Key Insights

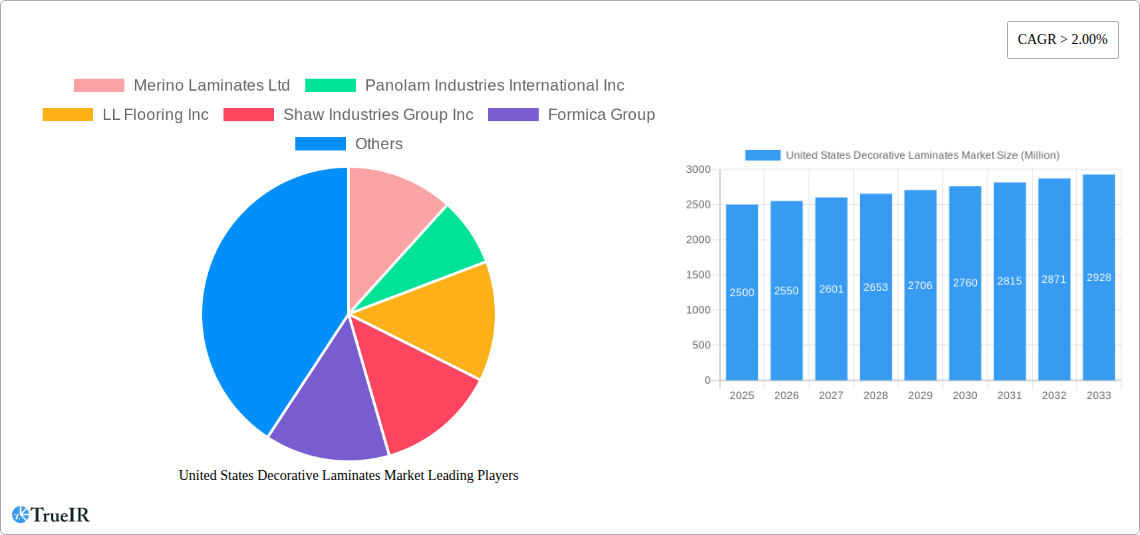

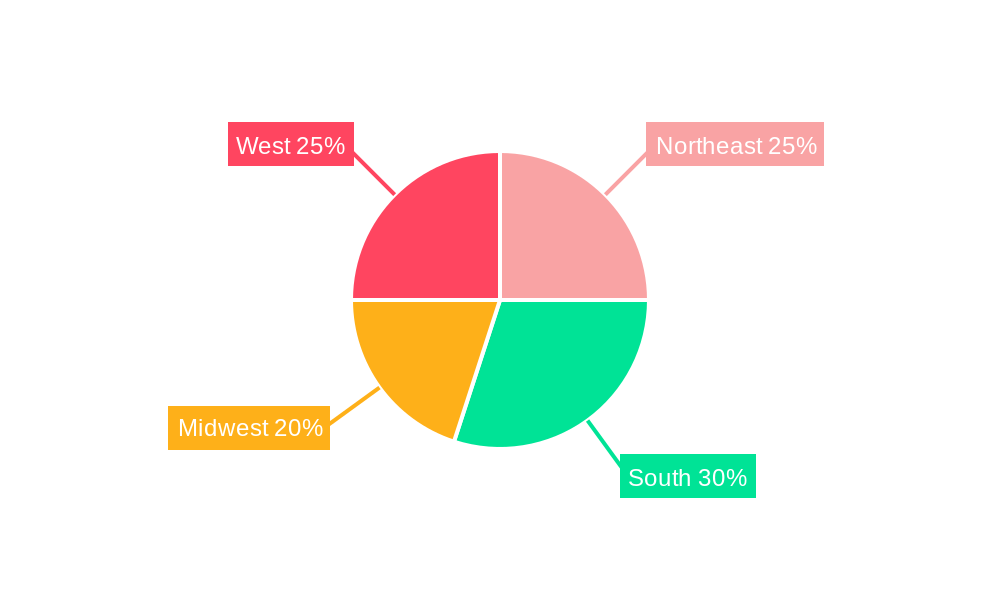

The United States decorative laminates market, valued at $2.1 billion in 2024, is projected for significant expansion, with a Compound Annual Growth Rate (CAGR) of 3.9% from 2024 to 2033. Key growth drivers include the robust construction sector, especially in residential and non-residential segments, increasing demand for decorative laminates in furniture, cabinetry, flooring, and wall panels. Evolving consumer preferences for durable and aesthetically appealing interior surfaces further fuel adoption across applications like tabletops and countertops. The transportation sector's need for lightweight, visually attractive materials also contributes to market growth. Major market trends include the rise of sustainable and eco-friendly laminate options, aligning with increasing environmental awareness, and continuous innovation in design and texture to meet diverse consumer tastes. Conversely, volatile raw material pricing, particularly for plastic resins, and potential economic slowdowns present market challenges. The market is segmented by raw materials (plastic resins, overlays, adhesives, wood substrates), applications (furniture, cabinets, flooring, wall panels, etc.), and end-user industries (residential, non-residential, transportation). Leading market participants such as Formica Group, Wilsonart International, and Shaw Industries Group Inc. are instrumental in driving innovation and competitive dynamics. Regional analysis of the U.S. market indicates varying growth trajectories across the Northeast, South, Midwest, and West, influenced by construction trends and consumer spending.

United States Decorative Laminates Market Market Size (In Billion)

The Northeast and West regions are anticipated to experience superior growth due to higher disposable incomes and a pronounced emphasis on home improvement and new construction projects. The South, characterized by its dynamic housing market, is another significant contributor to market demand. While the Midwest may present a more moderate growth profile, it remains a substantial market opportunity. The competitive landscape is defined by established enterprises and emerging innovators focused on product differentiation. This includes the development of high-performance laminates offering enhanced durability, scratch resistance, and stain resistance for a broad spectrum of applications. The forecast period (2024-2033) indicates sustained market expansion, propelled by ongoing construction activities, design advancements, and evolving consumer demands. Vigilant monitoring of raw material costs and economic indicators is essential for strategic market navigation and informed business decisions.

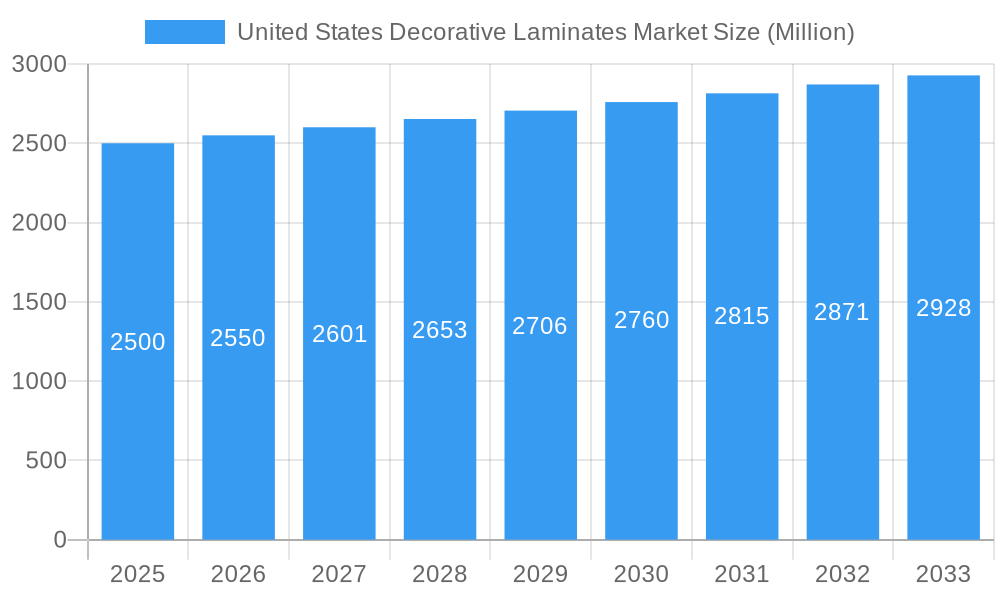

United States Decorative Laminates Market Company Market Share

United States Decorative Laminates Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the United States decorative laminates market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with 2025 serving as the base and estimated year. We delve into market size, segmentation, competitive dynamics, growth drivers, and challenges, providing a holistic view of this evolving sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

United States Decorative Laminates Market Structure & Competitive Landscape

The US decorative laminates market exhibits a moderately concentrated structure, with key players like Formica Group, Wilsonart International, and Mohawk Industries Inc. holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately competitive landscape. Innovation drives market growth, with companies focusing on developing sustainable, high-performance laminates. Regulatory changes concerning VOC emissions and material sourcing impact the industry. Product substitutes, such as solid surface materials and engineered stone, pose a competitive threat. The market witnesses frequent mergers and acquisitions (M&A) activities, as companies strive for market consolidation and expansion. The total value of M&A deals in the decorative laminates sector from 2019 to 2024 was approximately xx Million.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Drivers: Sustainable materials, enhanced performance, and design innovation.

- Regulatory Impacts: Stringent environmental regulations influence material selection and manufacturing processes.

- Product Substitutes: Solid surface materials, engineered stone, and other surfacing options compete for market share.

- End-User Segmentation: Residential, non-residential, and transportation sectors drive demand.

- M&A Trends: Consolidation through mergers and acquisitions is a prominent trend.

United States Decorative Laminates Market Trends & Opportunities

The US decorative laminates market is experiencing robust growth, driven by several key factors. The increasing demand for aesthetically pleasing and durable surfacing materials in both residential and commercial construction is a primary growth catalyst. Technological advancements in laminate production, focusing on improved durability, water resistance, and sustainability, are further expanding market opportunities. The changing consumer preferences towards eco-friendly and customizable products are also significantly impacting the market. The market penetration rate for high-pressure laminates (HPL) in residential applications is estimated at xx% in 2025, with projected growth to xx% by 2033. The CAGR for the overall market during this period is estimated at xx%. Competitive dynamics are characterized by product differentiation, brand recognition, and strategic partnerships.

Dominant Markets & Segments in United States Decorative Laminates Market

The residential sector dominates the end-user industry segment, accounting for approximately xx Million in 2025. Within raw materials, plastic resins represent the largest segment, followed by wood substrates. The furniture and cabinet applications exhibit the highest demand for decorative laminates.

- Leading Segment: Residential end-user industry and plastic resin raw material.

- Key Growth Drivers (Residential): New home construction, remodeling activities, and increasing disposable incomes.

- Key Growth Drivers (Plastic Resins): Cost-effectiveness, versatility, and availability of various types of resins.

- Key Growth Drivers (Furniture & Cabinets): Growing demand for customized and aesthetically appealing furniture.

United States Decorative Laminates Market Product Analysis

Technological advancements focus on enhancing the durability, scratch resistance, and stain resistance of decorative laminates. Innovations include the introduction of antimicrobial properties and improved color stability. The market is witnessing a growing demand for sustainable and eco-friendly laminates made from recycled materials or with lower VOC emissions. These products offer compelling advantages in terms of environmental responsibility and compliance with stringent building regulations.

Key Drivers, Barriers & Challenges in United States Decorative Laminates Market

Key Drivers:

- Increasing demand for aesthetically pleasing and durable surfacing materials.

- Technological advancements leading to improved product features and sustainability.

- Growth in the construction industry and residential remodeling projects.

Challenges:

- Fluctuations in raw material prices, particularly resins and wood substrates, impacting profitability.

- Intense competition from alternative materials like solid surface and engineered stone.

- Stringent environmental regulations necessitate continuous investments in sustainable production processes.

Growth Drivers in the United States Decorative Laminates Market Market

The growth of the U.S. decorative laminates market is fueled by a surge in construction activities, especially residential building and renovations. Technological advancements, leading to improved product performance, sustainability, and aesthetic appeal, are significant drivers. Government initiatives promoting energy-efficient buildings indirectly stimulate demand for high-performance laminates.

Challenges Impacting United States Decorative Laminates Market Growth

Supply chain disruptions and volatility in raw material costs remain significant challenges. Stringent environmental regulations increase production costs and require continuous adaptation. Intense competition from alternative surfacing materials limits market expansion. The combined impact of these factors can lead to reduced profit margins and slower market growth.

Key Players Shaping the United States Decorative Laminates Market Market

Significant United States Decorative Laminates Market Industry Milestones

- October 2022: Uniboard Canada expands its US Midwest distribution network through a partnership with Atlantic Plywood, increasing the availability of its TFL and HPL products. This move enhances market reach and strengthens the company's position.

- August 2022: LL Flooring expands its retail presence with three new store openings, signaling confidence in market growth and strengthening its retail network.

Future Outlook for United States Decorative Laminates Market Market

The US decorative laminates market is poised for continued growth, driven by ongoing construction activities and increasing demand for aesthetically pleasing and durable surfacing solutions. Strategic partnerships, investments in research and development, and focus on sustainable product offerings will shape the market's future. The expansion into niche applications and the exploration of new material technologies will create further opportunities for market expansion and growth.

United States Decorative Laminates Market Segmentation

-

1. Raw Material

- 1.1. Plastic Resin

- 1.2. Overlays

- 1.3. Adhesives

- 1.4. Wood Substrate

-

2. Application

- 2.1. Furniture

- 2.2. Cabinets

- 2.3. Flooring

- 2.4. Wall Panels

- 2.5. Other Applications (Table Tops and Counter Tops)

-

3. End-User Industry

- 3.1. Residential

- 3.2. Non-residential

- 3.3. Transportation

United States Decorative Laminates Market Segmentation By Geography

- 1. United States

United States Decorative Laminates Market Regional Market Share

Geographic Coverage of United States Decorative Laminates Market

United States Decorative Laminates Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Construction Sector; Increased Consumption of Furniture; Low Cost of Installation and Maintenance

- 3.3. Market Restrains

- 3.3.1. Availability of Substitutes; Other Restraints

- 3.4. Market Trends

- 3.4.1. Furniture Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Decorative Laminates Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Plastic Resin

- 5.1.2. Overlays

- 5.1.3. Adhesives

- 5.1.4. Wood Substrate

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Furniture

- 5.2.2. Cabinets

- 5.2.3. Flooring

- 5.2.4. Wall Panels

- 5.2.5. Other Applications (Table Tops and Counter Tops)

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Residential

- 5.3.2. Non-residential

- 5.3.3. Transportation

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Merino Laminates Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Panolam Industries International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 LL Flooring Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Shaw Industries Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Formica Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ATI Decorative Laminates

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Uniboard Canada Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wilsonart International

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Armstrong World Industries Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mohawk Industries Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Arpa Industriale SpA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 OMNOVA Solutions Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Merino Laminates Ltd

List of Figures

- Figure 1: United States Decorative Laminates Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Decorative Laminates Market Share (%) by Company 2025

List of Tables

- Table 1: United States Decorative Laminates Market Revenue billion Forecast, by Raw Material 2020 & 2033

- Table 2: United States Decorative Laminates Market Volume Square Meters Forecast, by Raw Material 2020 & 2033

- Table 3: United States Decorative Laminates Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: United States Decorative Laminates Market Volume Square Meters Forecast, by Application 2020 & 2033

- Table 5: United States Decorative Laminates Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 6: United States Decorative Laminates Market Volume Square Meters Forecast, by End-User Industry 2020 & 2033

- Table 7: United States Decorative Laminates Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: United States Decorative Laminates Market Volume Square Meters Forecast, by Region 2020 & 2033

- Table 9: United States Decorative Laminates Market Revenue billion Forecast, by Raw Material 2020 & 2033

- Table 10: United States Decorative Laminates Market Volume Square Meters Forecast, by Raw Material 2020 & 2033

- Table 11: United States Decorative Laminates Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: United States Decorative Laminates Market Volume Square Meters Forecast, by Application 2020 & 2033

- Table 13: United States Decorative Laminates Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 14: United States Decorative Laminates Market Volume Square Meters Forecast, by End-User Industry 2020 & 2033

- Table 15: United States Decorative Laminates Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: United States Decorative Laminates Market Volume Square Meters Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Decorative Laminates Market?

The projected CAGR is approximately 3.9%.

2. Which companies are prominent players in the United States Decorative Laminates Market?

Key companies in the market include Merino Laminates Ltd, Panolam Industries International Inc, LL Flooring Inc, Shaw Industries Group Inc, Formica Group, ATI Decorative Laminates, Uniboard Canada Inc, Wilsonart International, Armstrong World Industries Inc, Mohawk Industries Inc, Arpa Industriale SpA, OMNOVA Solutions Inc.

3. What are the main segments of the United States Decorative Laminates Market?

The market segments include Raw Material, Application, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Construction Sector; Increased Consumption of Furniture; Low Cost of Installation and Maintenance.

6. What are the notable trends driving market growth?

Furniture Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Availability of Substitutes; Other Restraints.

8. Can you provide examples of recent developments in the market?

October 2022: Uniboard Canada announced the appointment of Atlantic Plywood as a distributor for Uniboard products in the US Midwest. The offering will include 24 specifically selected colors of Uniboard's Thermally Fused Laminates (TFL) and High Pressure Laminates (HPL) product line.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Square Meters.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Decorative Laminates Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Decorative Laminates Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Decorative Laminates Market?

To stay informed about further developments, trends, and reports in the United States Decorative Laminates Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence