Key Insights

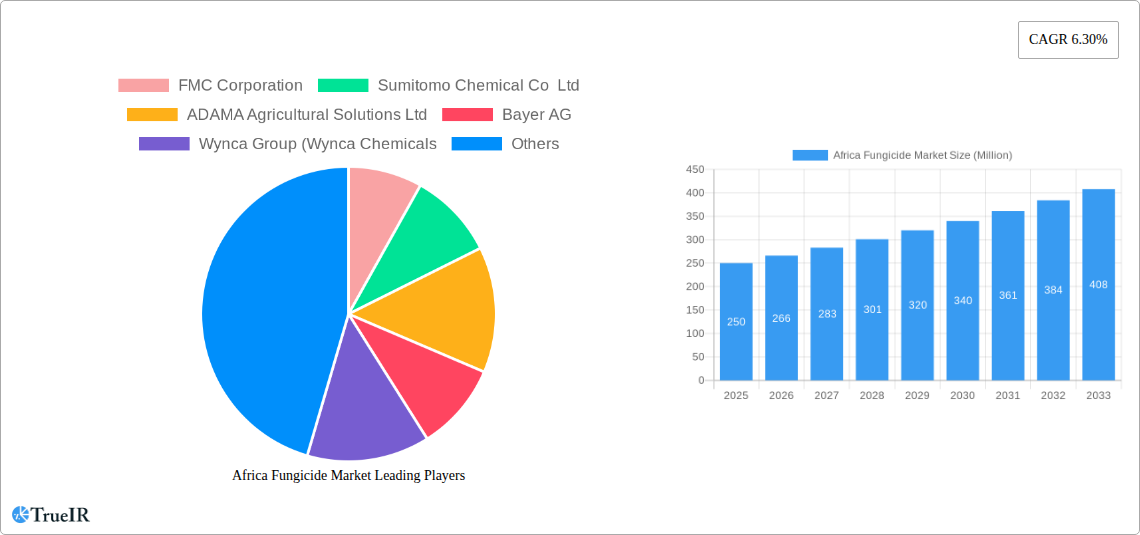

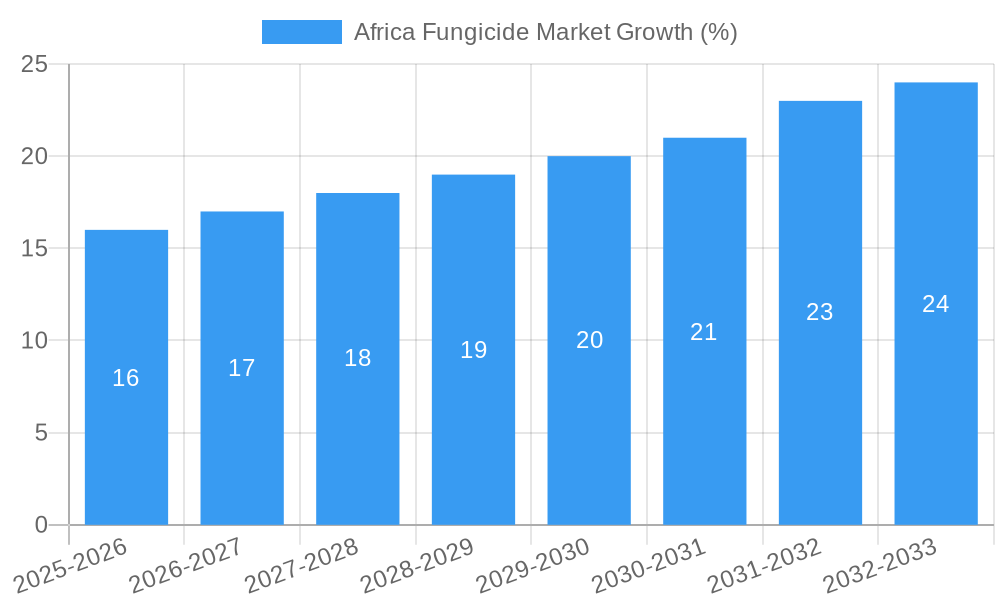

The African fungicide market, valued at approximately $XXX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.30% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing prevalence of fungal diseases impacting major crops like grains, fruits, and vegetables necessitates greater fungicide application. Rising agricultural activities across Africa, fueled by growing populations and increasing demand for food security, further contribute to this market growth. Secondly, the adoption of advanced farming techniques, such as chemigation and precision agriculture, enhances fungicide efficacy and reduces waste, stimulating market demand. Finally, supportive government policies promoting sustainable agriculture and investment in agricultural infrastructure in key regions such as South Africa, Kenya, and Tanzania are playing a crucial role.

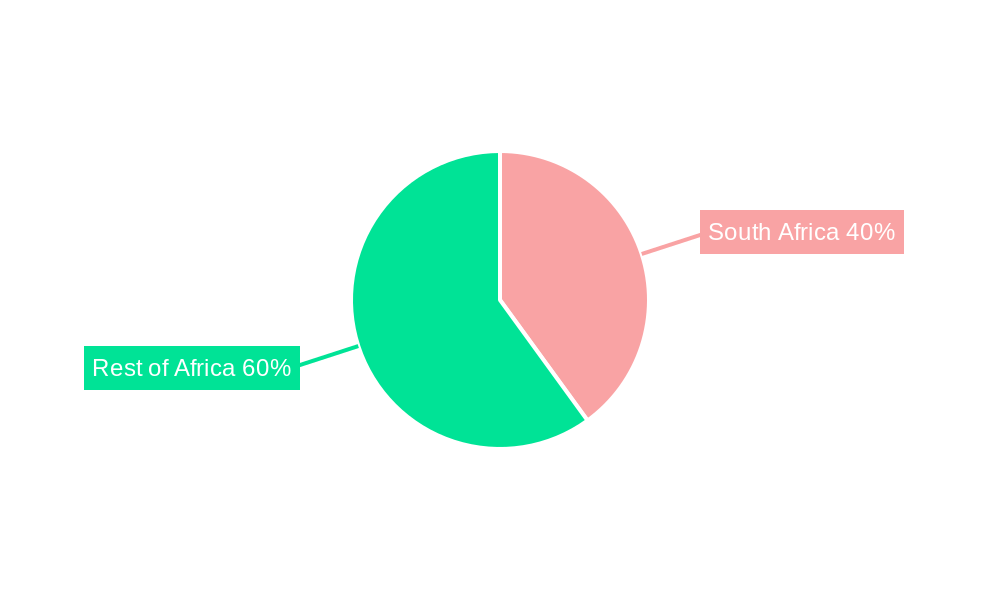

However, the market faces certain constraints. High fungicide costs can limit accessibility, particularly for smallholder farmers who form a significant portion of the agricultural landscape in Africa. Furthermore, concerns regarding environmental impacts of fungicides, including potential harm to beneficial insects and soil health, are prompting stricter regulations and a push towards environmentally friendly alternatives. Nevertheless, the market's growth trajectory is positive, with strong prospects particularly within the commercial crops and fruits & vegetable segments. The increasing adoption of integrated pest management strategies, which incorporate fungicides alongside other methods, is expected to propel future market expansion. Regional disparities exist, with South Africa likely maintaining its dominant position owing to its relatively advanced agricultural sector. However, substantial growth potential lies in other African countries experiencing increasing agricultural investment and intensification.

This dynamic report provides a deep dive into the burgeoning Africa Fungicide Market, offering invaluable insights for stakeholders, investors, and industry professionals. Leveraging extensive market research and analysis, spanning the period 2019-2033, this report unveils the market's structure, competitive landscape, growth drivers, and future trajectory. The report forecasts a market valued at xx Million by 2025, with a robust Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033.

Africa Fungicide Market Market Structure & Competitive Landscape

The Africa fungicide market exhibits a moderately concentrated structure, with a few multinational players dominating the landscape. Key players include FMC Corporation, Sumitomo Chemical Co Ltd, ADAMA Agricultural Solutions Ltd, Bayer AG, Wynca Group (Wynca Chemicals), Syngenta Group, UPL Limited, Corteva Agriscience, Nufarm Ltd, and BASF SE. The Herfindahl-Hirschman Index (HHI) for the market in 2024 was estimated at xx, indicating a moderately concentrated market. Innovation plays a crucial role, driven by the need for effective solutions to combat evolving fungal diseases and increasing regulatory pressure for eco-friendly products. The market is susceptible to regulatory changes impacting product registration and usage. Significant product substitution occurs, particularly with the emergence of bio-fungicides. End-user segmentation is largely determined by crop type (commercial crops, fruits & vegetables, grains & cereals, pulses & oilseeds, turf & ornamental) and application mode (chemigation, foliar, fumigation, seed treatment, soil treatment). Mergers and acquisitions (M&A) activity is moderate, with several instances of strategic partnerships and technology acquisitions in recent years. The total value of M&A deals in the sector between 2019 and 2024 was approximately xx Million.

- High concentration ratio: xx% market share held by the top 5 players in 2024.

- Significant R&D investments: Companies are investing heavily in developing novel fungicides with improved efficacy and environmental profiles.

- Stringent regulations: Compliance with environmental and safety standards is a key challenge.

- Growing adoption of bio-fungicides: A shift towards more sustainable crop protection solutions is evident.

- Strategic partnerships & acquisitions: Companies are actively engaging in M&A activities to expand their product portfolios and market reach.

Africa Fungicide Market Market Trends & Opportunities

The Africa fungicide market is experiencing significant growth fueled by rising agricultural production, increasing crop disease prevalence, and growing awareness of crop protection needs. The market size expanded from xx Million in 2019 to xx Million in 2024, showcasing a robust trajectory. Technological advancements, such as the development of more effective and targeted fungicides, are further driving market expansion. Consumer preferences are increasingly leaning towards environmentally friendly and sustainable solutions, creating opportunities for bio-fungicides and integrated pest management (IPM) strategies. Competitive dynamics are characterized by a mix of intense competition among established players and the emergence of new entrants with innovative products. The market penetration rate for fungicides in major crop segments remains relatively low, presenting significant potential for future growth.

Dominant Markets & Segments in Africa Fungicide Market

South Africa remains the dominant market in the region, accounting for approximately xx% of total market share in 2024, owing to its relatively advanced agricultural infrastructure and higher adoption rates of modern farming practices. However, the rest of Africa shows strong growth potential, particularly in regions with expanding agricultural production.

- Leading segments: Fruits & vegetables and grains & cereals are major contributors to the overall market, driven by high disease incidence and the economic significance of these crops.

- Dominant application method: Foliar application currently holds the largest market share due to its widespread adoption and ease of use.

- Growth drivers in South Africa: Well-established agricultural infrastructure, readily available technology and strong government support for agricultural development.

- Growth drivers in Rest of Africa: Expanding agricultural land, increasing investment in agricultural infrastructure, and rising awareness about crop protection among farmers.

Africa Fungicide Market Product Analysis

The market offers a diverse range of fungicides catering to various crop types and application methods. Recent innovations focus on enhancing efficacy, reducing environmental impact, and optimizing application methods. Products with improved selectivity, broader spectrum activity, and systemic action are gaining popularity. The emphasis on environmentally friendly solutions is evident in the rise of bio-fungicides and formulations with reduced toxicity. The successful market fit of newer products depends on their efficacy, cost-effectiveness, and ease of use, along with adherence to stringent regulatory norms.

Key Drivers, Barriers & Challenges in Africa Fungicide Market

Key Drivers:

- Growing agricultural output across the continent.

- Increased frequency and severity of fungal diseases due to climate change.

- Rising awareness of crop protection among farmers.

- Investments in agricultural research and development.

Key Barriers and Challenges:

- Limited access to quality fungicides in many parts of Africa.

- High cost of fungicides, making them inaccessible to smallholder farmers.

- Lack of awareness about proper fungicide application and IPM strategies.

- Complex and evolving regulatory landscape. This is estimated to hinder growth by xx% by 2030.

- Supply chain disruptions and logistical challenges in many regions.

Growth Drivers in the Africa Fungicide Market Market

The rising demand for food and feed, combined with the increasing prevalence of fungal diseases due to climatic changes, is a significant driver. Government initiatives promoting agricultural development and investments in research and development are further boosting market growth. The growing adoption of modern farming practices, including improved irrigation and mechanization, contributes to the expansion of the fungicide market.

Challenges Impacting Africa Fungicide Market Growth

Limited access to financing, particularly for smallholder farmers, remains a major hurdle. The prevalence of counterfeit fungicides impacts both farmer profitability and environmental safety. The lack of infrastructure, especially in rural areas, poses considerable logistical challenges to product distribution and access.

Key Players Shaping the Africa Fungicide Market Market

- FMC Corporation

- Sumitomo Chemical Co Ltd

- ADAMA Agricultural Solutions Ltd

- Bayer AG

- Wynca Group (Wynca Chemicals)

- Syngenta Group

- UPL Limited

- Corteva Agriscience

- Nufarm Ltd

- BASF SE

Significant Africa Fungicide Market Industry Milestones

- October 2021: ADAMA Agricultural Solutions Ltd invested in a new chemist's center, boosting R&D for plant protection.

- November 2022: Corteva Agriscience launched Zorvec Encantia, a novel fungicide targeting late blight in potatoes.

- January 2023: Bayer AG partnered with Oerth Bio to develop eco-friendly crop protection technologies.

Future Outlook for Africa Fungicide Market Market

The Africa fungicide market is poised for continued growth, driven by factors such as increasing agricultural production, rising consumer demand, and technological advancements. Opportunities exist in developing sustainable and cost-effective solutions, expanding market access in underserved regions, and fostering partnerships to support smallholder farmers. The market’s future growth is strongly linked to investments in agricultural infrastructure, research and development, and farmer education initiatives. The market is expected to exceed xx Million by 2033.

Africa Fungicide Market Segmentation

-

1. Application Mode

- 1.1. Chemigation

- 1.2. Foliar

- 1.3. Fumigation

- 1.4. Seed Treatment

- 1.5. Soil Treatment

-

2. Crop Type

- 2.1. Commercial Crops

- 2.2. Fruits & Vegetables

- 2.3. Grains & Cereals

- 2.4. Pulses & Oilseeds

- 2.5. Turf & Ornamental

-

3. Application Mode

- 3.1. Chemigation

- 3.2. Foliar

- 3.3. Fumigation

- 3.4. Seed Treatment

- 3.5. Soil Treatment

-

4. Crop Type

- 4.1. Commercial Crops

- 4.2. Fruits & Vegetables

- 4.3. Grains & Cereals

- 4.4. Pulses & Oilseeds

- 4.5. Turf & Ornamental

Africa Fungicide Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Fungicide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Increased awareness among farmers for using fungicides to protect crops is boosting the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Fungicide Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 5.1.1. Chemigation

- 5.1.2. Foliar

- 5.1.3. Fumigation

- 5.1.4. Seed Treatment

- 5.1.5. Soil Treatment

- 5.2. Market Analysis, Insights and Forecast - by Crop Type

- 5.2.1. Commercial Crops

- 5.2.2. Fruits & Vegetables

- 5.2.3. Grains & Cereals

- 5.2.4. Pulses & Oilseeds

- 5.2.5. Turf & Ornamental

- 5.3. Market Analysis, Insights and Forecast - by Application Mode

- 5.3.1. Chemigation

- 5.3.2. Foliar

- 5.3.3. Fumigation

- 5.3.4. Seed Treatment

- 5.3.5. Soil Treatment

- 5.4. Market Analysis, Insights and Forecast - by Crop Type

- 5.4.1. Commercial Crops

- 5.4.2. Fruits & Vegetables

- 5.4.3. Grains & Cereals

- 5.4.4. Pulses & Oilseeds

- 5.4.5. Turf & Ornamental

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 6. South Africa Africa Fungicide Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Fungicide Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Fungicide Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Fungicide Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Fungicide Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Fungicide Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 FMC Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Sumitomo Chemical Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 ADAMA Agricultural Solutions Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Bayer AG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Wynca Group (Wynca Chemicals

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Syngenta Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 UPL Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Corteva Agriscience

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Nufarm Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 BASF SE

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 FMC Corporation

List of Figures

- Figure 1: Africa Fungicide Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Fungicide Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Fungicide Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Fungicide Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: Africa Fungicide Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 4: Africa Fungicide Market Volume Kiloton Forecast, by Application Mode 2019 & 2032

- Table 5: Africa Fungicide Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 6: Africa Fungicide Market Volume Kiloton Forecast, by Crop Type 2019 & 2032

- Table 7: Africa Fungicide Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 8: Africa Fungicide Market Volume Kiloton Forecast, by Application Mode 2019 & 2032

- Table 9: Africa Fungicide Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 10: Africa Fungicide Market Volume Kiloton Forecast, by Crop Type 2019 & 2032

- Table 11: Africa Fungicide Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Africa Fungicide Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 13: Africa Fungicide Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Africa Fungicide Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 15: South Africa Africa Fungicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Africa Africa Fungicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 17: Sudan Africa Fungicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Sudan Africa Fungicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 19: Uganda Africa Fungicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Uganda Africa Fungicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 21: Tanzania Africa Fungicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Tanzania Africa Fungicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 23: Kenya Africa Fungicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Kenya Africa Fungicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 25: Rest of Africa Africa Fungicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Africa Africa Fungicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 27: Africa Fungicide Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 28: Africa Fungicide Market Volume Kiloton Forecast, by Application Mode 2019 & 2032

- Table 29: Africa Fungicide Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 30: Africa Fungicide Market Volume Kiloton Forecast, by Crop Type 2019 & 2032

- Table 31: Africa Fungicide Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 32: Africa Fungicide Market Volume Kiloton Forecast, by Application Mode 2019 & 2032

- Table 33: Africa Fungicide Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 34: Africa Fungicide Market Volume Kiloton Forecast, by Crop Type 2019 & 2032

- Table 35: Africa Fungicide Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Africa Fungicide Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 37: Nigeria Africa Fungicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Nigeria Africa Fungicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 39: South Africa Africa Fungicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: South Africa Africa Fungicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 41: Egypt Africa Fungicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Egypt Africa Fungicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 43: Kenya Africa Fungicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Kenya Africa Fungicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 45: Ethiopia Africa Fungicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Ethiopia Africa Fungicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 47: Morocco Africa Fungicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Morocco Africa Fungicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 49: Ghana Africa Fungicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Ghana Africa Fungicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 51: Algeria Africa Fungicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Algeria Africa Fungicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 53: Tanzania Africa Fungicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Tanzania Africa Fungicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 55: Ivory Coast Africa Fungicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Ivory Coast Africa Fungicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Fungicide Market?

The projected CAGR is approximately 6.30%.

2. Which companies are prominent players in the Africa Fungicide Market?

Key companies in the market include FMC Corporation, Sumitomo Chemical Co Ltd, ADAMA Agricultural Solutions Ltd, Bayer AG, Wynca Group (Wynca Chemicals, Syngenta Group, UPL Limited, Corteva Agriscience, Nufarm Ltd, BASF SE.

3. What are the main segments of the Africa Fungicide Market?

The market segments include Application Mode, Crop Type, Application Mode, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Increased awareness among farmers for using fungicides to protect crops is boosting the market.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.November 2022: Corteva Agriscience introduced Zorvec Encantia, a fungicide that targets late blight, a detrimental pathogen inhibiting potato growth. The product is based on Zorvec Active and is the first of a novel family of fungicides that uses a distinct biochemical mode of action and does not cross-resist other fungicides.October 2021: By investing in a new chemist's center, ADAMA enhanced its R&D capabilities that are aimed to expand and accelerate its own research and development in the field of plant protection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Fungicide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Fungicide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Fungicide Market?

To stay informed about further developments, trends, and reports in the Africa Fungicide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence