risks and potential data breaches necessitate significant investments in robust security measures. Competition from new technologies and alternative trading systems could impact market share and profitability.

Key Players Shaping the United States Clearing Houses and Settlements Market Market

- New York Stock Exchange

- NASDAQ

- CBOE Option Exchange

- International Securities Exchange

- Miami Stock Exchange

- National Stock Exchange

- Philadelphia Stock Exchange

Significant United States Clearing Houses and Settlements Market Industry Milestones

- December 2023: Miami International Holdings, Inc. launched MIAX Sapphire, a novel exchange designed to accommodate both electronic and physical trading floor operations.

- December 2023: New directives issued by Wall Street regulators have enforced a greater reliance on clearing houses to bolster the reduction of systemic risk within the U.S. Treasury market.

Future Outlook for United States Clearing Houses and Settlements Market Market

The U.S. clearing houses and settlements market is projected for sustained growth, propelled by ongoing technological innovation, evolving regulatory landscapes, and consistently increasing trading volumes. Significant strategic opportunities are emerging for market participants to harness advanced technologies such as blockchain and AI to substantially enhance operational efficiency, mitigate risk profiles, and improve overall market transparency. The market's potential for expansion is considerable, particularly within burgeoning areas like algorithmic trading and the progressive adoption of Distributed Ledger Technology (DLT) solutions. However, navigating the continuous evolution of regulatory frameworks and maintaining robust cybersecurity measures will remain paramount strategic considerations for all market participants moving forward.

United States Clearing Houses and Settlements Market Segmentation

-

1. Type of Market

- 1.1. Primary Market

- 1.2. Secondary Market

-

2. Financial Instruments

- 2.1. Debt

- 2.2. Equity

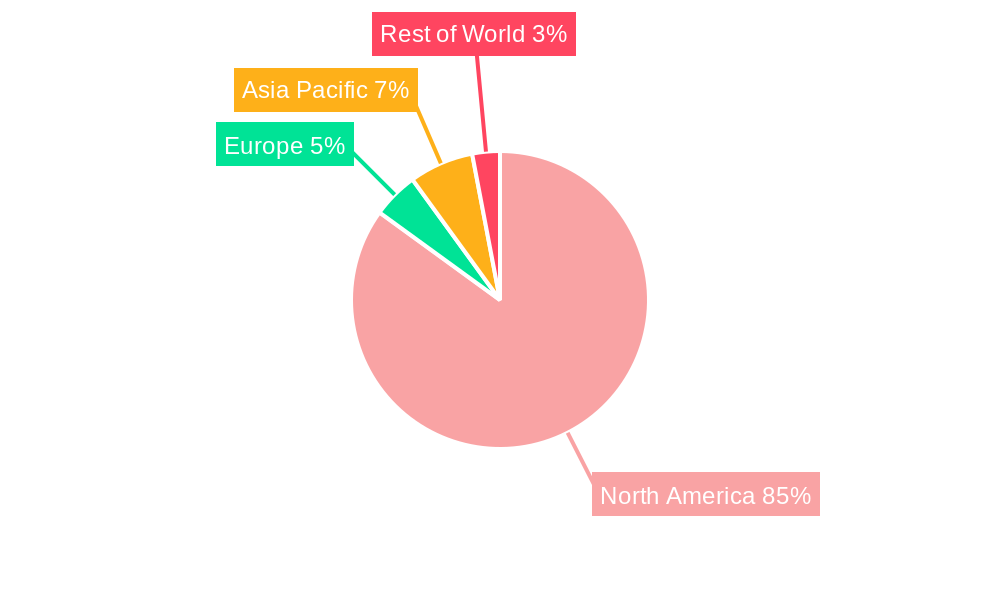

United States Clearing Houses and Settlements Market Segmentation By Geography

- 1. United States

United States Clearing Houses and Settlements Market Regional Market Share

Geographic Coverage of United States Clearing Houses and Settlements Market

United States Clearing Houses and Settlements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Digital Assets and Digitalization is Expected to Boost the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 5.1.1. Primary Market

- 5.1.2. Secondary Market

- 5.2. Market Analysis, Insights and Forecast - by Financial Instruments

- 5.2.1. Debt

- 5.2.2. Equity

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 New York Stock Exchange

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NASDAQ

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CBOE Option Exchange

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 International Securities Exchange

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Miami Stock Exchange

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 National Stock Exchange

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Philadelphia Stock Exchange*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 New York Stock Exchange

List of Figures

- Figure 1: United States Clearing Houses and Settlements Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Clearing Houses and Settlements Market Share (%) by Company 2025

List of Tables

- Table 1: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Type of Market 2020 & 2033

- Table 2: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Financial Instruments 2020 & 2033

- Table 3: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Type of Market 2020 & 2033

- Table 5: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Financial Instruments 2020 & 2033

- Table 6: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Clearing Houses and Settlements Market?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the United States Clearing Houses and Settlements Market?

Key companies in the market include New York Stock Exchange, NASDAQ, CBOE Option Exchange, International Securities Exchange, Miami Stock Exchange, National Stock Exchange, Philadelphia Stock Exchange*List Not Exhaustive.

3. What are the main segments of the United States Clearing Houses and Settlements Market?

The market segments include Type of Market, Financial Instruments.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.75 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Digital Assets and Digitalization is Expected to Boost the Growth of the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In December 2023, Miami International Holdings, Inc. has introduced new MIAX Sapphire, physical trading floor located in Miami's Wynwood district. The new MIAX Sapphire exchange, which will run both an electronic exchange and a physical trading floor, will be MIAX's fourth national securities exchange for U.S. multi-listed options.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Clearing Houses and Settlements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Clearing Houses and Settlements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Clearing Houses and Settlements Market?

To stay informed about further developments, trends, and reports in the United States Clearing Houses and Settlements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence