Key Insights

The North American pharmaceutical logistics market is projected for significant expansion, fueled by rising healthcare spending, escalating demand for specialized pharmaceuticals, and innovations in drug delivery. The market, valued at approximately $76.59 billion in the base year 2025, is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 8% through 2033. Key growth catalysts include the increasing incidence of chronic diseases, an aging demographic, and continuous R&D in biopharmaceuticals, necessitating efficient and compliant logistics. The generic drug segment is expected to maintain a substantial market share due to patent expirations and the demand for affordable treatments. Concurrently, branded and specialized pharmaceutical segments are experiencing rapid growth driven by novel therapies, including biologics and personalized medicine, which require strict temperature control and specialized handling.

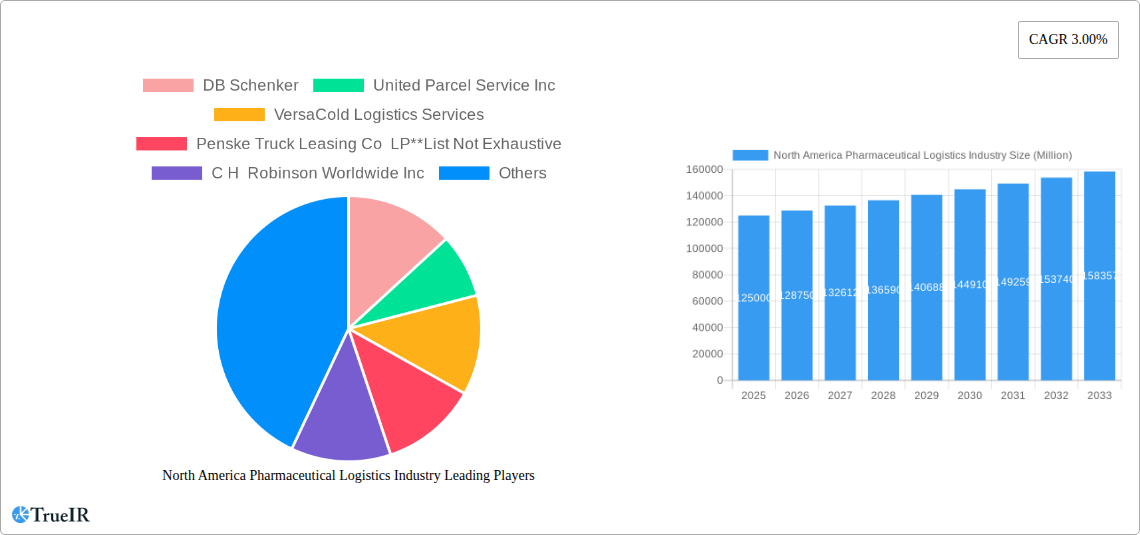

North America Pharmaceutical Logistics Industry Market Size (In Billion)

The industry's operational environment is defined by the critical role of cold chain transport for temperature-sensitive pharmaceuticals like vaccines and biologics, driving investment in controlled infrastructure and advanced tracking. While non-cold chain transport remains vital for conventional drugs, cold chain solutions exhibit a stronger growth trajectory. Air freight is increasingly favored for high-value, time-sensitive shipments, supplementing road and rail for regional distribution. Leading companies such as DB Schenker, UPS, FedEx, and DHL are significantly enhancing their cold chain capacities and global networks to serve evolving pharmaceutical manufacturing needs. However, the market faces challenges including stringent regulatory compliance, high infrastructure costs, and potential supply chain disruptions from geopolitical events or extreme weather. The United States, Canada, and Mexico are the primary contributors to this dynamic North American market.

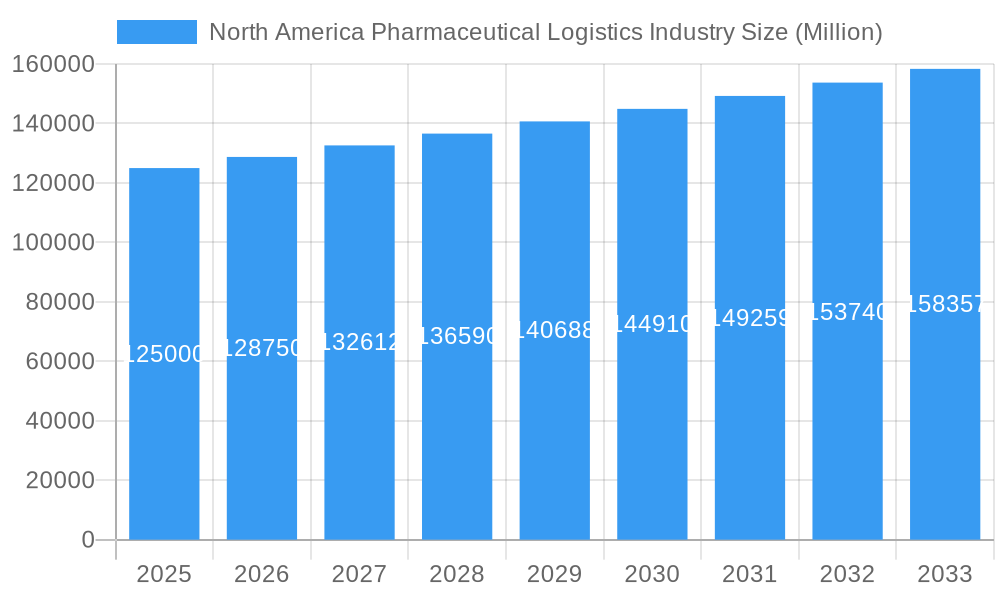

North America Pharmaceutical Logistics Industry Company Market Share

North America Pharmaceutical Logistics Industry: A Comprehensive Market Analysis (2019-2033)

This in-depth report provides a dynamic and SEO-optimized analysis of the North America Pharmaceutical Logistics Industry. Leveraging high-volume keywords such as "pharmaceutical logistics," "cold chain transport," "biopharma logistics," "drug supply chain," and "medical device logistics," this report aims to enhance search rankings and engage a broad spectrum of industry professionals, from logistics providers and pharmaceutical manufacturers to investors and policymakers.

The study encompasses a comprehensive Study Period of 2019–2033, with a Base Year of 2025, an Estimated Year of 2025, and a detailed Forecast Period of 2025–2033. The Historical Period analyzed is 2019–2024.

Key Market Segments Covered:

- Product: Generic Drugs, Branded Drugs

- Mode of Operation: Cold Chain Transport, Non-Cold Chain Transport

- Application: Bio Pharma, Chemical Pharma, Specialized Pharma

- Mode of Transport: Air Shipping, Rail Shipping, Road Shipping, Sea Shipping

Leading Companies in the Landscape:

While the list is not exhaustive, the report features analysis on key players including DB Schenker, United Parcel Service Inc., VersaCold Logistics Services, Penske Truck Leasing Co LP, C H Robinson Worldwide Inc., Kuehne + Nagel International AG, FedEx, CEVA Logistics, Agility Logistics, Air Canada, Deutsche Post DHL, and Expeditors International of Washington Inc.

North America Pharmaceutical Logistics Industry Market Structure & Competitive Landscape

The North America Pharmaceutical Logistics Industry exhibits a moderately concentrated market structure, characterized by a blend of global giants and specialized regional players. Innovation drivers are predominantly linked to advancements in temperature-controlled technologies, real-time tracking and visibility solutions, and the increasing demand for specialized handling of high-value biologics and vaccines. Regulatory impacts, including stringent FDA guidelines and evolving customs procedures, play a pivotal role in shaping operational strategies and market entry barriers. Product substitutes, while limited in the core logistics services, manifest in the adoption of advanced digital solutions and the outsourcing of specialized supply chain functions. End-user segmentation is largely defined by the specific therapeutic areas and product types, with biologics and gene therapies demanding more complex logistics. Mergers & Acquisitions (M&A) trends indicate a strategic consolidation aimed at expanding service portfolios, geographical reach, and technological capabilities. For instance, the past five years have seen several significant acquisitions focused on bolstering cold chain capabilities and expanding last-mile delivery networks. The concentration ratio for the top five players is estimated to be around 60%, reflecting a significant but not monopolistic market dominance. M&A volumes have been steadily increasing, with an estimated USD 500 Million in deals annually over the historical period, signaling a dynamic and evolving competitive arena.

North America Pharmaceutical Logistics Industry Market Trends & Opportunities

The North America pharmaceutical logistics market is on an upward trajectory, driven by an expanding pharmaceutical pipeline, increasing healthcare expenditure, and a growing emphasis on patient-centric delivery models. The market size is projected to experience a robust CAGR of approximately 8.5% over the forecast period, potentially reaching a valuation of over USD 150 Billion by 2033. Technological shifts are a cornerstone of this growth, with the integration of artificial intelligence (AI), blockchain, and IoT devices revolutionizing supply chain visibility, temperature monitoring, and predictive analytics. These technologies are crucial for ensuring the integrity of sensitive pharmaceutical products, from raw materials to finished goods. Consumer preferences are increasingly favoring direct-to-patient delivery models for certain medications, creating opportunities for specialized last-mile logistics providers and decentralized distribution networks. This shift necessitates enhanced inventory management and temperature control at decentralized points. Competitive dynamics are intensifying, with established players investing heavily in digitalization and expanding their cold chain infrastructure to cater to the burgeoning demand for biologics, vaccines, and temperature-sensitive drugs. The growing prevalence of chronic diseases and an aging population are further fueling the demand for pharmaceuticals, thereby directly impacting the logistics sector. Opportunities abound in specialized logistics for cell and gene therapies, which require highly specialized handling, ultra-low temperature storage, and rapid, precise delivery. Furthermore, the increasing adoption of generics, driven by cost-containment measures, also contributes to a higher volume of logistics activity. The emphasis on supply chain resilience, highlighted by recent global disruptions, is prompting significant investments in robust and diversified logistics networks, creating a fertile ground for innovative solutions and strategic partnerships. The penetration rate of advanced tracking technologies within the cold chain segment is expected to exceed 90% by 2030.

Dominant Markets & Segments in North America Pharmaceutical Logistics Industry

Within the North America pharmaceutical logistics industry, the United States stands as the dominant market, driven by its vast pharmaceutical manufacturing base, extensive research and development activities, and a significant consumer market for healthcare products. The country's well-developed infrastructure, encompassing advanced road networks, major international airports, and efficient port facilities, further solidifies its leadership position.

- Mode of Operation: Cold Chain Transport is the most dominant and rapidly growing segment. The increasing prevalence of biologics, vaccines, and other temperature-sensitive medications necessitates specialized cold chain solutions, including refrigerated trucks, temperature-controlled air cargo, and specialized warehousing. This segment is projected to account for over 65% of the total market value by 2033.

- Key Growth Drivers:

- Surge in demand for vaccines and temperature-sensitive biologics.

- Technological advancements in cold chain monitoring and reefer containers.

- Stringent regulatory requirements for maintaining product integrity.

- Key Growth Drivers:

- Application: Bio Pharma represents the largest application segment, due to the high value and specialized handling requirements of biopharmaceutical products such as monoclonal antibodies, gene therapies, and vaccines. The growing investments in biopharmaceutical research and development contribute significantly to the demand for sophisticated logistics.

- Key Growth Drivers:

- Rapid innovation and development of new biologic drugs.

- Increasing global demand for advanced therapies.

- Expansion of clinical trials requiring specialized transportation.

- Key Growth Drivers:

- Mode of Transport: Road Shipping remains the most utilized mode for domestic distribution due to its flexibility, cost-effectiveness, and ability to provide door-to-door services. However, Air Shipping plays a critical role for high-value, time-sensitive pharmaceuticals and international shipments, particularly for temperature-sensitive products requiring rapid transit. The growth of e-commerce in pharmaceuticals is also bolstering the importance of efficient road and air networks.

- Key Growth Drivers:

- Extensive highway networks and logistics infrastructure.

- Demand for rapid delivery of time-sensitive medications.

- Growth of specialized courier services for pharmaceuticals.

- Key Growth Drivers:

- Product: Branded Drugs continue to hold a significant share, owing to their higher value and often complex supply chains. However, Generic Drugs are also a substantial contributor, driven by their widespread use and the need for efficient, high-volume distribution to ensure accessibility and affordability.

North America Pharmaceutical Logistics Industry Product Analysis

The North America pharmaceutical logistics industry is witnessing continuous product innovation focused on enhancing supply chain efficiency, integrity, and visibility. Technological advancements such as advanced temperature monitoring sensors, real-time tracking enabled by GPS and IoT, and blockchain for enhanced security and transparency are transforming how pharmaceutical products are managed. These innovations are critical for maintaining the efficacy and safety of diverse products, from high-volume generic drugs requiring cost-efficient distribution to specialized biologics demanding stringent temperature control and rapid delivery. The competitive advantage lies in offering integrated logistics solutions that can adapt to the unique requirements of each product type and application, ensuring compliance with evolving regulatory standards and meeting the growing demand for faster, more reliable, and traceable pharmaceutical supply chains.

Key Drivers, Barriers & Challenges in North America Pharmaceutical Logistics Industry

Key Drivers:

- Technological Advancements: Integration of AI, IoT, and blockchain for enhanced tracking, temperature control, and supply chain visibility.

- Growing Pharmaceutical Market: Increasing R&D investments, new drug approvals, and a rising demand for pharmaceuticals, particularly biologics and personalized medicines.

- Stringent Regulatory Environment: Compliance with FDA and other regulatory bodies necessitates sophisticated logistics for product safety and efficacy.

- Shift Towards Biologics and Specialty Drugs: These high-value products require specialized cold chain logistics and handling.

Barriers & Challenges:

- Supply Chain Complexities: Managing temperature excursions, ensuring product integrity across multiple touchpoints, and dealing with counterfeit drugs remain significant challenges. The estimated annual loss due to temperature excursions is approximately USD 1 Billion.

- Regulatory Hurdles: Navigating diverse and evolving regulatory landscapes across different North American countries and states adds complexity and cost.

- High Operational Costs: Maintaining specialized infrastructure for cold chain logistics, investing in advanced technology, and ensuring compliance incurs substantial operational expenses.

- Skilled Workforce Shortage: A lack of trained personnel capable of handling specialized pharmaceutical logistics operations presents a challenge.

Growth Drivers in the North America Pharmaceutical Logistics Industry Market

The North America pharmaceutical logistics market is propelled by several critical growth drivers. Technologically, the pervasive adoption of IoT devices for real-time temperature and condition monitoring is paramount, ensuring product integrity and reducing waste. Economically, the escalating global demand for pharmaceuticals, fueled by an aging population and the rising prevalence of chronic diseases, directly translates into increased logistics volumes. Furthermore, the continuous pipeline of new drug approvals, particularly in the biopharmaceutical sector, necessitates advanced and specialized logistics solutions. Regulatory drivers, such as the increasing focus on supply chain security and the Drug Supply Chain Security Act (DSCSA) in the US, mandate greater traceability and transparency, pushing for investments in compliant logistics infrastructure and digital solutions. The expansion of personalized medicine and cell/gene therapies also presents a significant growth avenue, requiring ultra-cold chain capabilities and precise delivery networks.

Challenges Impacting North America Pharmaceutical Logistics Industry Growth

Despite robust growth prospects, the North America pharmaceutical logistics industry faces several critical challenges. Regulatory complexities continue to be a significant hurdle, with differing regulations across federal, state, and provincial levels demanding constant adaptation and compliance efforts. Supply chain disruptions, as evidenced by recent global events, highlight the vulnerability of extended and intricate pharmaceutical supply chains, leading to potential product shortages and increased costs. Competitive pressures are intensifying, with a need for continuous innovation and cost optimization to maintain market share. The significant capital investment required for specialized cold chain infrastructure and advanced tracking technologies can act as a barrier to entry for smaller players. Moreover, the persistent challenge of a shortage of skilled labor, particularly those with expertise in handling sensitive pharmaceutical products and navigating complex logistics systems, can impede operational efficiency and growth. The estimated cost of drug counterfeiting globally, which impacts the pharmaceutical supply chain, is in the tens of billions of dollars annually.

Key Players Shaping the North America Pharmaceutical Logistics Industry Market

- DB Schenker

- United Parcel Service Inc.

- VersaCold Logistics Services

- Penske Truck Leasing Co LP

- C H Robinson Worldwide Inc.

- Kuehne + Nagel International AG

- FedEx

- CEVA Logistics

- Agility Logistics

- Air Canada

- Deutsche Post DHL

- Expeditors International of Washington Inc.

Significant North America Pharmaceutical Logistics Industry Industry Milestones

- Aug 2022: The Life Sciences & Healthcare (LSH) Campus of DHL Supply Chain was further developed in Florstadt, close to Frankfurt Airport. The new branch expands the multi-user campus' logistics capabilities by adding a third facility that specializes in pharmaceutical and medical products. This development enhances DHL's capacity for specialized pharmaceutical handling and distribution in a key European hub, impacting global pharmaceutical logistics strategies.

- Feb 2022: The life sciences and healthcare division of the Deutsche Post DHL Group will invest USD 400 million to extend its network of supply chains for pharmaceuticals and medical devices, according to DHL Supply Chain, a US division of the company. This substantial investment underscores the growing importance of the pharmaceutical logistics sector and signals a significant expansion of DHL's capabilities in North America and globally, aiming to address increasing demand and improve supply chain resilience.

Future Outlook for North America Pharmaceutical Logistics Industry Market

The future outlook for the North America pharmaceutical logistics industry is exceptionally promising, driven by an ever-expanding market for healthcare products and relentless technological innovation. Strategic opportunities lie in the continued development of integrated cold chain solutions, advanced track-and-trace technologies, and the expansion of direct-to-patient delivery models. The growing emphasis on sustainability within the supply chain will also present opportunities for logistics providers to implement eco-friendly solutions. The increasing complexity of pharmaceutical products, such as cell and gene therapies, will fuel demand for highly specialized logistics services, creating niche markets and high-value service offerings. Furthermore, the ongoing consolidation within the industry is expected to lead to the emergence of larger, more capable logistics providers with end-to-end service offerings. The market potential is vast, with a projected continued high single-digit CAGR over the next decade, supported by sustained investment in healthcare infrastructure and a commitment to patient well-being.

North America Pharmaceutical Logistics Industry Segmentation

-

1. Product

- 1.1. Generic Drugs

- 1.2. Branded Drugs

-

2. Mode of Operation

- 2.1. Cold Chain Transport

- 2.2. Non-Cold Chain Transport

-

3. Application

- 3.1. Bio Pharma

- 3.2. Chemical Pharma

- 3.3. Specialized Pharma

-

4. Mode of Transport

- 4.1. Air Shipping

- 4.2. Rail Shipping

- 4.3. Road Shipping

- 4.4. Sea Shipping

North America Pharmaceutical Logistics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Pharmaceutical Logistics Industry Regional Market Share

Geographic Coverage of North America Pharmaceutical Logistics Industry

North America Pharmaceutical Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Rise in Demand for Outsourcing Pharmaceutical Warehousing Services4.; Increasing Need for Pharmaceutical Products

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Efficient Logistics Support4.; Stringent Government Regulations

- 3.4. Market Trends

- 3.4.1. United States Leading the Pharmaceutical Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Pharmaceutical Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Generic Drugs

- 5.1.2. Branded Drugs

- 5.2. Market Analysis, Insights and Forecast - by Mode of Operation

- 5.2.1. Cold Chain Transport

- 5.2.2. Non-Cold Chain Transport

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Bio Pharma

- 5.3.2. Chemical Pharma

- 5.3.3. Specialized Pharma

- 5.4. Market Analysis, Insights and Forecast - by Mode of Transport

- 5.4.1. Air Shipping

- 5.4.2. Rail Shipping

- 5.4.3. Road Shipping

- 5.4.4. Sea Shipping

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 United Parcel Service Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 VersaCold Logistics Services

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Penske Truck Leasing Co LP**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 C H Robinson Worldwide Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kuehne + Nagel International AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 FedEx

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CEVA Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Agility Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Air Canada

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Deutsche Post DHL

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Expeditors International of Washington Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: North America Pharmaceutical Logistics Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Pharmaceutical Logistics Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Pharmaceutical Logistics Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: North America Pharmaceutical Logistics Industry Revenue billion Forecast, by Mode of Operation 2020 & 2033

- Table 3: North America Pharmaceutical Logistics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: North America Pharmaceutical Logistics Industry Revenue billion Forecast, by Mode of Transport 2020 & 2033

- Table 5: North America Pharmaceutical Logistics Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Pharmaceutical Logistics Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 7: North America Pharmaceutical Logistics Industry Revenue billion Forecast, by Mode of Operation 2020 & 2033

- Table 8: North America Pharmaceutical Logistics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 9: North America Pharmaceutical Logistics Industry Revenue billion Forecast, by Mode of Transport 2020 & 2033

- Table 10: North America Pharmaceutical Logistics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States North America Pharmaceutical Logistics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Pharmaceutical Logistics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Pharmaceutical Logistics Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Pharmaceutical Logistics Industry?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the North America Pharmaceutical Logistics Industry?

Key companies in the market include DB Schenker, United Parcel Service Inc, VersaCold Logistics Services, Penske Truck Leasing Co LP**List Not Exhaustive, C H Robinson Worldwide Inc, Kuehne + Nagel International AG, FedEx, CEVA Logistics, Agility Logistics, Air Canada, Deutsche Post DHL, Expeditors International of Washington Inc.

3. What are the main segments of the North America Pharmaceutical Logistics Industry?

The market segments include Product, Mode of Operation, Application, Mode of Transport.

4. Can you provide details about the market size?

The market size is estimated to be USD 76.59 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; The Rise in Demand for Outsourcing Pharmaceutical Warehousing Services4.; Increasing Need for Pharmaceutical Products.

6. What are the notable trends driving market growth?

United States Leading the Pharmaceutical Market.

7. Are there any restraints impacting market growth?

4.; Lack of Efficient Logistics Support4.; Stringent Government Regulations.

8. Can you provide examples of recent developments in the market?

Aug 2022: The Life Sciences & Healthcare (LSH) Campus of DHL Supply Chain was further developed in Florstadt, close to Frankfurt Airport. The new branch expands the multi-user campus' logistics capabilities by adding a third facility that specializes in pharmaceutical and medical products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Pharmaceutical Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Pharmaceutical Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Pharmaceutical Logistics Industry?

To stay informed about further developments, trends, and reports in the North America Pharmaceutical Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence