Key Insights

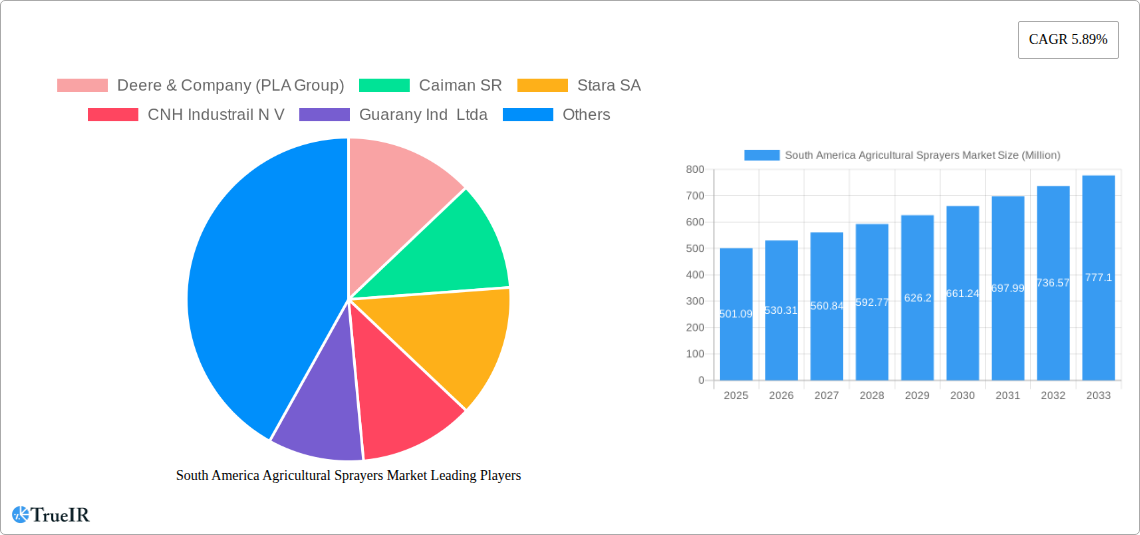

The South America Agricultural Sprayers Market is poised for robust growth, projected to reach approximately USD 501.09 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 5.89% extending through 2033. This expansion is primarily driven by the increasing adoption of advanced agricultural technologies aimed at enhancing crop yields and optimizing resource management. Growing concerns about food security and the need for efficient pest and disease control in a region with significant agricultural output are compelling farmers to invest in modern spraying solutions. Furthermore, government initiatives supporting agricultural modernization and the development of sustainable farming practices are acting as significant catalysts for market expansion. The demand for both traditional and sophisticated sprayer technologies, including precision sprayers and automated systems, is on an upward trajectory as farmers seek to improve efficiency and reduce environmental impact.

South America Agricultural Sprayers Market Market Size (In Million)

The market's dynamism is further shaped by several key trends. The escalating demand for drone-based sprayers, offering unparalleled precision and reduced labor costs, is a prominent development. Simultaneously, the increasing integration of IoT and AI in agricultural machinery, enabling real-time data analysis for targeted spraying, is gaining traction. However, certain restraints could temper this growth, including the high initial investment cost associated with advanced spraying equipment and limited access to financing for smallholder farmers, particularly in less developed regions. Operational challenges such as the availability of skilled labor to operate and maintain complex machinery also present hurdles. Despite these challenges, the South America Agricultural Sprayers Market is expected to witness sustained innovation and increasing adoption, especially within key agricultural economies like Brazil and Argentina, driven by the continuous pursuit of agricultural productivity and sustainability.

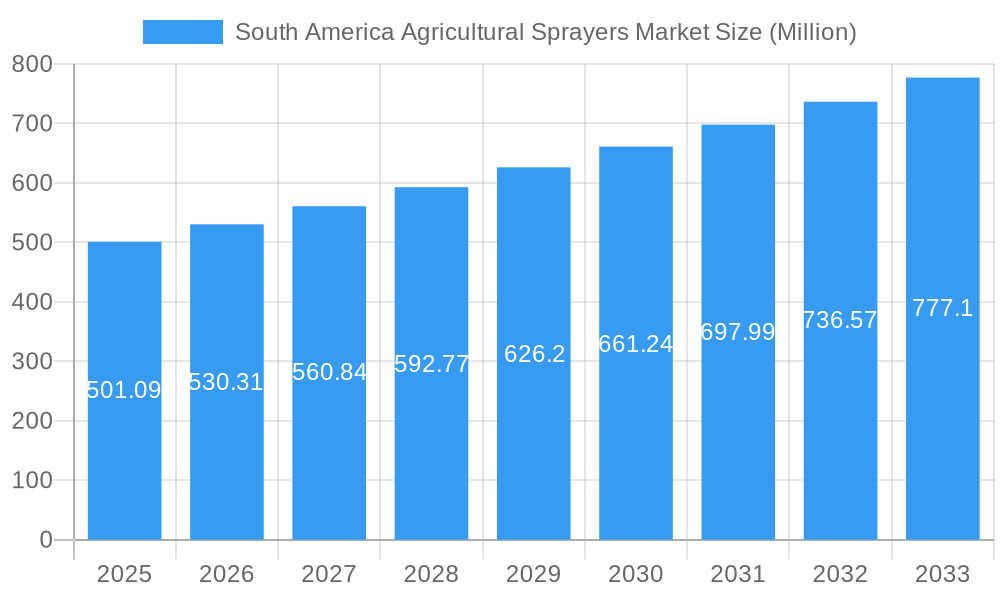

South America Agricultural Sprayers Market Company Market Share

This in-depth report provides a definitive analysis of the South America Agricultural Sprayers Market, covering historical performance, current trends, and future forecasts from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study delves into critical market dynamics, including production and consumption analysis, import/export market analysis (value & volume), and price trend analysis. Leveraging high-volume SEO keywords such as "agricultural sprayers South America," "precision agriculture technology," "crop protection equipment," and "smart farming solutions," this report is optimized for maximum search engine visibility and industry engagement.

South America Agricultural Sprayers Market Market Structure & Competitive Landscape

The South America Agricultural Sprayers Market is characterized by a moderately concentrated structure, with leading players continuously vying for market share through innovation and strategic expansions. The market is driven by increasing adoption of precision agriculture technologies, which enhances operational efficiency and reduces chemical usage. Regulatory frameworks surrounding pesticide application and environmental impact also play a crucial role in shaping market dynamics. Product substitutes, such as drone sprayers and manual application methods, exist but are progressively being outpaced by the advanced capabilities of tractor-mounted and self-propelled sprayers. End-user segmentation primarily includes large-scale commercial farms, medium-sized farms, and smaller agricultural holdings, each with distinct purchasing power and technology adoption rates. Mergers and acquisitions (M&A) are infrequent but significant, often aimed at consolidating market presence or acquiring innovative technologies. For instance, the concentration ratio of the top 5 players is estimated to be around 55-60%, reflecting a competitive yet consolidated landscape. The volume of M&A activities in the historical period (2019-2024) stands at approximately 3-5 significant transactions, indicating strategic consolidation.

South America Agricultural Sprayers Market Market Trends & Opportunities

The South America Agricultural Sprayers Market is poised for robust growth, driven by an increasing demand for enhanced crop yields and efficient resource management. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025-2033, reaching an estimated value of US$ 2,800 Million by 2033. Technological shifts are a dominant trend, with a significant move towards smart spraying solutions and precision application technologies. These innovations, such as AI-powered weed detection and targeted spraying, offer substantial benefits by optimizing herbicide and pesticide usage, thereby reducing environmental impact and operational costs. Consumer preferences are increasingly leaning towards sustainable agricultural practices, which further fuels the demand for advanced spraying equipment that minimizes chemical drift and overspray. Competitive dynamics are intensifying, with established players investing heavily in research and development to introduce next-generation sprayers. The market penetration rate for advanced spraying technologies is expected to rise from an estimated 40% in 2025 to over 65% by 2033. Opportunities lie in the development of cost-effective smart spraying solutions for smaller farm holdings, expansion into emerging agricultural regions within South America, and integration of IoT and data analytics for enhanced farm management. The total market size is estimated at US$ 1,550 Million in 2025.

Dominant Markets & Segments in South America Agricultural Sprayers Market

Brazil stands out as the dominant market within South America for agricultural sprayers, driven by its vast agricultural land, extensive soybean and corn production, and a strong emphasis on modern farming practices. Production analysis reveals Brazil accounts for over 45% of the region's total sprayer output, with a significant volume of self-propelled and tractor-mounted units manufactured locally. Consumption analysis further solidifies Brazil's leadership, consuming an estimated 40% of all agricultural sprayers in the region due to its extensive agricultural sector.

- Import Market Analysis (Value & Volume): Brazil and Argentina are the primary import markets, accounting for approximately 35% and 20% of the total import value, respectively. The import value for agricultural sprayers in South America is projected to reach US$ 700 Million by 2033, with a volume of around 120,000 units. Argentina's strong demand for advanced boom sprayers for its extensive grain production contributes significantly to this figure.

- Export Market Analysis (Value & Volume): Brazil is also the leading exporter, shipping an estimated 30% of the region's agricultural sprayer volume. These exports are primarily directed towards other Latin American countries and select African nations. The export market value is anticipated to reach US$ 550 Million by 2033, with a volume of approximately 95,000 units.

- Price Trend Analysis: The price trend analysis indicates a steady upward trajectory for agricultural sprayers, driven by the inclusion of advanced technologies and rising manufacturing costs. The average selling price (ASP) for self-propelled sprayers is expected to increase from US$ 150,000 in 2025 to US$ 200,000 by 2033. Similarly, tractor-mounted sprayers are predicted to see their ASP rise from US$ 15,000 to US$ 22,000 during the same period. This rise is attributed to the integration of GPS, LiDAR, and intelligent nozzle control systems.

South America Agricultural Sprayers Market Product Analysis

Product innovation in the South America agricultural sprayers market is primarily focused on enhancing efficiency, precision, and sustainability. Key advancements include the integration of artificial intelligence (AI) for real-time weed and pest detection, leading to highly targeted spraying applications. GPS guidance systems and automated boom control significantly reduce overlap and under-application, optimizing chemical usage. The development of lightweight yet durable materials improves maneuverability and reduces soil compaction. Furthermore, the emergence of smart connectivity features enables remote monitoring and data collection, allowing farmers to make informed decisions for crop management. These technological integrations provide a significant competitive advantage and cater to the growing demand for advanced crop protection solutions.

Key Drivers, Barriers & Challenges in South America Agricultural Sprayers Market

Key Drivers:

- Increasing Demand for Precision Agriculture: The adoption of precision agriculture technologies, driven by the need for higher crop yields and efficient resource utilization, is a primary growth catalyst. Smart spraying solutions enable targeted application of fertilizers and pesticides, reducing waste and environmental impact.

- Technological Advancements: Continuous innovation in sprayer technology, including AI, GPS, and IoT integration, offers enhanced accuracy, automation, and data-driven insights, appealing to modern farmers.

- Government Initiatives and Subsidies: Supportive government policies and subsidies aimed at promoting modern farming practices and sustainable agriculture encourage investment in advanced agricultural machinery.

Barriers & Challenges:

- High Initial Investment Costs: Advanced agricultural sprayers, particularly self-propelled and precision models, come with a substantial upfront cost, posing a significant barrier for small and medium-sized farmers.

- Limited Access to Technology and Infrastructure: In some rural areas of South America, limited internet connectivity and lack of skilled technicians for maintenance and repair can hinder the adoption and effective utilization of sophisticated spraying equipment.

- Regulatory Complexities: Stringent regulations regarding pesticide use and environmental compliance can create challenges for manufacturers and end-users, requiring continuous adaptation to new standards.

Growth Drivers in the South America Agricultural Sprayers Market Market

The growth of the South America Agricultural Sprayers Market is propelled by several key factors. The escalating need for improved crop productivity to meet global food demand is a significant driver. Technological advancements, such as the integration of AI and machine learning for precision spraying, are creating new opportunities and enhancing the efficiency of agricultural operations. Government initiatives promoting sustainable agriculture and offering subsidies for modern farm equipment further stimulate market expansion. Economic factors, including the increasing disposable income of farmers and access to credit facilities, also play a crucial role in facilitating the adoption of advanced sprayers. The growing awareness among farmers regarding the benefits of precision application in terms of cost savings and environmental protection is also a pivotal growth catalyst.

Challenges Impacting South America Agricultural Sprayers Market Growth

Several challenges impact the growth trajectory of the South America Agricultural Sprayers Market. The high initial investment required for sophisticated spraying systems remains a significant barrier, particularly for smallholder farmers with limited capital. Regulatory complexities, including evolving environmental standards and pesticide registration processes, can create hurdles for both manufacturers and end-users. Supply chain disruptions, exacerbated by global economic volatility and logistical challenges, can affect the availability of components and finished products. Furthermore, the competitive pressure from both domestic and international players necessitates continuous innovation and cost-effectiveness. The need for skilled labor to operate and maintain advanced machinery is another pressing concern that can slow down adoption rates in regions with limited technical expertise.

Key Players Shaping the South America Agricultural Sprayers Market Market

- Deere & Company (PLA Group)

- Caiman SR

- Stara SA

- CNH Industrial N V

- Guarany Ind Ltda

- Jacto Inc

- AGCO Corporation

Significant South America Agricultural Sprayers Market Industry Milestones

- September 2022: John Deere launched its 'see and spray' technology on new sprayers at the Farm Progress Show. This innovative machine combines targeted spray technology with a conventional broadcast system, offering growers flexibility and marking the company's first commercialized green-on-green targeted spray technology.

- June 2022: Bosch BASF Smart Farming GmbH, a joint venture between Bosch and BASF Digital Farming, entered a commercial sales collaboration with Stara for its Smart Spraying solution. This partnership aims to create a line for the Imperador 4000 Eco Spray smart sprayer, following successful product trials in Brazil and bringing an innovative Smart Spraying solution to the Latin American market.

Future Outlook for South America Agricultural Sprayers Market Market

The future outlook for the South America Agricultural Sprayers Market is exceptionally promising, driven by the persistent need for enhanced agricultural productivity and sustainable farming practices. The increasing adoption of smart technologies, including AI-driven precision application and IoT-enabled monitoring, will continue to reshape the market. Opportunities for growth lie in the development of more affordable and user-friendly smart spraying solutions targeted at a broader segment of farmers. Expansion into untapped agricultural regions within South America and the growing demand for technologically advanced crop protection equipment will further fuel market expansion. Strategic collaborations and partnerships between technology providers and agricultural machinery manufacturers are expected to accelerate innovation and market penetration. The focus will remain on delivering solutions that optimize resource use, minimize environmental impact, and contribute to food security.

South America Agricultural Sprayers Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South America Agricultural Sprayers Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Agricultural Sprayers Market Regional Market Share

Geographic Coverage of South America Agricultural Sprayers Market

South America Agricultural Sprayers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Brazilian Farm Structure and Consolidation of Smaller Farms; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. High Cost of Equipment and Price Sensitivity; Data Privacy Concerns

- 3.4. Market Trends

- 3.4.1. Increase in Average Farm Size Leading To Adoption of Agricultural Sprayers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Agricultural Sprayers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Deere & Company (PLA Group)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Caiman SR

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Stara SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CNH Industrail N V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Guarany Ind Ltda

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jacto Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AGCO Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Deere & Company (PLA Group)

List of Figures

- Figure 1: South America Agricultural Sprayers Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Agricultural Sprayers Market Share (%) by Company 2025

List of Tables

- Table 1: South America Agricultural Sprayers Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: South America Agricultural Sprayers Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: South America Agricultural Sprayers Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: South America Agricultural Sprayers Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: South America Agricultural Sprayers Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: South America Agricultural Sprayers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: South America Agricultural Sprayers Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: South America Agricultural Sprayers Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: South America Agricultural Sprayers Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: South America Agricultural Sprayers Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: South America Agricultural Sprayers Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: South America Agricultural Sprayers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil South America Agricultural Sprayers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina South America Agricultural Sprayers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Chile South America Agricultural Sprayers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Colombia South America Agricultural Sprayers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Peru South America Agricultural Sprayers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Venezuela South America Agricultural Sprayers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Ecuador South America Agricultural Sprayers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Bolivia South America Agricultural Sprayers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Paraguay South America Agricultural Sprayers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Uruguay South America Agricultural Sprayers Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Agricultural Sprayers Market?

The projected CAGR is approximately 5.89%.

2. Which companies are prominent players in the South America Agricultural Sprayers Market?

Key companies in the market include Deere & Company (PLA Group), Caiman SR, Stara SA, CNH Industrail N V, Guarany Ind Ltda, Jacto Inc, AGCO Corporation.

3. What are the main segments of the South America Agricultural Sprayers Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 501.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Brazilian Farm Structure and Consolidation of Smaller Farms; Technological Advancements.

6. What are the notable trends driving market growth?

Increase in Average Farm Size Leading To Adoption of Agricultural Sprayers.

7. Are there any restraints impacting market growth?

High Cost of Equipment and Price Sensitivity; Data Privacy Concerns.

8. Can you provide examples of recent developments in the market?

September 2022: John Deere has launched its 'see and spray' technology on one of the new sprayers released at the Farm Progress Show. The machine combines targeted spray technology with a conventional broadcast system to offer growers options throughout the season and it is the first green-on-green targeted spray technology to be commercialized by the company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Agricultural Sprayers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Agricultural Sprayers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Agricultural Sprayers Market?

To stay informed about further developments, trends, and reports in the South America Agricultural Sprayers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence