Key Insights

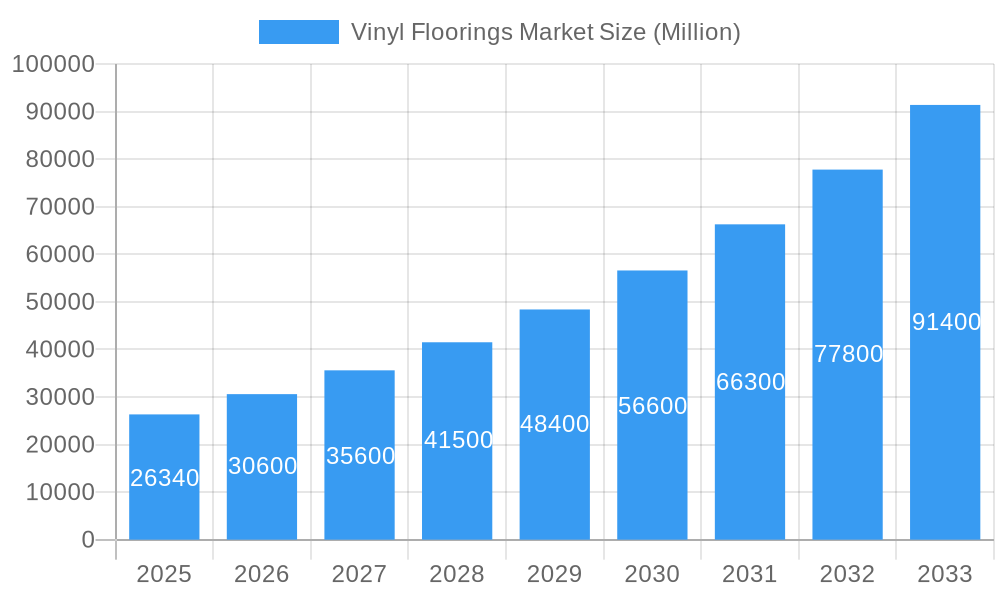

The global vinyl flooring market, valued at $26.34 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 16.17% from 2025 to 2033. This expansion is fueled by several key factors. The increasing preference for durable, waterproof, and easy-to-maintain flooring solutions in both residential and commercial settings is a major driver. Luxury vinyl tile (LVT) and vinyl composite tile (VCT), known for their aesthetic appeal and cost-effectiveness, are experiencing particularly strong demand, contributing significantly to market growth. Furthermore, ongoing advancements in vinyl flooring technology, leading to improved designs, enhanced durability, and eco-friendly options, are further stimulating market expansion. The growing construction industry, particularly in developing economies, also contributes to the market's positive outlook. However, potential restraints include fluctuating raw material prices and growing concerns about the environmental impact of certain vinyl flooring products. Addressing these concerns through sustainable manufacturing practices and the development of eco-friendly alternatives will be crucial for sustained growth.

Vinyl Floorings Market Market Size (In Billion)

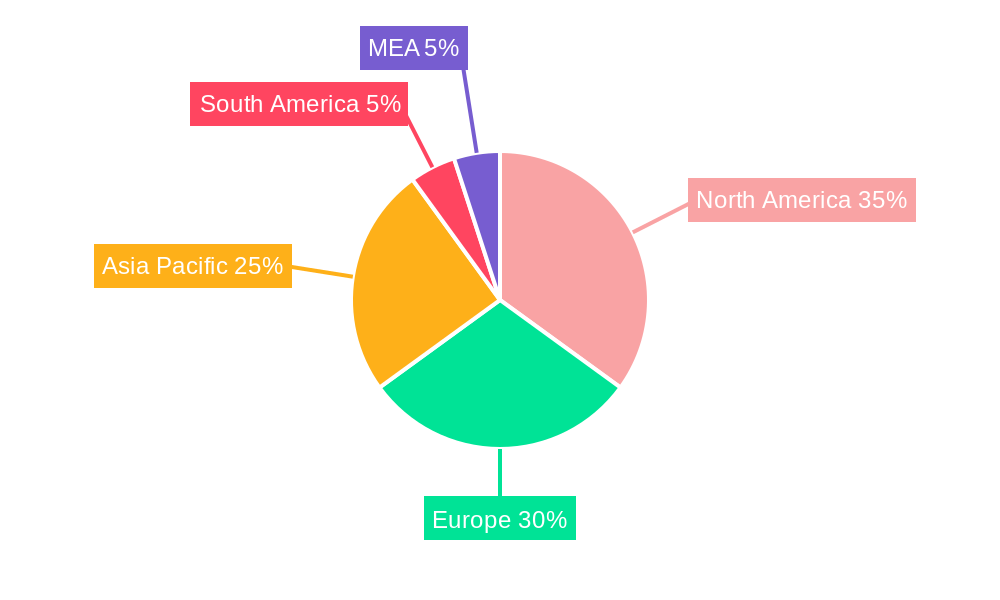

Segmentation analysis reveals a significant contribution from both residential and commercial end-use sectors. North America and Europe currently dominate the market, but the Asia-Pacific region is poised for rapid growth due to expanding urbanization and rising disposable incomes. Key players such as Shaw Industries Group Inc, Tarkett S.A., and Mohawk Industries Inc are leveraging their established brand reputations and extensive distribution networks to maintain their market share. However, increasing competition from smaller, specialized manufacturers offering niche products and sustainable options is anticipated. The market's future success will depend on companies' ability to innovate, cater to evolving consumer preferences, and adopt environmentally conscious manufacturing practices. Strategic mergers and acquisitions, coupled with research and development efforts focused on superior product performance and sustainable materials, will play a vital role in shaping the market's trajectory in the coming years.

Vinyl Floorings Market Company Market Share

Vinyl Floorings Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a comprehensive analysis of the global Vinyl Floorings Market, offering invaluable insights for stakeholders across the value chain. Leveraging extensive research and data covering the period 2019-2033 (base year 2025), this report meticulously examines market trends, competitive landscapes, and future growth prospects. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

Vinyl Floorings Market Market Structure & Competitive Landscape

The global vinyl flooring market exhibits a moderately concentrated structure, with a core group of leading manufacturers holding a substantial market share. Prominent players such as Shaw Industries Group Inc., Polyflor Ltd., Tarkett S.A., Armstrong Flooring Inc., Mannington Mills Inc., Forbo, Mohawk Industries Inc., Beaulieu International Group, Fatra a.s., Gerflor, and Forbo Flooring Systems (this list is not exhaustive) are key contributors to the market's dynamics. The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, reinforcing the notion of a moderately consolidated industry.

Innovation serves as a critical differentiator, compelling companies to consistently introduce products that offer enhanced durability, sophisticated aesthetics, and improved sustainability credentials. Regulatory landscapes, particularly those addressing Volatile Organic Compound (VOC) emissions and the utilization of eco-friendly materials, exert a significant influence on product development strategies and overall market trajectory. While facing competitive pressure from alternative flooring materials like ceramic tiles, hardwood, and laminate flooring, vinyl flooring maintains a robust market position owing to its inherent cost-effectiveness and remarkable versatility.

The market's performance is heavily influenced by end-user segmentation, with the residential and commercial sectors representing the largest consumer bases. Residential applications typically drive higher sales volumes, while commercial applications contribute significantly to the market's value. Recent strategic moves, exemplified by Mohawk Industries' acquisition of Vitromex, highlight the ongoing trend of mergers and acquisitions (M&A) among major players seeking to broaden their product portfolios and expand their global reach. The estimated M&A volume within the sector between 2019 and 2024 was approximately xx Million, indicating a strong inclination towards consolidation and strategic growth initiatives.

Vinyl Floorings Market Market Trends & Opportunities

The global vinyl flooring market is experiencing significant growth driven by several key trends. The increasing preference for cost-effective and durable flooring solutions in both residential and commercial sectors fuels market expansion. Technological advancements, particularly in the development of luxury vinyl tile (LVT) and resilient flooring solutions, are broadening market applications and increasing product appeal. The rising demand for aesthetically pleasing and easy-to-maintain flooring solutions is also boosting market growth.

Consumer preferences are shifting toward sustainable and eco-friendly products, creating opportunities for manufacturers who adopt sustainable manufacturing practices and incorporate recycled materials. Furthermore, the construction boom in developing economies is bolstering market growth. However, intense competition and price fluctuations in raw materials remain significant factors influencing market growth. The market is poised for substantial growth due to the factors mentioned above. Market penetration rates for LVT are increasing, reaching approximately xx% in 2024, further indicating the shift in consumer preferences.

Dominant Markets & Segments in Vinyl Floorings Market

The North American region is currently the dominant market for vinyl floorings, followed by Europe. Within these regions, the United States and Germany respectively represent the leading national markets. The Luxury Vinyl Tile (LVT) segment exhibits the highest growth rate among product types, driven by its superior aesthetic appeal, durability, and ease of installation.

- Key Growth Drivers in North America: Robust residential construction activity, increasing disposable incomes, and preference for easy-to-maintain flooring.

- Key Growth Drivers in Europe: Renovation projects, particularly in older buildings, and rising demand for LVT in commercial spaces.

- Key Growth Drivers for LVT: Superior aesthetics, durability, water resistance, and variety of design options.

- Key Growth Drivers for Residential: Affordability, durability, and ease of installation.

- Key Growth Drivers for Commercial: Cost-effectiveness, durability, and ease of maintenance.

The commercial segment displays consistent growth, driven by the increasing construction of commercial buildings and renovation projects. Government initiatives promoting sustainable building practices also contribute to the growth of this segment.

Vinyl Floorings Market Product Analysis

The vinyl flooring market is characterized by a relentless pace of innovation across materials, design aesthetics, and installation methodologies. Luxury Vinyl Tile (LVT) has emerged as a dominant segment, offering a premium blend of visual appeal and superior durability compared to conventional vinyl flooring options. Recent advancements include substantial improvements in water resistance, enhanced scratch resilience, and an expanded palette of design possibilities. These enhancements directly address evolving consumer demands for both practical functionality and refined aesthetics, solidifying vinyl flooring's competitive edge across a diverse range of applications. A pronounced trend towards the development and adoption of eco-friendly vinyl flooring products, utilizing recycled materials and boasting reduced VOC emissions, is a significant indicator of the market's forward-looking orientation.

Key Drivers, Barriers & Challenges in Vinyl Floorings Market

Key Drivers: A primary catalyst for market expansion is the burgeoning demand for flooring solutions that offer both exceptional durability and affordability, catering to the needs of both residential and commercial spaces. Technological advancements, particularly within the LVT segment, coupled with a growing consumer appreciation for visually appealing designs, are potent drivers of market growth. Furthermore, supportive government initiatives aimed at promoting sustainable construction practices are contributing to the overall expansion of the vinyl flooring sector.

Key Challenges: The inherent volatility in raw material prices, with PVC being a notable example, presents a significant hurdle for manufacturers. Intense competition from alternative flooring materials such as ceramic tiles and hardwood exerts considerable pressure on market share. Stringent environmental regulations pertaining to VOC emissions necessitate higher manufacturing costs and add layers of complexity to production processes. Moreover, supply chain disruptions, stemming from geopolitical instability or unforeseen natural disasters, have impacted the consistent availability and pricing of essential raw materials, thereby affecting profitability.

Growth Drivers in the Vinyl Floorings Market Market

The Vinyl Floorings Market is experiencing robust growth fueled by several key factors. The increasing demand for durable, affordable, and aesthetically pleasing flooring options in both residential and commercial settings is a primary driver. Technological advancements in LVT and other resilient flooring options are expanding market applications and consumer appeal. Growing investments in infrastructure projects globally, including residential and commercial construction, fuel market growth. Furthermore, the rising disposable incomes in developing economies contribute significantly to increased market demand.

Challenges Impacting Vinyl Floorings Market Growth

Several factors continue to pose significant impediments to the sustained growth of the Vinyl Floorings Market. Fluctuations in the cost of key raw materials, particularly PVC resin, directly impact manufacturers' profit margins and their ability to maintain stable pricing strategies. The imposition of stringent environmental regulations concerning VOC emissions and the adoption of sustainable manufacturing practices inevitably lead to increased production expenses and demand for technological adaptation. The competitive landscape is further intensified by the persistent rivalry from substitute flooring materials, including ceramic tiles, wood, and laminate flooring, which exert pressure on market shares and pricing dynamics. Additionally, disruptions within the global supply chain, especially concerning the sourcing of critical raw materials, can adversely affect manufacturing output and necessitate adjustments to delivery timelines.

Key Players Shaping the Vinyl Floorings Market Market

- Shaw Industries Group Inc

- Polyflor Ltd

- Tarkett S A

- Armstrong Flooring Inc

- Mannington Mills Inc

- Forbo

- Mohawk Industries Inc

- Beaulieu International Group

- Fatra a.s

- Gerflor

- Forbo Flooring Systems

Significant Vinyl Floorings Market Industry Milestones

- June 2022: Mohawk Industries, Inc. acquired the Vitromex ceramic tile business for approximately USD 293 Million, expanding its product portfolio and market reach. This acquisition strengthens their position in the broader flooring market.

- February 2023: Shaw Industries Group, Inc. acquired a controlling interest in Watershed Solar LLC, demonstrating a commitment to sustainable practices and diversifying its business model into renewable energy. This move positions them as a leader in environmentally conscious flooring solutions.

Future Outlook for Vinyl Floorings Market Market

The Vinyl Floorings Market is projected for a trajectory of sustained growth, propelled by ongoing technological advancements, an escalating demand for environmentally conscious products, and a consistent upswing in global construction activities. Strategic alliances, mergers and acquisitions, and the expansion into emerging markets are anticipated to play pivotal roles in shaping the future industry landscape. Companies that prioritize the development of innovative and eco-friendly products will be best positioned to capture significant market share in the coming years. The future prosperity of the market hinges on effectively navigating challenges such as raw material price volatility and evolving environmental regulations, while simultaneously fostering continuous innovation and adeptly meeting the ever-changing preferences of consumers.

Vinyl Floorings Market Segmentation

-

1. Product

- 1.1. Vinyl Sheet

- 1.2. Vinyl Composite Tile

- 1.3. Luxury Vinyl Tile

-

2. End-Use

- 2.1. Residential

- 2.2. Commercial

Vinyl Floorings Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Vinyl Floorings Market Regional Market Share

Geographic Coverage of Vinyl Floorings Market

Vinyl Floorings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Construction Activities; Increase in Demand for Luxury Vinyl Tiles is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Luxury Vinyl Tile Segment to Remain the most Popular Category

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vinyl Floorings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Vinyl Sheet

- 5.1.2. Vinyl Composite Tile

- 5.1.3. Luxury Vinyl Tile

- 5.2. Market Analysis, Insights and Forecast - by End-Use

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Vinyl Floorings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Vinyl Sheet

- 6.1.2. Vinyl Composite Tile

- 6.1.3. Luxury Vinyl Tile

- 6.2. Market Analysis, Insights and Forecast - by End-Use

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Vinyl Floorings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Vinyl Sheet

- 7.1.2. Vinyl Composite Tile

- 7.1.3. Luxury Vinyl Tile

- 7.2. Market Analysis, Insights and Forecast - by End-Use

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Vinyl Floorings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Vinyl Sheet

- 8.1.2. Vinyl Composite Tile

- 8.1.3. Luxury Vinyl Tile

- 8.2. Market Analysis, Insights and Forecast - by End-Use

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Latin America Vinyl Floorings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Vinyl Sheet

- 9.1.2. Vinyl Composite Tile

- 9.1.3. Luxury Vinyl Tile

- 9.2. Market Analysis, Insights and Forecast - by End-Use

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Middle East and Africa Vinyl Floorings Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Vinyl Sheet

- 10.1.2. Vinyl Composite Tile

- 10.1.3. Luxury Vinyl Tile

- 10.2. Market Analysis, Insights and Forecast - by End-Use

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Shaw Industries Group Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Polyflor Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tarkett S A

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Armstrong Flooring Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mannington Mills Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Forbo**List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mohawk Industries Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Beaulieu International Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fatra a s

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Gerflor

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Forbo Flooring Systems

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Shaw Industries Group Inc

List of Figures

- Figure 1: Global Vinyl Floorings Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Vinyl Floorings Market Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Vinyl Floorings Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Vinyl Floorings Market Revenue (Million), by End-Use 2025 & 2033

- Figure 5: North America Vinyl Floorings Market Revenue Share (%), by End-Use 2025 & 2033

- Figure 6: North America Vinyl Floorings Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Vinyl Floorings Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Vinyl Floorings Market Revenue (Million), by Product 2025 & 2033

- Figure 9: Europe Vinyl Floorings Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: Europe Vinyl Floorings Market Revenue (Million), by End-Use 2025 & 2033

- Figure 11: Europe Vinyl Floorings Market Revenue Share (%), by End-Use 2025 & 2033

- Figure 12: Europe Vinyl Floorings Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Vinyl Floorings Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Vinyl Floorings Market Revenue (Million), by Product 2025 & 2033

- Figure 15: Asia Pacific Vinyl Floorings Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Asia Pacific Vinyl Floorings Market Revenue (Million), by End-Use 2025 & 2033

- Figure 17: Asia Pacific Vinyl Floorings Market Revenue Share (%), by End-Use 2025 & 2033

- Figure 18: Asia Pacific Vinyl Floorings Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Vinyl Floorings Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Vinyl Floorings Market Revenue (Million), by Product 2025 & 2033

- Figure 21: Latin America Vinyl Floorings Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Latin America Vinyl Floorings Market Revenue (Million), by End-Use 2025 & 2033

- Figure 23: Latin America Vinyl Floorings Market Revenue Share (%), by End-Use 2025 & 2033

- Figure 24: Latin America Vinyl Floorings Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Vinyl Floorings Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Vinyl Floorings Market Revenue (Million), by Product 2025 & 2033

- Figure 27: Middle East and Africa Vinyl Floorings Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East and Africa Vinyl Floorings Market Revenue (Million), by End-Use 2025 & 2033

- Figure 29: Middle East and Africa Vinyl Floorings Market Revenue Share (%), by End-Use 2025 & 2033

- Figure 30: Middle East and Africa Vinyl Floorings Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Vinyl Floorings Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Vinyl Floorings Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Vinyl Floorings Market Revenue Million Forecast, by End-Use 2020 & 2033

- Table 3: Global Vinyl Floorings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Vinyl Floorings Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Global Vinyl Floorings Market Revenue Million Forecast, by End-Use 2020 & 2033

- Table 6: Global Vinyl Floorings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Vinyl Floorings Market Revenue Million Forecast, by Product 2020 & 2033

- Table 8: Global Vinyl Floorings Market Revenue Million Forecast, by End-Use 2020 & 2033

- Table 9: Global Vinyl Floorings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Vinyl Floorings Market Revenue Million Forecast, by Product 2020 & 2033

- Table 11: Global Vinyl Floorings Market Revenue Million Forecast, by End-Use 2020 & 2033

- Table 12: Global Vinyl Floorings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Vinyl Floorings Market Revenue Million Forecast, by Product 2020 & 2033

- Table 14: Global Vinyl Floorings Market Revenue Million Forecast, by End-Use 2020 & 2033

- Table 15: Global Vinyl Floorings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Vinyl Floorings Market Revenue Million Forecast, by Product 2020 & 2033

- Table 17: Global Vinyl Floorings Market Revenue Million Forecast, by End-Use 2020 & 2033

- Table 18: Global Vinyl Floorings Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vinyl Floorings Market?

The projected CAGR is approximately 16.17%.

2. Which companies are prominent players in the Vinyl Floorings Market?

Key companies in the market include Shaw Industries Group Inc, Polyflor Ltd, Tarkett S A, Armstrong Flooring Inc, Mannington Mills Inc, Forbo**List Not Exhaustive, Mohawk Industries Inc, Beaulieu International Group, Fatra a s, Gerflor, Forbo Flooring Systems.

3. What are the main segments of the Vinyl Floorings Market?

The market segments include Product, End-Use.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Construction Activities; Increase in Demand for Luxury Vinyl Tiles is Driving the Market.

6. What are the notable trends driving market growth?

Luxury Vinyl Tile Segment to Remain the most Popular Category.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

February 2023: Shaw Industries Group, Inc. completed the purchase of a controlling interest in Watershed Solar LLC. (Watershed Solar). Watershed Solar provides patented renewable energy solutions. The technology, branded PowerCap, supplies low-profile, high-output solar arrays on top of landfills, coal ash closures, and rooftops, turning liabilities or underused spaces into renewable energy assets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vinyl Floorings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vinyl Floorings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vinyl Floorings Market?

To stay informed about further developments, trends, and reports in the Vinyl Floorings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence