Key Insights

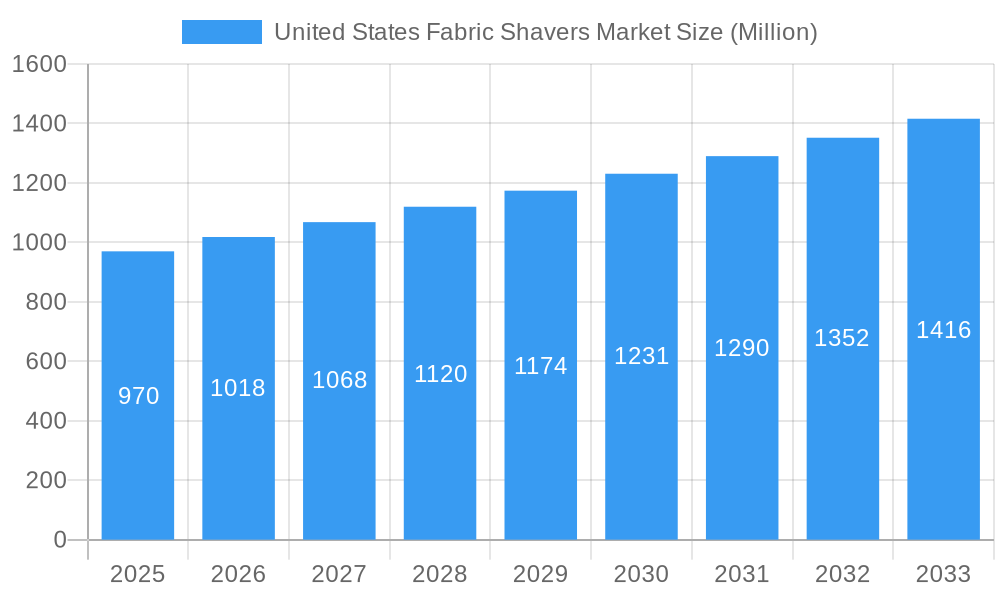

The United States fabric shavers market, valued at $0.97 billion in 2025, is projected to experience steady growth, driven by increasing consumer demand for convenient and effective clothing care solutions. The market's Compound Annual Growth Rate (CAGR) of 4.78% from 2025 to 2033 indicates a positive outlook, fueled by several key factors. The rising popularity of online shopping channels provides consumers with easy access to a wide variety of fabric shavers, boosting market expansion. Furthermore, the increasing awareness of fabric care among consumers and a preference for maintaining the appearance of clothing contribute to market growth. The diverse product segments, including handheld manual, electric, and battery-operated shavers, cater to varied consumer preferences and budgets, further fueling market expansion. While the market faces some restraints including competition from traditional dry cleaning services and the relatively low price point of certain products limiting profit margins for manufacturers, the convenience and effectiveness of fabric shavers continues to outweigh these challenges. The dominance of specific product types within the market, such as electric fabric shavers due to their ease of use and efficiency, is likely to shape future market dynamics.

United States Fabric Shavers Market Market Size (In Million)

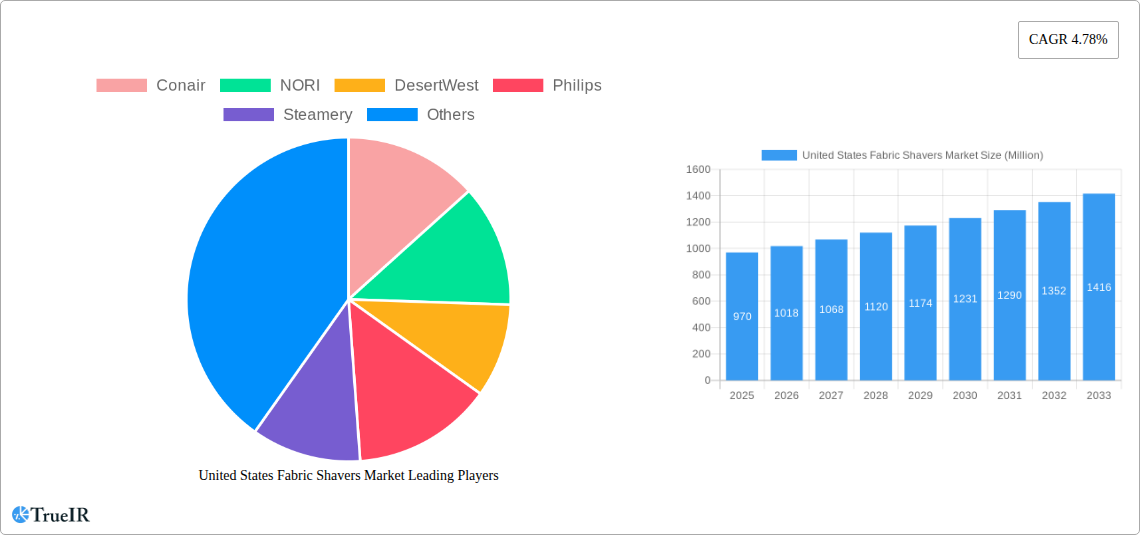

The residential end-user segment currently holds a significant market share, though the commercial sector, encompassing hotels, dry cleaners, and laundromats, is anticipated to witness increasing adoption of fabric shavers due to their efficiency in handling large volumes of garments. Growth in the commercial segment is expected to gradually increase the overall market value over the forecast period. Major players like Conair, Philips, and Rowenta are leveraging their brand recognition and established distribution networks to maintain a competitive edge. However, smaller, specialized brands are focusing on niche product features and designs, leading to increased innovation and choice within the market. The market’s segmentation by distribution channels shows a growing preference for online channels due to their convenience and wider product selection, pushing hypermarkets/supermarkets and specialty stores to adapt their strategies to compete effectively. This evolving landscape highlights the importance of brand recognition, product innovation, and strategic online presence in securing market share.

United States Fabric Shavers Market Company Market Share

This dynamic report provides a comprehensive analysis of the United States Fabric Shavers Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033, this report delves into market segmentation, competitive dynamics, growth drivers, and future trends. Leveraging high-volume keywords such as "fabric shaver market," "United States fabric shavers," "electric fabric shaver," and "handheld fabric shaver," this report ensures maximum visibility and accessibility for target audiences. The report's detailed analysis incorporates quantitative and qualitative data, providing a holistic understanding of this evolving market.

United States Fabric Shavers Market Structure & Competitive Landscape

The United States fabric shavers market is characterized by a moderately concentrated landscape, with key players including Conair, NORI, DesertWest, Philips (now Versuni), Steamery, Rowenta, Butler Home Products, Sencor, Falconeri, Gleener, and Super Lint. Market concentration is estimated at a Herfindahl-Hirschman Index (HHI) of xx in 2025, indicating a moderately competitive environment. Innovation drives market growth, with companies focusing on developing cordless, rechargeable models with enhanced features like multiple settings and ergonomic designs. Regulatory impacts, mainly concerning safety standards and energy efficiency, are relatively low but constantly monitored. Product substitutes, such as professional dry cleaning services, exist but are often more costly and less convenient.

- End-User Segmentation: The market is primarily driven by residential consumers, with a smaller but growing commercial segment (e.g., hotels, dry cleaners).

- M&A Trends: Recent activity, such as the Philips Domestic Appliances rebranding to Versuni in February 2023, highlights the ongoing evolution and consolidation within the sector. While the total M&A volume in the broader appliance sector remains high (xx Million USD in 2024), specific deals directly impacting the fabric shaver segment are limited, indicating organic growth as the primary strategy for most companies.

United States Fabric Shavers Market Market Trends & Opportunities

The United States fabric shavers market is experiencing robust growth, projected to reach xx Million USD by 2033, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is propelled by several factors. Increasing consumer awareness of fabric care and the desire for convenient clothing maintenance contribute significantly. Technological advancements, particularly in battery technology and motor efficiency, are driving the adoption of electric and battery-operated models. Changing consumer preferences towards convenience and ease of use are also key drivers. Market penetration remains relatively low, with significant untapped potential among various consumer demographics. Competitive dynamics are influenced by pricing strategies, product differentiation, and branding efforts.

Dominant Markets & Segments in United States Fabric Shavers Market

The United States fabric shavers market exhibits dynamic growth across its distribution and product segments. Currently, the online channel stands out as the fastest-growing distribution segment, fueled by the pervasive shift towards e-commerce and the unparalleled convenience it offers consumers. Within product categories, electric fabric shavers continue to command a dominant market share, owing to their superior performance and features. These are followed by battery-operated/rechargeable fabric shavers, which offer portability and ease of use. Geographically, the market is largely driven by the residential end-user segment, which consistently represents the largest portion of market demand for fabric care solutions.

- Key Growth Drivers:

- E-commerce Expansion & Digitalization: The escalating adoption of online retail platforms and the increasing digital footprint of consumers are directly propelling the growth of the online distribution channel.

- Technological Advancements & Product Innovation: Continuous improvements in battery technology, motor efficiency, and design ergonomics are enhancing the performance, user experience, and appeal of both electric and battery-operated fabric shavers.

- Rising Disposable Incomes & Focus on Garment Care: An increase in consumer disposable incomes allows for greater investment in home convenience products, with a growing emphasis on extending the lifespan and appearance of clothing through effective fabric care.

- Growing Awareness of Sustainable Fashion Practices: Consumers are increasingly seeking ways to maintain their existing wardrobes, which directly boosts the demand for products like fabric shavers that help prolong garment life and reduce textile waste.

The sustained market dominance of electric fabric shavers can be attributed to their inherent efficiency, advanced features, and longer lifespan when compared to manual alternatives. The residential sector's predominant share underscores the widespread need for effective fabric maintenance solutions within households. The market is also witnessing an increasing demand for travel-sized and cordless models, catering to the on-the-go consumer.

United States Fabric Shavers Market Product Analysis

Recent innovations within the United States fabric shavers market are significantly enhancing product functionality and user satisfaction. Key advancements include the integration of advanced motor technology, leading to quieter operation and optimized fabric de-pilling performance. Ergonomic designs are also a major focus, ensuring comfortable handling and reducing user fatigue during prolonged use. Furthermore, the introduction of multi-setting capabilities and interchangeable heads offers greater versatility, allowing shavers to effectively tackle various fabric types and de-pilling needs. These cutting-edge features not only elevate the user experience but also provide crucial points of differentiation in a highly competitive marketplace. The market fit of these innovations is strongly aligned with evolving consumer preferences for convenient, efficient, and user-friendly fabric care appliances that contribute to garment longevity and aesthetic appeal.

Key Drivers, Barriers & Challenges in United States Fabric Shavers Market

Key Drivers: The increasing popularity of casual wear, requiring frequent cleaning and maintenance, and the rising adoption of e-commerce platforms for convenient purchasing are significant drivers. Furthermore, technological advancements in motor efficiency, battery life, and ergonomic design continue to boost market growth.

Key Challenges: Intense competition among established brands and the emergence of new players pose challenges to market expansion. Supply chain disruptions and fluctuations in raw material prices can also impact profitability and market stability. Additionally, stringent safety and regulatory compliance requirements can add to operational complexities. These issues collectively hinder growth potential.

Growth Drivers in the United States Fabric Shavers Market Market

Technological advancements in motor efficiency and battery life lead to more powerful, portable, and convenient fabric shavers. The rise of e-commerce platforms and improved online marketing strategies enhance product accessibility and boost sales. Finally, favorable economic conditions enabling greater consumer spending directly supports market expansion.

Challenges Impacting United States Fabric Shavers Market Growth

Supply chain disruptions resulting from global events impact the availability of raw materials and components, increasing production costs and potentially limiting supply. Stringent safety and quality standards increase the complexity and cost of product development and testing. Lastly, intense competition amongst numerous brands necessitates significant investment in research, development, and marketing to achieve sustainable growth.

Key Players Shaping the United States Fabric Shavers Market Market

- Conair

- NORI

- DesertWest

- Versuni (formerly Philips Domestic Appliances)

- Steamery

- Rowenta

- Butler Home Products

- Sencor

- Falconeri

- Gleener

- Super Lint

- Pure Enrichment

- Beautural

Significant United States Fabric Shavers Market Industry Milestones

- April 2022: Aaron's Company's acquisition of BrandsMart U.S.A. for USD 230 Million, while not directly related to fabric shavers, broadened Aaron's reach in the appliance retail landscape. This expansion may influence future distribution strategies and market penetration for various home appliances, including fabric shavers.

- February 2023: The rebranding of Philips Domestic Appliances to Versuni marks a strategic realignment of its domestic appliance business. This transition could lead to a renewed focus on product innovation, marketing strategies, and potentially introduce new fabric shaver models or enhance existing ones under the Versuni umbrella.

- Ongoing: Continued investment in research and development by key players, leading to the regular launch of upgraded models with improved battery life, motor power, and blade technology, which directly impacts market dynamics and consumer choices.

Future Outlook for United States Fabric Shavers Market Market

The United States fabric shavers market is projected to experience robust and sustained growth in the coming years. This optimistic outlook is underpinned by several key factors, including the relentless pace of technological advancements, a continually rising consumer demand for convenient and efficient home appliances, and the unyielding expansion of the e-commerce sector, which offers unparalleled access to a broad consumer base. Strategic opportunities for market players are abundant, focusing on the development of innovative products that offer enhanced features such as faster de-pilling, gentler fabric care, and smart connectivity. Furthermore, targeting niche markets, such as sustainable fashion enthusiasts or those with specific fabric care needs, and exploring novel distribution channels beyond traditional retail will be crucial for capturing increased market share. The overall market potential remains significant, with ample room for deeper penetration across diverse consumer segments and expanding geographic regions within the United States.

United States Fabric Shavers Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

United States Fabric Shavers Market Segmentation By Geography

- 1. United States

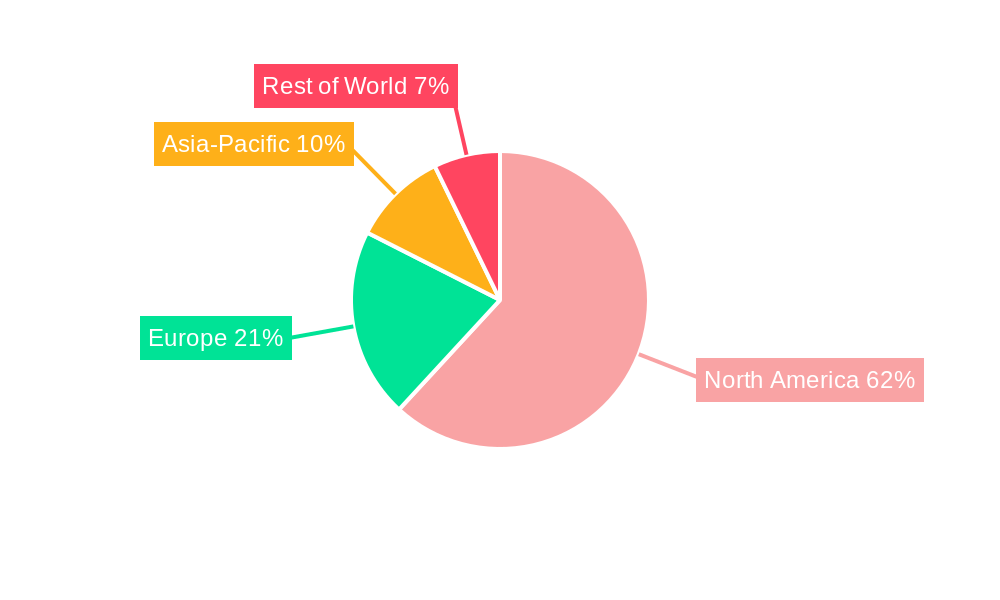

United States Fabric Shavers Market Regional Market Share

Geographic Coverage of United States Fabric Shavers Market

United States Fabric Shavers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Sales of Apparel and Textile Market; Increasing Revenue of Small Home Appliances

- 3.3. Market Restrains

- 3.3.1. Rising Average Price Level of Small Appliances in United States; Lack of Product Awareness Affecting the Market Sales

- 3.4. Market Trends

- 3.4.1. Rising Online Sales of Fabric Shavers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Fabric Shavers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Conair

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NORI

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DesertWest

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Philips

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Steamery

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rowenta

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Butler Home Products

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sencor

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Falconeri

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Gleener

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Super Lint

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Conair

List of Figures

- Figure 1: United States Fabric Shavers Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Fabric Shavers Market Share (%) by Company 2025

List of Tables

- Table 1: United States Fabric Shavers Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: United States Fabric Shavers Market Volume K Units Forecast, by Production Analysis 2020 & 2033

- Table 3: United States Fabric Shavers Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: United States Fabric Shavers Market Volume K Units Forecast, by Consumption Analysis 2020 & 2033

- Table 5: United States Fabric Shavers Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: United States Fabric Shavers Market Volume K Units Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: United States Fabric Shavers Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: United States Fabric Shavers Market Volume K Units Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: United States Fabric Shavers Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: United States Fabric Shavers Market Volume K Units Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: United States Fabric Shavers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 12: United States Fabric Shavers Market Volume K Units Forecast, by Region 2020 & 2033

- Table 13: United States Fabric Shavers Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: United States Fabric Shavers Market Volume K Units Forecast, by Production Analysis 2020 & 2033

- Table 15: United States Fabric Shavers Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: United States Fabric Shavers Market Volume K Units Forecast, by Consumption Analysis 2020 & 2033

- Table 17: United States Fabric Shavers Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: United States Fabric Shavers Market Volume K Units Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: United States Fabric Shavers Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: United States Fabric Shavers Market Volume K Units Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: United States Fabric Shavers Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: United States Fabric Shavers Market Volume K Units Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: United States Fabric Shavers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: United States Fabric Shavers Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Fabric Shavers Market?

The projected CAGR is approximately 4.78%.

2. Which companies are prominent players in the United States Fabric Shavers Market?

Key companies in the market include Conair, NORI, DesertWest, Philips, Steamery, Rowenta, Butler Home Products, Sencor, Falconeri, Gleener, Super Lint.

3. What are the main segments of the United States Fabric Shavers Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.97 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Sales of Apparel and Textile Market; Increasing Revenue of Small Home Appliances.

6. What are the notable trends driving market growth?

Rising Online Sales of Fabric Shavers.

7. Are there any restraints impacting market growth?

Rising Average Price Level of Small Appliances in United States; Lack of Product Awareness Affecting the Market Sales.

8. Can you provide examples of recent developments in the market?

April 2022: Aaron's Company acquired BrandsMart U.S.A. in a deal valuing USD 230 million. Aaron's Company, Inc. is an Atlanta-based firm providing lease-to-own and retail purchase solutions with BrandsMart U.S.A. exists as an appliance and consumer electronics retailer in the southeast United States with ten retail stores in Florida and Georgia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Fabric Shavers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Fabric Shavers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Fabric Shavers Market?

To stay informed about further developments, trends, and reports in the United States Fabric Shavers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence