Key Insights

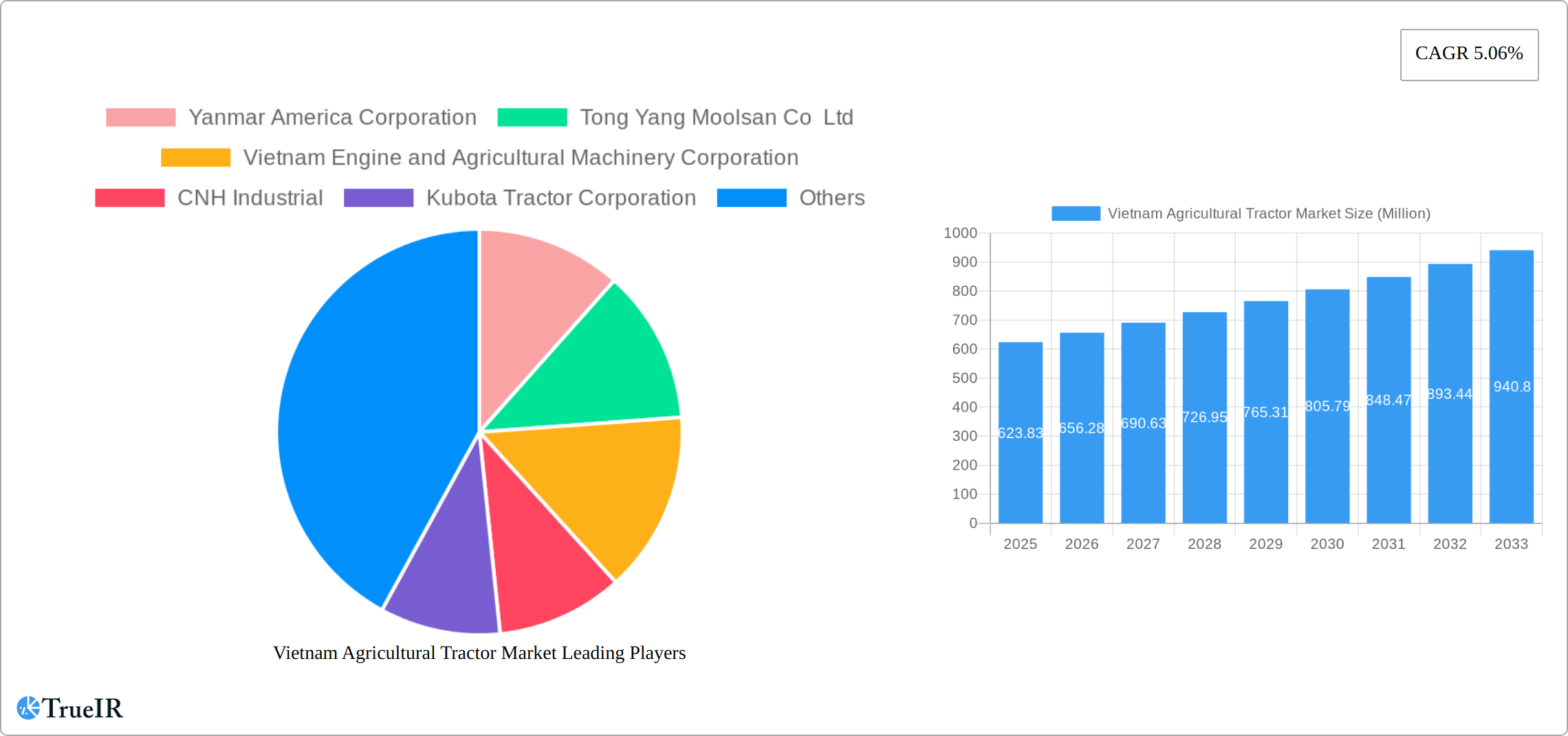

The Vietnam agricultural tractor market, valued at $623.83 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.06% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, Vietnam's agricultural sector is undergoing modernization, with farmers increasingly adopting mechanized farming techniques to boost productivity and efficiency. Government initiatives promoting agricultural mechanization and modernization are also contributing to market growth. Secondly, the increasing demand for food products within Vietnam and globally is creating a need for higher agricultural output, driving investment in tractors and other agricultural machinery. The growing adoption of precision farming techniques and the increasing availability of financing options for agricultural equipment further fuel this market expansion. Finally, the rising disposable incomes among Vietnamese farmers are enhancing their purchasing power, facilitating the adoption of modern agricultural equipment.

Vietnam Agricultural Tractor Market Market Size (In Million)

However, market growth faces some challenges. High initial investment costs for tractors can be a barrier for smallholder farmers. Moreover, the limited availability of skilled labor to operate and maintain these sophisticated machines, coupled with potential infrastructural limitations in certain regions, may hinder market penetration. Despite these restraints, the long-term outlook for the Vietnam agricultural tractor market remains positive, driven by the continuous modernization of agricultural practices and the government's focus on enhancing agricultural productivity. The market segmentation by engine power (less than 15 HP, 15-30 HP, 31-45 HP, 46-75 HP, and more than 75 HP) offers insights into the diverse needs of farmers and the various segments' growth potentials. Key players like Yanmar America Corporation, Kubota Tractor Corporation, and AGCO Corporation are vying for market share, leading to increased competition and innovation.

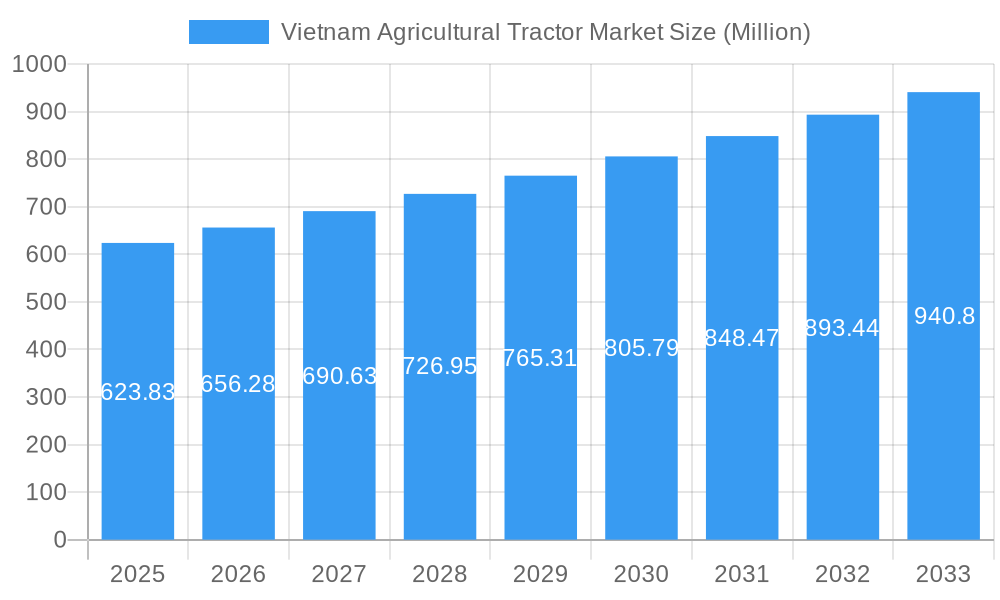

Vietnam Agricultural Tractor Market Company Market Share

Vietnam Agricultural Tractor Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Vietnam agricultural tractor market, offering invaluable insights for stakeholders across the agricultural machinery industry. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report utilizes both historical data (2019-2024) and predictive modeling to deliver a robust and actionable understanding of this dynamic market. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Vietnam Agricultural Tractor Market Structure & Competitive Landscape

The Vietnam agricultural tractor market exhibits a moderately concentrated structure, with several key players dominating market share. Market concentration ratios (e.g., CR4, CR8) are estimated at xx% and xx% respectively in 2025, indicating the presence of both larger multinational corporations and significant domestic players. Innovation drivers include the increasing demand for higher efficiency and technologically advanced tractors, fueled by government initiatives promoting mechanization in agriculture. Regulatory impacts, such as import duties and emission standards, significantly shape market dynamics. Product substitutes, such as animal labor and smaller, less-mechanized farming techniques, remain prevalent in certain regions, posing a competitive challenge. End-user segmentation primarily consists of smallholder farmers, large-scale commercial farms, and agricultural cooperatives, each with distinct equipment needs and purchasing power. M&A activity in the sector has been moderate in recent years, with a total transaction value of approximately xx Million during 2019-2024.

- Key Market Players: Yanmar America Corporation, Tong Yang Moolsan Co Ltd, Vietnam Engine and Agricultural Machinery Corporation, CNH Industrial, Kubota Tractor Corporation, AGCO Corporation, Truong Hai Auto Corporation (THACO), Belarus, CLAAS KGaA mbH, ShanDong Huaxin Machinery Co Ltd.

- Innovation Drivers: Government subsidies for mechanization, rising labor costs, and demand for improved yields.

- Regulatory Impacts: Import tariffs, emission standards, and safety regulations.

- M&A Trends: Consolidation is expected to increase, driven by the need for scale and technological advancements.

Vietnam Agricultural Tractor Market Trends & Opportunities

The Vietnam agricultural tractor market is experiencing robust growth, driven by a confluence of factors. Market size expansion is fueled by rising agricultural output, government support for modernization, and increasing farm sizes. Technological advancements, such as GPS-guided tractors and precision farming technologies, are gaining traction, enhancing efficiency and yield. Consumer preferences are shifting towards fuel-efficient, technologically advanced tractors with improved features and ease of operation. The competitive landscape is characterized by both domestic and international players vying for market share, leading to product differentiation and price competition. The market exhibits significant potential for growth in the coming years, particularly in areas with underdeveloped agricultural infrastructure. This presents considerable opportunities for both established players and new entrants. The predicted market size for 2033 is xx Million.

Dominant Markets & Segments in Vietnam Agricultural Tractor Market

The Southern and Central regions of Vietnam are currently dominating the agricultural tractor market due to their favorable agricultural conditions and higher adoption of mechanization. Within engine power segments, the 15-30 HP and 31-45 HP categories represent the most significant share, driven by the prevalence of small to medium-sized farms.

- Key Growth Drivers (Southern & Central Regions):

- Favorable climate and fertile land for various crops.

- Higher concentration of commercial farming operations.

- Government incentives and investment in agricultural infrastructure.

- Key Growth Drivers (15-30 HP & 31-45 HP Segments):

- Cost-effectiveness and suitability for small to medium-sized farms.

- Wide availability of these tractors from domestic and international manufacturers.

- Strong demand from rice and other cereal crop cultivation.

Vietnam Agricultural Tractor Market Product Analysis

The Vietnam agricultural tractor market showcases a diverse range of products, from small-scale tractors for individual farmers to larger, more powerful machines for commercial operations. Technological advancements, such as improved fuel efficiency, enhanced safety features, and precision farming capabilities, are driving product innovation. Tractors tailored to specific crops and farming conditions are becoming increasingly popular. Competition is intensifying, with manufacturers emphasizing features like ease of maintenance, durability, and affordability. The market is witnessing a gradual shift towards higher horsepower tractors as farms grow in size and adopt more intensive agricultural practices.

Key Drivers, Barriers & Challenges in Vietnam Agricultural Tractor Market

Key Drivers: Government initiatives promoting agricultural modernization, rising labor costs, increasing demand for higher crop yields, and expanding agricultural land under cultivation. Technological advancements are lowering tractor costs and enhancing efficiency.

Challenges: High initial investment costs can deter smallholder farmers from adopting tractors. Limited access to financing and credit for agricultural equipment purchases. Supply chain disruptions can affect the availability of parts and tractors. Competition from cheaper, lower-quality imported tractors poses a threat to established players. The impact of these challenges is estimated to reduce market growth by approximately xx% annually.

Growth Drivers in the Vietnam Agricultural Tractor Market

The Vietnamese agricultural tractor market is experiencing robust growth, propelled by a confluence of factors. Government initiatives promoting agricultural mechanization are paramount, offering crucial subsidies and incentives to farmers. This is further amplified by the escalating demand for higher crop yields to meet the nutritional needs of Vietnam's burgeoning population. The rising cost of labor is also a significant driver, making the economic case for tractor adoption increasingly compelling. Furthermore, continuous technological advancements in tractor design, encompassing enhanced fuel efficiency and advanced features, are significantly impacting market expansion.

Challenges Impacting Vietnam Agricultural Tractor Market Growth

Significant challenges include the high initial cost of tractors creating a barrier for smaller farms, limited access to credit, and the potential for supply chain disruptions to impact the timely availability of machines and parts. Infrastructure limitations in certain regions also restrict the efficient operation of larger tractors.

Key Players Shaping the Vietnam Agricultural Tractor Market

- Yanmar America Corporation

- Tong Yang Moolsan Co Ltd

- Vietnam Engine and Agricultural Machinery Corporation

- CNH Industrial

- Kubota Tractor Corporation

- AGCO Corporation

- Truong Hai Auto Corporation (THACO)

- Belarus

- CLAAS KGaA mbH

- ShanDong Huaxin Machinery Co Ltd

Significant Vietnam Agricultural Tractor Market Industry Milestones

- January 2024: [Insert a new significant milestone for January 2024 if available. Otherwise, remove this line or replace with a placeholder like "Further market expansion reported by key players."]

- January 2023: New Holland unveiled a prototype T7 methane-powered tractor, showcasing a commitment to sustainable and efficient agricultural practices by offering extended working times and reduced environmental impact.

- January 2023: Yanmar strengthened its market penetration with the opening of a new dealership branch in Kim Thanh district, Hai Duong province, enhancing accessibility for farmers in the region.

- January 2022: Yanmar strategically expanded its market presence through the establishment of new dealerships in Thanh Hoa, Binh Dinh, and Binh Thuan provinces, broadening its distribution network and market reach.

Future Outlook for Vietnam Agricultural Tractor Market

The future of the Vietnam agricultural tractor market appears exceptionally bright. Sustained growth is anticipated, driven by the government's unwavering commitment to agricultural modernization and its continued investment in supporting infrastructure. The increasing agricultural output, fueled by a growing demand for food and other agricultural products, will further solidify the need for mechanized farming solutions. This trend will be accompanied by a rise in the adoption of technologically advanced tractors equipped with features such as precision farming capabilities, GPS guidance, and automated functionalities. Opportunities for market players are plentiful, particularly for those who can provide cost-effective, fuel-efficient, and technologically sophisticated tractors tailored to the unique requirements of Vietnamese farmers. The market is projected to exhibit strong growth, with continued dominance of smaller to medium-sized tractor segments, alongside a notable increase in the adoption of advanced technologies. This will likely lead to increased competition and innovation within the sector.

Vietnam Agricultural Tractor Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Vietnam Agricultural Tractor Market Segmentation By Geography

- 1. Vietnam

Vietnam Agricultural Tractor Market Regional Market Share

Geographic Coverage of Vietnam Agricultural Tractor Market

Vietnam Agricultural Tractor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Skilled Labor Shortage; Favorable Government Policies

- 3.3. Market Restrains

- 3.3.1. Fragmentation of Land Holdings; Increasing Interest of Farmers Toward Custom Hiring Center

- 3.4. Market Trends

- 3.4.1. Shortage of Agricultural Labor

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Agricultural Tractor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Yanmar America Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tong Yang Moolsan Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vietnam Engine and Agricultural Machinery Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CNH Industrial

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kubota Tractor Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AGCO Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Truong Hai Auto Corporation (THACO

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Belarus

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CLAAS KGaA mbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ShanDong Huaxin Machinery Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Yanmar America Corporation

List of Figures

- Figure 1: Vietnam Agricultural Tractor Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam Agricultural Tractor Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Agricultural Tractor Market?

The projected CAGR is approximately 5.06%.

2. Which companies are prominent players in the Vietnam Agricultural Tractor Market?

Key companies in the market include Yanmar America Corporation, Tong Yang Moolsan Co Ltd, Vietnam Engine and Agricultural Machinery Corporation, CNH Industrial, Kubota Tractor Corporation, AGCO Corporation, Truong Hai Auto Corporation (THACO, Belarus, CLAAS KGaA mbH, ShanDong Huaxin Machinery Co Ltd.

3. What are the main segments of the Vietnam Agricultural Tractor Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 623.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Skilled Labor Shortage; Favorable Government Policies.

6. What are the notable trends driving market growth?

Shortage of Agricultural Labor.

7. Are there any restraints impacting market growth?

Fragmentation of Land Holdings; Increasing Interest of Farmers Toward Custom Hiring Center.

8. Can you provide examples of recent developments in the market?

January 2023: New Holland revealed a prototype T7 methane power tractor that runs on a liquified version of the gas, giving longer working times to fill. The new tractor has four times the fuel storage of the firm's existing methane-powered T6, which utilizes compressed gas (CNG).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Agricultural Tractor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Agricultural Tractor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Agricultural Tractor Market?

To stay informed about further developments, trends, and reports in the Vietnam Agricultural Tractor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence