Key Insights

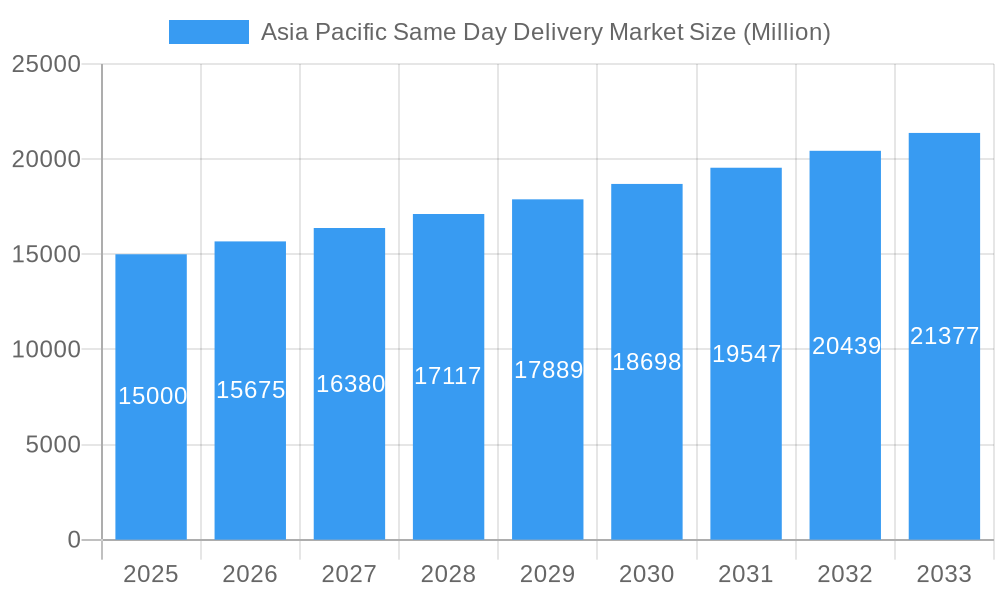

The Asia Pacific Same Day Delivery Market is experiencing significant expansion, driven by the surge in e-commerce and the growing consumer preference for immediate delivery. With an estimated market size of $172.37 billion in 2025, the sector is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.7% through 2033. This growth is primarily fueled by the expanding e-commerce industry, alongside increasing demands from the healthcare and manufacturing sectors for rapid logistics solutions. Road transport is expected to remain dominant due to its cost-effectiveness and extensive reach across urban and suburban areas. While heavy-weight shipments are substantial, light and medium-weight shipments will see considerable growth as consumers increasingly demand on-demand delivery of everyday items. Emerging markets in India and Southeast Asia are anticipated to be key growth drivers, benefiting from rising disposable incomes and widespread digital adoption.

Asia Pacific Same Day Delivery Market Market Size (In Billion)

The market is characterized by intense competition from global leaders such as DHL Group, FedEx, and UPS, as well as strong regional players like China Post, CJ Logistics, and Yamato Holdings. These companies are investing in technological advancements, including AI for route optimization and real-time tracking, to improve operational efficiency and customer experience. Increasing urbanization across the Asia Pacific region further accelerates the need for faster delivery services, creating a fertile environment for same-day delivery solutions. However, challenges such as high operational costs, traffic congestion in densely populated cities, and the requirement for sophisticated logistics infrastructure may pose restraints. Strategic partnerships, innovative delivery models, and enhanced urban planning will be critical for sustained market leadership and realizing the full potential of the Asia Pacific Same Day Delivery Market.

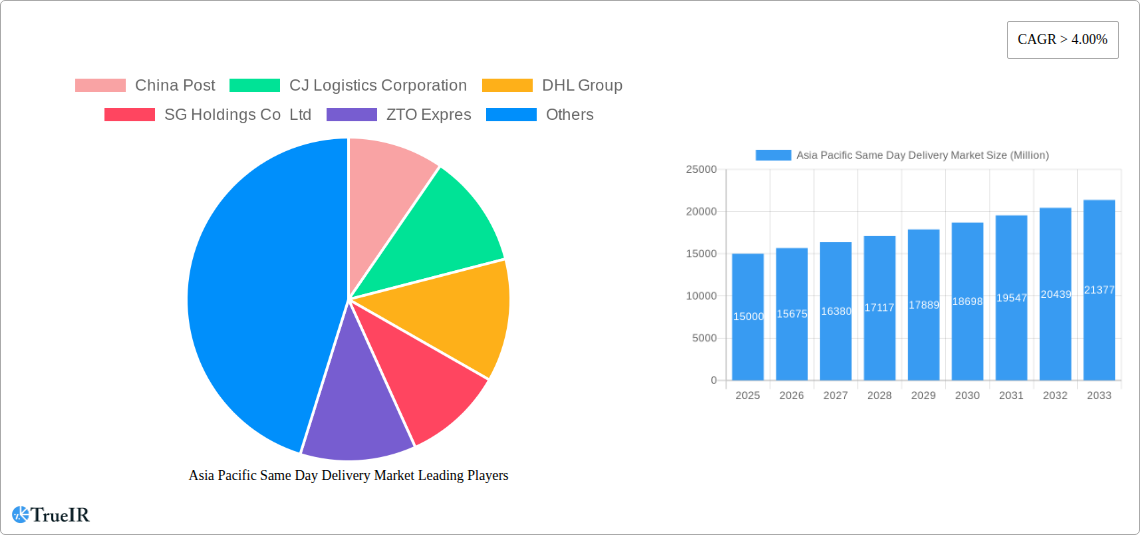

Asia Pacific Same Day Delivery Market Company Market Share

This report provides a comprehensive analysis of the Asia Pacific same day delivery market, projecting its growth from 2025 to 2033, with a 2025 base year. The study examines market structure, competitive dynamics, trends, opportunities, dominant segments, product innovations, key drivers, barriers, and leading players. With a projected market size in the billions of US dollars, this report is essential for stakeholders aiming to leverage the growing demand for expedited logistics solutions in the region.

Asia Pacific Same Day Delivery Market Market Structure & Competitive Landscape

The Asia Pacific same day delivery market exhibits a moderately concentrated structure, with a few dominant players like DHL Group, FedEx, and UPS leading innovation and service expansion. However, the landscape is increasingly characterized by the rise of regional powerhouses such as China Post, ZTO Express, and SF Express, alongside specialized logistics providers like CJ Logistics Corporation and Yamato Holdings. Regulatory frameworks, particularly concerning cross-border logistics and data privacy, are evolving and exert a significant influence on market entry and operational strategies. Innovation drivers are primarily centered around last-mile delivery optimization, fueled by AI-powered logistics platforms, autonomous delivery solutions, and advanced route planning software. The threat of product substitutes is low for same-day delivery due to its inherent speed advantage, but indirect competition arises from improved next-day delivery services and hyperlocal fulfillment centers. End-user segmentation reveals a strong reliance on the E-Commerce sector, followed by Wholesale and Retail Trade (Offline), Healthcare, and Financial Services (BFSI). Merger and acquisition (M&A) trends are notable, with larger players acquiring smaller, technologically advanced firms to enhance their delivery networks and service offerings. For instance, in the historical period, we've observed several strategic partnerships aimed at expanding reach and operational efficiency. The market concentration ratio is estimated to be around 60-70% for the top five players, with M&A volumes averaging 5-10 significant deals annually.

Asia Pacific Same Day Delivery Market Market Trends & Opportunities

The Asia Pacific same day delivery market is experiencing exponential growth, driven by a confluence of factors including the relentless expansion of e-commerce, evolving consumer expectations for instant gratification, and significant technological advancements in logistics. The market size is projected to reach upwards of USD 30,000 Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 18.5% during the forecast period of 2025-2033. This rapid expansion is underpinned by increasing disposable incomes and a burgeoning middle class across key economies like China, India, and Southeast Asian nations. Technological shifts are profoundly reshaping the industry, with the integration of Artificial Intelligence (AI) for demand forecasting and route optimization, the deployment of drones and autonomous vehicles for last-mile deliveries, and the adoption of sophisticated Warehouse Management Systems (WMS) and Transportation Management Systems (TMS) becoming commonplace. These innovations are not only enhancing efficiency but also reducing operational costs, making same-day delivery more economically viable.

Consumer preferences are increasingly leaning towards speed and convenience. The ability to receive purchased goods within hours of placing an order is becoming a key differentiator for online retailers. This paradigm shift is compelling businesses across various sectors, from fashion and electronics to pharmaceuticals and groceries, to invest heavily in robust same-day delivery capabilities. The competitive dynamics are intensifying, with established global players like DHL Group, FedEx, and UPS fiercely competing with agile local and regional providers such as China Post, ZTO Express, and SF Express. The focus is shifting from mere delivery to providing a superior customer experience, encompassing real-time tracking, flexible delivery windows, and efficient returns processing. The market penetration rate for same-day delivery services, while varying across countries, is steadily increasing, especially in major metropolitan areas. Opportunities abound for innovative logistics solutions, such as micro-fulfillment centers strategically located within urban cores, and partnerships with local businesses to leverage existing infrastructure for faster deliveries. The growth in cross-border e-commerce also presents a significant avenue for expansion, necessitating optimized international same-day delivery networks. The overall market potential is vast, with continued digital transformation and evolving consumer habits serving as perpetual growth catalysts.

Dominant Markets & Segments in Asia Pacific Same Day Delivery Market

The Asia Pacific same day delivery market is characterized by significant regional variations and segment dominance. Domestic deliveries overwhelmingly lead the market, driven by the sheer volume of e-commerce transactions within individual countries. China, as the largest e-commerce market globally, exerts substantial influence, with its extensive road networks and advanced logistics infrastructure supporting a high frequency of same-day deliveries. India, with its rapidly growing digital economy and expanding urban populations, is another key driver.

Mode of Transport: The Road segment is the undisputed leader, accounting for over 80% of all same-day deliveries due to its cost-effectiveness, flexibility, and reach across diverse geographies. Air transport plays a crucial role in facilitating International same-day deliveries between major hubs, particularly for time-sensitive goods like pharmaceuticals and urgent documents. The "Others" category, encompassing drones and autonomous vehicles, is nascent but shows promising future growth potential.

Shipment Weight: Light Weight Shipments constitute the largest segment, driven by the prevalence of small, high-value e-commerce items such as electronics, apparel, and personal care products. Medium Weight Shipments are gaining traction with the growth of online grocery and general merchandise delivery. Heavy Weight Shipments, while less frequent for same-day services, are critical for certain industrial and construction materials requiring specialized handling and transport.

Destination: Domestic deliveries are paramount, forming over 90% of the market volume. However, International same-day delivery is a rapidly growing niche, especially for urgent business documents, critical medical supplies, and high-value personal items between proximate economic zones.

End User Industry: The E-Commerce sector is the dominant force, accounting for an estimated 65% of the market share. This is closely followed by Wholesale and Retail Trade (Offline), which is increasingly adopting same-day delivery to compete with online retailers. The Healthcare industry is a critical and growing segment, demanding rapid delivery of pharmaceuticals, medical equipment, and diagnostic samples. Financial Services (BFSI) utilizes same-day delivery for urgent documents, cheque clearing, and secure delivery of financial instruments. Manufacturing and Primary Industry also contribute, albeit to a lesser extent, for urgent spare parts and materials.

Key growth drivers include government initiatives promoting digital infrastructure and logistics modernization in countries like Singapore and South Korea. Robust policy frameworks supporting e-commerce and the development of efficient transportation networks are crucial. For instance, China's continued investment in high-speed rail and expressways directly benefits road-based same-day deliveries. The proliferation of mobile internet penetration and smartphone adoption across the Asia Pacific region further fuels the demand for on-demand delivery services.

Asia Pacific Same Day Delivery Market Product Analysis

The Asia Pacific same day delivery market is witnessing a surge in product innovations focused on enhancing speed, reliability, and customer experience. Advanced route optimization algorithms powered by AI and machine learning are central to these innovations, enabling dynamic adjustments based on real-time traffic conditions and delivery priorities. The development of specialized packaging solutions ensures the integrity of temperature-sensitive goods, fragile items, and urgent documents during transit. Furthermore, the integration of IoT devices for real-time tracking and condition monitoring of shipments provides unparalleled visibility and accountability. The competitive advantage lies in the seamless integration of these technologies into a unified delivery platform, offering end-to-end logistics solutions from pick-up to doorstep delivery.

Key Drivers, Barriers & Challenges in Asia Pacific Same Day Delivery Market

The Asia Pacific same day delivery market is propelled by the explosive growth of e-commerce, which has fundamentally reshaped consumer expectations for immediate gratification. Technological advancements, including AI for route optimization and drone/autonomous vehicle deployment, are key enablers. Economic growth and rising disposable incomes across the region further fuel demand. Supportive government policies aimed at improving infrastructure and streamlining customs procedures for cross-border logistics also play a significant role.

However, the market faces significant barriers and challenges. Infrastructure limitations in developing regions, particularly in last-mile connectivity, can impede efficiency. Regulatory complexities and varying customs regulations across countries create hurdles for international same-day deliveries. High operational costs associated with expedited logistics, including fuel, labor, and technology investment, can strain profit margins. Intense competition from established global players and agile local startups necessitates continuous innovation and competitive pricing. Supply chain disruptions, such as unexpected weather events or geopolitical instability, can also severely impact the ability to meet same-day delivery promises.

Growth Drivers in the Asia Pacific Same Day Delivery Market Market

Several key drivers are propelling the Asia Pacific same day delivery market. The unparalleled growth of e-commerce is the primary catalyst, with consumers increasingly prioritizing speed and convenience. Technological advancements, particularly in AI, drone technology, and real-time tracking systems, are enhancing operational efficiency and enabling faster delivery times. Economic prosperity and rising disposable incomes across the region translate into higher consumer spending on goods that benefit from expedited shipping. Supportive government initiatives aimed at digital transformation and logistics infrastructure development are also crucial, fostering an environment conducive to the expansion of same-day delivery services.

Challenges Impacting Asia Pacific Same Day Delivery Market Growth

Despite robust growth, the Asia Pacific same day delivery market faces significant challenges. Infrastructure inadequacies, especially in last-mile connectivity in less developed areas, can hamper efficiency and increase delivery times. Complex and varied regulatory environments across different countries present substantial hurdles for cross-border operations and compliance. The high operational costs associated with rapid delivery, including fuel, labor, and technology investments, can impact profitability. Furthermore, intense competitive pressures from a crowded marketplace necessitate continuous innovation and strategic pricing to maintain market share. Supply chain disruptions, whether due to natural disasters, pandemics, or geopolitical events, pose a constant threat to the reliability of same-day delivery commitments.

Key Players Shaping the Asia Pacific Same Day Delivery Market Market

- China Post

- CJ Logistics Corporation

- DHL Group

- SG Holdings Co Ltd

- ZTO Expres

- FedEx

- United Parcel Service of America Inc (UPS)

- YTO Express

- Yamato Holdings

- SF Express (KEX-SF)

- Blue Dart Express

- DTDC Express Limited

- Toll Group

- JWD Group

Significant Asia Pacific Same Day Delivery Market Industry Milestones

- June 2023: China Post launched its first integrated indoor and outdoor “Robot Plus” AI delivery solution in China, enhancing last-mile logistics with AI transport capacity sharing.

- April 2023: China Post and the Automobile Consumption Financial Center of Ping An Bank Co. Ltd launched an intelligent archives service center in Guangdong, promoting service integration for auto finance and express/logistics businesses.

- March 2023: Colowide MD Co. Ltd and Yamato Transport Co. Ltd entered an agreement to promote the visualization and optimization of the Colowide Group's supply chain, impacting operational efficiency for multiple retail brands.

Future Outlook for Asia Pacific Same Day Delivery Market Market

The future outlook for the Asia Pacific same day delivery market is exceptionally bright, fueled by sustained e-commerce expansion and rapidly evolving consumer expectations. Strategic opportunities lie in the further integration of AI and automation for hyper-efficient last-mile logistics, the expansion of drone and autonomous vehicle delivery networks in urban and suburban areas, and the development of robust cross-border same-day delivery solutions. The market potential is immense as businesses increasingly recognize same-day delivery as a critical competitive advantage. Investment in micro-fulfillment centers and partnerships with local businesses will continue to drive growth, ensuring that the region remains at the forefront of the global logistics revolution. The continuous push towards digitalization and on-demand services will solidify same-day delivery as an indispensable component of the modern supply chain.

Asia Pacific Same Day Delivery Market Segmentation

-

1. Mode Of Transport

- 1.1. Air

- 1.2. Road

- 1.3. Others

-

2. Shipment Weight

- 2.1. Heavy Weight Shipments

- 2.2. Light Weight Shipments

- 2.3. Medium Weight Shipments

-

3. Destination

- 3.1. Domestic

- 3.2. International

-

4. End User Industry

- 4.1. E-Commerce

- 4.2. Financial Services (BFSI)

- 4.3. Healthcare

- 4.4. Manufacturing

- 4.5. Primary Industry

- 4.6. Wholesale and Retail Trade (Offline)

- 4.7. Others

Asia Pacific Same Day Delivery Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

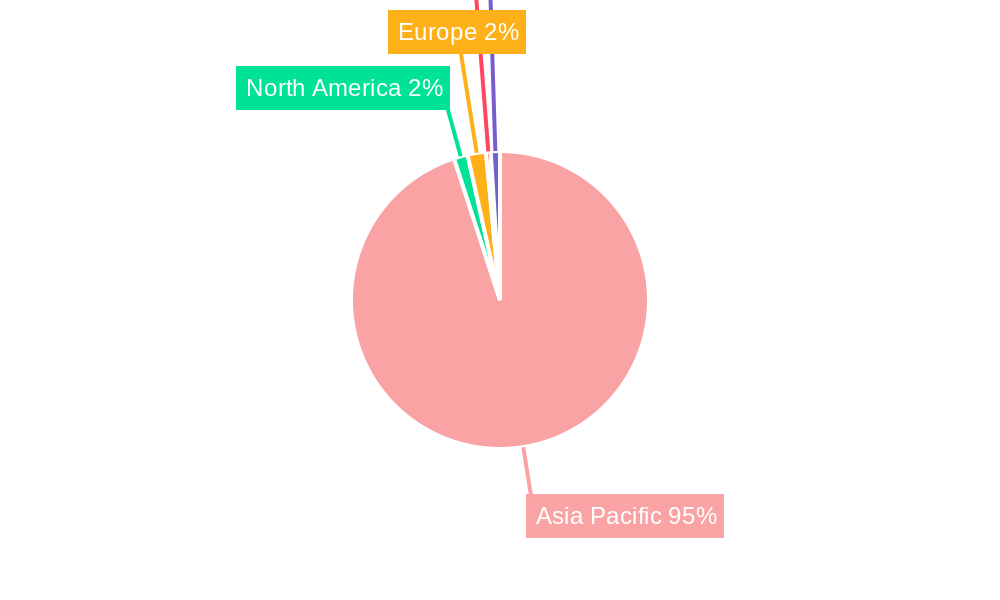

Asia Pacific Same Day Delivery Market Regional Market Share

Geographic Coverage of Asia Pacific Same Day Delivery Market

Asia Pacific Same Day Delivery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle

- 3.3. Market Restrains

- 3.3.1. Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Same Day Delivery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.1.1. Air

- 5.1.2. Road

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.2.1. Heavy Weight Shipments

- 5.2.2. Light Weight Shipments

- 5.2.3. Medium Weight Shipments

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by End User Industry

- 5.4.1. E-Commerce

- 5.4.2. Financial Services (BFSI)

- 5.4.3. Healthcare

- 5.4.4. Manufacturing

- 5.4.5. Primary Industry

- 5.4.6. Wholesale and Retail Trade (Offline)

- 5.4.7. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Post

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CJ Logistics Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SG Holdings Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ZTO Expres

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 United Parcel Service of America Inc (UPS)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 YTO Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Yamato Holdings

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SF Express (KEX-SF)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Blue Dart Express

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 DTDC Express Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Toll Group

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 JWD Group

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 China Post

List of Figures

- Figure 1: Asia Pacific Same Day Delivery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Same Day Delivery Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Same Day Delivery Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 2: Asia Pacific Same Day Delivery Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 3: Asia Pacific Same Day Delivery Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 4: Asia Pacific Same Day Delivery Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 5: Asia Pacific Same Day Delivery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia Pacific Same Day Delivery Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 7: Asia Pacific Same Day Delivery Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 8: Asia Pacific Same Day Delivery Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 9: Asia Pacific Same Day Delivery Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 10: Asia Pacific Same Day Delivery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: China Asia Pacific Same Day Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Japan Asia Pacific Same Day Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: South Korea Asia Pacific Same Day Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: India Asia Pacific Same Day Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Australia Asia Pacific Same Day Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: New Zealand Asia Pacific Same Day Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Indonesia Asia Pacific Same Day Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Asia Pacific Same Day Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Singapore Asia Pacific Same Day Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Thailand Asia Pacific Same Day Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Vietnam Asia Pacific Same Day Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Philippines Asia Pacific Same Day Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Same Day Delivery Market?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the Asia Pacific Same Day Delivery Market?

Key companies in the market include China Post, CJ Logistics Corporation, DHL Group, SG Holdings Co Ltd, ZTO Expres, FedEx, United Parcel Service of America Inc (UPS), YTO Express, Yamato Holdings, SF Express (KEX-SF), Blue Dart Express, DTDC Express Limited, Toll Group, JWD Group.

3. What are the main segments of the Asia Pacific Same Day Delivery Market?

The market segments include Mode Of Transport, Shipment Weight, Destination, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 172.37 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits.

8. Can you provide examples of recent developments in the market?

June 2023: China Post launched its first integrated indoor and outdoor “Robot Plus” AI delivery solution in China. The intelligent delivery solution relies on a combination of unmanned vehicles outdoors and robots indoors, constructing an integrated indoor and outdoor unmanned distribution mode and developing a last-mile logistics network with AI transport capacity sharing.April 2023: China Post and the Automobile Consumption Financial Center of Ping An Bank Co. Ltd launched an intelligent archives service center in Guangdong to promote the service integration of auto finance and express and logistics businesses.March 2023: Colowide MD Co. Ltd, which oversees merchandising for the Colowide Group, and Yamato Transport Co. Ltd entered an agreement. The two companies will promote the visualization and optimization of the entire supply chain of Colowide Group, which operates multiple brands such as Gyu-Kaku, Kappa Sushi, and OOTOYA.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Same Day Delivery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Same Day Delivery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Same Day Delivery Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Same Day Delivery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence