Key Insights

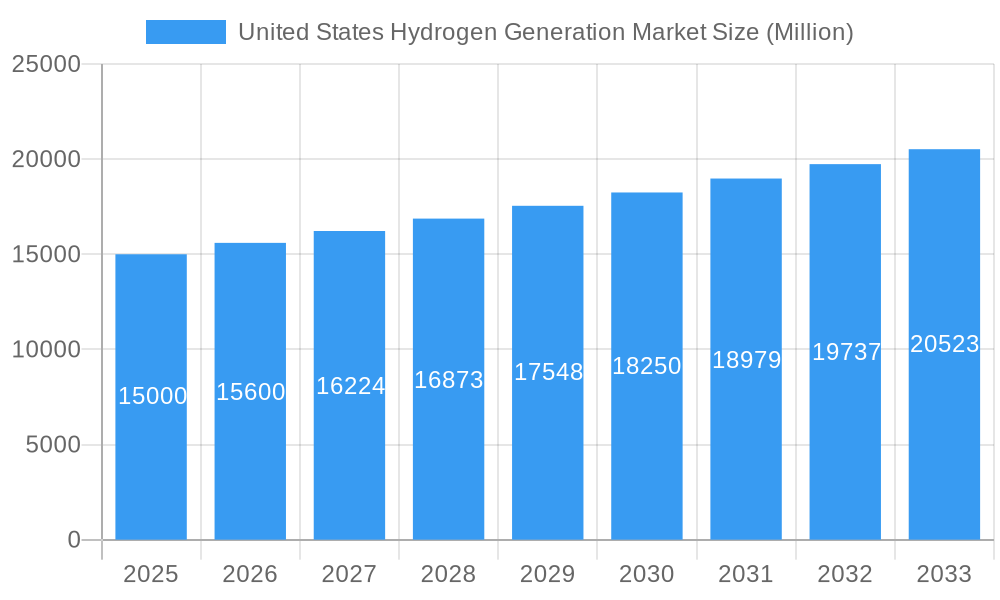

The United States hydrogen generation market is projected for significant expansion, driven by increasing demand across various sectors and supportive government initiatives for clean energy transition. The market is anticipated to reach $204.86 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 8.6% from the base year 2025. Key growth drivers include the escalating adoption of fuel cell electric vehicles, the burgeoning need for hydrogen in industrial processes such as oil refining and chemical production, and heightened awareness of hydrogen's pivotal role in decarbonizing heavy industries like iron and steel manufacturing. The market is segmented by hydrogen color (blue, green, grey), production technology (Steam Methane Reforming (SMR), coal gasification, others), and application. While green hydrogen, produced from renewable energy, is gaining momentum due to environmental mandates, blue hydrogen (produced from natural gas with carbon capture) currently holds a substantial market share, benefiting from established infrastructure and competitive production costs. However, ongoing technological advancements and robust government incentives are accelerating green hydrogen's growth, poised to significantly increase its market share. Market restraints include substantial initial capital investment for production facilities, challenges in hydrogen storage and transportation, and competition from alternative energy solutions. Leading industry players such as Air Products and Chemicals Inc., Fuel Cell Energy Inc., and Linde Plc are instrumental in shaping the market through technological innovation and capacity expansion.

United States Hydrogen Generation Market Market Size (In Billion)

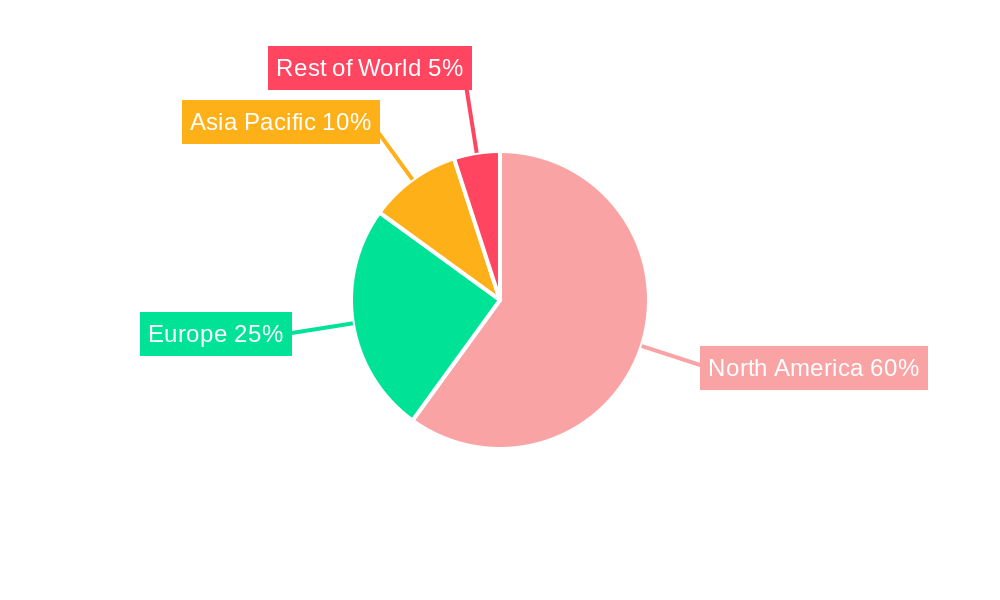

North America, led by the United States, dominates the global hydrogen generation market, attributed to its strong industrial base and extensive energy consumption. Substantial investments in renewable energy infrastructure, coupled with government policies focused on reducing greenhouse gas emissions, further energize market dynamics. While the historical period (2019-2024) saw moderate growth, the forecast period (2025-2033) is expected to witness accelerated expansion, fueled by the convergence of technological progress, policy support, and increasing industrial demand. Strategic collaborations, mergers, and acquisitions are also anticipated to significantly influence the competitive landscape and foster further growth within the US hydrogen generation market. The market's trajectory will critically depend on balancing the cost-effectiveness of blue hydrogen with the environmentally driven expansion of green hydrogen production.

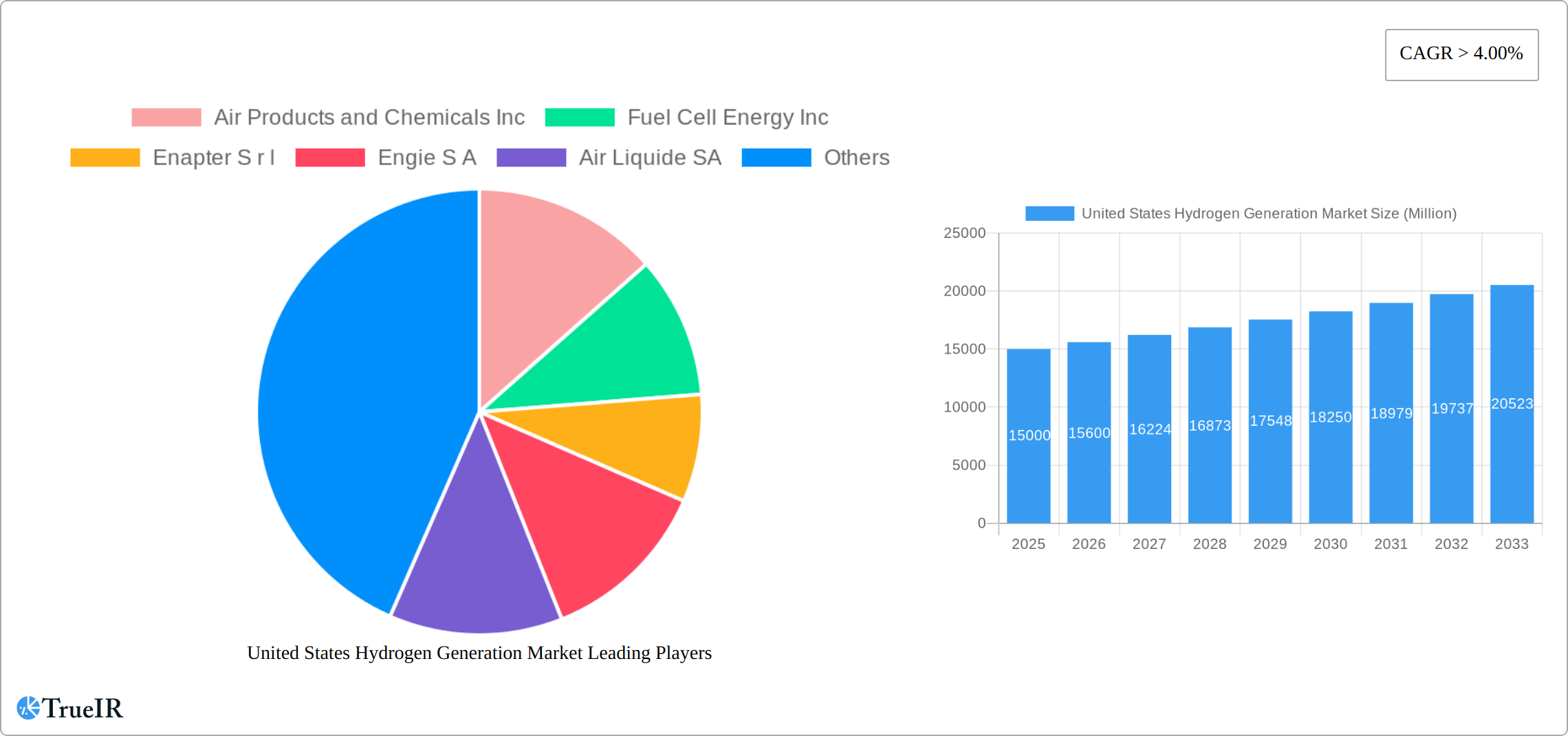

United States Hydrogen Generation Market Company Market Share

This comprehensive report offers a detailed analysis of the United States hydrogen generation market, providing valuable strategic insights for investors, industry professionals, and policymakers. Spanning the forecast period of 2025-2033, with a base year of 2025, and leveraging extensive historical data from 2019-2024, this report projects future market trends with precision. The market is granularly segmented by source (blue, green, grey hydrogen), technology (Steam Methane Reforming (SMR), coal gasification, others), and application (oil refining, chemical processing, iron & steel production, others), offering a deep understanding of this dynamic sector. The market size is projected to reach $204.86 billion by 2033, demonstrating a CAGR of 8.6% during the forecast period.

United States Hydrogen Generation Market Market Structure & Competitive Landscape

The United States hydrogen generation market exhibits a moderately concentrated structure, with several major players commanding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market. Key innovation drivers include advancements in electrolysis technologies, particularly PEM (Proton Exchange Membrane) electrolyzers, and ongoing research into cost-effective hydrogen production methods. Government regulations, including incentives for renewable energy and carbon emission reduction targets, significantly influence market dynamics. Product substitutes, such as natural gas and electricity, pose competitive challenges, but hydrogen's unique attributes, especially in heavy industry and transportation, offer considerable advantages. The market experiences frequent mergers and acquisitions (M&A) activities, with an estimated xx Million in M&A volume during the historical period. End-user segmentation is dominated by the oil refining, chemical processing, and iron & steel production sectors, although increasing demand from transportation and power generation segments is anticipated.

- Market Concentration: Moderately concentrated, with HHI estimated at xx.

- Innovation Drivers: Advancements in electrolysis, cost reduction efforts.

- Regulatory Impacts: Strong influence from government incentives and emission reduction targets.

- Product Substitutes: Natural gas, electricity.

- End-User Segmentation: Oil refining, chemical processing, iron & steel production showing dominant demand, with emerging demand from transportation and power generation.

- M&A Trends: Significant activity, with an estimated xx Million in M&A volume during 2019-2024.

United States Hydrogen Generation Market Market Trends & Opportunities

The United States hydrogen generation market is experiencing robust and accelerating growth, fueled by a compelling confluence of factors. The market is poised for significant expansion, with projections indicating a rise to approximately [Insert Projected Market Size] Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around [Insert Projected CAGR]%. This upward trajectory is underpinned by an intensified global focus on decarbonization and the urgent need to transition towards cleaner energy sources. Crucially, governmental support for renewable hydrogen projects is escalating, with substantial investments and policy incentives being rolled out across federal and state levels. Simultaneously, continuous technological advancements are driving down the cost of hydrogen production, making it increasingly competitive with traditional fossil fuels. The burgeoning adoption of hydrogen fuel cells, particularly in the transportation sector for heavy-duty vehicles, buses, and potentially light-duty vehicles, alongside its critical role in grid-scale energy storage solutions, is a major demand driver. The market penetration rate for green hydrogen, produced from renewable energy sources via electrolysis, is set to surge dramatically, projected to increase from an estimated [Insert Current Green Hydrogen %]% in 2025 to a substantial [Insert Future Green Hydrogen %]% by 2033. This shift is further propelled by evolving consumer preferences that increasingly favor environmentally conscious and sustainable energy alternatives. On the competitive front, the market is characterized by heightened investment in research and development (R&D) to enhance production efficiency and cost-effectiveness, the formation of strategic partnerships to leverage expertise and scale, and a dynamic landscape of mergers and acquisitions (M&A) as companies consolidate their positions and expand their offerings.

Dominant Markets & Segments in United States Hydrogen Generation Market

Leading Region/Segment: The dominant segment is projected to be Green Hydrogen in terms of market value and growth rate in the coming years driven by the growing government support and technological advancements. Texas and California are leading states based on investments in the infrastructure and industrial demands for hydrogen.

Key Growth Drivers:

- Infrastructure Development: Significant investments in pipelines and storage facilities are accelerating market expansion.

- Supportive Policies: Government incentives, tax credits, and emission reduction targets are encouraging hydrogen adoption.

- Technological Advancements: Cost reductions in electrolysis and other production technologies are enhancing market competitiveness.

- Increasing Demand: Growing demand from the transportation, industrial, and power generation sectors is driving market growth.

Detailed analysis shows that the Green Hydrogen segment enjoys the fastest growth rate and highest value. This growth is being driven by supportive government policies focusing on decarbonization, technological advancements that continuously reduce production costs, and the increased acceptance of green hydrogen in various industries. Significant investments in R&D are further improving the efficiency and scalability of green hydrogen production, attracting further investment in this sector.

United States Hydrogen Generation Market Product Analysis

Innovation in hydrogen production technologies is a key differentiator in the U.S. market. Significant advancements are being made in electrolysis technologies, with Proton Exchange Membrane (PEM) electrolyzers and alkaline electrolyzers leading the charge. These technologies are not only enhancing energy efficiency and consequently lowering the cost of producing hydrogen but are also improving the scalability and modularity of hydrogen generation systems. This allows for more flexible deployment across a wider range of applications. The market is witnessing the emergence of increasingly sophisticated, compact, modular, and even portable hydrogen generation units, designed to meet the diverse and often localized demands of various industries. Competitive advantages are being carved out through the development and deployment of proprietary technologies, achieving cost leadership in production, and establishing robust and integrated supply chains that ensure reliable access to raw materials and efficient distribution of hydrogen.

Key Drivers, Barriers & Challenges in United States Hydrogen Generation Market

Key Drivers:

- Decarbonization Initiatives: Growing focus on reducing greenhouse gas emissions across various sectors.

- Government Support: Financial incentives, tax credits, and supportive regulations are boosting market growth.

- Technological Advancements: Cost reductions in hydrogen production technologies are increasing market competitiveness.

Challenges & Restraints:

- High Production Costs: The relatively high cost of hydrogen production remains a barrier to widespread adoption.

- Supply Chain Constraints: Limited infrastructure for hydrogen storage, transportation, and distribution pose challenges.

- Safety Concerns: Safety concerns related to hydrogen storage and handling continue to require attention and investment in better solutions.

Growth Drivers in the United States Hydrogen Generation Market Market

The accelerating growth of the United States hydrogen generation market is propelled by a trifecta of powerful drivers. Foremost among these are technological advancements, particularly in electrolysis and other emerging production methods, which are continuously driving down the cost of hydrogen, making it a more economically viable and attractive energy carrier. Complementing this is a supportive government policy and regulatory environment, with federal and state initiatives actively promoting renewable energy adoption, incentivizing carbon reduction strategies, and establishing clear frameworks for hydrogen development and deployment. This creates a fertile ground for investment and innovation. Finally, the increasing demand from diverse end-use sectors is a significant growth catalyst. This includes the transportation sector, aiming for zero-emission heavy-duty trucks and fleet vehicles, the industrial sector seeking to decarbonize high-heat processes, and the energy sector leveraging hydrogen for long-term energy storage and grid stabilization.

Challenges Impacting United States Hydrogen Generation Market Growth

The high capital cost associated with hydrogen production facilities remains a significant barrier. The lack of established infrastructure for hydrogen storage, transportation, and distribution poses a major challenge. Competitive pressures from traditional energy sources and the need to address safety concerns are also factors impacting growth.

Key Players Shaping the United States Hydrogen Generation Market Market

- Air Products and Chemicals Inc

- Fuel Cell Energy Inc

- Enapter S r l

- Engie S A

- Air Liquide SA

- McPhy Energy S A

- Messer Group GmbH

- Cummins Inc

- Linde Plc

- ITM Power Plc

- Taiyo Nippon Sanso Holding Corporation

Significant United States Hydrogen Generation Market Industry Milestones

- September 2022: Linde announced plans to build a 35-megawatt PEM electrolyzer in Niagara Falls, New York, significantly expanding its green hydrogen production capacity.

- August 2022: NREL and Toyota collaborated on a one-megawatt PEM fuel cell power generation system, demonstrating large-scale power production using hydrogen fuel cells.

Future Outlook for United States Hydrogen Generation Market Market

The future outlook for the United States hydrogen generation market is exceptionally promising, signaling a period of sustained and substantial growth. This optimistic forecast is built upon the continued momentum of technological advancements, which are expected to further refine production processes, enhance efficiency, and drive down costs. The ongoing commitment to supportive government policies and incentives, including the Inflation Reduction Act and various state-level initiatives, will continue to de-risk investments and accelerate deployment. The ever-increasing demand from a widening array of sectors, driven by decarbonization mandates and the pursuit of energy independence, will solidify hydrogen's role as a critical energy vector. Strategic opportunities abound for companies that can lead in developing next-generation hydrogen production technologies, pioneer innovative hydrogen infrastructure solutions (including pipelines, storage, and refueling stations), and forge robust collaborations across the entire hydrogen value chain, from production to end-use. The market's vast potential is being increasingly recognized, with significant growth anticipated not only in the green hydrogen segment but also in the blue hydrogen segment, which offers a lower-carbon alternative to traditional grey hydrogen production.

United States Hydrogen Generation Market Segmentation

-

1. Source

- 1.1. Blue hydrogen

- 1.2. Green hydrogen

- 1.3. Grey Hydrogen

-

2. Technology

- 2.1. Steam Methane Reforming (SMR)

- 2.2. Coal Gasification

- 2.3. Others

-

3. Application

- 3.1. Oil Refining

- 3.2. Chemical Processing

- 3.3. Iron & Steel Production

- 3.4. Others

United States Hydrogen Generation Market Segmentation By Geography

- 1. United States

United States Hydrogen Generation Market Regional Market Share

Geographic Coverage of United States Hydrogen Generation Market

United States Hydrogen Generation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand From Refining And Industrial Sector4.; Favourable Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Capital Costs For Hydrogen Energy Storage

- 3.4. Market Trends

- 3.4.1. Grey to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Hydrogen Generation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Blue hydrogen

- 5.1.2. Green hydrogen

- 5.1.3. Grey Hydrogen

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Steam Methane Reforming (SMR)

- 5.2.2. Coal Gasification

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Oil Refining

- 5.3.2. Chemical Processing

- 5.3.3. Iron & Steel Production

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Air Products and Chemicals Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fuel Cell Energy Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Enapter S r l

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Engie S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Air Liquide SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 McPhy Energy S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Messer Group GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cummins Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Linde Plc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ITM Power Plc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Taiyo Nippon Sanso Holding Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Air Products and Chemicals Inc

List of Figures

- Figure 1: United States Hydrogen Generation Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Hydrogen Generation Market Share (%) by Company 2025

List of Tables

- Table 1: United States Hydrogen Generation Market Revenue billion Forecast, by Source 2020 & 2033

- Table 2: United States Hydrogen Generation Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 3: United States Hydrogen Generation Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: United States Hydrogen Generation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United States Hydrogen Generation Market Revenue billion Forecast, by Source 2020 & 2033

- Table 6: United States Hydrogen Generation Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 7: United States Hydrogen Generation Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: United States Hydrogen Generation Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Hydrogen Generation Market?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the United States Hydrogen Generation Market?

Key companies in the market include Air Products and Chemicals Inc, Fuel Cell Energy Inc, Enapter S r l, Engie S A, Air Liquide SA, McPhy Energy S A, Messer Group GmbH, Cummins Inc, Linde Plc, ITM Power Plc, Taiyo Nippon Sanso Holding Corporation.

3. What are the main segments of the United States Hydrogen Generation Market?

The market segments include Source, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 204.86 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand From Refining And Industrial Sector4.; Favourable Government Policies.

6. What are the notable trends driving market growth?

Grey to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Capital Costs For Hydrogen Energy Storage.

8. Can you provide examples of recent developments in the market?

In September 2022, Linde announced plans to build a 35-megawatt PEM (Proton Exchange Membrane) electrolyzer to produce green hydrogen in Niagara Falls, New York. The new plant will be the largest electrolyzer installed by Linde globally and will more than double Linde's green liquid hydrogen production capacity in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Hydrogen Generation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Hydrogen Generation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Hydrogen Generation Market?

To stay informed about further developments, trends, and reports in the United States Hydrogen Generation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence