Key Insights

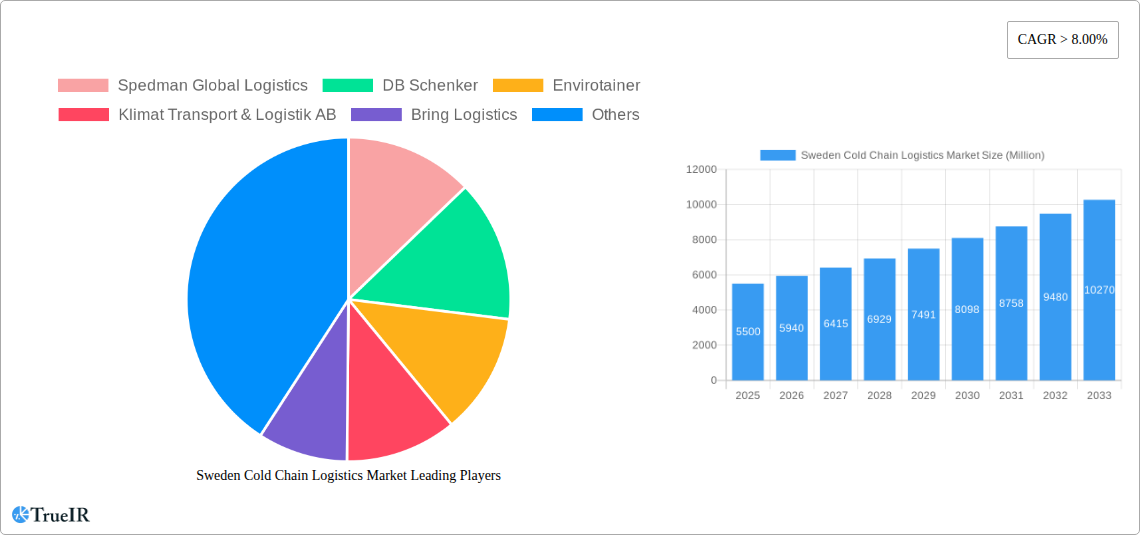

The Swedish cold chain logistics market is projected for substantial expansion, anticipated to reach over $5,500 million by 2025. The market is expected to experience a robust Compound Annual Growth Rate (CAGR) of 5.16% during the forecast period (2025-2033). This growth is driven by increasing demand for temperature-sensitive goods such as fresh produce, dairy, meat, and pharmaceuticals. Key factors include rising consumer preference for high-quality perishable products, enhanced awareness, and stringent regulations for pharmaceutical and biopharmaceutical transport. Technological advancements, including smart monitoring and energy-efficient refrigeration, are improving operational efficiency and reducing spoilage. Sweden's commitment to sustainability also encourages the adoption of green logistics solutions.

Sweden Cold Chain Logistics Market Market Size (In Billion)

Significant growth segments include "Storage" and "Transport" services, crucial for maintaining product integrity. "Chilled" logistics are essential for food products, while "Frozen" solutions serve specific food items and pharmaceuticals. "Value-Ad" services, such as re-packaging and quality control, are vital for meeting client needs and regulatory compliance. Key application sectors include "Horticulture (Fresh Fruits & Vegetables)" and "Dairy Products," alongside the rapidly expanding "Pharmaceutical (Including Biopharma)" sector, requiring specialized temperature-controlled environments. Emerging trends focus on IoT integration for real-time tracking and temperature monitoring, predictive analytics for inventory management, and optimizing last-mile delivery for perishable goods.

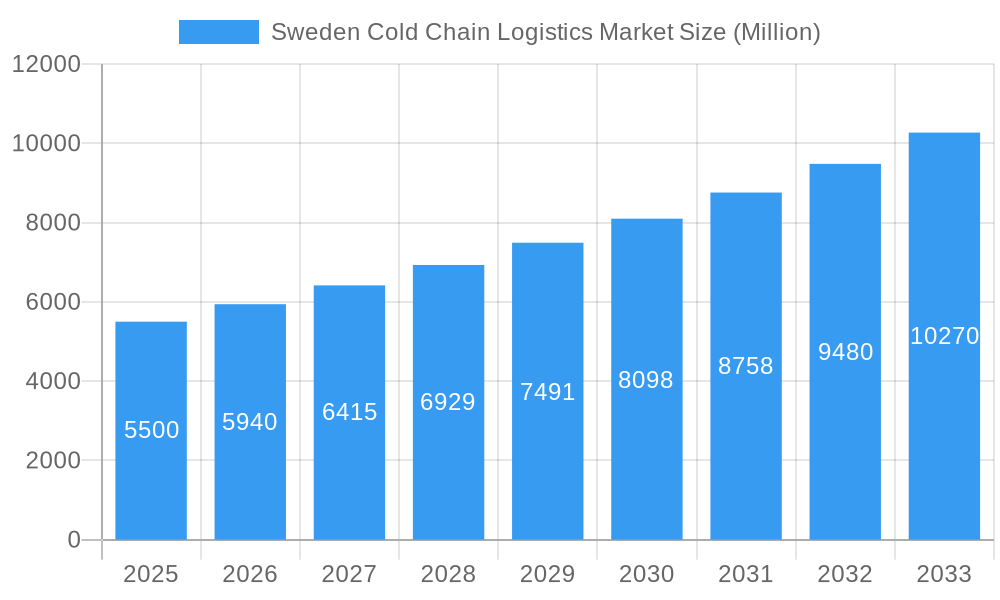

Sweden Cold Chain Logistics Market Company Market Share

Sweden Cold Chain Logistics Market: Analysis & Forecast (2025-2033)

This comprehensive report analyzes the Sweden Cold Chain Logistics Market, offering insights into its structure, trends, and future trajectory from 2025 to 2033. The report covers market size, segmentation, key players, industry developments, drivers, and challenges. It is optimized with high-volume keywords including "Sweden cold chain logistics," "cold storage Sweden," "refrigerated transport Sweden," "pharmaceutical logistics Sweden," and "frozen food logistics Sweden." The projected market size is $1.93 billion, with a CAGR of 5.16%.

Sweden Cold Chain Logistics Market Market Structure & Competitive Landscape

The Sweden Cold Chain Logistics Market is characterized by a moderate level of concentration, with a few key players holding significant market share, while a host of specialized and regional providers cater to niche demands. Innovation is a primary driver, fueled by the increasing demand for advanced temperature-controlled solutions across various sectors, particularly pharmaceuticals and high-value perishables. Regulatory frameworks, while stringent, are evolving to support sustainable logistics practices, including carbon-neutral operations. Product substitutes are limited in the core cold chain services, but advancements in packaging and temperature monitoring technologies offer alternative solutions to traditional cold storage. End-user segmentation reveals a strong reliance on the pharmaceutical and food & beverage industries, with horticulture and other applications also contributing to market growth. Mergers and acquisitions (M&A) are a notable trend, with larger players consolidating their market presence and expanding their service portfolios. The estimated market concentration ratio stands at approximately 35-40% for the top five companies, with ongoing M&A activities indicating a trend towards further consolidation. The volume of reported M&A deals in the European cold chain logistics sector, directly impacting Swedish operations, averaged 10-15 annually over the historical period.

Sweden Cold Chain Logistics Market Market Trends & Opportunities

The Sweden Cold Chain Logistics Market is poised for substantial growth, driven by an increasing demand for specialized temperature-controlled services and a burgeoning e-commerce sector. The market size for cold chain logistics in Sweden is projected to reach an estimated XX Billion USD by 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. Technological advancements are at the forefront of this evolution, with the adoption of Internet of Things (IoT) sensors for real-time temperature monitoring, advanced tracking systems, and automated warehousing solutions significantly enhancing efficiency and reducing spoilage. Consumer preferences are shifting towards higher quality and longer shelf-life perishable goods, including fresh produce and ready-to-eat meals, thereby increasing the need for robust cold chain infrastructure. Furthermore, the expanding pharmaceutical sector, with its stringent requirements for the safe transportation of vaccines, biologics, and other temperature-sensitive medications, is a significant growth catalyst. The rise of online grocery shopping and the increasing demand for frozen and chilled food products further amplify the market's potential. Competitive dynamics are evolving, with a focus on developing sustainable and eco-friendly cold chain solutions, including the use of electric vehicles and carbon-neutral warehousing. The increasing adoption of digital platforms for supply chain management and customer interaction presents opportunities for enhanced visibility and operational efficiency. The market penetration of advanced cold chain technologies is estimated to increase by XX% over the forecast period. The estimated market size for Sweden Cold Chain Logistics was XX Billion USD in 2019 and is expected to reach XX Billion USD by 2033.

Dominant Markets & Segments in Sweden Cold Chain Logistics Market

The Sweden Cold Chain Logistics Market exhibits dominance across several key segments, with Transport and Storage services forming the backbone of the industry. Within the temperature categories, Chilled and Frozen segments represent the largest share due to the extensive requirements of the food and beverage industry. The Pharmaceutical (Including Biopharma) application segment is a critical and high-growth area, driven by the increasing demand for temperature-sensitive medicines and vaccines.

Service Dominance:

- Transport: This segment is crucial, encompassing the movement of goods from origin to destination under controlled temperatures. Key growth drivers include advancements in refrigerated trucking technology, intermodal connectivity, and the expansion of last-mile delivery networks. The estimated market share for transport services is XX%.

- Storage: Cold storage facilities, including warehouses and distribution centers, are vital for maintaining product integrity. Growth is fueled by the need for increased capacity, advanced temperature zoning within facilities, and the integration of automation. The estimated market share for storage services is XX%.

- Value-Ad: Services such as cross-docking, kitting, and specialized handling of temperature-sensitive products are gaining traction, offering enhanced supply chain efficiency.

Temperature Segment Dominance:

- Chilled: This segment caters to products requiring temperatures between 2°C and 8°C, including fresh produce, dairy, and certain pharmaceuticals. Growth is driven by consumer demand for fresh foods and the expanding pharmaceutical market. The estimated market share for chilled products is XX%.

- Frozen: Products requiring temperatures below -18°C, such as frozen foods and some biopharmaceuticals, constitute a significant portion of the market. The growing popularity of frozen meals and the expanding biopharmaceutical sector are key contributors. The estimated market share for frozen products is XX%.

- Ambient: While not strictly cold chain, ambient temperature-controlled logistics plays a role in the overall supply chain for some products.

Application Segment Dominance:

- Horticulture (Fresh Fruits & Vegetables): This segment is crucial for minimizing post-harvest losses and delivering high-quality produce to consumers. Investments in efficient handling and transportation are key growth factors.

- Dairy Products: The extensive cold chain network required for dairy products makes this a stable and significant segment.

- Fish, Meat and Poultry: Ensuring the safety and freshness of these products necessitates a robust cold chain from farm to fork.

- Processed Food: The increasing consumption of ready-to-eat meals and other processed food items drives demand for chilled and frozen logistics solutions.

- Pharmaceutical (Including Biopharma): This segment is experiencing exponential growth due to the complexity of temperature requirements for vaccines, biologics, and specialty drugs. Stringent regulatory compliance and advanced technological solutions are paramount. The estimated market share for pharmaceuticals is XX%.

Sweden Cold Chain Logistics Market Product Analysis

The Sweden Cold Chain Logistics Market is witnessing continuous innovation in product offerings, primarily focused on enhancing temperature integrity, visibility, and efficiency across the supply chain. Advancements in reefer (refrigerated) container technology, including improved insulation, energy efficiency, and precise temperature control systems, are key. The development of smart packaging solutions, incorporating temperature indicators and data loggers, provides real-time insights into product conditions. Furthermore, the integration of IoT sensors and telematics in transport vehicles allows for continuous monitoring and proactive intervention in case of deviations. These technological advancements are crucial for meeting the stringent demands of the pharmaceutical and high-value food segments, offering competitive advantages through reduced product spoilage, enhanced safety, and improved customer trust. The market fit for these innovations is strong, driven by increasing regulatory compliance requirements and the growing demand for premium, traceable products.

Key Drivers, Barriers & Challenges in Sweden Cold Chain Logistics Market

Key Drivers:

- Growing Demand for Perishable Goods: Increasing consumer preference for fresh, frozen, and ready-to-eat food products is a primary growth engine.

- Pharmaceutical Industry Expansion: The rising prevalence of temperature-sensitive biologics, vaccines, and specialty drugs necessitates advanced cold chain logistics.

- E-commerce Growth: The surge in online grocery and food delivery services requires efficient and reliable cold chain networks.

- Technological Advancements: Innovations in IoT, AI, and automation are enhancing efficiency, visibility, and temperature control within the cold chain.

- Focus on Sustainability: Growing environmental awareness is driving demand for eco-friendly cold chain solutions, including carbon-neutral operations and energy-efficient technologies.

Barriers & Challenges:

- High Infrastructure Costs: Establishing and maintaining sophisticated cold chain infrastructure, including specialized vehicles and temperature-controlled warehouses, requires significant capital investment.

- Energy Consumption: Cold chain operations are energy-intensive, leading to higher operational costs and environmental concerns.

- Regulatory Compliance: Strict regulations governing the transportation and storage of pharmaceuticals and food products can be complex and costly to adhere to.

- Skilled Workforce Shortage: A lack of trained personnel for operating and maintaining advanced cold chain equipment poses a challenge.

- Supply Chain Disruptions: Geopolitical events, extreme weather conditions, and other unforeseen circumstances can disrupt cold chain operations, leading to product loss and increased costs. The estimated impact of supply chain disruptions on market growth is a reduction of XX% in potential revenue annually.

Growth Drivers in the Sweden Cold Chain Logistics Market Market

The Sweden Cold Chain Logistics Market is propelled by several key factors. Technologically, the widespread adoption of IoT for real-time temperature monitoring, predictive maintenance, and supply chain visibility is crucial. Economically, the expanding pharmaceutical sector, with its increasing reliance on temperature-sensitive biologics and vaccines, represents a significant demand driver. Furthermore, the growing consumer demand for high-quality, traceable perishable food products, including fresh fruits, vegetables, and premium meat, fuels the need for robust cold chain solutions. Regulatory advancements promoting food safety standards and carbon-neutral logistics practices also incentivize investment in more sophisticated and sustainable cold chain operations. The estimated impact of technological advancements on market efficiency is an improvement of XX%.

Challenges Impacting Sweden Cold Chain Logistics Market Growth

Several challenges impact the growth of the Sweden Cold Chain Logistics Market. Regulatory complexities, particularly concerning the handling of pharmaceuticals and international trade, can create significant hurdles and increase compliance costs. Supply chain issues, such as last-mile delivery inefficiencies and the need for greater end-to-end visibility, remain persistent problems. Competitive pressures among logistics providers, while fostering innovation, can also lead to price wars that may impact profitability. The high capital expenditure required for advanced cold chain infrastructure, coupled with the increasing cost of energy, presents a financial barrier for some market participants. The estimated cost of non-compliance with pharmaceutical cold chain regulations can lead to financial penalties of up to XX Million USD annually.

Key Players Shaping the Sweden Cold Chain Logistics Market Market

- Spedman Global Logistics

- DB Schenker

- Envirotainer

- Klimat Transport & Logistik AB

- Bring Logistics

- DHL logistics

- Nordic Cold Chain Solutions

- Agility logistics

- Kyl & Frysexpressen AB

- Toll Group

Significant Sweden Cold Chain Logistics Market Industry Milestones

- November 2022: DHL Supply Chain established a 400,000 sqm carbon-neutral real estate portfolio across six European Tier 1 markets to support customer expansion. This development signifies a commitment to sustainable logistics and enhanced multi-modal connectivity.

- May 2022: DHL Supply Chain announced plans to construct a 44,000 sqm multi-user logistics center in Sipoo, Finland, scheduled for opening in Q1 2024. This expansion highlights the growing investment in strategically located logistics hubs to serve key European markets.

Future Outlook for Sweden Cold Chain Logistics Market Market

The future outlook for the Sweden Cold Chain Logistics Market is overwhelmingly positive, driven by sustained demand and continuous innovation. Key growth catalysts include the ongoing expansion of the pharmaceutical sector, the increasing adoption of e-commerce for perishable goods, and a growing consumer preference for fresh and high-quality food products. Investments in advanced technologies such as AI-powered route optimization, autonomous warehousing, and predictive analytics will further enhance operational efficiency and reduce waste. Furthermore, the drive towards sustainable logistics, with a focus on reducing carbon footprints and adopting eco-friendly solutions, will shape future market strategies. Strategic opportunities lie in expanding specialized cold chain services for emerging industries and in fostering greater collaboration across the supply chain to ensure seamless temperature-controlled product delivery. The market is expected to witness continued consolidation and the emergence of integrated logistics solutions.

Sweden Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transport

- 1.3. Value-Ad

-

2. Temparature

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Ambient

-

3. Application

- 3.1. Horticulture (Fresh Fruits & Vegetables)

- 3.2. Dairy Pr

- 3.3. Fish, Meat and Poultry

- 3.4. Processed Food

- 3.5. Pharmaceutical (Including Biopharma)

- 3.6. Other Applications

Sweden Cold Chain Logistics Market Segmentation By Geography

- 1. Sweden

Sweden Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Sweden Cold Chain Logistics Market

Sweden Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Pharmaceutical Industry Demands Advanced Cold-Chain Services; E-commerce driving the cold chain logistics

- 3.3. Market Restrains

- 3.3.1. Damaged Goods; Increasing Transportation Cost

- 3.4. Market Trends

- 3.4.1. Pharmaceutical Industry Demands Advanced Cold-Chain Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transport

- 5.1.3. Value-Ad

- 5.2. Market Analysis, Insights and Forecast - by Temparature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Ambient

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits & Vegetables)

- 5.3.2. Dairy Pr

- 5.3.3. Fish, Meat and Poultry

- 5.3.4. Processed Food

- 5.3.5. Pharmaceutical (Including Biopharma)

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Spedman Global Logistics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DB Schenker

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Envirotainer

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Klimat Transport & Logistik AB

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bring Logistics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DHL logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nordic Cold Chain Solutions

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agility logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kyl & Frysexpressen AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Toll Group**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Spedman Global Logistics

List of Figures

- Figure 1: Sweden Cold Chain Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Sweden Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Temparature 2020 & 2033

- Table 3: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Temparature 2020 & 2033

- Table 7: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Cold Chain Logistics Market?

The projected CAGR is approximately 5.16%.

2. Which companies are prominent players in the Sweden Cold Chain Logistics Market?

Key companies in the market include Spedman Global Logistics, DB Schenker, Envirotainer, Klimat Transport & Logistik AB, Bring Logistics, DHL logistics, Nordic Cold Chain Solutions, Agility logistics, Kyl & Frysexpressen AB, Toll Group**List Not Exhaustive.

3. What are the main segments of the Sweden Cold Chain Logistics Market?

The market segments include Service, Temparature, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.93 billion as of 2022.

5. What are some drivers contributing to market growth?

Pharmaceutical Industry Demands Advanced Cold-Chain Services; E-commerce driving the cold chain logistics.

6. What are the notable trends driving market growth?

Pharmaceutical Industry Demands Advanced Cold-Chain Services.

7. Are there any restraints impacting market growth?

Damaged Goods; Increasing Transportation Cost.

8. Can you provide examples of recent developments in the market?

November 2022: To serve customers' expansion needs across six European Tier 1 markets, DHL Supply Chain, the top contract logistics provider in the world, has established a 400,000 sqm carbon-neutral real estate portfolio. All of the locations, which are strategically located in logistics hubs, will have strong multi-modal transport connectivity to meet the needs of a variety of clients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Sweden Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence