Key Insights

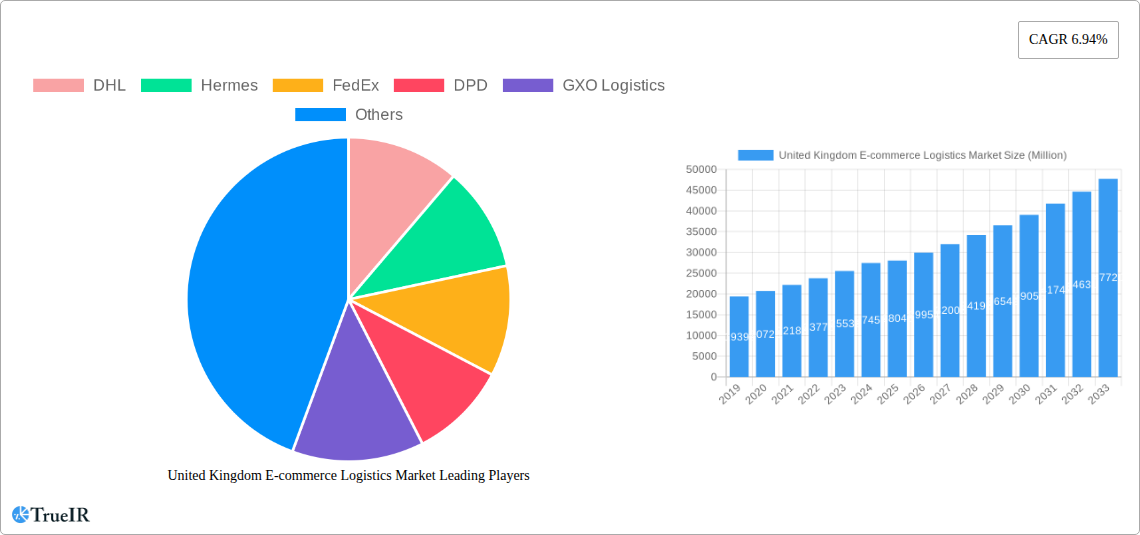

The United Kingdom's e-commerce logistics market is poised for robust growth, projected to reach approximately £28.04 billion by 2025, driven by a compelling CAGR of 6.94%. This expansion is fueled by escalating online shopping adoption across diverse consumer segments, including fashion and apparel, consumer electronics, and home appliances. The increasing demand for rapid and reliable delivery services, coupled with the growing complexity of last-mile delivery, positions transportation as a dominant segment. Warehousing and inventory management are also critical components, with businesses investing in efficient storage solutions to meet dynamic consumer expectations. Furthermore, value-added services like customized labeling and packaging are becoming essential differentiators, enhancing the overall customer experience and contributing significantly to market value. The market is predominantly characterized by B2B and B2C transactions, with domestic e-commerce maintaining a strong presence while international cross-border logistics witness a steady upward trajectory. Key players such as DHL, FedEx, Amazon Logistics, and Royal Mail are at the forefront, continuously innovating to streamline operations and enhance delivery networks to capture a larger market share.

United Kingdom E-commerce Logistics Market Market Size (In Billion)

Looking ahead, the United Kingdom's e-commerce logistics market is expected to navigate several key trends and challenges. The continued surge in online retail, amplified by the convenience and accessibility it offers, will be a primary growth driver. Companies are increasingly focusing on sustainable logistics solutions, integrating eco-friendly practices in their transportation and warehousing operations to align with environmental consciousness and regulatory pressures. The adoption of advanced technologies, including AI-powered route optimization, automation in warehouses, and real-time tracking systems, will be instrumental in improving efficiency and reducing operational costs. However, the market faces potential restraints such as rising operational costs, including fuel prices and labor shortages, which could impact profitability. Intense competition among established logistics providers and the emergence of new, agile players will necessitate continuous innovation and service differentiation. The market's trajectory indicates a sustained period of growth, underscoring the critical role of efficient and adaptable logistics in supporting the thriving UK e-commerce ecosystem.

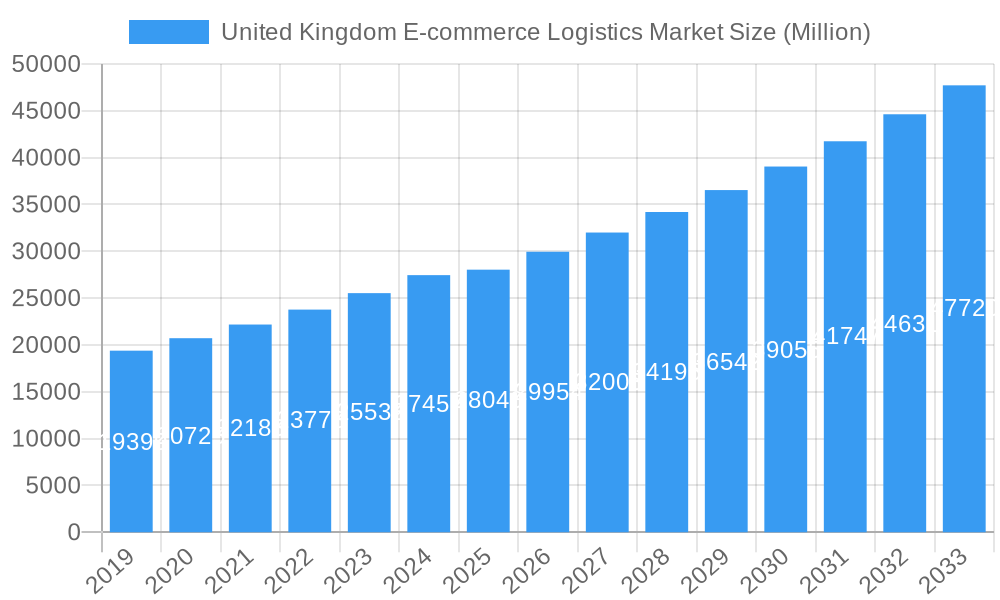

United Kingdom E-commerce Logistics Market Company Market Share

United Kingdom E-commerce Logistics Market: Comprehensive Market Analysis and Forecast (2019-2033)

This in-depth report provides a strategic analysis of the United Kingdom e-commerce logistics market, offering critical insights into its current state and future trajectory. Spanning from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this research leverages high-volume keywords such as "UK e-commerce fulfillment," "online retail logistics UK," "last-mile delivery UK," "e-commerce warehousing UK," and "cross-border e-commerce logistics UK" to ensure maximum visibility and engagement for industry professionals. Discover market size projections, key trends, dominant segments, and the competitive landscape of this rapidly evolving sector.

United Kingdom E-commerce Logistics Market Market Structure & Competitive Landscape

The United Kingdom e-commerce logistics market exhibits a moderately concentrated structure, with several large players dominating significant market share. Key players like DHL, Hermes, FedEx, and DPD have established extensive networks, contributing to a high concentration ratio within the transportation and last-mile delivery segments. Innovation is a primary driver, fueled by advancements in automation, Artificial Intelligence (AI), and data analytics aimed at optimizing efficiency and reducing costs. Regulatory impacts, while generally supportive of e-commerce growth, can influence operational costs and compliance requirements, particularly concerning sustainability and labor practices. Product substitutes are limited in the core logistics services, but technological advancements in inventory management and fulfillment solutions offer alternative approaches. The end-user segmentation is heavily skewed towards B2C, reflecting the dominance of online retail. Mergers and acquisitions (M&A) are a notable trend, with companies consolidating to expand service offerings, geographical reach, and technological capabilities. For instance, the acquisition of Shopify Logistics assets by Flexport in May 2023 exemplifies this trend, aiming to integrate logistics seamlessly into e-commerce platforms. The market is characterized by a continuous pursuit of operational excellence and customer satisfaction, driving intense competition among established providers and emerging disruptors.

United Kingdom E-commerce Logistics Market Market Trends & Opportunities

The United Kingdom e-commerce logistics market is experiencing robust growth, driven by the persistent surge in online retail penetration and evolving consumer expectations for faster, more convenient delivery options. The market size is projected to reach £XX Million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). Technological shifts are profoundly reshaping the landscape, with increasing adoption of automation, robotics in warehousing, and AI-powered route optimization solutions. These advancements are crucial for enhancing efficiency, reducing operational costs, and improving delivery speed, thereby addressing the growing demand for same-day and next-day deliveries. Consumer preferences are increasingly centered around personalized delivery experiences, including flexible delivery windows, click-and-collect options, and a growing demand for sustainable delivery methods. This shift presents significant opportunities for logistics providers to innovate and differentiate their offerings. Competitive dynamics are intensifying, with established players investing heavily in their infrastructure and technology to maintain market share, while agile startups focus on niche segments and disruptive business models. The rise of omnichannel retail further necessitates integrated logistics solutions that seamlessly connect online and offline sales channels. Opportunities abound for companies specializing in last-mile delivery optimization, reverse logistics, and temperature-controlled logistics for sectors like online grocery. Furthermore, the expansion of cross-border e-commerce presents avenues for growth, provided that customs clearance and international shipping complexities are effectively managed. The ongoing digital transformation within the UK economy ensures that the e-commerce logistics sector will remain a critical enabler of economic activity and a fertile ground for innovation and investment.

Dominant Markets & Segments in United Kingdom E-commerce Logistics Market

Within the United Kingdom e-commerce logistics market, the Transportation segment commands the largest share, driven by the sheer volume of goods moved across the nation to fulfill online orders. This dominance is fueled by the ever-increasing demand for efficient and timely last-mile delivery, a critical component of the online shopping experience. The B2C business segment is by far the most dominant, reflecting the vast consumer base engaging in online purchases across all product categories. Consequently, Domestic destination shipments represent the lion's share of logistics activities, as most e-commerce transactions occur within the UK.

Key Growth Drivers and Market Dominance Analysis:

Transportation Dominance:

- Infrastructure: Extensive road networks and strategic urban centers facilitate efficient distribution.

- Policies: Government initiatives supporting infrastructure development and digital connectivity indirectly benefit transportation logistics.

- Technological Advancements: Real-time tracking, route optimization software, and telematics are enhancing efficiency and reducing transit times.

- Last-Mile Innovation: Growing investment in electric vehicles and micro-fulfillment centers is addressing urban congestion and delivery speed demands.

B2C Segment Dominance:

- Consumer Behavior: The ingrained habit of online shopping for a wide array of products.

- E-commerce Platforms: Proliferation of online marketplaces and direct-to-consumer (DTC) brand websites.

- Convenience: The unparalleled convenience of home delivery and flexible return options.

Domestic Destination Dominance:

- Market Size: The sheer volume of domestic online sales dwarfs international e-commerce transactions for UK consumers.

- Reduced Complexity: Simpler customs procedures, lower shipping costs, and faster transit times compared to international shipments.

- Local Logistics Networks: Well-established domestic courier and delivery networks adept at serving the UK population.

While Fashion and Apparel and Consumer Electronics are leading product categories driving e-commerce logistics demand, the Home Appliances and Furniture segments are growing significantly, requiring specialized logistics for bulky items and white-glove delivery services. Beauty and Personal Care also contribute consistently to volumes. The "Other Products" category, encompassing toys, food products, and groceries, is witnessing rapid expansion, particularly in the online grocery sector, demanding temperature-controlled logistics and same-day delivery capabilities. The Warehousing and Inventory Management segment is also experiencing substantial growth, with a rising need for strategically located fulfillment centers and advanced warehouse management systems (WMS) to support the dynamic demands of online retail. Value-added services like labeling, packaging, and kitting are becoming increasingly important as brands seek to enhance customer experience and streamline their supply chains.

United Kingdom E-commerce Logistics Market Product Analysis

Innovations in the United Kingdom e-commerce logistics market are predominantly focused on enhancing efficiency, speed, and sustainability. The integration of AI and machine learning in route optimization and demand forecasting is a significant advancement, enabling logistics providers to predict delivery times with greater accuracy and reduce unnecessary mileage. Robotic automation within fulfillment centers, as exemplified by DHL Supply Chain's alliance with Robust.ai, is transforming warehouse operations by speeding up picking, packing, and sorting processes. Furthermore, the development of advanced tracking technologies, including IoT devices, provides real-time visibility of goods throughout the supply chain, improving inventory management and reducing losses. The market is also witnessing a rise in eco-friendly packaging solutions and the adoption of electric vehicles for last-mile delivery, addressing growing consumer and regulatory pressure for sustainable practices.

Key Drivers, Barriers & Challenges in United Kingdom E-commerce Logistics Market

Key Drivers:

- Evolving Consumer Behavior: The persistent shift towards online shopping, driven by convenience and a wider product selection, continues to propel demand for efficient e-commerce logistics.

- Technological Advancements: The adoption of AI, automation, and data analytics is optimizing operations, reducing costs, and improving delivery speeds.

- Infrastructure Development: Ongoing investment in road networks, warehousing facilities, and last-mile delivery hubs supports market growth.

- Government Support: Favorable policies promoting digital transformation and e-commerce indirectly boost the logistics sector.

Barriers & Challenges:

- Labor Shortages and Costs: A persistent shortage of skilled logistics workers and rising labor costs can impact operational efficiency and profitability.

- Supply Chain Disruptions: Geopolitical events, economic volatility, and unforeseen incidents can lead to delays and increased operational expenses.

- Regulatory Complexities: Evolving environmental regulations, data privacy laws, and customs procedures for cross-border e-commerce present compliance challenges.

- Intensified Competition: The crowded market necessitates continuous innovation and cost management to maintain a competitive edge.

Growth Drivers in the United Kingdom E-commerce Logistics Market Market

The United Kingdom e-commerce logistics market is significantly propelled by the exponential growth of online retail, a trend amplified by changing consumer preferences for digital purchasing. Technological integration, particularly in areas like AI-powered route optimization, autonomous vehicles, and advanced warehouse automation, is a major growth catalyst, promising enhanced efficiency and reduced operational costs. Economic factors such as rising disposable incomes and increasing digital literacy further fuel consumer spending online. Furthermore, supportive government policies aimed at fostering innovation and infrastructure development within the logistics sector contribute to market expansion. The increasing demand for faster delivery times, including same-day and next-day services, also drives investment in robust last-mile delivery networks.

Challenges Impacting United Kingdom E-commerce Logistics Market Growth

The United Kingdom e-commerce logistics market faces several significant challenges that can impede growth. Regulatory complexities, including evolving environmental standards and labor laws, necessitate continuous adaptation and can increase operational expenses. Supply chain disruptions, stemming from global events or domestic issues, can lead to significant delays, increased costs, and reputational damage for logistics providers. Intense competitive pressures, driven by both established players and agile new entrants, force companies to maintain competitive pricing while investing in costly technological upgrades. The persistent shortage of qualified logistics personnel and increasing labor costs also pose a substantial restraint on expansion and operational capacity.

Key Players Shaping the United Kingdom E-commerce Logistics Market Market

- DHL

- Hermes

- FedEx

- DPD

- GXO Logistics

- Amazon Logistics

- Agility Logistics

- TNT Express

- DTDC

- Royal Mail

- Zendbox

- 7 3 Other Companies

Significant United Kingdom E-commerce Logistics Market Industry Milestones

- January 2024: DHL Supply chain announced a strategic alliance with robotics company Robust.ai to create and deploy a cutting-edge robotic warehouse fleet. This strategic alliance brought together the DHL Supply chain’s extensive knowledge of logistics issues, track record in implementing automated solutions, and Robust.ai’s experience in AI and advanced robotics.

- May 2023: Flexport, a leading technology-driven logistics platform, acquired Shopify Logistics assets, including Deliverr, Inc.

Future Outlook for United Kingdom E-commerce Logistics Market Market

The future outlook for the United Kingdom e-commerce logistics market is exceptionally promising, characterized by sustained growth and continuous innovation. Key growth catalysts include the ongoing digital transformation across all sectors of the economy, further embedding e-commerce into daily life. Strategic opportunities lie in the expansion of specialized logistics services, such as temperature-controlled delivery for groceries and pharmaceuticals, and the development of more sustainable and environmentally friendly logistics solutions. The increasing adoption of AI and automation will drive operational efficiencies, while a greater focus on customer experience will lead to personalized delivery options and seamless returns processes. The market is poised for significant investment in technology and infrastructure to meet the evolving demands of online consumers.

United Kingdom E-commerce Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Inventory Management

- 1.3. Value-added services (labeling, packaging, etc.)

-

2. Business

- 2.1. B2B

- 2.2. B2C

-

3. Destination

- 3.1. Domestic

- 3.2. International/Cross Border

-

4. product

- 4.1. Fashion and pparel

- 4.2. Consumer electronics

- 4.3. Home Appliances

- 4.4. Furniture

- 4.5. Beauty and Personal care

- 4.6. Other products (Toys, Food Products, etc.)

United Kingdom E-commerce Logistics Market Segmentation By Geography

- 1. United Kingdom

United Kingdom E-commerce Logistics Market Regional Market Share

Geographic Coverage of United Kingdom E-commerce Logistics Market

United Kingdom E-commerce Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing E-commerce Penetration; Surge in Cross-Border Trade Activities

- 3.3. Market Restrains

- 3.3.1. Infrastructure Challenges; Regulatory Complexities

- 3.4. Market Trends

- 3.4.1. Immense Growth Projection for the Domestic Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom E-commerce Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Inventory Management

- 5.1.3. Value-added services (labeling, packaging, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Business

- 5.2.1. B2B

- 5.2.2. B2C

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International/Cross Border

- 5.4. Market Analysis, Insights and Forecast - by product

- 5.4.1. Fashion and pparel

- 5.4.2. Consumer electronics

- 5.4.3. Home Appliances

- 5.4.4. Furniture

- 5.4.5. Beauty and Personal care

- 5.4.6. Other products (Toys, Food Products, etc.)

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hermes

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FedEx

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DPD

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GXO Logistics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amazon Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Agility Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TNT Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DTDC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Royal Mail

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Zendbox**List Not Exhaustive 7 3 Other Companie

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DHL

List of Figures

- Figure 1: United Kingdom E-commerce Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Kingdom E-commerce Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 3: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 4: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by product 2020 & 2033

- Table 5: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 7: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 8: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 9: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by product 2020 & 2033

- Table 10: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom E-commerce Logistics Market?

The projected CAGR is approximately 6.94%.

2. Which companies are prominent players in the United Kingdom E-commerce Logistics Market?

Key companies in the market include DHL, Hermes, FedEx, DPD, GXO Logistics, Amazon Logistics, Agility Logistics, TNT Express, DTDC, Royal Mail, Zendbox**List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the United Kingdom E-commerce Logistics Market?

The market segments include Service, Business, Destination, product.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing E-commerce Penetration; Surge in Cross-Border Trade Activities.

6. What are the notable trends driving market growth?

Immense Growth Projection for the Domestic Segment.

7. Are there any restraints impacting market growth?

Infrastructure Challenges; Regulatory Complexities.

8. Can you provide examples of recent developments in the market?

January 2024: DHL Supply chain announced a strategic alliance with robotics company Robust.ai to create and deploy a cutting-edge robotic warehouse fleet. This strategic alliance brought together the DHL Supply chain’s extensive knowledge of logistics issues, track record in implementing automated solutions, and Robust.ai’s experience in AI and advanced robotics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom E-commerce Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom E-commerce Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom E-commerce Logistics Market?

To stay informed about further developments, trends, and reports in the United Kingdom E-commerce Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence