Key Insights

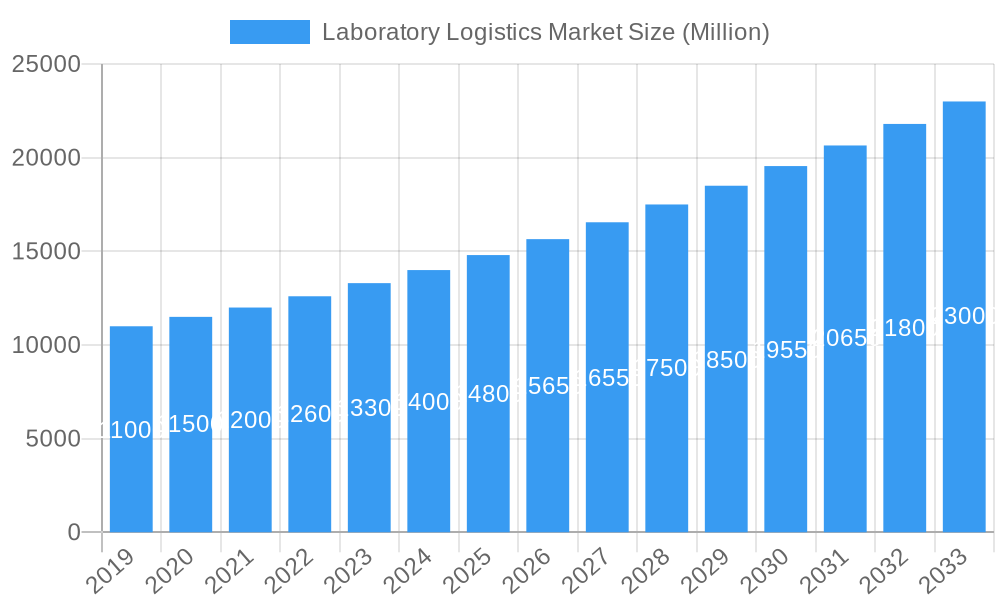

The global Laboratory Logistics Market is projected to expand significantly, reaching an estimated size of $3.5 billion by 2024. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% from 2024 to 2033. This growth is driven by the increasing demand for specialized transportation and storage of biological samples, diagnostic kits, and sensitive laboratory equipment. Key factors include the expanding life sciences sector, advancements in medical research, and the growing complexity of global healthcare supply chains. The rising prevalence of chronic diseases and the corresponding increase in diagnostic testing globally are also creating sustained demand for efficient and reliable laboratory logistics. The market's expansion is further supported by the critical need for temperature-controlled and secure handling of time-sensitive and fragile laboratory materials, ensuring the integrity of research and patient diagnoses.

Laboratory Logistics Market Market Size (In Billion)

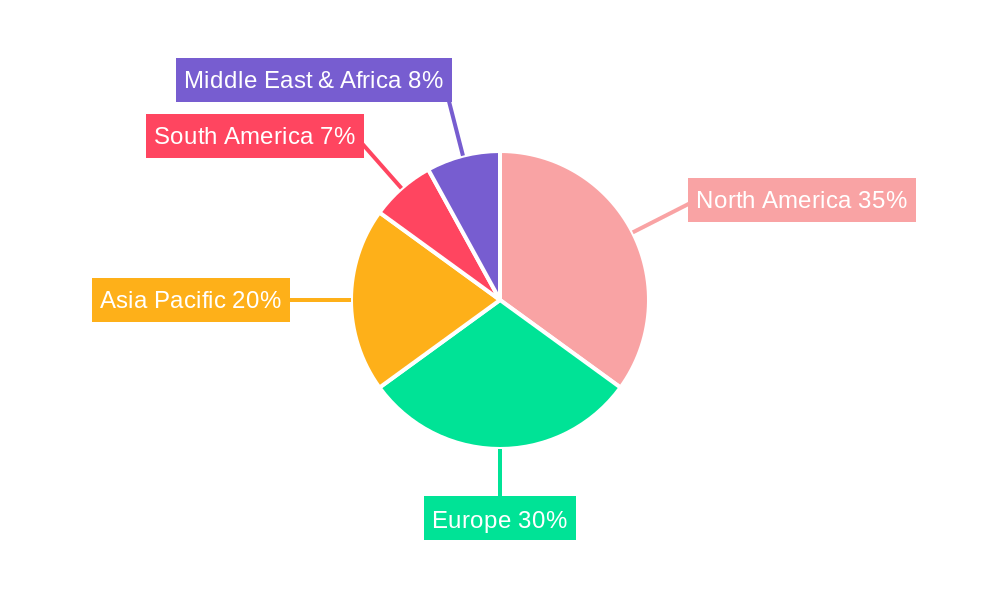

Key market segments include specialized services such as Transportation, Storage, and Value-Added Services, all experiencing elevated demand. Medical Laboratories and Biology Laboratories are dominant end-user segments, with growing contributions from academic institutions and research facilities. Geographically, North America, with its robust healthcare infrastructure and substantial research investment, currently holds a significant market share, followed by Europe. However, the Asia Pacific region is anticipated to experience the most rapid growth due to increasing healthcare expenditure, rising R&D activities, and a growing number of medical laboratories. Restraints such as stringent regulatory compliance, high operational costs, and potential supply chain disruptions are being mitigated through technological innovations and strategic partnerships among key players, including Eurofins, Parexel, and Cardinal Health, who are actively shaping the market's trajectory.

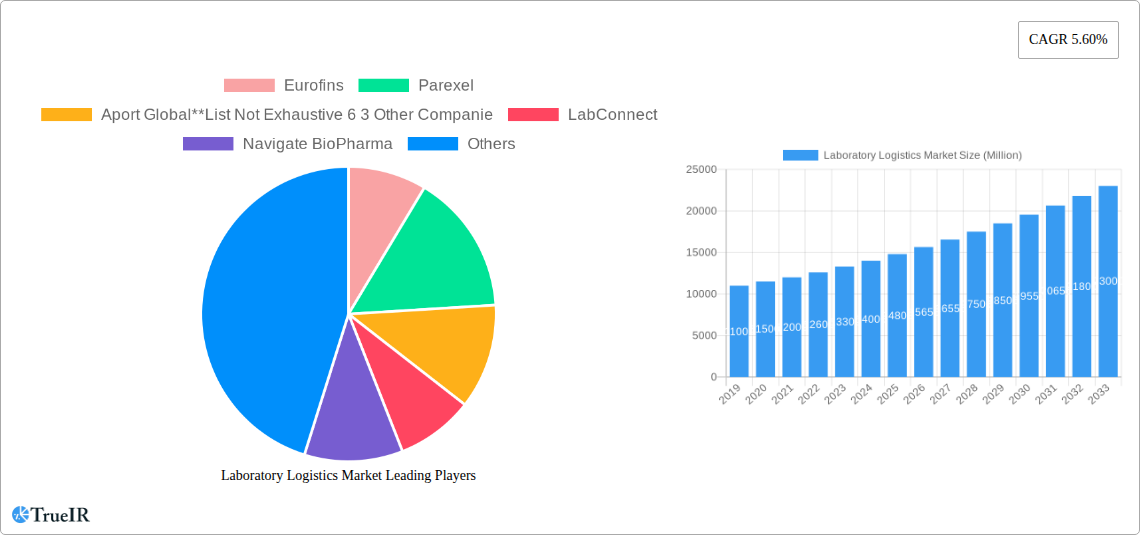

Laboratory Logistics Market Company Market Share

This report provides an in-depth analysis of the global Laboratory Logistics Market, a critical sector supporting advancements in healthcare and scientific research. Spanning from 2024 to 2033, with a base year of 2024 and a forecast period of 2024–2033, this study offers comprehensive insights into market dynamics, emerging trends, and future growth prospects. Understand key players, dominant segments, and the technological innovations driving the laboratory supply chain.

Laboratory Logistics Market Market Structure & Competitive Landscape

The Laboratory Logistics Market exhibits a moderately consolidated structure, characterized by a blend of large, established players and emerging niche providers. Key innovation drivers include the increasing demand for specialized cold chain logistics for biological samples, advancements in track-and-trace technologies, and the growing adoption of smart warehousing solutions. Regulatory impacts, such as stringent compliance requirements for sample integrity and data security (e.g., HIPAA, GDPR), significantly influence operational strategies and market entry barriers. Product substitutes, while limited in core logistics services, can emerge from integrated service offerings by CROs or in-house logistics capabilities of large research institutions.

The end-user segmentation is diverse, with Medical Laboratories and Biology Laboratories representing the largest and fastest-growing segments. This is driven by the expansion of personalized medicine, the increasing volume of diagnostic testing, and burgeoning biopharmaceutical research. Other end users, including academic institutions and industrial research facilities, also contribute significantly to market demand.

Mergers & Acquisitions (M&A) remain a crucial strategy for market consolidation and expansion. In the historical period (2019-2024), an estimated 25 significant M&A deals were observed, involving players seeking to enhance their service portfolios, geographic reach, and technological capabilities. Concentration ratios are expected to remain dynamic, with the top five players estimated to hold approximately 40% of the market share by 2025.

Laboratory Logistics Market Market Trends & Opportunities

The Laboratory Logistics Market is poised for substantial growth, with an estimated Compound Annual Growth Rate (CAGR) of 9.2% projected for the forecast period (2025–2033). This robust expansion is fueled by a confluence of factors including the escalating global demand for sophisticated diagnostic services, the rapid advancements in biotechnology and pharmaceutical research, and the increasing complexity of clinical trials requiring specialized sample handling. The market size, estimated at approximately 35 Million in the base year 2025, is expected to reach 70 Million by 2033.

Technological shifts are profoundly reshaping the landscape. The integration of Artificial Intelligence (AI) and Machine Learning (ML) for route optimization, demand forecasting, and inventory management is becoming paramount. Furthermore, the adoption of Internet of Things (IoT) devices for real-time temperature monitoring, humidity control, and shipment tracking ensures sample integrity throughout the supply chain, a critical concern for sensitive biological materials. Blockchain technology is also gaining traction for enhancing transparency and security in sample chain of custody.

Consumer preferences are evolving towards end-to-end, integrated logistics solutions that offer greater convenience, reliability, and cost-efficiency. Clients are increasingly seeking partners who can manage the entire lifecycle of sample transportation and storage, including specialized packaging, temperature-controlled fleets, and customized reporting. Competitive dynamics are intensifying, pushing providers to differentiate through specialized expertise, advanced technological integration, and superior customer service. The penetration rate of specialized laboratory logistics services is currently estimated at 65% and is expected to rise significantly as more organizations recognize the strategic importance of outsourced logistics. Opportunities abound in emerging markets, particularly in Asia-Pacific, driven by increasing healthcare investments and the growth of the biopharmaceutical industry. The demand for niche logistics services, such as the transport of rare biological samples, advanced therapies, and gene therapies, presents significant untapped potential.

Dominant Markets & Segments in Laboratory Logistics Market

The Medical Laboratory segment is currently the dominant end-user in the Laboratory Logistics Market, accounting for an estimated 55% of the total market share in the base year 2025. This dominance is attributed to the continuous and high volume of diagnostic testing, the growing prevalence of chronic diseases globally, and the expansion of healthcare infrastructure, particularly in emerging economies. Key growth drivers within this segment include advancements in in-vitro diagnostics (IVD), the rise of point-of-care testing, and the increasing outsourcing of laboratory services by hospitals and clinics. The robust demand for reliable and timely transportation of patient samples, reagents, and specialized equipment further solidifies its leading position.

The Biology Laboratory segment, encompassing biopharmaceutical research, academic research, and biotechnology firms, is the second-largest end-user, projected to represent approximately 30% of the market by 2025. Growth in this segment is propelled by substantial investments in drug discovery and development, the burgeoning field of genomics and proteomics, and the increasing need for specialized logistics to handle temperature-sensitive biological materials like cell lines, tissues, and vaccines. Policies supporting research and development, along with the establishment of biopharmaceutical hubs, are crucial growth drivers.

Among the service segments, Transportation holds the largest market share, estimated at 45% in 2025, due to its fundamental role in the supply chain. This includes specialized temperature-controlled transportation, courier services for time-sensitive samples, and international freight forwarding. Storage services, accounting for approximately 35% of the market, are also critical, with a growing demand for specialized warehousing facilities equipped with advanced temperature and humidity monitoring systems, cryogenic storage, and secure inventory management. Value-Added Services, including kitting, labeling, sample accessioning, and data management, are experiencing the fastest growth, projected at a CAGR of 10.5%, and are expected to capture 20% of the market by 2025. This expansion is driven by the increasing complexity of research projects and the desire for integrated, end-to-end solutions.

Geographically, North America currently leads the Laboratory Logistics Market, driven by its mature healthcare system, significant pharmaceutical and biotechnology R&D expenditure, and advanced logistics infrastructure. Europe follows closely, with strong regulatory frameworks and a well-established research ecosystem. The Asia-Pacific region, however, is emerging as the fastest-growing market due to increasing healthcare investments, a rapidly expanding biopharmaceutical industry, and government initiatives to improve healthcare access.

Laboratory Logistics Market Product Analysis

The Laboratory Logistics Market is characterized by a steady stream of product innovations focused on enhancing sample integrity, traceability, and operational efficiency. Technological advancements are central to these developments, with a strong emphasis on cold chain solutions, including advanced temperature-controlled packaging, refrigerated transport fleets equipped with real-time monitoring, and cryogenic storage facilities. Smart warehousing technologies, incorporating automation, AI-driven inventory management, and secure access control, are also gaining prominence. The application of these innovations spans the entire logistics lifecycle, from sample collection at clinical sites to final storage or analysis, ensuring compliance with stringent regulatory requirements and preserving the quality of sensitive biological materials. Competitive advantages are increasingly derived from the seamless integration of these advanced technologies into comprehensive logistics platforms, offering clients enhanced visibility, reduced risk of sample degradation, and improved operational cost-effectiveness.

Key Drivers, Barriers & Challenges in Laboratory Logistics Market

Key Drivers:

- Growing Biopharmaceutical R&D Expenditure: Significant investments in drug discovery and development, particularly in oncology and rare diseases, drive demand for specialized sample handling and transportation.

- Advancements in Diagnostic Technologies: The proliferation of advanced diagnostic tools and personalized medicine necessitates sophisticated logistics for sample collection, processing, and delivery.

- Increasing Global Incidence of Diseases: Rising rates of chronic and infectious diseases globally fuel the demand for diagnostic testing and research, consequently boosting laboratory logistics needs.

- Technological Innovations: The integration of IoT, AI, and blockchain in logistics ensures enhanced sample integrity, traceability, and supply chain visibility.

Key Barriers & Challenges:

- Stringent Regulatory Compliance: Navigating complex and varying regulations across different geographies for sample handling, transportation, and data security poses a significant hurdle.

- High Operational Costs: Maintaining specialized temperature-controlled infrastructure, advanced technology, and highly trained personnel incurs substantial operational expenses.

- Supply Chain Disruptions: Geopolitical events, natural disasters, and global health crises can severely disrupt intricate supply chains, impacting timely delivery of critical materials.

- Skilled Workforce Shortage: A lack of adequately trained personnel for specialized laboratory logistics operations can hinder service quality and scalability. The estimated impact of regulatory non-compliance on fines and reputational damage can be in the millions for a single incident.

Growth Drivers in the Laboratory Logistics Market Market

The Laboratory Logistics Market is experiencing robust growth driven by several key factors. Technologically, the pervasive adoption of IoT sensors for real-time temperature and humidity monitoring ensures the integrity of sensitive biological samples, while AI-powered route optimization reduces delivery times and costs. Economically, escalating global healthcare expenditure and substantial investments in pharmaceutical and biotechnology research and development are creating an unprecedented demand for reliable logistics services. Regulatory factors, such as the increasing emphasis on sample integrity for clinical trials and diagnostic accuracy, are also pushing companies to adopt advanced logistics solutions. For example, the growth in gene therapy research, requiring ultra-cold chain logistics, is a significant catalyst.

Challenges Impacting Laboratory Logistics Market Growth

Despite its promising trajectory, the Laboratory Logistics Market faces several critical challenges. Regulatory complexities, with varying international standards for sample handling and transportation, can create compliance hurdles and increase operational overheads. Supply chain disruptions, exacerbated by global events, can lead to significant delays and potential sample degradation, impacting research timelines and patient care. Competitive pressures from both established players and new entrants, alongside the need for continuous investment in advanced technologies to maintain a competitive edge, are also significant factors. The cost of specialized equipment and the scarcity of skilled personnel trained in handling biological samples present further restraints. For instance, a single breakdown in a cold chain shipment can result in losses exceeding 1 Million.

Key Players Shaping the Laboratory Logistics Market Market

- Eurofins

- Parexel

- Aport Global

- LabConnect

- Navigate BioPharma

- Accelerated Laboratory Logistics

- CSM

- Intertek

- Cardinal Health

- Johnsons Laboratory Logistics

- Yourway

- Q2 solutions

- 6 Other Companies

Significant Laboratory Logistics Market Industry Milestones

- 2019: Launch of advanced blockchain-based sample tracking solutions by several logistics providers, enhancing transparency and security.

- 2020: Accelerated adoption of cold chain technologies due to the global pandemic and the need for vaccine and biological sample transportation.

- 2021: Major acquisitions of specialized cold chain logistics companies by larger players to expand service offerings and geographic reach.

- 2022: Increased investment in AI and IoT integration for predictive maintenance of refrigerated fleets and optimized route planning.

- 2023: Emergence of specialized logistics services for advanced therapies like cell and gene therapies, requiring ultra-low temperature storage and highly controlled transport.

Future Outlook for Laboratory Logistics Market Market

The future outlook for the Laboratory Logistics Market is exceptionally bright, driven by persistent innovation and growing global demand. Strategic opportunities lie in expanding specialized services for emerging areas like personalized medicine, gene editing, and vaccine distribution. The ongoing integration of digital technologies, including AI, IoT, and blockchain, will continue to enhance efficiency, security, and transparency across the supply chain. Furthermore, the increasing focus on sustainable logistics practices presents another avenue for differentiation and growth. The market is expected to witness further consolidation through M&A activities as companies strive for comprehensive service portfolios and expanded global footprints, solidifying its role as a cornerstone of scientific advancement and global healthcare.

Laboratory Logistics Market Segmentation

-

1. Services

- 1.1. Transportation

- 1.2. Storage

- 1.3. Value Added Services

-

2. End User

- 2.1. Medical Laboratory

- 2.2. Biology Laboratory

- 2.3. Other End Users

Laboratory Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Laboratory Logistics Market Regional Market Share

Geographic Coverage of Laboratory Logistics Market

Laboratory Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Development of Healthcare Industry4.; Growing Reliability of Trnasportation Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Increased Competition Hampering Market Value

- 3.4. Market Trends

- 3.4.1. The Storage Market is Growing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Laboratory Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Transportation

- 5.1.2. Storage

- 5.1.3. Value Added Services

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Medical Laboratory

- 5.2.2. Biology Laboratory

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. North America Laboratory Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Services

- 6.1.1. Transportation

- 6.1.2. Storage

- 6.1.3. Value Added Services

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Medical Laboratory

- 6.2.2. Biology Laboratory

- 6.2.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Services

- 7. South America Laboratory Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Services

- 7.1.1. Transportation

- 7.1.2. Storage

- 7.1.3. Value Added Services

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Medical Laboratory

- 7.2.2. Biology Laboratory

- 7.2.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Services

- 8. Europe Laboratory Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Services

- 8.1.1. Transportation

- 8.1.2. Storage

- 8.1.3. Value Added Services

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Medical Laboratory

- 8.2.2. Biology Laboratory

- 8.2.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Services

- 9. Middle East & Africa Laboratory Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Services

- 9.1.1. Transportation

- 9.1.2. Storage

- 9.1.3. Value Added Services

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Medical Laboratory

- 9.2.2. Biology Laboratory

- 9.2.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Services

- 10. Asia Pacific Laboratory Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Services

- 10.1.1. Transportation

- 10.1.2. Storage

- 10.1.3. Value Added Services

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Medical Laboratory

- 10.2.2. Biology Laboratory

- 10.2.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Services

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Eurofins

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Parexel

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Aport Global**List Not Exhaustive 6 3 Other Companie

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LabConnect

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Navigate BioPharma

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Accelerated Laboratory Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CSM

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Intertek

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cardinal Health

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Johnsons Laboratory Logistics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Yourway

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Q2 solutions

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Eurofins

List of Figures

- Figure 1: Global Laboratory Logistics Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Laboratory Logistics Market Revenue (billion), by Services 2025 & 2033

- Figure 3: North America Laboratory Logistics Market Revenue Share (%), by Services 2025 & 2033

- Figure 4: North America Laboratory Logistics Market Revenue (billion), by End User 2025 & 2033

- Figure 5: North America Laboratory Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Laboratory Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Laboratory Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Laboratory Logistics Market Revenue (billion), by Services 2025 & 2033

- Figure 9: South America Laboratory Logistics Market Revenue Share (%), by Services 2025 & 2033

- Figure 10: South America Laboratory Logistics Market Revenue (billion), by End User 2025 & 2033

- Figure 11: South America Laboratory Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: South America Laboratory Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Laboratory Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Laboratory Logistics Market Revenue (billion), by Services 2025 & 2033

- Figure 15: Europe Laboratory Logistics Market Revenue Share (%), by Services 2025 & 2033

- Figure 16: Europe Laboratory Logistics Market Revenue (billion), by End User 2025 & 2033

- Figure 17: Europe Laboratory Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Europe Laboratory Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Laboratory Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Laboratory Logistics Market Revenue (billion), by Services 2025 & 2033

- Figure 21: Middle East & Africa Laboratory Logistics Market Revenue Share (%), by Services 2025 & 2033

- Figure 22: Middle East & Africa Laboratory Logistics Market Revenue (billion), by End User 2025 & 2033

- Figure 23: Middle East & Africa Laboratory Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East & Africa Laboratory Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Laboratory Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Laboratory Logistics Market Revenue (billion), by Services 2025 & 2033

- Figure 27: Asia Pacific Laboratory Logistics Market Revenue Share (%), by Services 2025 & 2033

- Figure 28: Asia Pacific Laboratory Logistics Market Revenue (billion), by End User 2025 & 2033

- Figure 29: Asia Pacific Laboratory Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Asia Pacific Laboratory Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Laboratory Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Laboratory Logistics Market Revenue billion Forecast, by Services 2020 & 2033

- Table 2: Global Laboratory Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Global Laboratory Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Laboratory Logistics Market Revenue billion Forecast, by Services 2020 & 2033

- Table 5: Global Laboratory Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Laboratory Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Laboratory Logistics Market Revenue billion Forecast, by Services 2020 & 2033

- Table 11: Global Laboratory Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Global Laboratory Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Laboratory Logistics Market Revenue billion Forecast, by Services 2020 & 2033

- Table 17: Global Laboratory Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Global Laboratory Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Laboratory Logistics Market Revenue billion Forecast, by Services 2020 & 2033

- Table 29: Global Laboratory Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 30: Global Laboratory Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Laboratory Logistics Market Revenue billion Forecast, by Services 2020 & 2033

- Table 38: Global Laboratory Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 39: Global Laboratory Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Laboratory Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Laboratory Logistics Market?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the Laboratory Logistics Market?

Key companies in the market include Eurofins, Parexel, Aport Global**List Not Exhaustive 6 3 Other Companie, LabConnect, Navigate BioPharma, Accelerated Laboratory Logistics, CSM, Intertek, Cardinal Health, Johnsons Laboratory Logistics, Yourway, Q2 solutions.

3. What are the main segments of the Laboratory Logistics Market?

The market segments include Services, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Development of Healthcare Industry4.; Growing Reliability of Trnasportation Industry.

6. What are the notable trends driving market growth?

The Storage Market is Growing.

7. Are there any restraints impacting market growth?

4.; Increased Competition Hampering Market Value.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Laboratory Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Laboratory Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Laboratory Logistics Market?

To stay informed about further developments, trends, and reports in the Laboratory Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence