Key Insights

The Europe Chemical Logistics Market is projected for significant expansion, expected to reach $14.52 billion by 2033, driven by a robust CAGR of 8.09%. This growth is fueled by increasing chemical production and global trade, particularly in pharmaceuticals, cosmetics, and oil & gas, demanding sophisticated logistics. Enhanced supply chain efficiency, stringent regulatory compliance, and the safe handling of hazardous materials are key market drivers. Investments in advanced technologies like real-time tracking, automated warehousing, and specialized transportation are optimizing operational costs and meeting industry standards. The demand for integrated logistics services, encompassing transportation, warehousing, and value-added solutions, is rising as businesses seek comprehensive end-to-end supply chain management.

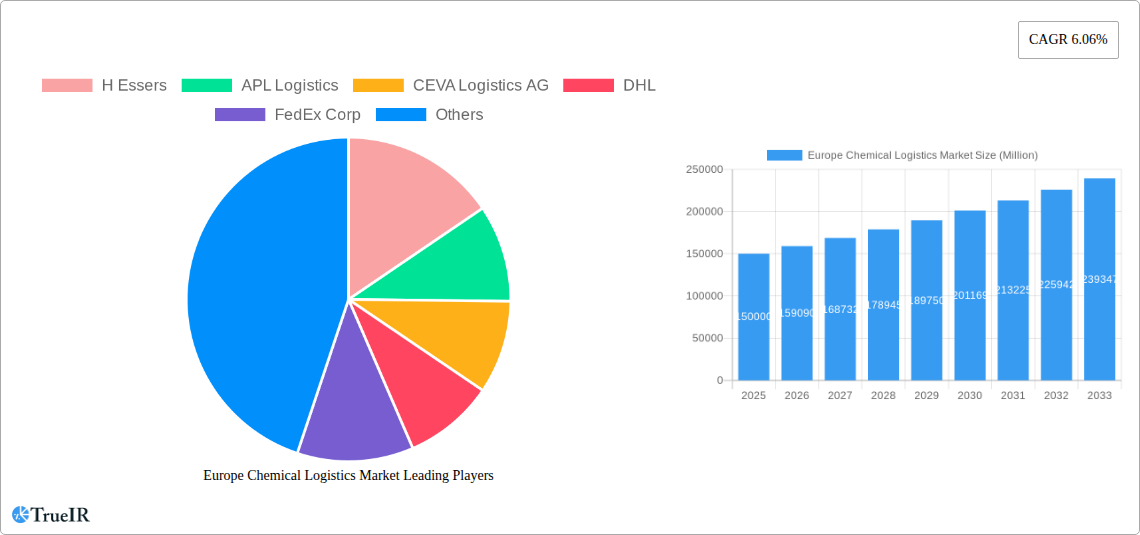

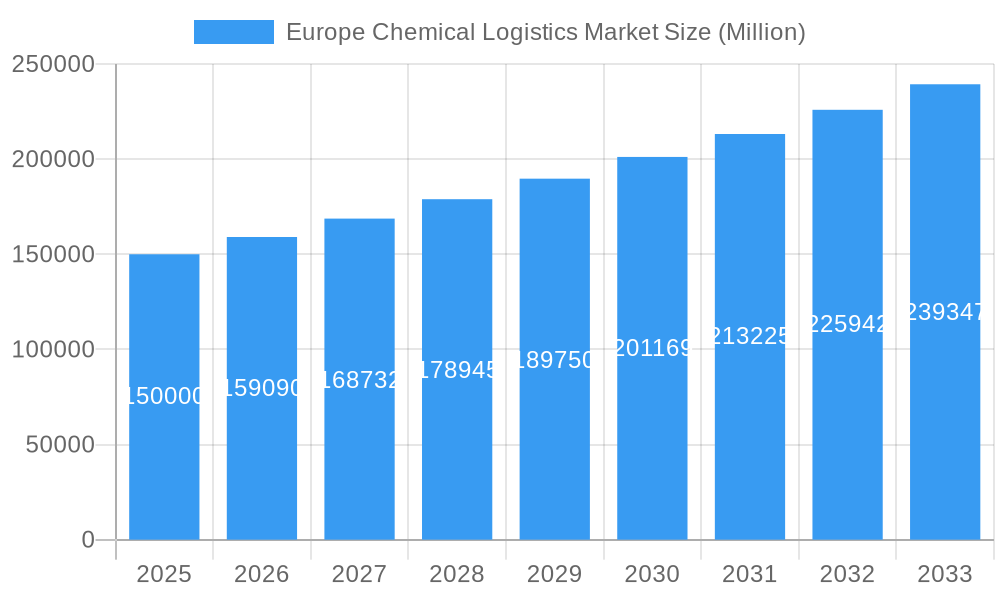

Europe Chemical Logistics Market Market Size (In Billion)

Digitalization and Industry 4.0 principles are transforming chemical logistics, enhancing transparency, efficiency, and predictive capabilities. Sustainability initiatives, focusing on reduced carbon footprints through optimized routing and greener fuels, are also gaining momentum. Challenges include high infrastructure and equipment costs, diverse European regulatory landscapes, and potential supply chain disruptions from geopolitical events. Despite these, the market's segmentation across service types, transportation modes, and end-user industries indicates a dynamic and resilient sector poised for substantial development.

Europe Chemical Logistics Market Company Market Share

This report offers in-depth analysis of the Europe Chemical Logistics Market, detailing market dynamics, competitive landscapes, and future growth trajectories. Covering the historical period (2019-2024) and the forecast period (2025-2033), with 2025 as the base year, this study is essential for stakeholders navigating European chemical supply chains. The Europe Chemical Logistics Market is projected to reach $14.52 billion by 2033, with an anticipated CAGR of 8.09% from 2025 to 2033.

Europe Chemical Logistics Market Market Structure & Competitive Landscape

The Europe Chemical Logistics Market exhibits a moderately consolidated structure, with a mix of global giants and specialized regional players vying for market share. Key innovation drivers include the growing demand for sustainable logistics solutions, advancements in supply chain visibility technologies, and the increasing need for specialized handling of hazardous and temperature-sensitive chemicals. Regulatory frameworks, particularly those related to environmental protection, safety standards (e.g., REACH, CLP), and cross-border transportation, significantly influence market operations and strategic decisions. The presence of robust infrastructure and stringent compliance requirements acts as a barrier to new entrants, while also fostering loyalty among established chemical logistics providers. Product substitutes are limited due to the specialized nature of chemical handling, but the efficiency and cost-effectiveness of logistics services can be a differentiating factor. M&A activity is a notable trend, with logistics companies consolidating to expand their service portfolios, geographical reach, and technological capabilities, thereby enhancing their competitive advantage in the chemical supply chain. The chemical logistics market is characterized by a strong emphasis on specialized transportation and warehousing for a diverse range of chemical products.

Europe Chemical Logistics Market Market Trends & Opportunities

The Europe Chemical Logistics Market is experiencing robust growth, driven by the expansion of key end-user industries and an increasing focus on efficiency and safety within the chemical supply chain. Market size growth is directly correlated with the production volumes of pharmaceuticals, cosmetics, oil and gas, and specialty chemicals across the continent. Technological shifts are revolutionizing operations, with the adoption of IoT for real-time tracking and monitoring, AI for demand forecasting and route optimization, and automation in warehouses to enhance throughput and accuracy. These advancements are crucial for ensuring the integrity of sensitive chemical shipments and reducing operational costs. Consumer preferences are increasingly leaning towards suppliers who demonstrate a commitment to environmental sustainability and ethical sourcing, pushing chemical logistics companies to invest in greener fleets and energy-efficient warehousing solutions. Competitive dynamics are intensifying, compelling companies to differentiate through specialized services, flexible solutions, and a strong emphasis on regulatory compliance. Opportunities abound in emerging markets within Eastern Europe, as well as in the development of integrated logistics solutions that encompass end-to-end chemical supply chain management. The specialty chemicals industry is a particularly strong growth segment, demanding highly specialized handling and transportation services. The increasing demand for cold chain logistics for temperature-sensitive chemicals presents a significant opportunity.

Dominant Markets & Segments in Europe Chemical Logistics Market

The Transportation segment currently holds the largest market share within the Europe Chemical Logistics Market, primarily driven by the extensive road and rail networks across the continent, facilitating efficient movement of bulk and packaged chemicals. The Road mode of transportation is dominant due to its flexibility and accessibility, connecting production facilities to diverse end-user locations. However, Sea transportation remains crucial for intercontinental and large-volume shipments, particularly for bulk chemicals and petrochemicals. The Pharmaceutical Industry is a leading end-user segment, demanding stringent quality control, temperature-sensitive handling, and secure transportation for high-value products. Similarly, the Specialty Chemicals Industry is experiencing significant growth, necessitating tailored logistics solutions for diverse applications.

- Dominant Service Segment: Transportation, driven by the sheer volume of chemical movement across Europe.

- Dominant Mode of Transportation: Road, offering unparalleled flexibility and last-mile delivery capabilities for various chemical products.

- Leading End User: Pharmaceutical Industry, characterized by high-value, sensitive, and often time-critical shipments.

- Key Growth Drivers:

- Infrastructure Development: Continuous investment in road, rail, and port infrastructure across major European economies like Germany, France, and the Netherlands.

- Regulatory Harmonization: Efforts towards harmonizing safety and environmental regulations across EU member states facilitate smoother cross-border chemical logistics.

- Industry Demand: The sustained and growing demand from the pharmaceutical, cosmetics, and specialty chemicals sectors directly fuels the need for efficient logistics services.

- Technological Adoption: Increasing integration of digital solutions, such as real-time tracking and supply chain visibility platforms, enhances operational efficiency and safety.

Europe Chemical Logistics Market Product Analysis

The Europe Chemical Logistics Market product analysis highlights a continuous evolution towards enhanced safety, efficiency, and sustainability in the handling and transportation of chemical goods. Innovations in specialty chemicals logistics are focused on developing specialized containers, advanced temperature control systems, and real-time monitoring technologies to ensure product integrity. Competitive advantages are increasingly derived from the ability to offer end-to-end solutions, including customs clearance, warehousing, and value-added services like repackaging and blending. The market is witnessing a rise in demand for integrated logistics platforms that provide seamless visibility and control over the entire chemical supply chain.

Key Drivers, Barriers & Challenges in Europe Chemical Logistics Market

Key Drivers: The Europe Chemical Logistics Market is propelled by the steady growth of its end-user industries, such as pharmaceuticals and specialty chemicals, which require sophisticated transportation and warehousing solutions. Technological advancements in supply chain management, including IoT and AI, are enhancing efficiency and visibility. Furthermore, the increasing emphasis on sustainability and green logistics is creating demand for eco-friendly solutions. Regulatory support for cross-border trade also acts as a catalyst.

Barriers & Challenges: Significant barriers include the complex and evolving regulatory landscape across different European nations, particularly concerning hazardous materials. High operational costs associated with specialized equipment, trained personnel, and stringent safety protocols pose a challenge. Supply chain disruptions, geopolitical uncertainties, and labor shortages further impact the chemical logistics sector. Intense competition among established and emerging players can also pressure profit margins.

Growth Drivers in the Europe Chemical Logistics Market Market

The Europe Chemical Logistics Market is experiencing significant growth driven by several key factors. The expansion of the pharmaceutical industry, with its increasing demand for specialized and secure transportation, is a primary growth catalyst. The burgeoning specialty chemicals industry, catering to diverse applications, further fuels this expansion. Technological advancements, including the adoption of AI for predictive analytics and route optimization, are enhancing operational efficiency and reducing costs. Moreover, a growing emphasis on sustainable logistics practices, such as the use of electric vehicles and optimized route planning to reduce emissions, presents a substantial opportunity. Government initiatives promoting trade and investment within the EU also contribute positively to the market's growth trajectory.

Challenges Impacting Europe Chemical Logistics Market Growth

Despite the positive growth outlook, the Europe Chemical Logistics Market faces several critical challenges. The stringent and often divergent regulatory frameworks across EU member states regarding the handling and transportation of hazardous chemicals create compliance complexities and increase operational costs. Supply chain disruptions, stemming from geopolitical events, natural disasters, or port congestion, pose significant risks to timely deliveries and product integrity. Furthermore, the increasing cost of fuel, labor shortages within the logistics sector, and intense competition among service providers can impact profitability and service quality. The need for substantial investment in specialized infrastructure and advanced technology to meet evolving industry demands also presents a financial hurdle for many chemical logistics companies.

Key Players Shaping the Europe Chemical Logistics Market Market

- H. Essers

- APL Logistics

- CEVA Logistics AG

- DHL

- FedEx Corp

- XPO Logistics

- JCL Logistics

- Log4Chem

- Schneider National Inc

- Rhenus Logistics

- DB Schenker BTT

- RMI Global Logistics Services

- Univar Inc

- Chemical Express

- Broekman Logistics

- BDP International Inc

- DSV Panalpina AS

Significant Europe Chemical Logistics Market Industry Milestones

- September 2023: The German Chemical Industry Association (Verband der Chemischen Industrie e.V., or VCI) and DACHSER Chem Logistics extended their purchasing partnership in logistics ahead of time by five years, reinforcing their strong collaboration and commitment to efficient chemical supply chains through to 2029.

- May 2023: Wincanton, a leading supply chain partner for UK businesses, secured a pivotal 10-year warehousing and logistics contract with Tata Chemicals Europe (“TCE”). This long-term partnership underscores Wincanton’s integral role in supporting TCE’s strategic growth plans, including the introduction of a UK-first from British Salt Limited, TCE’s high purity salt manufacturing business.

Future Outlook for Europe Chemical Logistics Market Market

The future outlook for the Europe Chemical Logistics Market is promising, driven by continued growth in its key end-user industries and an increasing demand for specialized and sustainable logistics solutions. Strategic opportunities lie in leveraging digital technologies for enhanced supply chain visibility and efficiency, expanding into emerging Eastern European markets, and developing innovative cold chain and hazardous material handling capabilities. The market's trajectory will be shaped by a persistent focus on regulatory compliance, operational resilience, and the integration of eco-friendly practices, ensuring a secure and efficient flow of chemicals across the continent.

Europe Chemical Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehous

- 1.3. Other Value-added Services

-

2. Mode of Transportation

- 2.1. Road

- 2.2. Rail

- 2.3. Sea

- 2.4. Pipeline

-

3. End User

- 3.1. Pharmaceutical Industry

- 3.2. Cosmetics Industry

- 3.3. Oil and Gas Industry

- 3.4. Specialty Chemicals Industry

- 3.5. Other End Users (like Coating Industry)

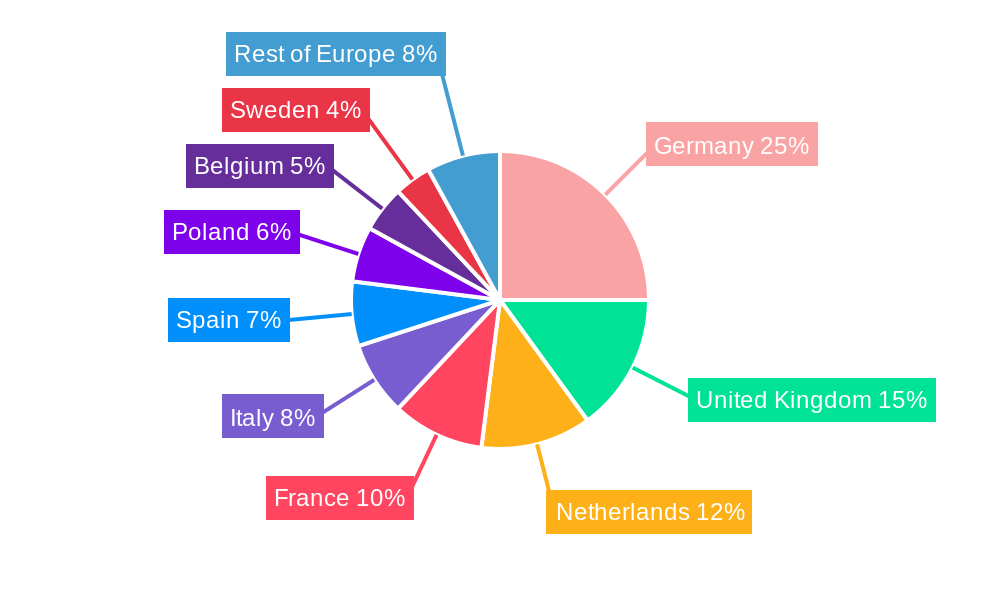

Europe Chemical Logistics Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Netherlands

- 4. France

- 5. Italy

- 6. Spain

- 7. Poland

- 8. Belgium

- 9. Sweden

- 10. Rest of Europe

Europe Chemical Logistics Market Regional Market Share

Geographic Coverage of Europe Chemical Logistics Market

Europe Chemical Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost Efficiency and Time Efficiency; Increasing E-commerce Sector

- 3.3. Market Restrains

- 3.3.1. Regulatory Environment; Technical Limitations

- 3.4. Market Trends

- 3.4.1. Europe is the second largest Chemical Producer Globally

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Chemical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehous

- 5.1.3. Other Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 5.2.1. Road

- 5.2.2. Rail

- 5.2.3. Sea

- 5.2.4. Pipeline

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Pharmaceutical Industry

- 5.3.2. Cosmetics Industry

- 5.3.3. Oil and Gas Industry

- 5.3.4. Specialty Chemicals Industry

- 5.3.5. Other End Users (like Coating Industry)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. Netherlands

- 5.4.4. France

- 5.4.5. Italy

- 5.4.6. Spain

- 5.4.7. Poland

- 5.4.8. Belgium

- 5.4.9. Sweden

- 5.4.10. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Germany Europe Chemical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Warehous

- 6.1.3. Other Value-added Services

- 6.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 6.2.1. Road

- 6.2.2. Rail

- 6.2.3. Sea

- 6.2.4. Pipeline

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Pharmaceutical Industry

- 6.3.2. Cosmetics Industry

- 6.3.3. Oil and Gas Industry

- 6.3.4. Specialty Chemicals Industry

- 6.3.5. Other End Users (like Coating Industry)

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. United Kingdom Europe Chemical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Warehous

- 7.1.3. Other Value-added Services

- 7.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 7.2.1. Road

- 7.2.2. Rail

- 7.2.3. Sea

- 7.2.4. Pipeline

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Pharmaceutical Industry

- 7.3.2. Cosmetics Industry

- 7.3.3. Oil and Gas Industry

- 7.3.4. Specialty Chemicals Industry

- 7.3.5. Other End Users (like Coating Industry)

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Netherlands Europe Chemical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Warehous

- 8.1.3. Other Value-added Services

- 8.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 8.2.1. Road

- 8.2.2. Rail

- 8.2.3. Sea

- 8.2.4. Pipeline

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Pharmaceutical Industry

- 8.3.2. Cosmetics Industry

- 8.3.3. Oil and Gas Industry

- 8.3.4. Specialty Chemicals Industry

- 8.3.5. Other End Users (like Coating Industry)

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. France Europe Chemical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Warehous

- 9.1.3. Other Value-added Services

- 9.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 9.2.1. Road

- 9.2.2. Rail

- 9.2.3. Sea

- 9.2.4. Pipeline

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Pharmaceutical Industry

- 9.3.2. Cosmetics Industry

- 9.3.3. Oil and Gas Industry

- 9.3.4. Specialty Chemicals Industry

- 9.3.5. Other End Users (like Coating Industry)

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Italy Europe Chemical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Transportation

- 10.1.2. Warehous

- 10.1.3. Other Value-added Services

- 10.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 10.2.1. Road

- 10.2.2. Rail

- 10.2.3. Sea

- 10.2.4. Pipeline

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Pharmaceutical Industry

- 10.3.2. Cosmetics Industry

- 10.3.3. Oil and Gas Industry

- 10.3.4. Specialty Chemicals Industry

- 10.3.5. Other End Users (like Coating Industry)

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Spain Europe Chemical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service

- 11.1.1. Transportation

- 11.1.2. Warehous

- 11.1.3. Other Value-added Services

- 11.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 11.2.1. Road

- 11.2.2. Rail

- 11.2.3. Sea

- 11.2.4. Pipeline

- 11.3. Market Analysis, Insights and Forecast - by End User

- 11.3.1. Pharmaceutical Industry

- 11.3.2. Cosmetics Industry

- 11.3.3. Oil and Gas Industry

- 11.3.4. Specialty Chemicals Industry

- 11.3.5. Other End Users (like Coating Industry)

- 11.1. Market Analysis, Insights and Forecast - by Service

- 12. Poland Europe Chemical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Service

- 12.1.1. Transportation

- 12.1.2. Warehous

- 12.1.3. Other Value-added Services

- 12.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 12.2.1. Road

- 12.2.2. Rail

- 12.2.3. Sea

- 12.2.4. Pipeline

- 12.3. Market Analysis, Insights and Forecast - by End User

- 12.3.1. Pharmaceutical Industry

- 12.3.2. Cosmetics Industry

- 12.3.3. Oil and Gas Industry

- 12.3.4. Specialty Chemicals Industry

- 12.3.5. Other End Users (like Coating Industry)

- 12.1. Market Analysis, Insights and Forecast - by Service

- 13. Belgium Europe Chemical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Service

- 13.1.1. Transportation

- 13.1.2. Warehous

- 13.1.3. Other Value-added Services

- 13.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 13.2.1. Road

- 13.2.2. Rail

- 13.2.3. Sea

- 13.2.4. Pipeline

- 13.3. Market Analysis, Insights and Forecast - by End User

- 13.3.1. Pharmaceutical Industry

- 13.3.2. Cosmetics Industry

- 13.3.3. Oil and Gas Industry

- 13.3.4. Specialty Chemicals Industry

- 13.3.5. Other End Users (like Coating Industry)

- 13.1. Market Analysis, Insights and Forecast - by Service

- 14. Sweden Europe Chemical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by Service

- 14.1.1. Transportation

- 14.1.2. Warehous

- 14.1.3. Other Value-added Services

- 14.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 14.2.1. Road

- 14.2.2. Rail

- 14.2.3. Sea

- 14.2.4. Pipeline

- 14.3. Market Analysis, Insights and Forecast - by End User

- 14.3.1. Pharmaceutical Industry

- 14.3.2. Cosmetics Industry

- 14.3.3. Oil and Gas Industry

- 14.3.4. Specialty Chemicals Industry

- 14.3.5. Other End Users (like Coating Industry)

- 14.1. Market Analysis, Insights and Forecast - by Service

- 15. Rest of Europe Europe Chemical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - by Service

- 15.1.1. Transportation

- 15.1.2. Warehous

- 15.1.3. Other Value-added Services

- 15.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 15.2.1. Road

- 15.2.2. Rail

- 15.2.3. Sea

- 15.2.4. Pipeline

- 15.3. Market Analysis, Insights and Forecast - by End User

- 15.3.1. Pharmaceutical Industry

- 15.3.2. Cosmetics Industry

- 15.3.3. Oil and Gas Industry

- 15.3.4. Specialty Chemicals Industry

- 15.3.5. Other End Users (like Coating Industry)

- 15.1. Market Analysis, Insights and Forecast - by Service

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2025

- 16.2. Company Profiles

- 16.2.1 H Essers

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 APL Logistics

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 CEVA Logistics AG

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 DHL

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 FedEx Corp

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 XPO Logistics

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 JCL Logistics

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Log4Chem

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Schneider National Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Rhenus Logistics

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 DB Schenker BTT

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 RMI Global Logistics Services**List Not Exhaustive

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Univar Inc

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Chemical Express

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Broekman Logistics

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 BDP International Inc

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.17 DSV Panalpina AS

- 16.2.17.1. Overview

- 16.2.17.2. Products

- 16.2.17.3. SWOT Analysis

- 16.2.17.4. Recent Developments

- 16.2.17.5. Financials (Based on Availability)

- 16.2.1 H Essers

List of Figures

- Figure 1: Europe Chemical Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Chemical Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Chemical Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Europe Chemical Logistics Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 3: Europe Chemical Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Europe Chemical Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Chemical Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Europe Chemical Logistics Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 7: Europe Chemical Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Europe Chemical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Europe Chemical Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 10: Europe Chemical Logistics Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 11: Europe Chemical Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Europe Chemical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Chemical Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 14: Europe Chemical Logistics Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 15: Europe Chemical Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 16: Europe Chemical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Europe Chemical Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 18: Europe Chemical Logistics Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 19: Europe Chemical Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 20: Europe Chemical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Europe Chemical Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 22: Europe Chemical Logistics Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 23: Europe Chemical Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 24: Europe Chemical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Europe Chemical Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 26: Europe Chemical Logistics Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 27: Europe Chemical Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 28: Europe Chemical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Europe Chemical Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 30: Europe Chemical Logistics Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 31: Europe Chemical Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 32: Europe Chemical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 33: Europe Chemical Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 34: Europe Chemical Logistics Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 35: Europe Chemical Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 36: Europe Chemical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Europe Chemical Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 38: Europe Chemical Logistics Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 39: Europe Chemical Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 40: Europe Chemical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Europe Chemical Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 42: Europe Chemical Logistics Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 43: Europe Chemical Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 44: Europe Chemical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Chemical Logistics Market?

The projected CAGR is approximately 8.09%.

2. Which companies are prominent players in the Europe Chemical Logistics Market?

Key companies in the market include H Essers, APL Logistics, CEVA Logistics AG, DHL, FedEx Corp, XPO Logistics, JCL Logistics, Log4Chem, Schneider National Inc, Rhenus Logistics, DB Schenker BTT, RMI Global Logistics Services**List Not Exhaustive, Univar Inc, Chemical Express, Broekman Logistics, BDP International Inc, DSV Panalpina AS.

3. What are the main segments of the Europe Chemical Logistics Market?

The market segments include Service, Mode of Transportation, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.52 billion as of 2022.

5. What are some drivers contributing to market growth?

Cost Efficiency and Time Efficiency; Increasing E-commerce Sector.

6. What are the notable trends driving market growth?

Europe is the second largest Chemical Producer Globally.

7. Are there any restraints impacting market growth?

Regulatory Environment; Technical Limitations.

8. Can you provide examples of recent developments in the market?

September 2023: The German Chemical Industry Association (Verband der Chemischen Industrie e.V., or VCI) and DACHSER Chem Logistics have extended their purchasing partnership in logistics ahead of time by five years. Early contract extension to 2029 reflects sound collaboration

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Chemical Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Chemical Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Chemical Logistics Market?

To stay informed about further developments, trends, and reports in the Europe Chemical Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence