Key Insights

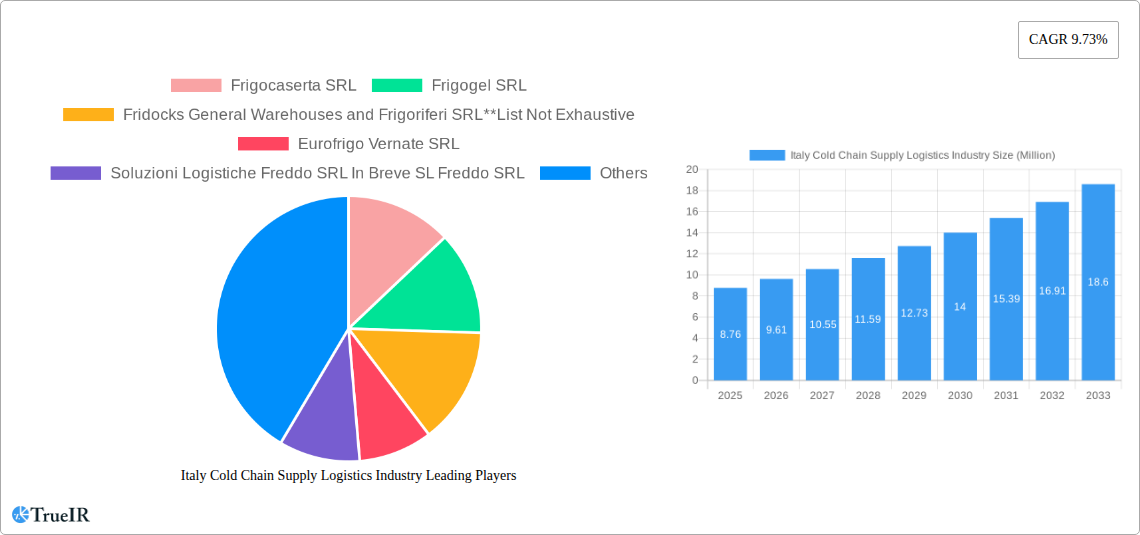

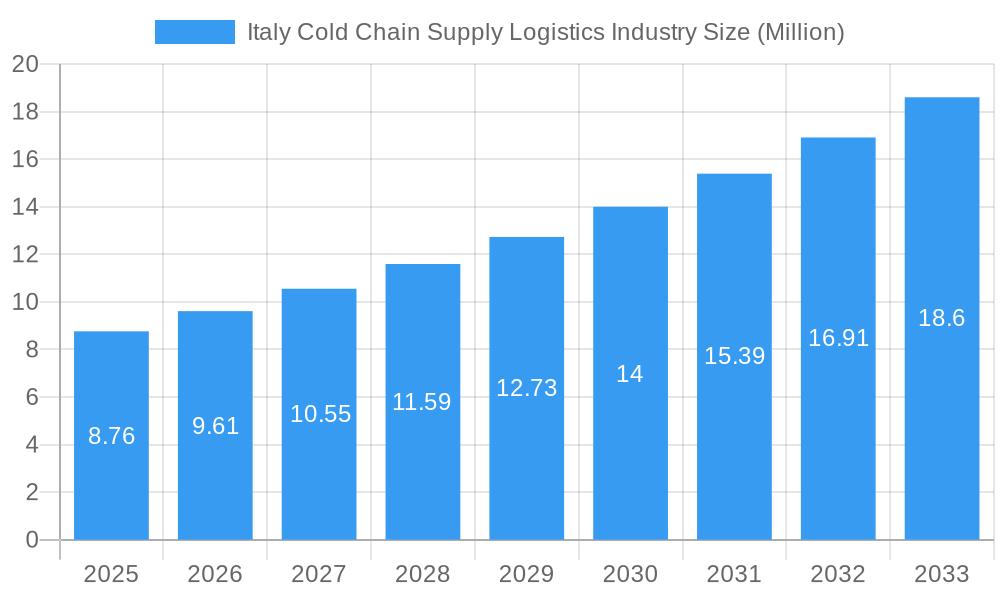

The Italian cold chain supply logistics market is poised for significant expansion, projected to reach an estimated €8.76 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 9.73% over the forecast period of 2025-2033. This remarkable growth is primarily fueled by escalating consumer demand for fresh and frozen food products, stringent regulations governing the transportation of perishable goods, and the increasing adoption of advanced cold chain technologies across various sectors. The horticulture segment, encompassing fresh fruits and vegetables, is a major contributor, alongside the dairy products and processed food sectors, all of which rely heavily on maintaining specific temperature controls throughout the supply chain. The pharmaceutical and life sciences industries also represent a growing area of demand, driven by the need for secure and temperature-controlled distribution of sensitive medicines and biological materials.

Italy Cold Chain Supply Logistics Industry Market Size (In Million)

The market's trajectory is further supported by ongoing investments in infrastructure, including the development of modern cold storage facilities and the expansion of specialized transportation fleets capable of handling chilled and frozen goods. Key players are focusing on enhancing their service offerings through value-added services such as order fulfillment, inventory management, and specialized packaging solutions. While the market benefits from strong demand drivers, it also faces challenges, including the high operational costs associated with maintaining cold chain integrity and the need for continuous technological upgrades to meet evolving industry standards and sustainability goals. However, the overall outlook remains highly positive, with opportunities for innovation and market penetration in a sector critical to Italy's food security, healthcare, and overall economic well-being.

Italy Cold Chain Supply Logistics Industry Company Market Share

Italy Cold Chain Supply Logistics Industry: Market Analysis, Trends, and Forecast (2019–2033)

This comprehensive report provides an in-depth analysis of the Italy Cold Chain Supply Logistics industry, a vital sector for preserving the integrity and quality of perishable goods. Leveraging high-volume keywords such as "Italy cold chain logistics," "refrigerated transport Italy," "cold storage Italy," and "pharmaceutical logistics Italy," this report is meticulously crafted for SEO optimization and to engage industry stakeholders. Our analysis covers the historical period from 2019 to 2024, with a base year of 2025, and projects growth through to 2033, offering unparalleled insights into market dynamics, competitive strategies, and future opportunities. The report details advancements in temperature-controlled warehousing, specialized transportation services, and value-added solutions across ambient, chilled, and frozen segments. Key application areas examined include horticulture, dairy, meats and fish, processed foods, pharmaceuticals, life sciences, and chemicals, highlighting the sector's critical role in various Italian industries.

Italy Cold Chain Supply Logistics Industry Market Structure & Competitive Landscape

The Italian cold chain supply logistics industry is characterized by a moderately concentrated market, with a growing number of specialized players vying for market share. Innovation drivers are primarily focused on enhancing operational efficiency, ensuring product integrity, and meeting stringent regulatory requirements, particularly within the pharmaceutical and food sectors. Regulatory impacts are significant, with evolving EU and national directives on food safety, pharmaceutical handling, and environmental sustainability influencing operational practices and investment decisions. Product substitutes, while limited in the core cold chain function, exist in less stringent temperature controls for non-perishable goods, but the demand for specialized cold chain solutions remains robust. End-user segmentation reveals a strong reliance on the food and beverage, and pharmaceutical sectors, driving demand for specific temperature profiles and handling protocols. Mergers and acquisitions (M&A) trends are on the rise as larger players seek to expand their network reach, service capabilities, and technological expertise. For instance, the estimated M&A volume in the Italian cold chain logistics sector is projected to reach 500 Million within the study period, indicating consolidation and strategic growth. Key companies actively shaping this landscape include Frigocaserta SRL, Frigogel SRL, Fridocks General Warehouses and Frigoriferi SRL (List Not Exhaustive), Eurofrigo Vernate SRL, Soluzioni Logistiche Freddo SRL In Breve SL Freddo SRL, DRS Depositi Regionali Surgelati SRL, Sodele Magazzini Generali Frigoriferi SRL, Safim Logistics, Horigel SRL, and Frigoscandia SPA. These entities are continuously investing in modern infrastructure and advanced technologies to maintain a competitive edge.

Italy Cold Chain Supply Logistics Industry Market Trends & Opportunities

The Italy Cold Chain Supply Logistics industry is poised for substantial growth, driven by an expanding demand for temperature-sensitive products, increasing consumer expectations for freshness and quality, and the burgeoning e-commerce sector for groceries and pharmaceuticals. The market size for cold chain logistics in Italy is projected to grow from an estimated 20,000 Million in the historical period to over 35,000 Million by the end of the forecast period in 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 5.8%. Technological shifts are profoundly impacting the industry, with a strong emphasis on IoT-enabled real-time temperature monitoring, advanced warehouse management systems (WMS), and the adoption of automation and robotics for improved efficiency and reduced human error. Consumer preferences are increasingly leaning towards fresh, locally sourced produce and a wider variety of chilled and frozen food options, further boosting the demand for sophisticated cold chain solutions. Competitive dynamics are intensifying, with a focus on service differentiation, reliability, and sustainability. Companies are investing in green logistics, including electric vehicles and energy-efficient warehousing, to align with environmental regulations and attract eco-conscious clients. Opportunities abound in specialized logistics for pharmaceuticals and life sciences, where the demand for stringent temperature control and secure handling is paramount. The growth of online grocery delivery services presents a significant avenue for expansion, requiring robust last-mile cold chain capabilities. Furthermore, the development of specialized cold chain infrastructure in less developed regions of Italy, coupled with government incentives for cold chain modernization, offers untapped potential. The increasing complexity of global supply chains also necessitates more integrated and resilient cold chain networks, creating opportunities for end-to-end service providers. The market penetration rate for advanced cold chain solutions is expected to rise from 65% in the base year to 85% by 2033.

Dominant Markets & Segments in Italy Cold Chain Supply Logistics Industry

The Chilled segment is a dominant force within the Italy Cold Chain Supply Logistics industry, driven by the consistent demand for fresh produce, dairy products, and chilled processed foods. Within services, Transportation represents the largest segment, accounting for an estimated 45% of the market value, followed closely by Storage at approximately 40%, and Value-added services at 15%. The Pharma, Life Sciences, and Chemicals application segment is experiencing the most rapid growth, driven by stringent regulatory requirements and the high value of the products handled. This segment is expected to contribute significantly to the overall market expansion. The Horticulture (Fresh Fruits and Vegetables) segment remains a cornerstone, with robust demand fueled by dietary trends and agricultural output.

- Leading Segments and Drivers:

- Chilled Temperature Type: Essential for dairy, fresh produce, and a significant portion of processed foods. Growth is driven by consumer demand for fresh, ready-to-eat, and minimally processed food items.

- Transportation Service: The backbone of cold chain logistics, ensuring timely and temperature-controlled delivery. Growth is propelled by the expansion of e-commerce, increased inter-regional trade, and the need for specialized refrigerated fleets. The market for refrigerated transport is projected to reach 15,000 Million by 2033.

- Storage Service: Critical for maintaining inventory and ensuring supply chain continuity. Demand is fueled by larger retail chains, food manufacturers, and pharmaceutical companies requiring specialized, temperature-controlled warehousing facilities. The cold storage market is estimated to grow to 14,000 Million by 2033.

- Pharma, Life Sciences, and Chemicals Application: This high-value segment is characterized by stringent regulatory compliance and the need for highly specialized temperature control (e.g., ultra-low temperatures). Growth is driven by an aging population, advancements in biotechnology, and the increasing complexity of pharmaceutical supply chains. The value of this segment is projected to exceed 10,000 Million by 2033.

- Dairy Products Application: A consistent and significant contributor, encompassing milk, ice cream, butter, and cheese. Growth is linked to stable consumer consumption patterns and innovation in dairy product offerings.

- Meats and Fish Application: While subject to fluctuations, this segment remains vital, requiring rigorous temperature management to ensure safety and quality.

- Horticulture (Fresh Fruits and Vegetables) Application: A perennial segment driven by seasonal availability and evolving consumer preferences for diverse and healthy food options.

The geographical dominance within Italy is concentrated in the northern regions due to their advanced infrastructure and higher concentration of food processing and pharmaceutical manufacturing industries. However, there is a notable push for developing cold chain capabilities in the southern regions to support agricultural exports and local distribution networks.

Italy Cold Chain Supply Logistics Industry Product Analysis

The Italy Cold Chain Supply Logistics industry product landscape is defined by a suite of specialized services and technological solutions designed to maintain product integrity across various temperature ranges. Innovations are centered on enhancing real-time visibility, predictive analytics for inventory management, and the integration of AI for route optimization and demand forecasting. Key product offerings include temperature-controlled warehousing, refrigerated transport fleets (vans, trucks, and specialized containers), and value-added services such as blast freezing, cross-docking, and specialized packaging. Competitive advantages are derived from advanced temperature monitoring systems (IoT sensors), adherence to strict regulatory standards (e.g., HACCP, GDP), and the ability to offer end-to-end cold chain solutions. The market is witnessing a growing demand for solutions catering to ultra-low temperature requirements for specialized pharmaceuticals and research materials, alongside efficient, last-mile delivery networks for online grocery platforms.

Key Drivers, Barriers & Challenges in Italy Cold Chain Supply Logistics Industry

Key Drivers:

- Growing Demand for Perishable Goods: Increasing consumption of fresh produce, dairy, meats, and ready-to-eat meals fuels the need for robust cold chain infrastructure.

- Pharmaceutical Sector Expansion: The booming pharmaceutical and life sciences industries require highly specialized and regulated cold chain logistics, driving significant investment.

- E-commerce Growth: The surge in online grocery and food delivery services necessitates advanced, last-mile cold chain capabilities.

- Technological Advancements: IoT, AI, and automation are enhancing efficiency, visibility, and reliability in cold chain operations.

- Government Support and Regulations: Favorable policies and stricter regulations promoting food safety and quality indirectly boost demand for professional cold chain services.

Barriers & Challenges:

- High Infrastructure Investment: Establishing and maintaining state-of-the-art cold chain facilities and fleets requires substantial capital expenditure.

- Energy Costs: Refrigeration is energy-intensive, making operational costs sensitive to fluctuating energy prices. The estimated impact of energy costs on operational expenses can range from 25-35%.

- Regulatory Compliance: Navigating complex and evolving food safety and pharmaceutical handling regulations demands continuous adaptation and investment.

- Skilled Labor Shortage: A lack of trained personnel for operating and maintaining specialized cold chain equipment poses a challenge.

- Supply Chain Disruptions: Global events and unforeseen circumstances can disrupt the flow of goods and necessitate agile response mechanisms within the cold chain.

- Competitive Pressure: An increasingly competitive market can lead to price wars and pressure on profit margins.

Growth Drivers in the Italy Cold Chain Supply Logistics Industry Market

The Italy Cold Chain Supply Logistics Industry Market is propelled by several critical growth drivers. Technologically, the increasing adoption of IoT for real-time temperature monitoring and supply chain visibility is revolutionizing operational efficiency and product integrity assurance. Economically, the sustained demand for fresh, healthy food options, coupled with the expanding market for pharmaceuticals and life sciences products, creates a consistent need for reliable cold chain solutions. The growth of e-commerce, particularly in the grocery sector, presents a significant opportunity, demanding scalable and efficient last-mile delivery networks. Regulatory factors, such as stringent food safety standards and pharmaceutical handling guidelines, incentivize businesses to invest in professional cold chain logistics services, ensuring compliance and minimizing risks. For example, the implementation of stricter EU directives on temperature control for food products has directly led to an estimated 15% increase in demand for specialized cold storage and transport services.

Challenges Impacting Italy Cold Chain Supply Logistics Industry Growth

Challenges impacting Italy Cold Chain Supply Logistics Industry growth are multifaceted. Regulatory complexities, particularly concerning the transportation and storage of pharmaceuticals and certain food products, demand continuous investment in compliance and certification. Supply chain issues, including disruptions caused by global events or localized infrastructure limitations, can lead to significant operational hurdles and increased costs. Competitive pressures within the market, characterized by a growing number of players, can lead to price sensitivity and pressure on profit margins. The high capital investment required for modern cold chain infrastructure, including advanced refrigeration systems and specialized vehicles, acts as a significant barrier to entry for smaller companies. Furthermore, the volatile nature of energy prices directly impacts operational costs, as refrigeration is a highly energy-intensive process. For instance, a 10% increase in energy prices can translate to a 3-5% rise in overall operational expenses for cold chain logistics providers.

Key Players Shaping the Italy Cold Chain Supply Logistics Industry Market

- Frigocaserta SRL

- Frigogel SRL

- Fridocks General Warehouses and Frigoriferi SRL

- Eurofrigo Vernate SRL

- Soluzioni Logistiche Freddo SRL In Breve SL Freddo SRL

- DRS Depositi Regionali Surgelati SRL

- Sodele Magazzini Generali Frigoriferi SRL

- Safim Logistics

- Horigel SRL

- Frigoscandia SPA

Significant Italy Cold Chain Supply Logistics Industry Industry Milestones

- May 2022: Bomi Group, through its Picking Farma brand, announced the forthcoming opening of a new logistics hub near Madrid, Spain, dedicated to the Healthcare sector. This facility represents an investment of 15 Million euros and is expected to create 150 jobs. The new platform will span 25,000 m² with a capacity of 60,000 pallet places, positioning it as a key reference warehouse for the pharmaceutical sector in Europe. This development highlights the growing trend of international expansion and specialization in pharmaceutical logistics.

- April 2022: Bomi Group, a leader in integrated logistics for the Healthcare sector, announced the acquisition by its French branch of Tendron Pharma. Tendron Pharma, a division of Tendron Transports, specializes in the transport of pharmaceutical products. It operates a fleet of 25 temperature-controlled vehicles (+15+25° C) and serves the Ile-de-France region, transporting drugs and devices from pharmaceutical plants to distributors, pharmacies, hospitals, and clinics. This acquisition signifies strategic consolidation and enhancement of specialized pharmaceutical transport capabilities within the European market.

Future Outlook for Italy Cold Chain Supply Logistics Industry Market

The future outlook for the Italy Cold Chain Supply Logistics industry is exceptionally promising, driven by sustained demand and continuous innovation. Strategic opportunities lie in the further development of hyper-specialized cold chain solutions for the growing biopharmaceutical and cell and gene therapy sectors, which require ultra-precise temperature controls. The expansion of sustainable logistics practices, including the adoption of electric fleets and renewable energy sources for warehouses, will be crucial for long-term competitiveness and regulatory adherence. Investments in digital transformation, such as advanced data analytics for predictive maintenance and route optimization, will further enhance efficiency and reduce operational costs. The increasing integration of cold chain services within broader supply chain management platforms will create end-to-end solutions for clients, solidifying market positions. As consumer expectations for fresh, high-quality products continue to rise, and the pharmaceutical industry innovates, the demand for sophisticated, reliable, and sustainable cold chain logistics in Italy is set to surge, with market potential expected to reach over 50,000 Million by 2033.

Italy Cold Chain Supply Logistics Industry Segmentation

-

1. Services

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Ambient

- 2.2. Chilled

- 2.3. Frozen

-

3. Application

- 3.1. Horticulture (Fresh Fruits and Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 3.3. Meats and Fish

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

- 3.6. Other Applications

Italy Cold Chain Supply Logistics Industry Segmentation By Geography

- 1. Italy

Italy Cold Chain Supply Logistics Industry Regional Market Share

Geographic Coverage of Italy Cold Chain Supply Logistics Industry

Italy Cold Chain Supply Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand for customizable delivery solutions4.; Growing need for operational effciency

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of efficient transportation infrastructure4.; High cost of white glove services

- 3.4. Market Trends

- 3.4.1. Increasing Usage of Dairy Products in the Country is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Cold Chain Supply Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Ambient

- 5.2.2. Chilled

- 5.2.3. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits and Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3. Meats and Fish

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Frigocaserta SRL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Frigogel SRL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fridocks General Warehouses and Frigoriferi SRL**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eurofrigo Vernate SRL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Soluzioni Logistiche Freddo SRL In Breve SL Freddo SRL

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DRS Depositi Regionali Surgelati SRL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sodele Magazzini Generali Frigoriferi SRL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Safim Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Horigel SRL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Frigoscandia SPA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Frigocaserta SRL

List of Figures

- Figure 1: Italy Cold Chain Supply Logistics Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Italy Cold Chain Supply Logistics Industry Share (%) by Company 2025

List of Tables

- Table 1: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 6: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 7: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Cold Chain Supply Logistics Industry?

The projected CAGR is approximately 9.73%.

2. Which companies are prominent players in the Italy Cold Chain Supply Logistics Industry?

Key companies in the market include Frigocaserta SRL, Frigogel SRL, Fridocks General Warehouses and Frigoriferi SRL**List Not Exhaustive, Eurofrigo Vernate SRL, Soluzioni Logistiche Freddo SRL In Breve SL Freddo SRL, DRS Depositi Regionali Surgelati SRL, Sodele Magazzini Generali Frigoriferi SRL, Safim Logistics, Horigel SRL, Frigoscandia SPA.

3. What are the main segments of the Italy Cold Chain Supply Logistics Industry?

The market segments include Services, Temperature Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.76 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand for customizable delivery solutions4.; Growing need for operational effciency.

6. What are the notable trends driving market growth?

Increasing Usage of Dairy Products in the Country is Driving the Market.

7. Are there any restraints impacting market growth?

4.; Lack of efficient transportation infrastructure4.; High cost of white glove services.

8. Can you provide examples of recent developments in the market?

May 2022: Bomi Group, through the Picking Farma brand, announces the forthcoming opening of the new logistics hub near Madrid dedicated to the Healthcare sector. The warehouse, whose work has already begun, will involve an investment of 15 million euros and the creation of 150 jobs. The new logistics platform will join the seven already present in Spain, including one near Madrid, four in Catalonia, and two in the Canary Islands. This new logistics center will have an area of 25,000 m² and a capacity of 60,000 pallet places, making it one of the essential reference warehouses for the pharmaceutical sector in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Cold Chain Supply Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Cold Chain Supply Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Cold Chain Supply Logistics Industry?

To stay informed about further developments, trends, and reports in the Italy Cold Chain Supply Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence